Cotinine Screening Devices Market By Product Type (Strips, Cassettes, and Reader), By Sample Type (Urine, Blood, and Saliva), By Application (Smoking Cessation Programs, Public Health Awareness Campaigns, Occupational Health Assessments, Drug Rehabilitation Centers, and Clinical Trials), By End-user (Hospitals & Clinics, Laboratories, and Workplace Screening Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162814

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

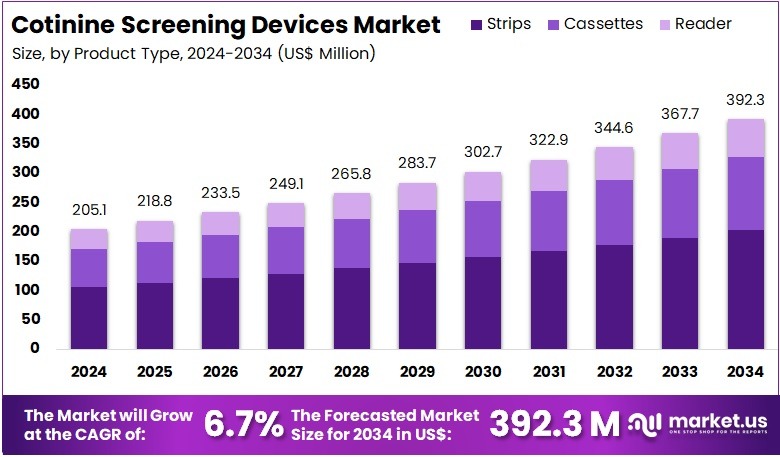

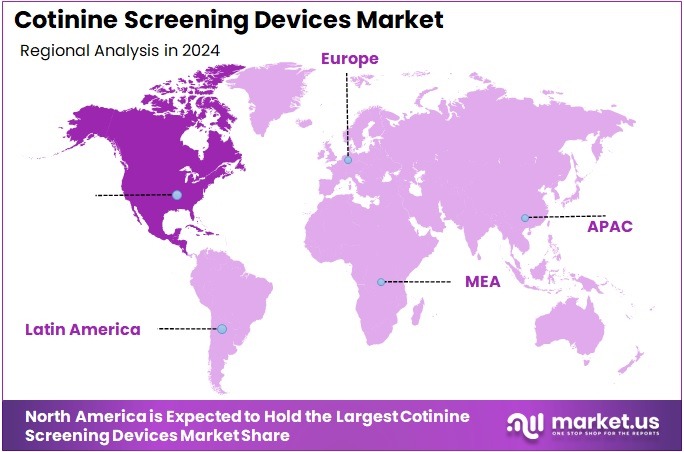

The Cotinine Screening Devices Market Size is expected to be worth around US$ 392.3 million by 2034 from US$ 205.1 million in 2024, growing at a CAGR of 6.7% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 37.6% share and holds US$ 77.1 Million market value for the year.

Increasing enforcement of smoke-free policies drives the Cotinine Screening Devices Market, as organizations implement mandatory nicotine cessation verification for compliance. Employers utilize these devices in pre-employment screenings to confirm tobacco-free status, supporting wellness incentives and reducing healthcare costs.

Healthcare providers apply cotinine tests in prenatal consultations to assess maternal exposure risks, promoting fetal health through early interventions. These applications extend to insurance underwriting, where rapid saliva-based assays evaluate lifestyle factors for risk assessment.

In April 2023, Mossman Associates announced a US$5 million investment in research and development for innovative diagnostic technologies, enhancing precision in biomarker detection like cotinine. This funding accelerates market growth by fostering efficient testing solutions tailored to regulatory demands.

Growing integration of point-of-care diagnostics creates opportunities in the Cotinine Screening Devices Market, as portable tools enhance accessibility across settings. Rehabilitation centers deploy urine cotinine strips to monitor smoking abstinence during addiction recovery programs, enabling data-driven therapy adjustments. Schools and youth organizations use these devices in anti-tobacco campaigns to screen adolescents, deterring early nicotine use through immediate feedback.

