Global Coaxial Multi-rotor Drones Market Size, Share, Growth Analysis By Type (x8 Coaxial Quad, x12 Coaxial Hex, x16 Coaxial Octo), By Application (Photography, Surveying and Mapping, Firefighting, Logistics, Others), By End Use (Consumer-grade, Professional-grade), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169515

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

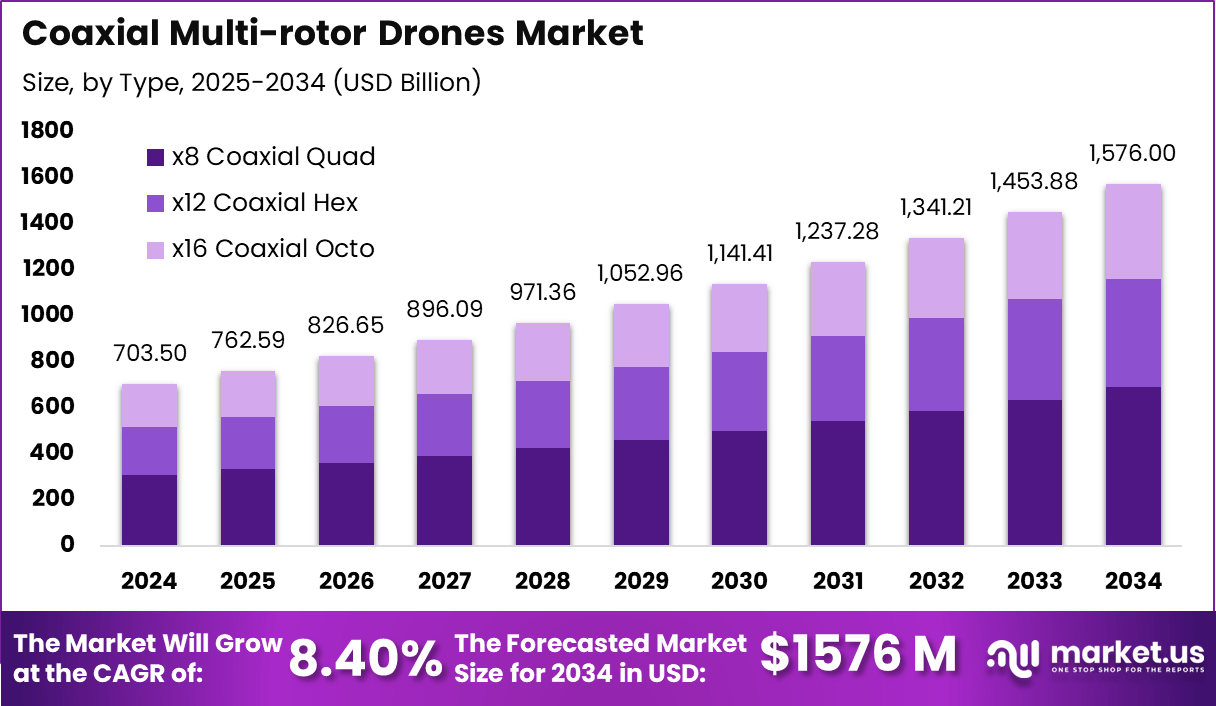

The Coaxial Multi-rotor Drones Market is expected to expand steadily, increasing from USD 703.5 million in 2024 to approximately USD 1576 million by 2034, supported by a CAGR of 8.40% during the forecast period. Growth is driven by rising demand for stable, high-lift drone platforms used in defense, industrial inspections, logistics, and advanced aerial imaging. Coaxial configurations enhance thrust efficiency, payload capacity, and maneuverability, making them suitable for complex environmental, commercial, and tactical applications.

