Global Contract Catering Market Size, Share Analysis Report By Contract (Fixed Price, Cost-Plus, Others), By Menu Type (Standard Menu, Customized/Bespoke Menu, Buffet/Cafeteria Style, Others), By End-User (Corporate/Office Catering, Education Catering, Healthcare Catering, Defense and Offshore Catering, Sports and Leisure Catering, Travel Catering, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153515

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

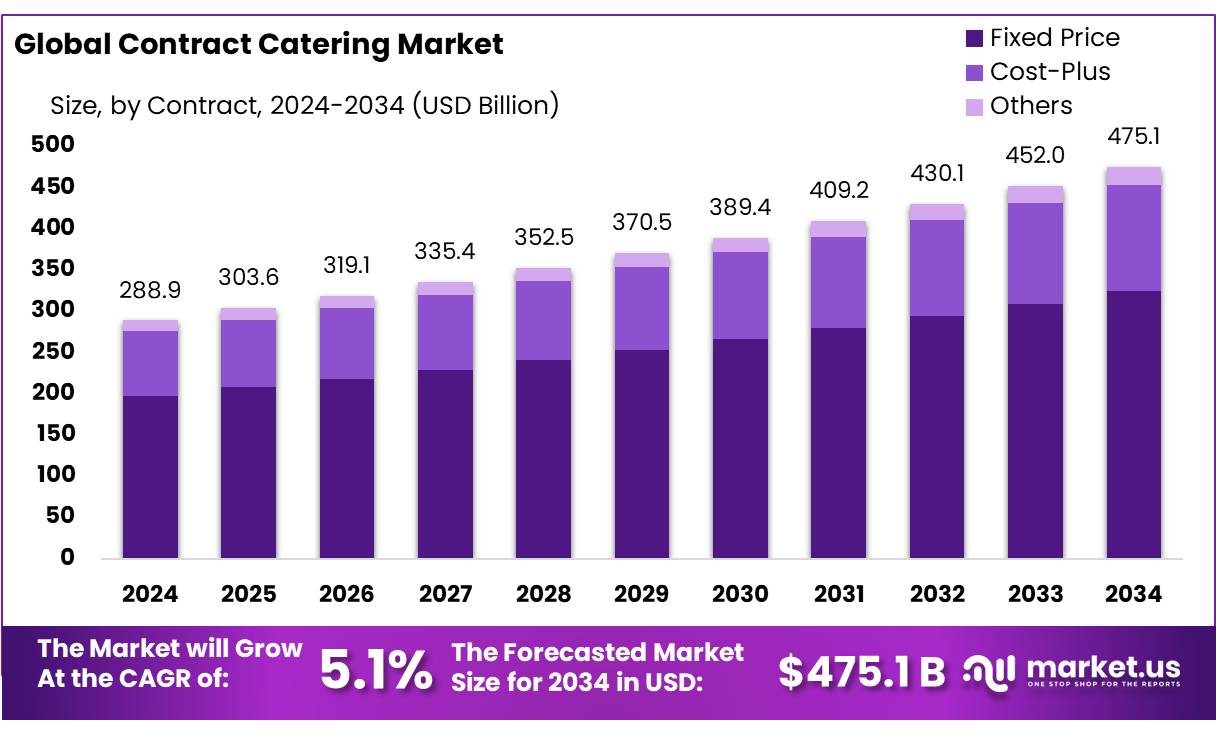

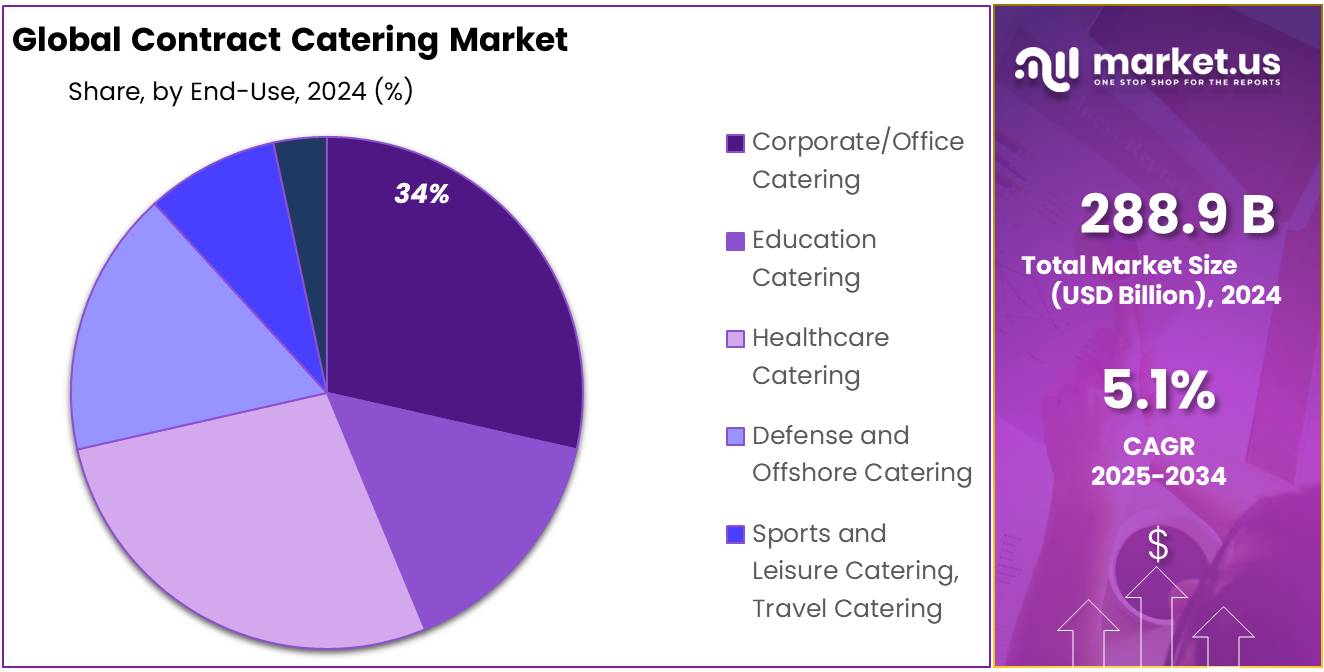

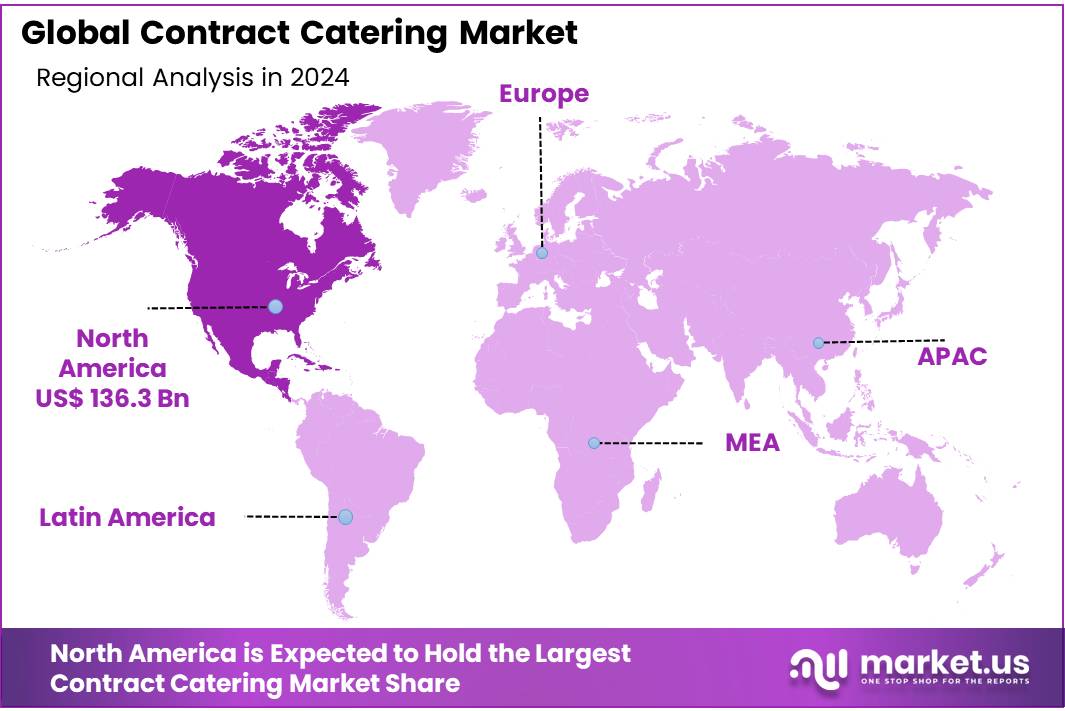

The Global Contract Catering Market size is expected to be worth around USD 475.1 Billion by 2034, from USD 288.9 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 38.6% share, holding USD 4.6 Billion revenue.

Contract catering concentrates refer to compact, bulk-format food products (such as soups, sauces, and drink bases) formulated for large-scale institutional or corporate kitchens. These products support operational efficiency by reducing preparation time, managing consistency, and ensuring food safety. Within institutional settings—including healthcare facilities, schools, and corporate offices—such concentrates serve as fundamental building blocks of outsourced catering services.

Government initiatives such as the Skill India campaign play a crucial role in supporting the growth of the contract catering industry. Launched in 2015, Skill India aims to train over 40 crore citizens in various industry-relevant skills by 2022, thereby