Global Commercial Aircraft Landing Gear Market By Gear Position (Main Landing, Nose Landing), By Aircraft Type (Narrow-Body, Wide-Body, Regional Jet), By Sub-system (Steering System, Brake System, Actuation System, Others), By End User (OEM and Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 20000

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

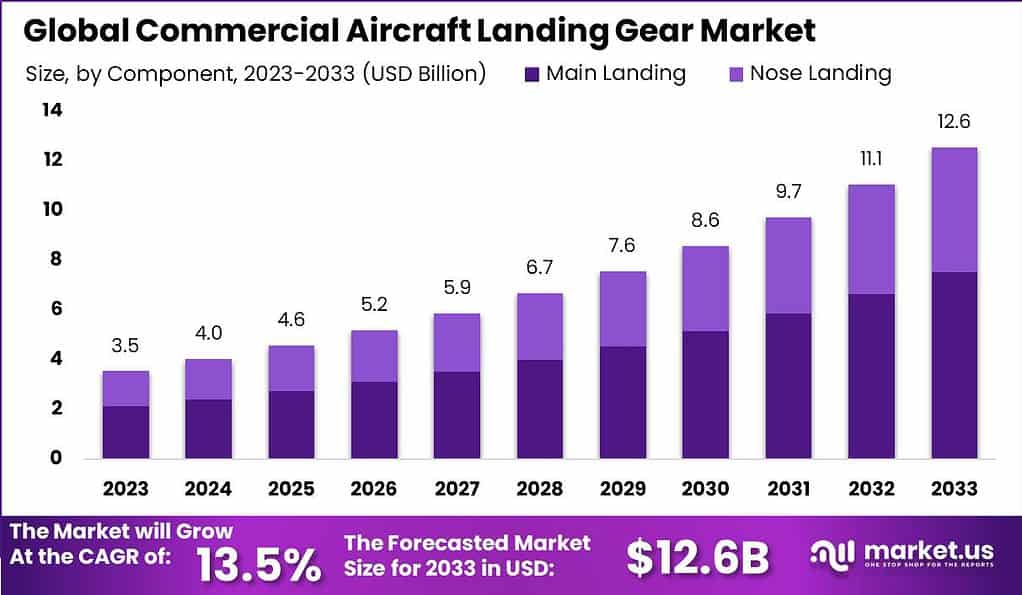

The Global Commercial Aircraft Landing Gear Market size is expected to be worth around USD 12.6 Billion by 2033, from USD 3.5 Billion in 2023, growing at a CAGR of 13.5% during the forecast period from 2024 to 2033.

Commercial aircraft landing gear refers to the undercarriage components of an aircraft that support the vehicle during landing, take-off, and when stationary. This system is crucial for the structural integrity of the aircraft, enabling it to withstand the considerable forces exerted during these phases of flight. The design and manufacture of landing gear involve advanced materials and technologies to ensure reliability, safety, and durability. Components typically include wheels, brakes, shock absorbers, and the structural members that connect the gear to the aircraft’s airframe.

The commercial aircraft landing gear market is driven by several factors, including the increasing demand for commercial aircraft due to the growth of the global aviation sector, advancements in landing gear technology, and the need for more durable and lightweight components. This market is characterized by its research and development efforts aimed at enhancing the efficiency and performance of landing gear systems.

Factors such as the rising emphasis on reducing the overall weight of the aircraft to improve fuel efficiency and the need for regular maintenance and replacement of landing gear parts contribute to the market’s growth. The growth of the market can also be attributed to the expansion of the global aircraft fleet and the increase in air passenger traffic. Key players in this market are focused on innovation and the development of environmentally sustainable and energy-efficient landing gear systems, catering to the evolving needs of the aviation industry.

According to the latest updates from IATA, ICAO, ACI, and UNWTO, international air passenger traffic experienced a significant recovery in 2022 compared to the previous year. The data indicates that international air passenger traffic increased by a remarkable 152.7% in 2022 as compared to 2021. This recovery is a positive sign for the aviation industry, showing a strong rebound from the challenges faced during the pandemic.

