Global Dairy Starter Culture Market Size, Share Analysis Report By Type (Mesophilic Type, Thermophilic Type, Probiotics, Others), By Form (Liquid, Powder, Freeze-Dried), By Fermentation Type (Yeast-Lactic Acid, Fungus-Lactic Acid, Lactic Acid), By Application (Cheese, Yogurt, Kefir), By End-use (Dairy and Dairy-Based Products, Meat and Seafood, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152861

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

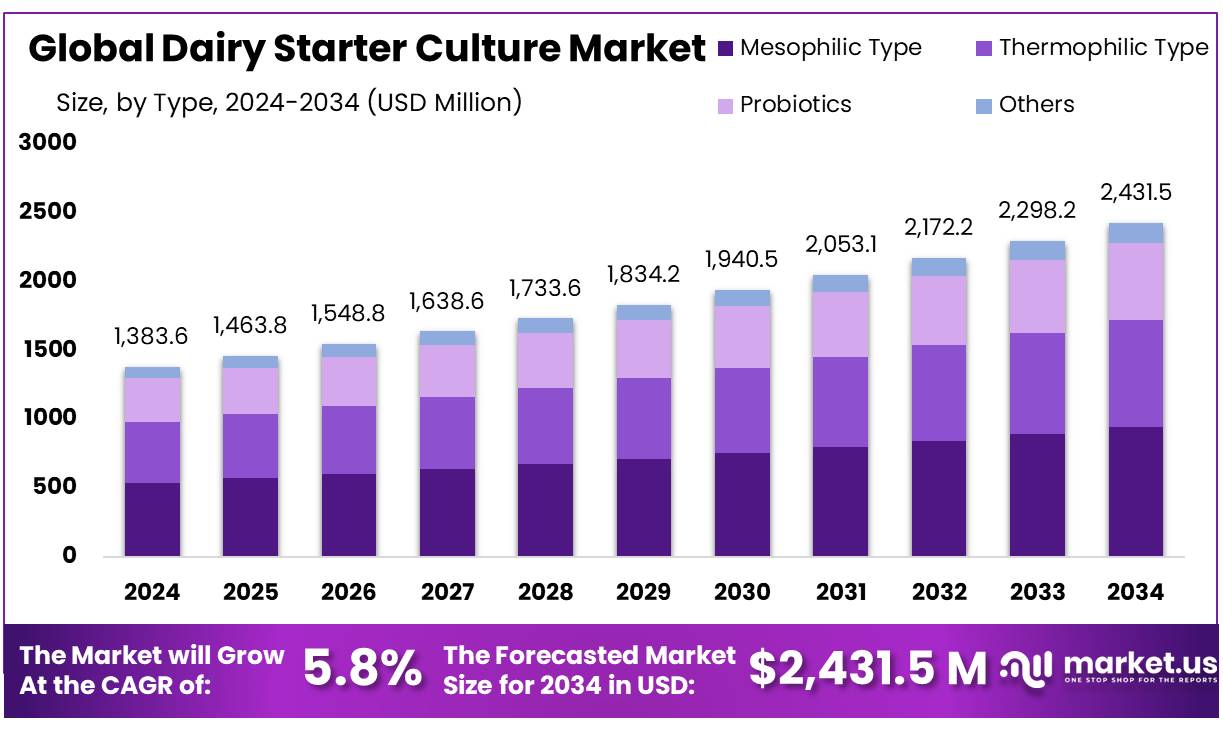

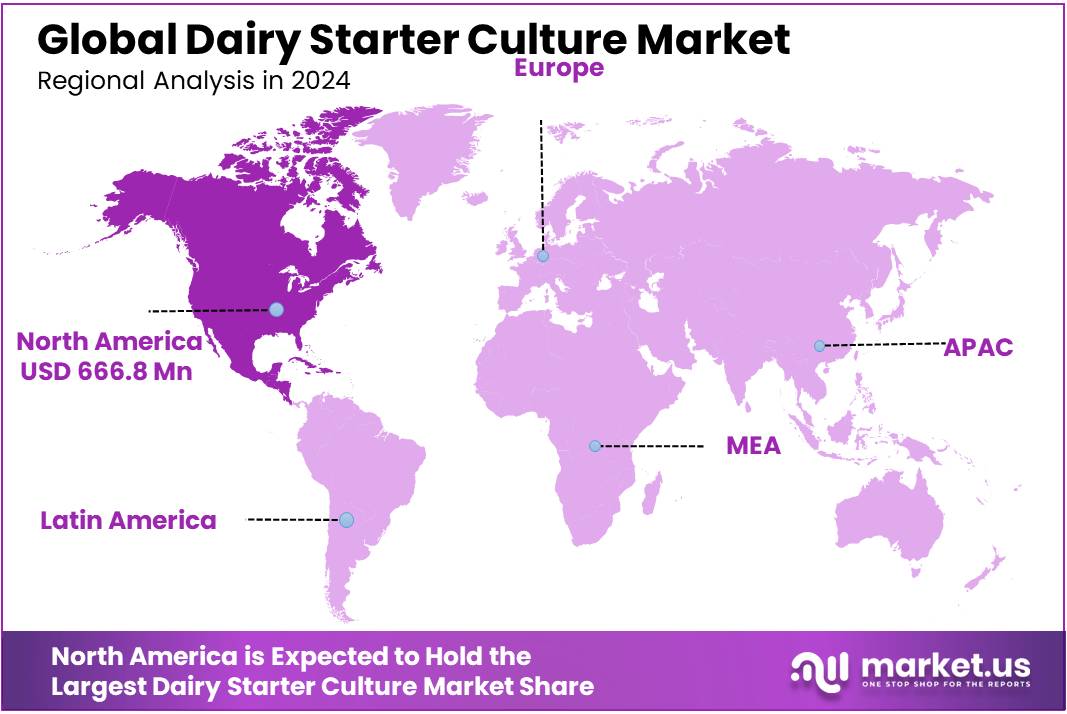

The Global Dairy Starter Culture Market size is expected to be worth around USD 2431.5 Million by 2034, from USD 1383.6 Million in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034. In 2024, North American held a dominant market position, capturing more than a 48.2% share, holding USD 666.8 Million revenue.

Dairy starter culture concentrates, comprising mesophilic, thermophilic, and probiotic strains, function as essential microbial agents in the transformation of raw milk into cheese, yogurt, fermented butter, and other cultured dairy products. These concentrates, commonly available in concentrated forms such as frozen, freeze-dried, or liquid cultures, become activated upon addition to milk, initiating fermentation that yields desired organoleptic and textural properties. Their utilization ensures product consistency, enhanced shelf life, and compliance with food safety regulations.

Health-oriented government initiatives further stimulate demand. In India, the National Animal Disease Control Programme and Dairy Entrepreneurship Development Scheme provide vaccination and subsidy support to dairy farms, facilitating herd expansion and production capacity growth. Concurrently, the Animal Husbandry Infrastructure Development Fund—valued at ₹15,000 crore—promotes infrastructure development, indirectly supporting downstream industries such as starter culture production.

