Global Consumer Electronics Packaging Market Size, Share, Growth Analysis By Material Type (Plastic, Paper & Paperboard, Metal, Others), By Type (Rigid, Flexible), By Product Type (Corrugated Boxes, Paperboard Boxes, Thermoformed Trays, Bags & Pouches, Blister Packs & Clamshells, Protective Packaging, Others), By Application (Mobile Phones, Computers, Tvs, Dth & Set- Top Boxes, Music Systems, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 154249

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

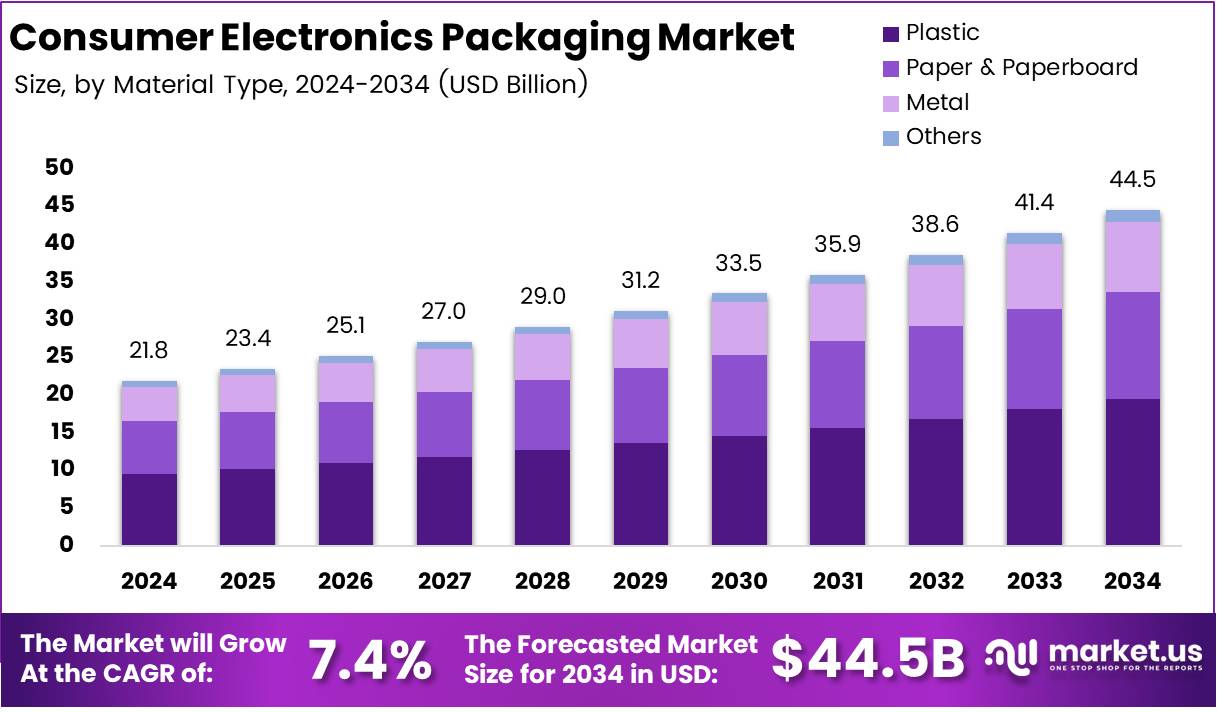

The Global Consumer Electronics Packaging Market size is expected to be worth around USD 44.5 Billion by 2034, from USD 21.8 Billion in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034.

The Consumer Electronics Packaging Market has seen significant growth due to increasing demand for innovative and sustainable solutions. Packaging plays a crucial role in protecting fragile electronic components during transportation and storage. With the rise of e-commerce, there’s a growing need for packaging solutions that ensure both safety and product presentation. Consequently, the market is expected to expand.

The growing demand for eco-friendly materials is a key driver in the market. Companies are increasingly adopting sustainable packaging options, responding to both consumer demand and environmental concerns. Additionally, manufacturers are investing in recyclable and biodegradable materials, which are gaining traction among environmentally-conscious consumers. Thus, there is a notable shift toward sustainability.

