Dairy Alternatives Market By Source(Soy, Almond, Coconut, Rice, Oats, Others), By Product Type(Milk, Butter, Cheeses, Yogurts, Ice Cream, Others), By Distribution Channel(Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116654

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

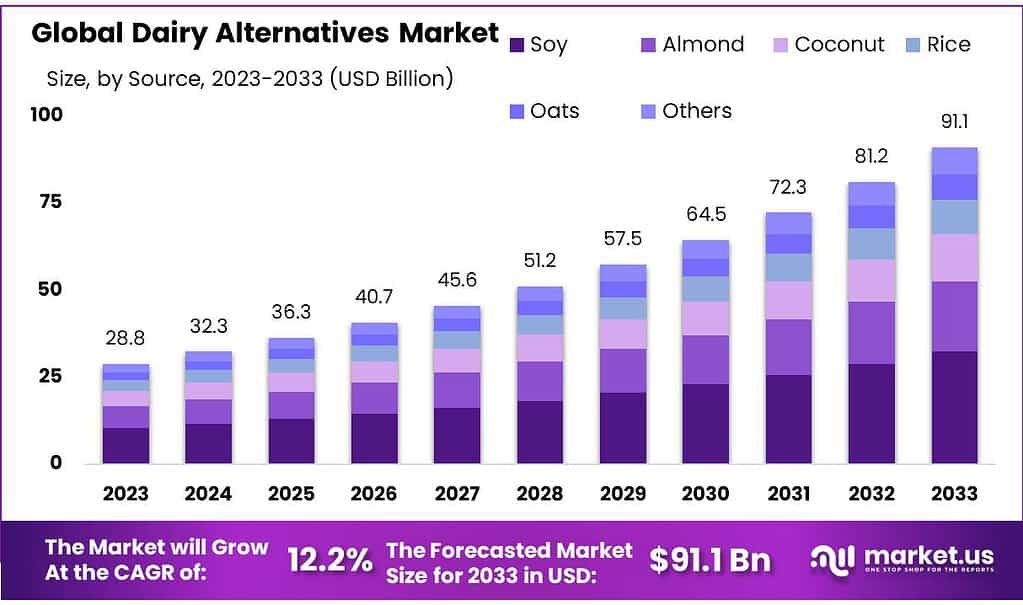

The global Dairy Alternatives Market size is expected to be worth around USD 91.1 billion by 2033, from USD 28.8 billion in 2023, growing at a CAGR of 12.2% during the forecast period from 2023 to 2033.

The Dairy Alternatives Market encompasses a range of non-dairy products that are designed to replace traditional dairy items such as milk, cheese, yogurt, and butter. These alternatives are derived from plant-based sources including soy, almond, coconut, rice, oat, and pea. The market for dairy alternatives has emerged in response to various consumer needs and preferences, including dietary restrictions (such as lactose intolerance and veganism), health considerations (lower calories, reduced cholesterol intake), environmental concerns (reducing carbon footprint associated with dairy farming), and ethical reasons.

The growth of the dairy alternatives market can be attributed to increasing awareness of nutritional benefits offered by plant-based products, advancements in product taste and texture, and wider availability in mainstream supermarkets and food service outlets. These products are often fortified with vitamins and minerals to enhance their nutritional profile, making them competitive with their dairy counterparts.

Market research within the dairy alternatives sector focuses on understanding consumer behaviors, preferences, and demographic trends that influence demand. It also examines the competitive landscape, identifying key players, their market strategies, product innovations, and investment in research and development. The analysis of this market includes assessing the impact of regulatory frameworks, global supply chains, and technological advancements that can affect the availability and quality of dairy alternatives.

As consumers increasingly prioritize sustainability, health, and dietary diversity, the dairy alternatives market is poised for continued growth. This sector’s evolution is closely monitored by industry stakeholders, including manufacturers, investors, and policymakers, to adapt to changing consumer demands and to drive innovation in food production and distribution methods.

Key Takeaways

- Dairy Alternatives Market Expected to reach USD 91.1 billion by 2033, up from USD 28.8 billion in 2023, growing at a CAGR of 12.2%.