The National Dairy Development Board coordinates the National Dairy Plan, bolstering production via Operation Flood—the world’s most extensive dairy cooperative movement—which elevated national milk output to approximately 187.7 million tonnes by 2018–19, with per-capita availability at 394 g/day. Such government-backed cooperation infrastructure stimulates downstream demand for starter cultures within processing facilities.

Future growth opportunities lie in both functional and geographic diversification. First, the rise of functional dairy products enriched with probiotic benefits presents expanding application avenues. FAO/WHO has observed improved gastrointestinal outcomes linked to fermented dairy, reinforcing producer investment. Second, emerging economies in Asia Pacific, notably India and China, are gaining rapid adoption rates.

Key Takeaways

- Dairy Starter Culture Market size is expected to be worth around USD 2431.5 Million by 2034, from USD 1383.6 Million in 2024, growing at a CAGR of 5.8%.

- Mesophilic Type held a dominant market position, capturing more than a 38.9% share in the global dairy starter culture market.

- Freeze-Dried held a dominant market position, capturing more than a 48.3% share in the global dairy starter culture market.

- Lactic Acid held a dominant market position, capturing more than a 67.2% share in the global dairy starter culture market.

- Cheese held a dominant market position, capturing more than a 55.5% share in the global dairy starter culture market.

