Global Computerized Maintenance Management System (CMMS) Market Size, Share, Statistics Analysis Report By Deployment (Cloud, On-premises), By Enterprise Size (Large Enterprises, SMEs), By End-Use (Energy and Utility, Manufacturing, Healthcare, Transportation and Logistics, Retail, Oil & Gas, Other End-Users), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Mar 25

- Report ID: 142417

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Scope

- Key Takeaways

- Analyst’s Review

- Key Statistics

- Regional Analysis

- By Deployment

- By Enterprise Size

- By End-Use

- Key Market Segments

- Driving Factor

- Restraining Factor

- Growth Opportunity

- Challenging Factor

- Challenging Factor

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Report Scope

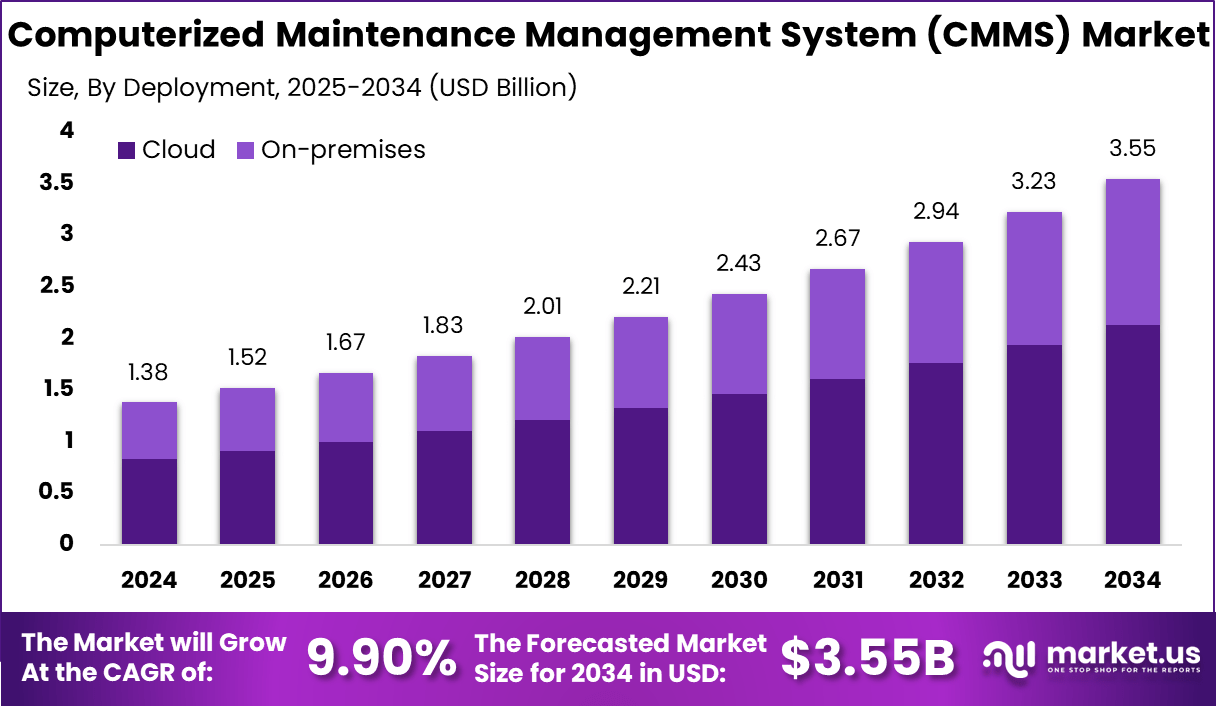

The Global Computerized maintenance management system (CMMS) Market is expected to be worth around USD 3.55 billion by 2034, up from USD 1.38 billion in 2024. It is expected to grow at a CAGR of 9.90% from 2025 to 2034.

