Global Data Centric Security Market By Component (Software & Solution ( Data Discovery & Classification, Data Protection, Data Governance & Compliance, Others), Services (Professional, Managed)), By Deployment (On-premise, Cloud), By Enterprise Size (Large Enterprises and SMEs), By Industry Vertical (BFSI, IT & Telecom, Government & Defense, Healthcare, Retail, Others), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 115588

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

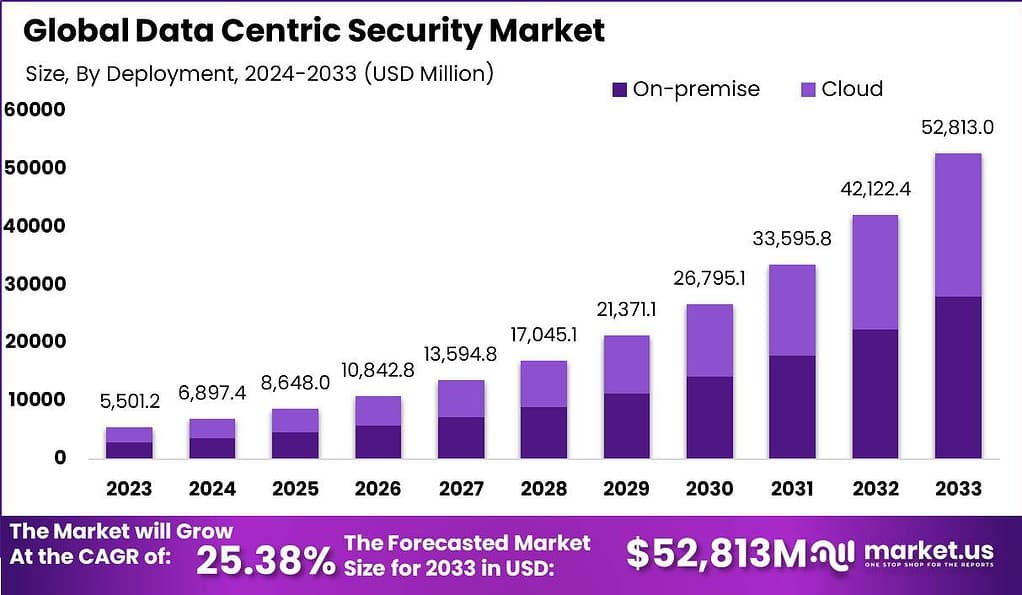

The Global Data Centric Security Market size is expected to be worth around USD 52,813.0 Million by 2033, from USD 5,501.2 Million in 2023, growing at a CAGR of 25.38% during the forecast period from 2024 to 2033.

Data centric security refers to an approach to cybersecurity that focuses on protecting data at its core. Traditional security measures primarily focus on securing networks and devices, but data centric security shifts the focus towards securing the data itself, regardless of its location or the systems accessing it. This approach recognizes that data is the most valuable asset for organizations, and it must be protected throughout its lifecycle, from creation to storage, transmission, and deletion.

The data-centric security market is witnessing significant growth as organizations recognize the importance of securing their sensitive data assets against evolving threats such as cyberattacks, data breaches, and insider threats. Factors driving this growth include the increasing adoption of cloud services, the proliferation of mobile devices, and the growing volume of data being generated and exchanged digitally.

The market encompasses various solution providers offering a range of data centric security technologies and services. These include encryption solutions, data access controls, data masking and tokenization, data loss prevention, and data-centric auditing and monitoring tools. The market also caters to different industry verticals, such as healthcare, finance, retail, and government, where data security and privacy are of most importance.

From an analyst viewpoint, the statistics surrounding data breaches and the benefits of data-centric security solutions demonstrate the critical need for organizations to prioritize data protection. In 2023, data breaches exposed an average of 29,379 records per incident, according to IBM Security. This alarming figure highlights the scale of the problem and the potential impact on businesses and individuals. With such large quantities of data at risk, it is imperative for organizations to adopt robust security measures.

