Global Data Encryption in ERP Systems Market Size, Share Analysis Report By Encryption Type (Data-at-Rest Encryption, Data-in-Transit Encryption, End-to-End Encryption), By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs), By Industry Vertical (Manufacturing, Healthcare, Retail, Financial Services, Government, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152677

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

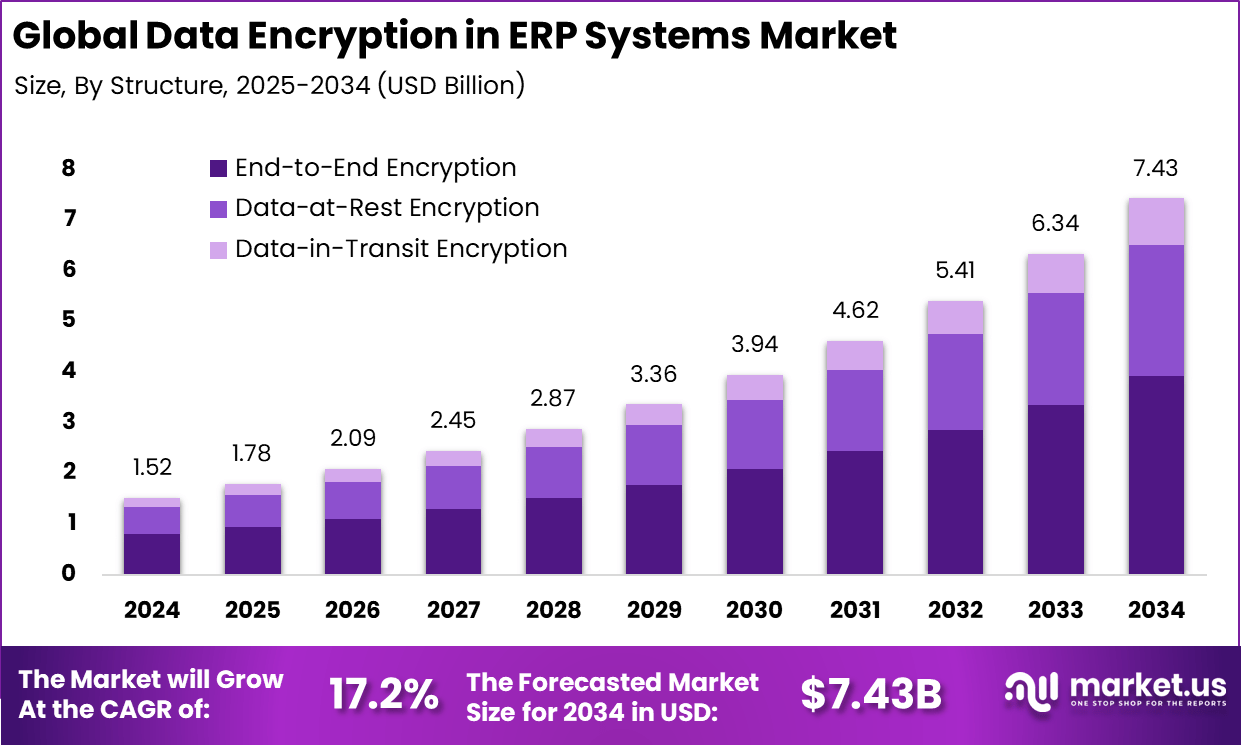

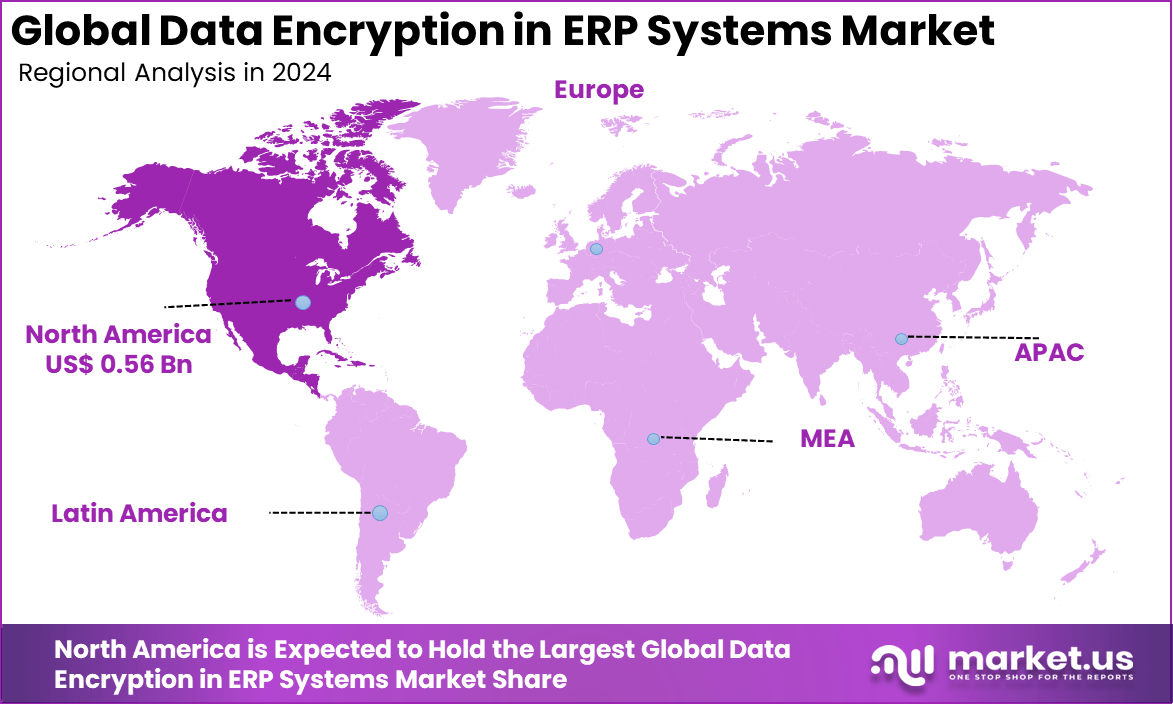

The Global Data Encryption in ERP Systems Market size is expected to be worth around USD 7.43 billion by 2034, from USD 1.52 billion in 2024, growing at a CAGR of 17.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.26% share, holding USD 0.56 billion in revenue.

The market for data encryption in ERP systems is gaining momentum as businesses increasingly store sensitive operational data in centralized platforms. ERP systems manage critical information across finance, HR, manufacturing, and logistics. Without strong encryption, this data remains exposed to unauthorized access. Enterprises are now prioritizing encryption to protect data at rest, during transmission, and increasingly, while in use.

