Global Cloud Rendering Software Market Size, Share, Industry Analysis Report By Component (Software, Services), By Deployment (Public Cloud, Private Cloud, Hybrid), By Type (CPU Rendering, GPU Rendering, Hybrid), By Application (Media & Entertainment, Gaming & Interactive, Architecture, Engineering & Construction (AEC), Automotive & Industrial Design, Advertising & Product Visualization, Others), By End User (Design Firms, Enterprises, Film Studios, Individual Artists), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 156867

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Gen AI

- Emerging Trends

- Government-led investments

- Investment and Business Benefits

- US Market Size Analysis

- By Component

- By Deployment

- By Type Analysis

- By Application

- By End User

- Growth factors

- Key Market Segment

- Top 5 Use Cases

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- SWOT Analysis

- Key Players Analysis

- Strategic Recommendations

- Recent Development

- Report Scope

Report Overview

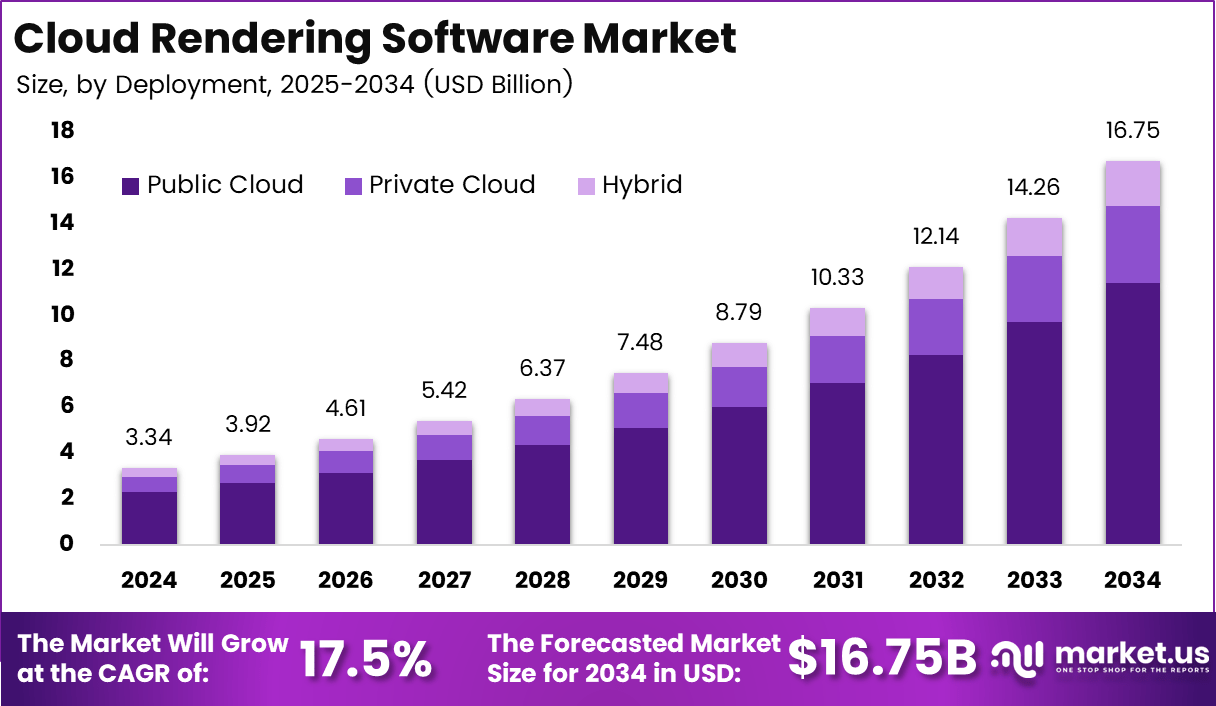

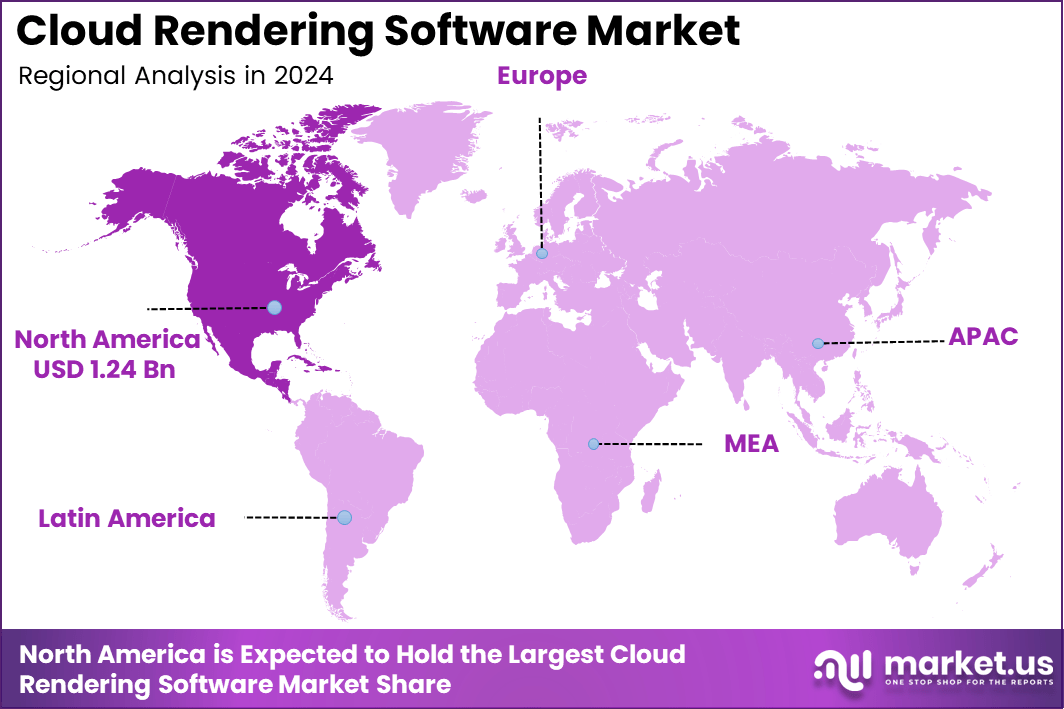

