Global Connected Worker Market Size, Share Analysis Report By Component (Hardware, Software, Services), By Technology (RFID Location Triangulation, Wi-Fi, Cellular, Bluetooth, Low-Power Wide-Area Network (LPWAN), Wireless Field Area Network (WFAN), Zigbee), By Deployment (On-premise, Cloud), By End-Use (Manufacturing, Construction, Mining, Oil & Gas, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153246

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

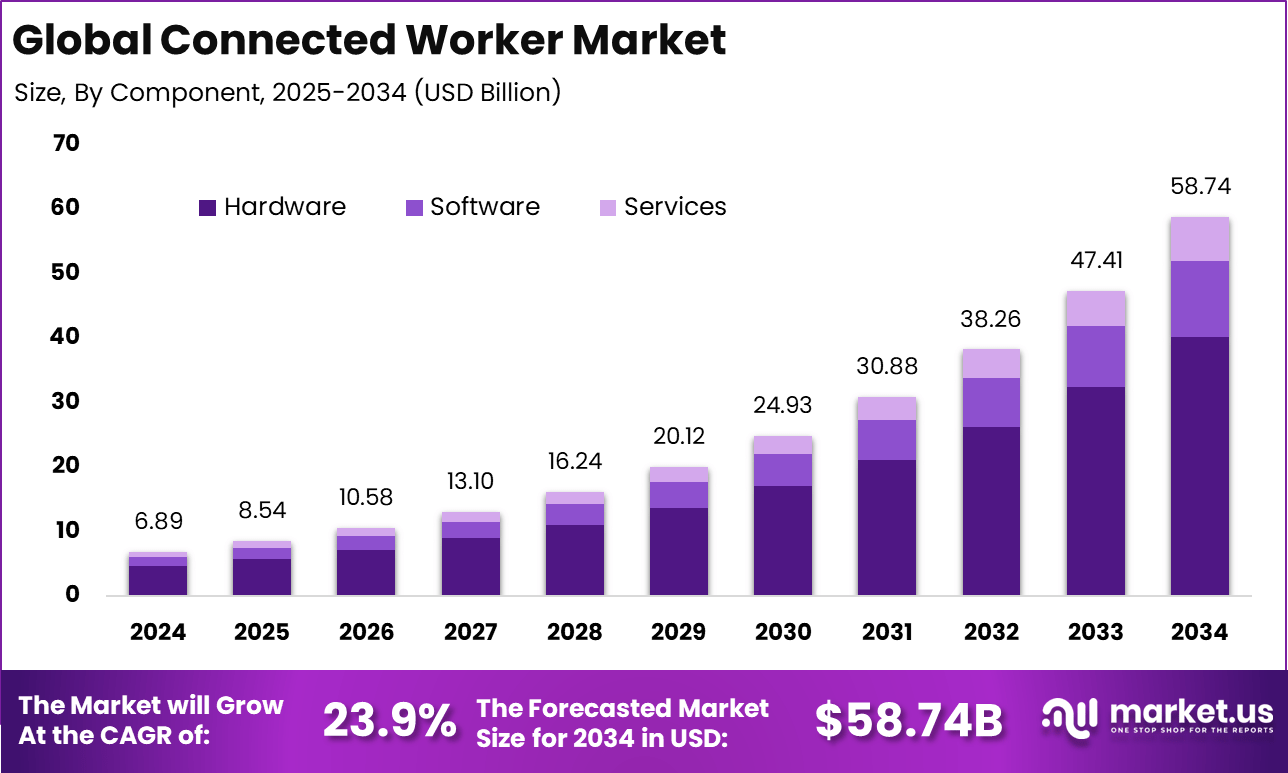

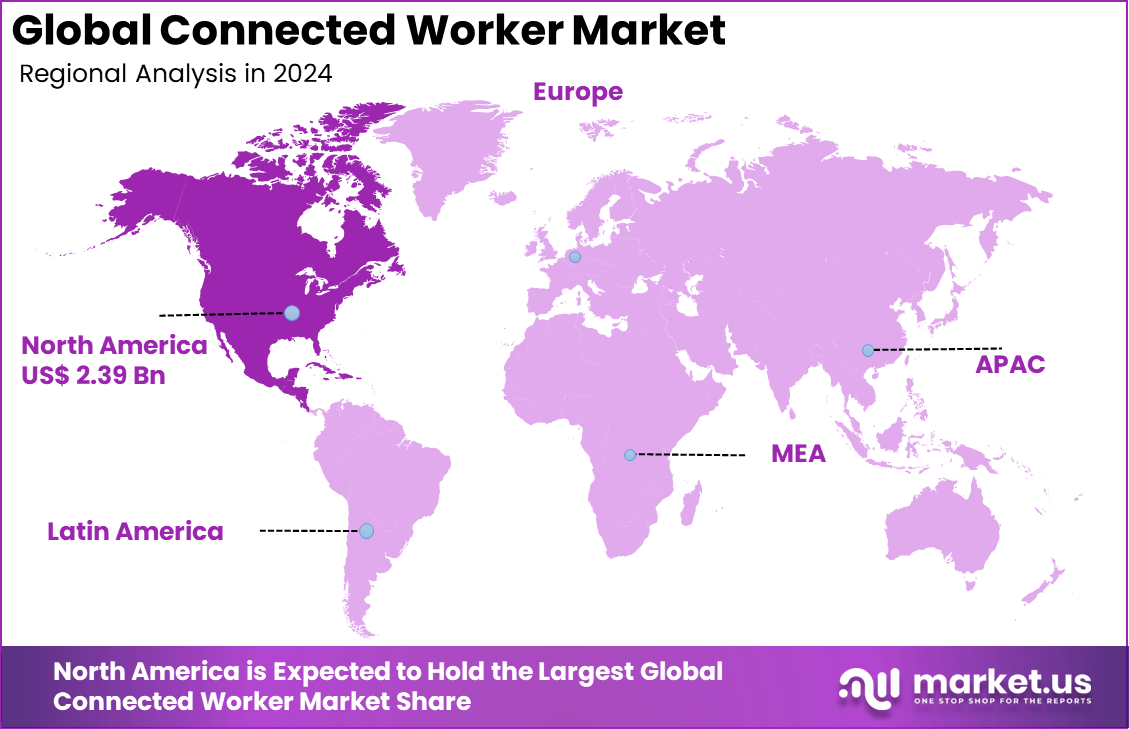

The Global Connected Worker Market size is expected to be worth around USD 58.74 billion by 2034, from USD 6.89 billion in 2024, growing at a CAGR of 23.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.8% share, holding USD 2.39 billion in revenue.

The connected worker market refers to the ecosystem of digital technologies that enable frontline workers to operate more safely, efficiently, and collaboratively across industrial environments. These solutions include wearables, mobile devices, augmented reality tools, voice-controlled interfaces, and IoT-powered data collection systems.

For instance, in March 2025, SymphonyAI upgraded its Proceedix connected worker platform to enhance compliance and operational efficiency. The update introduced advanced workflow management, real-time task tracking, and integrated analytics to support frontline workers in regulated industries.

Connected worker technologies are being adopted to digitize manual tasks and enable real-time communication among teams in industries like manufacturing, construction, and logistics. One of the top driving factors of this market is the increasing emphasis on operational efficiency and workforce productivity.

As per TrendFeedr, a total of 54 companies operating in the Connected Worker domain have secured funding. Cumulatively, these firms have raised USD 771.9 million across 172 distinct funding rounds, reflecting sustained investor interest in this emerging sector.

Organizations are under constant pressure to reduce downtime, minimize human errors, and enhance asset utilization. Connected worker tools enable real-time access to equipment manuals, remote assistance, and automated reporting. These functionalities have become vital in high-risk or regulated sectors, where worker safety and compliance must be maintained without disrupting core operations.

