Global Consumer Battery Market By Type (Primary, Secondary), By Battery Chemistry (Alkaline Battery, Zinc Carbon Battery, Lithium-ion Battery, Nickel Cadmium Battery, Nickel Metal Hydride, Others), By Application (Consumer Electronics, Household Devices, Automotive, Power Tools, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 131228

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

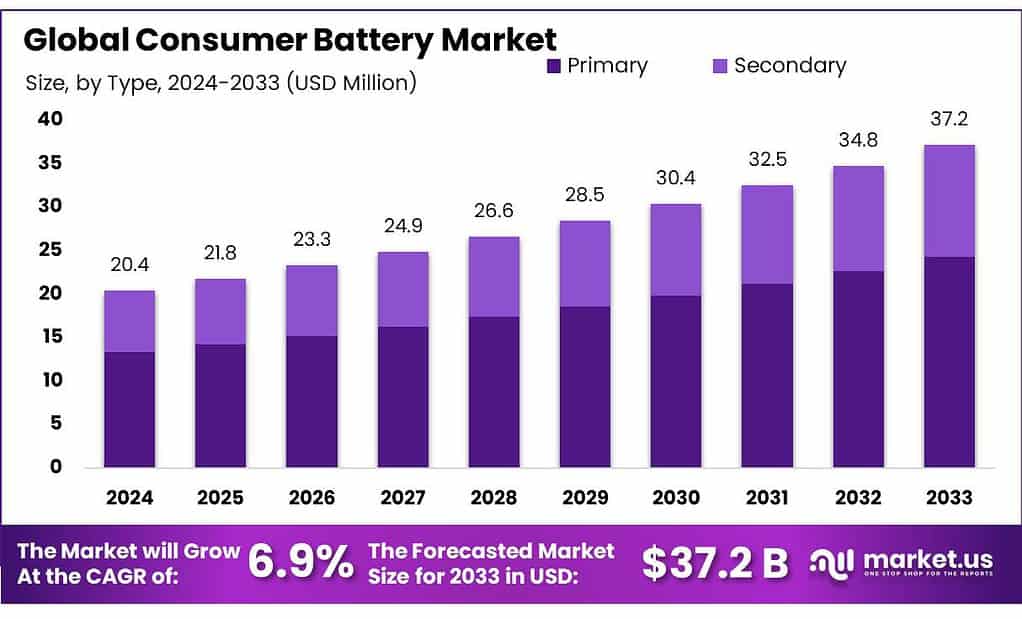

The Global Consumer Battery Market size is expected to be worth around USD 37.2 by 2033, from USD 20.4 Bn in 2023, growing at a CAGR of 6.9% during the forecast period from 2024 to 2033.

A consumer battery refers to any battery used to power small electronic devices that are typically utilized by individuals rather than for industrial or large-scale energy storage applications. These batteries are essential components in a wide range of consumer electronics, from mobile phones and laptops to remote controls and power tools.

They vary widely in size, capacity, and technology, encompassing alkaline batteries commonly used in household items, rechargeable lithium-ion batteries favored in portable electronics and electric vehicles, and other types such as nickel-cadmium and nickel-metal hydride.

According to the U.S. Consumer Product Safety Commission (CPSC), the Setting Consumer Standards for Lithium-Ion Batteries Act was introduced to enhance safety standards for rechargeable lithium-ion batteries, particularly those used in e-mobility devices such as electric bikes and scooters. This bipartisan legislation aims to address the increasing incidents of battery-related fires, which have become a significant concern in urban areas like New York City, where 268 battery fires were reported in 2023 alone.

In India, the Ministry of Heavy Industries has launched the Electric Mobility Promotion Scheme 2024 (EMPS 2024), allocating INR 500 crore to promote electric vehicles (EVs). This initiative is part of a broader strategy to transition towards electric transportation and is projected to support approximately 560,789 electric vehicles, including 500,080 electric two-wheelers and 60,709 electric three-wheelers. The scheme emphasizes affordability and aims to bolster the domestic EV manufacturing ecosystem as part of India’s green initiatives.