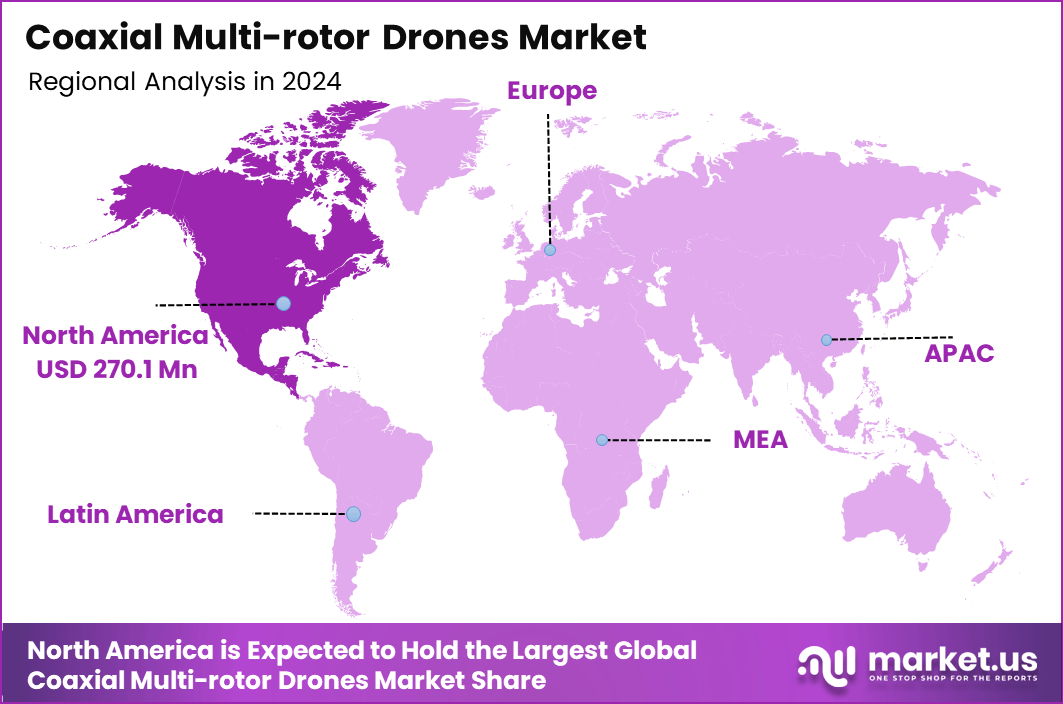

North America holds a significant share of 38.4%, reaching a market size of USD 270.1 million in 2024, fueled by strong adoption across security agencies, agricultural monitoring, and enterprise-based drone operations. The region benefits from mature regulatory frameworks, expanding commercial drone corridors, and increasing investments in autonomous aerial systems.

