Global Data Center Robotic Market Size, Share, Trends Analysis Report By Component (Hardware, Software, Services), By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Robot Type (Collaborative Robots, Industrial Robots, Service Robots), By Vertical (BFSI, Healthcare, Education, IT & Telecom, Government, Retail & E-commerce, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 132818

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

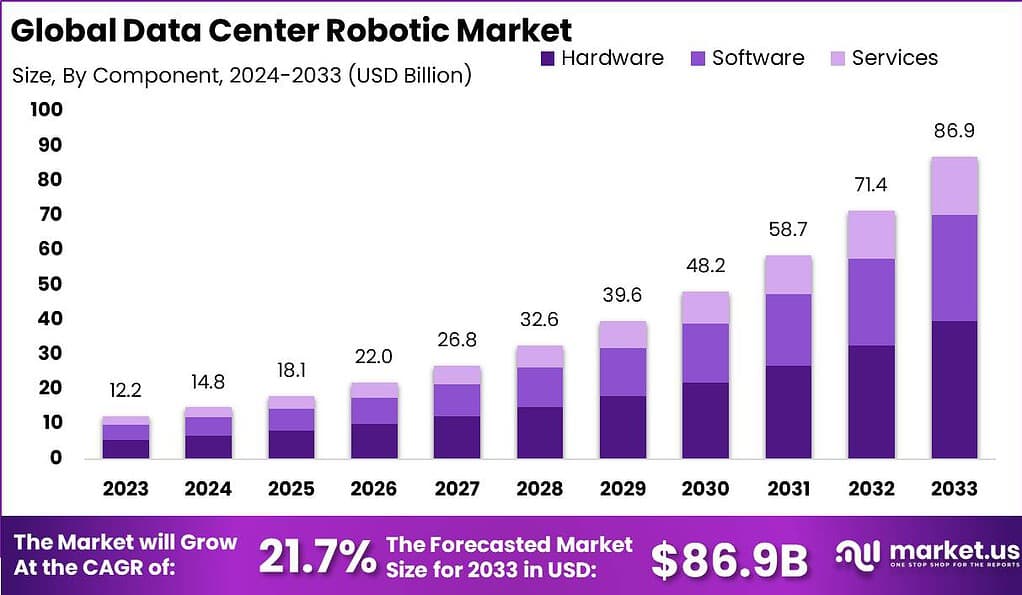

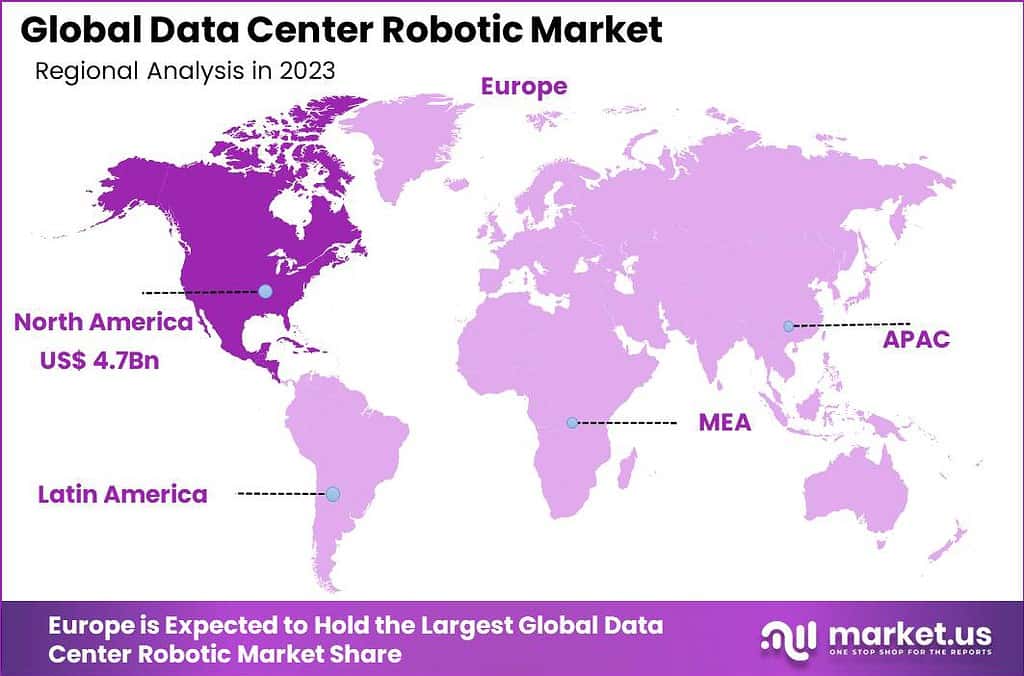

The Global Data Center Robotic Market size is expected to be worth around USD 86.9 Billion By 2033, from USD 12.2 billion in 2023, growing at a CAGR of 21.7% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 38.6% share, holding USD 4.7 Billion revenue.

Data center robotics refers to the use of robotic systems to automate various tasks in data centers, such as server management, maintenance, and monitoring. These robots are designed to operate autonomously within the complex environment of data centers, handling tasks ranging from installing servers to managing cables and even conducting inspections.

The data center robotics market is experiencing significant growth, driven by the increasing demand for data center services and the need for operational efficiency. This market encompasses the development, production, and deployment of robotic systems specifically tailored for data center applications. As businesses increasingly rely on data storage and processing, the expansion of data centers fuels the adoption of robotic solutions to manage the scale and complexity of these facilities.

The primary driver for the adoption of robotics in data centers is the need to automate to manage the increasing scale and complexity of data center operations. Automation not only helps in reducing the labor costs but also enhances the precision and efficiency of operations, such as maintenance and real-time monitoring of critical metrics like temperature and humidity. This leads to better management of the data center environment and can preemptively address issues before they escalate.

