Cytology Market By Product Type (Instruments & Analysis Software System and Consumables & Reagents), By Type of Examination (Histology (Molecular Pathology, Microscopy, Immunohistochemistry, and Cryostat & Microtomy) and Cytology (Molecular Pathology, Microscopy, Immunohistochemistry, and Cryostat & Microtomy)), By Application (Drug Discovery & Designing, Clinical Diagnostics (Point-of-Care (PoC) and Non-PoC), and Research), By End-user (Hospitals, Biotechnology & Pharmaceutical Industry, Diagnostic Centers, and Other), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154596

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

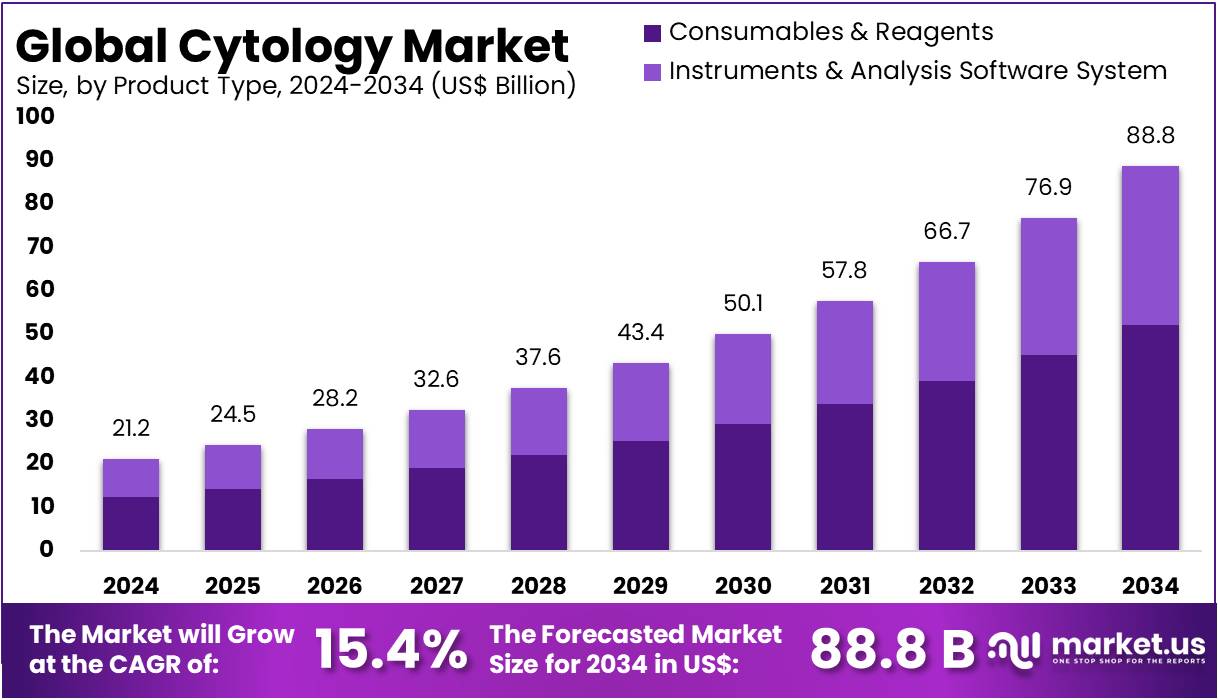

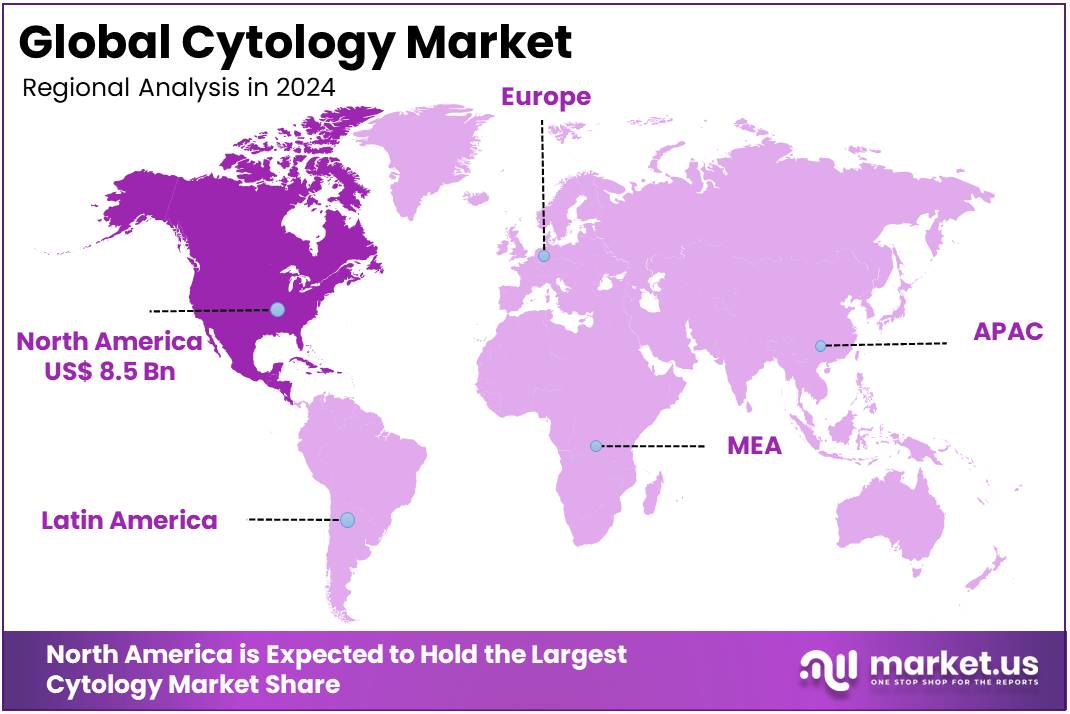

The Cytology Market Size is expected to be worth around US$ 88.8 billion by 2034 from US$ 21.2 billion in 2024, growing at a CAGR of 15.4% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 39.9% share and holds US$ 8.5 Billion market value for the year.

Rising demand for more advanced diagnostic solutions is driving growth in the cytology market. Cytology, which involves analyzing cell samples to diagnose a range of conditions such as cancers, infections, and inflammatory diseases, is critical for early detection and disease management. The increasing prevalence of cancers, particularly lung, breast, and cervical cancer, is a key factor fueling this growth, as cytology techniques like Pap smears and liquid-based cytology continue to be central in screening processes.

Technological advancements, including the integration of artificial intelligence (AI) and digital imaging, are transforming the landscape of cytology. For instance, in December 2023, Merck KGaA entered into a collaboration with Incellerate to co-develop AI-powered digital pathology solutions. This partnership focuses on using digital imaging and machine learning to improve diagnostic precision, reduce errors, and streamline workflows, ultimately enhancing patient outcomes.

The growing preference for non-invasive diagnostic techniques, such as fine needle aspiration (FNA) and brush biopsies, is also contributing to the market’s expansion by providing safer alternatives to traditional tissue biopsies. As healthcare systems prioritize early diagnosis and personalized treatment, opportunities for innovation in cytology are increasing. The application of molecular cytology, such as fluorescence in situ hybridization (FISH), is further enhancing diagnostic accuracy and enabling more targeted treatments. As the field evolves, cytology is positioned to play a vital role in improving patient outcomes, offering strong growth prospects for the market.

Key Takeaways

- In 2024, the market for cytology generated a revenue of US$ 21.2 billion, with a CAGR of 15.4%, and is expected to reach US$ 88.8 billion by the year 2034.

- The product type segment is divided into instruments & analysis software system and consumables & reagents, with consumables & reagents taking the lead in 2023 with a market share of 58.7%.