One effective approach to mitigating data breaches is the implementation of data-centric security solutions. According to a study by Forrester, organizations utilizing these solutions reported a 56% reduction in the time taken to detect and respond to security incidents. This significant improvement in incident response capabilities can lead to faster containment of breaches, minimizing the potential damage caused and reducing downtime.

Moreover, data-centric security is viewed as essential by a majority of security professionals. According to the Ponemon Institute, a staggering 83% of these professionals believe that data-centric security is crucial for protecting sensitive information and complying with regulations. This finding underscores the growing recognition of the importance of data protection and the need to prioritize data-centric security measures.

Key Takeaways

- Data Centric Security Market size is expected to be worth around USD 52,813.0 Million by 2033, CAGR of 25.38%

- the Software segment held a dominant market position within the Data Centric Security Market, capturing more than a 62% share.

- The Cloud segment held a dominant market position within the Data Centric Security Market, capturing more than a 53% share.

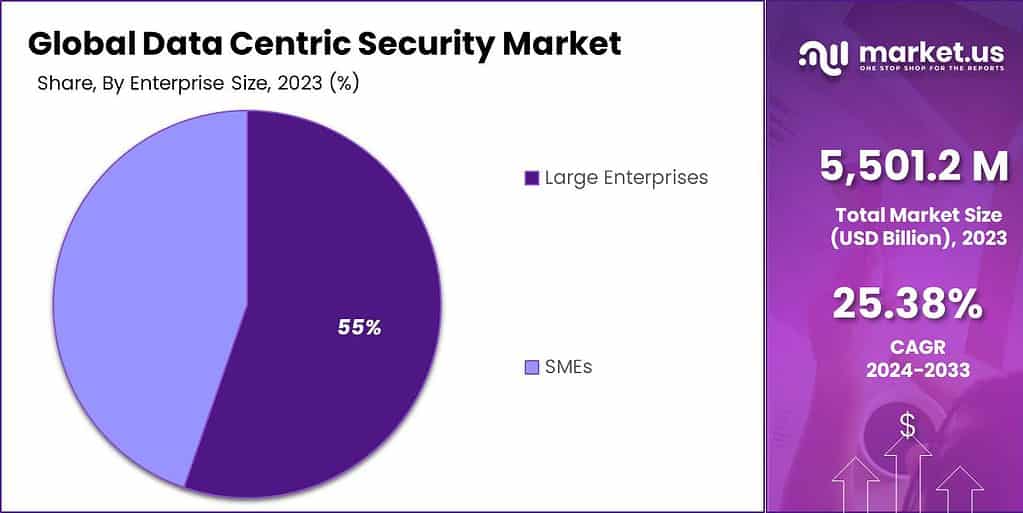

- The Large Enterprises segment held a dominant market position in the Data Centric Security Market, capturing more than a 55% share.

- The BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Data Centric Security Market, capturing more than a 26% share.