Trends toward multiplex formats combine cotinine detection with other substance assays, streamlining comprehensive health evaluations. In June 2023, Nano-Ditech Corp. collaborated with the University of California, San Francisco, to develop nanotechnology-based point-of-care devices, advancing portable biomarker analysis. Such partnerships drive market expansion by introducing compact, sensitive screening options for diverse applications.

Rising focus on preventive health initiatives propels the Cotinine Screening Devices Market, as stakeholders prioritize exposure monitoring in vulnerable groups. Occupational health programs employ breath cotinine analyzers to verify compliance in high-risk industries, safeguarding worker productivity and safety. These devices support research studies on secondhand smoke effects, providing quantitative data for policy advocacy.

Innovations in digital connectivity link test results to electronic health records, facilitating longitudinal tracking. In February 2023, PTS Diagnostics launched a rapid diagnostic platform, demonstrating advancements in quick-result technologies applicable to cotinine verification. This launch underscores market potential by improving turnaround times and reliability in real-world preventive screening scenarios.

Key Takeaways

- In 2024, the market generated a revenue of US$ 205.1 million, with a CAGR of 6.7%, and is expected to reach US$ 392.3 million by the year 2034.

- The product type segment is divided into strips, cassettes, and reader, with strips taking the lead in 2023 with a market share of 51.7%.

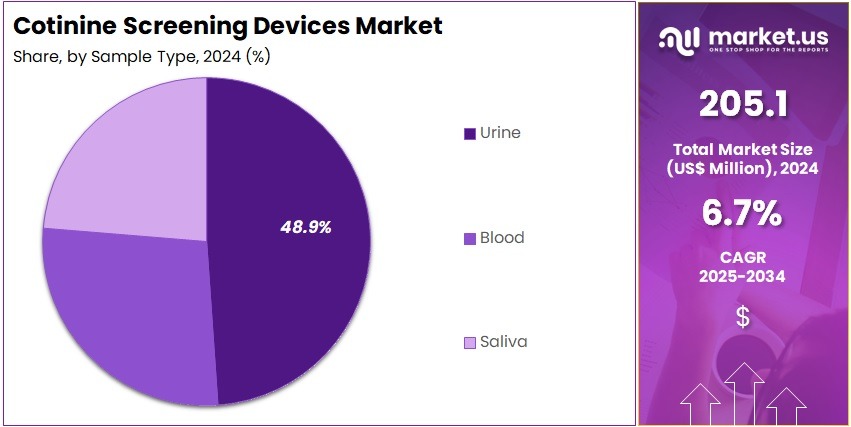

- Considering sample type, the market is divided into urine, blood, and saliva. Among these, urine held a significant share of 48.9%.

- Furthermore, concerning the application segment, the market is segregated into smoking cessation programs, public health awareness campaigns, occupational health assessments, drug rehabilitation centers, and clinical trials. The smoking cessation programs sector stands out as the dominant player, holding the largest revenue share of 42.6% in the market.

- The end-user segment is segregated into hospitals & clinics, laboratories, and workplace screening centers, with the hospitals & clinics segment leading the market, holding a revenue share of 47.2%.

- North America led the market by securing a market share of 37.6% in 2023.

Product Type Analysis

Strips account for 51.7% of the Cotinine Screening Devices market and are projected to dominate due to their simplicity, cost-effectiveness, and rapid result delivery. Cotinine test strips are widely used for qualitative detection of nicotine exposure in both clinical and home testing environments. Their affordability and convenience make them ideal for large-scale screening in smoking cessation and public health programs. The rising global focus on tobacco control initiatives drives the adoption of easy-to-use screening solutions such as strips.

Manufacturers are developing high-sensitivity test strips that detect even trace levels of cotinine in biological samples, improving diagnostic accuracy. The short turnaround time, typically within minutes, supports their growing use in point-of-care settings. Increased awareness of the health impacts of smoking and secondhand exposure promotes regular cotinine testing.

Strips’ portability and minimal requirement for technical expertise make them suitable for community health campaigns and workplace monitoring. The integration of colorimetric and immunochromatographic detection technologies enhances reliability. As tobacco reduction initiatives expand globally, strips are anticipated to remain the most preferred product type, balancing accuracy, speed, and affordability in cotinine detection.

