Global convenience store market Market Size, Share, Growth Analysis By Product Type (Staple Products, Impulse Products, Emergency Products), By Store Type (Kiosks, Mini Convenience Stores, Limited Selection Convenience Stores, Traditional Convenience Stores, Expanded Convenience Stores, Hyper Convenience Stores), By Ownership Model (Independent Stores, Franchise Stores, Corporate-Owned Chains), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167285

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

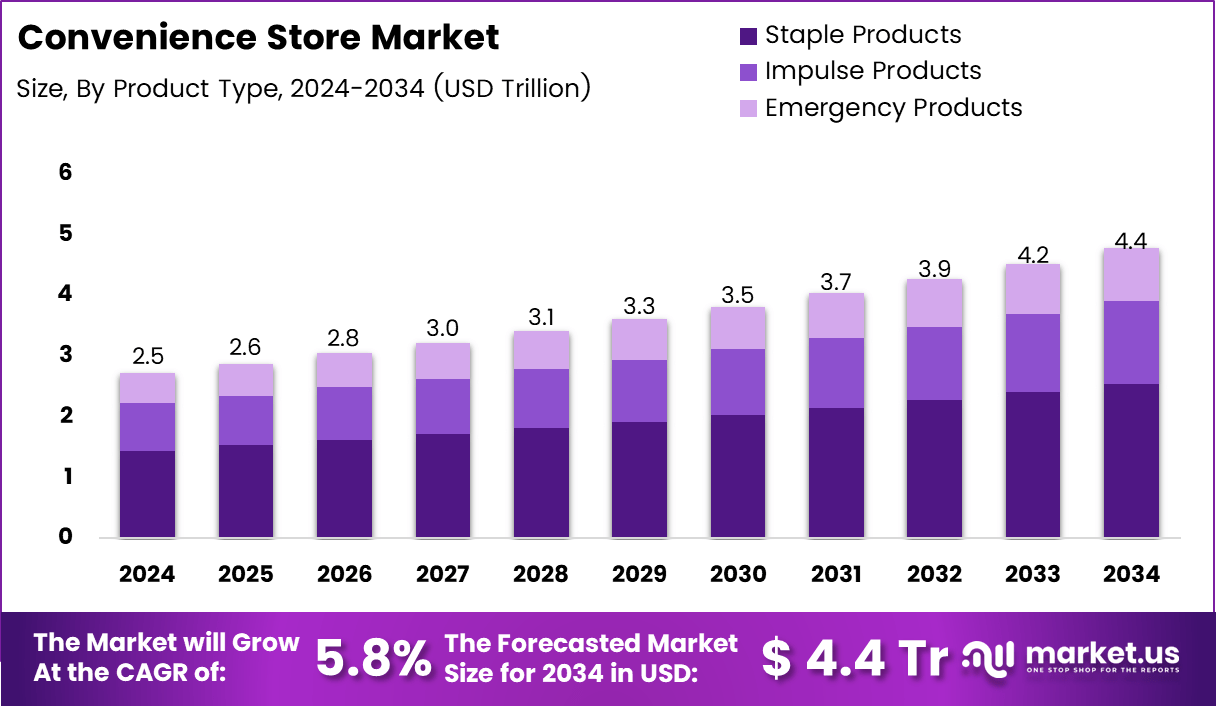

The Global convenience store market size is expected to be worth around USD 4.4 trillion by 2034, from USD 2.5 trillion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

The convenience store market reflects a fast-evolving retail environment shaped by mobility, urban density, and growing consumer preference for quick-service formats. The sector benefits from increasing demand for ready-to-eat products, last-minute purchases, and extended operating hours. Moreover, expanding road infrastructure and neighborhood retail zoning continue to support steady growth across urban and semi-urban clusters.

Analysts observe that the convenience store market advances as digital payment adoption rises and contactless checkout systems improve shopping efficiency. Transitioning toward healthier food ranges, prepared meals, and impulse-driven categories strengthens transaction values. Simultaneously, supportive municipal regulations on micro-retail establishments and fuel-station-attached stores enable operators to scale offerings across diversified consumer missions.

