Global Capacitive Sensors Market By Type (Touch Sensors, Motion Sensors, Position Sensors, Other Types), By End-Use (Consumer Electronics, Automotive, Food & Beverages, Aerospace & Defense, Oil & Gas, Healthcare, Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2023

- Report ID: 40116

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

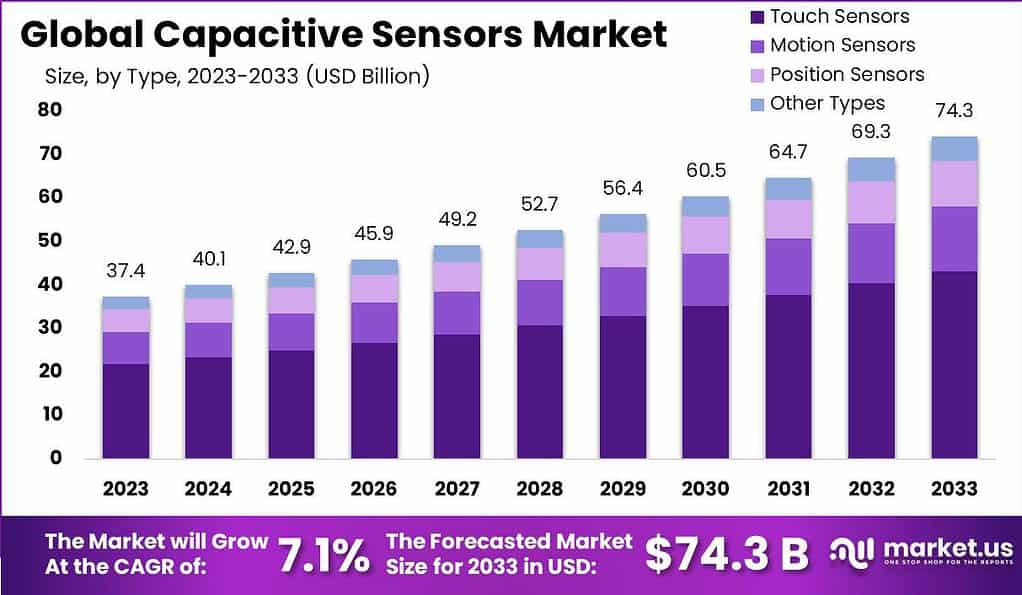

The Global Capacitive Sensors Market is expected to be worth around USD 74.3 Billion by 2033 from USD 37.4 Billion in 2023, growing at a CAGR of 7.1% during the forecast period 2024 to 2033.

Capacitive sensors are electronic devices that detect and measure changes in capacitance, which is the ability of a system to store an electrical charge. These sensors utilize the principle of capacitance to sense proximity, touch, pressure, and position. They consist of two conductive plates separated by a dielectric material, and when a target object comes close to or touches the sensor surface, the capacitance changes, allowing for detection and measurement.

The global capacitive sensors market is expected to grow steadily in the coming years. Factors driving the growth include increasing demand from key end-use industries such as consumer electronics, automotive, healthcare, and industrial manufacturing. Capacitive sensors are increasingly being used in smartphones, wearables, vehicles, and smart home devices for sensing and control applications. Other factors promoting market growth are innovations in sensor technology and miniaturization as well as advantages offered by capacitive sensors in terms of cost and sensitivity over other sensor types.

Note: Actual Numbers Might Vary In Final Report

Key Takeaways

- Market Size and Growth: The Capacitive Sensors Market is anticipated to grow to USD 74.3 billion in 2033. It will also have a constant CAGR in the range of 7.1% from 2024 until 2033.

- Type Analysis: By 2023, Touch Sensors dominated the market, with an estimated share of 58.3 %, driven by their wide applications in smartphones, tablets, laptops, and touch screen displays.

