Global Collision Avoidance Sensor Market By Technology (Radar, Camera, Ultrasound, LiDAR, and Other Technologies), By Applications, By End-User (Automobile, Aerospace & Defense, Maritime, Rail, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2023

- Report ID: 58010

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

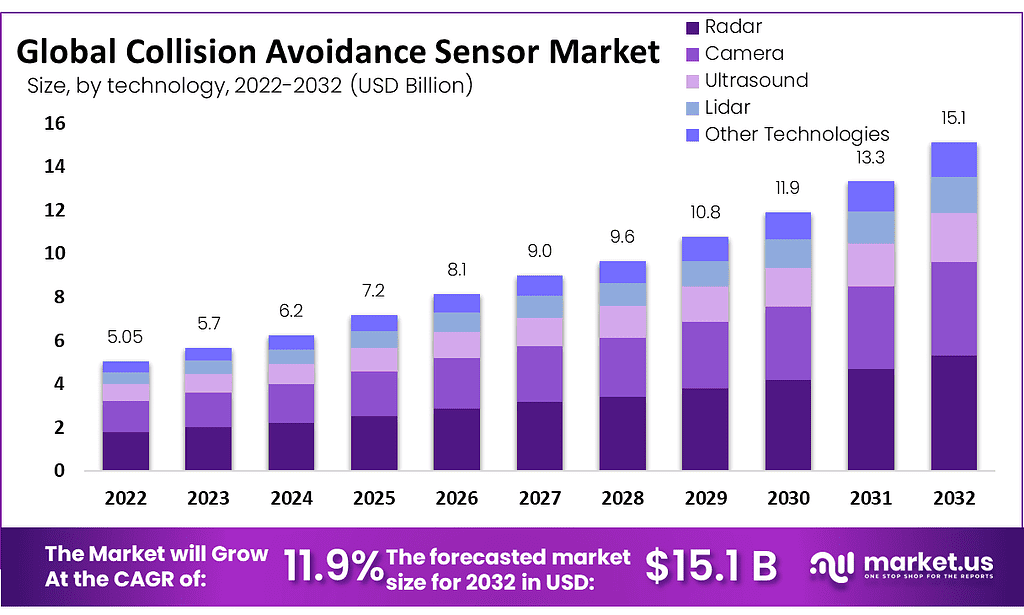

The Global Collision Avoidance Sensor Market size is expected to be worth around USD 15.1 Billion by 2032 from USD 5.7 Billion in 2023, growing at a CAGR of 11.9% during the forecast period from 2023 to 2032.

The global market for these sensors is expanding as a result of the rising demand for collision avoidance sensors in the mining, automotive, and building industries. There is a larger need for enhanced sensory technology due to the rise in accidents globally and the development of automated driving assistance systems. To provide the maximum level of precision, suppliers have started launching element-specific vehicle sensors.

Due to advances in LiDAR, cameras, ultrasound technologies and radar, the market for collision avoidance sensors in vehicles has seen rapid expansion over the last few years. It is anticipated that many luxury automakers will widely adopt these sensors and integrate them as a significant part of the active safety system package in a car. Sports utility vehicles (SUVs), high-end luxury cars, and utility vehicles are expected to be major growth drivers of the market. Basic collision avoidance sensors are now being offered by some major automakers in their mass-market products.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Projected Growth: The market is expected to reach around USD 15.1 Billion by 2032, with a CAGR of 11.90% during 2023-2032.

- Drivers: Increasing demand for advanced driver assistance systems (ADAS) and advancements in sensor technology are propelling market growth.

- Challenges: High costs and limited range and accuracy are hindering the widespread adoption of collision avoidance sensors.

- Trends and Opportunities: The use of advanced technologies like LiDAR and radar, along with government safety and frequency regulations, is driving market expansion.

- Technology: Radar accounts for the largest revenue share in the collision avoidance sensor market, followed by camera, ultrasound, LiDAR, and other technologies.

- Application: The parking assistance segment dominates the market, followed by adaptive cruise control, blind spot detection, forward collision warning system, lane departure warning system, night vision, autonomous emergency braking, and other applications.