Scope and Forecast

Report Features Description Market Value (2024) USD 6.8 Bn Forecast Revenue (2034) USD 58.7 Bn CAGR (2025-2034) 23.9% Largest market in 2024 North America [34.8% market share] Key Takeaway

- The global connected worker market is projected to grow from USD 6.89 billion in 2024 to approximately USD 58.74 billion by 2034, registering a strong CAGR of 23.9% during 2025–2034, driven by the increasing need for workforce safety, productivity, and real-time operational visibility.

- In 2024, North America held a leading position with over 34.8% market share, generating about USD 2.39 billion, supported by advanced industrial digitalization and strong investment in smart workforce technologies.

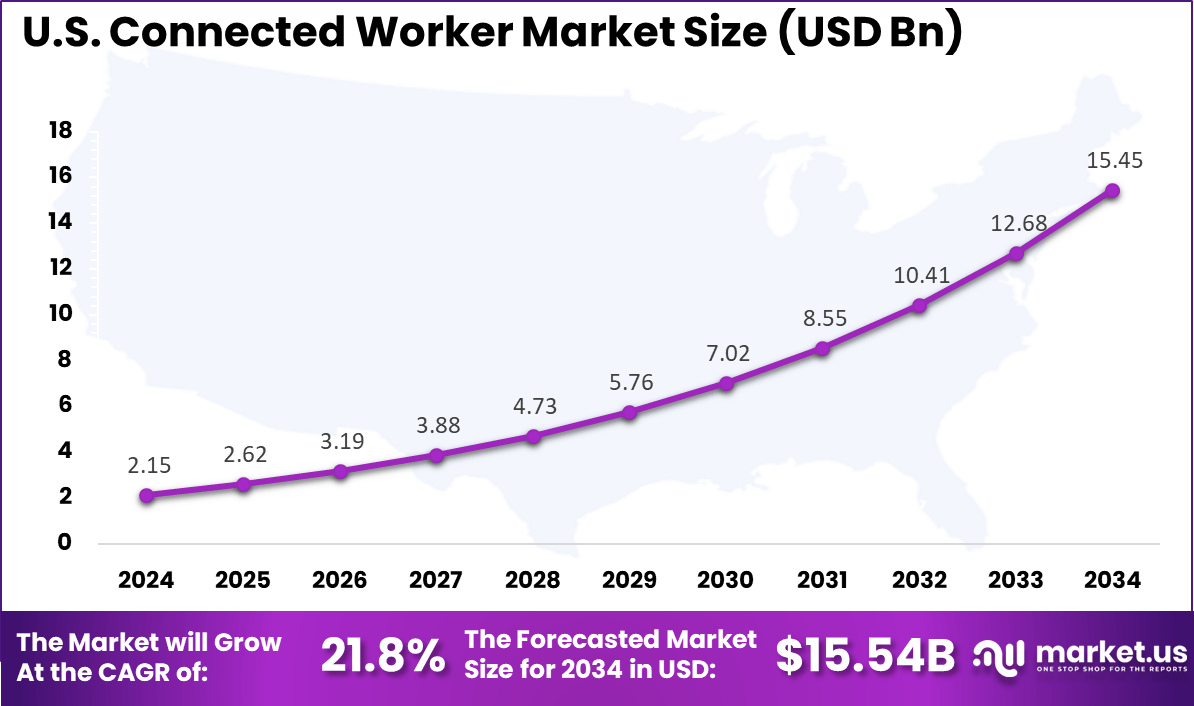

- Within North America, the U.S. contributed USD 2.15 billion in 2024, with an expected CAGR of 21.8%, reflecting early adoption of connected solutions in manufacturing and utilities.

- By component, hardware dominated with a 68.4% share, as wearables, sensors, and communication devices form the backbone of connected worker systems.

- By technology, cellular connectivity led with a 37.1% share, favored for its wide coverage, mobility, and reliability in remote and dynamic work environments.

- By deployment, on-premise solutions accounted for 61.8% share, as many industries prioritize data control and security in critical operations.