Government regulations and incentives have further accelerated market growth. Various countries have introduced regulations to promote the use of sustainable materials. For instance, stricter packaging waste reduction policies have prompted companies to innovate. This regulatory push not only ensures environmental protection but also opens new avenues for the development of green technologies in the packaging industry.

Consumer behavior is also shaping the packaging market. According to a recent study, 74% of consumers are willing to pay more for products with sustainable packaging. This shift in consumer preferences emphasizes the importance of incorporating eco-friendly practices in packaging strategies. Consequently, businesses that prioritize sustainable packaging solutions are gaining a competitive edge.

With increasing competition, there is also significant growth in the development of smart packaging solutions. These innovative solutions include features like QR codes and NFC chips that enable product tracking and enhance consumer engagement. Such advancements cater to the growing need for transparency and interaction in the consumer electronics sector.

The Consumer Electronics Packaging Market is ripe with opportunity. Companies can capitalize on the demand for sustainable and smart packaging by adopting emerging technologies and materials. As environmental concerns continue to rise, there will be growing demand for packaging that minimizes waste and reduces carbon footprints, benefiting both businesses and consumers.

Key Takeaways

- The Global Consumer Electronics Packaging Market is expected to reach USD 44.5 Billion by 2034, growing at a CAGR of 7.4% from 2025 to 2034.

- Rigid packaging type dominates with a market share of 65.2% due to high demand for protective packaging in consumer electronics.

- Corrugated Boxes hold 27.3% market share, favored for their cost-effectiveness and durability, especially for large consumer electronics.

- Plastic material type leads with 43.6% market share, attributed to its versatility in protective packaging forms.

