Global Cystoscope Market Analysis By Type (Flexible Cystoscope, Rigid Cystoscope), By End-User (Hospitals, Clinics, Ambulatory Surgical Centers), By Technology (Video Cystoscope, Fiber Optic Cystoscope), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 16085

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

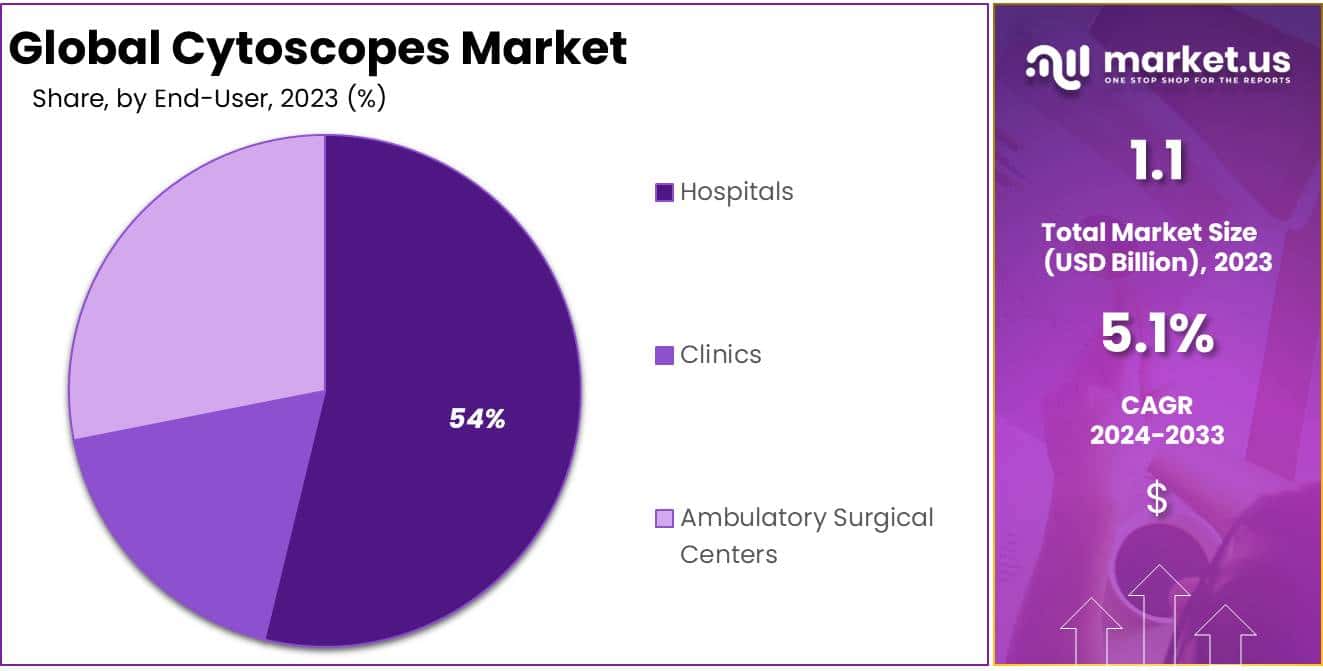

The Global Cystoscope Market size is expected to be worth around USD 1.8 Billion by 2033, from USD 1.1 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

Cystoscopy is a medical procedure for examining the bladder and urethra using a cystoscope, a tube-like instrument with a camera and light. It diagnoses bladder conditions like tumors, stones, and infections, and investigates symptoms such as frequent UTIs, hematuria, and dysuria. Performed under various types of anesthesia, the procedure involves inserting the cystoscope through the urethra to the bladder. It may use rigid or flexible cystoscopes. While generally safe, cystoscopy can cause infections, bleeding, and discomfort. Patients should drink fluids and avoid strenuous activities post-procedure.

The cystoscope market primarily serves hospitals, ambulatory surgical centers, and specialized urology clinics, with hospitals being the largest end-user segment. This dominance is driven by the substantial volume of urological procedures performed in hospitals. According to the American Hospital Association (AHA), there are over 6,000 hospitals in the United States, conducting approximately 11 million urological procedures annually. This high demand underscores the crucial role hospitals play in the cystoscope market.

Government regulations significantly impact the cystoscope market. The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) enforce stringent guidelines to ensure patient safety and device efficacy. According to industry research, this growth is propelled by the rising prevalence of prostate cancer and advancements in minimally invasive technologies. North America is leading the market due to the rapid adoption of advanced medical equipment.

Government initiatives are pivotal in driving the cystoscope market’s expansion. The U.S. government, through various healthcare infrastructure programs, and the European Union, with its funding for medical device research and development, play significant roles. According to the National Kidney Foundation, urinary tract infections result in about 10 million doctor visits annually in the U.S.