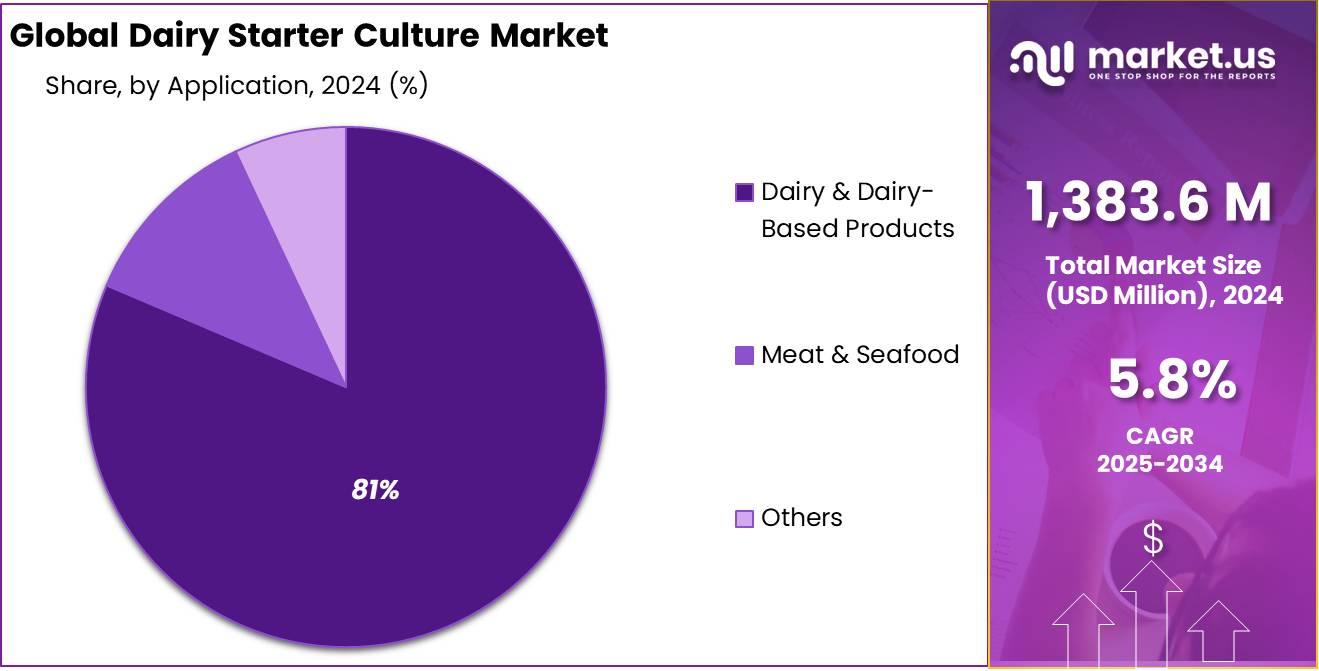

- Dairy and Dairy-Based Products held a dominant market position, capturing more than a 81.4% share in the global dairy starter culture market.

- North America emerged as the leading region within the dairy starter culture market, accounting for 48.2%, equivalent to approximately USD 666.8 million.

By Type Analysis

Mesophilic Type leads with 38.9% share driven by its versatile application in cheese and cultured dairy.

In 2024, Mesophilic Type held a dominant market position, capturing more than a 38.9% share in the global dairy starter culture market. This leadership is mainly due to its wide use in producing soft and semi-hard cheeses like cream cheese, cottage cheese, and traditional fermented milk products. Mesophilic cultures, which grow best at moderate temperatures between 20°C and 30°C, are preferred in regions where ambient conditions naturally support such fermentation ranges, making them cost-effective and easy to handle without extensive climate control.

Additionally, their ability to enhance flavor development, improve shelf stability, and ensure consistent acidification has made them a preferred choice in both artisanal and industrial dairy processing. With the growing demand for clean-label and traditional dairy products, the mesophilic type continues to be favored by manufacturers seeking high-quality output with minimal additives.

By Form Analysis

Freeze-Dried format dominates with 48.3% share due to its long shelf life and easy storage.

In 2024, Freeze-Dried held a dominant market position, capturing more than a 48.3% share in the global dairy starter culture market. This leading position can be attributed to the convenience, stability, and extended shelf life that freeze-dried cultures offer to dairy manufacturers. Unlike liquid or frozen formats, freeze-dried cultures do not require cold chain storage, making them ideal for transportation over long distances and for use in regions with limited refrigeration infrastructure.