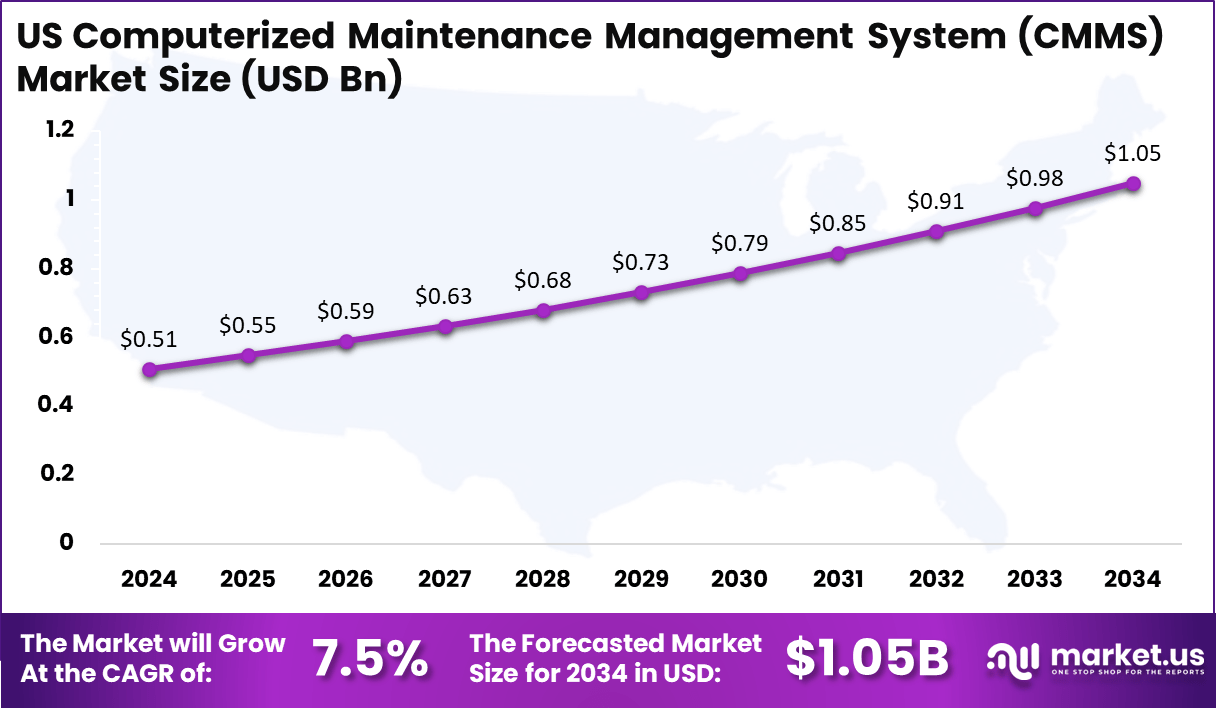

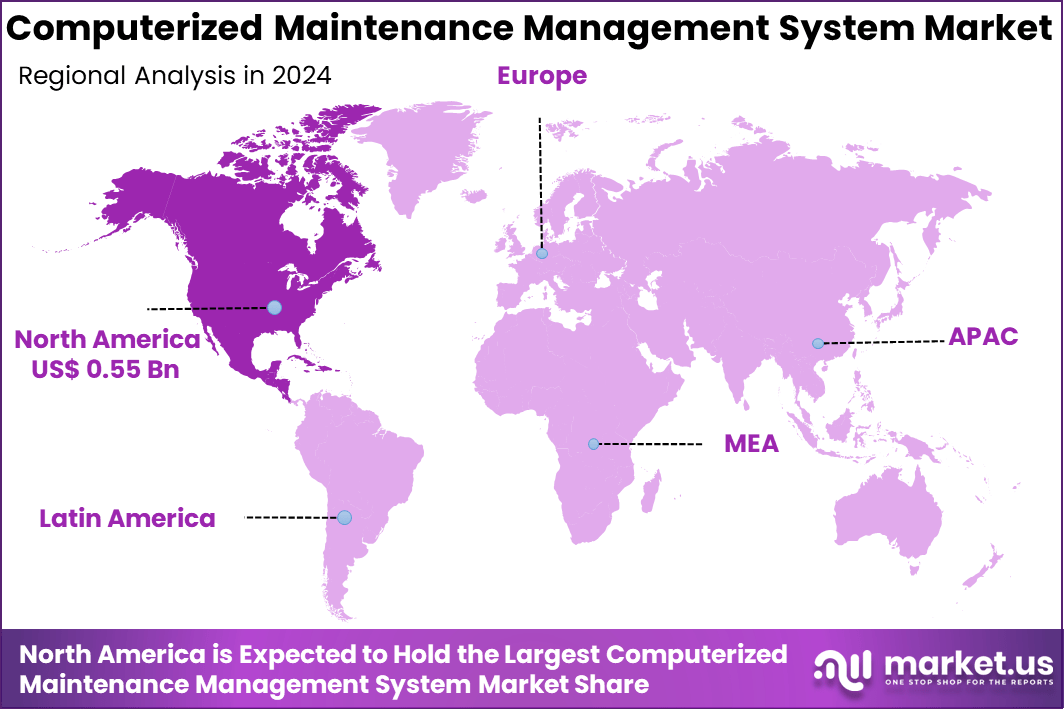

In 2024, North America held a dominant market position, capturing over a 40% share and earning USD 0.55 billion in revenue. Further, the United States dominates the market by USD 0.51 Billion, steadily holding a strong position with a CAGR of 7.5%.

Several key factors are driving the expansion of the CMMS market. The rising need for automation in maintenance processes is a significant contributor, as organizations seek to reduce downtime and improve operational efficiency.

The integration of advanced technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) into CMMS solutions enables predictive maintenance, allowing companies to anticipate equipment failures and schedule timely interventions. This proactive approach not only extends the lifespan of assets but also minimizes unexpected disruptions in operations.

Several key factors are driving the expansion of the CMMS market. The rising need for automation in maintenance processes is a significant contributor, as organizations seek to reduce downtime and improve operational efficiency.

Key Takeaways

- Market Growth: The global CMMS market is expected to grow from USD 1.38 billion in 2024 to USD 3.55 billion by 2034, reflecting a CAGR of 9.90%.

- Deployment Trends: Cloud-based CMMS solutions dominate the market, accounting for 60% of total deployments, driven by flexibility and cost-efficiency.

