Global Contract Furniture Market By Type (Chairs & Stools, Tables & Desks, Storage Furniture, Sofa & Couch), By End-user (Government, Corporate Offices, Institutional, Healthcare and Medical Facilities, Other End-Users), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 103764

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

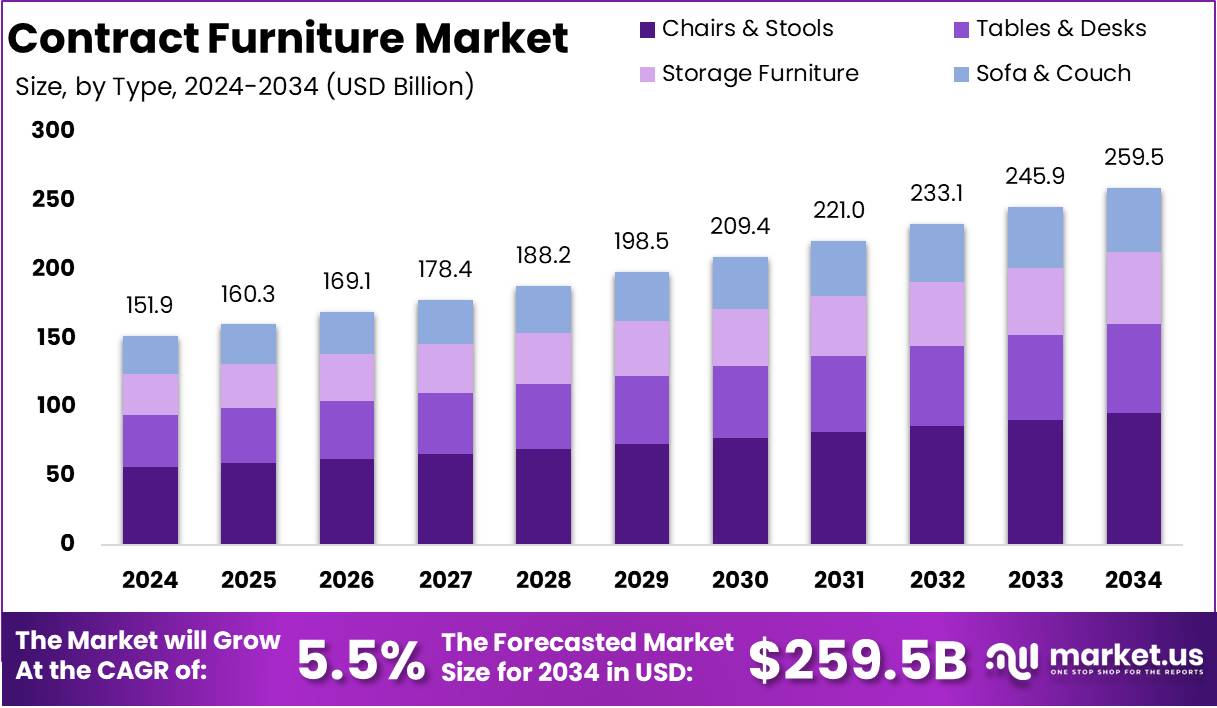

The Global Contract Furniture Market size is expected to be worth around USD 259.5 Billion by 2034 from USD 151.9 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

Contract furniture refers to commercial-grade furniture specifically designed and manufactured for use in high-traffic environments such as offices, hotels, healthcare facilities, restaurants, and educational institutions. Unlike residential furniture, contract furniture is built to meet stringent durability, safety, and compliance standards, ensuring long-term performance under heavy usage. These products are often customized to align with corporate branding, functionality requirements, and industry regulations.

The contract furniture market encompasses the production, distribution, and sales of furniture designed for commercial applications. This market includes a diverse range of products, such as office workstations, ergonomic chairs, modular seating, hospitality furnishings, and healthcare furniture. It is characterized by a strong demand for durability, aesthetics, and functionality, with manufacturers focusing on innovation, sustainability, and adaptability to evolving workplace and hospitality trends.

The expansion of the contract furniture market is driven by several key factors. The increasing adoption of flexible and ergonomic workspaces is prompting businesses to invest in modular and adaptable furniture solutions. Rapid urbanization and commercial infrastructure development, particularly in emerging economies, are fueling demand.