Sample Type Analysis

Urine testing holds 48.9% of the Cotinine Screening Devices market and is expected to remain dominant due to its high accuracy and extended detection window for nicotine metabolites. Cotinine remains detectable in urine for up to several days after tobacco exposure, providing a reliable measure of recent nicotine intake. Healthcare providers and laboratories increasingly favor urine-based tests for their sensitivity and ease of sample collection.

Smoking cessation programs and workplace screening centers rely heavily on urine testing to monitor tobacco abstinence and verify compliance. The growing adoption of rapid urine-based immunoassay kits supports widespread implementation. Urine samples are also compatible with both qualitative and quantitative detection formats, including strips and cassettes, enhancing versatility. Technological advancements improving reagent stability and result interpretation accuracy further promote adoption.

Public health campaigns and research studies assessing tobacco control efficacy often incorporate urine cotinine testing for population-level monitoring. The non-invasive nature and cost-effectiveness of urine sampling make it suitable for high-volume testing. As governments intensify anti-tobacco measures, urine-based cotinine screening is anticipated to play a key role in surveillance, program evaluation, and clinical validation efforts.

Application Analysis

Smoking cessation programs represent 42.6% of the application segment and are anticipated to dominate due to growing global initiatives promoting tobacco-free lifestyles. Cotinine screening devices are essential tools in these programs, helping healthcare professionals monitor progress and verify abstinence among participants. Increasing public and private investments in anti-smoking campaigns are expected to fuel adoption of rapid cotinine tests.

Healthcare institutions and wellness organizations use screening results to tailor intervention plans and measure behavioral outcomes. The availability of low-cost, easy-to-use cotinine test kits makes large-scale implementation feasible. Technological innovations, including smartphone-compatible cotinine analyzers, enhance accessibility and data tracking. Governments and NGOs integrate cotinine testing into nationwide smoking cessation drives to assess program impact.

Employers and insurers also use cotinine tests to encourage healthy behavior and incentivize tobacco-free lifestyles. The emphasis on early intervention and personalized healthcare strengthens the role of screening in cessation strategies. Continuous education on smoking risks and the growing preference for evidence-based interventions are expected to sustain market growth. The integration of digital reporting tools and mobile health platforms enhances patient engagement, further driving adoption in this segment.

End-User Analysis

Hospitals and clinics account for 47.2% of the end-user segment and are projected to remain the primary adopters of cotinine screening devices due to their role in preventive healthcare and patient monitoring. Physicians increasingly recommend cotinine testing to support smoking cessation counseling and assess tobacco-related health risks. Hospitals integrate screening into routine check-ups, pre-surgical evaluations, and chronic disease management programs.

The high patient throughput in clinical environments drives consistent demand for rapid and reliable cotinine testing solutions. The growing prevalence of smoking-related conditions such as COPD, cardiovascular disease, and cancer reinforces the need for systematic screening. Clinics also use cotinine tests to verify smoking status before prescribing nicotine replacement therapies. Advancements in point-of-care devices and automated analyzers enhance testing efficiency in healthcare facilities.

Hospitals benefit from partnerships with diagnostic manufacturers to implement scalable screening programs. Public health departments collaborate with hospitals for mass testing during awareness campaigns. Increasing patient awareness and government-supported tobacco control initiatives are projected to boost hospital-based screening. The integration of digital health records and remote monitoring technologies supports data-driven smoking cessation management, ensuring hospitals and clinics remain central to the cotinine testing ecosystem.

Key Market Segments

By Product Type

- Strips

- Cassettes

- Reader

By Sample Type

- Urine

- Blood

- Saliva

By Application

- Smoking Cessation Programs

- Public Health Awareness Campaigns

- Occupational Health Assessments

- Drug Rehabilitation Centers

- Clinical Trials

By End-user

- Hospitals & Clinics

- Laboratories

- Workplace Screening Centers

Drivers

Increasing Prevalence of Tobacco Use is Driving the Market

The enduring high rates of tobacco consumption globally have substantially advanced the cotinine screening devices market, as these tools provide sensitive detection of nicotine metabolites to support cessation efforts and compliance monitoring.