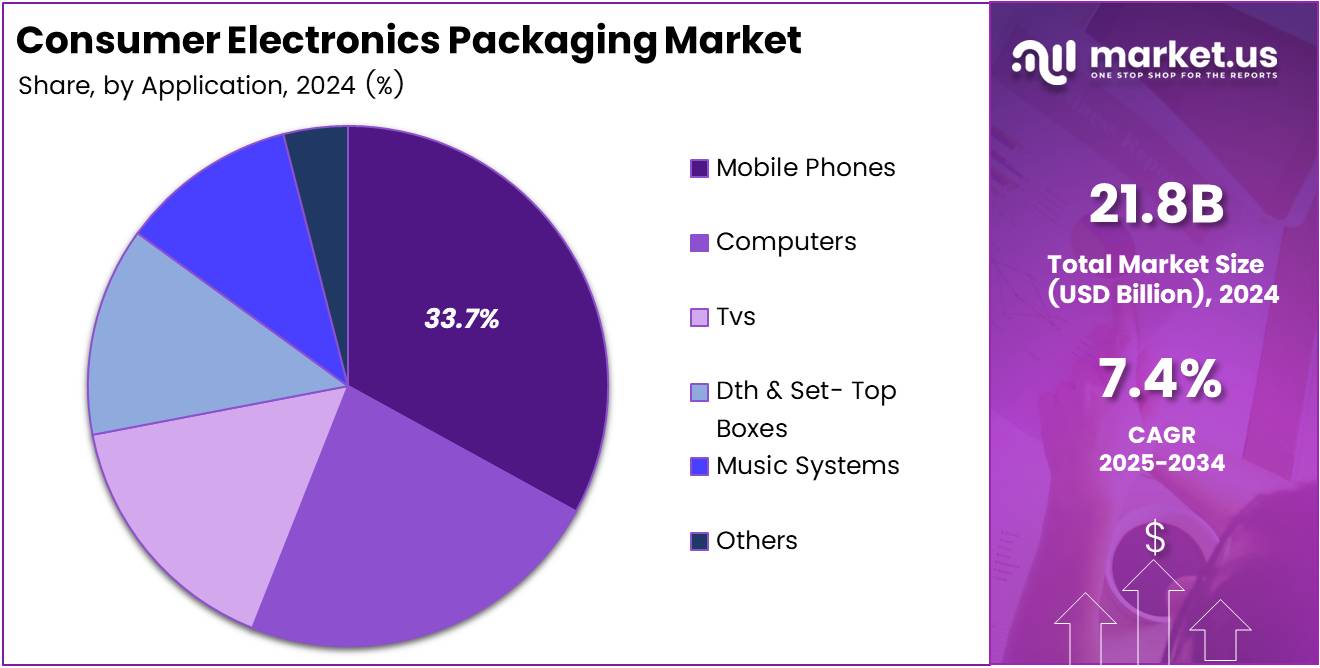

- The Mobile Phones application segment is the largest, accounting for 33.7% of the market, driven by global demand for smartphones.

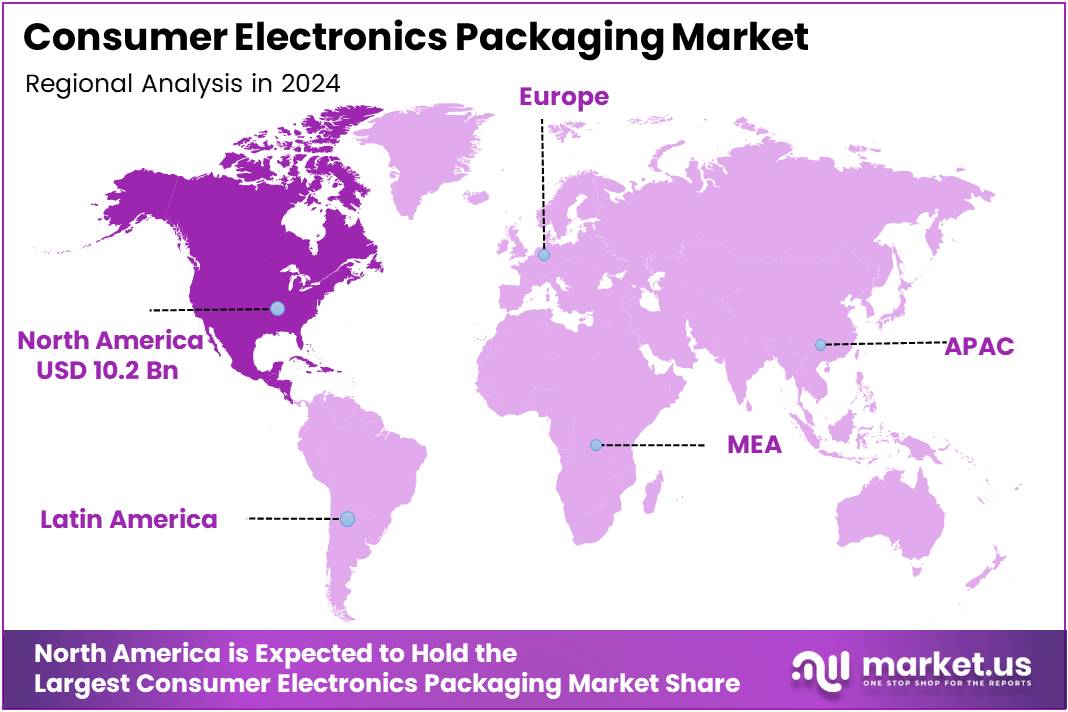

- North America dominates the market with 46.8% share, valued at USD 10.2 Billion, driven by demand for electronic devices and eco-friendly packaging solutions.

Type Analysis

Rigid sub-segment dominates with 65.2% due to higher demand for sturdy packaging.

In the Consumer Electronics Packaging market, the Rigid packaging type holds a dominant position with a market share of 65.2%. This segment’s growth is driven by the increased demand for protective packaging in high-end consumer electronics like smartphones, tablets, and laptops.

Rigid packaging is preferred because it offers better protection against external damage, ensuring that expensive electronic devices reach consumers in perfect condition. It is widely used for products requiring a sturdy, well-constructed design, especially where long-distance transportation is involved. For instance, a high-end smartphone packaged in a rigid box not only enhances the product’s appeal but also offers better protection during shipping.