enhancing the employability of the workforce in sectors including hospitality and catering. Furthermore, the government’s focus on improving infrastructure and promoting tourism in smaller cities has expanded the reach of catering services beyond metropolitan areas, creating new opportunities for growth.

Supportive policies for energy efficiency and clean energy indirectly facilitate growth in this sector. For instance, India’s National Mission for Enhanced Energy Efficiency (NMEEE) outlines capacity additions of 19,598 MW across industries, with fuel savings of around 23 million tonnes annually and emissions reductions of 98.55 million tCO2 per year.

The Bureau of Energy Efficiency’s ‘Perform, Achieve, Trade’ scheme incentivizes energy-saving measures—measures readily adopted by centralized concentrate producers. Additionally, the Maharashtra Energy Development Agency (MEDA), a nodal agency under India’s Energy Conservation Act (2001), has undertaken extensive energy-efficient street lighting and building retrofit programs, showcasing the regulatory environment that supports efficiency investments in food processing facilities.

Key Takeaways

- Contract Catering Market size is expected to be worth around USD 475.1 Billion by 2034, from USD 288.9 Billion in 2024, growing at a CAGR of 5.1%.

- Fixed Price held a dominant market position, capturing more than a 68.4% share of the global contract catering market.

- Standard Menu held a dominant market position, capturing more than a 42.9% share in the contract catering market.

- Corporate/Office Catering held a dominant market position, capturing more than a 34.8% share of the global contract catering market.

- North American contract catering market is a pivotal segment within the global food service industry, commanding a substantial share of approximately 47.2%, valued at USD 136.3 billion.

By Contract Analysis

Fixed Price dominates with 68.4% share due to its cost predictability and client preference

In 2024, Fixed Price held a dominant market position, capturing more than a 68.4% share of the global contract catering market. This model remains the preferred choice for many organizations because it offers predictable costs over the contract duration, helping clients manage budgets effectively. Under this structure, catering providers commit to delivering services at a pre-agreed rate, regardless of fluctuations in ingredient costs, labor wages, or operational overheads.

The stability it brings has made it particularly popular among government bodies, educational institutions, and corporate offices where budget planning is critical. Additionally, in post-pandemic recovery scenarios, many businesses have opted for fixed pricing to ensure continuity and avoid financial surprises. This contract model also enables catering companies to streamline operations, forecast revenue with more accuracy, and negotiate long-term supplier agreements. As cost control and financial transparency continue to be top priorities in 2025, the fixed price segment is expected to maintain its leading position in the market.