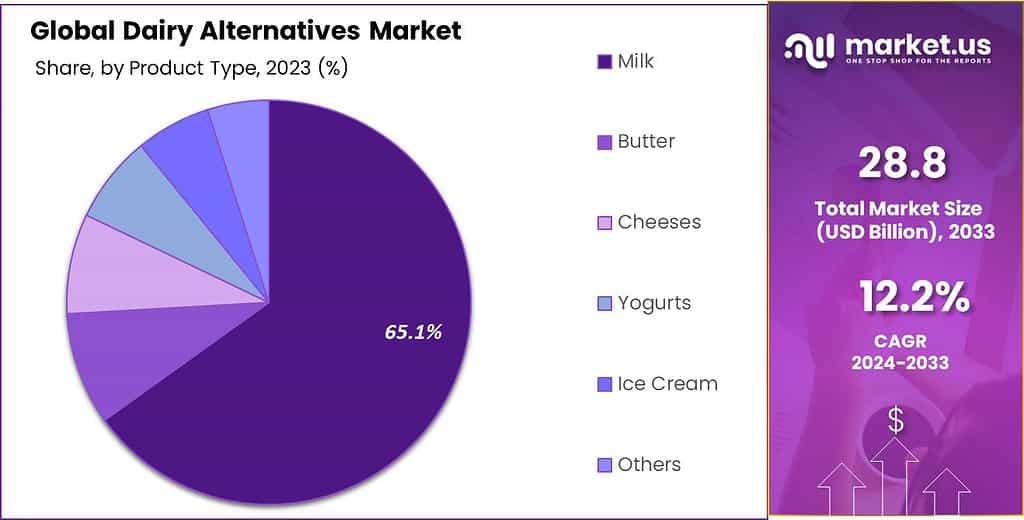

- Milk: Dominates with a 65.1% market share due to popular almond, soy, oat, and coconut milk.

- Soy: Holds 35.6% market share due to high-protein content and established presence.

- Supermarkets/Hypermarkets: Lead with a 38.5% market share.

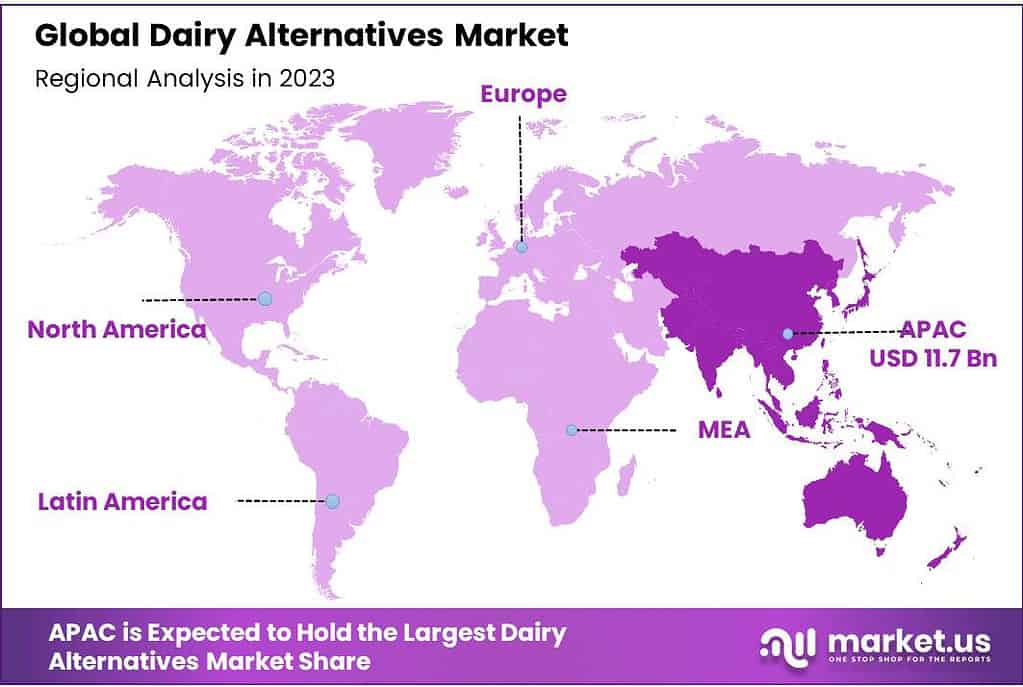

- Asia Pacific, especially China, leads with a 40.8% market share.

By Source

In 2023, the Dairy Alternatives Market experienced significant diversification across various segments, with Soy, Almond, Coconut, Rice, Oats, and other sources vying for market share. Each segment displayed unique characteristics and consumer preferences, contributing to the dynamic landscape of the dairy alternatives sector.