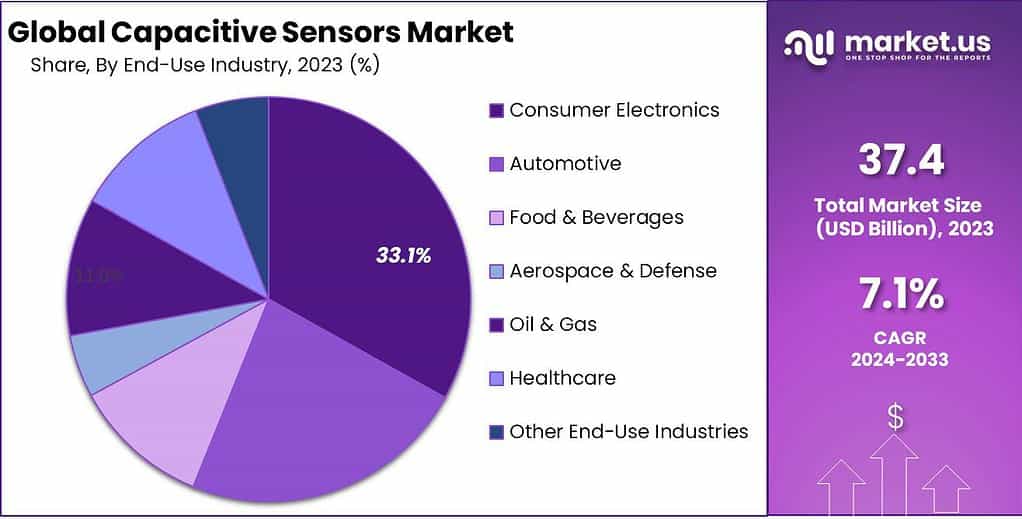

- End-Use Industries: Consumer Electronics captured over 33.1% of the market in 2023, with capacitive sensors integrated into devices like tablets, smartphones, and touch screen displays. Automotive, Food & Beverages, Aerospace & Defense, Oil & Gas, Healthcare, and other industries also contributed significantly.

- Driving Factors: The growth of the capacitive sensors market is driven by rising demand in consumer electronics, automotive integration, industrial automation, and healthcare applications.

- Restraining Factors: Factors such as cost sensitivity, sensitivity to environmental conditions, competition from alternative technologies,and complex integration pose challenges to the capacitive sensors market’s growth.

- Growth Opportunities: Emerging Internet of Things (IoT) applications, enhanced sensing capabilities, customization, and miniaturization offer growth opportunities for capacitive sensors. Cross-industry collaborations can also drive innovation.

- Challenges: The absence of universal standards, environmental factors, security concerns, and market competition are challenges that capacitive sensor manufacturers need to address.

