Global Critical Illness Insurance Market, By Disease (Cancer, Heart Attack, Stroke, and Other Applications), By Premium Mode (Monthly, Quarterly, Half Yearly, and Yearly), By Type (Individual and Family), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct. 2023

- Report ID: 11942

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

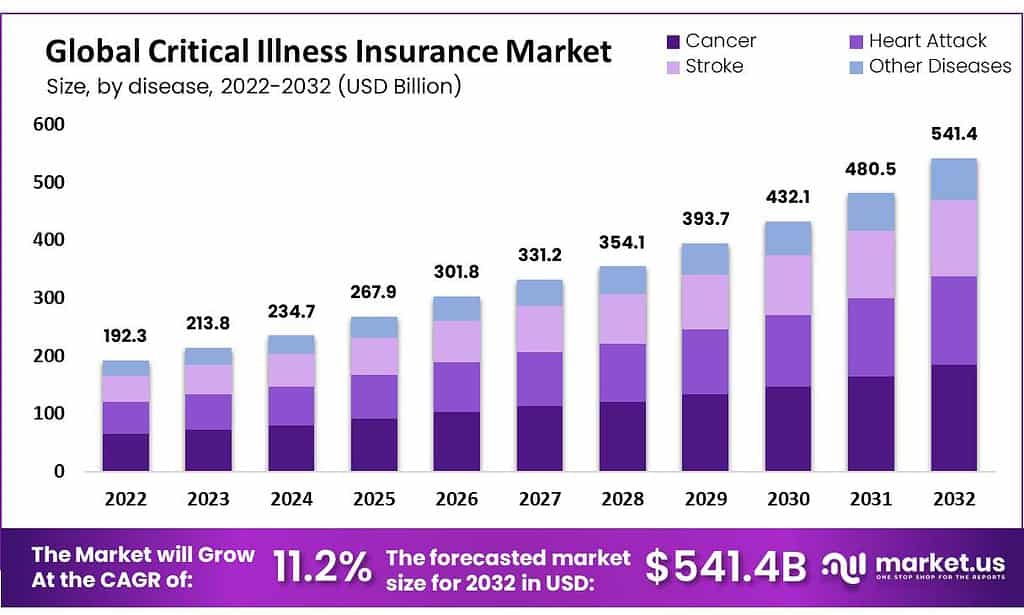

In 2022, the global critical illness insurance market was valued at USD 192.3 billion and expected to grow USD 541.4 billion in 2032. Between 2023 and 2032 this market is estimated to register a CAGR of 11.2%.

Critical illness insurance is a type of policy that pays out a lump-sum amount if the policyholder is diagnosed with an eligible serious illness or medical condition covered by the policy. Critical illness insurance was created to offer financial stability to those facing high medical bills, lost income, or other costs due to a serious illness. Critical illness insurance provides protection from serious diseases like cancer, heart attack, stroke, organ failure, and other life-threatening ailments.

On diagnosis of a covered illness, the policyholder typically receives an amount of money that can be used for medical bills, lost income, and other necessary expenses. The cost of critical illness insurance varies based on several factors, such as the age and health of the policyholder, coverage amount, and illnesses covered by the policy. Premiums for critical illness policies tend to be higher than standard life policies but benefits could be substantial in case of serious illness.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaway

- Market Statistics: The global critical illness insurance market is expected to reach USD 541.4 billion in 2032, growing at a CAGR of 11.2% during the forecast period 2022-2033.

- Driving Factors: Raising Awareness and Education about Critical Illnesses as well as financing them; these were two factors which drove our initiative.

- Restraining Factors: High Cost and Limited Coverage Benefits Are Major Restrictions

- Disease Analysis: The cancer segment is the most lucrative in the global critical illness insurance market, with a projected CAGR of 11.4%.