Furthermore, the figures reveal that by the end of 2022, international air passenger traffic had reached 62.2% of the levels recorded in 2019. This suggests a gradual recovery towards pre-pandemic levels, although there is still some ground to cover before reaching full restoration.

In December 2022, international air traffic continued to see improvements, with a notable increase of 80.2% compared to December 2021. At that point, international air traffic had recovered to 75.1% of the levels observed in December 2019. These figures indicate a positive trend towards recovery, as more travelers regained confidence and resumed international travel towards the end of 2022.

Key Takeaways

- The Commercial Aircraft Landing Gear Market is anticipated to expand significantly, with an estimated value reaching USD 12.6 billion by 2033, indicating a robust Compound Annual Growth Rate (CAGR) of 13.5%.

- The Main Landing Gear segment held a dominant position in the market, capturing over 60% share in 2023. This segment’s prominence is attributed to its pivotal role in bearing the aircraft’s weight upon landing, necessitating robust design and engineering.

- In 2023, the Narrow-Body Aircraft segment secured a commanding stance, boasting a share exceeding 38%. This dominance stems from the surge in demand for short to medium-haul flights, favoring cost-efficient and flexible narrow-body aircraft.

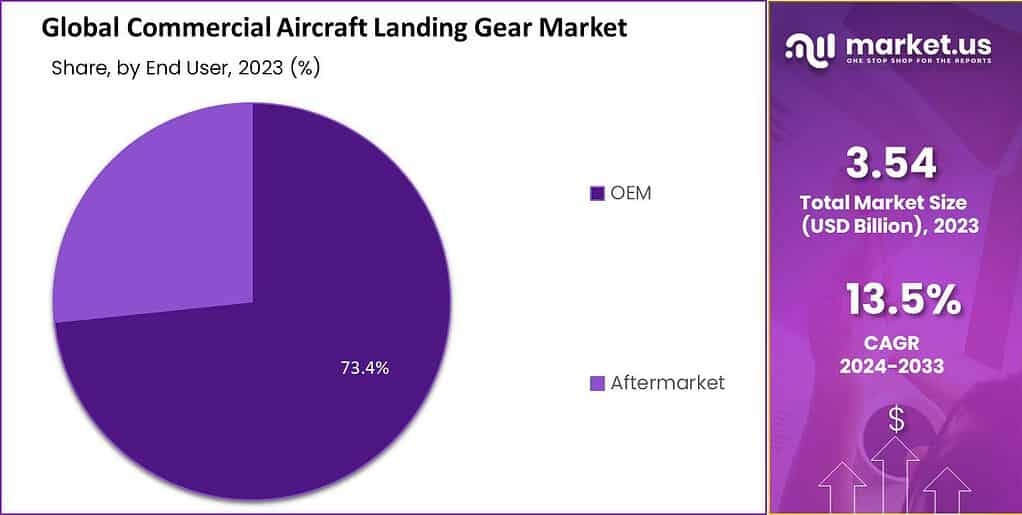

- The Original Equipment Manufacturer (OEM) segment captured over 75% market share in 2023, driven by rigorous requirements for high-quality landing gear systems in newly manufactured aircraft. OEMs play a pivotal role in integrating landing gear seamlessly with aircraft design.

- The Steering System segment held a dominant market position in 2023 due to its crucial role in ensuring aircraft maneuverability and safety during ground operations. Advanced steering systems are increasingly indispensable in modern aviation.