Top driving factors include rising cyber threats and stricter compliance requirements. Regulations such as GDPR, HIPAA, and PCI-DSS demand secure data processing and storage. This regulatory pressure is compelling enterprises to adopt built-in encryption capabilities within their ERP systems. Simultaneously, the increase in cyberattacks targeting enterprise software has made encryption not just a compliance requirement but a critical security imperative.

For instance, In April 2025, Thales introduced its PQC-ready Client-Side Encryption for Google Workspace at Google Cloud Next 2025. The solution combines CipherTrust Cloud Key Management and SafeNet Trust Access to deliver quantum-resistant encryption. It is designed to help businesses secure sensitive cloud data and meet future security compliance requirements.

Market Scope and Forecast

Report Features Description Market Value (2024) USD 1.52 Bn Forecast Revenue (2034) USD 7.43 Bn CAGR (2025-2034) 17.2% Largest market in 2024 North America [37.26% market share] Key Insight Summary

- The market is projected to grow from USD 1.52 billion in 2024 to approximately USD 7.43 billion by 2034, registering a strong CAGR of 17.2%, driven by growing concerns over data breaches, compliance requirements, and the protection of sensitive enterprise data.

- North America led the global market in 2024, holding more than 37.26% share and generating about USD 0.56 billion in revenue, supported by early ERP adoption, strict data protection regulations, and cyber risk mitigation strategies.