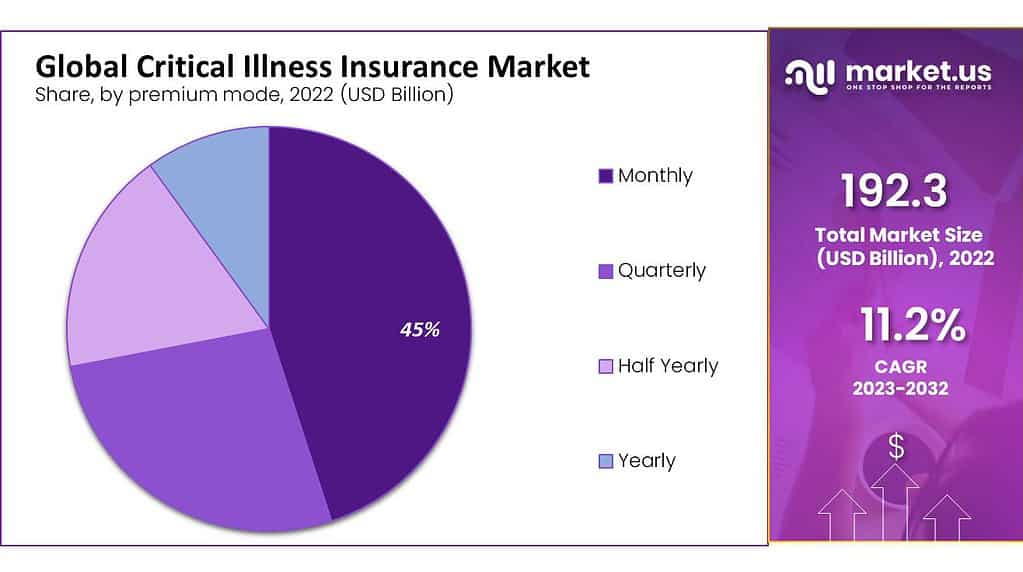

- Premium Mode Analysis: The monthly premium mode is estimated to be the most lucrative segment of the global critical illness insurance market, accounting for an estimated market share of 45%.

- Type Analysis: It is estimated that individuals comprise the most lucrative segment in the global critical illness insurance market with 55% revenue share, contributing over one fifth of all critical illness insurance sales revenues worldwide.

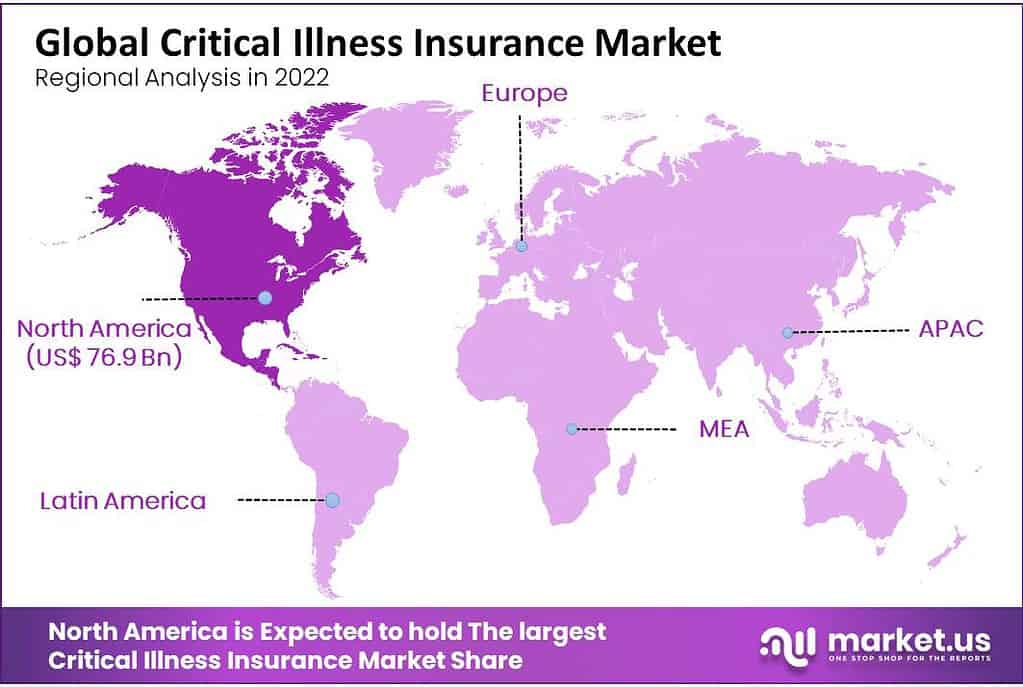

- Regional Analysis: North America Is Dominant Region for Critical Illness Insurance Market

- Top Key Players: Allianz SE, China Life Insurance Company, Aflac Incorporated, Aegon, Prudential PLC, AIG Inc., American Fidelity, Anthem Inc., Aviva PLC, UnitedHealthcare, Desjardins Group and Other Key Players

Driving Factors

Increasing Awareness and Education about Critical Illnesses and required finances

The increasing prevalence of critical illnesses like cancer, heart disease, and stroke has driven up the demand for critical illness insurance. Medical treatments and survival rates continue to improve, increasing the likelihood that more people will develop critical illnesses and need financial protection to cover associated expenses. Healthcare costs worldwide continue to rise, creating a financial strain on individuals and families alike. Critical illness insurance can offer individuals and families financial protection to cover the high cost of medical treatments and other expenses resulting from a critical illness. With increased awareness and education about critical illnesses and their financial toll, more people are becoming cognizant of the need for critical illness insurance. This growing awareness has driven a demand for policies that offer comprehensive protection against financial hardships resulting from critical illnesses. Insurers are increasingly offering customized critical illness insurance policies tailored to policyholders’ requirements, whether these cover specific illnesses or are tailored specifically to individual’s and families requirements.