The demand for contract furniture is influenced by changing workplace dynamics, including the rise of hybrid work models and collaborative office layouts. The hospitality sector’s expansion, coupled with increased investments in luxury and boutique hotel interiors, is driving sustained furniture procurement. The healthcare industry’s emphasis on patient-centric design is also leading to increased demand for specialized, ergonomic medical furniture.

The evolving business landscape presents substantial opportunities for contract furniture manufacturers. The growing preference for sustainable and recycled materials creates a niche for eco-conscious product offerings. The shift toward customized and branded environments opens up avenues for bespoke furniture solutions catering to specific corporate identities.

According to HNI, the Contract Furniture Market is experiencing strategic consolidation, with HNI acquiring all outstanding shares of Kimball International in a $485 million cash and stock transaction. Under the agreement, Kimball shareholders receive $9.00 in cash and 0.1301 HNI shares per Kimball share, ultimately owning 10% of the combined entity.

The contract furniture market is evolving rapidly, driven by digital adoption and shifting consumer behavior. Online sales account for 14% of total furniture purchases, with revenues projected to reach $99.89 billion. According to Why Does Everything Suck, the pet furniture segment has surged by 20%, reflecting changing household dynamics. China led global spending on furniture, homeware, and home decor at $68.6 billion, followed by Germany $7.3 billion and the UK $7 billion.

Key Takeaways

- The global contract furniture market is projected to reach USD 259.5 billion by 2034, up from USD 151.9 billion in 2024, reflecting a CAGR of 5.5% during the forecast period (2025-2034).

- In 2024, Chairs & Stools emerged as the leading product category, accounting for more than 37% of the total market share.

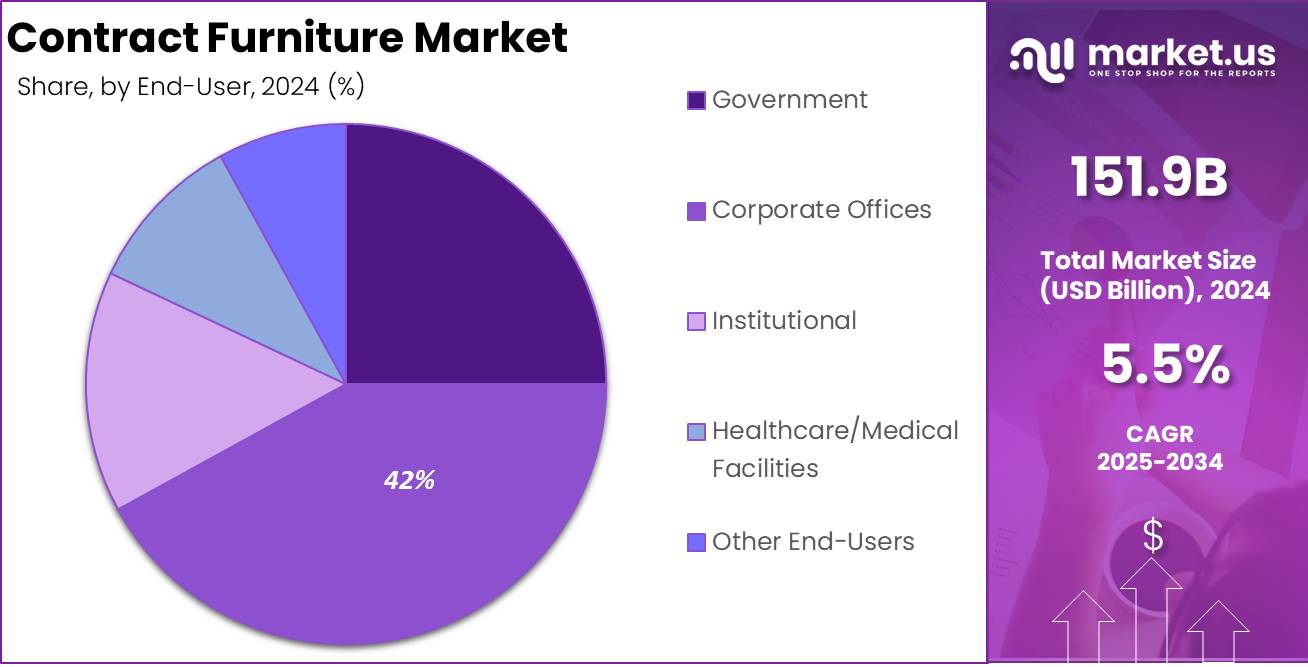

- Corporate Offices remained the largest end-use segment in 2024, capturing over 42% of the market.