Furthermore, growing investment in energy-efficient refrigeration, smart inventory management, and IoT-enabled shelf systems enhances operational visibility. Governments in many regions promote small-format retail modernization through incentives for e-billing, taxation compliance, and improved safety standards. As urban mobility patterns shift, these stores increasingly act as neighborhood service hubs, fulfilling urgent needs such as beverages, snacks, household essentials, and to-go meals.

In parallel, expanding opportunities emerge from rising demand for hot food, meal-prep kits, and premium on-the-go beverages. Operators focusing on optimized layouts, curated assortments, and quick-delivery partnerships attract younger consumers seeking rapid convenience. Additionally, regulatory clarity around fuel-station retail, zoning approvals, and health-safety guidelines improves business predictability for new and expanding store formats.

Toward the demand side, analysts note that subconscious consumer behavior significantly shapes in-store conversions. According to NACS, 95% of convenience store shopping decisions occur subconsciously, underscoring the importance of intuitive layouts and quick-grab merchandising. Moreover, evolving digital loyalty programs and cashless payments further accelerate small-ticket, high-frequency purchases across key retail missions.

Finally, customer motivations highlight hygiene, mission-based shopping, and value-driven selections. According to GasBuddy, 84% of customers stopping for fuel consider store cleanliness a deciding factor for entering. Additionally, NielsenIQ reports that 55% visit for top-up missions, 11% for meal prep, and 17% for to-go food—reinforcing continued demand across diverse convenience store market occasions.

Key Takeaways

- The Global Convenience Store Market reached USD 2.5 trillion in 2024 and is projected to reach USD 4.4 trillion by 2034 at a 5.8% CAGR.

- Staple Products led the product type segment with a dominant share of 57.9% in 2024.

- Traditional Convenience Stores held the highest store-type share at 34.3% in 2024.