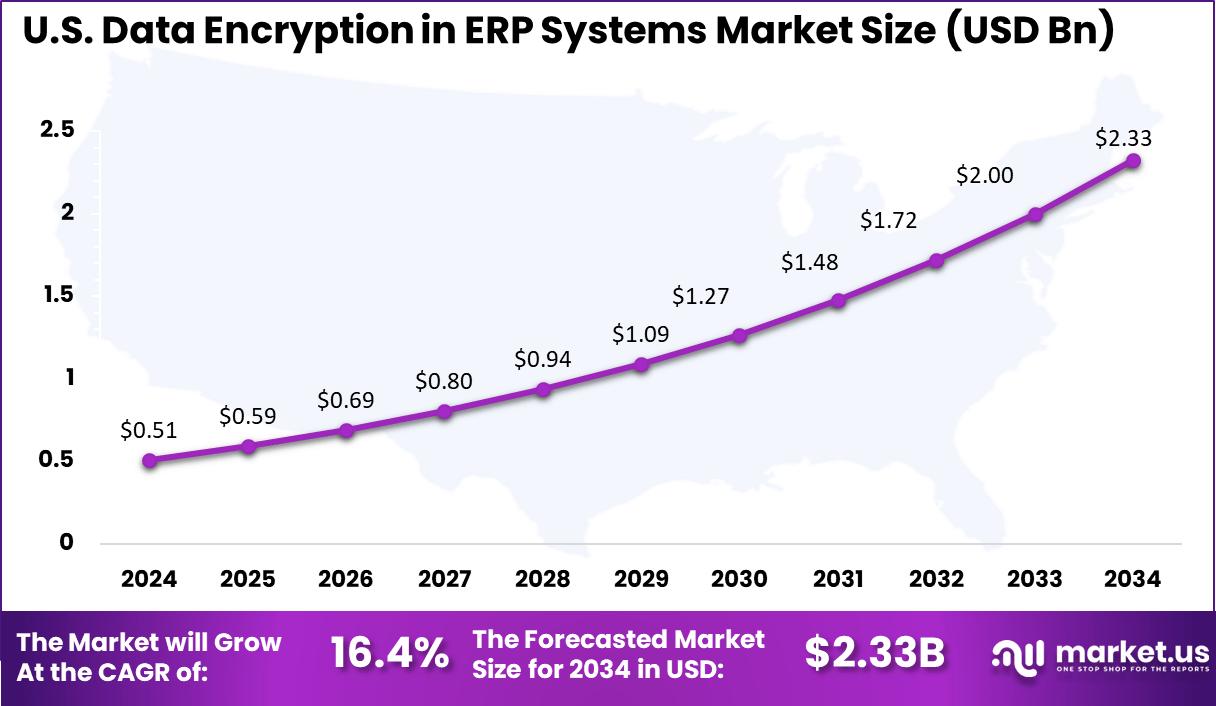

- The U.S. market alone contributed approximately USD 0.51 billion, with a projected CAGR of 16.4%, reflecting high investments in cybersecurity infrastructure across large ERP-driven enterprises.

- By encryption type, End-to-End Encryption dominated with 52.7% share, as organizations prioritize full-cycle data protection from input to storage within ERP systems.

- By organization size, Large Enterprises held the largest share at 64.3%, driven by their complex data environments and greater regulatory exposure.