Their compact form and ease of handling allow for accurate dosing, improved hygiene, and better consistency in end products. These features are particularly valuable in the production of yogurt, cheese, and other fermented dairy items where precision and repeatability are critical. The demand for freeze-dried cultures has also grown in small and medium-sized dairy enterprises that require culture solutions with minimal storage and equipment demands.

By Fermentation Type Analysis

Lactic Acid fermentation leads with 67.2% share due to its essential role in dairy preservation and taste.

In 2024, Lactic Acid held a dominant market position, capturing more than a 67.2% share in the global dairy starter culture market. This strong lead reflects the central role of lactic acid fermentation in the production of widely consumed dairy products such as yogurt, sour cream, buttermilk, and a wide range of cheeses. The fermentation process carried out by lactic acid bacteria helps in converting lactose into lactic acid, which not only improves the taste and texture of dairy products but also extends their shelf life naturally by lowering pH and inhibiting harmful microbes.

The high share of this segment is also supported by the growing preference for clean-label and naturally preserved foods among consumers. In both traditional and industrial dairy production, lactic acid fermentation is considered reliable, safe, and efficient, making it the standard fermentation method across the sector.

By Application Analysis

Cheese dominates with 55.5% share driven by rising global demand for artisanal and processed varieties.

In 2024, Cheese held a dominant market position, capturing more than a 55.5% share in the global dairy starter culture market. This large share is primarily due to the widespread use of starter cultures in cheese production, where they play a crucial role in acidification, flavor development, and texture formation. Different types of cheese—ranging from fresh varieties like mozzarella to aged types like cheddar and gouda—rely heavily on specific bacterial strains to achieve desired characteristics.

The steady rise in global cheese consumption, both in traditional markets like Europe and North America and emerging ones across Asia-Pacific, continues to support the growth of this application segment. In recent years, the demand for specialty and artisanal cheeses has surged, especially among health-conscious consumers seeking high-protein and probiotic-rich dairy products.

By End-use Analysis

Dairy and Dairy-Based Products lead with 81.4% share due to widespread use in everyday fermented foods.

In 2024, Dairy and Dairy-Based Products held a dominant market position, capturing more than a 81.4% share in the global dairy starter culture market. This overwhelming share is largely driven by the extensive application of starter cultures in producing everyday dairy staples such as yogurt, cheese, buttermilk, sour cream, and fermented milk beverages. Starter cultures are essential in developing the flavor, texture, and safety of these products, making them a foundational element in both industrial and small-scale dairy operations.

With the global increase in consumption of fermented dairy for their probiotic and digestive health benefits, demand for cultures in this end-use segment remains strong. Moreover, dairy-based foods are deeply rooted in many cultural diets, ensuring consistent year-round demand. Growth in urbanization, rising incomes, and the expanding middle class in emerging markets have further boosted the popularity of value-added dairy products.

Key Market Segments

By Type

- Mesophilic Type

- Thermophilic Type

- Probiotics

- Others

By Form

- Liquid

- Powder

- Freeze-Dried

By Fermentation Type

- Yeast-Lactic Acid

- Fungus-Lactic Acid

- Lactic Acid

By Application

- Cheese

- Yogurt

- Kefir

By End-use

- Dairy & Dairy-Based Products

- Meat & Seafood

- Others

Emerging Trends

Emphasis on Strain-Specific Starter Cultures

A notable trend in the dairy starter culture industry is the growing emphasis on strain-specific starter cultures. These specialized cultures are tailored to produce distinct flavors, textures, and functional properties in dairy products, particularly in fermented items like yogurt and cheese. The International Dairy Federation (IDF) highlights that over 226 bacterial and 95 fungal strains are utilized in dairy fermentation processes, underscoring the industry’s move towards precision in fermentation.

The Food and Agriculture Organization (FAO) notes that the increasing demand for probiotic-rich dairy products has driven the need for starter cultures that can deliver specific health benefits. This shift towards functional foods is supported by scientific research indicating that certain microbial strains can confer health benefits when consumed in adequate amounts.

Governments are also recognizing the importance of this trend. For instance, the Codex Alimentarius Commission, a joint FAO/WHO body, is working on developing harmonized guidelines for probiotics in foods and food supplements. These guidelines aim to ensure the safety, quality, and efficacy of probiotic products, thereby fostering consumer confidence and facilitating international trade.

