Global Cognitive Agents Market Size, Share, Industry Analysis Report By Technology (Machine Learning (ML), Natural Language Processing, Computer Vision, Robotics Process Automation (RPA), Cognitive Computing, Others), By Agent System (Single Agent Systems, Multi-Agent Systems), By End Use (Technology and Software, Healthcare, BFSI, Retail & E-Commerce, Manufacturing & Logistics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156212

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Investment & Benefits

- Role and Applications

- Economic Impact of Cognitive Agents

- Regional Analysis

- By Technology: ML (32.2%)

- By Agent System: Single Agent Systems (64.1%)

- By End Use: Healthcare (47.2%)

- Emerging Trends

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

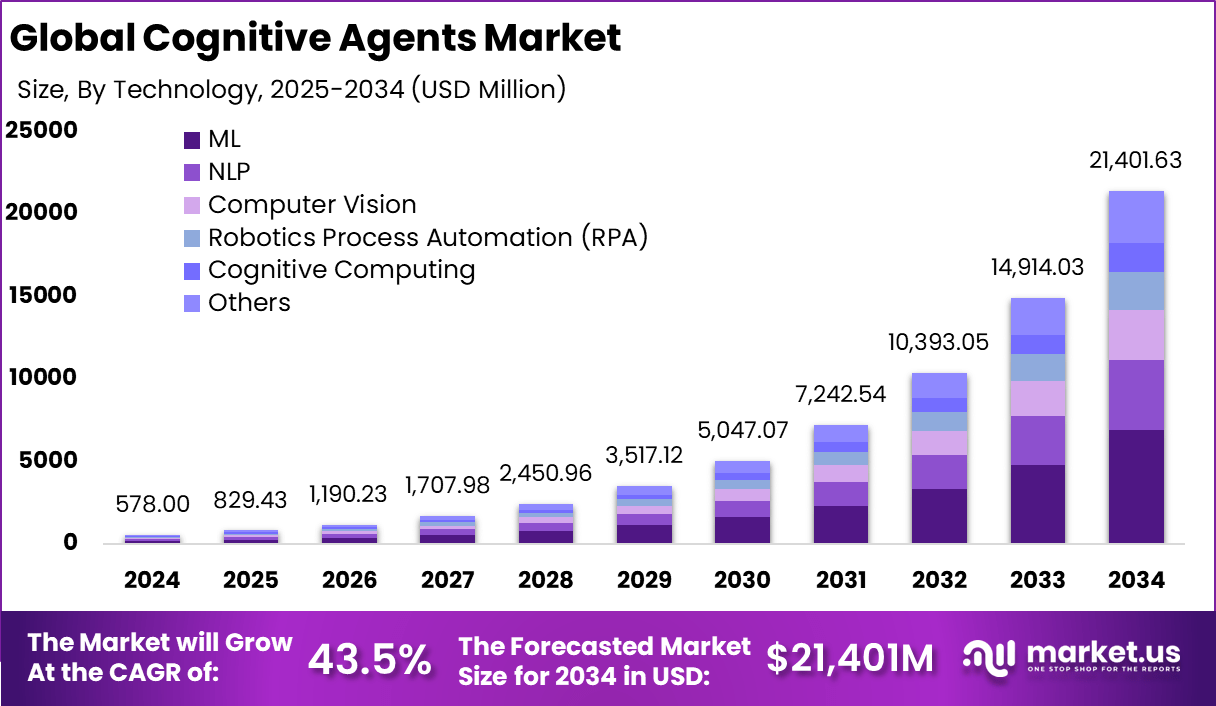

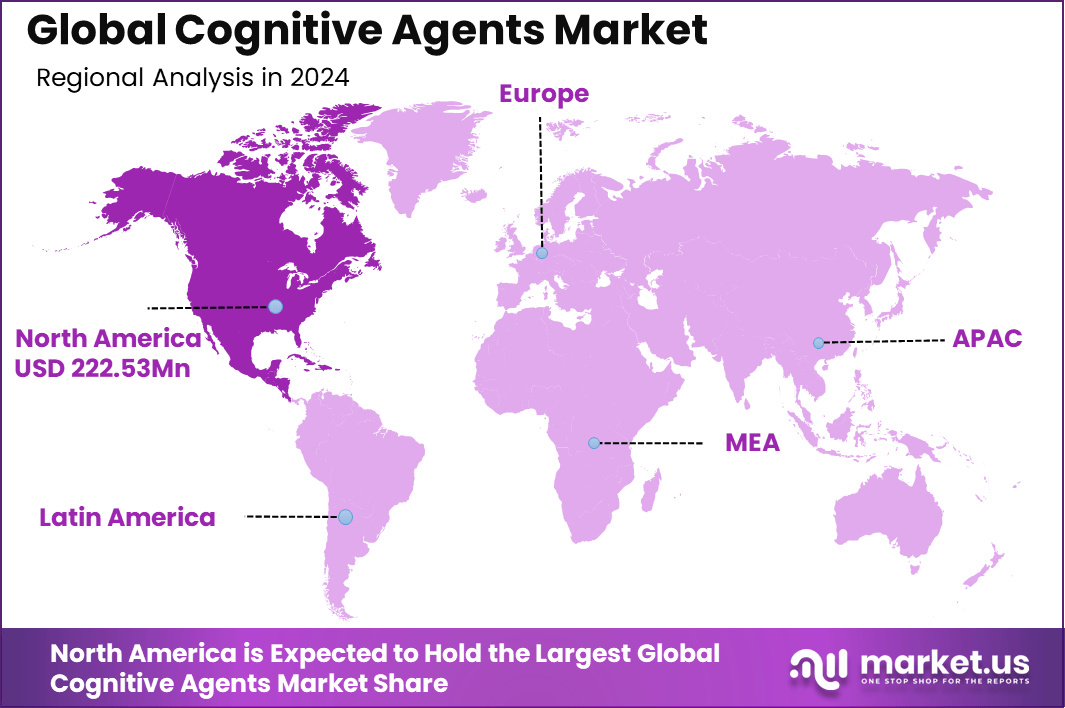

The Global Cognitive Agents Market size is expected to be worth around USD 21,401.6 Million By 2034, from USD 578 Million in 2024, growing at a CAGR of 43.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 38.5% share, holding USD 222.53 Million revenue.

The Cognitive Agents Market involves AI-driven software programs designed to simulate and automate complex human decision-making and interaction processes. These agents use technologies such as natural language processing, machine learning, computer vision, and robotic process automation to deliver personalized and intelligent responses, manage workflows, and analyze data in real time.