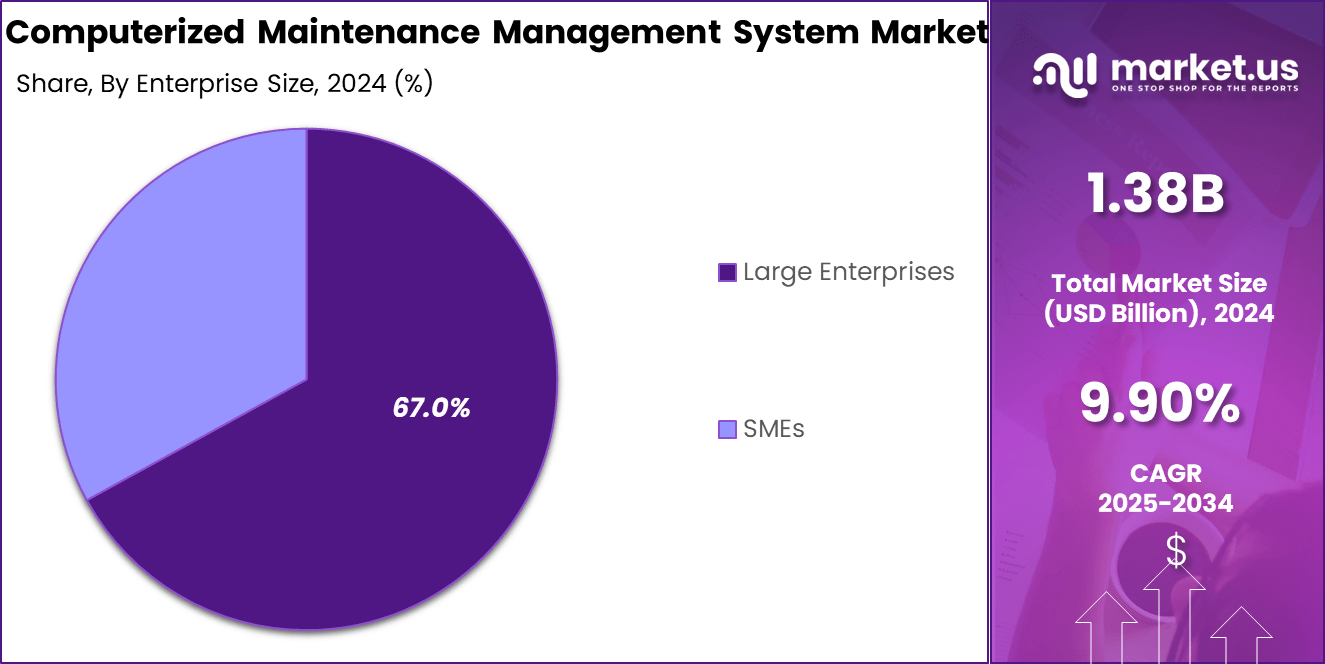

- Enterprise Size: Large enterprises represent the majority of CMMS adoption, contributing 67% to the market, as they require robust maintenance management systems.

- End-Use Industry: Manufacturing remains the leading sector utilizing CMMS, comprising 35% of the total market demand due to its high reliance on equipment maintenance.

- Regional Insights: North America leads the global market, holding a 40% share, fueled by digital transformation and stringent compliance regulations.

- US Regional Insights: The US alone contributes USD 0.51 billion in 2024, with a CAGR of 7.5%, highlighting steady adoption across industries.

Analyst’s Review

The integration of advanced technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) into CMMS solutions enables predictive maintenance, allowing companies to anticipate equipment failures and schedule timely interventions. This proactive approach not only extends the lifespan of assets but also minimizes unexpected disruptions in operations.

Opportunities within the CMMS market are expanding as more small and medium-sized enterprises (SMEs) recognize the benefits of implementing these systems. The availability of cloud-based CMMS solutions has made it more accessible for SMEs to adopt these technologies without significant upfront investments in IT infrastructure.

Additionally, the growing emphasis on sustainability and energy efficiency presents opportunities for CMMS providers to offer features that monitor and optimize resource consumption, aligning with global environmental goals.

Technological advancements are at the forefront of the CMMS market’s evolution. The integration of IoT devices allows for real-time monitoring of equipment conditions, facilitating data-driven decision-making.

AI-powered analytics enable predictive maintenance by analyzing patterns and predicting potential failures before they occur. Moreover, the shift towards mobile CMMS applications provides maintenance teams with the flexibility to access information and manage tasks on-the-go, enhancing responsiveness and productivity.

Key Statistics

User Statistics

- CMMS Users and Predictive Maintenance: 48% of CMMS users have implemented predictive maintenance regimes, indicating a strong trend towards proactive maintenance strategies.

- Interest in Core CMMS Functions: Only 21% of companies are interested solely in core CMMS functions like asset tracking, job logging, and work order management.

Usage and Implementation

- Existing Maintenance Systems: About 58% of users seeking a CMMS currently use spreadsheets for maintenance management, while 28% use no system at all.

- Implementation Timescales: 70% of users plan to implement a CMMS within one to three months or are uncertain about their timeline.

Work Order Management

- Work Order Volumes: 85% of users manage less than 500 maintenance jobs per month2.

- Work Order Types: 55% of users perform in-house maintenance work, while 30% handle both in-house and external customer work.

User Volumes and System Size

- System Size Preference: The most popular CMMS solution size is suitable for 2 to 10 users (44%), with 68% seeking systems for up to 25 users.

- Large-Scale Systems: 10% of users are interested in systems that support hundreds of users.

Features and Functionality

- Desired Features: 79% of users want features beyond core functions, including service management analytics and parts management.