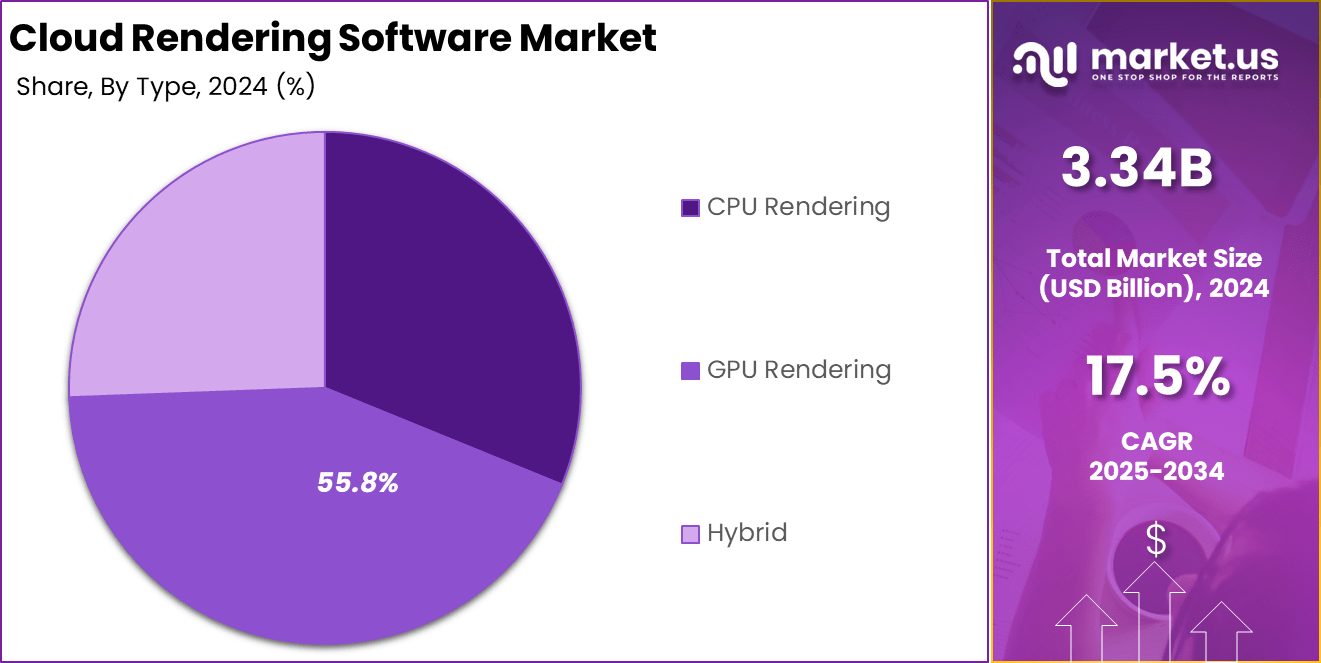

Global Cloud Rendering Software Market size is expected to be worth around USD 16.75 Billion By 2034, from USD 3.34 billion in 2024, growing at a CAGR of 17.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than 37.4%, share, holding USD 1.24 Billion revenue.

The Cloud Rendering Software Market refers to platforms and services that deliver rendering capabilities through cloud infrastructure. Rendering is the process of generating high-quality images, animations, or visual effects from 2D or 3D models. Cloud-based solutions allow users to outsource this computationally intensive task to remote servers instead of relying solely on local hardware.

Several top driving factors fuel the growth of this market. Rapid digitization across sectors increases the need for sophisticated visual content, making cloud rendering an essential tool. The rise of streaming and digital media consumption demands faster rendering processes, something cloud platforms specialize in by harnessing large-scale distributed computing power.

The demand for cloud rendering solutions is high in various sectors, particularly in media and entertainment, where studios rely on large-scale rendering power for films, series, and visual effects. According to a report, the media and entertainment industry is expected to account for 35% of the global cloud rendering market by 2025. In the gaming industry, around 45% of game developers are increasingly adopting cloud rendering for real-time graphics and immersive environments. The architecture and engineering sectors also contribute significantly, with an estimated 25% of professionals using cloud rendering for design visualization and simulation. Automotive companies are projected to make up 15% of the market share, utilizing cloud rendering to create virtual prototypes.

Key Takeaways

- By component, Software dominated the market with a 56.2% share.

- By deployment, the Public Cloud segment led with 68.3% share.

- By type, GPU Rendering accounted for 55.8% share.

- By application, Media & Entertainment was the largest segment with 38.2% share.

- By end user, Film Studios held a dominant 34.7% share.