By Menu Type Analysis

Standard Menu leads with 42.9% share as institutions favor consistency and cost efficiency

In 2024, Standard Menu held a dominant market position, capturing more than a 42.9% share in the contract catering market. This menu type remains a top choice across workplaces, hospitals, and educational facilities where balanced nutrition, simplicity, and portion control are essential. The Standard Menu format offers predefined meals with limited variation, making it easier for caterers to manage inventory, ensure food safety, and maintain quality across large-scale operations.

For clients, it ensures reliable meal planning at a fixed cost, which is particularly valuable for institutions operating under tight budgets. Its popularity in 2024 was also driven by its suitability for centralized production models, which reduce food waste and streamline kitchen workflows. Moving into 2025, the demand for standard menus is expected to stay steady as organizations continue to prioritize operational efficiency and predictable service delivery over customized or à la carte dining formats.

By End-User Analysis

Corporate/Office Catering dominates with 34.8% share as workplaces seek reliable meal solutions for employees

In 2024, Corporate/Office Catering held a dominant market position, capturing more than a 34.8% share of the global contract catering market. This segment continues to lead due to the growing emphasis on employee wellness, productivity, and work-life balance within corporate environments. Organizations are increasingly investing in on-site meal services to provide convenient, nutritious, and time-saving dining options for their staff. Fixed catering contracts in office settings also help standardize food quality and ensure compliance with health and safety norms.

The return-to-office trend in many regions during 2024 contributed further to the demand for professional catering services, especially in tech parks, business hubs, and multinational company campuses. Going into 2025, the corporate catering segment is expected to remain strong as companies continue using food services as a tool to enhance workplace satisfaction, reduce absenteeism, and support employee engagement initiatives.

Key Market Segments

By Contract

- Fixed Price

- Cost-Plus

- Others

By Menu Type

- Standard Menu

- Customized/Bespoke Menu

- Buffet/Cafeteria Style

- Others

By End-User

- Corporate/Office Catering

- Education Catering

- Healthcare Catering

- Defense and Offshore Catering

- Sports and Leisure Catering, Travel Catering

- Others

Emerging Trends

Digital Transformation in Contract Catering

The contract catering industry is undergoing a significant digital transformation, reshaping how services are delivered and experienced. In the United States, over 61% of enterprises now outsource food services, with more than 59% preferring providers that offer wellness-centric and customizable meal solutions. Digital menu platforms and remote catering account for nearly 46% of service requests in the region.

This digital shift is not just about convenience; it’s about enhancing the overall dining experience. Approximately 60% of clients seek vendors with proven sustainability protocols, while over 56% prioritize vendors offering tech-integrated services. The shift toward hybrid work culture has resulted in a 47% increase in demand for mobile and modular catering setups.

Governments are recognizing the importance of digitalization in the catering sector. For instance, the U.S. Department of Agriculture (USDA) offers various programs to support the adoption of technology in food services, aiming to enhance efficiency and service quality. Similarly, the UK’s Food Standards Agency (FSA) provides guidelines and support for food businesses to implement digital solutions that ensure food safety and compliance.

This growth is driven by factors such as rising health consciousness, increasing demand for customized and dietary-specific meals, and the growing preference for convenience in urban areas. Technological advancements, such as online booking platforms and AI-driven solutions, are enhancing operational efficiency and customer engagement, further propelling the market.

Drivers

Growth in Corporate and Institutional Catering

The demand for contract catering services has seen a significant rise, driven by various factors, including the growing need for outsourcing food services in corporate environments, educational institutions, and healthcare facilities. As more businesses focus on core operations, outsourcing non-core services like catering becomes an attractive option.

According to the National Association of College & University Food Services (NACUFS), nearly 40% of higher education institutions in the U.S. have transitioned to outsourcing their food services to meet the rising expectations of students and staff for high-quality, diverse meal offerings. This trend is evident in other sectors as well, as businesses increasingly seek cost-effective solutions without compromising on quality.