Drivers

Increased Demand for Dairy Products

A major driving factor for the dairy starter culture market is the rising global demand for dairy products, which is primarily fueled by the increasing consumer preference for fermented dairy products like yogurt, cheese, and kefir. According to the Food and Agriculture Organization (FAO), global dairy consumption has been steadily increasing, driven by growing populations and evolving dietary preferences. In 2024, global milk production was forecasted to reach over 900 million tons, with major growth occurring in emerging economies like India and China.

The demand for dairy products, particularly those with probiotics, has been on the rise due to their perceived health benefits, such as improving digestive health and boosting immunity. The International Dairy Federation (IDF) reports that the global probiotic dairy product market is expected to grow by 5.7% annually from 2025 to 2030, underscoring the increasing adoption of these products.

Government initiatives also support this growth. For example, the U.S. Department of Agriculture (USDA) has long promoted dairy as part of a balanced diet, especially through programs such as the National Dairy Council, which aims to encourage consumption of dairy products due to their nutritional value. The European Union’s Common Agricultural Policy continues to provide subsidies and investments in dairy farming to increase dairy production, further enhancing the need for starter cultures in dairy processing.

As the preference for dairy-based probiotic products increases globally, manufacturers are focused on innovating with new starter cultures that improve fermentation processes and flavor profiles, meeting consumer demand for healthier, more functional dairy options. This trend is supported by both the growing health-conscious consumer base and favorable government policies aimed at promoting dairy consumption.

Restraints

High Costs of Production and Raw Materials

One of the major restraining factors for the dairy starter culture market is the high costs associated with the production and sourcing of raw materials, as well as the production process itself. Dairy starter cultures require specific strains of microorganisms that must be carefully cultured and stored under controlled conditions. According to the Food and Agriculture Organization (FAO), the costs involved in these processes are considerable, especially for high-quality, standardized cultures used in premium dairy products like probiotics. In fact, the price of certain dairy cultures has increased by 10-15% in the past few years due to rising demand for specialty strains that are more effective in fermentation processes.

In addition, fluctuations in the price of milk and other dairy ingredients, which are essential for the production of dairy starter cultures, directly affect the cost structure. In 2023, the price of milk in the U.S. was reported to be around USD 24.7 per hundredweight, a significant increase from previous years, contributing to the overall cost burden for dairy producers. The rise in dairy ingredient prices has created challenges for small-scale dairy producers, who often struggle to absorb such increases without raising product prices, thus affecting demand for their products.

Government regulations and environmental standards also impact production costs. Many countries, including the European Union, have stringent regulations regarding the production and safety of dairy products. For instance, the EU’s General Food Law mandates that dairy products, including those involving starter cultures, must meet high hygiene and quality standards, adding to the operational costs of dairy manufacturers.

Opportunity

Growth of the Probiotic Dairy Product Segment

One of the key growth opportunities for the dairy starter culture market lies in the increasing demand for probiotic dairy products. Consumers are becoming more health-conscious, and products like yogurt, kefir, and probiotic cheese are gaining popularity due to their potential health benefits, such as improved gut health and immune support. This surge in demand for probiotic products is a significant driver for the dairy starter culture market, as these cultures are essential for fermenting and producing probiotic-rich dairy products.

The rising awareness of the health benefits of probiotics has led to increased consumer demand across regions. In the U.S., for example, the National Yogurt Association reports that more than 75% of yogurt sales are now attributed to probiotic yogurt, underscoring the shift toward functional foods that offer health benefits beyond basic nutrition. Similarly, in Europe, the consumption of probiotic yogurt has been rising steadily, with a market size valued at approximately EUR 5.7 billion in 2022 and expected to grow by 6.3% annually over the next five years.

Governments are also playing a role in supporting the growth of the probiotic dairy sector. For instance, the European Union has invested in programs promoting the health benefits of dairy, including probiotics, through its EU Dairy Policy and the European Food Safety Authority (EFSA), which supports the scientific validation of health claims for probiotics. In North America, the U.S. Department of Agriculture (USDA) encourages the consumption of dairy, including probiotic products, as part of a healthy diet, further boosting demand.

Regional Insights

North America dominates with 48.2% share, representing USD 666.8 million in 2024.

