Global Cochlear Implant Market By Type (Unilateral Implants and Bilateral Implants), By Patient (Adult, Pediatric), By End-User (Hospitals, ENT Clinics, Ambulatory Surgical Centers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 105985

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

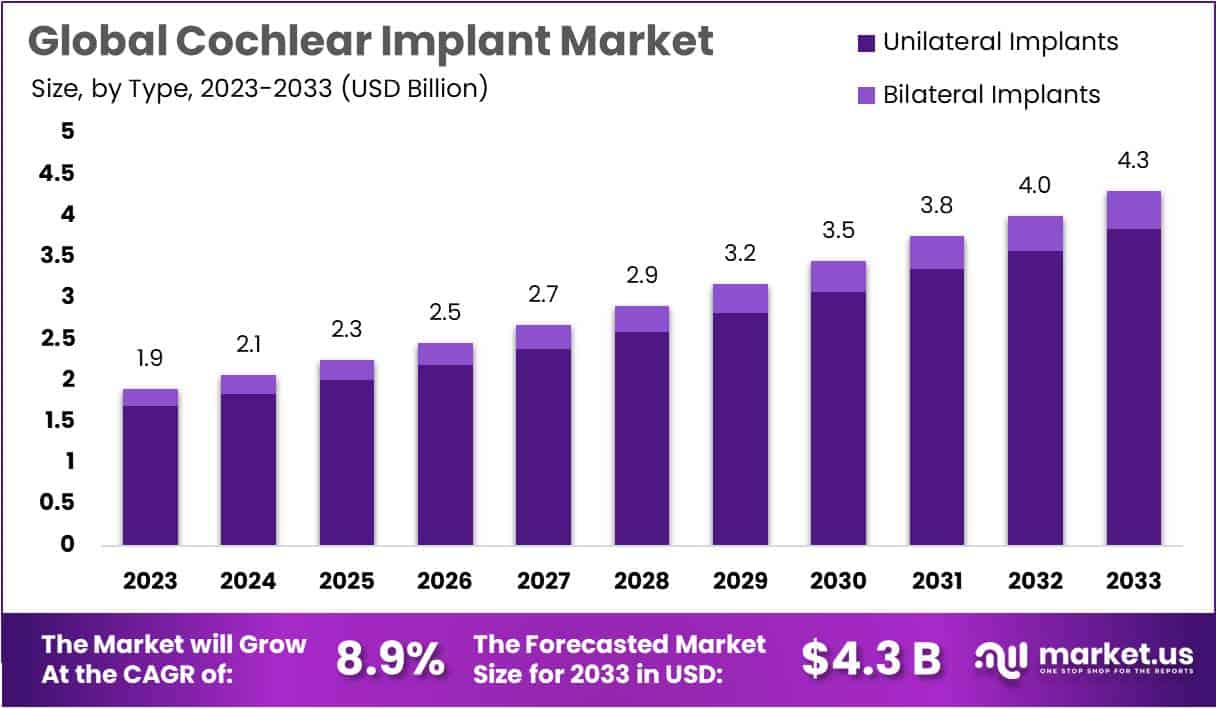

The Global Cochlear Implant Market size is expected to be worth around USD 4.3 Billion by 2033, from USD 1.9 Billion in 2023, growing at a CAGR of 8.9% during the forecast period from 2024 to 2033.

Cochlear implants are electronic devices designed to enhance hearing. These devices can be a great choice for people with severe inner-ear hearing loss who cannot hear as well as act as an alternative for those with hearing aids. Unlike hearing aids, (which increase the volume of sound), cochlear implants work by bypassing damaged parts of the ear and sending sound signals directly to the auditory nerve. In cochlear implants, a sound processor to capture sound signals is installed behind the ear.

These signals are then transmitted by the processor to a receiver, which is implanted under the skin behind the ear. This receiver transmits the signals to an electrode implanted in the inner ear, known as the cochlea. These signals trigger the auditory nerve to send them to the brain, where the brain interprets them as sounds, although these sounds will not be identical to natural hearing. The decoding of cochlear implants requires a significant amount of practice and instruction. Generally, within 3 to 6 months after implantation, most individuals experience significant improvements in speech comprehension.