Government initiatives are also contributing to the expansion of the contract catering market. In many countries, regulations and policies around food safety, nutrition, and environmental impact are becoming stricter, prompting companies to turn to professional caterers who are equipped to handle compliance effectively.

For example, in the UK, the government’s Food Standards Agency (FSA) has been working to ensure that food hygiene standards are met across all sectors, encouraging the outsourcing of catering services to certified providers. This shift not only ensures food safety but also enhances the consumer experience by providing nutritious, well-prepared meals.

The increased focus on sustainability is another key driver. As environmental concerns grow, contract caterers are responding by adopting sustainable practices, including sourcing locally produced ingredients, minimizing food waste, and using eco-friendly packaging. This approach aligns with the global push for sustainability and meets the demands of consumers who are increasingly eco-conscious. In the U.S., the Environmental Protection Agency (EPA) encourages businesses to adopt sustainable food practices, supporting the growth of environmentally responsible catering services.

Restraints

Rising Food and Labor Costs

One of the significant challenges faced by the contract catering industry is the escalating cost of food and labor, which directly impacts profitability and service pricing. The food service sector has been particularly affected by inflation and supply chain disruptions. According to the U.S. Bureau of Labor Statistics, food prices in the U.S. increased by 9.2% in 2023, and this surge has continued to challenge caterers. As a result, many contract caterers have faced difficulties in managing operating costs while maintaining competitive pricing for their clients. This inflationary pressure forces companies to either absorb the rising costs, which can erode margins, or pass them on to clients, potentially making services less attractive.

The labor shortage is another critical issue affecting the sector. According to the National Restaurant Association (NRA), nearly 60% of restaurant operators in the U.S. reported staffing shortages in 2023. This shortage is compounded by the high turnover rates in the catering industry, which increases recruitment and training costs.

Labor costs have skyrocketed, with many companies needing to offer higher wages and better benefits to attract and retain qualified staff. In addition to that, stringent labor laws in various regions, such as minimum wage laws and regulations surrounding employee benefits, add further pressure to caterers, especially smaller businesses trying to maintain profitability while adhering to these regulations.

Government initiatives are addressing these concerns but may not be enough to offset the rising costs. For example, the U.S. Department of Agriculture (USDA) offers some relief through programs like the Supplemental Nutrition Assistance Program (SNAP) for qualifying institutions, but these do not directly impact the operational costs of private caterers. As food and labor costs continue to rise, businesses must seek innovative solutions, such as automation in food prep and distribution, to mitigate the financial burden.

Opportunity

Embracing Digital Transformation in Contract Catering

The contract catering industry is experiencing a significant shift towards digitalization, presenting a substantial growth opportunity. In the United States, over 61% of enterprises now outsource food services, with more than 59% preferring providers that offer wellness-centric and customizable meal solutions. Additionally, digital menu platforms and remote catering account for nearly 46% of service requests in the region.

This digital transformation is not limited to menu offerings. Approximately 60% of clients seek vendors with proven sustainability protocols, while over 56% prioritize vendors offering tech-integrated services. The shift toward hybrid work culture has also resulted in a 47% increase in demand for mobile and modular catering setups.

Governments are recognizing the importance of digitalization in the catering sector. For instance, the U.S. Department of Agriculture (USDA) offers various programs to support the adoption of technology in food services, aiming to enhance efficiency and service quality. Similarly, the UK’s Food Standards Agency (FSA) provides guidelines and support for food businesses to implement digital solutions that ensure food safety and compliance.

Regional Insights

The North American contract catering market is a pivotal segment within the global food service industry, commanding a substantial share of approximately 47.2%, valued at USD 136.3 billion as of 2023. This dominance is primarily attributed to the region’s robust infrastructure, high consumer spending power, and advanced technological adoption.