- IoT and Sensor Integration: While many users desire advanced features, only a subset specifically mentions IoT sensor connections.

Regional Analysis

United States Market Size

In North America, the United States dominates the market size by USD 0.51 Billion, holding a strong position steadily with a CAGR of 7.5%. The region continues to witness rapid adoption of CMMS solutions, primarily due to the increasing demand for asset management, predictive maintenance, and regulatory compliance in industries such as manufacturing, healthcare, and facilities management.

Cloud-based deployment remains the preferred choice, offering scalability, cost efficiency, and ease of remote access. The growing reliance on cloud-based CMMS platforms has enabled organizations to streamline operations and improve equipment reliability. Large enterprises continue to lead the adoption curve, recognizing the strategic importance of efficient maintenance systems in reducing downtime and operational costs.

The manufacturing sector remains a key end-user, driven by the need for real-time equipment monitoring and preventive maintenance strategies to optimize production processes. As companies focus on automation and digital transformation, CMMS solutions are playing a crucial role in improving efficiency and extending asset lifespan.

With advancements in AI, IoT, and mobile accessibility, CMMS solutions are evolving rapidly, enabling businesses to make data-driven decisions and minimize unplanned downtime. The market is poised for steady growth, supported by ongoing technological innovation and increasing awareness of maintenance optimization strategies.

North America Market Size

In 2024, North America held a dominant market position in the Computerized Maintenance Management System (CMMS) market, capturing more than a 40% share, equating to approximately USD 0.55 billion in revenue.

The United States, in particular, has been at the forefront of this growth, driven by the presence of numerous essential players, including eMaint, Hippo, Service Channel, FIIX, Mpluse, DPSI, MicroMain, Fastrak, FMX, Limble CMMS, and CMMS Data Group, which serve the majority of local and foreign enterprises.

Moreover, the integration of advanced technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) into CMMS solutions has been more pronounced in North America. These technologies enable predictive maintenance strategies, allowing organizations to anticipate equipment failures and schedule timely interventions, thereby reducing downtime and maintenance costs.

The region’s strong emphasis on regulatory compliance, particularly in sectors like healthcare and manufacturing, has also contributed to the widespread adoption of CMMS solutions. Organizations are leveraging these systems to maintain detailed records, ensure safety standards, and meet stringent regulatory requirements.

By Deployment

In 2024, the Cloud segment held a dominant market position, capturing more than a 60% share in the Computerized Maintenance Management System (CMMS) market. The shift towards cloud-based CMMS solutions is primarily driven by their flexibility, scalability, and cost-effectiveness compared to traditional on-premises systems. Businesses across various industries are increasingly adopting cloud solutions to streamline maintenance operations without the need for heavy infrastructure investments.

One of the key advantages of cloud-based CMMS is its ability to provide real-time access to maintenance data from any location, enabling organizations to improve operational efficiency and decision-making. Additionally, cloud deployment eliminates the need for expensive IT maintenance and software updates, as these are managed by service providers. This has made it particularly attractive for small and medium-sized enterprises (SMEs) looking to optimize their maintenance strategies without significant upfront costs.

Furthermore, the integration of AI, IoT, and mobile applications into cloud-based CMMS platforms has enhanced predictive maintenance capabilities, reducing unplanned downtime. With businesses prioritizing digital transformation and remote accessibility, the cloud segment is expected to continue leading the CMMS market in the coming years.

By Enterprise Size

In 2024, the Large Enterprises segment held a dominant market position, capturing more than a 67% share in the Computerized Maintenance Management System (CMMS) market. Large enterprises are leading this segment due to their complex operational structures, extensive asset bases, and the growing need for predictive and preventive maintenance to enhance productivity and minimize downtime. These organizations rely on CMMS solutions to manage large-scale maintenance operations across multiple locations, ensuring efficiency, compliance, and cost savings.