Key Takeaways

- Market size to reach USD 4.3 Billion by 2033, growing at 8.9% CAGR from 2024.

- Unilateral implants hold 89.2% market share, driven by reimbursement ease and lower cost.

- Bilateral implants segment to grow at 9.9% CAGR, offering social communication benefits.

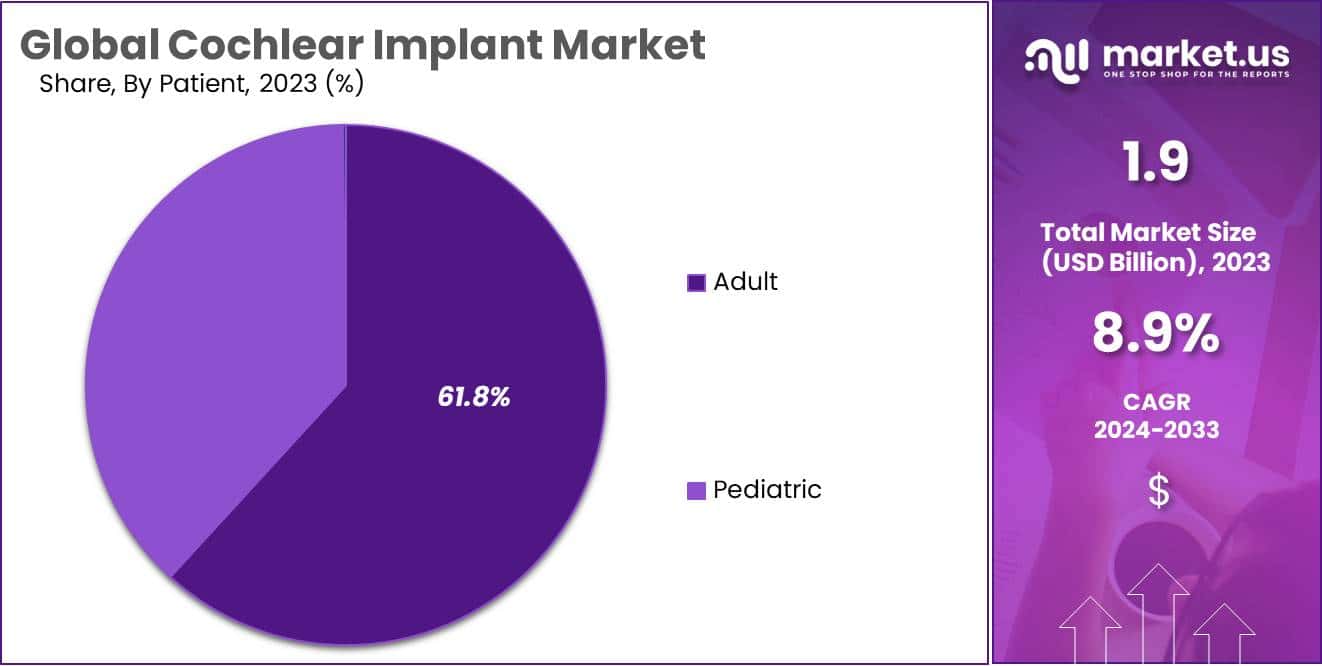

- Adult segment holds 61.8% market share; pediatric segment to grow at 9.4% CAGR.

- Hospitals dominate with 47.7% market share, providing implantation surgeries and care.

- Technological advancements drive growth; prevalence of hearing loss fuels demand.

- High cost and maintenance pose significant restraints to market growth.

- Government initiatives, like India’s ADIP program, present growth opportunities.

- Increased awareness observed globally; over 60,000 individuals benefit from cochlear implants.