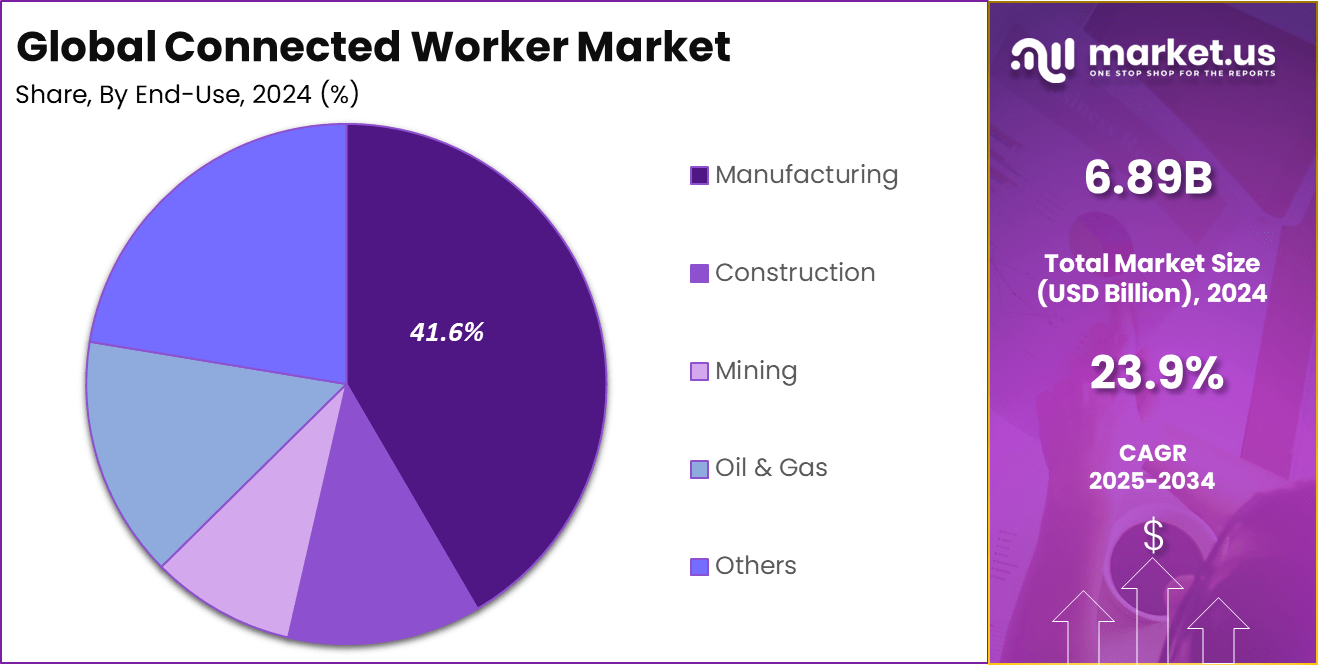

- By end use, manufacturing dominated with 41.6% share, driven by the sector’s focus on efficiency, predictive maintenance, and workforce safety in complex production settings.

U.S. Connected Worker Market Size

The market for Connected Worker within the U.S. is growing tremendously and is currently valued at USD 2.15 billion, the market has a projected CAGR of 21.8%. The market is expanding rapidly, driven by a strong focus on workplace safety, regulatory compliance, and digital transformation across key sectors like manufacturing, construction, and healthcare.

Labor shortages and the demand for real-time data, remote collaboration, and seamless communication are accelerating adoption. Post-pandemic shifts have heightened interest in IoT, AI, wearables, and AR technologies, which enhance workforce productivity, safety, and operational efficiency by enabling real-time monitoring, workflow optimization, and compliance management for frontline workers.

For instance, In October 2024, Epicor acquired Acadia, a U.S.-based connected worker platform. Acadia’s tools in training, compliance, and performance support aligned well with Epicor’s industrial software. The deal reflects the U.S. market’s strong focus on boosting digital workforce productivity and safety.

In 2024, North America held a dominant market position in the Global Connected Worker Market, capturing more than a 34.8% share, holding USD 2.39 billion in revenue. This dominance is due to its robust digital infrastructure, proactive safety regulations, and early adoption of Industry 4.0 technologies.