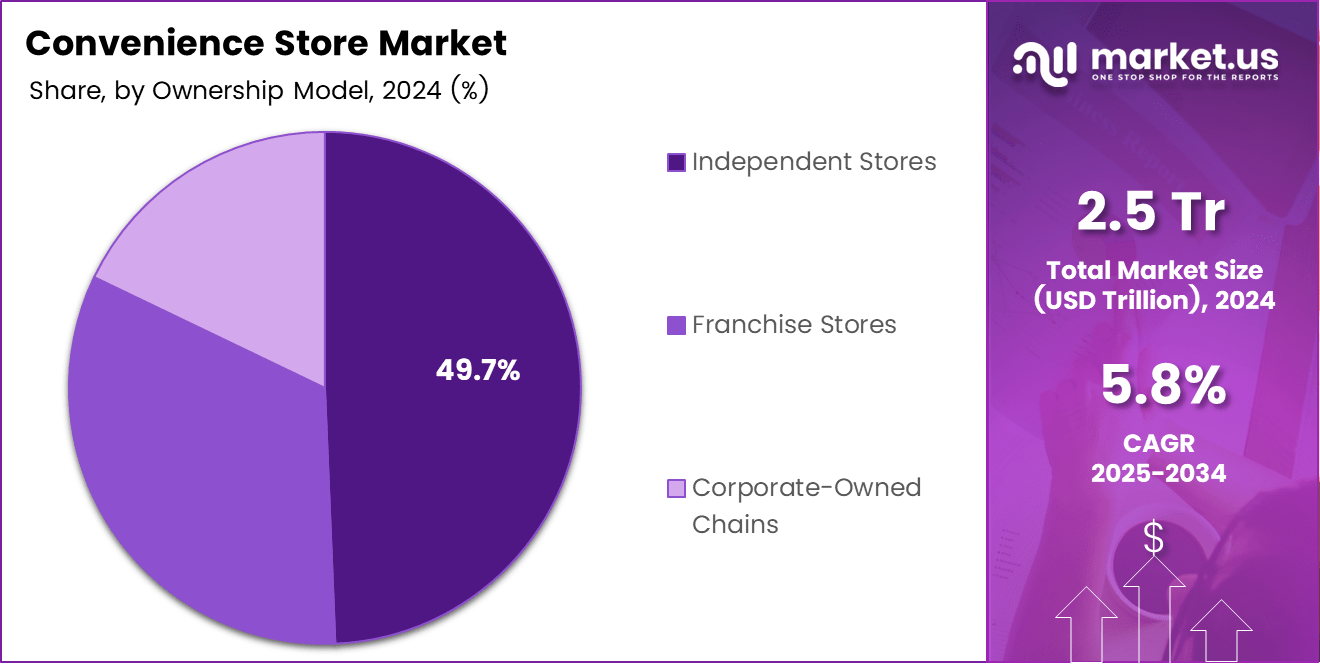

- Independent Stores dominated the ownership model with a strong 49.7% share.

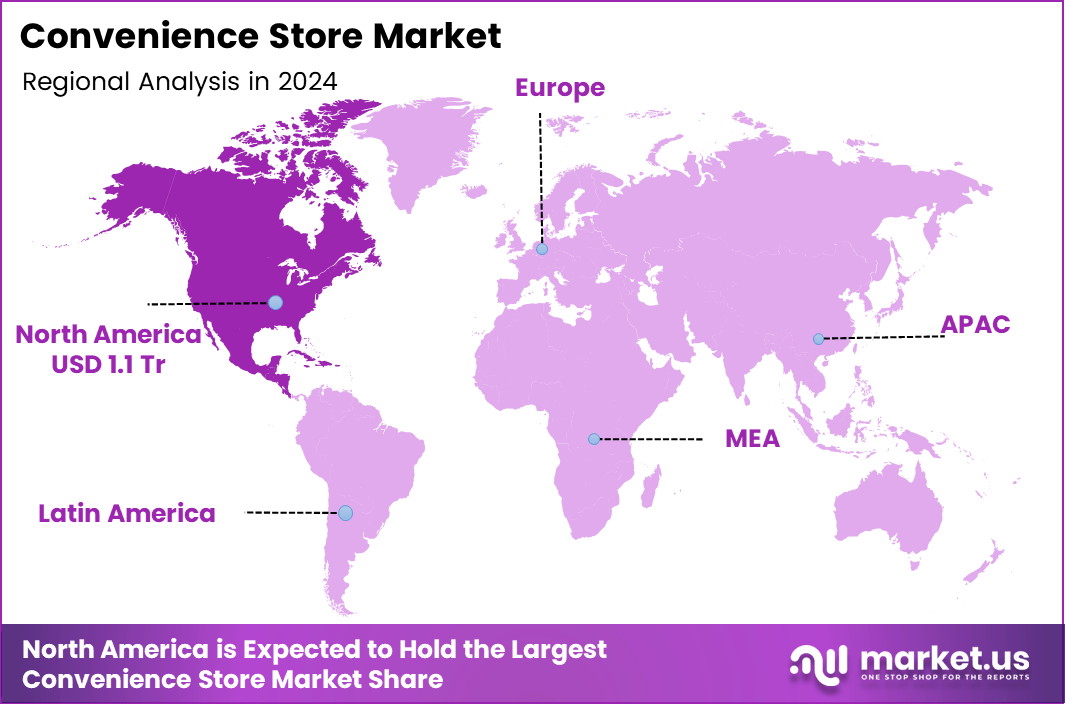

- North America remained the leading region with a 45.90% share valued at USD 1.1 trillion.

- The US contributed significantly to regional leadership through high demand for fuel-linked convenience shopping and ready-to-eat food purchases.

By Product Type Analysis

Staple Products dominate with 57.9% due to their recurring household demand and consistent purchase frequency.

In 2024, ‘Staple Products’ held a dominant market position in the ‘By Product Type’ Analysis segment of the convenience store market, with a 57.9% share. This category benefits from continuous demand for essentials, including groceries and daily-use items, driving frequent store visits and stable revenue streams across major convenience formats.

Impulse Products support revenue growth as customers seek quick-add items during routine visits. Positioned strategically near checkout counters, these products drive unplanned purchases. Their fast-moving nature and low price thresholds help operators maximize conversion opportunities and enhance overall basket size within various convenience environments.