A major driver for CMMS adoption in large enterprises is regulatory compliance and asset tracking, particularly in industries such as manufacturing, healthcare, energy, and transportation. These sectors require stringent maintenance protocols to meet safety and quality standards, making CMMS an essential tool. Additionally, large enterprises have greater financial capacity to invest in advanced CMMS solutions that integrate AI, IoT, and cloud capabilities for real-time monitoring and predictive analytics.

With increasing digital transformation initiatives, large organizations are prioritizing automation and centralized maintenance management to optimize operational efficiency. The ability to integrate CMMS with other enterprise systems like ERP and IoT platforms further strengthens its value proposition, ensuring its continued dominance in the market.

By End-Use

In 2024, the Manufacturing segment held a dominant market position, capturing more than a 35% share in the Computerized Maintenance Management System (CMMS) market. The manufacturing industry heavily relies on machinery, equipment, and production lines, making maintenance management a critical aspect of operational efficiency. CMMS solutions play a key role in ensuring minimum downtime, maximizing productivity, and reducing maintenance costs, which are crucial for manufacturing companies operating on tight production schedules.

One of the primary reasons for CMMS adoption in the manufacturing sector is predictive and preventive maintenance. With automation and IoT integration, manufacturers can track machine performance in real-time, schedule repairs before failures occur, and optimize asset lifespan. This not only reduces unexpected breakdowns but also improves overall equipment effectiveness (OEE), ensuring smooth production workflows.

Additionally, regulatory compliance in the manufacturing industry, especially in sectors like automotive, electronics, and food & beverage, has further accelerated CMMS adoption. Companies are required to maintain strict safety and quality standards, and CMMS provides detailed maintenance records, audit trails, and automated compliance tracking. With manufacturers continuously seeking ways to enhance efficiency and reduce operational risks, CMMS is expected to remain a vital tool for industry growth in the coming years.

Key Market Segments

By Deployment

- Cloud

- On-premises

By Enterprise Size

- Large Enterprises

- SMEs

By End-Use

- Energy and Utility

- Manufacturing

- Healthcare

- Transportation and Logistics

- Retail

- Oil & Gas

- Other End-Users

Driving Factor

Integration of IoT and AI Technologies

The integration of the Internet of Things (IoT) and Artificial Intelligence (AI) into Computerized Maintenance Management Systems (CMMS) has significantly propelled market growth. IoT devices enable real-time monitoring of equipment by collecting data on various parameters such as temperature, vibration, and pressure.

This continuous data stream allows maintenance teams to gain immediate insights into equipment performance, facilitating timely interventions. For instance, sensors can detect anomalies that may indicate potential failures, prompting preemptive maintenance actions.

AI complements this by analyzing the vast amounts of data collected, identifying patterns, and predicting future equipment behavior. Through machine learning algorithms, AI can forecast when a machine is likely to fail or require servicing, enabling predictive maintenance strategies.

This shift from reactive to predictive maintenance reduces unexpected downtime and extends the lifespan of assets.

Restraining Factor

High Implementation and Integration Costs

Despite the benefits, the high costs associated with implementing and integrating CMMS solutions pose a significant restraint to market growth. The initial investment for purchasing the software, coupled with expenses related to customization to fit specific organizational needs, can be substantial.

Additionally, integrating CMMS with existing enterprise systems such as Enterprise Resource Planning (ERP) requires specialized expertise and can incur further costs. Small and medium-sized enterprises (SMEs) often find these costs prohibitive, limiting their ability to adopt CMMS solutions. Beyond financial considerations, the complexity of integration can lead to operational disruptions during the transition period.

Growth Opportunity

Adoption of Cloud-Based CMMS Solutions

The shift towards cloud-based CMMS solutions presents a significant growth opportunity in the market. Cloud deployment offers numerous advantages, including reduced upfront costs, scalability, and remote accessibility. Organizations can avoid substantial investments in IT infrastructure by opting for cloud-based services, making CMMS more accessible, especially for SMEs.

Furthermore, cloud-based solutions facilitate real-time data access from any location, enhancing collaboration among maintenance teams and enabling swift decision-making. This flexibility is particularly beneficial in the current global scenario, where remote work has become more prevalent.