Restraining Factors

High Cost and Limited Coverage Benefits becomes Major Restraints

Critical illness insurance policies can be pricey and high premiums may deter some individuals and organizations from purchasing them. This could limit the growth of the critical illness insurance market particularly in regions where healthcare costs are already high. Some critical illness insurance policies may offer limited coverage making them less appealing to consumers. Policies may exclude certain critical illnesses or have limits on coverage amounts or duration. Government policies and regulations can also influence the growth of the critical illness insurance market. For instance, in certain countries,, governments may offer free or subsidized healthcare for critical illnesses which could reduce demand for critical illness insurance policies. Critical illness insurance policies may not be widely accessible through all distribution channels, which could restrict their reach and accessibility. This is particularly true in developing countries where insurance distribution networks may not be well established.

Growth Opportunities

Customized Policies as per the requirement of Policyholders

Emerging markets present a great growth potential, where healthcare costs are rising and individuals and businesses are seeking financial protection against critical illnesses. As insurance penetration increases in these markets, demand for critical illness insurance policies is expected to increase. Insurers can create customized policies that cater specifically to different customer segments by covering specific critical illnesses or offering different coverage amounts and durations based on what the policyholder requires.

Modern Technologies Enable the Better Assessment of the Insurers

Modern technologies such as telemedicine and wearable devices enable insurers to better assess the risk of critical illnesses and tailor policies accordingly. This allows them to provide more personalized policies leading to higher customer satisfaction levels. Insurers may partner with healthcare providers to develop comprehensive critical illness insurance policies that cover both medical and non-medical expenses associated with a critical illness. Partnerships like these help insurers provide more comprehensive protection while improving customer experience.

Trending Factors

Comprehensive Critical Illness Insurance Policies

Consumers are increasingly searching for comprehensive critical illness insurance policies that cover both medical and non-medical expenses associated with a critical illness. This includes coverage for expenses such as travel, accommodation, and loss of income. Insurers are offering more specialized critical illness insurance policies tailored to each customer’s requirements. These policies may provide coverage for specific critical illnesses or provide different amounts and durations based on the needs of the policyholder. Insurers are utilizing technology, such as telemedicine and wearable devices, to enhance the underwriting and claims process. This helps assess risk for critical illnesses more accurately and offers personalized policies to customers. Furthermore, insurers are offering features with critical illness insurance policies like partial payouts for less severe illnesses or policies that cover children – all to increase policyholder satisfaction and attract new customers.

Disease Analysis

The Cancer Disease Segment is Dominant

Based on disease, the market for critical illness insurance is segmented into cancer, heart attack, stroke, and other applications. Among these diseases, the cancer segment is the most lucrative in the global critical illness insurance market, with a projected CAGR of 11.4%. The total revenue share of the cancer segment is 34% in 2022. Many critical illness insurance policies are tailored to provide coverage for cancer, one of the most prevalent and financially devastating illnesses. These policies typically cover various cancer types, and stages, as well as provide benefits for treatments like chemotherapy, radiation therapy, and surgery. Heart disease can also be caused by genetics, lifestyle choices, and age; policies in this category may cover conditions like a heart attack or stroke with benefits like bypass surgery, stenting, and angioplasty.

Premium Mode Analysis

Monthly Premium Mode is Dominant in Global Critical Illness Insurance Market

By premium mode, the market is further divided into monthly, quarterly, half-yearly, and yearly. The monthly premium mode is estimated to be the most lucrative segment in the global critical illness insurance market, with a market share of 45% and a projected CAGR of 14.4%, in 2022. Premium mode refers to the frequency at which premiums are paid and insurers typically provide a range of options to accommodate different policyholder needs.

Monthly premium mode is the most frequent option, where policyholders make monthly premium payments. When selecting a premium mode for an insurance policy, the policyholder’s financial situation, budget, and preferences must all be taken into consideration. Policyholders who prefer making fewer payments annually can opt for annual or semi-annual premium modes, while those who favor smaller, more frequent payments might select monthly or quarterly premium modes. Furthermore, the premium mode selected may affect the overall cost of the policy – insurers often offer discounts or surcharges based on which premium mode is selected, with annual premium mode usually being the most cost-effective option.

