Global Commercial Grade Chip Antenna Market Size and Forecast Industry Analysis Report By Product Type (Ceramic Multilayer Chip Antennas, Dielectric Chip Antennas, LTCC Chip Antennas), By Application (Telecommunications, Automotive, Consumer Electronics, Industrial, Healthcare, Others), By Frequency Range (UHF, VHF, SHF, Others), By End-User (OEMs, Aftermarket), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 159107

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

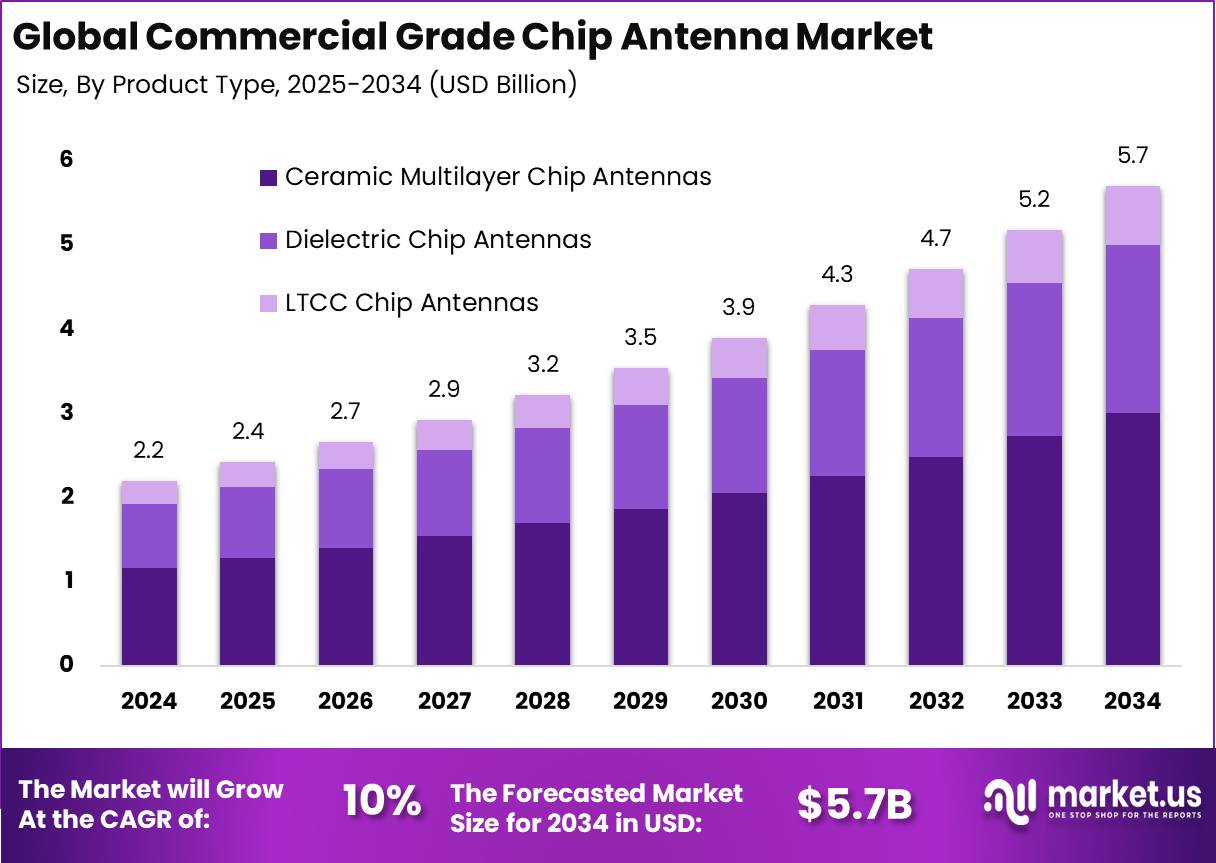

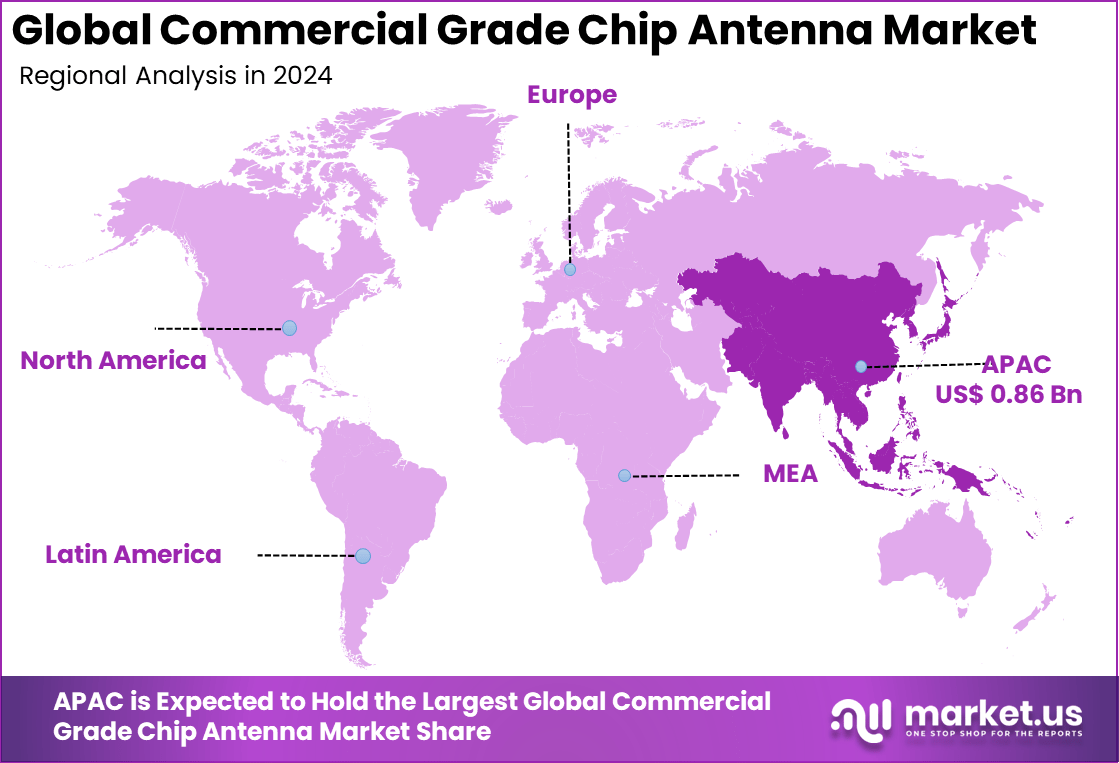

The Global Commercial Grade Chip Antenna Market size is expected to be worth around USD 5.7 billion by 2034, from USD 2.2 billion in 2024, growing at a CAGR of 10% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 39.5% share, holding USD 0.86 billion in revenue.

The Commercial Grade Chip Antenna Market refers to the industry focused on compact antennas designed for wireless communication applications across consumer electronics, automotive, industrial, and IoT devices. Chip antennas are surface-mounted components that provide wireless connectivity while minimizing space requirements.

Top driving factors for this market include the rapid surge in IoT device deployment across various sectors such as healthcare, automotive, industrial automation, and smart cities. As IoT devices require compact and efficient wireless communication components, chip antennas meet this need by offering multi-band support for Bluetooth, Wi-Fi, cellular networks (including 5G), and GPS.

For instance, in February 2024, RF-star introduced its new CC2340R5 Bluetooth 5.3 modules, featuring flexible RF output options including PCB, IPEX, and chip antennas. Designed for industrial-grade performance, these compact modules deliver ultra-low power consumption, robust connectivity, and multi-protocol support across Bluetooth, ZigBee, Thread, and Matter.

Key Takeaway

- By product type, Ceramic Multilayer Chip Antennas dominated with 52.7% share, owing to their compact size and reliable performance.