- The Offline distribution channel continued to dominate the market in 2024, holding more than 77% of the total market share.

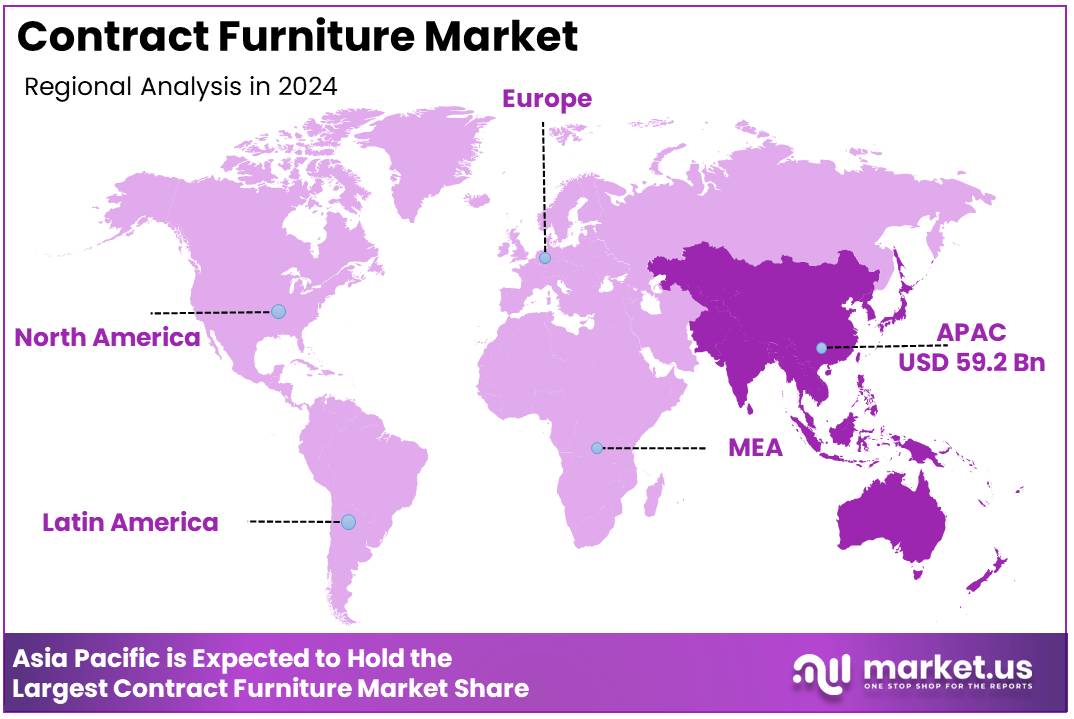

- Asia Pacific led the contract furniture market in 2024, accounting for 39% of the total market share, driven by rapid urbanization, infrastructure development, and increasing demand for modern office spaces. The region’s market was valued at USD 59.2 billion in 2024.

By Type Analysis

Chairs & Stools Dominate the Contract Furniture Market with a 37% Share

In 2024, Chairs & Stools maintained a dominant position in the Contract Furniture Market, capturing more than 37% of the total market share. The demand for ergonomic, flexible, and multi-functional seating solutions in commercial spaces, including offices, hospitality, and educational institutions, has significantly contributed to this segment’s growth. The rising adoption of sustainable and modular seating designs further supports its strong market presence.

The Tables & Desks segment is witnessing steady growth, driven by the increasing demand for modern and adaptable workspace solutions. The shift toward hybrid and co-working office models has led to a surge in demand for height-adjustable, space-saving, and tech-integrated tables and desks. Corporate and institutional sectors continue to be the primary consumers, reinforcing strong market momentum.

Storage Furniture plays a crucial role in commercial interiors, offering functional and aesthetic solutions for workspace organization. The adoption of smart storage solutions with integrated digital locking systems and customizable designs is fueling segment growth. Additionally, the expansion of corporate spaces and the need for efficient storage in retail and healthcare sectors contribute to its market stability.