The Flexible packaging type, on the other hand, has a smaller market share but plays an important role in reducing material costs and offering more flexibility in packaging design. It is used for smaller and lighter consumer electronics, such as headphones or accessories.

Flexible packaging is cost-effective and more environmentally friendly, with growing interest in its recyclability. However, it is not as protective as rigid packaging and is typically used in situations where the product is less likely to suffer damage during transit.

Product Type Analysis

Corrugated Boxes sub-segment dominates with 27.3% due to cost-effectiveness and durability.

Corrugated Boxes are the dominant choice, holding a significant market share of 27.3%. This is primarily due to their cost-effectiveness and durability. Corrugated boxes are widely used for packaging large consumer electronics, such as TVs, and other bulky items that need strong protection during transportation. These boxes are lightweight, recyclable, and provide excellent cushioning, which makes them the preferred choice for manufacturers aiming to balance cost and safety.

The Paperboard Boxes sub-segment is another significant player, though it holds a smaller market share. Paperboard boxes are generally used for smaller consumer electronics, like smartphones, due to their lightweight nature and ease of customization. They provide a good level of protection and are often used in conjunction with other packaging materials to enhance overall safety.

Thermoformed Trays and Blister Packs & Clamshells are also important in packaging, particularly for smaller products or accessories. These forms of packaging are efficient for retail display purposes and ensure that the product is visible and secure, though they are not typically used for larger items. Protective Packaging focuses on adding layers of security, such as bubble wraps or foam inserts, and plays a crucial role in high-end product protection but holds a smaller portion of the market compared to corrugated boxes.

Material Type Analysis

Plastic sub-segment dominates with 43.6% due to versatility and widespread usage.

The Plastic material type holds the largest share in the Consumer Electronics Packaging market, with 43.6%. This sub-segment dominates due to the versatility of plastic in creating various packaging forms, such as protective wraps, inserts, and molded trays.

It is particularly beneficial for consumer electronics products requiring customized shapes and durable packaging solutions. Plastic also offers excellent protection against moisture, dust, and physical damage, making it ideal for electronics like smartphones and laptops that are sensitive to environmental factors.

Paper & Paperboard comes next as a more environmentally friendly alternative. These materials are commonly used for packaging smaller consumer electronics and offer recyclability, which is increasingly demanded by environmentally conscious consumers.

Metal packaging is used less frequently but can be applied in premium product segments where aesthetics and brand perception are crucial. Others include various composite materials, like foam and hybrid packaging, which cater to specific needs in terms of cushioning or sustainability.

Plastic’s dominant position is expected to continue due to its practicality, cost-effectiveness, and growing potential in innovative packaging designs.

Application Analysis

Mobile Phones sub-segment dominates with 33.7% due to the high demand for smartphones.

The Mobile Phones application segment leads the Consumer Electronics Packaging market with a market share of 33.7%. This dominance can be attributed to the global demand for smartphones, which requires high-quality packaging solutions to ensure the safe delivery of these expensive devices.

Mobile phone packaging needs to provide not only protection but also an enhanced consumer experience. As smartphones become increasingly sophisticated, the packaging must reflect the premium nature of the product, while ensuring durability against drops or impacts during shipping.

The Computers and TVs sub-segments are also significant in the market but hold a smaller market share compared to mobile phones. The Computers sub-segment benefits from the demand for laptops and desktops, where packaging must offer robust protection against physical damage during transit.

Similarly, TVs require large, durable packaging solutions like corrugated boxes to ensure their safe delivery. DTH & Set-Top Boxes and Music Systems represent niche markets but still contribute to the overall growth of the sector, though at a lesser scale.