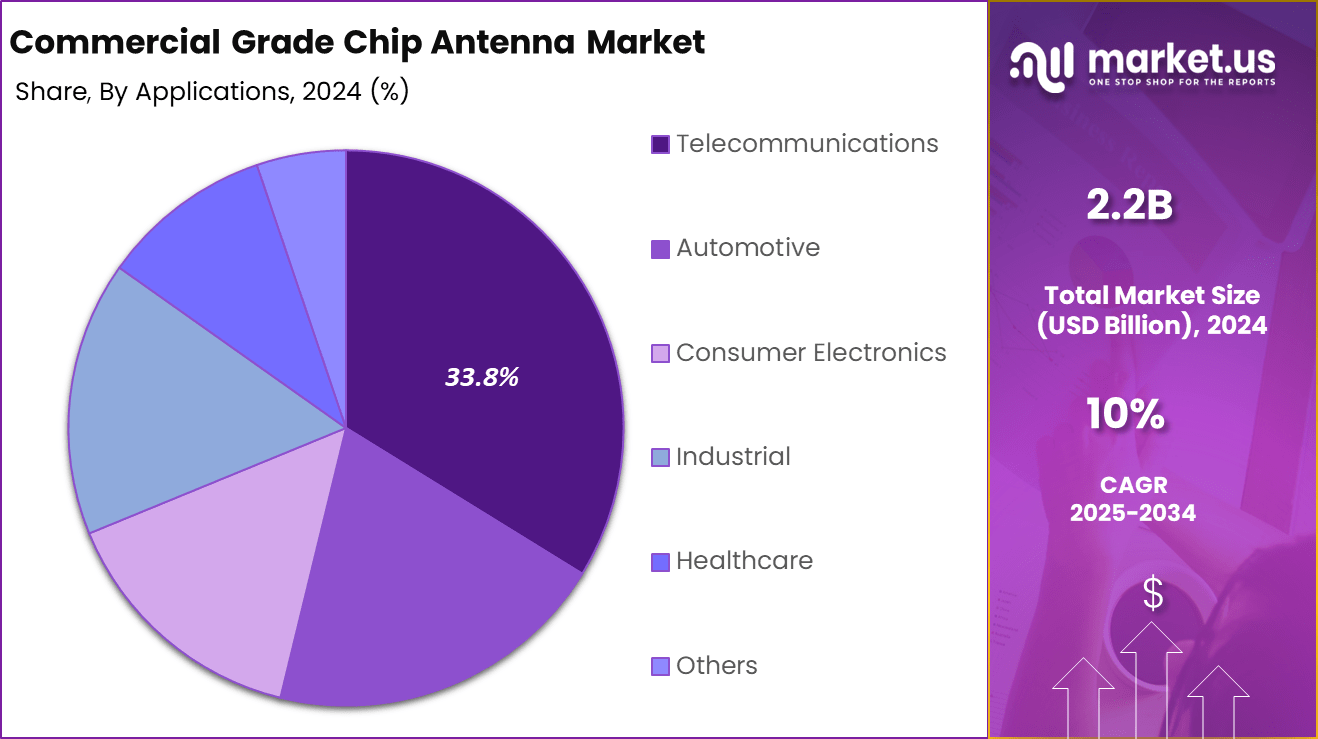

- By application, the Telecommunications segment led with 33.8% share, driven by demand for mobile devices and wireless communication infrastructure.

- By frequency range, the UHF segment captured 34.7% share, reflecting its widespread use in IoT, RFID, and connectivity solutions.

- By end-user, OEMs accounted for the largest share at 58.9%, emphasizing integration of chip antennas in consumer electronics and industrial devices.

- Regionally, Asia Pacific held 39.5% share, supported by large-scale electronics manufacturing.