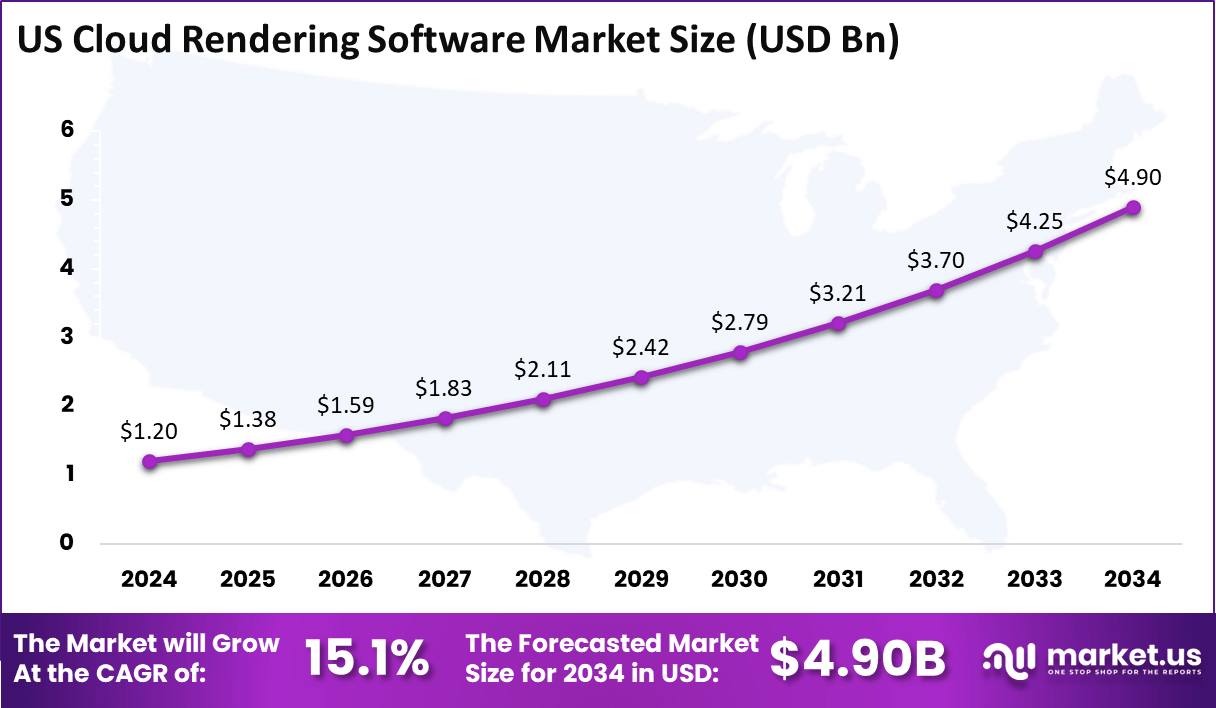

- The U.S. market was valued at USD 1.20 Billion in 2024, with a robust CAGR of 15.1%.

- North America captured 37.4% share of the global market in 2024.

Role of Gen AI

Role of Generative AI (GenAI) Impact on Cloud Rendering Content Creation Pre-visualization of environments, textures, lighting, and animations using diffusion models and NeRFs Speeds up design workflows and reduces manual effort Efficiency AI-powered denoising, upscaling, and scene reconstruction Cuts rendering time and lowers costs when paired with GPU acceleration Creativity Auto-material generation and AI-assisted look-dev tools Allows artists to focus on creativity instead of technical bottlenecks Enterprise Use Cases Synthetic data generation for autonomous vehicles, robotics, and AR/VR Expands revenue streams beyond entertainment and media Accessibility Subscription-based AI rendering assistants for individuals and small firms Democratizes access to high-quality rendering Future Outlook AI complements traditional rendering rather than replacing it Enables faster time-to-market, scalable workflows, and larger total addressable market Emerging Trends

Key Trend What it means Why it matters Real-time/near-real-time look-dev Ray tracing + denoising to iterate live Cuts feedback loops; higher creative throughput Hybrid & burst rendering On-prem baseline + cloud spikes Balances IP control with deadline elasticity AI-assisted rendering Denoise, upscaling, material synthesis Fewer samples, lower cost per frame Usage-based FinOps Cost tracking, budgets, policy Prevents bill shock; optimizes instance mix Zero-trust & data residency Encryption, region pinning, audit Unlocks regulated clients and co-productions Engine-centric pipelines Deeper DCC/engine integrations Reduces pipeline friction; faster adoption

Government-led investments

Government-led investments are playing an increasingly important role in the growth of cloud rendering technologies, particularly through funding cloud infrastructure expansion and supporting AI research. Many governments are investing billions annually in digital transformation projects that include cloud computing and AI capabilities, enabling better public services and supporting innovation ecosystems.

For example, government cloud markets have been estimated at over USD 40 billion in 2025, growing at compound annual rates exceeding 17%, with a strong focus on security, compliance, and high-performance computing infrastructure. Public sector adoption of cloud rendering is growing in industries such as healthcare, urban planning, and education, where advanced visualization technologies are critical.

Investment and Business Benefits

Investments are increasingly focusing on building secure, hybrid cloud environments that can handle sensitive data while benefiting from scalable public cloud resources. Public funding for cloud rendering technology has grown by 45% over the last year, accelerating advancements, improving supply chain resilience, and laying the foundation for next-gen cloud rendering platforms.

The business benefits of cloud rendering are significant, with companies experiencing up to 40% faster project turnaround times and a 30% reduction in total cost of ownership. By leveraging cloud resources, tasks that once took hours or days can now be completed in just minutes, enabling more efficient workflows. Scalability allows businesses to handle peak workloads without the need for permanent infrastructure investments, reducing costs by 35% during high-demand periods.