The market demand for data center robotics is bolstered by technological advancements that enable robots to perform a variety of tasks more effectively. These include the use of sensors and AI to monitor systems and predict failures, thereby reducing downtime and increasing the reliability of data centers. Innovations in robotics are also making these systems more adaptable and capable of working in complex environments, which is crucial for modern data centers that handle vast amounts of data.

For instance, In April 2024, UiPath, a leading enterprise automation and AI software provider, expanded its presence in India by launching two new data centers in Pune and Chennai. This move reflects the rising demand for cloud services in the region, with a focus on ensuring business continuity and meeting compliance standards. The new facilities are designed to deliver faster service and improved accessibility for customers, thanks to high availability and low latency capabilities.

There are significant opportunities in the data center robotics market, particularly in enhancing data center sustainability and operational efficiency. The integration of AI with robotics has led to the development of more sophisticated and capable robotic systems. AI enhances the functionality of robotics in data centers by enabling real-time decision-making and improving the management of resources.

Key Takeaways

- The global data center robotics market is on a remarkable growth trajectory. The market is expected to grow from USD 12.2 billion in 2023 to a staggering USD 86.9 billion by 2033, with a compound annual growth rate (CAGR) of 21.7% during the forecast period from 2024 to 2033.

- In 2023, North America held the leading position in the market, accounting for more than 38.6% of the total share and generating USD 4.7 billion in revenue. This dominance is fueled by advanced infrastructure and the rapid adoption of robotics in data centers across the region.

- The Hardware segment emerged as the largest contributor within the market, capturing over 45.7% of the market share in 2023. This includes robotic arms, sensors, and physical automation devices, which are critical for efficient operations.

- Large enterprises accounted for the majority of the market share, contributing over 64.2% in 2023. Their extensive data management needs and investment capacity make them key drivers of the sector.