The market growth is driven by the rising demand for intelligent automation that handles unstructured data and streamlines complex tasks. Enhancements in natural language processing and machine learning enable cognitive agents to deliver better contextual understanding and personalized interactions. Enterprises increasingly integrate these AI platforms with core business systems to proactively identify customer issues, optimize service quality, and drive innovation.

For instance, in February 2025, SupportLogic, a U.S. based software company, launched its Cognitive AI Cloud, an AI-native platform designed to enhance enterprise customer support. The solution introduces autonomous and context-aware AI agents capable of streamlining workflows, reducing response times, and improving overall service quality.

According to index.dev, AI adoption is accelerating rapidly, with 78% of organizations already using AI and 85% deploying AI agents in at least one workflow. The market has shown strong momentum, growing from USD 3.7 billion in 2023 to USD 7.38 billion in 2025, and is expected to exceed USD 100 billion by 2032, highlighting its massive economic potential and the increasing reliance on AI-driven automation across industries.

The reasons for adopting cognitive agents include their capacity to enhance service quality through intelligent automation, reduce human error, and enable real-time, context-aware decision-making. Companies benefit from improved efficiency and customer experience, while also gaining a competitive edge by deploying AI that can continuously learn and adapt.

Key Insight Summary

- By Technology, the Machine Learning (ML) segment led with a 32.2% share, highlighting its role in enabling adaptive decision-making and natural language understanding.

- By Agent System, Single Agent Systems dominated with a 64.1% share, reflecting their efficiency in handling focused and targeted enterprise tasks.