Substantial investments from both government and private sectors have been observed in the cystoscope market. In 2023, the National Institutes of Health (NIH) allocated over $1 billion for urological research, including advancements in cystoscopy. Private investments from key players like Olympus Corporation, Karl Storz, and Stryker Corporation also fuel market growth. According to a report from the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), the economic burden of urologic diseases in the U.S. is approximately $11 billion annually.

Continuous innovations and strategic activities mark the cystoscope market. Companies are developing advanced cystoscopes with enhanced imaging capabilities, such as high-definition cameras. For instance, Olympus Corporation’s OES Elite cystoscope offers improved visualization and patient comfort. Stryker Corporation expanded its urological product portfolio by acquiring ProPep Surgical in 2022.

Partnerships, like the one between Karl Storz and Ambu A/S, focus on single-use cystoscopes to meet the growing demand for disposable devices. Agreements, such as Richard Wolf GmbH’s with a major European hospital network, and expansions like Olympus’s production facility in Japan, aim to meet increasing global demand. Mergers, such as Boston Scientific’s merger with a leading cystoscope manufacturer in 2023, further consolidate the market.

Key Takeaways

- By 2033, the global Cystoscope Market is projected to reach a value of USD 1.8 billion, growing from USD 1.1 billion in 2023 at a 5.1% CAGR.

- The Flexible Cystoscope segment led the market’s Type Segment in 2023, holding a substantial 63.9% market share.

- In 2023, Flexible Cystoscopes also dominated the end-user category within the Cystoscope Market, capturing over 53.8% of the share.

- The Flexible Cystoscope segment maintained its dominance in the Technology Segment of the Cystoscope Market in 2023.

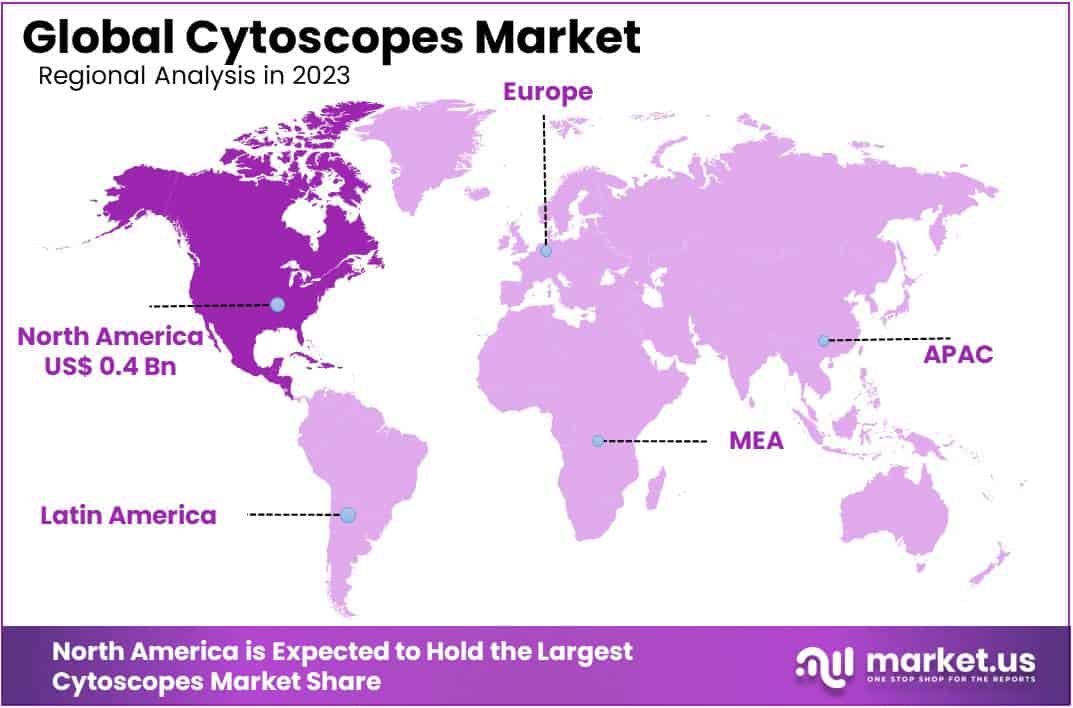

- North America was the leading regional market for cystoscopes in 2023, securing a significant 38% of the global market share, valued at USD 0.4 billion.

Type Analysis

In 2023, the Flexible Cystoscope segment secured a commanding position in the Cystoscope Market’s Type Segment, accounting for over 63.9% of the market share. This dominance is largely due to technological advancements that improve procedural comfort and efficiency. Flexible cystoscopes are particularly favored in diagnostic and therapeutic procedures for their ability to navigate the urinary tract with minimal discomfort. Their increasing preference in urology underpins the segment’s growth, reflecting a shift towards less invasive medical practices.