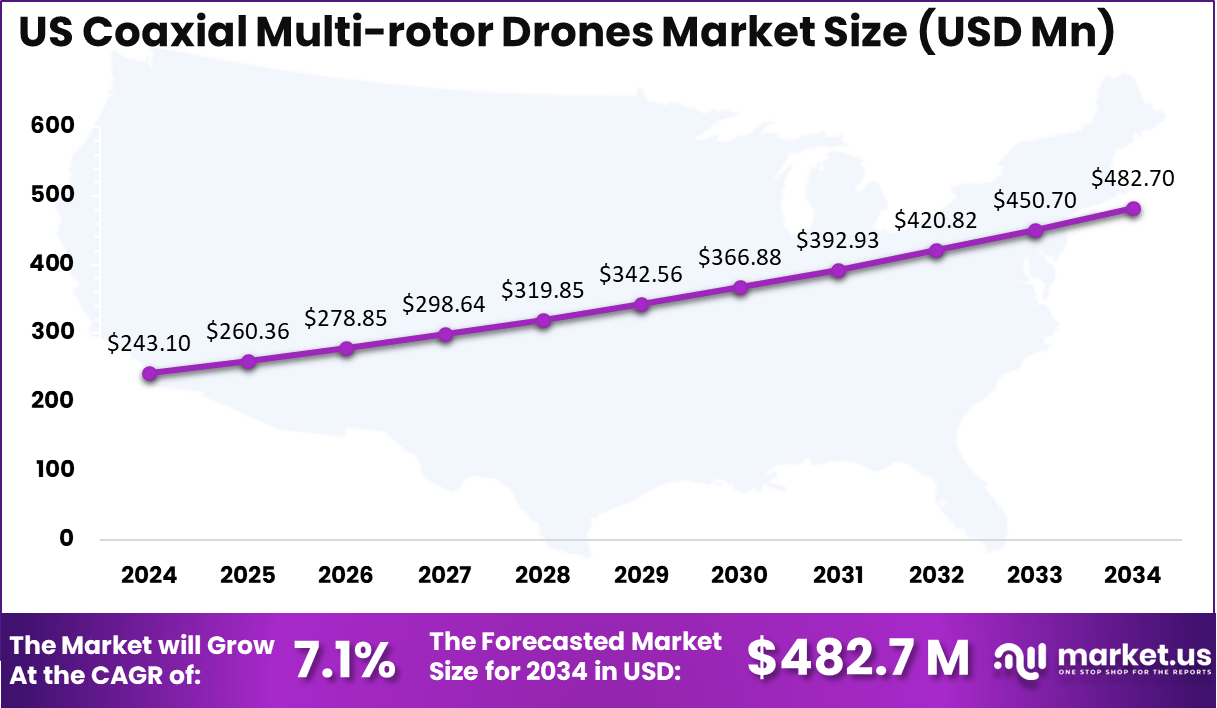

The US remains the core contributor, valued at USD 243.1 million in 2024 and projected to reach USD 482.7 million by 2034, growing at a CAGR of 7.1%. Demand strengthens as industries integrate coaxial drones for real-time data acquisition, emergency response, precision mapping, and high-efficiency airborne tasks. This positions the market for long-term technological advancement and wider operational deployment over the next decade.

The Coaxial Multi-rotor Drones Market is advancing rapidly as industries shift toward aerial systems that deliver higher performance and operational reliability. Coaxial configurations enhance thrust output by nearly 20–30% compared to conventional multi-rotor setups, making them ideal for missions requiring stability and heavy payload capability. Many modern coaxial drones now support payload capacities above 10–15 kg, enabling integration of thermal cameras, LiDAR, multispectral sensors, and logistics modules.

Flight endurance is also improving, with several commercial platforms achieving 35–55 minutes of continuous operation, supported by efficient power distribution across dual-rotor stacks. These capabilities significantly boost adoption in surveillance, infrastructure inspection, mapping, emergency response, and agricultural monitoring. In addition, coaxial systems reduce rotor footprint by nearly 25%, allowing safer maneuvering in confined industrial spaces.

Government agencies and enterprises are accelerating UAV integration, with global drone usage increasing by over 40% in critical sectors such as utilities, construction, and public safety. The US alone records more than 870,000 registered drones, reflecting strong acceptance of advanced aerial platforms.

As organizations demand drones with higher stability, increased lift performance, and improved redundancy, coaxial multi-rotor models continue gaining market preference, positioning the segment for sustained technological and operational expansion.

In recent funding news, UK-based Certo Aerospace secured £3 million in April 2025 to fast-track flight trials of its CAPSTONE large VTOL drone—a coaxial multi-rotor design aimed at defense and aid missions—building on over $5 million from the U.S. Department of Defense. This infusion highlights investor enthusiasm for long-range, multi-role platforms amid rising defense tailwinds and autonomous tech trends.

Although specific mergers or acquisitions remain limited in public reports, industry observers note increasing collaborations, such as those between startups and film studios for aerial cinematography, alongside regulatory shifts favoring redundant power systems to speed certifications.

New product developments emphasize lightweight materials, extended battery life, and modular sensors, with six- and eight-rotor configurations gaining traction for high-payload tasks like infrastructure checks.

No major product launches were detailed in 2025 announcements, but ongoing R&D by firms like Lanzhong Technology and Tyto Robotics promises turnkey solutions for industrial users, potentially cutting downtime and boosting efficiency across agriculture and construction. Overall, these dynamics signal a maturing market poised for double-digit expansion in specialized niches.

Industrial coaxial drones with payload capacities exceeding 15 kg are projected to represent approximately 30% of volumetric shipments by 2026, reflecting rising adoption. Additionally, startups in the space have collectively secured over USD 120 million in funding rounds during 2025, fueling advancements in AI navigation and modular sensor systems.