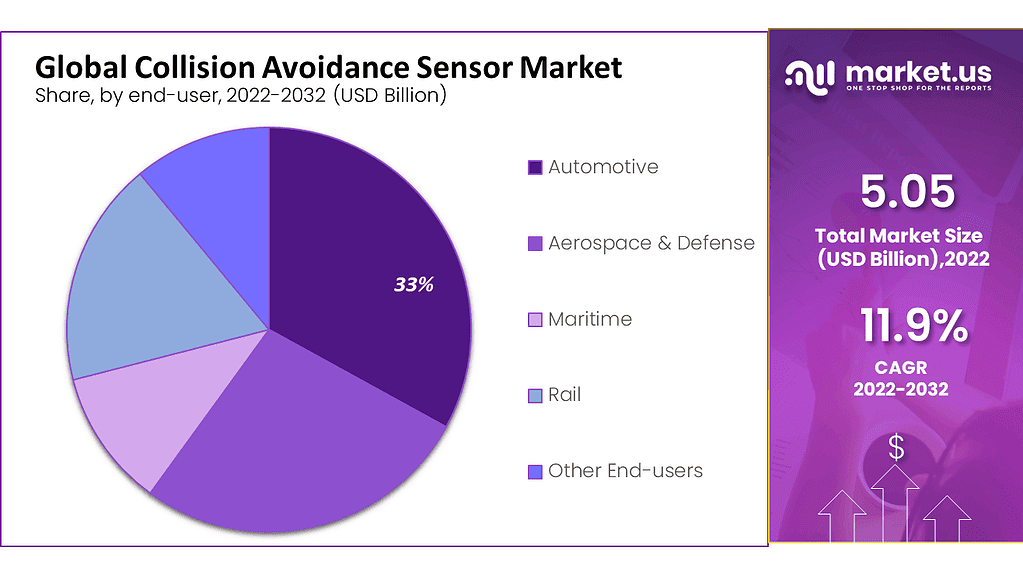

- End-User: The automotive segment holds the largest revenue share, with significant applications in collision avoidance systems and lane departure warning systems.

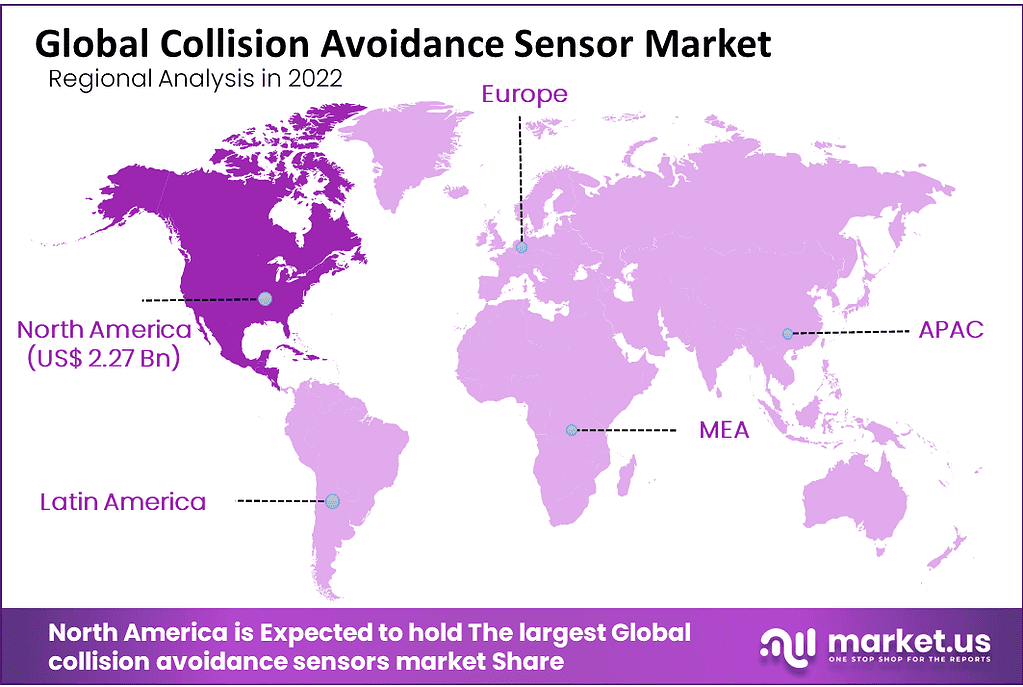

- Regional Analysis: North America and Asia-Pacific are the leading regions, with North America benefiting from the high adoption of advanced driver assistance systems.

- Key Players: Notable companies include Robert Bosch GmbH, Rockwell Collins, Inc., L3 Technologies, Saab AB, and others.

Driving Factors

- Increasing Demand for Advanced Driver Assistance Systems (ADAS): With the growing adoption of ADAS in modern vehicles, collision avoidance sensors have become an integral component. These sensors detect and avoid potential collisions with other vehicles, objects, or pedestrians.

- Advancements in Sensor Technology: The development of advanced sensor technologies, including radar, LiDAR, and camera-based systems, is driving innovation in the collision avoidance sensor market. These sensors are more precise, reliable, and cost-effective than their predecessors, making them accessible to a wider range of vehicles.