Soy: Soy held a dominant market position, capturing more than a 35.6% share. This can be attributed to its established presence and wide acceptance among consumers seeking lactose-free, high-protein alternatives. Soy-based products, including milk, yogurt, and cheese, have been favored for their nutritional benefits, versatility in recipes, and availability.

Almond: Almond-based alternatives have surged in popularity, prized for their light texture and nutty flavor. These products cater to consumers looking for low-calorie options with beneficial fats. Almond milk, in particular, has become a staple in coffee shops and households, reflecting a growing segment within the dairy alternatives market.

Coconut: The coconut segment has capitalized on its tropical taste and creamy consistency, making it a preferred choice for consumers desiring dairy-free options with a distinctive flavor. Coconut milk and related products have found their niche in both cooking and beverage applications, enhancing the diversity of the market.

Rice: Rice-based dairy alternatives offer a hypoallergenic and digestible option, especially important for consumers with soy or nut allergies. Although holding a smaller share of the market, rice milk and related products appeal to a specific consumer base seeking gentle, mild-flavored alternatives.

Oats: The oat segment has experienced rapid growth, driven by its environmental sustainability and nutritional profile. Oat milk’s creamy texture and suitability for barista applications have made it increasingly popular in cafes and among home consumers, signaling a significant trend in consumer preferences towards sustainability and health.

The Dairy Alternatives Market continues to evolve, with each segment responding to specific consumer needs related to health, taste, dietary restrictions, and environmental concerns. The diversity within this market highlights the increasing shift towards plant-based diets and the potential for further innovation and growth in the coming years.

By Product Type

In 2023, the Dairy Alternatives Market was characterized by a wide array of product types, including Milk, Butter, Cheeses, Yogurts, Ice Cream, and others, each catering to the diverse preferences and dietary needs of consumers.

Milk: Milk held a dominant market position, capturing more than a 65.1% share. This dominance is attributed to the widespread adoption of dairy-free milk as a staple in households and food service establishments. The popularity of almond, soy, oat, and coconut milk reflects consumer demand for alternatives that closely mimic the taste and texture of traditional cow’s milk, offering versatility in both drinking and cooking.

Butter: Dairy-free butter has gained traction, appealing to those seeking plant-based alternatives for baking and cooking. Made from sources like oils and nut butter, these products offer a similar taste and texture to dairy butter, enriching the culinary experience for those on dairy-free diets.

Cheeses: The cheese segment has shown notable growth, with innovations in texture and flavor capturing the attention of consumers. These alternatives are made from nuts, soy, and root vegetables, providing options for pizza, sandwiches, and gourmet dishes, without compromising on taste or experience.

Yogurts: Dairy-free yogurts, primarily made from coconut, almond, and soy, have become popular for their probiotic benefits and variety of flavors. This segment caters to consumers looking for healthy, gut-friendly breakfast options and snacks, reflecting a shift toward nutritional and digestive health.

Ice Cream: The ice cream segment has expanded significantly, with a variety of plant-based ingredients offering creamy textures and rich flavors. Dairy-free ice creams satisfy the sweet tooth of consumers looking for indulgent treats without dairy, making it a growing favorite in the alternatives market.

The Dairy Alternatives Market in 2023 showcased a comprehensive range of products, meeting the demand for plant-based, dairy-free options across different food categories. The market’s growth is fueled by consumer preferences for health, taste, and environmental sustainability, driving continuous innovation and expansion in product offerings.

By Distribution Channel

In 2023, the Dairy Alternatives Market was significantly influenced by its distribution channels, including Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and others. Each channel played a pivotal role in making dairy alternatives accessible to a wide consumer base.

Supermarkets/Hypermarkets: Supermarkets/Hypermarkets held a dominant market position, capturing more than a 38.5% share. This can be attributed to their extensive product range and the convenience they offer consumers looking for dairy alternatives alongside their regular grocery shopping. These outlets have become key destinations for consumers exploring various dairy-free options, from milk and cheeses to yogurts and ice creams, under one roof.

Convenience Stores: Convenience stores, although smaller in scale, have become increasingly important in providing quick access to dairy alternatives. Catering to the need for on-the-go consumption and last-minute purchases, these stores offer a selected range of popular dairy-free products, emphasizing the growing consumer demand for accessibility and convenience.

Online Retail: The online retail segment has seen a significant rise, driven by the broader trend towards e-commerce and digital shopping experiences. Offering the ease of home delivery and a wide selection of brands and products, online platforms have become a preferred choice for many consumers looking for specific dairy alternative products or brands that may not be available in physical stores.