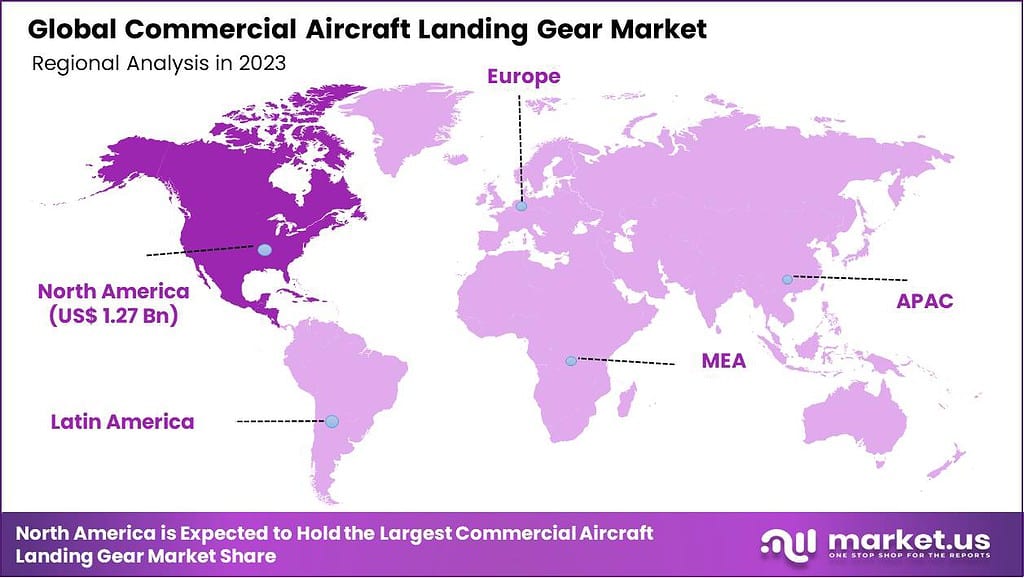

- North America held a dominant market position in 2023, accounting for over 36% share. This leadership is attributed to the region’s strong aviation infrastructure, presence of major aircraft manufacturers, and emphasis on innovation and safety.

Gear Position Analysis

In 2023, the Main Landing Gear Segment held a dominant position in the commercial aircraft landing gear market, capturing more than a 60% share. This significant market share can be attributed to the critical role main landing gears play in the overall operation and safety of commercial aircraft.

Main landing gears are primarily responsible for bearing the majority of the aircraft’s weight upon landing, a factor that necessitates robust design, advanced materials, and precision engineering. Consequently, the complexity and substantial material requirements associated with main landing gears contribute to their higher cost and, by extension, their larger share of the market.

The predominance of the Main Landing Gear Segment is further reinforced by the increasing demand for wide-body aircraft, which require more complex and sturdy landing gear systems to accommodate higher passenger capacity and longer flight ranges.

The development and production of main landing gears involve significant investment in research and development to meet stringent aviation standards, ensure safety, and enhance the aircraft’s performance and fuel efficiency. These gears are equipped with advanced technologies such as anti-skid braking systems and shock-absorbing mechanisms, making them integral to the aircraft’s overall value and operational capabilities.

Aircraft Type Analysis

In 2023, the Narrow-Body Segment secured a commanding stance in the commercial aircraft landing gear market, boasting a share exceeding 38%. This dominance is principally due to the surge in demand for short to medium-haul flights, which are predominantly serviced by narrow-body aircraft.

These aircraft types are favored for their cost-efficiency, lower operational expenses, and flexibility in accommodating a wide range of regional and domestic routes. The narrow-body segment’s significant market share also reflects the strategic expansion of low-cost carriers (LCCs), which primarily operate narrow-body aircraft to maintain their competitive pricing strategies.

Narrow-body aircraft require landing gear systems that are optimized for frequent takeoffs and landings, characteristic of the high utilization rates seen in short-haul flights. The technical specifications for narrow-body landing gear systems focus on durability, reliability, and maintenance efficiency, aligning with the operational demands of short to medium-haul services. This has led to increased investment in research and development to innovate landing gear technologies that reduce weight, enhance performance, and extend service life, further fueling the segment’s growth.

The leadership of the Narrow-Body Segment is also influenced by the aviation industry’s drive towards sustainability. The development of new-generation narrow-body aircraft equipped with advanced, fuel-efficient engines has prompted airlines to upgrade their fleets. This transition supports airlines’ efforts to reduce carbon emissions and operational costs, making narrow-body aircraft an attractive option.