Meanwhile, the Rigid Cystoscope segment, though smaller, remains integral within the market. These cystoscopes are valued for their durability and superior imaging quality, essential for complex surgical interventions. While they lack the flexibility of their counterparts, their precision makes them indispensable in specific surgical settings. The ongoing demand for rigid cystoscopes is supported by their critical role in precise medical procedures, contributing to a balanced growth within the Cystoscope market.

End-User Analysis

In 2023, the Flexible Cystoscope segment secured a leading position in the end-user category of the Cystoscope Market, claiming over a 53.8% share. This dominance is primarily due to advances in technology, the increasing preference for minimally invasive procedures, and their superior diagnostic capabilities. Hospitals were the main adopters, using these devices extensively for diagnosing and treating urological conditions, driven by the necessity for dependable, high-quality imaging crucial in managing issues like bladder cancer and urinary infections.

Clinics and Ambulatory Surgical Centers (ASCs) also integrated flexible cystoscopes significantly. Clinics are leveraging these devices to enhance outpatient care, catering to patients’ preferences for quicker recovery. Meanwhile, ASCs are incorporating them to provide cost-effective surgical options, aligning with trends towards healthcare decentralization and patient-focused services. The rising incidence of urological disorders and ongoing technological improvements are expected to spur further growth across these segments, as healthcare providers emphasize innovative diagnostic tools that improve patient outcomes and streamline operations.

Technology Analysis

In 2023, the Flexible Cystoscope segment held a dominant position in the Technology Segment of the Cystoscope Market. The segment’s leadership is largely due to the superior features of flexible cystoscopes, such as enhanced maneuverability and greater comfort for patients during procedures. These instruments are essential for diagnosing and treating bladder conditions, which has led to their widespread adoption in urological practices worldwide.

Meanwhile, video cystoscopes are gaining traction and are poised for significant growth in the coming years. These devices enhance visualization and documentation during examinations by utilizing digital imaging technology. The benefits of video cystoscopes, including increased diagnostic accuracy and ease of use, are expected to boost their adoption. Although the fiber optic cystoscope market is growing more slowly, it remains relevant, particularly in cost-sensitive regions where affordability is crucial.

Key Market Segments

Type

- Flexible Cystoscope

- Rigid Cystoscope

End-User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

Technology

- Video Cystoscope

- Fiber Optic Cystoscope

Drivers

Technological Advancements in Cystoscopes

One of the primary drivers of the global cystoscope market is the continuous technological advancements in cystoscopes. Innovations such as digital cystoscopes with high-definition cameras and flexible cystoscopes that enhance maneuverability are significantly improving diagnostic accuracy and patient outcomes. These advancements facilitate early diagnosis and treatment of bladder diseases, which is crucial in reducing the overall healthcare burden.

For instance, the development of digital cystoscopes with high-definition cameras offers significantly improved imaging capabilities. According to the World Health Organization (WHO), early and accurate diagnosis of bladder conditions can enhance treatment outcomes by up to 40%. This highlights the critical role of advanced diagnostic tools in healthcare settings.

Restraints

High Cost of Advanced Cystoscopes

A major restraint for the global cystoscope market is the high cost associated with advanced cystoscopes. These devices often incorporate sophisticated technologies that elevate their price, making them less accessible in lower-income countries and even for smaller healthcare providers in developed nations. The initial purchase and maintenance costs can be prohibitive, potentially limiting market penetration.

The price for a flexible digital cystoscope can exceed $25,000, not including maintenance and training costs. This price barrier can be particularly challenging in developing economies, where healthcare budgets are often limited. The World Bank data suggests that lower-income countries spend approximately $40 per capita on medical devices, compared to $3,000 in high-income countries, underscoring the affordability gap.

Opportunities

Rising Prevalence of Urological Conditions

The increasing prevalence of urological conditions, such as bladder cancer and urinary tract infections, presents significant opportunities for the cystoscope market. As the global population ages and these conditions become more common, the demand for effective diagnostic and therapeutic tools like cystoscopes is expected to rise. This demographic shift offers a substantial market expansion opportunity.

The global prevalence of urological conditions, particularly bladder cancer, is increasing. The International Agency for Research on Cancer (IARC) reports that bladder cancer accounts for nearly 3% of all cancer cases worldwide, translating into over 570,000 new cases annually. This rising prevalence is expected to drive the demand for diagnostic procedures like cystoscopy, indicating a growing market for these devices.

Trends

Integration of Artificial Intelligence

A notable trend in the global cystoscope market is the integration of artificial intelligence (AI) with cystoscopic systems. AI can assist in improving diagnostic accuracy by providing enhanced imaging analysis and pattern recognition. This integration not only improves the efficiency of procedures but also supports clinicians in making more informed decisions during diagnosis and treatment, thereby enhancing patient care.