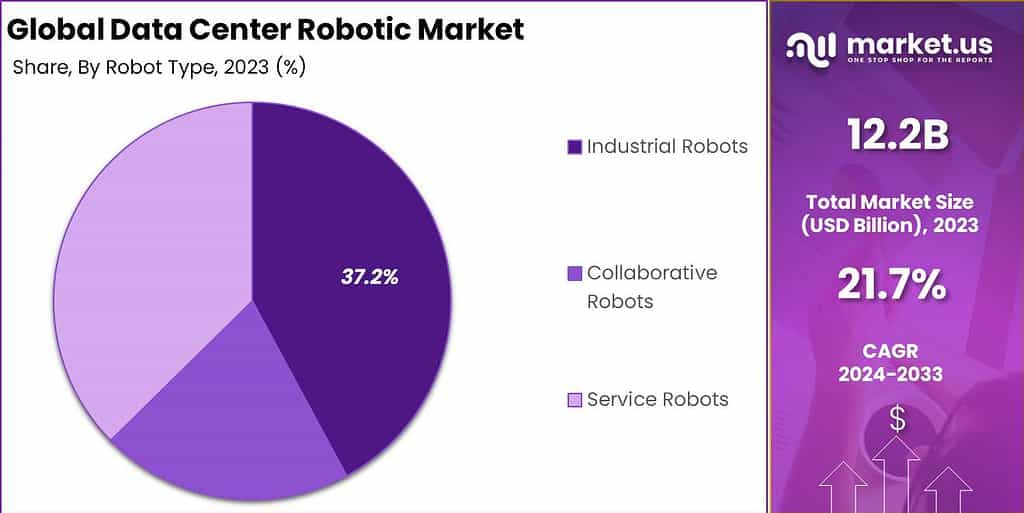

- Among the types of robotics, the Industrial Robots segment was at the forefront, commanding more than 37.2% of the market share in 2023. These robots play a vital role in automating repetitive tasks, improving efficiency, and reducing downtime in data center operations.

- The IT & Telecom sector stood out as a significant application area, representing over 21% of the market share in 2023. With massive amounts of data generated daily, this sector’s reliance on robotics is only set to grow.

Component Analysis

In 2023, the Hardware segment held a dominant market position within the data center robotics market, capturing more than a 45.7% share. This significant market share can be attributed to the essential role that hardware components, such as robotic arms, mobile robots, and server lifting systems, play in the automation of physical tasks in data centers.

The demand for hardware is driven by the need to enhance operational efficiency, reduce human intervention, and minimize the risk of errors and injuries associated with manual labor in data center environments. The importance of the Hardware segment is underscored by the increasing scale and complexity of data centers. As facilities expand to accommodate more data and improve services, the integration of sophisticated robotics hardware becomes crucial.

These hardware solutions are designed not only for routine tasks like server handling and precision cable management but also for complex operations that require high reliability and speed. This segment’s growth is further fueled by continuous innovations in robotics technology, which enhance the capabilities of these hardware systems to operate in diverse and challenging data center environments.

Additionally, the ongoing trend towards sustainability in data centers emphasizes the need for efficient hardware that can operate continuously without excessive energy consumption or frequent maintenance. Advanced robotic hardware meets these criteria, offering energy-efficient solutions that align with green technology initiatives.

As data centers evolve, the reliance on robust hardware that can support high-density configurations and maintain optimal cooling and energy distribution is expected to drive further growth in this segment. Overall, the Hardware segment’s dominance in the data center robotics market reflects its critical role in facilitating smooth and efficient data center operations. As technology advances and the demand for data storage and processing grows, the need for innovative hardware solutions in data centers is anticipated to increase, sustaining this segment’s significant market share.

Enterprise Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the data center robotics market, capturing more than a 64.2% share. This dominance is largely due to the extensive requirements of large enterprises for robust data management and storage solutions, which necessitate the adoption of automated and efficient data center operations.

Large enterprises typically operate vast data centers that handle immense volumes of data, making automation not just a luxury but a critical operational necessity. The use of robotics in these settings helps ensure the high reliability and precision required to manage large-scale data infrastructure effectively. Furthermore, large enterprises often have the financial capability to invest in advanced robotic technologies, which can be expensive and complex to implement.

This financial flexibility allows them to leverage the latest innovations in robotics, such as AI-driven automation and machine learning for predictive maintenance and enhanced security. The investment in these technologies helps large enterprises minimize downtime, reduce operational costs, and improve overall efficiency, thereby justifying the significant share of this market segment.