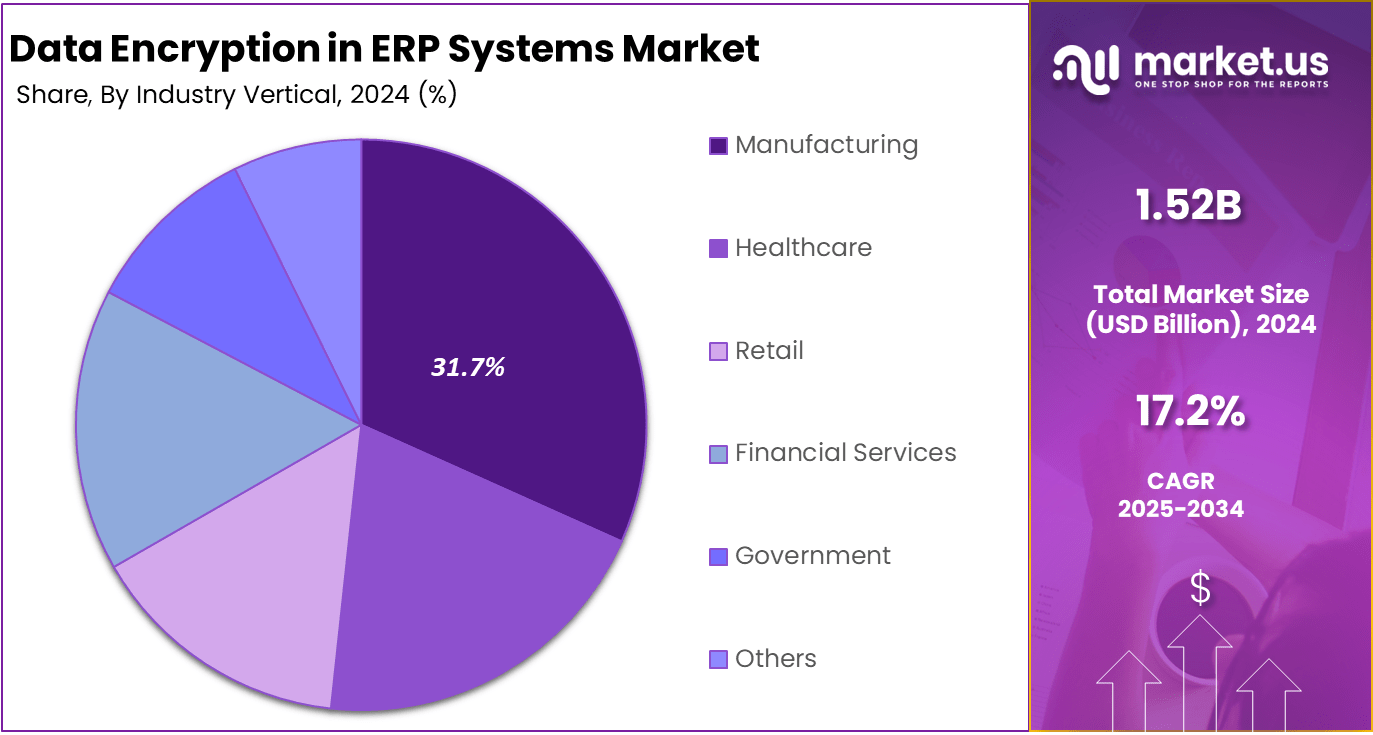

- Among verticals, Manufacturing led with 31.7% share, owing to the sector’s high reliance on ERP systems for operations and the critical need to safeguard proprietary process and supply chain data.

U.S. Market Size

The market for Data Encryption in ERP Systems within the U.S. is growing tremendously and is currently valued at USD 0.51 billion, the market has a projected CAGR of 16.4%. The U.S. market for data encryption in ERP systems is growing rapidly due to rising cyber threats, data breaches, and the increasing reliance on ERP systems to manage sensitive information.

The shift to remote work and BYOD policies has expanded security risks, making encryption crucial to protect data across various devices. Additionally, strict regulatory requirements and privacy laws are pushing businesses to adopt encryption to ensure compliance. The growth of cloud-based ERP systems and digital transactions further drives the demand for advanced encryption solutions.

For instance, In May 2025, Billerud revealed plans to adopt a data-driven business system as part of its strategic transformation. The shift includes integrating advanced data encryption within its ERP systems to secure sensitive operational data. This move supports regulatory compliance and improves decision-making across its U.S. and global operations.

In 2024, North America held a dominant market position in the Global Data Encryption in ERP Systems Market, capturing more than a 37.26% share, holding USD 0.56 billion in revenue. North America leads the global data encryption in the ERP systems market, driven by its advanced technological infrastructure, strong cybersecurity awareness, and stringent regulations.

The region hosts major tech companies and cloud service providers, offering integrated encryption solutions to secure sensitive ERP data. Regulations like CCPA and HIPAA push businesses to adopt encryption for compliance and data protection. Furthermore, the rising frequency of cyberattacks, particularly in sectors like finance, healthcare, and government, increases the demand for robust data encryption solutions in North America.

For instance, In May 2025, Tailor secured $14 million in the first close of its Series A funding to advance its composable ERP platform. The company is focused on delivering modular, customizable ERP solutions with greater flexibility for North American businesses. As part of its development plans, Tailor will integrate advanced data encryption to enhance data security across its ERP systems.

Encryption Type Analysis

In 2024, End-to-End Encryption segment held a dominant market position, capturing a 52.7% share of the Global Data Encryption in ERP Systems Market. This dominance is attributed to the growing need for comprehensive security across all stages of data transmission, from the point of origin to the endpoint.