The integration of artificial intelligence (AI) in cystoscopic procedures is a growing trend. AI technologies can enhance diagnostic accuracy by up to 20% through improved imaging analysis and pattern recognition, according to a recent study published in the Journal of Urology. This trend is not only improving procedural efficiency but is also poised to revolutionize patient management by aiding in faster and more accurate diagnoses.

Regional Analysis

In 2023, North America emerged as the leading market for cystoscopes, commanding over 38% of the global share and securing a market value of USD 0.4 billion. This prominence is largely due to the region’s sophisticated healthcare infrastructure, significant healthcare spending, and a rising incidence of urological issues that necessitate the use of cystoscopes for diagnosis and treatment. The region’s market is further bolstered by the presence of key industry players and ongoing technological advancements.

Europe also holds a substantial market share, driven by heightened awareness of bladder health issues, strong governmental support for healthcare facilities, and comprehensive healthcare policies that ensure access to advanced medical devices. The demand in Europe is also spurred by an aging population that is more susceptible to urological conditions.

Asia-Pacific is noted as the fastest-growing region in the cystoscope market. This growth is attributed to improvements in healthcare infrastructure, increased healthcare investments from public and private sectors, and a burgeoning medical tourism industry in countries such as India and Thailand. The region’s large and aging population, coupled with a rise in bladder-related health issues, further drives the demand for cystoscopic procedures.

Regions like Latin America and the Middle East & Africa, though smaller in market share, are expected to experience moderate growth. This outlook is encouraged by gradual improvements in healthcare facilities, rising public health consciousness, and government efforts to modernize healthcare. However, economic fluctuations and limited access to advanced medical technology might slow growth in these areas.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the cystoscope market, several key players are making significant contributions with their innovative products and technologies. SCHÖLLY FIBEROPTIC GMBH stands out for its advanced imaging solutions that ensure high-quality visualization, which aids in accurate diagnostics and treatments. The company’s fiberoptic technology is trusted for its reliability and precision. BD, also known as Becton, Dickinson and Company, is a global leader in medical technology, offering a range of cystoscopes designed for both diagnostic and therapeutic purposes.

Their strong distribution network ensures product availability worldwide, maintaining their market leadership through quality and innovation. Boston Scientific Corporation is another prominent player, providing advanced endoscopic solutions with user-friendly designs. Their investment in research and development results in cutting-edge products that cater to modern healthcare needs.

Ackermann Instrumente GmbH specializes in surgical instruments and endoscopic equipment, known for their precision and durability. Their focus on enhancing care quality through innovation makes them a preferred choice among healthcare professionals. Other notable players in the market contribute unique offerings, driving competitiveness and advancing patient care.

Market Key Players

- SCHÖLLY FIBEROPTIC GMBH

- BD

- Boston Scientific Corporation

- Ackermann Instrument

- Shenyang Shenda Endoscope Co. Ltd.

- Stryker Corporation

- Olympus Corporation

- KARL STORZ GmbH & Co. KG

- Coloplast Ltd

- NeoScope Inc.

Recent Developments

- In January 2024, Boston Scientific announced a definitive agreement to acquire Axonics, Inc., a company known for its technologies aimed at treating urinary and bowel dysfunction. This acquisition is significant as it introduces sacral neuromodulation to Boston Scientific’s portfolio, potentially enhancing their urology business.

- In November 2023, Boston Scientific completed the acquisition of Relievant Medsystems Inc. This acquisition added the Intracept Intraosseous Nerve Ablation System to Boston Scientific’s portfolio, a unique treatment for chronic vertebrogenic low back pain.

Report Scope

Report Features Description Market Value (2023) USD 1.1 Bn Forecast Revenue (2033) USD 1.8 Bn CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Flexible Cystoscope, Rigid Cystoscope), By End-User (Hospitals, Clinics, Ambulatory Surgical Centers), By Technology (Video Cystoscope, Fiber Optic Cystoscope) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape SCHÖLLY FIBEROPTIC GMBH, BD, Boston Scientific Corporation, Ackermann Instrument, Shenyang Shenda Endoscope Co. Ltd., Stryker Corporation, Olympus Corporation, KARL STORZ GmbH & Co. KG, Coloplast Ltd , NeoScope Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SCHÖLLY FIBEROPTIC GMBH

- BD

- Boston Scientific Corporation

- Ackermann Instrument

- Shenyang Shenda Endoscope Co. Ltd.

- Stryker Corporation

- Olympus Corporation

- KARL STORZ GmbH & Co. KG

- Coloplast Ltd

- NeoScope Inc.