Emergency Products remain essential during unexpected consumer needs, such as household shortages or last-minute requirements. Their availability encourages consumers to rely on nearby convenience stores for urgent purchases. This segment thrives on accessibility, extended operating hours, and the ability to offer quick replacements for urgently required items.

By Store Type Analysis

Traditional Convenience Stores lead with 34.3% due to their broad assortment and established neighborhood presence.

In 2024, ‘Traditional Convenience Stores’ held a dominant market position in the ‘By Store Type’ Analysis segment of the convenience store market, with a 34.3% share. These stores provide balanced product mixes, long operating hours, and strong consumer familiarity, supporting steady foot traffic and recurring purchases in dense local areas.

Kiosks offer compact layouts and rapid service for commuters and transit-zone shoppers. Their small footprint enables quick installation in high-traffic locations, supporting demand for snacks, beverages, and small essentials. This format thrives on accessibility and convenience-driven buying behavior.

Mini Convenience Stores serve residential and semi-urban clusters with curated assortments. Their moderate size allows them to offer essential groceries, chilled items, and snacks. The format continues expanding as consumers seek fast access to daily-use products without traveling to larger retail formats.

Limited Selection Convenience Stores operate with a focused product range, targeting immediate consumption and quick replenishment items. Their lean inventory structure enables efficient operations and quick service times. This model supports simplified stocking and faster customer movement through the store.

Expanded Convenience Stores provide broader assortments, including fresh food, bakery products, and beverages. They appeal to customers seeking upgraded convenience options and improved product variety. Their larger footprint helps retailers position themselves competitively against supermarkets in select categories.

Hyper Convenience Stores feature advanced layouts, premium assortments, and tech-enabled shopping. Often located in high-income urban districts, they cater to modern preferences such as ready meals, gourmet snacks, and digital checkout systems. This format continues gaining traction among time-pressed consumers.

By Ownership Model Analysis

Independent Stores dominate with 49.7% due to flexible operations and strong local customer relationships.

In 2024, ‘Independent Stores’ held a dominant market position in the ‘By Ownership Model’ Analysis segment of the convenience store market, with a 49.7% share. These stores benefit from personalized service, adaptable pricing, and community-driven familiarity, enabling them to maintain relevance across varied neighborhoods.

Franchise Stores continue expanding due to standardized operations, training support, and strong brand recognition. Their structured supply chains and marketing help ensure consistency across locations. Many franchise operators leverage centralized sourcing to improve efficiency and uphold predictable product quality.

Corporate-Owned Chains rely on scale-driven operations, centralized inventory technology, and superior logistics. Their broader financial capability allows them to adopt automation, advanced analytics, and digital checkout systems. They remain key contributors to innovation and premium store formats within the convenience retail ecosystem.

Key Market Segments

By Product Type

- Staple Products

- Impulse Products

- Emergency Products

By Store Type

- Kiosks

- Mini Convenience Stores

- Limited Selection Convenience Stores

- Traditional Convenience Stores

- Expanded Convenience Stores

- Hyper Convenience Stores

By Ownership Model

- Independent Stores

- Franchise Stores

- Corporate-Owned Chains

Drivers

Rising Adoption of Digital and On-the-Go Retail Behaviors Drives Market Growth

The convenience store market grows as more shoppers prefer contactless and mobile-wallet payment systems. These fast payment methods reduce checkout time and improve customer satisfaction. As digital payments become a daily habit, stores offering seamless transactions gain higher footfall and stronger repeat visits.

Growth also accelerates with the expansion of ready-to-eat and fresh-food choices. Consumers increasingly look for quick, on-the-go meals that fit busy lifestyles. Stores that provide fresh snacks, bakery items, and hot meals attract more daily customers, strengthening their role as immediate food-access points.

Additionally, growing demand for late-night and extended-hours retail access supports market expansion. Many consumers rely on convenience stores for urgent or last-minute needs. Locations that stay open longer capture a wider audience, especially urban residents, night-shift workers, and travelers seeking essential products.