Germany plays a crucial role in the global consumer battery market, being the fourth largest exporter of electric batteries. In 2022, Germany exported $8.38 billion worth of electric batteries, with significant exports directed towards the United States ($1.56 billion) and China ($725 million). Conversely, Germany imported $20.3 billion in electric batteries, primarily from China ($8.08 billion) and Poland ($4.42 billion). This dynamic highlights Germany’s strategic position in both production and consumption within the consumer battery sector.

Key Takeaways

- Consumer Battery Market size is expected to be worth around USD 37.2 by 2033, from USD 20.4 Bn in 2023, growing at a CAGR of 6.9%.

- Secondary Batteries held a dominant market position, capturing more than a 65.3% share.

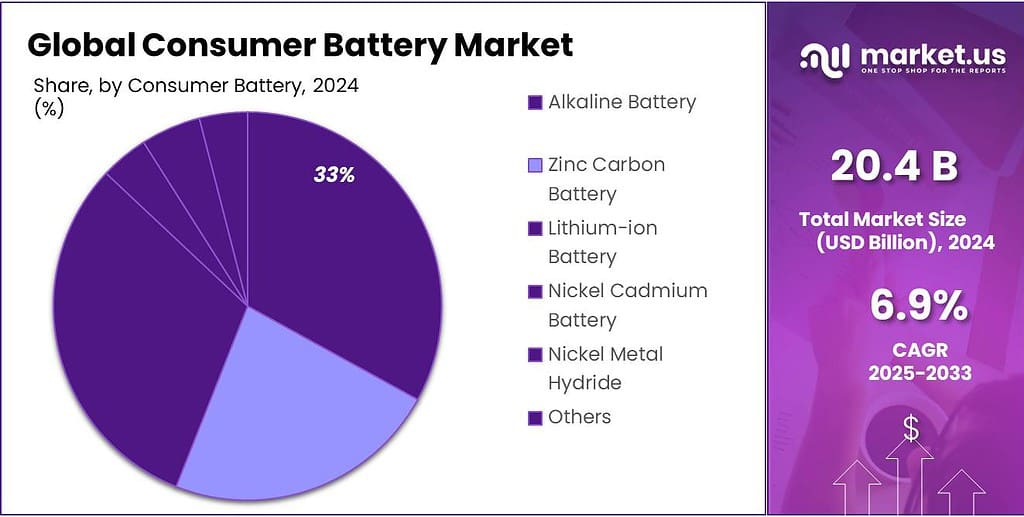

- Alkaline Batteries held a dominant market position, capturing more than a 33.4% share.

- Consumer Electronics held a dominant market position, capturing more than a 42.3% share.