In terms of operational features, new drones boast multiple independent power sources for flight safety redundancy, a key point in commercial certifications, while some models combine six to eight rotors to optimize payload and stability.

Notably, hybrid power prototypes integrating electric and fuel cell systems to extend operational endurance were showcased at several industry events in 2025. These numbers illustrate the rapid technological and financial momentum propelling the coaxial multi-rotor drone ecosystem.

Key Takeaways

- The Coaxial Multi-rotor Drones Market is valued at USD 703.5 million in 2024 and is projected to reach USD 1576 million by 2034, reflecting a CAGR of 8.40%.

- North America accounts for a 38.4% regional share, with a 2024 market size of USD 270.1 million.

- The US market stands at USD 243.1 million in 2024 and is expected to reach USD 482.7 million by 2034, growing at a 7.1% CAGR.

- By Type, x8 Coaxial Quad dominates the segment with a 43.8% share.

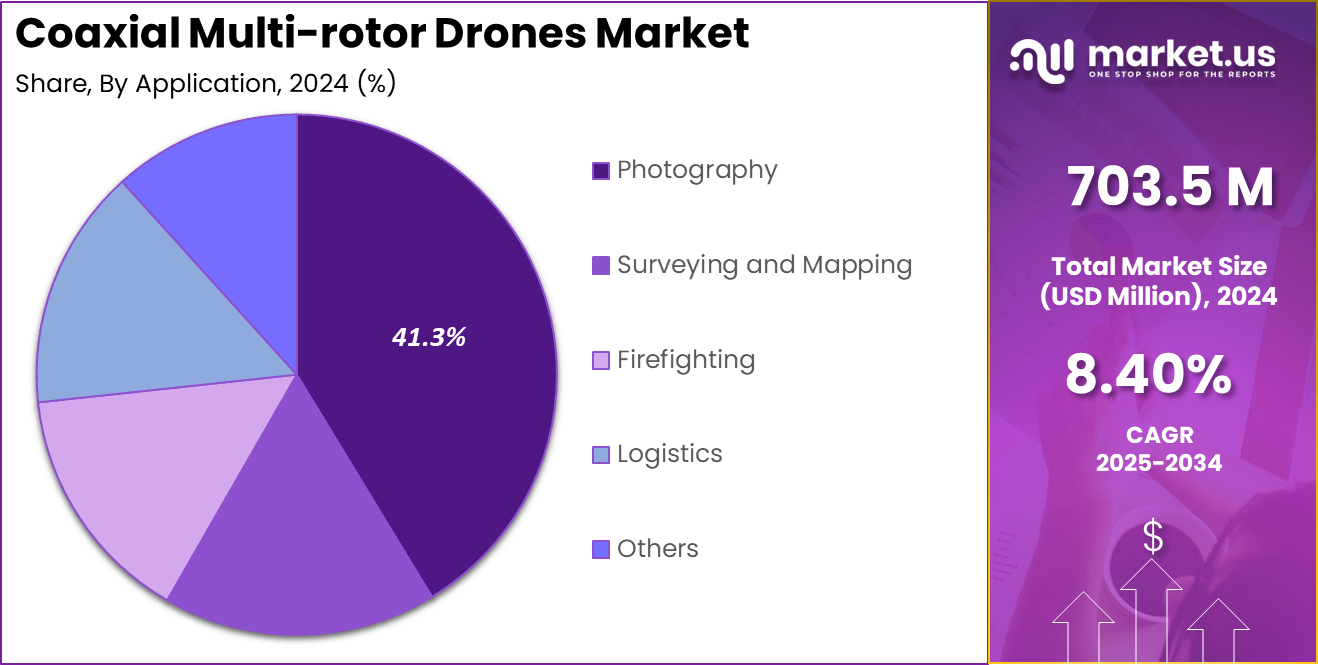

- By Application, Photography leads the market with a 41.3% share.

- By End Use, Professional-grade drones represent the largest segment with a 68.4% share.