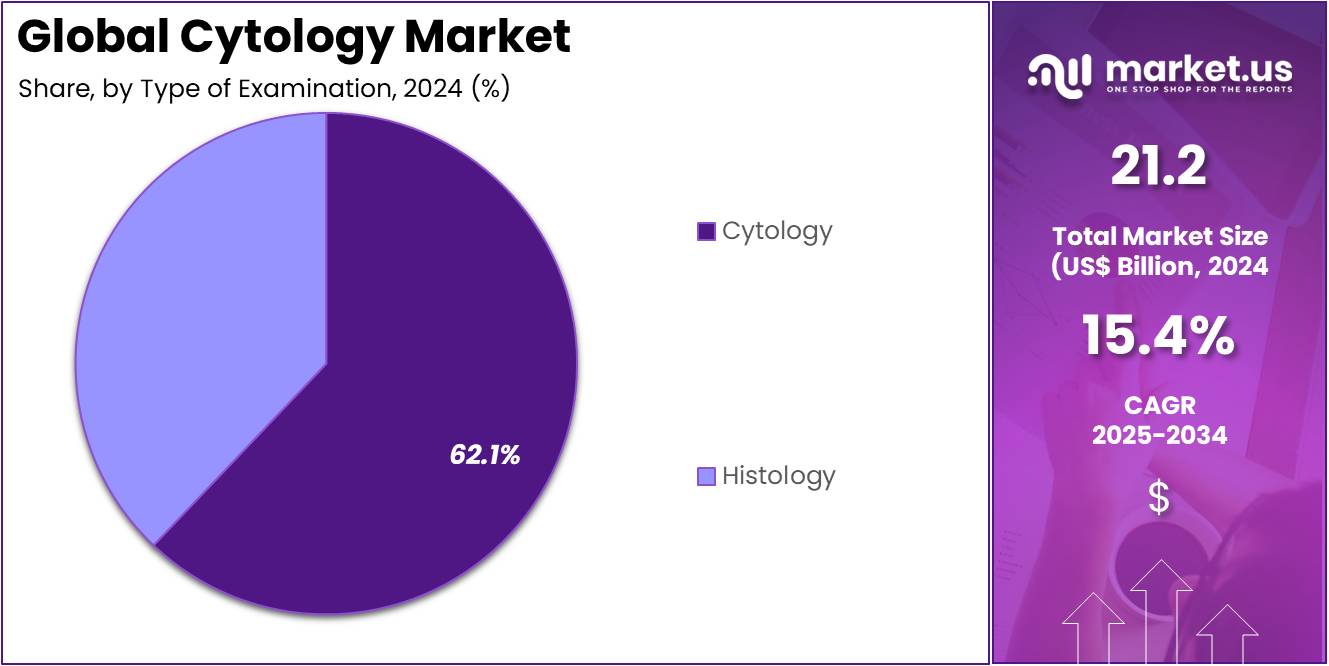

- Considering type of examination, the market is divided into histology and cytology. Among these, cytology held a significant share of 62.1%.

- Furthermore, concerning the application segment, the market is segregated into drug discovery & designing, clinical diagnostics, and research. The drug discovery & designing sector stands out as the dominant player, holding the largest revenue share of 48.5% in the cytology market.

- The end-user segment is segregated into hospitals, biotechnology & pharmaceutical industry, diagnostic centers, and other, with the hospitals segment leading the market, holding a revenue share of 52.4%.

- North America led the market by securing a market share of 39.9% in 2023.

Product Type Analysis

Consumables & reagents hold a commanding share of 58.7% in the cytology market. This segment is expected to continue its dominance due to the increasing need for reagents in diagnostic procedures and research. Consumables like staining kits, reagents for molecular testing, and cell culture media are indispensable in cytology labs. As the demand for advanced diagnostic testing and research in cell biology rises, so does the need for consumables and reagents.

Moreover, the global emphasis on early disease detection, especially cancer, has led to a surge in the adoption of cytology-based diagnostic tools. This growth is further driven by the need for high-quality, reliable reagents that provide accurate and reproducible results. The shift towards precision medicine, coupled with increasing investment in cancer diagnostics, is anticipated to drive continuous growth in this segment. Additionally, innovations in reagent technologies, such as those for molecular diagnostics and immunocytochemistry, are likely to enhance the utility of consumables and reagents, ensuring their sustained demand.