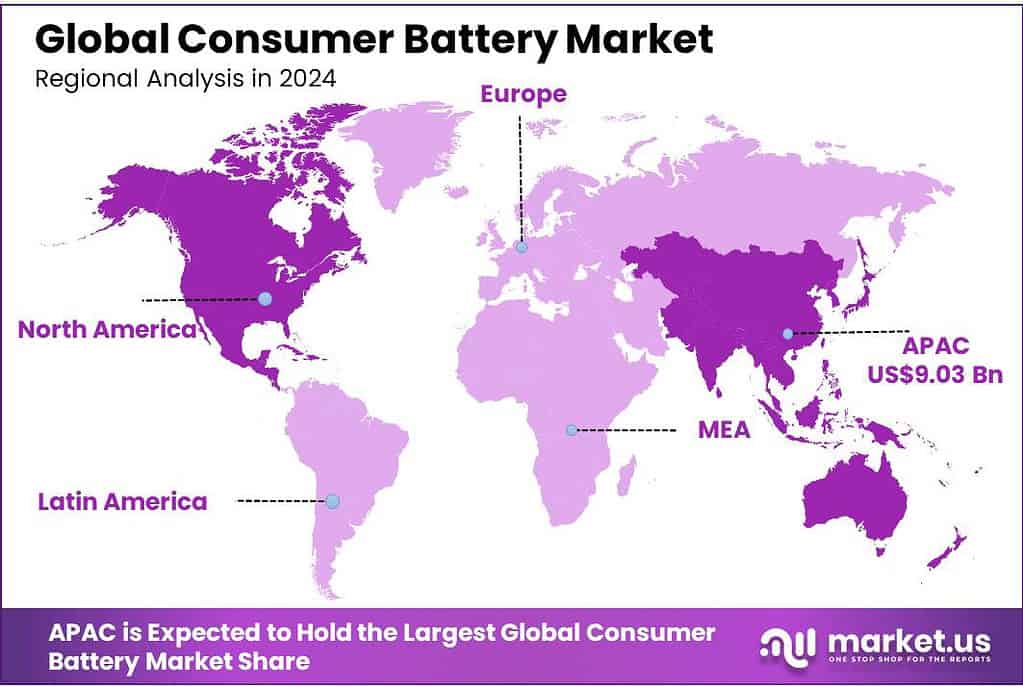

- Asia Pacific region dominated the Consumer Battery Market, holding a 44.3% share and generating revenues of USD 9.03 billion.

By Type

2023 Market Analysis: Dominance of Secondary Batteries with a 65.3% Share

In 2023, Secondary Batteries held a dominant market position, capturing more than a 65.3% share. This segment includes rechargeable batteries used in consumer electronics, electric vehicles, and renewable energy storage. The growth of this market segment is primarily driven by the increasing demand for portable devices and the shift towards sustainable energy solutions.

On the other hand, Primary Batteries, which are non-rechargeable, accounted for the remaining market share. These are commonly used in products requiring reliable, one-time use power sources, such as remote controls, smoke detectors, and certain medical devices. Although these batteries face competition from rechargeable alternatives, their demand remains steady in applications where long shelf life and immediate power are essential.

By Battery Chemistry

Market Share Analysis of Consumer Battery Chemistry in 2023: Dominance of Alkaline Batteries with a 33.4% Share

In 2023, Alkaline Batteries held a dominant market position, capturing more than a 33.4% share. Favored for their cost-effectiveness and reliability, these batteries are extensively used in household devices like remote controls and toys. The stability and longer shelf life of alkaline batteries contribute significantly to their market dominance.

Zinc Carbon Batteries, another important segment, are valued for their affordability and are primarily used in low-drain applications such as flashlights and radios. However, they have a smaller market share due to lower energy density and shorter lifespan compared to more advanced technologies.

Lithium-ion Batteries are gaining prominence rapidly due to their high energy density and reusability, making them ideal for mobile phones, laptops, and electric vehicles. Their market share is expanding as technological advancements and decreasing costs drive their adoption in a wide range of applications.

Nickel Cadmium Batteries, known for their robust performance in extreme conditions, have seen declining usage due to environmental concerns and the availability of better alternatives like Nickel Metal Hydride and Lithium-ion batteries.

Nickel Metal Hydride Batteries, which offer a good balance between cost and performance, are commonly used in hybrid vehicles and portable power tools. They are less harmful to the environment compared to nickel cadmium, making them a more popular choice in environmentally conscious markets.

By Application

Consumer Electronics Leads with a 42.3% Share

In 2023, Consumer Electronics held a dominant market position, capturing more than a 42.3% share. This segment benefits largely from the high demand for smartphones, laptops, and other portable devices, where batteries are essential for mobility and convenience.

Household Devices also represent a significant portion of the market. These include batteries used in items like remote controls, kitchen appliances, and security systems. The need for reliable power sources in these applications ensures steady market demand.

The Automotive sector is rapidly growing with the increase in production of electric vehicles (EVs), which rely heavily on advanced battery technologies such as lithium-ion. This segment’s expansion is supported by global efforts to reduce carbon emissions.