Restraints

High Operational Pressures Limit Market Expansion

The convenience store market faces restraints due to rising operating costs driven by labor shortages and wage inflation. Many stores struggle to maintain adequate staffing while keeping expenses under control. This pressure reduces margins and forces retailers to find new ways to optimize day-to-day operations.

Another key restraint is the limited SKU range compared to supermarkets. Because convenience stores operate in smaller spaces, they offer fewer product options. This restricts basket size and lowers the average transaction value. Customers seeking variety often shift to larger retail formats, affecting overall store performance.

Growth Factors

Technology Adoption and New Retail Formats Unlock Growth Opportunities

The convenience store market gains major opportunities through the integration of autonomous checkout and smart-shelf technology. These systems reduce wait times, improve inventory accuracy, and lower labor dependency. As automation grows, stores can operate more efficiently and enhance customer experience.

Another strong opportunity is the expansion of EV-charging-linked convenience retail hubs. As electric vehicle usage increases, charging stations become new touchpoints for food, beverages, and impulse purchases. Stores positioned near charging bays can capture longer dwell times and higher spending per visit.

Premiumization also opens new avenues, with rising demand for high-quality beverages, snacks, and fresh meal combos. Offering gourmet drinks, healthier snacks, and elevated meal kits helps stores boost their margins and appeal to modern customers seeking better choices.

Finally, partnerships with last-mile delivery platforms support hyperlocal fulfillment. By supplying quick-delivery orders for everyday essentials, convenience stores strengthen their role in digital retail ecosystems. This creates an additional revenue stream and expands customer reach beyond in-store traffic.

Emerging Trends

Health, Digital Loyalty, and Micro-Market Models Shape Emerging Trends

The convenience store market is witnessing rising demand for health-oriented beverages, protein snacks, and functional drinks. Consumers increasingly look for quick but healthier options during their daily routines. Stores offering nutritious drinks and snack choices align well with these evolving preferences.

Another major trend is the introduction of self-service micro-markets in workplaces. These tech-enabled, unattended retail setups offer fresh food, snacks, and packaged items to office employees. They provide convenience without requiring full-time staff, making them a popular alternative to traditional vending machines.

Digital loyalty apps are also gaining popularity. Customers appreciate instant rewards, personalized discounts, and fuel-linked points that encourage repeat visits. As mobile engagement increases, convenience stores use loyalty programs to strengthen customer retention and increase spending frequency.

Regional Analysis

North America Dominates the Convenience Store Market with a Market Share of 45.90%, Valued at USD 1.1 Trillion

North America holds the leading position in the convenience store market, driven by strong spending patterns and an advanced retail infrastructure. The region accounts for 45.90% of the total market share, amounting to USD 1.1 trillion, supported by high consumer demand for quick-service retail formats, extended operating hours, and mobile-wallet–enabled transactions. Evolving preferences for ready-to-eat meals and the rapid rollout of frictionless checkout formats continue to reinforce the region’s dominance in overall revenue contribution.

Europe Convenience Store Market Trends

Europe reflects a stable and mature market expansion supported by dense urban populations and the rising shift toward neighborhood-based retailing. Growth is influenced by sustained demand for fresh food, localized assortments, and digital payment integration across leading markets such as the UK, Germany, and France. Regulatory focus on sustainability and low-emission retail operations also accelerates investments in eco-friendly store formats, enhancing modernization across the region.

Asia Pacific Convenience Store Market Trends

Asia Pacific represents one of the fastest-adopting regions as rapid urbanization and an expanding middle-income population strengthen convenience-driven purchasing behavior. Countries such as China, Japan, South Korea, and Indonesia continue to lead store expansion with high footfall and an increased reliance on ready-to-eat meals and mobile-first payment systems. The region’s strong penetration of 24/7 store models reinforces long-term market growth.

Middle East & Africa Convenience Store Market Trends

The Middle East & Africa market is progressing steadily as modern retail formats expand across the Gulf nations and select African metros. Rising tourism, infrastructural developments, and the growth of fuel-station-attached convenience stores support wider adoption. Consumer preference for quick-purchase essentials, beverages, and snack categories is fueling additional store openings in urban corridors and transport hubs.