The Sofa & Couch segment is experiencing growth, primarily driven by the increasing focus on workplace comfort and hospitality industry expansion. The growing trend of collaborative workspaces and lounge areas in offices has boosted demand for modular and premium upholstered seating. Furthermore, rising investments in hotel and commercial real estate projects contribute to the segment’s continued growth.

By End-User Analysis

Corporate Offices Dominate the Contract Furniture Market with a 42% Share

In 2024, Corporate Offices maintained a dominant position in the Contract Furniture Market, capturing more than 42% of the total market share. The rising demand for ergonomic, flexible, and collaborative workspace solutions has significantly contributed to this segment’s growth. The shift towards hybrid work models and modern office designs has further fueled investments in premium office furniture, driving continuous market expansion.

The Government segment continues to play a significant role in the contract furniture market, supported by large-scale procurement initiatives for administrative and public service buildings. The demand for durable, functional, and cost-effective furniture in government offices, coupled with sustainable procurement policies, has contributed to steady market growth in this segment.

The Institutional segment is experiencing steady growth, driven by increasing investments in educational institutions, research centers, and training facilities. The rising focus on modernized learning spaces and technologically integrated furniture solutions has accelerated demand in this category, with universities and schools being the primary end-users.

The Healthcare/Medical Facilities segment is growing due to the expansion of hospitals, clinics, and wellness centers. The need for durable, easy-to-maintain, and patient-friendly furniture, including specialized seating and adjustable hospital beds, has contributed to consistent demand. Increased healthcare infrastructure investments further support market expansion.

The Other End-Users category, including hospitality, retail, and recreational spaces, is gaining traction in the contract furniture market. The growing emphasis on premium and customized furniture solutions in hotels, co-working spaces, and commercial establishments is driving demand. Additionally, the rising trend of experience-driven environments in retail and entertainment sectors is further strengthening market presence.

By Distribution Channel Analysis

Offline Channel Dominates the Contract Furniture Market with a 77% Share

In 2024, the Offline distribution channel maintained a dominant position in the Contract Furniture Market, capturing more than 77% of the total market share. The strong preference for physical showrooms, bulk procurement from corporate buyers, and the ability to assess furniture quality before purchase have significantly contributed to this segment’s growth. Additionally, established supplier networks and customized order placements further reinforce the offline channel’s market leadership.

The Online distribution channel is experiencing steady growth, driven by the increasing adoption of e-commerce platforms for furniture procurement. The convenience of digital catalogs, competitive pricing, and easy accessibility to a wide range of contract furniture options are fueling demand in this segment. Furthermore, advancements in virtual visualization tools and direct-to-consumer sales models are enhancing the appeal of online channels in the contract furniture industry

Key Market Segments

By Type

- Chairs & Stools

- Tables & Desks

- Storage Furniture

- Sofa & Couch

By End-user

- Government

- Corporate Offices

- Institutional

- Healthcare/Medical Facilities

- Other End-Users

By Distribution Channel

- Online

- Offline

Driver

Expansion of Commercial Spaces

The global contract furniture market is witnessing strong growth, largely driven by the expansion of commercial spaces worldwide. The increase in corporate offices, retail establishments, hospitality venues, and healthcare facilities has created substantial demand for durable and functional furniture solutions.

The rise in office spaces, alongside fluctuating vacancy rates, signals ongoing activity in the commercial real estate sector, which directly impacts the need for contract furniture. As new businesses emerge and existing organizations expand, the necessity for ergonomic, customizable, and brand-aligned furniture grows, further strengthening the market.

The proliferation of modern office environments requires innovative furniture that enhances employee productivity and well-being. Organizations are prioritizing workspaces that promote collaboration, flexibility, and comfort, leading to increased investments in high-quality furniture.

Additionally, rapid urbanization in developing regions is contributing to commercial space expansion, further fueling demand. As businesses adapt to hybrid work models, the need for modular and space-efficient furniture is also rising. The contract furniture industry is well-positioned to benefit from these trends by offering customized solutions that cater to evolving workplace requirements.