- Increasing Adoption of Autonomous Vehicles: As autonomous vehicle adoption rapidly increases, collision avoidance sensors will become more necessary. These sensors are part of autonomous driving systems that rely on advanced sensors and software to detect and avoid potential collisions.

Restraining Factors

- High Cost: One of the primary obstacles in the collision avoidance sensor market is its high price. Prices can vary significantly based on type and application, but they are usually costlier than other types of sensors used in automobiles or other industries. As a result, costs may restrict adoption, particularly in emerging markets where cost is an important factor.

- Limited Range and Accuracy: One major limitation of collision avoidance sensors is their limited range and accuracy. The accuracy of these sensors may be affected by factors like weather conditions and lighting conditions.

Growth Opportunities

Government safety and frequency regulations

The two frequency bands most commonly utilized in radar applications are 24 GHz and 7. GHz. However, due to regulations surrounding radar sensors, the market is shifting towards 77 GHz radars. This shift offers numerous advantages for industries such as automotive and industrial. The narrow band, commonly referred to as the ISM or the narrow band, has a bandwidth of 250 MHz and covers the frequency range between 24.25 GHz and 24.0 GHz. Blind spot detection uses this same 5 GHz range.

Though narrowband can sometimes be acceptable, ultra-wideband devices will be necessary for applications requiring a higher frequency range. Due to spectrum regulations and standards set by the Federal Communications Commission and European Telecommunications Standards Institute, ultra-wideband will be completely phased out beginning in 2022.

Trending Factors

Use of Advanced Technologies Like LiDAR and Radar

Due to the rise in road accidents, there is an increasing need for safety features on vehicles. Collision avoidance sensors help reduce accidents. With the advancement of technologies, automotive manufacturers are increasingly installing collision avoidance sensors in their vehicles. The incorporation of sophisticated sensors such as LiDAR and radar is expected to propel growth within the collision avoidance sensor market.

The rising popularity of electric vehicles is expected to drive up demand for collision avoidance sensors. These sensors are essential for guaranteeing the safety of electric vehicles, which have different driving characteristics compared to traditional automobiles. The rising adoption of autonomous vehicles is anticipated to fuel growth in the collision avoidance sensor market. Autonomous cars rely heavily on these sensors for navigation and safety, thus propelling demand for these sensors.

Technology Analysis

The Radar Segment Accounted for the Largest Revenue Share in the Collision Avoidance Sensor Market

Based on technology, the market for collision avoidance sensors is segmented into radar, camera, ultrasound, LiDAR, and other technologies. Among these types, the radar segment is the most lucrative at the global level. Radars are the most common choice when it comes to detection equipment that requires exact measurements of the position and distance of obstacles. While vision and infrared sensors, compared to radar, have a shorter and smaller field of vision.

They are more effective at detecting and classifying obstacles. With inexpensive ultrasound devices, short-range obstacle detection is feasible. They are especially used in parking assistance systems. LiDAR-based anti-collision sensors have a wide field of view and can generate detailed imagery. They require more vehicle room to place and are very expensive. Over the coming years, a stable market share is anticipated for the segments dependent on cameras and radar.

Application Analysis

The Parking Assistance Segment is the Most Lucrative Segment in the Session Analysis of the Collision Avoidance Sensor Market

Based on application, the market for collision avoidance sensors is dominating parking assistance, with a CAGR of 11.56% during the forecast period. Vehicles with parking assistance systems use vision-based and ultrasonic anti-collision sensors. The driver is alerted right away when the park assists detects a suitable parallel or perpendicular space. If the person is driving and presses the button to activate the park assist, the system determines the optimal path to take, the number of steering adjustments necessary, and the best method to approach the space.

End-User Analysis

The Automotive Segment Accounted for the Largest Revenue Share in Collision Avoidance Sensor Market

Based on end-user, the market for collision avoidance sensors is segmented into Automotive, Aerospace & Defense, Maritime, Rail, and Other End-users. Among these end-users, the automotive segment is the most lucrative in the global market for collision avoidance sensors. The automotive industry is a major user of collision avoidance sensors. These devices help prevent accidents and improve safety for drivers, passengers, and pedestrians.

Some common applications of these sensors in automobiles include the collision avoidance system, which utilizes collision avoidance sensors to detect objects in its path and send alerts to the driver so they can take corrective action. Lane departure warning systems include utilizing cameras or laser scanners to detect lane markings on the road surface; if a car drifts out of its lane, it will issue an alert to the driver.