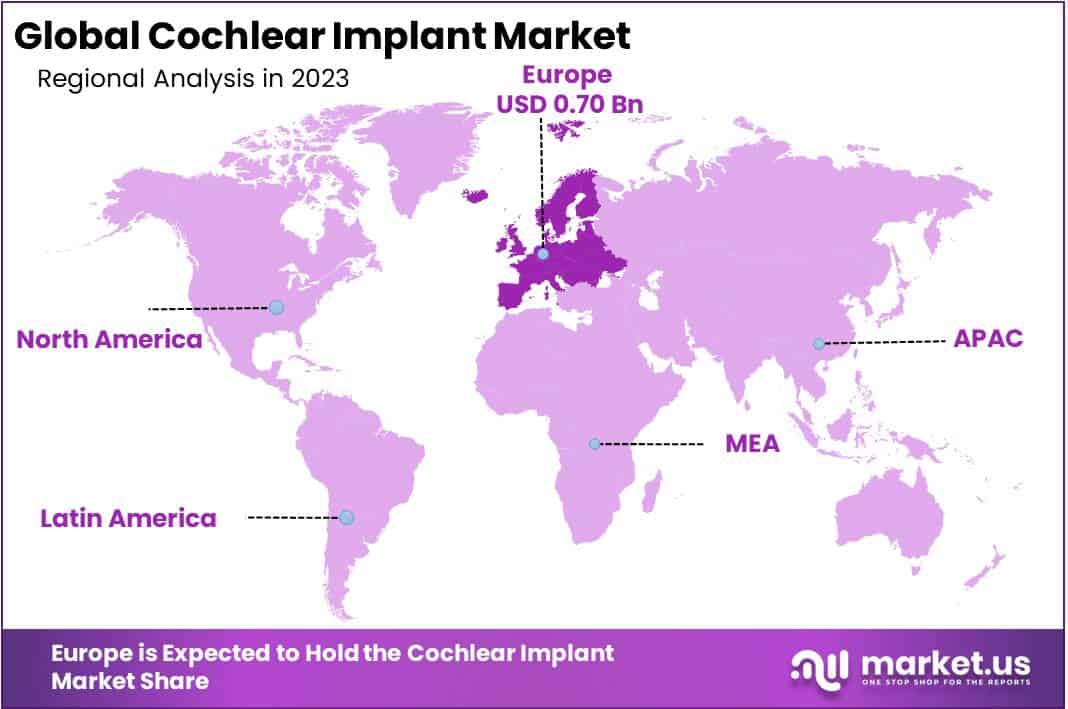

- Europe leads with 37.2% market share; Asia Pacific to witness fastest CAGR of 9.7%.

Type Analysis

Unilateral Implants Accounted for The Largest Market Share Due to High Demand for the devices.

The market is divided into bilateral implants and unilateral implants on the basis of the type of fitting. In 2023, the unilateral implant was the largest market segment holding 89.2% share. The growth of the unilateral implants segment can be attributed to high demand for these devices due to the ease of reimbursement, lower cost of the devices in comparison to bilateral implants, the shorter duration of the surgery, and the low requirement for anesthesia.

The bilateral implants segment is anticipated to rise at a CAGR of 9.9% over the forecast period. Bilateral implants are likely to provide more overall benefits, enabling children and adults to communicate better in social situations. Furthermore, the devices’ ability to detect speech in noise is also contributing to the segment’s growth.

Patient Type Analysis

The market for cochlear implants has been divided into two segments based on patient type: pediatric and adult. In 2023, the adult segment accounted for the largest market share of 61.8%. According to NIH data, around 2% of adults between the ages of 43 and 52 years have a disabling hearing loss. This number goes up to 8.5% for adults between 55 and 64 years, and to almost 25% for adults between 65 and 74 years, and 50% for people aged 75 years and older.

The pediatric segment is projected to experience a significant growth, with a CAGR of 9.4%. As per the National Institute of Deafness and other Communication Disorders (NIDCD), in the US, approximately 2 to 3% out of every 1000 children experience detectable hearing loss.

About 1 in every 1000 live births are affected by Sensorineural Unilateral Hearing Loss (UHL) in the US. In 2019, the US FDA granted the approval of cochlear implants in children aged 5 years or older with single-sided deafness (SSD) in the US, which is expected to be a major driving factor for the pediatric segment growth.