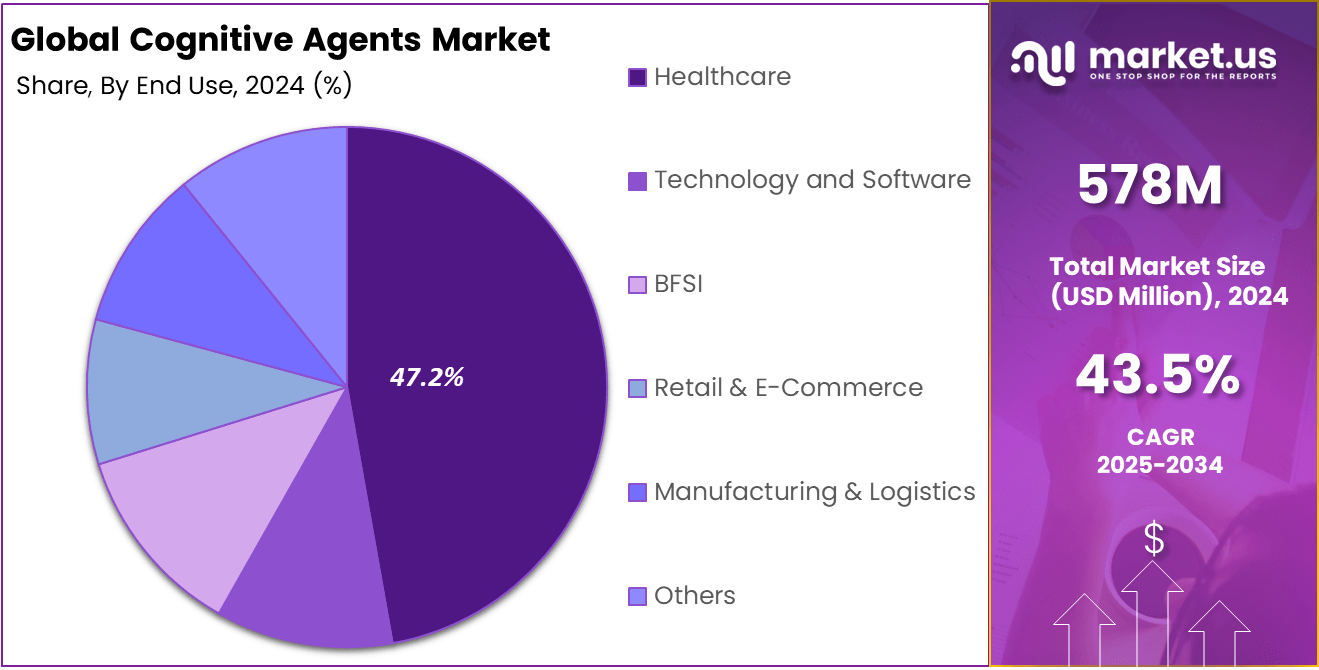

- By End Use, the Healthcare segment was the largest, capturing a 47.2% share, driven by applications in patient support, diagnostics assistance, and healthcare automation.

Investment & Benefits

Investment opportunities are abundant in the development of multi-agent platforms, AI integration tools, and industry-specific cognitive solutions. With businesses recognizing the value of these systems, investors are funding startups and technology providers focusing on autonomous AI agents capable of managing dynamic workflows and delivering actionable insights.

Organizations like Cognizant and SupportLogic have contributed to accelerating innovation by releasing open-source tools and AI platforms. From a business viewpoint, cognitive agents help improve operational efficiency, reduce labor costs, and elevate customer engagement through personalized and automated interactions. They unlock new opportunities for process optimization and innovation, particularly in sectors demanding high levels of accuracy and compliance, such as healthcare and finance.

The regulatory environment is evolving to address the use of AI-driven cognitive agents, focusing on transparency, data privacy, and ethical concerns. Companies deploying these systems must ensure compliance with emerging standards and demonstrate responsible AI usage. Regulatory support combined with industry investments is facilitating wider acceptance and deeper integration of cognitive agents across business functions.