Type of Examination Analysis

Cytology, accounting for 62.1% of the examination type segment, is projected to experience substantial growth in the cytology market. The primary driver for this growth is the increasing global demand for non-invasive diagnostic techniques, particularly in cancer screenings, where cytology plays a pivotal role. Cytology offers significant advantages in detecting early-stage cancers, such as cervical, lung, and breast cancer, which is likely to propel its continued adoption.

The rise in awareness regarding the benefits of cytology-based tests, such as Pap smears and fine needle aspiration biopsies, is expected to contribute to the segment’s growth. Furthermore, the integration of cytology with advanced technologies, including AI and molecular diagnostic tools, is anticipated to improve diagnostic accuracy and efficiency. With the focus on improving patient outcomes through early detection and treatment, cytology is expected to remain a critical tool in both clinical diagnostics and research.

Application Analysis

The drug discovery & designing segment represents 48.5% of the application share in the cytology market. This growth is projected to continue as cytology plays an essential role in early-stage drug development, especially in identifying potential biomarkers and testing drug efficacy. Pharmaceutical and biotechnology companies increasingly rely on cytological assays to screen compounds and predict their effects on cellular structures.

Cytology-based assays, such as high-throughput screening of cell cultures and 3D cell models, are increasingly used in drug discovery to identify compounds that can modify cellular behaviors. Additionally, the growing trend towards personalized medicine, which requires a detailed understanding of cellular responses to different treatments, is likely to contribute to the expansion of this segment. As the pharmaceutical industry continues to prioritize precision medicine and more effective drug candidates, the demand for cytological tools in drug discovery & designing is expected to grow steadily.

End-User Analysis

Hospitals dominate the end-user segment of the cytology market, accounting for 52.4% of the market share. This growth is expected to continue as hospitals are the primary settings for diagnostic testing and the treatment of diseases, particularly cancer. Hospitals increasingly invest in advanced cytology-based diagnostic tools to provide accurate and rapid results, particularly in high-volume areas such as pathology and oncology. The increasing prevalence of cancer, combined with the growing focus on early detection, has made cytology a vital component of diagnostic procedures in hospitals.

Additionally, advancements in cytology technologies, such as automated systems for cell analysis and image recognition, are anticipated to increase the efficiency of diagnostic workflows in hospital settings. Hospitals are also focusing on improving patient care by integrating cytological diagnostics with molecular testing and imaging, driving further demand for cytology-based solutions. As hospitals continue to expand their capabilities in precision diagnostics, cytology is expected to remain central to their diagnostic services, solidifying its dominance in this segment.

Key Market Segments

By Product Type

- Instruments & Analysis Software System

- Consumables & Reagents

By Type of Examination

- Histology

- Molecular Pathology

- Microscopy

- Immunohistochemistry

- Cryostat & Microtomy

- Cytology

- Molecular Pathology

- Microscopy

- Immunohistochemistry

- Cryostat & Microtomy

By Application

- Drug Discovery & Designing

- Clinical Diagnostics

- Point-of-Care (PoC)

- Non-PoC

- Research

By End-user

- Hospitals

- Biotechnology & Pharmaceutical Industry

- Diagnostic Centers

- Other

Drivers

Rising Incidence of Cancer and Chronic Diseases Driving Market Growth

The increasing global incidence and prevalence of cancers and chronic diseases are pivotal factors fueling the expansion of the cytology market. Cytology, a critical diagnostic discipline, provides an efficient and cost-effective method for the early detection, diagnosis, and monitoring of a wide range of conditions, particularly cancerous and pre-cancerous lesions. With its ability to analyze various bodily fluids and tissues, cytology is indispensable for both screening programs and ongoing disease management.

The World Health Organization (WHO) in its February 2024 update highlighted the rising global cancer burden, with an estimated 20 million new cancer cases and 9.7 million cancer-related deaths in 2022. Lung, breast, and colorectal cancers, which together account for approximately two-thirds of new global cancer cases, are the most prevalent.