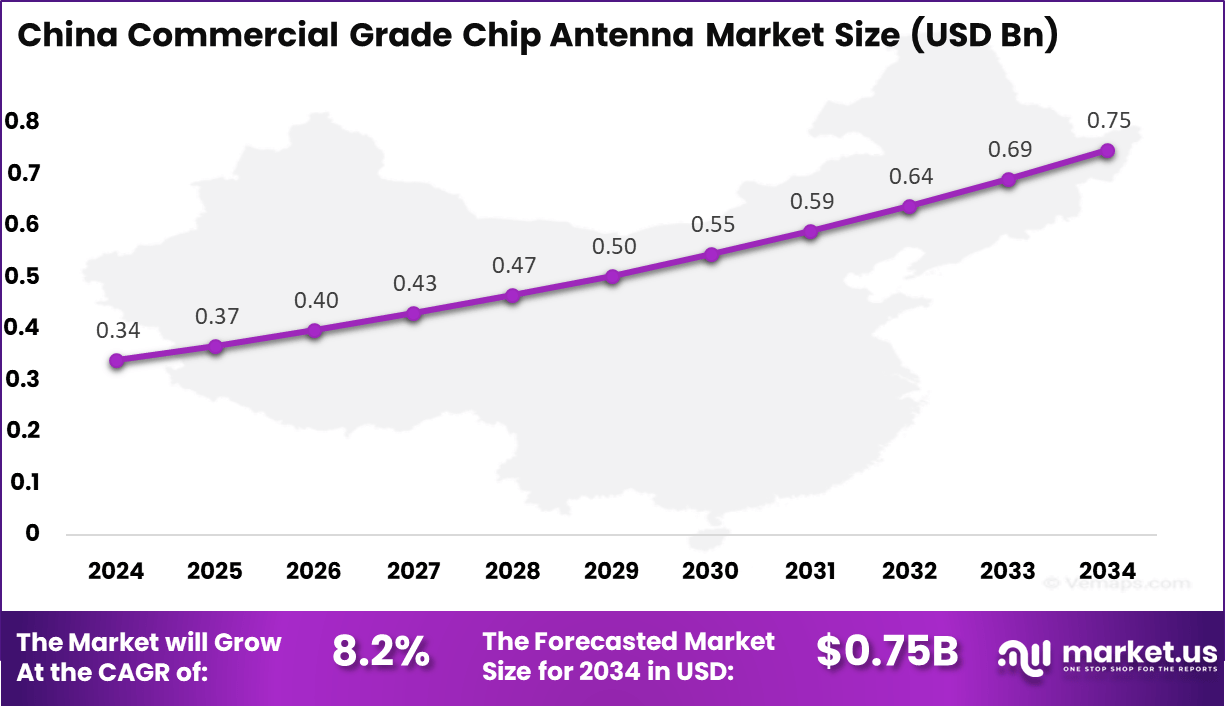

- Within the region, China’s market was valued at USD 0.34 Billion in 2024, expanding at a healthy CAGR of 8.2%, positioning it as a key growth hub.

China Market Size

The market for Commercial Grade Chip Antenna within China is growing tremendously and is currently valued at USD 0.34 billion, the market has a projected CAGR of 8.2%. The market is growing rapidly due to the country’s robust electronics manufacturing ecosystem and aggressive deployment of IoT, 5G, and smart infrastructure projects.

With strong government support for digitalization, rising demand for consumer electronics, and the expansion of smart cities, domestic manufacturers are scaling production of compact, cost-effective antenna solutions. Additionally, China’s leadership in electric vehicles and industrial automation is driving increased integration of wireless components, further boosting demand for high-performance chip antennas.

In 2024, Asia Pacific held a dominant market position in the Global Commercial Grade Chip Antenna Market, capturing more than a 39.5% share, holding USD 0.86 billion in revenue. This dominance is due to its strong electronics manufacturing base, rapid urbanization, and expanding digital infrastructure.

Countries like China, Japan, South Korea, and India led demand through high-volume production of smartphones, IoT devices, and connected automotive systems. Government initiatives supporting smart cities and 5G deployment further accelerated market growth. Additionally, the presence of key OEMs and cost-efficient supply chains solidified the region’s leadership in chip antenna adoption.

Product Type Analysis

Ceramic multilayer chip antennas accounted for 52.7% of the commercial grade chip antenna market. These antennas are highly valued for their compact size, durability, and ability to offer stable performance across varied frequency ranges. Their multilayer construction allows for efficient signal reception and transmission within tightly packed electronic devices where space optimization is crucial.

The growing adoption of smart electronics, IoT systems, and connected devices has further reinforced the role of ceramic multilayer antennas. Their cost-effectiveness and efficiency make them the preferred option for high-volume production, particularly in consumer electronics and industrial communications.

For Instance, in January 2025, KYOCERA AVX showcased its advanced ceramic multilayer chip antennas at CES 2025, highlighting their critical role in supporting compact, high-performance wireless devices. These antennas are designed for space-constrained applications and offer excellent frequency stability, making them ideal for IoT, automotive, and telecommunication solutions.

Application Analysis

Telecommunications represented 33.8% of the application share. The reliance on commercial grade chip antennas in this segment is driven by the need for reliable wireless connectivity, whether in mobile infrastructure, base stations, or handheld devices. These antennas help maintain low interference and deliver consistent performance in data-heavy environments.

With expanding 5G rollout and greater dependence on wireless communication, telecom networks increasingly require antennas that are compact yet efficient. The integration of chip antennas into advanced communication devices underpins the sector’s continuous demand growth.

For instance, in February 2025, Oso Semiconductor secured a $5.2 million seed round to develop next-generation phased array antennas for satellite communication, 5G, and radar systems. These innovations, featuring ultra-low loss and power-efficient chipsets, aim to significantly improve antenna performance in telecommunications.