Sub-System Analysis

In 2023, the Steering System segment held a dominant market position in the Commercial Aircraft Landing Gear Market, capturing a significant share. This prominence can be attributed to the critical role steering systems play in ensuring the maneuverability and safety of aircraft during ground operations, including taxiing, takeoff, and landing.

Advanced steering systems, which incorporate sophisticated technologies to improve precision and reliability, have become increasingly indispensable in modern aviation. The demand for these systems has been driven by the growing global aircraft fleet size, the surge in air traffic, and heightened safety regulations. Moreover, the development of more electric aircraft (MEA) and the integration of innovative materials and electronics in steering systems have further propelled this segment’s growth.

The Steering System segment’s leadership is underscored by its continuous evolution, marked by significant investments in research and development (R&D) by major market players. These efforts aim to enhance the efficiency, reliability, and safety of steering systems while minimizing their maintenance requirements and environmental impact.

For instance, the adoption of lightweight materials and the integration of advanced sensors and actuators have led to the development of more efficient and environmentally friendly steering systems. This progress is crucial in meeting the aviation industry’s growing demands for sustainability and reduced operational costs. Furthermore, the increased focus on aircraft safety and performance, coupled with stringent regulatory standards, necessitates the adoption of high-quality steering systems, thereby driving the segment’s growth.

End User Analysis

In 2023, the Original Equipment Manufacturer (OEM) segment held a dominant position in the commercial aircraft landing gear market, capturing more than a 75% share. This substantial market share can be attributed to the rigorous requirements for high-quality, reliable, and technologically advanced landing gear systems in newly manufactured aircraft.

OEMs are integral to the initial design and manufacturing phase, ensuring that the landing gear integrates seamlessly with the aircraft’s overall design and performance specifications. The demand for new aircraft, driven by increasing air passenger traffic and the replacement of older fleets with more fuel-efficient models, further bolstered the OEM segment’s growth.

The leadership of the OEM segment in the commercial aircraft landing gear market is also supported by substantial investments in research and development (R&D) activities. These investments are aimed at innovating lighter, more durable, and cost-effective landing gear solutions, which are crucial for enhancing aircraft performance and fuel efficiency.

Furthermore, strategic partnerships between aircraft manufacturers and OEMs facilitate the integration of the latest technologies in landing gear systems, including advanced materials and smart landing gear systems for improved safety and operational efficiency. The focus on sustainability and the adoption of environmentally friendly practices in manufacturing processes have also played a pivotal role in shaping the OEM segment’s leading position in the market.

Key Market Segments

By Gear Position

- Main Landing

- Nose Landing

By Aircraft Type

- Narrow-Body

- Wide-Body

- Regional Jet

By Sub-system

- Steering System

- Brake System

- Actuation System

- Others

By End User

- OEM

- Aftermarket

Driver

Increasing Global Air Traffic

The surge in global air traffic acts as a primary driver for the Commercial Aircraft Landing Gear Market. This increase is attributed to the rising demand for air travel, driven by economic growth, increased connectivity, and affordability of flights.

As airlines expand their fleets to accommodate the growing number of passengers, the demand for aircraft landing gear systems escalates. The growing air traffic necessitates the enhancement of aircraft efficiency, reliability, and safety, where advanced landing gear systems play a pivotal role.

Furthermore, the growing emphasis on reducing aircraft turnaround time amplifies the need for durable and reliable landing gear systems, propelling the market forward. This trend underscores the direct correlation between air traffic growth and the expansion of the landing gear market, positioning it for sustained growth.

Restraint

High Costs of Manufacturing and Maintenance

The high costs associated with the manufacturing and maintenance of advanced landing gear systems present significant restraints to the Commercial Aircraft Landing Gear Market. The development of these systems involves sophisticated materials and technologies, which escalate production expenses. Additionally, the stringent safety and performance standards imposed by aviation regulatory bodies require rigorous testing and certification processes, further inflating costs.