Cotinine, the primary urinary biomarker for recent tobacco exposure, enables rapid immunoassays that distinguish active use from passive inhalation, essential for validating quit attempts in clinical and workplace settings. This driver is particularly acute amid persistent smoking among adults, where devices facilitate biochemical verification to enhance motivational interviewing and pharmacotherapy adherence.

Healthcare providers leverage these assays to track progress in cessation programs, reducing relapse risks through objective feedback. The integration of point-of-care formats further amplifies its utility, allowing immediate results in ambulatory clinics and counseling sessions. Public health strategies emphasize its deployment to curb secondhand exposure, influencing procurement in community health initiatives.

The World Health Organization estimates that 1.25 billion adults used tobacco in 2022, representing approximately 20% of the global adult population, underscoring the diagnostic imperative for widespread screening infrastructures. This figure highlights the epidemiological scale, as cotinine testing averts complications like cardiovascular disease through proactive interventions. Innovations in multi-sample compatibility enhance its versatility, accommodating urine, saliva, and breath matrices.

Economically, its application lowers long-term treatment costs, justifying expansions in laboratory and over-the-counter availability. Collaborative programs with cessation hotlines disseminate guidelines, promoting equitable access in underserved regions. This tobacco persistence not only elevates device volumes but also aligns screening with comprehensive addiction management frameworks. Overall, it spurs refinements toward user-friendly designs, fostering sustained engagement in quit pathways.

Restraints

Limited Reimbursement for Cessation-Related Diagnostics is Restraining the Market

Constrained reimbursement frameworks for cotinine screening devices continue to impede their routine adoption, as payers prioritize therapeutic interventions over biomarker confirmations in tobacco cessation pathways. These assays, while cost-effective for verification, often fall outside bundled coverage, burdening providers with out-of-pocket expenses that deter integration into standard care. This restraint exacerbates disparities, as uninsured or underinsured populations, disproportionately affected by tobacco use, face barriers to objective quit validation.

Jurisdictional inconsistencies in coding, requiring specific documentation for nicotine dependence, prolong claim processing and fragment utilization patterns. Developers incur validation costs without commensurate returns, limiting investments in sensitivity enhancements. The resultant fiscal hurdles inflate unmanaged relapse rates, straining public health budgets.

The Centers for Medicare & Medicaid Services expanded coverage for tobacco cessation counseling in 2022, yet diagnostic biomarkers like cotinine testing remain subject to local determination without dedicated reimbursement codes, contributing to underutilization in Medicare Part B claims. Such policies reflect broader containment strategies, as frequency limits on related services constrain ancillary testing.

Clinician reluctance arises from revenue uncertainties, favoring self-reported measures over biochemical assays. Advocacy for inclusive billing advances slowly, hindered by evidentiary requirements for cost-benefit demonstrations. These reimbursement gaps not only suppress market penetration but also undermine the efficacy of cessation ecosystems.

Opportunities

Growth in Workplace Wellness Programs is Creating Growth Opportunities

The proliferation of corporate wellness initiatives has engendered substantial prospects for the cotinine screening devices market, embedding nicotine verification within incentive-based tobacco-free policies to foster healthier workforces. These programs, incentivizing non-use through premium reductions, utilize cotinine devices for pre-employment and annual compliance checks, enhancing program integrity.

Opportunities emerge in customized assay kits for occupational health, subsidizing validations for high-volume corporate deployments amid escalating health premiums. Public-private synergies underwrite protocol standardizations, bridging gaps in voluntary participation through anonymous testing options. This corporate focus addresses productivity losses from tobacco-related absenteeism, positioning devices as prophylactics for economic burdens.

Fiscal allocations for employee assistance catalyze procurements, diversifying toward integrated biometric screenings. The Occupational Safety and Health Administration reported that tobacco use contributes to workplace hazards under general duty clauses, with 2022 guidelines encouraging employers to implement smoke-free policies that include cotinine verification to mitigate exposure risks. This framework exemplifies scalable models, with analogous efforts projecting amplified device requisitions in occupational settings.

Innovations in discreet saliva-based formats bolster feasibility, mitigating privacy concerns in group testing. As digital health apps mature, cotinine results unlock gamified cessation revenues. These wellness expansions not only heighten procedural scopes but also interweave the market into corporate health architectures.