Note: Actual Numbers Might Vary In The Final Report

Type Analysis

The Individual Type Segment is Dominant

Based on type, the market is segmented into individuals and businesses. Among these types, the individual segment is estimated to be the most lucrative segment in the global critical illness insurance market with the largest revenue share of 55% and a projected CAGR of 13.4% during the forecast period. Individual policyholders are the primary beneficiaries of critical illness insurance who purchase policies to shield themselves and their families financially in case of serious illnesses.

Family insurance plans are more cost-effective than individual coverage offering better conditions at a lower price. Customers receive reasonable coverage at an affordable cost with this plan. many corporations also offer this coverage as part of employee benefits packages, providing workers with financial security in case they face serious illnesses. Coverage may be extended to all employees or targeted towards specific groups such as executives or those at high health risks.

Key Market Segments

Based on Disease

- Cancer

- Heart Attack

- Stroke

- Other Applications

Based on Premium Mode

- Monthly

- Quarterly

- Half Yearly

- Yearly

Based on Type

- Individual

- Family

Regional Analysis

North America is Dominant Region in the Global Critical Illness Insurance Market

North America is anticipated to be the most dominant region in the global critical illness insurance market with the largest market share of 40% and is projected to register a CAGR of 14.6% during the forecast period. The region’s high incidence of critical illnesses coupled with an established insurance industry and growing consumer awareness are driving the market growth. The United States leads this space as it is the leading contributor to this region.

Europe is the second-largest market for critical illness insurance with countries such as the United Kingdom, Germany, and France dominating this region. The aging population and high prevalence of chronic diseases are driving market growth in the Asia Pacific. Countries such as China, Japan, and India are leading this growth with their increasing middle classes, increased awareness about critical illnesses, and rising healthcare expenditure fuelling this expansion.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Emerging key players are employing various strategic tactics such as launching innovative services, partnerships, and collaboration to expand and strengthen their businesses in growing markets. Companies invest heavily in research and development to better meet consumer demands while expanding product portfolios with newly designed policies featuring more optional benefits, partial payouts, and claim coverage to boost customer satisfaction while gaining a competitive edge within the market.

Market Key Players

Listed below are some of the most prominent critical illness insurance industry players.

- Allianz SE

- China Life Insurance Company

- Aflac Incorporated

- Aegon

- Prudential PLC

- AIG Inc.

- American Fidelity

- Anthem Inc.

- Aviva PLC

- UnitedHealthcare

- Desjardins Group

- Other Key Players

Recent Developments

- In 2021, Prudential PLC released “Thrive,” a mental health app that provides policyholders with resources and support.

- In 2021, China Life Insurance Company introduced its “Health Plus” health and wellness program. This initiative provides policyholders with access to various wellness activities.

- In 2020, Aviva PLC unveiled its MyAviva digital platform that allows customers to manage their policies and make claims online.

Report Scope

Report Features Description Market Value (2022) USD 192.3 Bn Forecast Revenue (2032) USD 541.4 Bn CAGR (2023-2032) 11.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Disease (Cancer, Heart Attack, Stroke, and Other Applications), By Premium Mode (Monthly, Quarterly, Half Yearly, and Yearly), By Type (Individual and Family) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Allianz SE, China Life Insurance Company, Aflac Incorporated, Aegon, Prudential PLC, AIG Inc., American Fidelity, Anthem Inc., Aviva PLC, UnitedHealthcare, Desjardins Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are the upcoming trends of Critical Illness Insurance Market in the world?The rising number of health issues due to unhealthy lifestyle of people causes serious illness such as kidney failures, heart attack, cancer and other such serious illness is propelling consumers to take critical illness insurance coverage. In addition, rising awareness about the benefits of a critical illness insurance coverage among consumers is a major driving factor for the market. Moreover, the cost of treatment without having a insurance coverage may lead to huge medical bills for which customers opt for the critical illness insurance. Therefore, these are some of the factors propelling the growth of critical illness insurance market

Which is the largest regional market for Critical Illness Insurance?North America is the leading regional market for critical illness insurance market

How big is the critical illness insurance market?In 2022, the global critical illness insurance market was valued at USD 192.3 billion. Between 2023 and 2032 this market is estimated to register a CAGR of 11.2%.

Critical Illness Insurance MarketPublished date: Oct. 2023add_shopping_cartBuy Now get_appDownload Sample

Critical Illness Insurance MarketPublished date: Oct. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz SE

- China Life Insurance Company

- Aflac Incorporated

- Aegon

- Prudential PLC

- AIG Inc.

- American Fidelity

- Anthem Inc.

- Aviva PLC

- UnitedHealthcare

- Desjardins Group

- Other Key Players