Role of Drones

Drones are becoming essential tools across industries due to their ability to capture high-resolution data, automate workflows, and improve operational safety. More than 70% of global enterprises now integrate drones for tasks such as surveillance, inspections, mapping, and environmental monitoring.

Their capability to reduce field operation time by 50–60% significantly enhances productivity in sectors like construction, energy, and agriculture. Modern UAVs equipped with LiDAR, thermal imaging, and multispectral sensors generate precise analytics, enabling better decision-making and faster response in mission-critical operations.

In public safety, drones assist over 1,500 emergency departments worldwide, providing real-time situational awareness during search-and-rescue, disaster management, and incident assessment. In agriculture, drone-based crop monitoring increases efficiency by nearly 30%, helping farmers analyze crop health and optimize resource use. Logistics applications are also expanding, with drone delivery trials showing potential to cut delivery times by 40% for short-distance routes.

As regulatory frameworks evolve and autonomous navigation improves, drone usage is expected to rise sharply. With global UAV adoption projected to grow more than 15% annually, drones are transitioning from niche tools to mainstream assets, shaping the future of data-driven, automated operations across multiple industries.

Drone Industry Adoption

Drone adoption is accelerating worldwide as organizations recognize the efficiency, safety, and cost benefits of unmanned aerial systems. More than 4.5 million commercial drones are currently in global operation, and industry adoption has increased by over 35% in the past three years.

Sectors such as construction, utilities, agriculture, and logistics have integrated drones into routine workflows, with productivity gains often exceeding 50% on inspection and surveying tasks. Companies report operational cost savings of 20–30% when shifting from manual fieldwork to drone-enabled automation.

In infrastructure monitoring, drones now perform more than 60% of bridge and tower inspections across major economies, reducing human risk and improving data accuracy. Agriculture remains one of the fastest-growing adopters, with over 70 countries deploying UAVs for crop analytics, irrigation planning, and yield prediction. Emergency services have also embraced drone technology, with drone-assisted response times improving by up to 80% during critical incidents.

Regulatory approvals for commercial UAV flights have increased by 25% annually, reflecting higher acceptance and clearer operational standards. As investments in AI, BVLOS (Beyond Visual Line of Sight) operations, and autonomous fleet management expand, drone adoption is expected to grow further, positioning the technology as a core component of digital transformation across global industries.

Emerging Trends

The drone industry is undergoing rapid transformation as new technologies and operational models reshape its capabilities. One of the strongest trends is the rise of autonomous flight systems, with AI-driven navigation enabling drones to complete missions with minimal human intervention, improving efficiency by nearly 40%. BVLOS (Beyond Visual Line of Sight) approvals are also accelerating, allowing drones to cover longer distances for logistics, infrastructure monitoring, and environmental mapping.

Another major trend is the integration of advanced sensors, including LiDAR, hyperspectral imaging, and thermal modules, which enhance data precision for industries such as mining, agriculture, and defense. These sensors have increased data collection accuracy by up to 60%, making drones indispensable for analytics-driven operations. Swarm drone technology is also gaining momentum, with coordinated fleet deployment improving coverage and reducing mission time by 30–50%.

In the commercial ecosystem, drone deliveries are advancing rapidly, supported by pilot programs that show reductions of 40% in last-mile delivery times. Additionally, drones are increasingly aligned with sustainability goals, helping reduce carbon emissions by replacing fuel-based inspection and transportation methods.

As regulations evolve and digital infrastructure strengthens, these emerging trends are expected to accelerate, positioning drones as critical enablers of automation, data intelligence, and operational innovation across global markets.

US Market Size

The US market for coaxial multi-rotor drones is expanding steadily, driven by rising adoption across defense, commercial, and industrial sectors. The market stands at USD 243.1 million in 2024 and is projected to reach USD 482.7 million by 2034, supported by a 7.1% CAGR. Growth accelerates as industries integrate drones for high-precision imaging, infrastructure inspection, logistics, and emergency response, where coaxial configurations offer enhanced stability, higher lift performance, and improved redundancy.