Frequency Range Analysis

The UHF frequency segment held 34.7% of the market share. UHF chip antennas are widely used because they provide reliable data transfer over long distances and are suitable for both mobile and fixed wireless applications. Their adaptability makes them essential components in wireless communication equipment, tracking systems, and industrial automation.

As more applications demand seamless connectivity, UHF antennas continue to gain traction due to their performance in environments where both coverage and efficiency are critical. Their role in supporting strong signal propagation strengthens their use across a variety of commercial electronics.

For Instance, in May 2025, HMD and Lava announced the launch of feature phones equipped with direct-to-mobile (D2M) technology, featuring ultra-high frequency (UHF) chip antennas. Developed in collaboration with Tejas Networks and powered by Saankhya’s SL3000 chipset, these devices can receive live broadcast content without internet access.

End-User Analysis

In 2024, the OEMs accounted for 58.9% of the demand in this market. Original equipment manufacturers integrate chip antennas directly into products ranging from smartphones and laptops to automotive electronics and industrial systems. Their reliance on compact antenna solutions has risen in line with the demand for smaller devices without compromising connectivity.

The growing trend of connected devices across industries ensures that OEMs remain the largest consumer segment. By adopting chip antennas in their designs, they balance technical performance with cost efficiency, supporting mass adoption across global markets.

For Instance, in May 2025, NXP Semiconductors introduced its S32R47 radar processor, designed to enhance the performance of autonomous vehicles. Targeting OEMs, this processor supports high-resolution imaging and real-time processing of multiple antenna channels, including those using commercial-grade chip antennas.

Key Market Segments

By Product Type

- Ceramic Multilayer Chip Antennas

- Dielectric Chip Antennas

- LTCC Chip Antennas

By Application

- Telecommunications

- Automotive

- Consumer Electronics

- Industrial

- Healthcare

- Others

By Frequency Range

- UHF

- VHF

- SHF

- Others

By End-User

- OEMs

- Aftermarket

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

IoT Proliferation & Connected Devices

The explosive growth of IoT ecosystems is fueling demand for compact, high-efficiency antennas. From smart homes to industrial automation, devices require seamless wireless connectivity in ever-smaller packages. Commercial-grade chip antennas provide the necessary size, performance, and energy efficiency to meet these evolving needs.

Their integration flexibility makes them ideal for embedded applications, enabling scalable connectivity across diverse platforms. As IoT adoption accelerates globally, chip antennas are becoming foundational components in connected product design and deployment.

For instance, in May 2025, Taoglas introduced a modular, cable-free GNSS antenna solution for embedded systems. The design targets improved reliability, ease of integration (no connectors/coax), better resistance to vibration, etc. Ideal for drones, industrial platforms, handhelds, and IoT devices.

Restraint

Performance Limitations Compared to External Antennas

Despite their miniaturization and integration benefits, commercial grade chip antennas face performance limitations when compared to traditional external antennas. Their compact size can constrain radiation efficiency and limit communication range, especially in environments with significant interference or signal loss.

Achieving consistent performance, including impedance matching and radiation patterns across multiple frequency bands, presents ongoing engineering challenges that affect real-world reliability. As an example, small chip antennas might struggle in complex electromagnetic environments, resulting in weaker signals or reduced data transfer quality.

This can be a significant drawback in applications requiring robust connectivity over longer distances or through physical obstacles. The inherent compromise between size and performance can curtail adoption in some high-demand sectors, limiting broader market growth potential despite increasing device miniaturization trends.

Opportunities

Emerging Markets & Regional Growth

Rapid digital adoption across emerging regions presents significant growth opportunities for chip antenna manufacturers. Expanding mobile and internet infrastructure in Asia-Pacific, Latin America, and Africa is driving demand for compact wireless solutions in consumer and industrial applications.

As urbanization accelerates and middle-class consumption rises, localized production, strategic partnerships, and region-specific product offerings can unlock market share. Companies that tailor solutions to regional needs will be better positioned to capitalize on this dynamic and underserved market landscape.

For instance, in April 2025, Ericsson announced plans to expand antenna manufacturing in India, localizing production for the domestic telecom market in collaboration with VVDN Technologies. The initiative responds to strong 5G deployment by operators like Bharti Airtel and Reliance Jio, while also positioning India as an export hub for antenna systems.

Challenges

Market Fragmentation & Competition

The chip antenna market is highly fragmented, with numerous players offering similar technologies across various price points. Differentiation remains a core challenge, as commoditization exerts downward pressure on margins.