Key Market Segments

By Material Type

- Plastic

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyamide (PA)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Others

- Paper & Paperboard

- Metal

- Others

By Type

- Rigid

- Flexible

By Product Type

- Corrugated Boxes

- Paperboard Boxes

- Thermoformed Trays

- Bags & Pouches

- Blister Packs & Clamshells

- Protective Packaging

- Others

By Application

- Mobile Phones

- Computers

- Tvs

- Dth & Set- Top Boxes

- Music Systems

- Others

Drivers

Increasing Demand for Sustainable Packaging Solutions Drives Market Growth

The growing demand for sustainable packaging is a key driver for the consumer electronics packaging market. As environmental concerns increase, companies are shifting toward eco-friendly materials such as recycled plastics, paper, and biodegradable options. This trend not only meets consumer preferences but also aligns with global sustainability initiatives.

Advancements in smart packaging technologies have further accelerated the demand for sustainable solutions. These technologies incorporate sensors and RFID tags to provide valuable product information, enhance tracking, and reduce waste. Smart packaging also helps in minimizing over-packaging and maximizing resource efficiency, benefiting both businesses and the environment.

Restraints

High Cost of Advanced Packaging Materials Restraining Market Growth

The high cost of advanced packaging materials is one of the main challenges for the consumer electronics packaging market. Materials such as smart packaging components, biodegradable plastics, and other advanced solutions can be expensive to manufacture. This increases the overall packaging cost, making it difficult for some businesses to adopt these solutions on a large scale.

Stringent environmental regulations also pose a challenge. Packaging solutions must meet specific recycling and waste disposal standards, which can require substantial investments in compliance. Companies must navigate these regulations, which may lead to higher production costs and slower adoption of new packaging technologies.

Growth Factors

Integration of Biodegradable Packaging Materials Presents Growth Opportunities

There is a growing opportunity for integrating biodegradable materials into consumer electronics packaging. As companies face increasing pressure from consumers and regulators to reduce environmental impact, biodegradable options like plant-based plastics are gaining popularity. This trend is expected to expand as technology advances and costs decrease, enabling more widespread adoption.

The expansion of the consumer electronics industry in emerging markets also presents a significant opportunity for growth. As disposable incomes rise, demand for electronic products and sustainable packaging solutions is increasing. In these regions, businesses can leverage the growing awareness of environmental impact to introduce eco-friendly packaging options.

Emerging Trends

Increased Focus on Circular Economy in Packaging Influences Trends

The circular economy is a major trend influencing the consumer electronics packaging market. Companies are now focusing on designing packaging that can be reused, recycled, or composted, reducing waste and the need for new raw materials. This trend is driving innovation in packaging design and materials, aligning with both environmental goals and cost-saving strategies.

Development of eco-friendly packaging innovations has also gained traction. Consumers increasingly prefer products with minimal environmental impact, prompting brands to invest in new materials like recycled paper and bioplastics. This trend helps companies stay competitive while contributing to sustainability efforts.

Regional Analysis

North America Dominates the Consumer Electronics Packaging Market with a Market Share of 46.8%, Valued at USD 10.2 Billion

North America leads the consumer electronics packaging market, holding a dominant share of 46.8%, valued at USD 10.2 billion. The region’s growth is driven by robust demand for electronic devices and the increasing preference for eco-friendly and cost-effective packaging solutions. The technological advancements in packaging materials and sustainability practices further fuel the market in this region.

Europe Consumer Electronics Packaging Market Trends

Europe holds a significant share of the consumer electronics packaging market, driven by stringent regulations regarding sustainability and waste management. The rise in consumer electronics demand, combined with innovations in smart and sustainable packaging technologies, propels growth in the region. European manufacturers are focusing on integrating more eco-friendly materials into their packaging solutions to meet regulatory standards and consumer expectations.

Asia Pacific Consumer Electronics Packaging Market Outlook

Asia Pacific is experiencing rapid growth in the consumer electronics packaging market due to increased electronics manufacturing and growing consumer demand, particularly in emerging economies. The region’s market is expanding as manufacturers focus on advanced packaging technologies and adapting to local market needs. Additionally, the surge in e-commerce activities in countries like China and India significantly contributes to the market growth.