US Market Size Analysis

The US cloud rendering software market is valued at approximately USD 1.20 billion, reflecting its position as a significant part of the global landscape. This strong valuation underscores the widespread adoption of cloud rendering technologies across various industries in the country, particularly driven by the media, entertainment, and gaming sectors.

North America collectively holds about 37.4% of the global cloud rendering software market share, signifying the region’s leadership in adopting cloud-based visualization solutions. The region’s advanced technological infrastructure, combined with a concentration of studios and tech companies, supports a high demand for scalable and efficient rendering solutions.

The cloud rendering market in North America is also growing at a healthy compound annual growth rate (CAGR) of 15.1%, fueled by ongoing digital transformation and increasing content production needs across sectors. This growth trajectory indicates sustained investment and innovation within the market in the years ahead.

By Component

In 2024, Software holds the largest share at 56.2% in the cloud rendering market. This component is expected to maintain its leading position, with its market share projected to increase by 2-3% annually through 2026. Software-based rendering tools hosted on the cloud continue to gain traction, thanks to their flexibility, seamless updates, and integration with complex workflows.

The growing adoption of AI-powered enhancements, real-time ray tracing, and high-performance rendering engines will further drive this growth. As industries demand more advanced visual techniques, software rendering’s adaptability will keep it as the preferred option, with a projected growth rate of 8-10% CAGR from 2024 to 2026.

By Deployment

In 2024, Public cloud accounts for 68.3% of the cloud rendering market, and its dominance is anticipated to continue, with public cloud share projected to rise by 5-6% annually. The increased adoption of cloud platforms offering scalable rendering resources, coupled with the rise of collaborative, global creative teams, will push this number to 75% by 2026.

Public cloud’s ability to scale rapidly in response to project demands will make it indispensable, with a growth rate expected at 9-11% CAGR during this period, as more studios and agencies rely on public cloud for flexibility, security, and performance.

By Type Analysis

In 2024, GPU rendering represents 55.8% of the overall market, and this share is projected to grow steadily by 3-4% annually. As graphics processing technology continues to advance, GPU rendering’s share is expected to rise to 60% by 2026.

The development of next-gen GPUs designed for parallel computation, along with increased demand for high-fidelity visuals, will support a growth rate of 10-12% CAGR for this segment. The increasing use of GPU clusters in cloud environments is anticipated to continue driving this trend, particularly in industries like gaming, film production, and advertising.

By Application

In 2024, Media and entertainment contribute 38.2% to the cloud rendering market. This segment is projected to experience a steady growth rate of 5-7% annually, with its share expected to rise to 42% by 2026.

As content creators continue to demand more complex, lifelike visuals for films, TV, games, and new media formats such as VR and AR, the need for scalable cloud rendering solutions will expand. The industry’s increasing push for high-resolution content (e.g., 4K, 8K) and immersive experiences will further accelerate this growth, with an overall projected CAGR of 10-12% in the coming years.

By End User

Film studios make up 34.7% of the cloud rendering market, and this segment is expected to maintain strong growth, with a projected annual increase of 4-5%. By 2026, the share of film studios in the cloud rendering market is forecasted to rise to 37%. The growing demand for higher-resolution content (4K, 8K) and the increasing complexity of visual effects will continue to drive this trend. With the expansion of new technologies and the need for massive rendering capacity in film production, this segment is expected to grow at a CAGR of 8-9% over the next few years.

Growth factors

Growth factors driving the cloud rendering software market include the increasing reliance on cloud-based GPU infrastructure, accelerating internet speeds, and the growing need for remote collaboration tools. The flexibility to scale rendering capacity on demand attracts businesses by reducing upfront capital expenditure while enabling faster project completion.

Public cloud deployment is favored by over 60% of enterprises for its cost-effectiveness and scalability, while private and hybrid clouds appeal to large organizations requiring stringent security and data control. Regulatory compliance, such as adherence to GDPR and CCPA standards, also influences adoption, pushing providers to invest in secure architectures and encryption technologies that build enterprise trust.