Restraint

Volatility in Raw Material Prices Impacting Profit Margins

The contract furniture market faces significant challenges due to fluctuations in raw material prices, which directly impact production costs and profitability. Key materials such as wood, metal, plastics, and textiles are subject to price volatility driven by supply chain disruptions, inflation, and geopolitical factors.

Sudden cost increases force manufacturers to either absorb the higher expenses or pass them on to consumers, potentially affecting sales. This uncertainty complicates long-term pricing strategies, making it difficult for businesses to maintain stable profit margins.

To mitigate the effects of price fluctuations, manufacturers are exploring alternative materials, optimizing supply chains, and negotiating long-term contracts with suppliers. However, these strategies do not completely eliminate financial strain, especially for small and mid-sized manufacturers that lack the purchasing power of larger players.

Additionally, regulatory requirements regarding sustainability and responsible sourcing add further complexity, limiting cost-effective material options. As raw material costs remain unpredictable, contract furniture manufacturers must remain adaptable to sustain profitability while maintaining competitive pricing in the market.

Opportunity

Integration of Technology in Furniture Design

The integration of technology into contract furniture presents a significant growth opportunity, driven by the need for smart and connected workspaces. Businesses are increasingly prioritizing ergonomic and tech-enabled furniture to enhance workplace efficiency and employee comfort.

Features such as built-in charging ports, wireless connectivity, adjustable components, and smart desks that monitor posture and activity levels are becoming more popular. The growing adoption of technology-driven solutions is transforming traditional workspaces into dynamic environments that promote productivity.

Manufacturers who innovate by incorporating smart technology into their furniture can differentiate themselves in a competitive market. As hybrid and flexible work arrangements become the norm, the demand for adaptive furniture that supports seamless transitions between office and remote work is increasing.

Organizations are looking for solutions that integrate with digital workflows, providing added convenience and efficiency. The shift towards tech-enabled furniture is expected to accelerate, creating new revenue streams for manufacturers that invest in research and development to align their offerings with evolving workplace needs.

Trends

Emphasis on Sustainable and Eco-Friendly Practices

Sustainability is emerging as a defining trend in the contract furniture market, with businesses and consumers prioritizing eco-friendly solutions. The increasing demand for sustainable materials, such as recycled wood and biodegradable textiles, is pushing manufacturers to adopt greener production processes.

Environmental regulations and corporate sustainability initiatives are further encouraging the use of certified, low-impact materials. Companies that align their products with sustainability standards are gaining a competitive edge as more organizations implement green purchasing policies.

Beyond materials, the focus on circular economy principles is growing, with manufacturers exploring ways to design furniture for longevity, reuse, and recyclability. Energy-efficient manufacturing and waste reduction initiatives are also becoming essential for market players looking to enhance their environmental credentials.

As sustainability becomes a critical purchasing factor, contract furniture manufacturers that prioritize eco-friendly practices will strengthen their market position, appeal to environmentally conscious clients, and drive long-term growth.

Regional Analysis

Asia Pacific Leads the Contract Furniture Market with the Largest Market Share of 39% in 2024

The Asia Pacific region dominates the contract furniture market, holding the largest market share of 39% in 2024. This dominance is driven by rapid urbanization, increased infrastructure development, and rising demand for modern office spaces. The region’s contract furniture market is valued at USD 59.2 billion, supported by strong growth in commercial and hospitality sectors.

Countries such as China, India, and Japan are experiencing substantial expansion in corporate office spaces, co-working hubs, and hospitality-driven furniture demand, further strengthening the market’s position. Additionally, the rising real estate sector and government initiatives promoting commercial developments contribute significantly to the region’s market expansion.

North America holds a significant share of the contract furniture market, fueled by increasing demand for ergonomic and sustainable office furniture solutions. The expansion of corporate spaces, coupled with an evolving trend toward hybrid work environments, has driven market growth.

The region benefits from a well-established commercial infrastructure, with high demand for premium and customized contract furniture solutions. Additionally, investments in smart office furniture technology further support market expansion.

Europe maintains a steady growth trajectory in the contract furniture sector, largely influenced by the increasing adoption of innovative and eco-friendly furniture solutions in corporate environments. The region’s market growth is reinforced by stringent environmental regulations that promote the use of sustainable materials in contract furniture manufacturing. The rising number of corporate hubs and co-working spaces in key countries such as Germany, France, and the United Kingdom further enhances market demand.