Additionally, the strategic importance of data center reliability and efficiency in supporting global operations compels large enterprises to adopt robotic solutions that can provide 24/7 operational capabilities without the risk of human error. The scalability offered by robotics also aligns with the needs of large enterprises that frequently expand their data capabilities and infrastructure to support growth and international operations.

Overall, the Large Enterprises segment’s predominance in the data center robotics market is reinforced by their critical need for automation to manage extensive data operations, coupled with their capacity to invest in cutting-edge technology. This trend is expected to continue as more large enterprises recognize the operational benefits and cost efficiencies driven by robotics in data centers.

Robot Type Analysis

In 2023, the Industrial Robots segment held a dominant market position in the data center robotics market, capturing more than a 37.2% share. This segment’s prominence is largely due to the critical role that industrial robots play in automating heavy-duty tasks within data centers, such as equipment installation, heavy lifting, and structured cabling.

These tasks require precision and strength beyond human capabilities, making industrial robots indispensable for large-scale and high-density data centers where efficiency and precision are paramount. Industrial robots are favored in these environments for their robustness, reliability, and ability to operate continuously under strenuous conditions without fatigue, which significantly reduces the risk of downtime and enhances overall operational efficiency.

Their advanced technical capabilities allow for the handling of sensitive and expensive equipment with a level of precision that minimizes the risk of damage, a crucial factor in environments where even minor errors can lead to significant financial losses. Moreover, the evolution of smart factories and the integration of the Internet of Things (IoT) in industrial operations have driven the adoption of these robots.

Industrial robots integrated with AI and machine learning algorithms are capable of performing not only mechanical tasks but also of making data-driven decisions to optimize data center operations. This technological advancement has broadened the scope of industrial robots, enabling them to undertake more complex and varied tasks, thereby reinforcing their utility and dominance in the market.

Overall, the Industrial Robots segment continues to lead the data center robotics market due to its ability to meet the demanding requirements of modern data centers. As these facilities evolve, the reliance on industrial robots is expected to grow, driven by their unmatched efficiency, durability, and capacity for integration with advanced technological systems.

Vertical Analysis

In 2023, the IT & Telecom segment held a dominant market position in the data center robotics market, capturing more than a 21% share. This sector’s substantial share is primarily attributed to the critical need for managing vast data traffic and ensuring continuous service availability, which are pivotal in the IT and telecommunications industries.

These industries rely heavily on data centers to store, process, and manage the enormous amounts of data generated by increasing internet usage and mobile connectivity. The deployment of robotics in IT & Telecom data centers significantly enhances operational efficiency by automating routine tasks such as server management, maintenance, and monitoring. This not only helps in reducing the scope for human error but also ensures faster response times to any technical malfunctions, thereby minimizing downtime and improving service reliability.

As IT & Telecom companies are at the forefront of technology adoption, they are also more likely to invest in sophisticated robotic solutions that can provide advanced analytics and predictive maintenance capabilities. Furthermore, the ongoing expansion of cloud services and the rollout of 5G technology necessitate the modernization of data center infrastructure in the IT & Telecom sector.

Robotic systems play a crucial role in this transformation by enabling more agile and scalable operations. They are instrumental in managing the increased load and complexity of new technologies and services, which require not just maintenance but continuous optimization and scaling.

Overall, the significant market share of the IT & Telecom segment in the data center robotics market reflects its essential role in supporting the rapid pace of technological advancements and service demands within this industry. As digital transformation initiatives continue to expand across the globe, the adoption of robotics in IT & Telecom data centers is expected to grow, further driving the efficiency and reliability of services they provide.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Robot Type

- Collaborative Robots

- Industrial Robots

- Service Robots

By Vertical

- BFSI

- Healthcare

- Education

- IT & Telecom

- Government

- Retail & E-commerce

- Others

Driver

Expanding Data Center Needs and Automation

One of the main drivers of the data center robotics market is the escalating demand for data processing capabilities driven by the digital transformation across industries. As businesses generate more data, the need for efficient data management and processing becomes crucial.