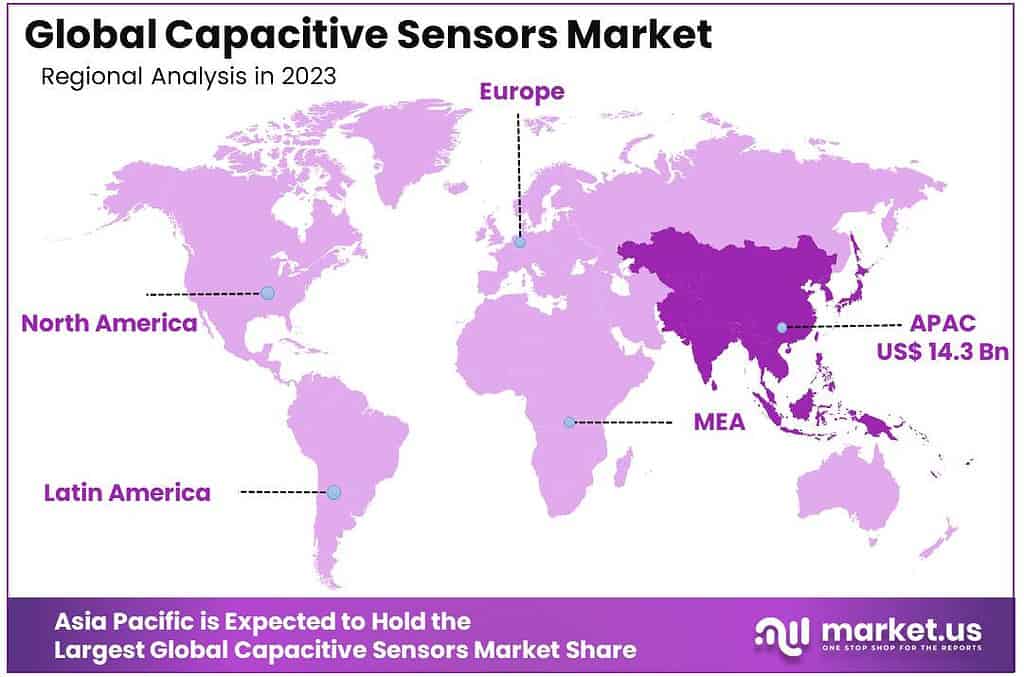

- Regional Analysis: In 2023, Asia Pacific held the dominant market position, driven by its role as a major manufacturing hub and the rising middle-class population. Europe and North America also played significant roles in the market.

- Key Players: Key players in the capacitive sensors market include Analog Devices, Inc., STMicroelectronics N.V., Texas Instruments Inc., Siemens AG, NXP Semiconductors N.V., Infineon Technologies AG, Renesas Electronics Corp., Microchip Technology, Inc., Omron Corporation, Schneider Electric SE, ON Semiconductor, and others.

Type Analysis

In 2023, the Touch Sensors segment emerged as a dominant force in the Capacitive Sensors market, securing a substantial share of over 58.3%. This remarkable position can be attributed to the widespread application of touch sensors in various industries and consumer electronics. Touch sensors are widely used in smartphones, tablets, laptops, and touch screen displays, driving their demand significantly. The intuitive and user-friendly interface provided by touch sensors has made them a preferred choice in human-machine interfaces, ensuring their prevalence in the market.

Motion Sensors also played a pivotal role in the market, holding a noteworthy share in 2023. These sensors are crucial in applications like gaming consoles, security systems, and automotive safety features. The growing emphasis on motion detection for security and automation purposes bolstered the adoption of motion sensors.

Position Sensors carved out a significant niche in the Capacitive Sensors market. These sensors are essential in industries like automotive, manufacturing, and aerospace, where precise position measurement is critical. The need for accurate and reliable position data in robotic systems and industrial machinery fueled the demand for position sensors.

Other Types of capacitive sensors, while representing a smaller segment, were not to be underestimated. This category encompasses various specialized sensors designed for specific applications, such as proximity sensors, humidity sensors, and level sensors. Their importance in industries like healthcare, agriculture, and environmental monitoring led to their presence in the market.

End-Use Outlook

In 2023, the Consumer Electronics segment emerged as a dominant force in the Capacitive Sensors market, capturing more than a significant 33.1% share. This remarkable position can be attributed to large-scale integration of capacitive sensors into consumer electronic devices like tablets, smartphones and touch screen displays and wearable devices.

The touch-sensitive interfaces of these devices are heavily dependent on capacitive sensors in order to offer users smooth and effortless interactions. As the consumer electronics industry continues to innovate and introduce new touch-enabled products, the demand for capacitive sensors remains robust, solidifying their pivotal role in this sector.

The Automotive sector also played a substantial role in the market, holding a notable share. Capacitive sensors are extensively used in automotive applications for functions like touch screens in infotainment systems, touch-sensitive controls, and airbag deployment systems. The increasing emphasis on advanced user interfaces and safety features in vehicles has led to the consistent adoption of capacitive sensors.

The Food & Beverages industry showcased a noteworthy presence in the Capacitive Sensors market. These sensors find utility in food and beverage processing equipment, ensuring precise control and monitoring of various processes. Capacitive sensors help maintain quality standards, prevent contamination, and enhance overall production efficiency in this sector.

Aerospace & Defense, Oil & Gas, and Healthcare industries also contributed significantly to the market. In aerospace and defense, capacitive sensors are used for position sensing, fuel level measurement, and aircraft controls. In the oil and gas sector, these sensors play a critical role in level measurement and process control. Meanwhile, the healthcare industry relies on capacitive sensors for applications like medical imaging equipment and patient monitoring devices.

Other End-Use Industries encompass a diverse range of applications, from environmental monitoring to industrial automation. This segment underscores the versatility of capacitive sensors and their adaptability to various specialized applications.