Challenging Factor

Data Security and Privacy Concerns

As CMMS solutions increasingly adopt cloud-based architectures, concerns regarding data security and privacy have become more pronounced. Storing sensitive maintenance and operational data off-premises introduces risks related to unauthorized access, data breaches, and compliance with data protection regulations. Organizations may be hesitant to transition to cloud-based CMMS solutions due to these security concerns.

Moreover, the integration of IoT devices, while beneficial for real-time monitoring, expands the attack surface for potential cyber threats. Each connected device can serve as a potential entry point for malicious actors if not properly secured.

Challenging Factor

Data Security and Privacy Concerns

As CMMS solutions increasingly adopt cloud-based architectures, concerns regarding data security and privacy have become more pronounced. Storing sensitive maintenance and operational data off-premises introduces risks related to unauthorized access, data breaches, and compliance with data protection regulations. Organizations may be hesitant to transition to cloud-based CMMS solutions due to these security concerns.

Moreover, the integration of IoT devices, while beneficial for real-time monitoring, expands the attack surface for potential cyber threats. Each connected device can serve as a potential entry point for malicious actors if not properly secured.

Growth Factors

Increasing Adoption of Predictive Maintenance

The global Computerized Maintenance Management System (CMMS) market is experiencing significant growth, largely driven by the increasing adoption of predictive maintenance strategies across various industries.

Predictive maintenance utilizes data analytics and real-time monitoring to anticipate equipment failures before they occur, allowing organizations to perform maintenance activities at optimal times. This approach not only minimizes unplanned downtime but also extends the lifespan of assets, leading to substantial cost savings.

Industries such as manufacturing, energy, and transportation are heavily investing in predictive maintenance to enhance operational efficiency. By integrating CMMS with technologies like the Internet of Things (IoT) and Artificial Intelligence (AI), companies can collect and analyze vast amounts of data from their equipment.

This integration enables the early detection of anomalies and facilitates timely interventions, thereby reducing maintenance costs by up to 30%. The proactive nature of predictive maintenance is a key factor propelling the growth of the CMMS market, as organizations strive to achieve higher reliability and efficiency in their operations.

Emerging Trends

Integration of IoT and AI Technologies

A prominent emerging trend in the CMMS market is the integration of IoT and AI technologies. IoT devices enable real-time data collection from machinery and equipment, providing valuable insights into their operational status.

When combined with AI, this data can be analyzed to predict potential failures and optimize maintenance schedules. This convergence allows for more informed decision-making and enhances the effectiveness of maintenance strategies.

The adoption of IoT and AI in CMMS is expected to grow exponentially, with projections indicating that by 2030, over 50% of maintenance activities will be driven by predictive analytics. This trend is transforming traditional maintenance practices, shifting from reactive to proactive approaches. As a result, organizations are experiencing improved asset performance and reduced operational costs, making the integration of IoT and AI a significant trend in the CMMS landscape.

Business Benefits

Enhanced Operational Efficiency and Cost Reduction

Implementing CMMS offers substantial business benefits, particularly in enhancing operational efficiency and reducing costs. By automating maintenance processes and providing real-time access to asset information, CMMS enables organizations to streamline workflows and improve resource allocation. This automation reduces the likelihood of human error and ensures that maintenance tasks are performed consistently and on schedule.

Moreover, CMMS facilitates better inventory management by tracking spare parts usage and predicting future requirements. This capability prevents overstocking and stockouts, leading to more efficient use of capital.

Studies have shown that companies utilizing CMMS can reduce maintenance costs by 10% to 15% and increase equipment uptime by 20%. These improvements contribute to a more efficient operation, allowing businesses to allocate resources more effectively and enhance their overall profitability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In November 2020, Rockwell Automation, a global leader in industrial automation, announced its agreement to acquire Fiix Inc., a Toronto-based company specializing in AI-enabled computerized maintenance management systems (CMMS).