Federal and state-level initiatives promoting advanced UAV operations, including expanded drone corridors and BVLOS testing programs, are accelerating commercial deployment. The US also leads in enterprise-based drone adoption, with sectors such as utilities, oil and gas, and construction increasingly shifting to aerial automation. These integrations reduce field inspection time by nearly 50%, improving operational efficiency and safety outcomes.

Demand is further strengthened by the surge in AI-powered flight systems, enabling autonomous data capture for mapping, surveillance, and asset monitoring. The growing use of LiDAR-equipped drones, thermal cameras, and multispectral sensors continues to expand application diversity. As regulatory frameworks mature and enterprises scale their UAV fleets, the US market is positioned for sustained growth, driven by technology innovation and expanding real-world use cases across high-value industries.

By Type Analysis

The x8 Coaxial Quad segment holds a dominant share of 43.8%, driven by its balance of power, stability, and compact design. This configuration is widely adopted in aerial photography, inspection services, and commercial operations due to its ability to generate high thrust while maintaining a smaller footprint.

Its dual-rotor coaxial structure enhances lift by nearly 25–30%, making it suitable for missions that demand reliable performance in varying wind conditions. As payload demand increases across industries, the x8 platform remains the preferred choice for users seeking efficiency without added structural complexity.

The X12 Coaxial Hex segment is gaining traction as industries adopt multi-rotor systems capable of supporting heavier sensors and more advanced imaging payloads. Its extended rotor configuration improves flight redundancy and endurance, making it a strong fit for surveying, mapping, and mid-range logistics operations. Adoption continues to rise as enterprises deploy drones with enhanced stability for data-intensive tasks.

The x16 Coaxial Octo segment caters to high-end professional and industrial applications requiring maximum lift, safety, and redundancy. This platform supports heavier payloads, advanced LiDAR units, and multi-sensor arrays, achieving superior stability in challenging environments. Its expanding use in defense, emergency response, and infrastructure inspection positions it as a growing segment with strong long-term potential.

By Application

The Photography segment leads the market with a 41.3% share, driven by increasing demand for high-quality aerial visuals across media, real estate, tourism, and commercial content production. Coaxial multi-rotor drones offer exceptional stability and smoother flight dynamics, enabling sharper image capture and consistent performance even in wind-sensitive environments.

Their ability to carry heavier camera payloads, including 8K, thermal, and multispectral sensors, further strengthens adoption. As content creation grows globally and industries rely more on aerial imaging for marketing, documentation, and surveillance, photography continues to dominate application usage.

Surveying and Mapping represent a rapidly expanding segment as enterprises adopt drones for precision measurements in construction, mining, agriculture, and infrastructure planning. Coaxial configurations support high-accuracy LiDAR and photogrammetry modules, allowing operators to generate detailed terrain models and inspection data with reduced field effort. The segment benefits from growing demand for time-efficient, cost-effective geospatial intelligence.

Firefighting applications are also increasing as drones assist emergency teams with thermal imaging, search-and-rescue support, and real-time situational awareness. Their ability to navigate smoke-dense zones and relay live data improves response effectiveness.

Logistics adoption is rising with the push toward automated deliveries and last-mile transport trials. Coaxial drones’ high lift capability enables efficient short-range payload movement. The Others category includes environmental monitoring, wildlife tracking, and infrastructure security, reflecting the continued diversification of drone utility.

By End Use

The Professional-grade segment dominates the market with a substantial 68.4% share, reflecting strong adoption across industrial, commercial, and governmental applications. These drones offer higher payload capacity, extended endurance, advanced navigation systems, and enhanced stability, making them essential for professional workflows such as inspection, mapping, surveillance, filmmaking, and public safety operations.

Their ability to integrate LiDAR, multispectral sensors, high-resolution cameras, and thermal imaging modules positions them as a preferred choice for data-intensive missions. Industries increasingly rely on these platforms to reduce field time by up to 50%, improve accuracy, and enhance operational safety, reinforcing the segment’s leadership.