Key sectors like manufacturing and energy are rapidly integrating IoT, AI, and wearable solutions to enhance safety and efficiency. Strong government backing for smart industry initiatives, coupled with substantial R&D investments and a concentration of top tech vendors, fuels continuous innovation. This ecosystem positions North America as a hub for connected workforce transformation and market expansion.

For instance, In June 2023, IFS acquired Poka, a North American connected worker platform. Poka’s solutions support real-time training, knowledge sharing, and operational visibility in manufacturing. This acquisition highlights North America’s lead in digital workforce transformation, backed by strong innovation and early Industry 4.0 adoption.

Component Analysis

In 2024, the Hardware segment dominated the connected worker market, accounting for approximately 68.4% of the total market share. This leadership is primarily due to the rising deployment of smart wearables, ruggedized mobile devices, head-mounted displays (HMDs), sensor-embedded personal protective equipment (PPE), and handheld communication tools, which form the backbone of connected worker solutions.

The adoption of industrial-grade hardware is essential for enabling real-time communication, worker safety tracking, and operational efficiency, especially in hazardous or high-risk environments. Industries such as manufacturing, oil & gas, and construction are investing heavily in connected worker hardware to enhance workforce visibility, reduce downtime, and minimize on-site hazards.

Moreover, ongoing technological advancements – such as AR (Augmented Reality)-enabled headsets and real-time biometric monitoring devices – are further pushing companies toward hardware integration. The need for durable, reliable, and scalable hardware is expected to keep this segment in a leading position as more organizations prioritize digital transformation on the frontline.

For Instance, in March 2024, Apple’s Vision Pro headset began gaining traction as a connected worker tool, particularly in industrial settings. The device integrates advanced spatial computing, real-time visualization, and immersive AR interfaces, positioning it as a transformative piece of hardware for frontline workers. Companies are exploring its use for remote assistance, hands-free training, and digital work instruction.

Technology Analysis

In 2024, the Cellular technology segment led the connected worker market, capturing around 37.1% of the total share. As industries expand into remote or large-scale operational sites, cellular networks – particularly LTE and private 5G – provide essential connectivity for mobile workers who require seamless communication, real-time data transmission, and access to cloud-based systems.

The proliferation of private 5G infrastructure is accelerating the adoption of cellular connectivity within industrial environments, enabling ultra-low-latency communication and more stable connections for mission-critical applications. As more companies deploy IoT-enabled wearables and mobile tools for frontline workers, cellular networks are proving to be a reliable foundation for connected workforce strategies, driving long-term growth in this technology segment.

For instance, In September 2024, Nokia and Rockwell Automation partnered to enhance private 5G networks in industrial settings. The collaboration enables ultra-reliable, low-latency communication essential for real-time data, video, and safety functions. This integration strengthens connected worker capabilities, especially in remote or high-demand environments.

Deployment Analysis

In 2024, The On-premise segment held a dominant market position, capturing a 61.8% share of the Global Connected Worker Market. This dominance is due to heightened demand for data security, system control, and compliance with internal IT policies.

Many major corporations, particularly in heavily regulated industries like manufacturing and utilities, prefer to have on-premise installations as a means of maintaining complete control over their data and infrastructure. It offers better flexibility for customization, lower latency, and compatibility with existing legacy systems, making it an ideal solution for important applications.

For instance, In October 2024, Nokia launched industrial applications to enhance worker safety and efficiency in on-premise environments. These solutions use private wireless and edge computing for real-time monitoring and secure data handling. The launch addresses growing demand for connected worker tools in high-risk, compliance-heavy industries.

End-Use Analysis

In 2024, the Manufacturing sector emerged as the leading end-use segment in the connected worker market, contributing approximately 41.6% of the global share. The demand for connected worker solutions in manufacturing is mainly driven by the need for real-time workforce monitoring, predictive maintenance, workflow optimization, and enhanced safety protocols amid Industry 4.0 transformations.