This strategic move aimed to enhance Rockwell’s software capabilities, particularly in maintenance operations. The acquisition was finalized in December 2020, integrating Fiix’s cloud-native CMMS into Rockwell’s Lifecycle Services business.

IBM has been a significant player in the CMMS market, offering solutions that integrate with its broader enterprise asset management (EAM) systems. The company has focused on enhancing its Maximo Application Suite, which provides comprehensive asset management capabilities, including maintenance management, monitoring, and reliability. IBM’s approach emphasizes leveraging AI and IoT technologies to deliver predictive maintenance and optimized asset performance.

MaintainX is recognized as a key player in the CMMS market, offering user-friendly mobile-first solutions designed to streamline maintenance and operations workflows. The company focuses on providing tools that enhance real-time communication, work order management, and procedural tracking.

While specific recent acquisitions, mergers, or new product launches were not detailed in the provided data, MaintainX’s commitment to simplifying maintenance processes and improving operational efficiency has solidified its position in the industry. The adoption of mobile-ready CMMS solutions has increased, enabling maintenance teams to access real-time data and manage tasks remotely, thereby improving operational efficiency and response times.

Top Key Players in the Market

- Fiix (Rockwell Automation Inc.)

- IBM Corporation

- MaintainX

- Accruent

- Fracttal Tech SL

- NexGen

- Mapcon Technologies Inc.

- MicroMain Corp.

- eMaint (Fluke Corporation)

- UpKeep Technologies Inc.

- Hippo CMMS (iOFFICE)

- Limble CMMS

- Maxpanda Software Inc.

- MPulse Software Inc.

- MVP One

- eWorkOrders

- LLumin

- eFACiLiTY (SIERRA ODC Private Limited)

- HELIXIntel Inc.

- AFiSOL Intelligent Solutions

- Other Key Players

Recent Developments

- In 2024: The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies into CMMS platforms has enhanced predictive maintenance capabilities, allowing organizations to anticipate equipment failures and optimize maintenance schedules.

- In 2024: The adoption of mobile-ready CMMS solutions has increased, enabling maintenance teams to access real-time data and manage tasks remotely, thereby improving operational efficiency and response times.

Report Scope

Report Features Description Market Value (2024) USD 1.38 Billion Forecast Revenue (2034) USD 3.55 Billion CAGR (2025-2034) 9.90% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Deployment (Cloud, On-premises), By Enterprise Size (Large Enterprises, SMEs), By End-Use (Energy and Utility, Manufacturing, Healthcare, Transportation and Logistics, Retail, Oil & Gas, Other End-Users) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Fiix (Rockwell Automation Inc.), IBM Corporation, MaintainX, Accruent, Fracttal Tech SL, NexGen, Mapcon Technologies Inc., MicroMain Corp., eMaint (Fluke Corporation), UpKeep Technologies Inc., Hippo CMMS (iOFFICE), Limble CMMS, Maxpanda Software Inc., MPulse Software Inc., MVP One, eWorkOrders, LLumin, eFACiLiTY (SIERRA ODC Private Limited), HELIXIntel Inc., AFiSOL Intelligent Solutions, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Computerized Maintenance Management System (CMMS) MarketPublished date: Mar 25add_shopping_cartBuy Now get_appDownload Sample

Computerized Maintenance Management System (CMMS) MarketPublished date: Mar 25add_shopping_cartBuy Now get_appDownload Sample -

-

- Fiix (Rockwell Automation Inc.)

- IBM Corporation

- MaintainX

- Accruent

- Fracttal Tech SL

- NexGen

- Mapcon Technologies Inc.

- MicroMain Corp.

- eMaint (Fluke Corporation)

- UpKeep Technologies Inc.

- Hippo CMMS (iOFFICE)

- Limble CMMS

- Maxpanda Software Inc.

- MPulse Software Inc.

- MVP One

- eWorkOrders

- LLumin

- eFACiLiTY (SIERRA ODC Private Limited)

- HELIXIntel Inc.

- AFiSOL Intelligent Solutions

- Other Key Players