Middle East and Africa Consumer Electronics Packaging Market Analysis

The consumer electronics packaging market in the Middle East and Africa is expanding, albeit at a slower pace compared to other regions. The rise in disposable income, increased consumer demand for electronics, and improvements in packaging technologies are driving market development. However, economic volatility and regulatory hurdles still pose challenges for faster market penetration.

Latin America Consumer Electronics Packaging Market Trends

In Latin America, the consumer electronics packaging market is witnessing gradual growth, driven by the increasing demand for electronics and improved packaging solutions. With rising consumer awareness and the need for more sustainable packaging materials, companies are adapting their packaging strategies to meet both regulatory standards and consumer preferences. Economic fluctuations may impact growth, but the sector remains optimistic for future expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Consumer Electronics Packaging Company Insights

In 2024, Amcor plc continues to be a prominent player in the global consumer electronics packaging market, driven by its innovation in sustainable packaging solutions. The company’s commitment to reducing environmental impact while maintaining high-quality packaging for electronics positions it as a leader in this sector.

Sonoco Products Company has established itself as a key contributor to the consumer electronics packaging space, leveraging its expertise in both rigid and flexible packaging. Its strategic focus on meeting consumer demands for sustainable and protective packaging for sensitive electronics makes it a trusted partner for various industries.

Huhtamaki plays a crucial role in the market by providing eco-friendly and functional packaging solutions for consumer electronics. The company’s commitment to sustainability and its investments in new materials, such as renewable and recyclable options, ensure that it remains competitive in this fast-growing sector.

DS Smith is recognized for its high-performance corrugated packaging solutions, which are widely used for electronics shipping. Their emphasis on providing cost-effective, sustainable packaging for delicate products has made them a strong player, catering to the growing demand for environmentally friendly solutions in electronics packaging.

Top Key Players in the Market

- Amcor plc

- Sonoco Products Company

- Huhtamaki

- DS Smith

- Smurfit Kappa

- Stora Enso

- Graphic Packaging International, LLC

- ITC Limited

- TCPL Packaging Limited

- UFlex Limited

- Mayr-Melnhof Karton AG

- Bekum Group

- Altium Packaging

Recent Developments

- In July 2025, Specialized Packaging Group expands its operations into Monterrey, Mexico, through the acquisition of Arkpack de México’s Monterrey assets, strengthening its presence in the region with a strategic move to increase production capabilities.

- In March 2025, Husky Technologies™ enhances its product portfolio by acquiring cutting-edge technology in a strategic move to broaden its capabilities in the injection molding sector, thus positioning itself for future growth in manufacturing innovation.

- In April 2025, Packsize announces the acquisition of Sparck Technologies from Standard Investment, further solidifying its global leadership in automated packaging solutions and accelerating its expansion into new markets with innovative packaging technologies.

Report Scope

Report Features Description Market Value (2024) USD 21.8 Billion Forecast Revenue (2034) USD 44.5 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Plastic, Paper & Paperboard, Metal, Others), By Type (Rigid, Flexible), By Product Type (Corrugated Boxes, Paperboard Boxes, Thermoformed Trays, Bags & Pouches, Blister Packs & Clamshells, Protective Packaging, Others), By Application (Mobile Phones, Computers, Tvs, Dth & Set- Top Boxes, Music Systems, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Amcor plc, Sonoco Products Company, Huhtamaki, DS Smith, Smurfit Kappa, Stora Enso, Graphic Packaging International, LLC, ITC Limited, TCPL Packaging Limited, UFlex Limited, Mayr-Melnhof Karton AG, Bekum Group, Altium Packaging Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Consumer Electronics Packaging MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample

Consumer Electronics Packaging MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor plc

- Sonoco Products Company

- Huhtamaki

- DS Smith

- Smurfit Kappa

- Stora Enso

- Graphic Packaging International, LLC

- ITC Limited

- TCPL Packaging Limited

- UFlex Limited

- Mayr-Melnhof Karton AG

- Bekum Group

- Altium Packaging