The Consumer-grade segment continues to grow steadily as recreational flying, hobby photography, and personal videography gain popularity. These drones appeal to users seeking lightweight, easy-to-fly systems with automated features such as obstacle detection, follow-me modes, and stabilized imaging.

While they carry lower payloads and have shorter flight durations than professional models, advancements in compact sensors and AI-assisted controls are improving performance. Consumer adoption is also driven by declining prices and wider availability through retail channels. Although the segment remains smaller, it supports market expansion by introducing new users to drone technology and fostering broader awareness of UAV capabilities.

Key Market Segments

By Type

- x8 Coaxial Quad

- x12 Coaxial Hex

- x16 Coaxial Octo

By Application

- Photography

- Surveying and Mapping

- Firefighting

- Logistics

- Others

By End Use

- Consumer-grade

- Professional-grade

Regional Analysis

North America accounts for a significant 38.4% share of the coaxial multi-rotor drones market, underscoring its position as the leading regional contributor. The region’s market size reached USD 270.1 million in 2024, supported by strong adoption across defense agencies, law enforcement, industrial inspection services, and enterprise-level imaging operations. Demand continues to accelerate as organizations prioritize advanced UAV technologies for automation, data intelligence, and field efficiency.

The US drives most of the regional growth due to its expanding programs in aerial surveillance, emergency response, infrastructure monitoring, and environmental assessment. High investment in UAV research, AI-driven navigation, and BVLOS (Beyond Visual Line of Sight) testing corridors further strengthens the adoption of coaxial platforms, which offer enhanced lift, stability, and redundancy. Canada also contributes to market expansion through increasing drone usage in forestry, mining, and large-scale land surveying.

North America’s regulatory frameworks, such as FAA approvals, pilot certifications, and drone integration initiatives, provide a structured environment that accelerates commercial deployment. As industries transition toward autonomous aerial systems and data-rich applications, the region is expected to sustain strong demand. Continued investment in high-performance drone fleets positions North America as a long-term growth hub for coaxial multi-rotor technologies.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

Driving factors for the coaxial multi-rotor drones market include rising demand for high-stability aerial systems across industrial and commercial sectors. Coaxial configurations offer up to 30% higher lift efficiency and improved maneuverability, enabling reliable performance in challenging environments.

Adoption is increasing as industries replace manual inspections with drone-based workflows, reducing field operation time by nearly 50%. Growth is further supported by expanding applications in public safety, where more than 1,500 emergency departments globally use drones for surveillance, search-and-rescue, and real-time situational assessment.

Advancements in AI-based navigation, autonomous flight modes, and sensor fusion also accelerate utilization across infrastructure, energy, and agriculture. As organizations prioritize automation and high-precision aerial data, demand for coaxial drones continues to strengthen.

Restraint Factors

Restraints in the coaxial multi-rotor drones market primarily stem from strict regulatory limitations, operational restrictions, and compliance requirements. Certification processes for BVLOS operations and advanced payload integration can delay deployments by 6–12 months, slowing commercial scale-up. High acquisition and maintenance costs also pose challenges, especially for small businesses, as professional-grade coaxial drones can cost 30–40% more than standard multi-rotors.

Concerns around airspace safety, cybersecurity vulnerabilities, and potential interference with manned aviation increase scrutiny from regulatory authorities. Additionally, limited battery endurance, often capped at 40–55 minutes, restricts continuous mission capability. These constraints collectively reduce adoption speed, particularly in markets with evolving UAV legislation.

Growth Opportunities

Growth opportunities emerge from increasing adoption of AI-driven autonomy, advanced data analytics, and industry-specific drone applications. The expanding BVLOS regulatory approvals—projected to grow by 25% annually—unlock new possibilities in logistics, infrastructure patrol, and environmental monitoring. Rising demand for LiDAR mapping, thermal inspections, and multispectral imaging creates opportunities for high-payload coaxial platforms.

In logistics, drone delivery pilots have shown delivery time reductions of 40%, encouraging wider implementation. Government investments in digital infrastructure and aerial automation also expand commercial use cases. The growing need for automated inspections across utilities, oil and gas, and construction, where drone usage can cut labor costs by 20–30%, further strengthens market potential.