The Middle East & Africa market is witnessing gradual growth, driven by expanding commercial infrastructure and hospitality investments. Large-scale urban development projects, especially in Gulf Cooperation Council (GCC) countries, have fueled the demand for high-quality contract furniture. The region is experiencing increased adoption of premium office furniture, supported by economic diversification efforts and significant investments in tourism and hospitality sectors.

Latin America is experiencing steady demand for contract furniture, with growing commercial infrastructure development in countries such as Brazil and Mexico. The increasing presence of multinational companies and the expansion of office spaces contribute to market growth. Additionally, the demand for cost-effective and durable furniture solutions is rising, supporting gradual market expansion in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global contract furniture market in 2024 is characterized by intense competition, with key players leveraging innovation, design efficiency, and sustainability to enhance their market presence. Samsung Electronics Co. Ltd., a major player, continues to integrate smart technology into furniture solutions, enhancing user convenience with IoT-enabled functionalities.

Apple Inc., known for its design-centric approach, is anticipated to influence the market through premium, ergonomic, and aesthetically appealing smart furniture that integrates seamlessly with its ecosystem. Similarly, Google Inc. plays a crucial role in advancing AI-driven smart furniture solutions, focusing on automation and connectivity to enhance user experience.

SanDisk and Belkin International Inc. contribute by introducing high-performance storage and connectivity solutions that support digital transformation in workplaces and commercial spaces. Meanwhile, Harman International Industries is driving innovation in the market with high-end audio-integrated furniture, catering to the growing demand for immersive audiovisual experiences in hospitality and corporate environments.

Aukey and Anker PowerCore are expanding their footprint by providing advanced power management solutions embedded in contract furniture, meeting the increasing need for wireless charging and energy-efficient systems. Groove Made Walnut is focusing on premium handcrafted wooden furniture, emphasizing sustainability and bespoke design trends. UE Boom, with its expertise in wireless audio solutions, enhances the entertainment and leisure furniture segment.

Top Key Players in the Market

- Samsung Electronics Co. Ltd

- Apple Inc.

- Google Inc.

- SanDisk

- Belkin International Inc.

- Harman International Industries

- Aukey

- Groove Made Walnut

- Anket Power Core

- UE Boom

- Other Key Players

Recent Developments

- In 2023, Relso secured $840,000 in a pre-seed funding round, with Venture Catalysts and Inflection Point Ventures leading the investment. The Bengaluru-based company aims to leverage these funds for growth and innovation.

- In 2025, Gordon Brothers finalized the sale of the Laura Ashley® brand, archives, and related intellectual property to Marquee Brands. This transaction marks a significant milestone, reflecting the global expansion and revitalization of the iconic British heritage brand under Gordon Brothers’ stewardship.

- In 2023, HNI Corporation (NYSE: HNI) announced the acquisition of Kimball International, Inc. (NASDAQ: KBAL) in a deal worth approximately $485 million. The agreement includes a mix of cash and stock, granting Kimball International shareholders $9.00 per share in cash along with 0.1301 shares of HNI common stock. Following the transaction, Kimball International shareholders will own roughly 10% of the newly merged entity.

- In 2023, the U.S. office market experienced significant turbulence, with rising interest rates, decreasing property values, and subdued demand creating uncertainties. The sector faced mounting pressure as loan maturities loomed, leading office landlords to navigate complex decisions amid declining sales activity.

Report Scope

Report Features Description Market Value (2024) USD 151.9 Billion Forecast Revenue (2034) USD 259.5 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Chairs & Stools, Tables & Desks, Storage Furniture, Sofa & Couch), By End-user (Government, Corporate Offices, Institutional, Healthcare and Medical Facilities, Other End-Users), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Samsung Electronics Co. Ltd, Apple Inc., Google Inc., SanDisk, Belkin International Inc., Harman International Industries, Aukey, Groove Made Walnut, Anket Power Core, UE Boom, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Contract Furniture MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Contract Furniture MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung Electronics Co. Ltd

- Apple Inc.

- Google Inc.

- SanDisk

- Belkin International Inc.

- Harman International Industries

- Aukey

- Groove Made Walnut

- Anket Power Core

- UE Boom

- Other Key Players