Additionally, cervical cancer, where cytology plays a central role in screening and early detection, accounted for over 660,000 new cases and more than 348,000 deaths in 2022. The substantial and ever-growing global cancer burden, coupled with the pivotal role cytology plays in identifying and managing these diseases, ensures the continued demand for cytological services, driving market growth and the need for advanced diagnostic tools.

Restraints

Shortage of Skilled Cytopathologists and Technologists Impeding Market Growth

One of the most pressing challenges facing the cytology market is the ongoing shortage of skilled cytopathologists and cytotechnologists, particularly in developed regions such as the United States. The field of cytopathology requires specialized training and expertise for the accurate microscopic examination and interpretation of cytological samples, a skill set that remains limited in availability.

The shortage of qualified professionals has significant implications for diagnostic efficiency, as it often leads to extended turnaround times for test results, increased operational costs for laboratories, and added strain on quality control processes. This can ultimately affect patient care and hinder timely access to crucial diagnostic services. According to the American Society for Clinical Pathology (ASCP) 2022 Vacancy Survey, vacancy rates for laboratory positions across various departments, including cytopathology, have been rising since the COVID-19 pandemic, with an increasing number of professionals retiring.

Although specific figures for cytotechnologists are not disaggregated, the data underscores a broader workforce shortage affecting the entire laboratory sector. The lack of trained personnel presents a fundamental barrier to the optimal functioning and expansion of cytology services, highlighting the critical need for effective workforce development and retention strategies to meet growing demand.

Opportunities

Advancements in Automation and Digital Cytology Creating New Market Opportunities

Advancements in automation and digital cytology are creating significant growth opportunities for the cytology market by enhancing diagnostic efficiency and improving the scalability of services. Key innovations, such as automated slide scanning systems, AI-powered image analysis, and telecytology platforms, are transforming the way cytology is practiced, offering higher throughput, greater diagnostic accuracy, and broader access to expert cytopathological services.

Automated systems are capable of pre-screening cytological slides, identifying suspicious areas for further review by professionals, thus increasing diagnostic throughput and reducing the manual workload. In fact, recent developments in AI have made substantial inroads in digital pathology, with more AI-enabled medical devices being cleared for clinical use by the US Food and Drug Administration (FDA). A review published in January 2024 noted that 2022 to 2024 has been a period of breakthrough progress for AI in digital pathology.

This technological evolution is expected to alleviate the pressures caused by workforce shortages, streamline diagnostic workflows, improve reproducibility, and enable access to high-quality cytological evaluations in remote or underserved areas. The increasing reliance on digital cytology and AI-powered tools promises to revolutionize cytopathology, driving both market growth and improved patient care.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic factors, such as inflation and the prioritization of public health investments, are also influencing the cytology market by impacting healthcare budgets, the affordability of diagnostic services, and funding allocated to cancer screening initiatives. Inflation, for example, can increase the costs associated with the production of diagnostic reagents, stains, and specialized laboratory equipment, leading to higher prices for cytology tests and reduced budgets for screening programs in some regions.

However, despite these inflationary pressures, governments and international health organizations recognize the critical importance of early cancer detection and prevention. This recognition continues to drive investments in diagnostic infrastructure, ensuring that funding for cancer screening programs remains robust. The Centers for Medicare & Medicaid Services (CMS) reported that US national health expenditures reached US$ 4.9 trillion in 2023, accounting for 17.6% of the country’s GDP.

The continued commitment to healthcare spending, despite economic challenges, highlights the global recognition of the importance of early diagnosis and cancer prevention. Geopolitical stability further ensures the smooth operation of international supply chains for diagnostic consumables and equipment. This continued investment in early cancer detection and diagnostic services is expected to drive sustained demand for cytology solutions, ensuring long-term market growth.