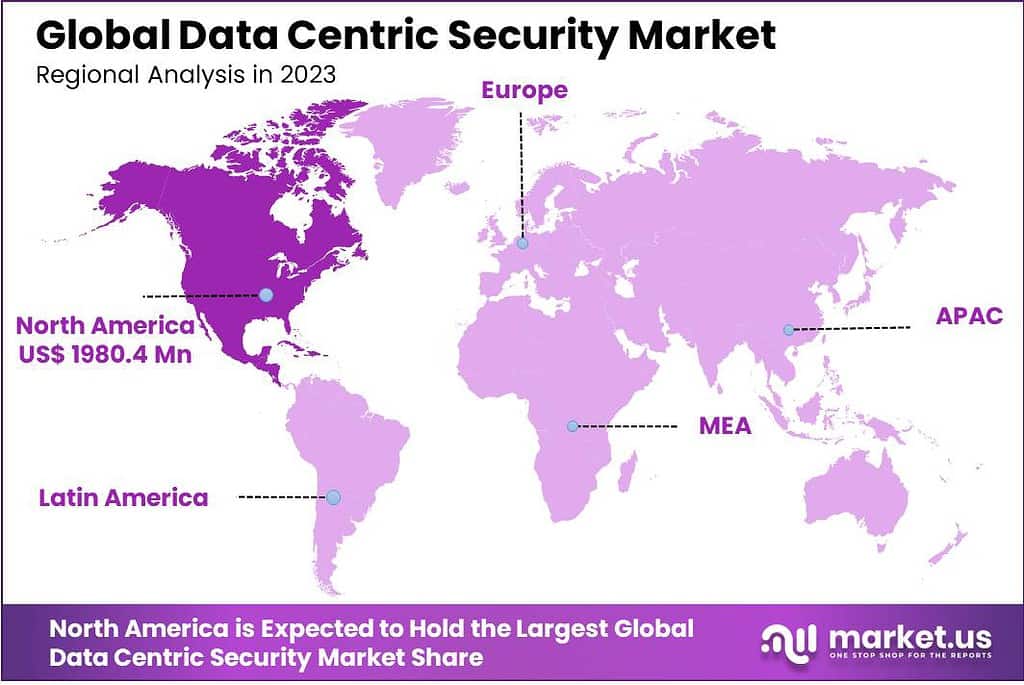

- In 2023, North America held a dominant market position in the Data Centric Security Market, capturing more than a 36% share.

Component Analysis

In 2023, the Software segment held a dominant market position within the Data Centric Security Market, capturing more than a 62% share. This segment’s leadership can be attributed to the increasing demand for robust data security solutions, driven by the escalating volume of data generated by businesses across various sectors.

Software & Solutions, encompassing Data Discovery & Classification, Data Protection, and Data Governance & Compliance, have become integral to organizations aiming to safeguard sensitive information against breaches, unauthorized access, and other cyber threats. The surge in the Software segment’s market share is further bolstered by the growing emphasis on compliance with global data protection regulations such as GDPR, HIPAA, and CCPA.

Organizations are investing in data discovery and classification software to accurately identify and categorize data, enabling the implementation of appropriate security measures and compliance strategies. Moreover, the advent of advanced data protection technologies, including encryption, tokenization, and data masking, has enhanced the ability of businesses to secure critical data assets across different environments, be it cloud or on-premises.

Additionally, the Data Governance & Compliance solutions within this segment have witnessed increased adoption as businesses strive to establish a standardized framework for data management and ensure adherence to legal and regulatory requirements. The emphasis on data integrity and accessibility, along with the need to mitigate risks associated with data security, has propelled the demand for comprehensive software solutions. These solutions not only provide the mechanisms for enforcing data security policies but also offer insights and analytics to optimize data management practices.

Deployment Analysis

In 2023, the Cloud segment held a dominant market position within the Data Centric Security Market, capturing more than a 53% share. This significant market share can be attributed to the accelerated migration of businesses towards cloud computing platforms, spurred by the need for scalable, flexible, and cost-effective data storage solutions.

The cloud deployment model offers the advantage of remote data management and enhanced collaboration capabilities, making it an attractive option for organizations looking to optimize their data security measures in a rapidly evolving digital landscape. The leadership of the Cloud segment is further reinforced by its inherent capability to facilitate robust data protection and compliance strategies.

As organizations navigate the complexities of complying with stringent data protection regulations, cloud-based data security solutions offer streamlined and automated processes to manage data privacy and security requirements efficiently. These solutions provide comprehensive data protection features, including advanced encryption, access control, and threat detection mechanisms, which are crucial for safeguarding sensitive information stored on cloud platforms.

Moreover, the adoption of cloud-based data centric security solutions is driven by their scalability and ease of integration with existing IT infrastructure. Businesses can leverage cloud services to deploy security measures dynamically, adapting to changing data volumes and threat landscapes without the need for significant capital investment in physical hardware.