Note: Actual Numbers Might Vary In Final Report

Driving Factors

- Rising Demand in Consumer Electronics: The proliferation of smartphones, tablets, and touch-based devices is a key driver. Capacitive sensors are integral to touchscreens and gesture recognition, ensuring their continued growth.

- Automotive Integration: The automotive industry’s emphasis on touch-sensitive interfaces and advanced driver-assistance systems (ADAS) is boosting demand for capacitive sensors in vehicles.

- Industrial Automation: Capacitive sensors are vital for precise positioning and object detection in industrial automation, facilitating improved manufacturing processes and efficiency.

- Healthcare Applications: The healthcare sector’s adoption of capacitive sensors in medical devices like ultrasound machines and patient monitoring systems is on the rise, driven by the need for accuracy and reliability.

Restraining Factors

- Cost Sensitivity: The cost of capacitive sensors, particularly in large-scale installations, can be a major factor especially for markets that are price sensitive.

- Sensitivity to Environmental Factors: Capacitive sensors are affected by conditions such as humidity and temperature, which makes them incompatible with certain extreme environments.

- Competition from Alternative Technologies: Alternative sensing technologies, such as resistive and optical sensors, can pose a competitive challenge, particularly in specific niche applications.

- Complex Integration: Integrating capacitive sensors into devices and systems may require specialized expertise, potentially posing a challenge for some manufacturers.

Growth Opportunities

- Emerging IoT Applications: Internet of Things (IoT) presents vast opportunities for capacitive sensors, notably with smart devices such as wearables, smart homes along with industry IoT applications.

- Enhanced Sensing Capabilities: The latest developments in capacitive sensor technology such as proximity sensing and 3D touch opens the door to new applications in robotics as well as interactive displays.

- Customization and Miniaturization: Tailoring capacitive sensors to meet specific industry requirements and the development of smaller, more compact sensors can create niche markets and growth avenues.

- Cross-Industry Collaboration: Collaborations between sensor manufacturers and industries like automotive, healthcare, and aerospace can lead to innovative sensor applications.

Challenges

- Standardization: The absence of universal standards for capacitive sensors can complicate integration and interoperability.

- Environmental Factors: Capacitive sensors may face challenges in extreme environments with high humidity, dust, or temperature variations.

- Security Concerns: In touch-sensitive applications, security concerns regarding data privacy and protection from unauthorized access are paramount.

- Market Competition: The competitive landscape with various sensor technologies requires capacitive sensor manufacturers to continually innovate and differentiate their offerings.

Key Market Trends

- Multi-Touch Displays: The trend toward multi-touch displays in consumer electronics, such as smartphones and tablets, is driving demand for capacitive sensors capable of detecting multiple touch points simultaneously.

- Gesture Recognition: Capacitive sensors are increasingly used in gesture recognition systems, enhancing user interfaces in various applications, from gaming consoles to home automation.

- Flexible and Transparent Sensors: Developments in flexible and transparent capacitive sensors are opening up opportunities in curved displays, wearables, and flexible electronics.

- Integration with AI and Machine Learning: Capacitive sensors integrated with AI and machine learning algorithms enable predictive maintenance and intelligent automation in industrial settings.

Key Market Segments

Type

- Touch Sensor

- Motion Sensor

- Position Sensor

- Other Types

End-Use

- Consumer Electronics

- Food & Beverages

- Oil & Gas

- Healthcare

- Automotive

- Aerospace & Defense

- Manufacturing

- Other End-Uses

Regional Analysis

In 2023, Asia Pacific held a dominant market position in the Capacitive Sensors Market, capturing more than a 38.4% share. The market share that this region has is due to a variety of significant reasons. Firstly, Asia Pacific has emerged as a major manufacturing hub in the world which has driven the demand for capacitive sensors across different industries, including automobiles, electronics for consumers along with industrial automation.

Furthermore, the rapid urbanization as well as the rising middle class population has led to an increase in electronic consumer usage, further increasing the demand for capacitive sensors on devices like tablets, smartphones and smart appliances.