Note: Actual Numbers Might Vary In The Final Report

Key Market Segments

Based on Technology

- Radar

- Camera

- Ultrasound

- Lidar

- Other Technologies

Based on Application

- Adaptive Cruise Control (ACC)

- Blind Spot Detection (BSD)

- Forward Collision Warning System (FCWS)

- Lane Departure Warning System (LDWS)

- Parking Assistance

- Night Vision (NV)

- Autonomous Emergency Braking

- Other Applications

Based on End-User

- Automotive

- Aerospace & Defense

- Maritime

- Rail

- Other End-users

Regional Analysis

North America is one of the largest markets for collision avoidance sensors, due to the widespread adoption of advanced driver assistance systems in this region. North America also has several top automotive and technology companies that are investing heavily in the research and development of collision avoidance sensors and systems.

Asia-Pacific is expected to grow rapidly in this market due to increased vehicle demand and an increasing focus on vehicle safety; countries such as China, Japan, and South Korea are leading this charge with heavy investments in collision avoidance technology development. This growth is driven by market expansion across this region.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market are investing heavily in research and development projects as well as setting up production infrastructure to develop differentiated and affordable vehicle safety solutions. It focuses on new product innovation and effective distribution through an expansive network of partners across multiple countries, such as the U.S., Germany, and India. Collision avoidance sensors are becoming more popular across a range of industries, including automotive, aviation, and maritime. These sensors play an integral role in avoiding accidents by detecting potential collisions and alerting the operator’s automatic safety systems.

Market Key Players:

Listed below are some of the most prominent collision avoidance sensor industry players.

- Robert Bosch GmbH

- Rockwell Collins, Inc.

- L3 Technologies

- Saab AB

- General Electric

- Delphi Automotive Plc.

- Denso Corporation

- Autoliv, Inc.

- Becker Mining Systems AG

- Hexagon AB

- Wabtec Corporation

- Honeywell International, Inc.

- Alstom

- Siemens AG

- Other Key Players

Recent Developments

- In 2021, ZF unveiled its “coPILOT” collision avoidance system, which utilizes AI and machine learning to provide real-time alerts to drivers and enhance safety.

- In 2020, Velodyne Lidar recently unveiled their “Velabit” collision avoidance sensor. This compact device utilizes LiDAR technology to provide real-time data about its environment, enabling autonomous vehicles to avoid accidents.

Report Scope

Report Features Description Market Value (2023) USD 5.7 Bn Forecast Revenue (2032) USD 15.1 Bn CAGR (2023-2032) 11.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Radar, Camera, Ultrasound, LiDAR, and Other Technologies), By Application (Adaptive Cruise Control (ACC), Blind Spot Detection (BSD), Forward Collision Warning System (FCWS), Lane Departure Warning System (LDWS), Parking Assistance and Other Applications), By End-User (Automobile, Aerospace & Defense, Maritime, Rail, and Other End-users) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Robert Bosch GmbH, Rockwell Collins, Inc., L3 Technologies, Saab AB, General Electric, Delphi Automotive Plc., Denso Corporation, Autoliv, Inc., Becker Mining Systems AG, Hexagon AB, Wabtec Corporation, Honeywell International, Inc., Alstom, Siemens AG, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are collision avoidance sensors?Collision avoidance sensors are devices that use various technologies such as radar, lidar, cameras, and ultrasonic sensors to detect obstacles or potential collisions and alert the driver or autonomously apply brakes to prevent an accident.

What factors are driving the growth of the collision avoidance sensor market?The growth of the collision avoidance sensor market is primarily driven by increasing concerns about road safety, government regulations mandating the installation of safety features in vehicles, the rise of autonomous vehicles, and the growing demand for advanced driver assistance systems (ADAS) in modern vehicles.

How big is Collision Avoidance Sensor Market?The Global Collision Avoidance Sensor Market size is expected to be worth around USD 15.1 Billion by 2032 from USD 5.7 Billion in 2023, growing at a CAGR of 11.9% during the forecast period from 2023 to 2032.

How do collision avoidance sensors contribute to vehicle safety?Collision avoidance sensors help improve vehicle safety by providing real-time information about the surrounding environment. They can detect obstacles, pedestrians, and other vehicles, and provide timely warnings to the driver or initiate automatic braking to prevent or mitigate potential collisions.

What are some challenges facing the collision avoidance sensor market?Some challenges facing the collision avoidance sensor market include high costs associated with advanced sensor technologies, reliability issues in adverse weather conditions, and the need for standardization in sensor technologies to ensure compatibility and interoperability across different vehicle models and manufacturers.

Collision Avoidance Sensor MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample

Collision Avoidance Sensor MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Robert Bosch GmbH

- Rockwell Collins, Inc.

- L3 Technologies

- Saab AB

- General Electric

- Delphi Automotive Plc.

- Denso Corporation

- Autoliv, Inc.

- Becker Mining Systems AG

- Hexagon AB

- Wabtec Corporation

- Honeywell International, Inc.

- Alstom

- Siemens AG

- Other Key Players