This flexibility, combined with the ongoing advancements in cloud security technologies, has propelled the Cloud segment to the forefront of the Data Centric Security Market. As organizations continue to prioritize data security in their digital transformation journeys, the Cloud segment’s prominence is expected to grow, underscoring its critical role in enabling secure and compliant data management practices.

Enterprise Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the Data Centric Security Market, capturing more than a 55% share. This considerable market share can be attributed to the heightened need for robust data security solutions within large organizations. Large enterprises, characterized by their extensive operational scale and complex data ecosystems, face significant data management challenges.

The vast volumes of sensitive information they handle, ranging from customer data to intellectual property, necessitate advanced security measures to prevent breaches and ensure regulatory compliance. Furthermore, the increasing sophistication of cyber threats has underscored the importance of data-centric security solutions for these entities.

The leadership of the Large Enterprises segment in the Data Centric Security Market is further reinforced by their substantial financial capabilities. These organizations allocate significant budgets to cybersecurity, enabling them to invest in cutting-edge data security solutions. Such investments are crucial for safeguarding against evolving threats and minimizing potential financial and reputational damages arising from data breaches.

Additionally, large enterprises often operate across multiple jurisdictions, requiring compliance with a complex web of data protection laws. This regulatory landscape has driven the adoption of comprehensive data-centric security solutions, further solidifying the segment’s market dominance.

Moreover, the strategic emphasis on digital transformation initiatives among large enterprises has propelled the demand for data-centric security solutions. As these organizations embark on digitalization to improve operational efficiency and customer engagement, the need to protect digital assets becomes paramount. Data-centric security solutions offer a holistic approach to securing the organization’s data throughout its lifecycle, irrespective of its location.

This capability is particularly appealing to large enterprises that manage data across diverse platforms and environments. Consequently, the combination of regulatory pressures, the complexity of managing vast data volumes, and the strategic imperative to secure digital transformation initiatives have positioned the Large Enterprises segment as the leading segment in the Data Centric Security Market.

Industry Vertical Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Data Centric Security Market, capturing more than a 26% share. This leading position is primarily attributed to the critical nature of the data handled by the BFSI sector, including sensitive financial information, personal identification details, and transaction records.

The intrinsic value of this data not only makes it a prime target for cyber threats but also places the sector under stringent regulatory scrutiny. Institutions within the BFSI sector are thus compelled to implement robust data-centric security measures to protect against data breaches, ensure customer trust, and comply with regulations such as GDPR, PCI DSS, and others.

The prominence of the BFSI segment in the Data Centric Security Market is further bolstered by the sector’s rapid digital transformation. As BFSI institutions embrace online banking, mobile applications, and digital transactions, the surface area for potential cyber attacks expands significantly. This digital shift necessitates advanced security solutions that can safeguard data across various platforms and networks, making data-centric security an indispensable component of the sector’s cybersecurity strategy.

Moreover, the increasing use of technologies such as cloud computing and big data analytics within BFSI operations requires sophisticated data-centric security solutions to manage risks associated with data storage, processing, and transmission. Additionally, the competitive landscape of the BFSI sector drives the continuous innovation and adoption of cutting-edge data-centric security solutions. Financial institutions seek to differentiate themselves by offering secure, reliable services, thereby enhancing customer loyalty and attracting new business.

Key Market Segments

By Component

- Software & Solution

- Data Discovery & Classification

- Data Protection

- Data Governance & Compliance

- Others

- Services

- Professional

- Managed

By Deployment

- On-premise

- Cloud

By Enterprise Size

- Large Enterprises

- SMEs

By Industry Vertical

- BFSI

- IT & Telecom

- Government & Defense

- Healthcare

- Retail

- Others

Driver

Increasing Demand for Data-Centric Security Solutions for Cloud-Based Data Security

The escalating demand for data-centric security solutions, particularly for cloud-based data security, reflects a pivotal driver in the cybersecurity landscape. As organizations increasingly migrate their operations and data storage to cloud environments, the necessity to protect sensitive information from unauthorized access and cyber threats intensifies. Cloud-based platforms, while offering scalability and efficiency, also present unique security challenges due to the shared responsibility model and the potential for data exposure in multi-tenant environments.