The distribution of Dairy Alternatives Market in 2023 highlighted the importance of varied channels in meeting consumer demand and preferences. Supermarkets/Hypermarkets emerged as the leading distribution channel, but the growth of online retail and the steady presence of convenience stores and other outlets underscore the market’s dynamic nature and evolving consumer shopping behavior.

Key Market Segments

By Source

- Soy

- Almond

- Coconut

- Rice

- Oats

- Others

By Product Type

- Milk

- Butter

- Cheeses

- Yogurts

- Ice Cream

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

Driving Factors

Increasing Awareness About Processed Dairy Products Expected to Fuel Market Expansion.

The dairy alternatives market is predominantly propelled by the needs of lactose-intolerant individuals, alongside a growing perception among the wider population that lactose-free products offer a healthier option compared to traditional dairy. This is largely due to lactose intolerance stemming from the lack of lactase enzyme, which is necessary for digesting lactose—a condition affecting nearly 65% of the global population post-infancy.

Notably, in the developed regions of Western Europe and North America, there has been a significant decline in both volume and value-based consumption of certain dairy categories over the last two decades, with a noticeable shift towards plant-based alternatives. This shift is driven by concerns over allergens, hormones, and unethical practices in animal husbandry within the dairy industry, as well as the considerable environmental footprint associated with dairy production, including soil degradation, air and water pollution, and biodiversity loss.

Innovative Product Offerings and Expanded Market Presence to Drive Market Success in the Coming Years.

Looking ahead, plant-based milks and dairy products are poised for a larger market share and stronger growth rates compared to traditional dairy, especially as veganism becomes more mainstream. The increasing adoption of flexitarian, vegetarian, and vegan diets is expected to boost demand for plant-based dairy substitutes, further impacted by ongoing concerns over health, animal welfare, and environmental sustainability.

Success in this evolving market will depend on product innovation and broad distribution networks. Products that meet the nutritional and aesthetic preferences of consumers, achieve effective market penetration, and are produced on a scale that ensures affordability and availability at traditional dairy selling points will be crucial for the sustainable growth of the dairy alternatives sector.

Restraining Factors

Limited Market Reach and Lack of Consumer Awareness Expected to Impact Sales Negatively.

One significant challenge facing the market for plant-based milks and dairy products is achieving organoleptic profiles comparable to traditional dairy. Processors often struggle with solubility issues and taste when developing these non-dairy alternatives, which has led to lower repeat purchase rates compared to conventional dairy products.

This indicates that the taste and overall sensory experience of milk alternatives have not yet matched those of dairy milk and its derivatives. Additionally, many plant-based milks and their derivatives fall short in providing adequate macro and micronutrients, rendering them less competitive nutritionally compared to traditional dairy products.

While soy milk comes close to cow’s milk in protein content, almond milk, despite its popularity as a non-dairy option, offers only 1 gram of protein per 8 ounces, highlighting the nutritional gap that exists between some plant-based and conventional dairy products.

Growing Opportunities

Consumer Lifestyle Changes

The surging global population is exerting additional pressure on already strained resources, with escalating energy prices and rising raw material costs directly influencing food prices and disproportionately impacting those with lower incomes. This challenge is exacerbated by water scarcity, especially in regions like Africa and Northern Asia.

Meanwhile, the Asia Pacific region presents cost advantages in production and processing, offering a significant boon for dairy alternative suppliers and manufacturers due to the combination of high demand and cost-effective production capabilities.

Concurrently, as lifestyles rapidly evolve, there’s a growing shift towards nutritious and healthier food options, with consumers increasingly distinguishing between fast food and unhealthy junk food in their quest for convenient, yet health-conscious choices. This trend underscores a valuable opportunity for suppliers and manufacturers to tap into the demand for products with naturally high nutritional value, marking a pivotal shift in the food industry’s landscape.

Latest Trends

Rising Veganism and Increasing Consumer Preference for Plant-based Foods Expected to Drive Growth.

Plant-based milk isn’t a new category in processed foods—major brands like Oatly and Alpro have been offering such products in Europe since the 1980s. However, the recent surge in demand for dairy alternatives, along with their dynamic growth in recent years, stems from the increasing popularity of plant-based ingredients and the rising adoption of meat and dairy substitutes.

The dairy and meat industries are among the largest emitters of greenhouse gases, and the water and carbon footprint of milk and dairy products significantly exceed those of horticultural products. This growing awareness of environmental sustainability is expected to positively impact the expansion of the global dairy alternatives market in the years ahead.