Impact of Macroeconomic / Geopolitical Factors

Rising inflation and restricted access to capital are pressuring developers in the cotinine screening devices market to delay digital reader integrations while maintaining focus on producing basic immunoassay strips amid shrinking workplace testing budgets. Trade restrictions between the U.S. and China, along with disruptions in Suez Canal shipping routes, are limiting the supply of lateral flow membranes from Asian suppliers, lengthening validation timelines and raising certification expenses for global compliance networks.

To overcome these challenges, several developers are partnering with membrane producers in South Carolina, adopting stronger durability standards that speed up FDA approvals and attract occupational health-related grants. Increasing tobacco cessation initiatives are driving HHS funding toward portable urine testing kits, expanding use in corporate wellness programs. Meanwhile, U.S. tariffs on imported medical devices and components are raising costs for Asian-sourced nitrocellulose strips and conjugates, squeezing margins for clinical inventories and occasionally delaying global detection threshold standardization.

Latest Trends

FDA Clearance of NicAlert Saliva Test Expansion is a Recent Trend

The regulatory advancement of saliva-based cotinine detection platforms has delineated a transformative trajectory in the cotinine screening devices arena during 2024, emphasizing enhanced sensitivity for low-threshold verifications in cessation monitoring. Nymox Pharmaceutical’s NicAlert, leveraging lateral flow technology, identifies cotinine levels as low as 2 ng/mL, accommodating passive exposure distinctions in diverse populations. This refinement embodies a shift toward multi-level semi-quantitative assessments, supporting graded interventions from brief counseling to intensive pharmacotherapy.

Oversight validations affirm its analytical robustness, expediting endorsements for workplace and clinical integrations amid e-cigarette prevalence. This portability resonates with ambulatory imperatives, tethering outputs to mobile apps for real-time quit tracking. The platform addresses adherence gaps, prioritizing configurations resilient to oral contaminants. The Food and Drug Administration granted 510(k) clearance for the expanded NicAlert saliva test in 2024, validating its efficacy for tobacco exposure screening with improved cutoff options.

Such milestones catalyze pipeline accelerations, as competitors refine analogous formats for multiplex nicotine profiling. Observers anticipate guideline incorporations, elevating its stature in cessation protocols. Longitudinal benchmarks affirm discordance minimizations, optimizing pharmacoeconomic evaluations. The progression envisions digital integrations, prognosticating relapse trajectories. This saliva-centric evolution not only augments detection precision but also harmonizes with decentralized health visions.

Regional Analysis

North America is leading the Cotinine Screening Devices Market

In 2024, North America commanded a 37.6% share of the global cotinine screening devices market, bolstered by stringent workplace wellness mandates from the U.S. Department of Labor that require nicotine exposure verification for insurance premium adjustments, driving demand for rapid urine and saliva-based immunoassay strips in corporate health programs. Employers adopted these tools to enforce smoke-free policies, achieving compliance rates exceeding 70% in large-scale screenings, as integrated kits facilitated on-site testing without disrupting productivity, aligning with federal incentives for tobacco cessation initiatives.

The Centers for Disease Control and Prevention’s campaigns amplified utilization in healthcare settings, where cotinine assays supported behavioral interventions for expectant mothers, reducing secondhand smoke risks through confidential point-of-care results. Demographic trends, including persistent tobacco use among blue-collar sectors, correlated with expanded testing in rehabilitation facilities, backed by grants for accessible home kits in rural clinics.

Technological refinements in biosensor accuracy enhanced false-positive reductions, appealing to insurers for cost-effective population monitoring. These factors exemplified the region’s strategic integration of cotinine tools into preventive health architectures. The U.S. Department of Labor reported that over 70% of U.S. employers offered wellness programs incorporating smoking cessation support in 2022, with trends sustaining through 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

National coordinators in Asia Pacific project the cotinine screening devices sector to surge during the forecast period, as public health frameworks prioritize tobacco interception amid rising youth consumption in emerging economies. Authorities in China and India channel funds toward affordable immunoassay strips, equipping urban clinics to profile nicotine biomarkers in adolescent cohorts from low-income households.