The maintenance of landing gear systems also demands specialized skills and equipment, leading to elevated operational costs for airlines. These financial implications can deter investment in new systems and constrain market growth, especially among budget carriers and in developing regions where cost sensitivity is higher. Therefore, the economic challenges associated with landing gear systems represent a considerable barrier to market expansion.

Opportunity

Advancements in Material Science and Technology

The advancements in material science and technology present significant opportunities for the Commercial Aircraft Landing Gear Market. The integration of composite materials and additive manufacturing (3D printing) offers the potential to create lighter, more durable, and cost-efficient landing gear systems. These technological innovations not only reduce the weight of the aircraft, leading to fuel savings and lower emissions but also enhance the performance and longevity of the landing gear.

Moreover, the adoption of smart technologies and sensors can improve monitoring and maintenance processes, optimizing operational efficiency and safety. As the aviation industry continues to focus on sustainability and cost-effectiveness, these technological advancements open new avenues for market growth, positioning companies at the forefront of the market to capitalize on these emerging trends.

Challenge

Stringent Regulatory Standards

The Commercial Aircraft Landing Gear Market faces the challenge of stringent regulatory standards. Aviation authorities worldwide impose rigorous requirements for the certification of aircraft components to ensure safety and reliability.

Meeting these standards necessitates extensive testing, evaluation, and documentation, which can be time-consuming and costly. These regulatory hurdles can slow down the introduction of new technologies and innovations in landing gear systems, limiting the market’s ability to respond swiftly to evolving demands.

Additionally, variations in regulatory standards across different regions complicate the global distribution of new products. This regulatory landscape presents a significant challenge for manufacturers in the landing gear market, demanding constant vigilance and adaptability to comply with global safety and performance criteria.

Emerging Trends

- Electrification of Landing Gear: Incorporation of electric motors to replace hydraulic systems, enhancing efficiency and reducing maintenance.

- Autonomous Landing Gear Systems: Development of systems that can perform autonomous operations, improving safety and efficiency on the ground.

- Increased Use of Composite Materials: Adoption of carbon fiber and other composites for lighter, stronger, and more corrosion-resistant landing gear components.

- Additive Manufacturing (3D Printing): Utilization of 3D printing for parts manufacturing, reducing weight and production costs, and allowing for complex designs.

- Advanced Diagnostics and Monitoring Systems: Integration of sensors and IoT technology for real-time monitoring of landing gear health, facilitating predictive maintenance and reducing downtime.

Regional Analysis

In 2023, North America held a dominant market position in the commercial aircraft landing gear market, capturing more than a 36% share. This leadership can be attributed to several key factors, including the presence of major aircraft manufacturers, a robust aviation infrastructure, and significant investments in aerospace research and development within the region.

The demand for Commercial Aircraft Landing Gear in North America was valued at USD 1.27 billion in 2023 and is anticipated to grow significantly in the forecast period. North America’s pioneering role in the aviation industry, coupled with its extensive network of airports and high frequency of both domestic and international flights, necessitates continuous advancements in aircraft technology, including landing gear systems.

The region’s emphasis on enhancing the safety, efficiency, and environmental sustainability of air travel has driven the demand for innovative landing gear solutions. These include lightweight materials, advanced manufacturing techniques, and improved design methodologies that contribute to reduced aircraft weight, lower fuel consumption, and decreased emissions.

Furthermore, North America’s stringent regulatory standards for aviation safety and environmental compliance have spurred the development of advanced landing gear systems that meet these rigorous requirements.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the landscape of the commercial aircraft landing gear market, several key players stand out due to their innovative contributions, strategic partnerships, and extensive product portfolios. These companies not only drive technological advancements within the sector but also shape market trends through their commitment to research and development, customer service, and sustainability initiatives. Understanding the role and strategic focus of these key players is essential for grasping the market’s dynamics

Top Market Leaders

- Collins Aerospace

- Parker- Hannifin Corporation

- Whippany Actuation Systems

- Héroux-Devtek Inc

- UTC Aerospace Systems

- Mecaer Aviation Group (MAG)

- Safran Landing Systems

- Eaton Corporation plc

- Honeywell International, Inc.