Regional Analysis

In 2023, the Asia Pacific region established itself as a key force in the global dairy alternatives market, securing a significant share of 40.8% due to the rapid expansion of the food and beverage industry within the area. The growth of sectors such as health and wellness, along with an increasing consumer shift towards plant-based diets, has markedly boosted the demand for dairy alternatives in the region.

China has been a major player in shaping the Asia Pacific market’s lead in the dairy alternatives industry. The country’s vast consumer base and advancements in food technology have propelled the production and availability of dairy-free products. This surge is linked to the rising consumer preference for plant-based milk and dairy substitutes in response to health, environmental, and ethical considerations, highlighting the essential role of dairy alternatives in meeting these evolving consumer needs.

The region’s strong demand for dairy alternatives is also driven by their use in an array of food and beverage applications. With China leading the way, Asia Pacific boasts an effective supply chain and advanced manufacturing infrastructure, enabling the broad utilization of dairy alternatives in sectors such as food service, retail, and packaged goods.

Furthermore, the strategic emphasis on enhancing health and environmental sustainability across the region has led to an increased demand for plant-based products, including dairy-free milk, cheese, and yogurt, further solidifying Asia Pacific’s position in the global dairy alternatives market. This trend reflects the region’s dynamic consumer landscape, where the pursuit of healthier lifestyles and sustainable choices propels the ongoing growth and popularity of dairy alternatives.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The dairy alternatives market is highly competitive and diverse, featuring a range of key players that have significantly contributed to the industry’s growth and innovation. These companies are pivotal in shaping the market dynamics through product innovation, strategic expansions, and by catering to the evolving consumer preferences towards plant-based diets.

The analysis of key players in the dairy alternatives market includes an examination of their market strategies, product offerings, and geographical presence.

Top Key Players

- Nestle SA

- Danone S.A.

- The Hain Celestial Group, Inc.

- The Whitewave Foods Company

- SunOpta Inc.

- Vitasoy International Holdings Limited

- Earth’s Own Food Company Inc.

- Califia Farms, LLC

- ADM

- Blue Diamond Growers

- Pacific Foods

- Ripple Foods

- Organic Valley Family of Farms

- DAIYA FOODS INC.

Recent Developments

2024: Nestle announced plans to invest in sustainable sourcing practices for its dairy alternative ingredients, aligning with its commitment to environmental stewardship and responsible sourcing.

2024: Danone partnered with leading food retailers to expand the distribution of its dairy alternative products, increasing accessibility for consumers in key markets.

Report Scope

Report Features Description Market Value (2023) USD 28.8 Bn Forecast Revenue (2033) USD 91.9 Bn CAGR (2024-2033) 12.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source(Soy, Almond, Coconut, Rice, Oats, Others), By Product Type(Milk, Butter, Cheeses, Yogurts, Ice Cream, Others), By Distribution Channel(Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Nestle SA, Danone S.A., The Hain Celestial Group, Inc., The Whitewave Foods Company, SunOpta Inc., Vitasoy International Holdings Limited, Earth’s Own Food Company Inc., Califia Farms, LLC, ADM, Blue Diamond Growers, Pacific Foods, Ripple Foods, Organic Valley Family of Farms, DAIYA FOODS INC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Name the major industry players in the Dairy Alternatives Market?Nestle SA, Danone S.A., The Hain Celestial Group, Inc., The Whitewave Foods Company, SunOpta Inc., Vitasoy International Holdings Limited, Earth’s Own Food Company Inc., Califia Farms, LLC, ADM, Blue Diamond Growers, Pacific Foods, Ripple Foods, Organic Valley Family of Farms, DAIYA FOODS INC.

What is the size of Dairy Alternatives Market?Dairy Alternatives Market size is expected to be worth around USD 91.1 billion by 2033, from USD 28.8 billion in 2023

What CAGR is projected for the Dairy Alternatives Market?The Dairy Alternatives Market is expected to grow at 12.2% CAGR (2023-2032). Dairy Alternatives MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Dairy Alternatives MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Nestle SA

- Danone S.A.

- The Hain Celestial Group, Inc.

- The Whitewave Foods Company

- SunOpta Inc.

- Vitasoy International Holdings Limited

- Earth’s Own Food Company Inc.

- Califia Farms, LLC

- ADM

- Blue Diamond Growers

- Pacific Foods

- Ripple Foods

- Organic Valley Family of Farms

- DAIYA FOODS INC.