The evolving landscape of US trade policies, particularly the imposition of tariffs on imported laboratory equipment, diagnostic reagents, and microscopic components, is directly influencing the cytology market by increasing manufacturing costs and altering supply chain strategies. Manufacturers of cytology equipment and consumables often rely on intricate global supply chains for essential materials, such as enzymes, glass slides, and precision-engineered components.

Tariffs on these imports raise the costs for companies that either produce domestically or import finished diagnostic products, potentially leading to higher prices for cytology tests and diagnostic equipment. The US Department of Commerce reported that US imports of optical, medical, and surgical instruments, which include cytology equipment, amounted to approximately US$ 115.8 billion in 2023. This underscores the heavy reliance of the cytology market on global supply chains.

While the imposition of tariffs is often aimed at promoting domestic manufacturing, these policies generally create more complex and costly operational environments for companies. Nonetheless, the crucial need for accurate and timely cytological diagnoses ensures that manufacturers will continue to strategically manage supply chains and absorb some of the additional costs, ensuring continued access to essential diagnostic tools and technologies in the US market.

Latest Trends

Increasing Integration of Molecular Biomarkers with Cytology

An emerging trend in the cytology market is the growing integration of molecular biomarker testing with traditional cytological diagnoses, creating a more comprehensive and precise approach to disease assessment, particularly in oncology. This convergence allows for a deeper understanding of the genetic underpinnings of diseases, enabling the identification of specific mutations or protein expressions that inform treatment decisions.

Cytological samples, often collected via minimally invasive procedures, are increasingly used for both morphological analysis and molecular assays, optimizing diagnostic yield. For instance, in lung cancer, fine-needle aspiration cytology samples are not only evaluated for morphological features but are also subjected to testing for specific genetic mutations such as epidermal growth factor receptor (EGFR) mutations.

The Centers for Disease Control and Prevention (CDC) and the American Cancer Society (ACS) continue to emphasize the importance of precision medicine in cancer care, advocating for the use of molecular profiling to tailor treatments to the individual genetic profiles of patients. This trend has redefined cytology, allowing it to evolve beyond its traditional role as a morphological tool into a multi-faceted diagnostic powerhouse that provides actionable insights for personalized treatment, thus enhancing patient outcomes and further solidifying its role in precision oncology.

Regional Analysis

North America is leading the Cytology Market

The cytology market in North America, commanding a notable 39.9% share, experienced robust growth in 2024. This expansion is largely attributed to sustained demand for cancer screening and diagnostic procedures, particularly cervical cancer, as well as the increasing integration of advanced diagnostic technologies. According to the Centers for Disease Control and Prevention (CDC), the incidence of cervical precancer among screened women aged 20–24 years in the US decreased by 79% from 2008 to 2022, and by 37% among those aged 25–29 years, underscoring the vital role of screening programs.

Additionally, the National Cancer Institute (NCI) projects that in 2025, the US will see 226,650 new cases of lung cancer, 84,870 new cases of bladder cancer, and 44,020 new cases of thyroid cancer, all of which rely on cellular analysis for diagnosis and monitoring. Key players within the diagnostics sector have shown strong financial results. Hologic’s Diagnostics revenue, excluding COVID-19-related sales, grew by 9.2% in constant currency for Q4 of fiscal year 2024, reaching US$ 987.9 million, reflecting significant demand for their molecular diagnostics, including cytology-related tests. Danaher, a diversified science and technology innovator, reported total revenue of US$ 23.9 billion for 2024, with its diagnostics segment making a substantial contribution to these figures.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

In the Asia Pacific region, the cytology market is expected to witness significant growth during the forecast period. This anticipated expansion is driven by a large and aging population, increasing cancer incidences, and expanding government initiatives focused on early cancer detection and screening. For example, China’s cervical cancer screening coverage among women aged 35–64 years reached 51.5% in 2023–2024, surpassing the country’s 2025 target of 50%, as reported by the China CDC Weekly. This highlights a clear commitment to advancing screening efforts. Furthermore, the World Health Organization (WHO) Western Pacific Region is actively supporting noncommunicable disease prevention and control, including cancer control strategies and the training of health workers for screening.