End-to-end encryption guarantees that data stays protected at every stage, reducing the risk of breaches during transfer and ensuring adherence to regulatory requirements. With businesses placing greater emphasis on data protection, this encryption method has become the preferred solution for securing sensitive ERP data.

For Instance, In April 2025, Google enabled enterprise Gmail users to send end-to-end encrypted emails to any recipient, regardless of the email provider. This update strengthens email security by safeguarding sensitive business data during transmission. It reflects growing demand for advanced data protection in cloud-based communication across large organizations.

Organization Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing a 64.3% share of the Global Data Encryption in ERP Systems Market. The demand in this sector is primarily fueled by the need to safeguard large amounts of sensitive data, adhere to stringent regulatory requirements, and address the increasing complexity of IT infrastructures.

Large enterprises, handling critical business data across various departments and locations, require advanced encryption solutions to secure their ERP systems, reduce risks, and maintain operational continuity. For instance, in June 2025, IBM introduced industry-first software designed to unify AI security and governance, providing a comprehensive view of a large organization’s risk posture.

This innovative solution integrates AI-powered insights with advanced encryption capabilities, allowing businesses to better manage data security across their entire digital infrastructure. By combining governance, security, and AI, IBM’s new software helps large enterprises navigate complex security challenges while ensuring compliance with regulatory standards and protecting sensitive data in ERP systems and beyond.

Industry Vertical Analysis

In 2024, Manufacturing segment held a dominant market position, capturing a 31.7% share of the Global Data Encryption in ERP Systems Market. This dominance is driven by the manufacturing sector’s growing dependence on interconnected ERP systems to manage sensitive data such as intellectual property, production schedules, and supply chain information.

With the rise of Industry 4.0, IoT integration, and smart factories, massive amounts of critical data are generated and exchanged, increasing vulnerability to cyberattacks. As a result, manufacturing companies are investing heavily in data encryption solutions for their ERP systems to safeguard trade secrets, ensure supply chain security, and protect against cyber threats, ensuring business continuity.

For Instance, In January 2025, Cetec ERP rolled out an update aimed at improving usability and data control for manufacturers. The update features enhanced data encryption to secure sensitive manufacturing data within the ERP system. This move supports the industry’s growing focus on data protection and regulatory compliance.

Key Market Segments

By Encryption Type

- Data-at-Rest Encryption

- Data-in-Transit Encryption

- End-to-End Encryption

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Industry Vertical

- Manufacturing

- Healthcare

- Retail

- Financial Services

- Government

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

Confidential Computing and Homomorphic Encryption

A significant trend shaping the encryption landscape within ERP systems is the shift toward confidential computing. This technology secures data during processing by isolating it within trusted execution environments.

When paired with homomorphic encryption, which allows computations on encrypted data without decryption, it creates a robust layer of security. This innovation is especially relevant as enterprises move sensitive ERP functions to cloud-based infrastructures.

These encryption advancements are helping address critical privacy challenges while allowing analytics and machine learning applications to operate securely on encrypted datasets. ERP vendors are beginning to test these advanced encryption models in finance and supply chain modules where data sensitivity is highest.

Driver

Rising Regulatory and Cybersecurity Pressure

The growth in ransomware attacks and data breach incidents has made encryption a non-negotiable requirement in ERP deployments. Regulatory frameworks like GDPR, HIPAA, and regional cybersecurity laws mandate the protection of personally identifiable information, especially in finance and healthcare ERP modules. This regulatory pressure is compelling organizations to adopt more sophisticated encryption protocols across all ERP layers.

Encryption also supports audit-readiness by ensuring that all transactional data and user activities are recorded securely, enhancing accountability and transparency in compliance reporting. As a result, decision-makers are prioritizing encryption-enabled ERP solutions over legacy setups lacking data security provisions.

For instance, in July 2024, a significant cybersecurity breach occurred when the servers of South Korean ERP vendors were hacked, compromising sensitive business data. The attack targeted the ERP systems of multiple organizations, highlighting the vulnerabilities within unprotected systems and underscoring the importance of robust data encryption.