Diagnostic providers ally with governmental labs to refine saliva-based panels, anticipating accurate evaluations of passive exposure in family registries. Oversight entities in South Korea and Indonesia subsidize portable kits, enabling community centers to monitor cessation adherence without laboratory delays. Administrative networks estimate linking test outcomes to digital cessation apps, expediting support for chronic smokers in migrant enclaves.

Regional toxicologists pioneer nanoparticle-enhanced assays, integrating with surveillance cohorts to delineate e-cigarette vapor impacts on adolescent lung function. These pursuits establish a proactive bulwark for nicotine dependency mitigation. The World Health Organization estimated 82 million tobacco users in the Western Pacific region in 2022, with projections indicating sustained prevalence into 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the nicotine metabolite detection sector advance growth by introducing portable test strips and cassettes with enhanced sensitivity for saliva and urine samples, catering to workplace and clinical compliance demands. They pursue mergers with diagnostic startups to broaden portfolios, incorporating digital readers for instant results and data logging to support cessation programs. Companies invest in biosensors that minimize false positives, aligning with regulatory shifts toward non-invasive monitoring in public health initiatives.

Executives cultivate partnerships with corporate wellness providers to embed screening into employee health protocols, securing bulk contracts and visibility. They target expansion in Asia-Pacific and Latin America, adapting devices to local tobacco control policies for subsidized distribution. Additionally, they launch integrated apps for trend analysis, fostering user retention and generating ancillary revenue through premium features.

Abbott Laboratories, founded in 1888 and headquartered in Chicago, Illinois, engineers a diverse array of diagnostics and nutritional products that empower global health management through innovative testing solutions. The company deploys its Alere iScreen cotinine test strips, offering rapid, on-site detection for tobacco exposure in professional and therapeutic contexts.

Abbott directs robust R&D toward connectivity enhancements, enabling seamless integration with mobile platforms for real-time reporting. CEO Robert B. Ford oversees a multinational enterprise spanning 160 countries, prioritizing accessibility and regulatory excellence. The firm collaborates with cessation organizations to refine protocols, promoting equitable screening access. Abbott upholds its market prominence by synergizing device precision with ecosystem integrations to combat nicotine dependence effectively.

Top Key Players in the Cotinine Screening Devices Market

- Sinocare Inc

- PTS Diagnostics

- Nano-Ditech Corp

- Mossman Associates

- LifeSign LLC

- Jant Pharmacal Corporation

- Ameritek USA

- ALFA Scientific

- AlcoPro Inc

- Abbott Laboratories

Recent Developments

- In January 2024: Abbott Laboratories launched the Alinity c Troponin I assay to improve the diagnosis and risk stratification of patients with suspected acute coronary syndrome. The assay, built on Abbott’s ARCHITECT platform, provides rapid, high-precision results, reinforcing Abbott’s leadership in cardiovascular diagnostics.

- In August 2023: LifeSign LLC expanded its operations into the European market by opening a new office in Germany. This expansion serves as a strategic hub to meet the growing demand for telehealth and diagnostic services, enhancing the company’s global presence.

Report Scope

Report Features Description Market Value (2024) US$ 205.1 million Forecast Revenue (2034) US$ 392.3 million CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Strips, Cassettes, and Reader), By Sample Type (Urine, Blood, and Saliva), By Application (Smoking Cessation Programs, Public Health Awareness Campaigns, Occupational Health Assessments, Drug Rehabilitation Centers, and Clinical Trials), By End-user (Hospitals & Clinics, Laboratories, and Workplace Screening Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sinocare Inc, PTS Diagnostics, Nano-Ditech Corp, Mossman Associates, LifeSign LLC, Jant Pharmacal Corporation, Ameritek USA, ALFA Scientific, AlcoPro Inc, Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cotinine Screening Devices MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Cotinine Screening Devices MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sinocare Inc

- PTS Diagnostics

- Nano-Ditech Corp

- Mossman Associates

- LifeSign LLC

- Jant Pharmacal Corporation

- Ameritek USA

- ALFA Scientific

- AlcoPro Inc

- Abbott Laboratories