Manufacturers are equipping their workers with wearable technologies and communication devices to gain operational visibility and increase productivity on the factory floor. As labor shortages and skill gaps continue to impact the manufacturing sector, connected worker technologies also serve as essential tools for training, remote support, and augmented guidance.

With the rise of smart factories and digital twins, manufacturers are prioritizing investments in digital workforce enablement, making this segment the cornerstone of connected worker adoption. The integration of connected devices and AI-based analytics is not just reshaping how work is done – it’s redefining the future of manufacturing.

For Instance, In April 2024, Zaptic expanded into the manufacturing sector through Hexagon’s Sixth Sense program. This collaboration accelerated the deployment of Zaptic’s connected worker tools for digitizing workflows and managing tasks in real time. It reflects the rising importance of digital solutions in enhancing productivity across manufacturing operations.

Key Market Segments

By Component

- Hardware

- Smart Glasses/Eyewear

- Smart Headgear

- Hearing Protection Devices

- Protective Textiles

- Mobile Devices

- Others

- Software

- Workforce Task Management

- Workforce Analytics

- Mobile Learning

- Services

- Consulting

- Training & Implementation

By Technology

- RFID Location Triangulation

- Wi-Fi

- Cellular

- Bluetooth

- Low-Power Wide-Area Network (LPWAN)

- Wireless Field Area Network (WFAN)

- Zigbee

By Deployment

- On-premise

- Cloud

By End-Use

- Manufacturing

- Construction

- Mining

- Oil & Gas

- Others

Emerging Trend

AI-Powered Worker Empowerment

The connected worker landscape is witnessing a clear shift as artificial intelligence becomes more deeply woven into everyday industrial tasks. AI capabilities are empowering frontline staff to receive real-time guidance, intuitive task recommendations, and even natural language support when troubleshooting problems.

In practice, this means workers on the floor can interact with digital systems much like they would with a colleague, streamlining processes and reducing downtime. With AI now focused on augmenting human expertise rather than replacing it, connected platforms are helping workers make faster, better-informed decisions, enabling a more intuitive and satisfying work experience.

As organizations refine their digital strategies, the integration of AI not only optimizes worker productivity but also enhances overall workplace safety. Wearables and smart tools capture data that AI uses to monitor working conditions and anticipate incidents before they happen. By bridging human insight with intelligent technologies, this trend signals that the future of manufacturing favors collaboration between people and machines.

Drivers

Increased Focus on Worker Safety and Regulatory Compliance

Companies are increasingly adopting connected worker technologies due to increased workplace safety regulations and regulatory requirements. Wearables and IoT devices enable the real-time tracking of health metrics, fatigue status, and employee whereabouts, which can help prevent accidents.

These systems support compliance with evolving labor and safety regulations, helping companies mitigate legal risks and improve workforce well-being, while also enhancing operational visibility and building a culture of safety-driven performance.

For instance, in February 2025, Epicore Biosystems raised $26 million to advance its sweat-sensing wearable technology, underscoring the growing emphasis on worker safety and health monitoring. These wearables track hydration, fatigue, and heat stress in real time, offering critical data to prevent injuries and support workforce well-being, especially in high-risk environments.

Restraint

Data Security and Privacy Concerns

Due to the abundance of confidential employee data generated and transmitted across an entire workforce, significant cybersecurity and privacy concerns arise. Companies face challenges in protecting this information from breaches, unauthorized access, and possible misuse.

Additionally, workers’ apprehensions about surveillance and data transparency may hinder adoption. Without robust data governance structures and well-defined regulatory guidelines, organizations face reputational and legal risks, making data protection a critical issue in the expansion of connected worker initiatives across industries.

For instance, In April 2025, a National Labor Relations Board complaint against SpaceX raised concerns over connected worker data privacy. Allegations involved the use of monitoring tools to track employee activities, sparking debate on ethical data use. The case highlights rising scrutiny over workplace surveillance and the need for strong data governance.