End-User Analysis

Hospitals accounted for 47.7% of the global market based on end-user in 2023. Hospitals play an important role by providing implantation surgeries and continuing care. Some of the reasons are:

Surgical procedures

Hospitals perform implantation procedures using cochlear devices. Implantation procedures are performed by specialists, surgeons or doctors using advanced implantation methods and procedures.

Follow-up care

Patients who have had implantation surgeries need to have regular checkups. The hospitals have clinical and specialized departments that take care of the patients and keep up with the checkups.

Medical expertise

Hospitals have multi-disciplinary teams that take care of patients, like otolaryngology, speech-language pathology, and audiology. These professionals are responsible for directing and rehabilitating procedures to improve patient needs.

Key Market Segments

By Type

- Unilateral Implants

- Bilateral Implants

By Patient

- Adult

- Pediatric

By End-User

- Hospitals

- ENT clinics

- Ambulatory Surgical Centers

Drivers

Technological Advancement in Cochlear Implants Surge the Market

Cochlear implants have become increasingly popular due to advances in technology that have made them more effective and easier to use. These improvements include enhanced sound quality, wireless connection, and smaller sizes. By incorporating cutting-edge technology into existing products, the appeal of cochlear implants has increased among people with hearing loss.

- In 2022, one of the key players, Cochlear Limited, received FDA clearance for its new Nucleus™ 8 Sound Processor. It is one of the smallest, lightest, and most compact behind-the-ear cochlear implants sound processor in the market.

Increasing Prevalence of Hearing Loss

Due to the rising prevalence of hearing loss, especially among the aging population the market for cochlear implants is rising. According to WHO, More than one billion individuals aged between 12 and 35 years are at risk of developing deafening due to excessive and long-term exposure to loud musical instruments and other recreational sound. According to WHO, age increases the incidence of hearing loss, with more than 25% of individuals over the age of 60 years suffering from disabling hearing loss.

Restraints

High Cost of the Device and Maintenance is hampering the growth of the market

The high cost of cochlear implants and t heir maintenance is a significant restraint for the market. The cost of cochlear implants can be a barrier for patients who require them, particularly in low- and developing countries. The implementation of a cochlear implant (CI) involves a surgical procedure and is associated with considerable expenses for the patient throughout their life. In addition, rehabilitation must be continued for a considerable period of time, particularly for children, which comes as an additional cost.

Risk of Injuries in Surgery

Another limiting factor for the market is the risk of injury during the surgical procedure to implant a cochlear implant. The procedure involves placing an electrode array inside the inner ear which can damage the ear or the surrounding tissues. For instance, the facial nerve is located in the middle ear and is responsible for providing movement to the facial muscles. The facial nerve is located so close to the surgical site, which can lead to risky procedure.

Opportunity

Government Initiatives and Support contributing to the market growth

Various government initiatives are supporting research in the field of cochlear implantation, which is contributing to market growth. For instance, cochlear implants through ADIP is a program of the Government of India’s Ministry of Social Justice & Empowerment. The aim of this program is to provide rehabilitation to children, implanted with such devices, who suffer from severe to profound hearing impairment and belong to economically weaker sections of society.

Trends

Increased Awareness

Cochlear implants have been utilized by over 60,000 individuals around the world to re-establish functional hearing. Despite the high variability in individual performance, the average cochlear implant user is able to converse on the telephone in quiet environment. Cochlear implants are subject to a wide range of clinical, audiological, engineering, anatomical, and physiological considerations, with a particular focus on their psychophysical properties, speech, musical accompaniment, and cognitive performance.

Regional Analysis

Europe Dominated the Global Cochlear Implant Market with Significant Shares

Europe held the largest market share, with 37.2% in cochlear implant in 2023, and holds USD 0.70 Billion market value for the year. The market in the region experienced growth in recent years due to the increasing recognition of hearing aids, the availability of speech therapy clinics, and the availability of favorable reimbursement policies.

Technological advancements and the establishment of new facilities within the European Union have also contributed to the growth of the market. For example, in March 2020 Med-EL Medical Electronics became the first manufacturer of cochlear implants to be certified with the European Medical Device Regulation (MDR).