The market is also benefiting from the growing adoption of automated and digital pathology solutions that improve efficiency and accuracy in cellular analysis. Leading diagnostics companies are expanding their operations across the region to capitalize on these opportunities. Roche Diagnostics, a global leader, delivered 30 billion tests to customers worldwide in 2024, indicating its strong global presence and contribution to diagnostic services, including cellular analysis. Additionally, Becton Dickinson (BD) Life Sciences continues to invest in the Asia Pacific region, further supporting the growth of the market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the cytology market employ various strategies to drive growth, including expanding their product offerings to cover a broader range of diagnostic needs. They focus on developing advanced technologies that improve the precision and speed of diagnoses, which enhances clinical outcomes. Companies also invest heavily in strategic partnerships and collaborations with healthcare providers and academic institutions to stay at the forefront of research and innovation.

Additionally, global expansion remains a key growth strategy, as companies target emerging markets with increasing healthcare demands. Strong marketing and branding campaigns help these players boost product visibility, while mergers and acquisitions enable quicker access to new technologies and customer bases. These strategies collectively strengthen their market positions and drive sustainable growth.

One notable player, Hologic, Inc., specializes in diagnostic products with a strong focus on women’s health. The company provides a range of solutions, including advanced cytology systems that cater to both routine and specialized diagnostics. Hologic’s commitment to innovation, especially in molecular diagnostics and imaging, supports its leading role in the healthcare industry, allowing it to maintain a competitive edge in the cytology sector.

Top Key Players in the Cytology Market

- Trivitron Healthcare

- Thermo Fisher Scientific, Inc

- Sysmex Corporation

- Merck KgaA

- Hologic, Inc

- Hoffmann-La Roche Ltd

- Danaher

- BD

- Abbott

- Koninklijke Philips N.V.

Recent Developments

- In January 2024: Hologic, Inc. achieved FDA clearance for its Panther Fusion Aptima HSV 1 & 2 Assay, a molecular diagnostic test designed for the detection of herpes simplex virus types 1 and 2. This approval enhances Hologic’s diagnostic capabilities, offering an advanced solution for the accurate and efficient detection of HSV, which plays a significant role in understanding and managing viral infections.

- In February 2024: BD introduced the BD Accuri Cytoflex LX flow cytometer, featuring enhanced automation capabilities. This new system is designed to improve the efficiency and precision of flow cytometry analysis, providing researchers and clinicians with more streamlined workflows and increased throughput in cellular analysis applications, particularly in immunology and cancer research.

- In November 2023: Abbott announced a strategic partnership with Microsoft to develop AI-driven solutions that will optimize pathology workflows. This collaboration aims to harness Microsoft’s AI technology to enhance diagnostic accuracy, speed up sample analysis, and improve overall workflow efficiency in pathology labs, benefiting both healthcare professionals and patients alike.

Report Scope

Report Features Description Market Value (2024) US$ 21.2 billion Forecast Revenue (2034) US$ 88.8 billion CAGR (2025-2034) 15.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Instruments & Analysis Software System and Consumables & Reagents), By Type of Examination (Histology (Molecular Pathology, Microscopy, Immunohistochemistry, and Cryostat & Microtomy) and Cytology (Molecular Pathology, Microscopy, Immunohistochemistry, and Cryostat & Microtomy)), By Application (Drug Discovery & Designing, Clinical Diagnostics (Point-of-Care (PoC) and Non-PoC), and Research), By End-user (Hospitals, Biotechnology & Pharmaceutical Industry, Diagnostic Centers, and Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Trivitron Healthcare, Thermo Fisher Scientific, Inc, Sysmex Corporation, Merck KgaA, Hologic, Inc, F. Hoffmann-La Roche Ltd, Danaher, BD, Abbott, Koninklijke Philips N.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Trivitron Healthcare

- Thermo Fisher Scientific, Inc

- Sysmex Corporation

- Merck KgaA

- Hologic, Inc

- Hoffmann-La Roche Ltd

- Danaher

- BD

- Abbott

- Koninklijke Philips N.V.