Power Tools are another important application area. Batteries in this segment need to provide long-lasting power and quick recharge capabilities to support both professional and home use. The growth in DIY activities and home improvements has bolstered this market segment.

Key Market Segments

By Type

- Primary

- Secondary

By Battery Chemistry

- Alkaline Battery

- Zinc Carbon Battery

- Lithium-ion Battery

- Nickel Cadmium Battery

- Nickel Metal Hydride

- Others

By Application

- Consumer Electronics

- Household Devices

- Automotive

- Power Tools

- Others

Driving Factors

The Impact of Electric Vehicles on Battery Demand

One major driving factor for the consumer battery market is the significant increase in demand driven by the electric vehicle (EV) sector. In 2023, the global demand for automotive lithium-ion (Li-ion) batteries surged by approximately 65%, reaching 550 GWh, up from 330 GWh in the previous year.

This increase aligns with a 55% rise in electric passenger car registrations during the same period. Furthermore, the battery demand for EVs in the United States alone grew by about 80%, influenced by a 55% increase in electric car sales.

The expansion of the EV market has profound implications for the battery industry, particularly in the development and utilization of lithium-ion batteries. This category of batteries dominates the market, thanks to significant cost reductions (over 90% since 2010) and improvements in energy density and longevity.

For instance, the price of lithium-ion batteries dropped from USD 1,400 per kilowatt-hour in 2010 to less than USD 140 per kilowatt-hour in 2023. These advancements make lithium-ion batteries indispensable not only in personal electronic devices but also in larger scale applications like EVs and renewable energy storage.

Moreover, policy support plays a crucial role in bolstering the deployment of batteries. Many governments globally are enacting policies and incentives to promote the adoption of EVs and the integration of renewable energy systems, which in turn boosts the demand for batteries.

These policies are integral to meeting the ambitious climate goals set forth in international agreements such as the Paris Agreement, aiming to significantly reduce CO2 emissions and enhance energy efficiency through increased use of renewable energy and battery storage.

Restraining Factors

Challenges of Raw Material Supply and Costs

One of the most significant restraining factors in the consumer battery market is the volatility and insecurity associated with the supply of critical raw materials necessary for battery production. The consumer battery industry, particularly lithium-ion batteries, relies heavily on materials like lithium, cobalt, and nickel, which are subject to fluctuating prices and geopolitical tensions that affect their availability.

In 2023, the market experienced a surge in the demand for batteries, especially for electric vehicles (EVs) and energy storage systems, which further strained these material supplies.

The International Energy Agency (IEA) reported that the total volume of batteries used in the energy sector was over 2,400 gigawatt-hours (GWh) in 2023, a substantial increase from previous years, with EVs accounting for over 90% of this usage. This significant demand puts immense pressure on the supply chain, highlighting the dependence on limited sources for these critical materials.

Moreover, the geopolitical landscape plays a crucial role in the accessibility of these materials. For instance, China controls a substantial portion of the global processing capacity for lithium and cobalt, crucial for manufacturing lithium-ion batteries. This concentration of supply chain stages in specific regions introduces risks related to political instability and regulatory changes, potentially leading to supply disruptions or increased costs for battery manufacturers outside these regions.

The rising costs of raw materials also pose a substantial challenge. The industry has seen dramatic increases in the prices of essential battery components due to the heightened demand coupled with supply constraints. These cost increases are likely to be passed on to the end consumers, potentially slowing down the adoption rates of technologies reliant on these batteries, such as electric vehicles and renewable energy systems.

To address these challenges, industry stakeholders, including governments and private entities, are exploring various strategies. These include investing in recycling technologies to reduce the dependence on raw material extraction, developing alternative battery chemistries that rely less on scarce materials, and diversifying supply sources to mitigate geopolitical risks.

However, these solutions require time to develop and implement, meaning that raw material supply and cost issues will continue to be a significant restraining factor for the battery market in the near term.