However, Asia Pacific is anticipated to experience fastest CAGR of 9.7% throughout the forecast period. This can be attributable to the fast-growing elderly population and high patient awareness of hearing implants. For instance, the Ministry of Social Justice & Empowerment of the Government of India grants INR 6 lacs per child for a cochlear implant.

Key Regions

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global cochlear implant market is saturated with a few major players dominating the market. Cochlear Ltd. Is one of the key companies of implantable hearing devices with significant market share. Some of the major player in the market includes Cochlear Ltd., Sonova, MED-EL Medical Electronics, Widex A/S, Zhejiang Nurotron Biotechnology Co., Ltd, and others.

Market Key Players

The following are some of the major players in the industry

- Cochlear Ltd.

- Sonova

- MED-EL Medical Electronics

- Widex A/S

- Zhejiang Nurotron Biotechnology Co., Ltd

- Advanced Bionics AG

- Demant A/s

- Oticon Medical

- GAES

- Other Key Players

Recent Development

- In January 2024, Widex A/S unveiled the MOMENT hearing aid series. This new series features an upgraded chipset and improved sound processing algorithms, with a specific focus on delivering a more natural and immersive hearing experience for individuals with mild to moderate hearing loss.

- In December 2023, Cochlear Ltd. entered into a collaboration with the University of Melbourne. The partnership focuses on developing a new generation of cochlear implants that leverage AI and machine learning technologies to personalize sound processing for individual users. The ultimate goal is to enhance speech perception capabilities for a more effective hearing solution.

- In November 2023, MED-EL Medical Electronics introduced the SONNET 2 cochlear implant system. The new system boasts a sleeker and lighter sound processor, along with enhanced connectivity and longer battery life. This launch is aimed at providing users with a more comfortable and discreet hearing experience.

- In October 2023, Sonova made a significant move by acquiring Atos Medical, a Swiss company specializing in middle ear implants, for CHF 700 million. This strategic acquisition not only expands Sonova’s presence in the hearing loss treatment market but also strengthens its position in the rapidly growing middle ear implant segment.

Report Scope

Report Features Description Market Value (2023) USD 1.7 Billion Forecast Revenue (2033) USD 3.8 Billion CAGR (2024-2033) 8.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Unilateral Implants and Bilateral Implants), By Patient (Adult, Pediatric), By End-User (Hospitals, ENT Clinics, Ambulatory Surgical Centers) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherland, Rest of Europe; APAC– China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cochlear Ltd., Sonova, MED-EL Medical Electronics, Widex A/S, Zhejiang Nurotron Biotechnology Co., Ltd, Advanced Bionics AG, Demant A/s, Oticon Medical, GAES., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Cochlear Implant market in 2023?The Cochlear Implant market size is USD 1.9 Billion in 2023.

What is the projected CAGR at which the Cochlear Implant market is expected to grow at?The Cochlear Implant market is expected to grow at a CAGR of 8.9% (2024-2033).

List the segments encompassed in this report on the Cochlear Implant market?Market.US has segmented the Cochlear Implant market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Unilateral Implants and Bilateral Implants. By Patient the market has been segmented into Adult, Pediatric. By End-User the market has been segmented into Hospitals, ENT Clinics, Ambulatory Surgical Centers.

List the key industry players of the Cochlear Implant market?Cochlear Ltd., Sonova, MED-EL Medical Electronics, Widex A/S, Zhejiang Nurotron Biotechnology Co. Ltd, Advanced Bionics AG, Demant A/s, Oticon Medical, GAES, Other Key Players

Which region is more appealing for vendors employed in the Cochlear Implant market?Europe is expected to account for the highest revenue share of 37.2% and boasting an impressive market value of USD 0.70 Billion. Therefore, the Cochlear Implant industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Cochlear Implant?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Cochlear Implant Market.

-

-

- Cochlear Ltd.

- Sonova

- MED-EL Medical Electronics

- Widex A/S

- Zhejiang Nurotron Biotechnology Co., Ltd

- Advanced Bionics AG

- Demant A/s

- Oticon Medical

- GAES

- Other Key Players