Restraint

Performance and Integration Complexity

Despite the benefits, the integration of encryption into ERP systems is often met with technical resistance. High computational overheads and encryption-induced latency can reduce ERP system performance, particularly in real-time operations such as order processing or manufacturing execution.

Furthermore, legacy ERP systems often lack native support for modern encryption libraries. Retrofitting encryption into such environments demands significant custom development, complex key management integration, and ongoing maintenance, which elevates both costs and operational risk.

For instance, In March 2025, Techzine highlighted that cost is the main barrier to ERP adoption, especially for data encryption. Implementing encryption requires high investment and technical expertise, making it challenging for smaller firms to ensure strong data protection and meet compliance standards.

Opportunity

Adoption of Post Quantum Encryption

The advancement of quantum computing poses a future risk to traditional encryption algorithms. In response, ERP providers are exploring the implementation of post quantum cryptographic standards, which are designed to withstand decryption attempts by quantum processors. By adopting these next-generation algorithms now, ERP systems can become quantum-resilient ahead of time.

Enterprises that integrate post quantum encryption into their ERP architecture can safeguard customer and transactional data well into the future, aligning with long-term data protection strategies and reinforcing customer trust in secure enterprise platforms.

Challenge

Talent Shortages and Skills Gaps

There remains a clear shortage of professionals with the necessary expertise in encryption, key lifecycle management, and ERP-specific cybersecurity frameworks. As encryption becomes more complex, the need for specialized roles – such as cryptographic engineers and ERP security architects – continues to rise.

This gap creates an operational challenge. Without adequate human resources, enterprises may struggle to implement or maintain encryption frameworks effectively, which could lead to misconfigurations, compliance failures, or exposure to cyberattacks. Bridging this talent gap is essential to ensure successful deployment and governance of encryption in ERP systems.

Key Players Analysis

HelpSystems, PKWARE, and Thales Group are actively advancing data encryption in ERP systems. Their tools focus on file-level encryption, policy enforcement, and secure data transfer. These companies are enabling secure ERP environments by integrating encryption directly into enterprise workflows. Their solutions support compliance with major data protection regulations, including GDPR and HIPAA.

IBM, Oracle, and Microsoft offer enterprise-grade encryption capabilities deeply embedded in their ERP and cloud ecosystems. These companies emphasize real-time data protection, key management, and multi-layered security frameworks. Their platforms are widely trusted by global enterprises for safeguarding sensitive business operations.

Amazon Web Services, Google, Varonis, McAfee, and Symantec continue to shape encryption capabilities with cloud-native architectures and advanced threat detection. Their technologies enhance access control, secure data at rest and in transit, and support identity-based encryption. These vendors are key enablers of secure digital transformation across ERP systems.

Top Key Players in the Market

- HelpSystems, LLC

- PKWARE, Inc.

- Thales Group

- International Business Machines Corporation (IBM)

- Oracle Corporation

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC

- Microsoft Corporation

- Varonis Systems, Inc.

- McAfee Corp.

- Symantec Corporation

- Others

Recent Developments

- In June 2025, AWS introduced the Active Threat Defense rule group for AWS Network Firewall to block communications with known malicious sources. This enhancement supports stronger protection for cloud-based ERP systems, helping businesses defend sensitive data and meet security compliance needs.

- In April 2025, Oracle issued a Critical Patch Update with seven new security patches for its database products. These updates fix key vulnerabilities that could impact ERP data security, enabling businesses to reduce risk, safeguard data integrity, and stay aligned with regulatory requirements.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Encryption Type (Data-at-Rest Encryption, Data-in-Transit Encryption, End-to-End Encryption), By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs), By Industry Vertical (Manufacturing, Healthcare, Retail, Financial Services, Government, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape HelpSystems, LLC, PKWARE, Inc., Thales Group, International Business Machines Corporation (IBM), Oracle Corporation, Microsoft Corporation, Amazon Web Services, Inc., Google LLC, Microsoft Corporation, Varonis Systems, Inc., McAfee Corp., Symantec Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Encryption in ERP Systems MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Data Encryption in ERP Systems MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- HelpSystems, LLC

- PKWARE, Inc.

- Thales Group

- International Business Machines Corporation (IBM)

- Oracle Corporation

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC

- Microsoft Corporation

- Varonis Systems, Inc.

- McAfee Corp.

- Symantec Corporation

- Others