Opportunities

Expansion Across Diverse Industries

In industries such as healthcare, mining, logistics, and construction, connected worker solutions are rapidly becoming more prevalent outside of industrial settings. Industries are seeking tools that can enhance safety, increase productivity, and strengthen their workforce in complex operational scenarios.

The integration of real-time communication, predictive analytics, and digital workflows enables greater agility in field operations. As digital transformation spreads across industries at a rapid pace, the demand for connected worker platforms and technology providers is driving significant growth.

For instance, in March 2024, Baby Memorial Hospital in Kozhikode launched its Continuous Connected Care@BMH initiative, marking a significant advancement in connected worker applications within the healthcare sector. This initiative integrates real-time communication tools, wearables, and mobile platforms to enhance coordination among clinical staff, improve patient monitoring, and support continuous care delivery.

Challenges

Ongoing Maintenance and Updates

Continuous updates, hardware modifications, software upgrades, and IT support are necessary to maintain connected worker systems, which is a significant challenge for companies. With the expansion of these implementations, operational complexity and costs for enterprise IT groups become more significant.

The need for regular updates is essential to address security risks and introduce new features, but it can also lead to interruptions in workflows and the utilization of particular resources. Organizations must be ready to offer technical support on an ongoing basis and adopt scalable frameworks that allow for continuous improvements without interfering with daily operations.

For instance, in April 2023, Augmentir integrated its AI-powered connected worker solution with SAP Plant Maintenance, highlighting the increasing complexity of maintaining and updating digital workforce platforms. As organizations adopt sophisticated, integrated solutions, the need for continuous software updates, system compatibility checks, and technical support grows.

Key Players Analysis

Leading players such as 3M Company, Honeywell, and Zebra Technologies are driving innovation in connected worker technologies by offering rugged wearables, safety sensors, and real-time tracking systems. These tools help improve worker safety, task efficiency, and visibility in complex environments like manufacturing and oil and gas.

Digital transformation leaders including Accenture, Oracle, and Tata Consultancy Services are focusing on cloud-based platforms and data-driven services. Their solutions enable smart workflows, enhance collaboration, and support predictive maintenance across distributed teams.

Emerging companies like Vandrico, Smart Track S.R.L, and Wearable Technology Limited are gaining attention with lightweight, industry-specific devices. Their innovations address field-level challenges such as fatigue detection and compliance monitoring, supporting safe and efficient workforce operations.

Top Key Players in the Market

- 3M Company

- Accenture

- Avnet, Inc.

- Fujitsu Ltd.

- Honeywell International Inc.

- Oracle Corp.

- Smart Track S.R.L

- Tata Consultancy Services

- TELUS

- Vandrico Solutions Inc

- Wearable Technology Limited

- Zebra Technologies

- Others

Recent Developments

- In January 2025, Dozuki announced its continued commitment to empowering the manufacturing workforce with its innovative digital Connected Worker Platform. The platform focuses on transforming how manufacturers train, engage, and support their frontline workers.

- In September 2024, Plex, by Rockwell Automation, launched new connected worker capabilities within its Manufacturing Execution System (MES). These tools help tackle labor issues in manufacturing by offering digital instructions, 2D/3D models, real-time support, and multimedia to boost productivity, quality, and safety.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Technology (RFID Location Triangulation, Wi-Fi, Cellular, Bluetooth, Low-Power Wide-Area Network (LPWAN), Wireless Field Area Network (WFAN), Zigbee), By Deployment (On-premise, Cloud), By End-Use (Manufacturing, Construction, Mining, Oil & Gas, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3M Company, Accenture, Avnet, Inc., Fujitsu Ltd., Honeywell International Inc., Oracle Corp., Smart Track S.R.L, Tata Consultancy Services, TELUS, Vandrico Solutions Inc., Wearable Technology Limited, Zebra Technologies, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M Company

- Accenture

- Avnet, Inc.

- Fujitsu Ltd.

- Honeywell International Inc.

- Oracle Corp.

- Smart Track S.R.L

- Tata Consultancy Services

- TELUS

- Vandrico Solutions Inc

- Wearable Technology Limited

- Zebra Technologies

- Others