Data-centric security solutions address these concerns by focusing on protecting the data itself, rather than the perimeter, ensuring encryption, access control, and monitoring are applied directly to the data, irrespective of its location. This approach is crucial in a cloud-centric world, where traditional security measures fall short, thereby fueling the demand for sophisticated data-centric security mechanisms.

Restraint

Organization’s Tolerance for Inconvenience and Security Breaches Due to Internal Vulnerabilities

A significant restraint facing the adoption of data-centric security solutions is organizations’ tolerance for inconvenience and the potential security breaches stemming from internal vulnerabilities. Many businesses prioritize operational efficiency and user convenience over stringent security measures, which can lead to the underutilization of comprehensive data-centric security solutions. The complexity and potential for disruption associated with implementing robust data security protocols can deter organizations from adopting necessary measures.

Additionally, internal vulnerabilities, such as insufficient employee training on security practices or the misuse of access privileges, further exacerbate the risk of data breaches. This tolerance for convenience over security underscores a critical challenge in enhancing organizational cybersecurity posture, highlighting the need for balancing user experience with the imperative of data protection.

Opportunity

Increase in Data Breaches Provide More Opportunities to Data-Centric Security Vendors

The rise in data breaches presents a significant opportunity for data-centric security vendors. As organizations grapple with the consequences of cyber attacks, including financial loss, reputational damage, and regulatory penalties, the urgency to adopt effective data protection measures escalates. This environment creates a fertile ground for data-centric security solutions, which offer a more holistic and effective approach to safeguarding sensitive information.

By focusing on protecting the data itself, regardless of where it resides, data-centric security vendors are well-positioned to address the evolving threats and complexities of modern cybersecurity. The increasing incidence of data breaches not only highlights the vulnerabilities in current security practices but also underscores the critical demand for innovative solutions that can preemptively secure data against unauthorized access.

Challenge

Lack of Awareness Toward Data-Centric Security Solutions

A prominent challenge in the proliferation of data-centric security solutions is the lack of awareness among organizations about the benefits and functionalities of these advanced security measures. Despite the growing cyber threat landscape, many businesses remain unfamiliar with the concept of data-centric security and how it differs from traditional perimeter-based security approaches. This gap in understanding can hinder the adoption of data-centric security practices, leaving sensitive data vulnerable to breaches and unauthorized access.

Educating organizations about the importance of protecting data at its core, the potential risks of neglecting such measures, and the long-term benefits of implementing data-centric security solutions is crucial. Overcoming this challenge requires concerted efforts from vendors, cybersecurity experts, and industry bodies to promote awareness and understanding of data-centric security’s critical role in contemporary cybersecurity strategies.

Regional Analysis

In 2023, North America held a dominant market position in the Data Centric Security Market, capturing more than a 36% share. This substantial market share can be attributed to the region’s advanced technological infrastructure, stringent regulatory landscape, and the presence of a large number of global corporations with significant investments in data security.

North America, particularly the United States, has been at the forefront of adopting cutting-edge cybersecurity solutions due to the high prevalence of cyber threats and the sophisticated nature of cyber attacks targeting both the public and private sectors. The region’s emphasis on protecting critical infrastructure and sensitive data across industries such as finance, healthcare, and government has driven the demand for robust data-centric security solutions.