Robotics provides a reliable solution by automating repetitive and labor-intensive tasks such as server maintenance, hardware installations, and cable management, which enhances operational efficiency and reduces the likelihood of human error. This automation is essential not only for handling the increasing scale of data but also for ensuring faster and more reliable data center operations.

Restraint

High Initial Costs and Integration Complexity

A significant restraint in the data center robotics market is the high initial cost associated with deploying robotic systems. These costs include not just the robots themselves but also the necessary infrastructure modifications and integration with existing IT systems.

Additionally, the complexity of integrating advanced robotic solutions into existing data center operations poses a challenge. It requires specialized expertise to ensure that the robotics systems are compatible with current infrastructure, which can add to the overall expense and deter smaller enterprises or those with limited technical capabilities from adopting these advanced technologies.

Opportunity

Remote Data Center Management and Monitoring

The advancement of robotics technology offers substantial opportunities in remote data center management and monitoring. Robots equipped with sensors and cameras can perform real-time environmental monitoring, security surveillance, and remote troubleshooting, which significantly enhances the resilience and efficiency of data center operations.

This capability is particularly valuable in maintaining the continuity of services and operational reliability across widespread or hard-to-reach locations. As such, robotics not only improve operational efficiency but also help in reducing the downtime and labor costs associated with traditional data center management methods.

Challenge

Navigating Regulatory and Technical Challenges

Data center robotics face regulatory and technical challenges that can hinder their widespread adoption. Ensuring compliance with local and international regulations regarding data security and operational standards is a significant hurdle. Moreover, the technical challenges of customizing robotic solutions to meet specific data center needs without disrupting existing operations require continuous innovation and adaptation.

These challenges necessitate ongoing research and development efforts and may require collaborations between robotics manufacturers and data center operators to ensure that the deployed solutions are both effective and compliant with regulatory standards.

Growth Factors

The rapid expansion of the data center robotics market is primarily fueled by the growing need for automation to enhance operational efficiency and manage the increasing data flow in modern data centers. Automation facilitates not only routine tasks like hardware installations and server maintenance but also complex operations, leading to significant reductions in downtime and overall enhanced system reliability.

This drive towards automation is further supported by advancements in artificial intelligence (AI) and machine learning (ML), which integrate with robotic systems to optimize data center operations through energy management and predictive maintenance capabilities. Additionally, the increasing adoption of cloud technologies and big data necessitates scalable and efficient solutions that robotics can provide, ensuring data centers can handle the larger scales of data processing required today.

Emerging Trends

One of the most notable trends is the integration of collaborative robots (cobots) that work alongside human operators, enhancing operational efficiency and safety within data centers. These cobots are increasingly used for tasks requiring precision and reliability, which are critical in high-stakes environments like data centers.

Moreover, there’s a growing emphasis on sustainability, with robotic solutions playing a pivotal role in reducing the environmental impact of data center operations. This trend is complemented by the development of smarter data center solutions that leverage robotics for improved security, operational control, and task versatility. The push towards digital transformation across various industries is also creating new opportunities for the deployment of advanced robotic systems in data centers.

Business Benefits

Adopting robotics in data centers brings numerous business benefits, including enhanced efficiency and accuracy in operations, leading to cost savings and improved customer experience. Robots excel in inventory management and can significantly reduce the latency between order processing and delivery, especially in sectors like retail and e-commerce. They also contribute to better resource management by automating energy-intensive tasks, thus reducing operational costs.

Furthermore, data center robotics allow for better scalability and flexibility in managing varying workloads, which is particularly beneficial for rapidly growing sectors like IT and telecommunications. The ability to maintain high standards of security and compliance with fewer human errors is another critical advantage, ensuring that businesses can protect sensitive data and meet stringent regulatory requirements effectively.

Regional Analysis

In 2023, North America held a dominant market position in the data center robotics market, capturing more than a 38.6% share with revenue amounting to USD 4.7 billion. This leadership stems from several factors that uniquely position North America at the forefront of the data center robotics industry.

Firstly, the region is home to some of the world’s largest technology companies and data centers that continuously innovate and integrate new technologies to maintain competitive edges, such as robotics for enhanced data management and operational efficiency.