To stay competitive, manufacturers must invest in R&D, improve antenna performance, and offer tailored solutions for niche applications. The race to innovate in areas like multi-band support, miniaturization, and ruggedization is intense, making it critical for firms to balance cost efficiency with technical superiority.

For instance, in July 2025, Taoglas launched its Patriot Series, a high-performance, multifunction antenna designed for connected vehicle fleets. Capable of integrating up to 18 antenna elements in one compact housing, it supports 5G, GNSS, WiFi, SDARS, and UHF/VHF frequencies. While this innovation highlights the pace of advancement, it also underscores the market’s fragmentation and intense competition.

Key Players Analysis

In the commercial grade chip antenna market, Murata Manufacturing, Taoglas, Antenova, and Johanson Technology are leading players with strong expertise in compact and high-performance antenna solutions. Their products are widely adopted in smartphones, IoT devices, and wireless communication systems due to their reliability, miniaturization, and efficient signal performance.

Other major contributors such as Yageo, Vishay Intertechnology, Abracon, Molex, Pulse Electronics, and TE Connectivity strengthen the market by offering diverse antenna solutions integrated into consumer electronics, automotive systems, and industrial devices.

Additional players including Laird Connectivity, Amphenol, Würth Elektronik, Antenna Company, Skyworks Solutions, HUBER+SUHNER, AVX Corporation, Rainsun Enterprise, and Partron add further diversity. Their focus on specialized antennas for 5G, Wi-Fi, GPS, and Bluetooth applications ensures compatibility with next-generation connectivity needs.

Top Key Players in the Market

- Taoglas Ltd.

- Antenova Ltd.

- Johanson Technology Inc.

- Linx Technologies Inc.

- Yageo Corporation

- Vishay Intertechnology Inc.

- Abracon LLC

- Molex LLC

- Pulse Electronics Corporation

- TE Connectivity Ltd.

- Laird Connectivity

- Amphenol Corporation

- Antenna Company

- Skyworks Solutions Inc.

- HUBER+SUHNER AG

- Murata Manufacturing Co., Ltd.

- AVX Corporation

- Rainsun Enterprise Co., Ltd.

- Partron Co., Ltd.

- Others

Recent Developments

- In July 2025, Antenova unveiled Sinica, a new embedded GNSS antenna operating on the 1559-1609 MHz bands, covering GPS, GLONASS, Beidou, and Galileo. It uses a novel design on FR4/dielectric laminate to give high performance from a low-profile antenna for global positioning/tracking applications.

- In March 2025, Antenova revealed a new chip antenna (named Latona, part of the lamiiANT family) for the newly ratified NB-IoT standard. It is sized 20 × 11 × 1.6 mm, designed for easier integration and to serve applications like smart metering, building automation, etc.

Report Scope

Report Features Description Market Value (2024) USD 2.2 Bn Forecast Revenue (2034) USD 5.7 Bn CAGR(2025-2034) 10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Ceramic Multilayer Chip Antennas, Dielectric Chip Antennas, LTCC Chip Antennas), By Application (Telecommunications, Automotive, Consumer Electronics, Industrial, Healthcare, Others), By Frequency Range (UHF, VHF, SHF, Others), By End-User (OEMs, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Taoglas Ltd., Antenova Ltd., Johanson Technology Inc., Linx Technologies Inc., Yageo Corporation, Vishay Intertechnology Inc., Abracon LLC, Molex LLC, Pulse Electronics Corporation, TE Connectivity Ltd., Laird Connectivity, Amphenol Corporation, Würth Elektronik Group, Antenna Company, Skyworks Solutions Inc., HUBER+SUHNER AG, Murata Manufacturing Co., Ltd., AVX Corporation, Rainsun Enterprise Co., Ltd., Partron Co., Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Commercial Grade Chip Antenna MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Commercial Grade Chip Antenna MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Taoglas Ltd.

- Antenova Ltd.

- Johanson Technology Inc.

- Linx Technologies Inc.

- Yageo Corporation

- Vishay Intertechnology Inc.

- Abracon LLC

- Molex LLC

- Pulse Electronics Corporation

- TE Connectivity Ltd.

- Laird Connectivity

- Amphenol Corporation

- Würth Elektronik Group

- Antenna Company

- Skyworks Solutions Inc.

- HUBER+SUHNER AG

- Murata Manufacturing Co., Ltd.

- AVX Corporation

- Rainsun Enterprise Co., Ltd.

- Partron Co., Ltd.

- Others