Trending Factors

Trending factors shaping the market include rapid advancements in autonomous flight, sensor innovation, and drone swarm technology. AI-powered navigation has boosted mission accuracy by nearly 40%, enabling fully automated operations across large areas. Swarm deployment, capable of reducing mission duration by 30–50%, is gaining interest in defense, surveying, and disaster response.

Miniaturized sensors, such as lightweight LiDAR, hyperspectral cameras, and thermal modules, enhance data quality while maintaining efficiency. Sustainability is also becoming a major trend, with drones increasingly replacing fuel-intensive ground inspections, reducing carbon emissions by an estimated 20–25% in some operations. Rising investments in digital twins, real-time analytics, and cloud-based fleet management further accelerate drone integration into enterprise ecosystems.

Competitive Analysis

The competitive landscape of the coaxial multi-rotor drones market is shaped by rapid technological innovation, expanding commercial applications, and increasing investments in advanced UAV platforms. Key manufacturers are focusing on improving lift efficiency, flight stability, and payload capacity to meet growing demand from professional users.

Many leading companies are integrating AI-driven autonomy, obstacle avoidance, and real-time data processing capabilities to strengthen their market position. Competition intensifies as brands differentiate through enhanced endurance, modular payload options, and ruggedized designs suited for industrial environments.

Partnerships with defense agencies, emergency responders, and enterprise sectors are becoming central strategies, with several companies securing multi-year contracts for surveillance, mapping, and inspection services.

The rise of LiDAR, thermal imaging, and multispectral sensors has further encouraged manufacturers to develop high-payload coaxial platforms that support advanced analytics. Meanwhile, new entrants are focusing on cost-effective systems to target small businesses and consumer applications.

Companies are also expanding global footprints by establishing local training centers, service networks, and regulatory support programs. As industry demand shifts toward automation, BVLOS operations, and integrated data ecosystems, competitive intensity is expected to increase. This ongoing innovation race positions the market for continued technological advancement and broader application diversity.

Top Key Players in the Market

- DJI

- Parrot

- Yuneec

- Autel Robotics

- Skydio

- Kespry

- senseFly

- Aeryon Labs

- Delair

- Hubsan

- Walkera

- PowerVision

- Draganfly

- Holy Stone

- Others

Recent Developments

- November 2025: Several aerospace engineering groups began deploying next-generation coaxial propulsion modules designed to increase lift efficiency by nearly 25% for heavy-payload drones. Early testing showed improved thermal stability and reduced vibration, enabling more reliable performance for industrial inspection and emergency-response fleets.

- October 14, 2025: A leading US research laboratory completed large-scale trials of autonomous firefighting drones equipped with enhanced coaxial rotors and high-heat-resistant composite frames. The upgraded systems demonstrated a 40% improvement in endurance during smoke-dense operations, supporting safer, remote suppression strategies.

- September 2025: Multiple public-safety agencies initiated integration of AI-based swarm-coordination software for coaxial multi-rotor platforms, enabling synchronized flight patterns for search-and-rescue missions. Field evaluations confirmed significantly faster grid-mapping and anomaly detection compared to manual UAV deployment.

Report Scope

Report Features Description Market Value (2024) USD 703.5 Million Forecast Revenue (2034) USD 1576 Million CAGR(2025-2034) 8.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Type (x8 Coaxial Quad, x12 Coaxial Hex, x16 Coaxial Octo), By Application (Photography, Surveying and Mapping, Firefighting, Logistics, Others), By End Use (Consumer-grade, Professional-grade) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape DJI, Parrot, Yuneec, Autel Robotics, Skydio, Kespry, senseFly, Aeryon Labs, Delair, Hubsan, Walkera, PowerVision, Draganfly, Holy Stone, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Coaxial Multi-rotor Drones MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Coaxial Multi-rotor Drones MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- DJI

- Parrot

- Yuneec

- Autel Robotics

- Skydio

- Kespry

- senseFly

- Aeryon Labs

- Delair

- Hubsan

- Walkera

- PowerVision

- Draganfly

- Holy Stone

- Others