- AAR Corp.

- Beaver Aerospace & Defense, Inc.

- CIRCOR Aerospace, Inc.

- Liebherr Group

- Other Key Players

Recent Development

- In March 2023, Emirates, the Dubai-based airline and the world’s largest operator of Airbus A380 long-range aircraft, signed two significant contracts with Lufthansa Technik AG for comprehensive Maintenance, Repair, and Overhaul (MRO) services.

- In June 2023, Boeing and Virgin Galactic announced a strategic partnership to collaborate on the development of high-speed commercial travel and explore supersonic and hypersonic technologies.

- In April 2023, Embraer introduced the E3, a new generation of commercial aircraft, aimed at improving fuel efficiency, reducing emissions, and enhancing passenger comfort.

- In March 2023, Vertical Aerospace partnered with American Airlines to develop and introduce electric vertical takeoff and landing (eVTOL) aircraft for urban transportation.

Report Scope

Report Features Description Market Value (2023) USD 3.5 Bn Forecast Revenue (2033) USD 12.6 Bn CAGR (2024-2033) 13.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Gear Position (Main Landing, Nose Landing), By Aircraft Type (Narrow-Body, Wide-Body, Regional Jet), By Sub-system (Steering System, Brake System, Actuation System, Others), By End User (OEM and Aftermarket) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Collins Aerospace, Parker- Hannifin Corporation, Whippany Actuation Systems, Héroux-Devtek Inc, UTC Aerospace Systems, Mecaer Aviation Group (MAG), Safran Landing Systems, Eaton Corporation plc, Honeywell International Inc., AAR Corp., Beaver Aerospace & Defense Inc., CIRCOR Aerospace Inc., Liebherr Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is commercial aircraft landing gear?Commercial aircraft landing gear refers to the undercarriage system of an aircraft, comprising wheels, brakes, shock absorbers, struts, and other components that support the aircraft during landing, takeoff, and taxiing.

How big is Commercial Aircraft Landing Gear Market?The Global Commercial Aircraft Landing Gear Market size is expected to be worth around USD 12.6 Billion by 2033, from USD 3.5 Billion in 2023, growing at a CAGR of 13.5% during the forecast period from 2024 to 2033.

Which gear position segment accounted for the largest commercial aircraft landing gear market share?In 2023, the Main Landing Gear Segment held a dominant position in the commercial aircraft landing gear market, capturing more than a 60% share.

Who are the key players in commercial aircraft landing gear market?Some key players operating in the commercial aircraft landing gear market include Collins Aerospace, Parker- Hannifin Corporation, Whippany Actuation Systems, Héroux-Devtek Inc, UTC Aerospace Systems, Mecaer Aviation Group (MAG), Safran Landing Systems, Eaton Corporation plc, Honeywell International Inc., AAR Corp., Beaver Aerospace & Defense Inc., CIRCOR Aerospace Inc., Liebherr Group, Other Key Players

What are the factors driving the growth of the commercial aircraft landing gear market?Factors driving market growth include increasing air passenger traffic, rising demand for new aircraft deliveries, fleet expansion plans by airlines, technological advancements in landing gear systems, and the need for lightweight and durable materials.

What are the challenges faced by the commercial aircraft landing gear market?Challenges include high initial investment costs, stringent regulatory requirements, complexities in design and manufacturing, and the need for continuous maintenance and inspection to ensure safety and reliability.

Commercial Aircraft Landing Gear MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Commercial Aircraft Landing Gear MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Collins Aerospace

- Parker- Hannifin Corporation

- Whippany Actuation Systems

- Héroux-Devtek Inc

- UTC Aerospace Systems

- Mecaer Aviation Group (MAG)

- Safran Landing Systems

- Eaton Corporation plc

- Honeywell International, Inc.

- AAR Corp.

- Beaver Aerospace & Defense, Inc.

- CIRCOR Aerospace, Inc.

- Liebherr Group

- Other Key Players