Europe, On the other hand, had a prominent presence in the market for capacitive sensors from 2023, although with a smaller share. European industries, particularly automotive and healthcare, have integrated capacitive sensors for applications like touchscreens, gesture recognition, and proximity sensing. Moreover, the region’s stringent regulations related to safety and environmental standards have encouraged the adoption of capacitive sensors for compliance and efficiency.

North America maintained a prominent position in the capacitive sensors market, driven by its thriving healthcare and automotive sectors. In the field of healthcare capacitive sensors are commonly utilized in medical devices as well as diagnostics. The focus of the region on innovation and cutting-edge technology aided in the growth of the market. Latin America and the Middle East & Africa regions collectively contributed to the market, showcasing growing potential for capacitive sensors in various applications.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

- Analog Devices, Inc.

- STMicroelectronics N.V.

- Texas Instruments Inc.

- Siemens AG

- NXP Semiconductors N.V.

- Infineon Technologies AG

- Renesas Electronics Corp.

- Microchip Technology, Inc.

- Omron Corporation

- Schneider Electric SE

- ON Semiconductor

- Other Key Players

Recent Developments

- February 2022 – FPC1552’s curved Fingerprint Cards AB’s second generation compact and curved capacitive touchscreen sensor has been integrated in Xiaomi’s newly unveiled Redmi K50. Its fingerprint scanner is situated on the side of the phone and features a curved surface to facilitate seamless integration.

- February 2022 – Hogar Controls Inc, a world-wide IoT company, has announced the launch of its brand-new Prima+ Smart Touch Panel collection. Hogar’s touch panels include three different versions of the Prima+ series, all of which have been designed using a the focus on design first and are part of the comprehensive smart home solutions.

Report Scope

Report Features Description Market Value (2023) US$ 37.4 Bn Forecast Revenue (2033) US$ 74.3 Bn CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Touch Sensors, Motion Sensors, Position Sensors, Other Types), By End-Use (Consumer Electronics, Automotive, Food & Beverages, Aerospace & Defense, Oil & Gas, Healthcare, Other End-Use Industries) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Analog Devices Inc., STMicroelectronics N.V., Texas Instruments Inc., Siemens AG, NXP Semiconductors N.V., Infineon Technologies AG, Renesas Electronics Corp., Microchip Technology, Inc., Omron Corporation, Schneider Electric SE, ON Semiconductor, Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a capacitive sensor?A capacitive sensor is a type of electronic sensor that measures changes in capacitance to detect the presence or proximity of objects. It is commonly used in touchscreens and various applications for proximity sensing.

How big is Capacitive Sensors Market?The Global Capacitive Sensors Market is expected to be worth around USD 74.3 Billion by 2033 from USD 37.4 Billion in 2023, growing at a CAGR of 7.1% during the forecast period 2024 to 2033.

What are the key applications of capacitive sensors?Capacitive sensors find applications in touchscreens, proximity sensing, automotive systems, industrial automation, consumer electronics, and more. They are widely used for their accuracy and reliability.

Why are capacitive sensors commonly used in touchscreens?Capacitive sensors are preferred for touchscreens due to their ability to provide accurate and responsive touch detection. They offer a seamless and intuitive user experience and are commonly found in smartphones, tablets, and other electronic devices.

What factors contribute to the growth of the capacitive sensors market?The growth of the capacitive sensors market is driven by increasing demand in consumer electronics, automotive applications, industrial automation, and the adoption of touch-based interfaces. Technological advancements and the rise of the Internet of Things (IoT) also contribute to market expansion.

Which industries prominently use capacitive sensors?Capacitive sensors are widely used in industries such as consumer electronics, automotive, healthcare, industrial automation, and robotics. Their versatility makes them suitable for diverse applications in these sectors.

-

-

- Analog Devices, Inc.

- STMicroelectronics N.V.

- Texas Instruments Inc.

- Siemens AG

- NXP Semiconductors N.V.

- Infineon Technologies AG

- Renesas Electronics Corp.

- Microchip Technology, Inc.

- Omron Corporation

- Schneider Electric SE

- ON Semiconductor

- Other Key Players