The United States stands as the leading contributor, driven by significant investments in research and development, a mature foodservice ecosystem, and a progressive regulatory environment that fosters innovation and scalability. Canada follows suit, experiencing growth propelled by government support for sustainable practices and digital transformation across various sectors. Mexico, with its competitive manufacturing sector and expanding consumer market, also plays a vital role in the regional dynamics.

Key drivers of market expansion include the increasing demand for customized meal solutions, the integration of digital technologies such as mobile ordering platforms and AI-powered analytics, and a heightened focus on employee wellness programs. Approximately 61% of U.S.-based enterprises now outsource food services, with more than 59% preferring providers that offer wellness-centric and customizable meal solutions. Additionally, the education sector contributes significantly, with approximately 48% of institutions opting for contract-based food programs focused on nutrition compliance, convenience, and operational efficiency.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

United Enterprises Co. Ltd. (UNENCO) is a diversified Saudi company headquartered in the Eastern Province of Saudi Arabia. While primarily engaged in sectors such as construction, water and wastewater treatment, and renewable energy, UNENCO also provides catering services for large-scale projects and industrial operations. The company is known for its commitment to quality and sustainability across its various service offerings.

Elior Group SA is a leading multinational contract catering and support services provider, headquartered in France. Operating in 11 countries, including the United States and India, Elior serves over 3.2 million guests daily across sectors such as business & industry, education, healthcare, and leisure. The company generated €6.05 billion in revenue in 2023 and employs approximately 133,000 people globally.

Aramark Corporation is a U.S.-based global leader in food services, facilities management, and uniform services. Headquartered in Philadelphia, Pennsylvania, Aramark operates in 15 countries, serving clients in education, healthcare, business, and leisure sectors. In 2023, the company reported revenues of $18.85 billion and employed over 266,000 individuals worldwide.

Top Key Players Outlook

- United Enterprises Co. Ltd.

- Elior Group SA

- Aramark Corporation

- CH&Co Catering Group Limited

- Mitie Group plc

- Sodexo S.A.

- Rhubarb Food Design Limited.

- AVI Foodsystems, Inc.

- Culinary Service Types Group

- Hospital Housekeeping Systems (HHS)

- Maxx Hospitalities & Catering Service Type

- Metz Culinary Management

- Prince Food Systems

- Red bean Hospitality

Recent Industry Developments

In January 2024, CH&Co was acquired by Compass Group for £475 million, a strategic move aimed at enhancing Compass’s presence in the UK market.

In 2024, Aramark Corporation reinforced its leading position in the contract catering sector by delivering strong financial performance and expanding its service footprint. The company reported full-year revenue of USD 17.4 billion, marking approximately 10% organic growth year-over-year, with the U.S. business contributing USD 12.58 billion and demonstrating 7.3% growth.

Report Scope

Report Features Description Market Value (2024) USD 288.9 Bn Forecast Revenue (2034) USD 475.1 Bn CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Contract (Fixed Price, Cost-Plus, Others), By Menu Type (Standard Menu, Customized/Bespoke Menu, Buffet/Cafeteria Style, Others), By End-User (Corporate/Office Catering, Education Catering, Healthcare Catering, Defense and Offshore Catering, Sports and Leisure Catering, Travel Catering, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape United Enterprises Co. Ltd., Elior Group SA, Aramark Corporation, CH&Co Catering Group Limited, Mitie Group plc, Sodexo S.A., Rhubarb Food Design Limited., AVI Foodsystems, Inc., Culinary Service Types Group, Hospital Housekeeping Systems (HHS), Maxx Hospitalities & Catering Service Type, Metz Culinary Management, Prince Food Systems, Red bean Hospitality Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- United Enterprises Co. Ltd.

- Elior Group SA

- Aramark Corporation

- CH&Co Catering Group Limited

- Mitie Group plc

- Sodexo S.A.

- Rhubarb Food Design Limited.

- AVI Foodsystems, Inc.

- Culinary Service Types Group

- Hospital Housekeeping Systems (HHS)

- Maxx Hospitalities & Catering Service Type

- Metz Culinary Management

- Prince Food Systems

- Red bean Hospitality