Growth Opportunity

Expansion of Electric Vehicle and Energy Storage Applications

A significant growth opportunity in the consumer battery market is the expanding demand for electric vehicles (EVs) and energy storage systems, which is driving the rapid increase in lithium-ion battery usage.

According to the International Energy Agency, the global battery manufacturing capacity is projected to potentially exceed 9 TWh by 2030, indicating robust growth driven by increasing electrification and power grid decarbonization. This capacity is crucial to meet the deployment needs for both road transport electrification and stationary storage targets under various environmental policy scenarios.

The lithium-ion battery market, in particular, has witnessed substantial growth and is expected to continue its upward trajectory with a projected market value of USD 446.85 billion by 2032, growing at a compound annual growth rate (CAGR) of 23.33%.

This growth is underpinned by the battery’s critical role in consumer electronics, automotive industries, and large-scale energy storage systems, which are all sectors experiencing significant technological advancements and increasing market demand.

Moreover, advancements in battery technology and the diversification of battery types, such as the development of sodium-ion batteries, present new opportunities. These batteries offer a cost-effective alternative to traditional lithium-ion batteries and are gaining attention for their potential to avoid the use of critical minerals, making them an attractive option for urban vehicles and stationary storage applications.

The rise in EV adoption and the expansion of energy storage applications are not only driven by consumer demand but also supported by stringent government regulations promoting environmentally friendly technologies. These regulations are catalyzing the automotive industry’s shift towards electric vehicles, further bolstering the demand for high-capacity, efficient batteries.

Latest Trends

The Rise of Lithium Iron Phosphate (LFP) and Sodium-Ion Batteries

A major trend in the consumer battery market in 2023 has been the increased adoption of Lithium Iron Phosphate (LFP) and the emergence of sodium-ion batteries. This shift is largely driven by the evolving needs of the electric vehicle (EV) and energy storage sectors, which require more sustainable and cost-effective battery solutions.

LFP batteries have gained significant market share due to their safety, cost-effectiveness, and longer cycle life compared to other lithium-ion chemistries. In 2022, LFP batteries constituted nearly 30% of the battery market, with a substantial portion used in Chinese-manufactured electric vehicles.

This trend is supported by major manufacturers like BYD and Tesla, which are incorporating LFP batteries into their vehicles, highlighting a shift towards these batteries due to their lower cost and adequate energy density for shorter-range vehicles.

Simultaneously, sodium-ion batteries are making headway as a viable alternative to traditional lithium-ion batteries, particularly in applications where high energy density is less critical. These batteries offer the advantage of using more abundant and less expensive materials, which could potentially reduce costs and dependency on scarce resources like lithium and cobalt.

With nearly 30 sodium-ion battery manufacturing plants operational or under construction, primarily in China, this technology is poised to make a significant impact on the market, especially in regions with lower range requirements or less access to charging infrastructure.

These trends reflect the battery industry’s response to the need for more sustainable energy solutions and illustrate the ongoing evolution of battery technologies to meet diverse market demands. The shift towards LFP and sodium-ion batteries is likely to continue as the industry seeks to overcome the challenges of cost, safety, and supply chain sustainability associated with more traditional lithium-ion batteries.

Regional Analysis

In 2023, the Asia Pacific region dominated the Consumer Battery Market, holding a 44.3% share and generating revenues of USD 9.03 billion. This region’s substantial market share is largely driven by the significant manufacturing capacities of countries like China, Japan, and South Korea, coupled with high local demand for consumer electronics and electric vehicles. Asia Pacific’s leadership in battery innovation and production technology further strengthens its market position.

North America also plays a crucial role in the global consumer battery landscape, primarily fueled by advancements in electric vehicle (EV) technology and renewable energy applications. The United States, in particular, is a hub for both battery innovation and demand, driven by supportive government policies promoting green energy.

Europe’s market is characterized by stringent environmental regulations and a robust automotive sector pushing for electrification, which in turn boosts the demand for high-performance batteries. The region’s focus on sustainability also drives innovations in battery recycling and second-life applications, supporting a circular economy in the battery industry.