Latin America Convenience Store Market Trends

Latin America shows improving momentum with increasing penetration of organized retail chains and growing demand for convenience-driven shopping among urban households. Markets such as Brazil, Mexico, and Chile are witnessing steady expansion supported by shifting lifestyle patterns and greater acceptance of digital payment tools. The region continues to evolve with hybrid store models, extended-hours formats, and localized assortments that cater to everyday consumer needs.

U.S. Convenience Store Market Trends

The U.S. remains the core contributor within North America, with strong consumer spending on snacks, beverages, prepared foods, and fuel-station-linked convenience purchases. Rapid adoption of contactless checkout technologies and loyalty-driven digital platforms is strengthening revenue per store. The market also benefits from wide geographic coverage and the increasing role of convenience outlets as last-minute and late-night shopping destinations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Convenience Store Market Company Insights

The global convenience store market in 2024 reflects steady expansion as leading operators strengthen their networks, expand fresh-food programs, and accelerate digital retail integration. Casey’s General Stores, Inc. maintains a strong regional presence in the Midwest, benefiting from rising foot traffic in fuel-attached locations and sustained demand for freshly prepared foodservice offerings. Its continued investments in store remodels and loyalty-focused digital platforms enhance customer retention and average basket value.

Alimentation Couche-Tard Inc. demonstrates significant operational scale across North America and Europe, supported by strategic acquisitions and a strong focus on modernizing store formats. The company’s emphasis on autonomous checkout trials, premium private-label assortments, and supply-chain optimization reinforces operational efficiency while strengthening profitability across its multi-country network.

Murphy USA Inc. leverages its highway-adjacent footprint and competitive fuel pricing to attract high-frequency customers. Growth is shaped by improved in-store merchandising, snack and beverage category expansion, and wider adoption of digital payment programs. Its compact, efficiency-driven store model continues to support strong transaction volumes in key southern and central US markets.

Parkland Corporation expands its influence across Canada and selected international markets through a diverse portfolio of convenience and fuel-retail formats. Continued upgrades to its foodservice programs, along with investment in loyalty ecosystems and multi-channel retailing, strengthen customer engagement. The company’s strategy of integrating convenience stores with energy-related services ensures steady market penetration and supports long-term revenue stability.

Other global operators such as 7-Eleven, FamilyMart, FEMSA, and Lawson Inc. continue shaping the broader landscape through rapid format innovation, digital commerce integration, and sustained international expansion, contributing to an increasingly competitive and consumer-centric convenience retail environment.

Top Key Players in the Market

- Casey’s General Stores, Inc

- Alimentation Couche-Tard Inc.

- Murphy USA Inc.

- Parkland Corporation

- 7-Eleven

- FamilyMart

- FEMSA

- Lawson Inc.

Recent Developments

- In Jun 2025, Getty Realty Corp. announced the acquisition of a $100 million convenience store portfolio in Houston, expanding its retail real estate footprint. This acquisition strengthens Getty Realty’s exposure to high-traffic fuel and convenience assets while supporting stable, long-term lease income.

- In Aug 2024, Alimentation Couche-Tard announced plans to acquire GetGo Café + Market stores from Giant Eagle, reinforcing its position in the North American convenience retail market. The transaction supports Couche-Tard’s growth strategy by expanding its store network and enhancing its foodservice and fuel retail offerings.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Trillion Forecast Revenue (2034) USD 4.4 Trillion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Staple Products, Impulse Products, Emergency Products), By Store Type (Kiosks, Mini Convenience Stores, Limited Selection Convenience Stores, Traditional Convenience Stores, Expanded Convenience Stores, Hyper Convenience Stores), By Ownership Model (Independent Stores 49.7%, Franchise Stores, Corporate-Owned Chains) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Casey’s General Stores, Inc, Alimentation Couche-Tard Inc., Murphy USA Inc., Parkland Corporation, 7-Eleven, FamilyMart, FEMSA, Lawson Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Casey's General Stores, Inc

- Alimentation Couche-Tard Inc.

- Murphy USA Inc.

- Parkland Corporation

- 7-Eleven

- FamilyMart

- FEMSA

- Lawson Inc.