Role and Applications

Application Area Description Customer Support AI agents offer personalized, proactive customer service with real-time context awareness Decision Support Analyze complex data across systems for intelligent, autonomous decision-making Workflow Automation Automate complex tasks and streamline operations Multi-Agent Collaboration Networks of cognitive agents support adaptive and real-time multi-task problem-solving Industry-Specific Solutions Tailored AI agents for regulatory and operational needs in sectors like healthcare and finance Autonomous Systems Used in autonomous vehicles, robotics, and drones for navigation and task completion Economic Impact of Cognitive Agents

Impact Area Details Productivity Enhancement Cognitive agents improve efficiency in customer engagement, process automation, and decision-making Cost Savings Reduction of downtime, error rates, and manual interventions Innovation Catalyst Facilitates faster innovation cycles and operational adaptability Market Expansion Potential Strong growth across BFSI, healthcare, retail, and manufacturing Regional Analysis

In 2024, North America held a dominant market position in the AI-generated synthetic passenger data market, capturing more than 38.5% of global share and generating approximately USD 222.5 million in revenue. This regional leadership is underpinned by advanced aviation and transport infrastructures, widespread adoption of AI technologies among carriers and research institutions, and a strong regulatory environment that encourages data innovation while protecting privacy.

Industry players in North America have leveraged synthetic passenger data to model demand, test systems, and simulate operations without exposing real personal data. The convergence of experienced data science teams, robust investment in aviation analytics, and early recognition of synthetic data’s strategic value has enabled the region to outpace others in both scale and sophistication.

By Technology: ML (32.2%)

Machine Learning (ML) leads the Cognitive Agents Market by technology, holding the largest revenue share of 32.2% in 2024. ML algorithms enable cognitive agents to learn from data, adapt to new information, and improve decision-making over time. This technology is fundamental to enhancing agent performance in understanding user intent, personalizing responses, and automating complex tasks.

The prominence of ML reflects its essential role in driving the intelligence and autonomy of cognitive agents, making them more effective across industries and use cases, particularly in environments that demand continuous learning and adaptation.

By Agent System: Single Agent Systems (64.1%)

Single agent systems dominate the market with a 64.1% revenue share in 2024. These systems consist of one autonomous agent interacting with users or other systems to accomplish tasks or provide services. The preference for single agent systems stems from their relatively simpler architecture, ease of deployment, and broad applicability across customer service, virtual assistance, and automation scenarios.

Their dominance indicates that many organizations prioritize targeted, standalone cognitive agent solutions that efficiently address specific operational needs without the complexity of multi-agent coordination.

By End Use: Healthcare (47.2%)

The healthcare sector holds the dominant end-use revenue share of 47.2% in 2024, underscoring its extensive adoption of cognitive agents. These agents support healthcare providers by automating patient interactions, managing medical records, assisting in diagnostics, and providing personalized health advice.

The growing complexity of healthcare delivery, rising patient volumes, and the need for efficient, scalable solutions drive the strong demand for cognitive agents. Their ability to enhance patient care while reducing administrative burdens solidifies their critical role in healthcare technology innovation.

Emerging Trends

Trend Description Multi-Agent Systems Collaborative intelligent agents working synergistically for complex workflows Integration with AI Platforms Seamless embedding into enterprise AI ecosystems for scalability and interoperability Human-like Interactions Enhanced natural language understanding and contextual awareness Adaptive Learning Agents improving decision accuracy via reinforcement learning and experience-based adaptation Hybrid Architectures Combining symbolic AI and neural networks for handling structured and unstructured data Key Market Segments

-

By Technology

- Machine Learning (ML)

- Natural Language Processing

- Computer Vision

- Robotics Process Automation (RPA)

- Cognitive Computing

- Others

-

By Agent System

- Single Agent Systems

- Multi-Agent Systems

-

End Use

- Technology and Software

- Healthcare

- BFSI

- Retail & E-Commerce

- Manufacturing & Logistics

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Need for Enhanced Customer Experience and Automation

The cognitive agents market is driven primarily by businesses aiming to improve customer experience through faster, personalized, and consistent service. Cognitive agents help automate routine interactions, freeing human agents for more complex tasks, leading to greater operational efficiency.

The growing preference among consumers for instantaneous, 24/7 support, especially in sectors like retail, banking, and telecommunications, fuels demand. Companies are investing in cognitive agents to meet these expectations while controlling costs.

Restraint

Integration Challenges and High Initial Investment

Complex integration with existing IT systems remains a significant restraint for cognitive agent deployment. Organizations often face difficulties integrating cognitive agents into legacy software, CRM systems, and communication channels, potentially delaying implementation.

Additionally, the high upfront investment for technology, customization, and staff training can be a barrier particularly for small and medium-sized enterprises. These factors can limit broader market adoption and slow growth.