The high adoption rate of advanced technologies such as AI, machine learning, and the Internet of Things (IoT) in North American data centers significantly contributes to this dominance. These technologies are integral to the functioning of modern robotics systems, enhancing their ability to perform tasks ranging from maintenance and monitoring to security and logistics more effectively and with minimal human intervention.

Moreover, the regulatory environment in North America supports the adoption of such advanced technologies. Strict data security and privacy regulations push data centers to adopt the most efficient and secure ways to manage and protect data. Robotics offers a solution that not only meets these stringent standards but also helps in reducing operational costs and improving reliability.

Additionally, the presence of a robust educational and technological infrastructure provides ongoing innovation and a skilled workforce to develop, deploy, and maintain robotic systems. This environment fosters a culture of technological advancement and supports the extensive R&D activities necessary to lead in the global data center robotics market. As a result, North America not only dominates in terms of market share but also drives significant advancements in data center robotic technologies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the data center robotics market, the presence of key players such as Cisco Systems, Inc., Rockwell Automation Inc., ABB, Hewlett Packard Enterprise Development LP (HPE), Siemens AG, Huawei Technologies Co., Ltd., ConnectWise, LLC, BMC Software, Inc., Microsoft Corporation, NTT Communications, and Amazon Web Services, indicates a highly competitive and dynamic industry.

Cisco Systems, Inc. is renowned for its networking hardware and telecommunications equipment, which are critical in managing the data flow and security in robotic operations within data centers. Cisco’s integration of network architecture with robotics technology helps streamline operations and enhance data center efficiency.

Rockwell Automation Inc. specializes in industrial automation and digital transformation. Its technologies are pivotal in automating complex data center operations, thus ensuring more reliable and efficient data management systems.

ABB is a leader in electrification and automation technologies. Their robotics solutions are integral to modernizing data centers, enhancing operational efficiency, and reducing human error in high-stakes environments.

Top Key Players in the Market

- Cisco Systems, Inc.

- Rockwell Automation Inc.

- ABB

- Hewlett Packard Enterprise Development LP

- Siemens AG

- Huawei Technologies Co., Ltd.

- ConnectWise, LLC

- BMC Software, Inc.

- Microsoft Corporation

- NTT Communications

- Amazon Web Services

- Other Key Players

Recent Developments

- In May 2024, Microsoft announced the Trillium chip, designed to enhance AI data center performance by nearly five times compared to previous generations, aiming to meet the growing demand for machine learning applications.

- In May 2024, SoftBank invested in Indian companies focusing on data centers and industrial robotics. This strategic investment aims to build a robust infrastructure for AI technologies, recognizing the high growth potential in these areas. SoftBank’s move into industrial robotics seeks to introduce more automation and AI into manufacturing, enhancing operational efficiencies and productivity.

- Earlier, in March 2024, NVIDIA launched Project GR00T, a groundbreaking initiative in the realm of humanoid robotics. Named Generalist Robot 00 Technology, GR00T is a foundation model designed to equip humanoid robots with the ability to understand natural language, mimic human gestures, and learn new skills from human interaction.

Report Scope

Report Features Description Market Value (2023) USD 12.2 Bn Forecast Revenue (2033) USD 86.9 Bn CAGR (2024-2033) 21.7% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Robot Type (Collaborative Robots, Industrial Robots, Service Robots), By Vertical (BFSI, Healthcare, Education, IT & Telecom, Government, Retail & E-commerce, Others) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Cisco Systems Inc., Rockwell Automation Inc., ABB, Hewlett Packard Enterprise Development LP, Siemens AG, Huawei Technologies Co. Ltd., ConnectWise LLC, BMC Software Inc., Microsoft Corporation, NTT Communications, Amazon Web Services, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Center Robotic MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample

Data Center Robotic MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Cisco Systems, Inc.

- Rockwell Automation Inc.

- ABB

- Hewlett Packard Enterprise Development LP

- Siemens AG

- Huawei Technologies Co., Ltd.

- ConnectWise, LLC

- BMC Software, Inc.

- Microsoft Corporation

- NTT Communications

- Amazon Web Services

- Other Key Players