The Middle East and Africa, though smaller in market share, are rapidly growing regions in the consumer battery market. This growth is spurred by increasing investments in renewable energy projects and the modernization of telecommunications infrastructure, which demand reliable battery solutions.

Latin America, while still an emerging market in the consumer battery industry, shows potential due to its growing renewable energy sector and the increasing adoption of portable electronics. The region’s market is expected to expand as more consumers gain access to modern technology and as local governments invest in cleaner energy sources.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The consumer battery market features a dynamic competitive landscape with several key players that are pivotal in shaping industry trends and technological advancements. Companies like Panasonic Corp., Samsung SDI, and LG Energy Solution are recognized leaders in lithium-ion technology, providing batteries for a wide range of applications from consumer electronics to electric vehicles. Their significant research and development capabilities allow them to innovate continually, thereby setting industry standards for battery efficiency, capacity, and safety.

companies such as Duracell Inc. and Energizer Holdings Inc. are prominent in the primary battery market, particularly in the alkaline and lithium battery segments. These companies have a strong consumer presence and brand recognition, with products that power everyday devices like remote controls, toys, and smoke detectors. Their focus tends to be on reliability, safety, and longevity of battery life, which are critical factors for consumer satisfaction.

Emerging players like EVE Energy Co., Ltd. and Tianjin Lishen Battery Joint-Stock Co., Ltd. are expanding their market presence, especially in the Asia-Pacific region. These companies are increasing their capacity to meet growing demands, particularly in the electric mobility and portable electronics markets. Moreover, innovative companies such as PolyPlus are working on next-generation battery technologies that could potentially disrupt the market with higher energy densities and lower costs.

Top Key Players in the Market

- Panasonic Corp.

- Duracell Inc.

- EVE Energy Co. Ltd.

- Tianjin Lishen Battery Joint-Stock Co., Ltd.

- Renata Battery

- Suzhou South Large Battery Co., Ltd.

- PolyPlus

- Maxell, Ltd.

- Samsung SDI

- VARTA AG

- GP Industrial

- LG Energy Solution

- FDK Corporation

- Murata Manufacturing Co., Ltd.

- Energizer Holdings Inc.

Recent Developments

In 2023, Panasonic is a leader in North America for EV batteries, operating one of the world’s largest manufacturing centers in Nevada and expanding with a new facility in Kansas.

In 2023 Duracell has maintained its position as one of the key companies driving advancements and maintaining substantial market share in the North American consumer battery market.

Report Scope

Report Features Description Market Value (2023) USD 20.4 Bn Forecast Revenue (2033) USD 37.2 Bn CAGR (2024-2033) 6.9% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Primary, Secondary), By Battery Chemistry (Alkaline Battery, Zinc Carbon Battery, Lithium-ion Battery, Nickel Cadmium Battery, Nickel Metal Hydride, Others), By Application (Consumer Electronics, Household Devices, Automotive, Power Tools, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Panasonic Corp., Duracell Inc., EVE Energy Co. Ltd., Tianjin Lishen Battery Joint-Stock Co., Ltd., Renata Battery, Suzhou South Large Battery Co., Ltd., PolyPlus, Maxell, Ltd., Samsung SDI, VARTA AG, GP Industrial, LG Energy Solution, FDK Corporation, Murata Manufacturing Co., Ltd., Energizer Holdings Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Panasonic Corp.

- Duracell Inc.

- EVE Energy Co. Ltd.

- Tianjin Lishen Battery Joint-Stock Co., Ltd.

- Renata Battery

- Suzhou South Large Battery Co., Ltd.

- PolyPlus

- Maxell, Ltd.

- Samsung SDI

- VARTA AG

- GP Industrial

- LG Energy Solution

- FDK Corporation

- Murata Manufacturing Co., Ltd.

- Energizer Holdings Inc.