In 2024, North America emerged as the leading region within the dairy starter culture market, accounting for 48.2%, equivalent to approximately USD 666.8 million, of the global market share. This commanding position is underpinned by several interlinked factors related to the region’s mature dairy infrastructure and consumer preferences. The United States, as a core market, registered a total starter cultures market valuation of USD 365.9 million in 2024, reflecting both industrial intensity and steady demand for fermented dairy products. The Canadian market supplemented this strength through its rising artisanal cheese and yogurt sectors, whereas Mexico contributed growth through expanding export channels and increasing domestic consumption, particularly in value-added dairy categories.

Government support further contributes to this dynamic environment. In the U.S., stringent quality control by the FDA and USDA has promoted confidence in cultured dairy products while supporting label claims such as “live and active cultures.” Meanwhile, dairy cooperatives in Canada have received investment via federal subsidies aimed at upgrading fermentation plants, which naturally increases uptake of high-performance starter cultures. As of 2025, these initiatives are expected to continue bolstering North America’s deep-rooted lead in the global dairy starter culture landscape.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Founded in 1938, Agropur operates as one of North America’s leading dairy cooperatives, processing approximately 6.7 billion liters of milk annually and generating C$7.3 billion in revenue in 2021. The company maintains six SQF certified ingredient plants across the U.S. Midwest and supports global markets including Canada, Mexico, China, and Singapore. Through its Agropur Ingredients division, it develops advanced starter culture systems geared toward enhanced texture, nutritional value, and shelf stability for dairy manufacturers.

Almarai is a Saudi-based dairy powerhouse founded in 1977 and recorded US$5.22 billion in revenue in 2023. With operations spanning more than 55,000 stores across the GCC, it employs about 46,000 staff and runs automated mega-dairies in Al Kharj. The company has integrated in-house fermentation capabilities for yogurt, cheese, infant nutrition, and bakery lines, supported by its dairy ingredient research that enhances reliability and quality across its cultured dairy portfolio.

Arla Foods is a cooperative based in Denmark and Sweden. It is globally recognized for creating a wide range of cultured dairy products—yogurt, quark, filmjölk—employing proprietary starter cultures optimized for flavor and consistency. Although specific figures were not sourced here, Arla’s fermentation innovation consistently features in its R&D investment and product rollout strategies across Europe and the Middle East.

Top Key Players Outlook

- Agropur

- Almarai

- Arla Foods

- Clover S.A. Proprietary Limited

- Fonterra Co-operative Group Limited

- foremost farms usa

- FrieslandCampina

- Novonesis Group

- Kerry Group

- Nestlé

- Saputo Fonterra

- Synergy Flavors

Recent Industry Developments

In 2024, Agropur reinforced its position in the dairy starter culture sector through strategic investments and innovation. The cooperative processed around 6.7 billion liters of milk annually, supported by C$8.8 billion in revenue from 29 plants across Canada and the U.S.—of which six are ingredients-focused and SQF certified, specializing in cultures and enzymes.

In 2024, Fonterra Co-operative Group Limited reaffirmed its leadership in the dairy starter culture market through a blend of strong financial performance and science backed innovation. The cooperative reported NZ$22.82 billion in revenue and NZ$1.56 billion in operating income, with a net profit of NZ$1.17 billion after tax.

Report Scope

Report Features Description Market Value (2024) USD 1383.6 Mn Forecast Revenue (2034) USD 2431.5 Mn CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Mesophilic Type, Thermophilic Type, Probiotics, Others), By Form (Liquid, Powder, Freeze-Dried), By Fermentation Type (Yeast-Lactic Acid, Fungus-Lactic Acid, Lactic Acid), By Application (Cheese, Yogurt, Kefir), By End-use (Dairy and Dairy-Based Products, Meat and Seafood, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Agropur, Almarai, Arla Foods, Clover S.A. Proprietary Limited, Fonterra Co-operative Group Limited, foremost farms usa, FrieslandCampina, Novonesis Group, Kerry Group, Nestlé, Saputo Fonterra, Synergy Flavors Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dairy Starter Culture MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Dairy Starter Culture MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Agropur

- Almarai

- Arla Foods

- Clover S.A. Proprietary Limited

- Fonterra Co-operative Group Limited

- foremost farms usa

- FrieslandCampina

- Novonesis Group

- Kerry Group

- Nestlé

- Saputo Fonterra

- Synergy Flavors