Opportunity

Growth in Healthcare and Financial Services Sectors

There is a growing opportunity for cognitive agents in specialized sectors such as healthcare and finance. In healthcare, cognitive agents assist with patient engagement, appointment scheduling, and providing personalized health advice.

In finance, they enhance services by automating customer inquiries, supporting fraud detection, and delivering financial recommendations. Tailored solutions that meet industry-specific regulatory and accuracy requirements can unlock significant value and differentiate providers in these markets.

Challenge

Data Security and Ethical Considerations

A key challenge involves ensuring data security and addressing ethical concerns. Cognitive agents process sensitive personal and business data, requiring strong encryption, secure access controls, and compliance with privacy regulations like GDPR.

Ethical AI deployment also involves mitigating biases in responses and ensuring transparency in decision-making. Addressing these issues is critical for maintaining user trust and achieving long-term success.

Competitive Analysis

In the Cognitive Agents Market, Accenture, Amazon Web Services, and Blue Yonder have established strong positions by integrating advanced AI into enterprise solutions. Accenture focuses on consulting-led implementations, helping organizations adopt cognitive agents for business transformation. Amazon Web Services offers scalable cloud-based AI services that enhance automation and customer engagement.

Cognigy, Cognizant, and Google are strengthening the market with advanced conversational platforms and AI-driven services. Cognigy delivers enterprise-grade conversational AI, enabling businesses to manage large-scale customer interactions efficiently. Cognizant applies its IT services expertise to integrate cognitive agents across industries, focusing on customer experience and operational agility.

IBM, Microsoft, Nuance Communications, and SAS Institute remain key leaders by combining deep AI expertise with enterprise trust. IBM advances its cognitive solutions through automation and AI-driven analytics. Microsoft integrates cognitive services within its cloud ecosystem, making AI accessible for organizations worldwide.

Top Key Players in the Market

- Accenture plc

- Amazon Web Services, Inc.

- Blue Yonder Group, Inc.

- Cognigy GmbH

- Cognizant Technology Solutions Corporation

- Google LLC

- IBM Corporation

- Microsoft

- Nuance Communications, Inc.

- SAS Institute Inc.

Recent Developments

- In June 2025, IBM launched a new software that unifies AI agent governance and security by combining watsonx.governance with Guardium AI Security. The solution offers enterprises a clear view of risk and compliance through lifecycle monitoring, automated red teaming, and global compliance frameworks, helping organizations scale AI in a secure and responsible way.

- In May 2025, Microsoft outlined its vision for enterprise-wide AI agents, introducing advancements such as GitHub Copilot upgrades, NLWeb, Grok models on Azure, Agent Factory, Phi-4-mini, and Entra Agent ID. These initiatives aim to create autonomous and interconnected AI operations across platforms, establishing AI agents as a core layer of enterprise infrastructure for collaboration, scalability, and context-driven actions.

- In January 2025, Accenture unveiled its AI Refinery for Industry, featuring 12 sector-specific AI agent solutions. Built on NVIDIA AI Enterprise software, the platform is designed to optimize workflows, boost workforce efficiency, and improve decision-making. By allowing customization with organizational data, it helps businesses deploy AI agents faster and achieve measurable value across industries.

Report Scope

Report Features Description Market Value (2024) USD 578 Mn Forecast Revenue (2034) USD 21,401 Mn CAGR(2025-2034) 43.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Technology (Machine Learning (ML), Natural Language Processing, Computer Vision, Robotics Process Automation (RPA), Cognitive Computing, Others), By Agent System (Single Agent Systems, Multi-Agent Systems), By End Use (Technology and Software, Healthcare, BFSI, Retail & E-Commerce, Manufacturing & Logistics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture plc, Amazon Web Services, Inc., Blue Yonder Group, Inc., Cognigy GmbH, Cognizant Technology Solutions Corporation, Google LLC, IBM Corporation, Microsoft, Nuance Communications, Inc., SAS Institute Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Accenture plc

- Amazon Web Services, Inc.

- Blue Yonder Group, Inc.

- Cognigy GmbH

- Cognizant Technology Solutions Corporation

- Google LLC

- IBM Corporation

- Microsoft

- Nuance Communications, Inc.

- SAS Institute Inc.