Furthermore, North America’s leadership in the Data Centric Security Market is reinforced by its stringent regulatory environment. Regulations such as the California Consumer Privacy Act (CCPA) and the Health Insurance Portability and Accountability Act (HIPAA) mandate rigorous data protection standards, compelling organizations to adopt comprehensive data-centric security measures.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Data Centric Security Market is characterized by the presence of several key players who are instrumental in shaping the industry’s landscape through their innovative solutions, strategic partnerships, and global reach. These players not only contribute to the market’s growth but also play a pivotal role in advancing data-centric security technologies. Below is an analysis of some key players in the market, focusing on their strengths, product offerings, and strategic initiatives.

Top Market Leaders

- Egnyte

- Virtru

- Netwrix

- Sophos

- Informatica

- IBM Corporation

- Broadcom

- Varonis Systems

- Micro Focus

- Orange Cyberdefense

- Infogix

- Other key players

Recent Developments

1. Informatica:

- January 2023: Launched Data Privacy Management Cloud, a unified platform for data discovery, classification, masking, and lineage tracking, empowering organizations to comply with data privacy regulations like GDPR and CCPA.

- April 2023: Partnered with Oracle to offer an integrated solution for cloud security and data governance. This combined offering leverages Informatica’s data security capabilities with Oracle’s cloud infrastructure to provide comprehensive data protection.

- July 2023: Acquired Precisely, a leader in data integration and data quality solutions. This acquisition strengthens Informatica’s data governance portfolio and helps organizations ensure data accuracy and consistency for security purposes.

2. Broadcom:

- March 2023: Launched Symantec Data Loss Prevention (DLP) 16.0, an enhanced version of its DLP solution offering improved data classification, anomaly detection, and user activity monitoring capabilities.

- August 2023: Partnered with Microsoft to integrate its DLP solution with Microsoft Azure Information Protection (AIP), enabling seamless data protection across hybrid cloud environments.

- December 2023: Acquired Pisto Technology, a leading provider of endpoint security solutions. This acquisition expands Broadcom’s security portfolio and strengthens its data protection capabilities for mobile devices and endpoints.

Report Scope

Report Features Description Market Value (2023) US$ 5,501.2 Mn Forecast Revenue (2033) US$ 52,813.0 Mn CAGR (2024-2033) 25.38% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software & Solution ( Data Discovery & Classification, Data Protection, Data Governance & Compliance, Others), Services (Professional, Managed)), By Deployment (On-premise, Cloud), By Enterprise Size (Large Enterprises and SMEs), By Industry Vertical (BFSI, IT & Telecom, Government & Defense, Healthcare, Retail, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Egnyte, Virtru, Netwrix, Sophos, Informatica, IBM Corporation, Broadcom, Varonis Systems, Micro Focus, Orange Cyberdefense, Infogix, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Data Centric Security?Data Centric Security is an approach to data protection that focuses on securing the data itself rather than the network or device that stores or transmits it. This approach ensures that data remains secure regardless of where it is stored or how it is accessed.

How big is Data Centric Security Market?The Global Data Centric Security Market size is expected to be worth around USD 52,813.0 Million by 2033, from USD 5,501.2 Million in 2023, growing at a CAGR of 25.38% during the forecast period from 2024 to 2033.

What are the Key Trends in the Data Centric Security Market?Some key trends in the Data Centric Security market include the adoption of cloud-based solutions, integration with other security technologies, focus on data privacy, and emphasis on compliance.

What are the Challenges Facing the Data Centric Security Market?Some challenges facing the Data Centric Security market include complexity, integration, cost, and compliance.

Who are the Key Players in the Data Centric Security Market?Some key players in the Data Centric Security market include Egnyte, Virtru, Netwrix, Sophos, Informatica, IBM Corporation, Broadcom, Varonis Systems, Micro Focus, Orange Cyberdefense, Infogix, Other key players

Data Centric Security MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample

Data Centric Security MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Egnyte

- Virtru

- Netwrix

- Sophos

- Informatica

- IBM Corporation

- Broadcom

- Varonis Systems

- Micro Focus

- Orange Cyberdefense

- Infogix

- Other key players