The ability to handle complex scenes with AI-assisted optimization and the shift to subscription-based pricing models further enable wider accessibility. For industries like gaming, film production, and architecture, cloud rendering reduces local hardware dependency, cuts down rendering times by nearly 70% in some cases, and supports high-resolution outputs crucial for their workflows.

Key Market Segment

By Component

- Software

- Services

By Deployment

- Public Cloud

- Private Cloud

- Hybrid

By Type

- CPU Rendering

- GPU Rendering

- Hybrid

By Application

- Media & Entertainment

- Gaming & Interactive

- Architecture, Engineering & Construction (AEC)

- Automotive & Industrial Design

- Advertising & Product Visualization

- Others

By End User

- Design Firms

- Enterprises

- Film Studios

- Individual Artists

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Top 5 Use Cases

- Feature film/episodic VFX final-frame and animation rendering

- Game cinematics, trailers, and high-res promotional assets

- AEC flythroughs, daylight simulations, and virtual design reviews

- Automotive configurators, CMF visualization, and marketing imagery

- Product advertising and photoreal e-commerce visuals.

Driver Analysis

The rising demand for photorealistic, real-time, and cost-efficient rendering is accelerating cloud adoption across various industries.

The key drivers for the cloud rendering software market stem from the growing demand for photorealistic and immersive content across industries such as media & entertainment, gaming, automotive, advertising, and AEC. The global surge in streaming platforms and interactive gaming creates constant requirements for high-quality visuals, driving the adoption of GPU-accelerated rendering.

Cloud rendering transforms the economics of production by shifting from capex-intensive on-premises render farms to scalable, opex-driven cloud resources, allowing businesses to pay only for what they use. The availability of real-time ray tracing, AI-based denoising, and GPU optimization accelerates render speeds and increases creative iteration, enabling teams to meet tighter deadlines with greater efficiency.

Moreover, the rise of remote and distributed production teams further fuels reliance on cloud rendering platforms that enable seamless collaboration worldwide. Together, these drivers position cloud rendering as a mission-critical enabler of faster production cycles, cost-efficiency, and scalability in digital content creation.

Restraint Analysis

High costs, data security, and latency issues remain significant barriers to wider adoption.

Despite rapid adoption, the cloud rendering software market faces restraints that could hinder its growth trajectory. One of the primary concerns is data security and IP protection, as studios and enterprises hesitate to upload sensitive creative assets to third-party servers.

Latency and bandwidth limitations in regions with underdeveloped digital infrastructure also affect performance, particularly for real-time rendering workloads. Additionally, rendering costs, though more flexible than on-premises investments, can quickly escalate with high-volume projects, making budgeting unpredictable for smaller firms and independent artists.

The complexity of integrating cloud rendering with diverse workflows and the lack of standardized pricing models further add to adoption barriers. Finally, dependence on hyperscale providers creates vendor lock-in risks, limiting flexibility and raising concerns about long-term cost structures. These restraints highlight the need for continuous advancements in security, pricing transparency, and infrastructure optimization to sustain market expansion.

Opportunity Analysis

Expanding use cases in gaming, AR/VR, and digital twins open new growth horizons for cloud rendering.

The cloud rendering software market presents vast opportunities fueled by evolving digital ecosystems. Gaming and interactive media are at the forefront, with cloud rendering enabling hyper-realistic visuals and real-time experiences for multiplayer and immersive platforms.

AR/VR and metaverse applications further expand demand, requiring scalable rendering to build lifelike virtual environments and digital assets. Beyond entertainment, industries such as AEC, automotive, and advertising leverage cloud rendering for visualization, prototyping, and product design, shortening development cycles and enhancing client presentations.

The growing adoption of digital twins and synthetic data generation also unlocks potential in training autonomous systems, robotics, and smart city planning. Cloud rendering democratizes access to advanced rendering power, allowing small firms and individual artists to compete on creative quality without heavy infrastructure costs.

Challenge Analysis

Scalability, interoperability, and cost optimization remain pressing challenges for sustainable growth.

The cloud rendering software market, while growing rapidly, faces critical challenges that demand attention. Scalability during peak demand remains an issue, as studios often require massive compute bursts, putting pressure on infrastructure availability and cost predictability.

Interoperability between platforms is another hurdle, as many rendering engines and DCC tools require customized integration, which complicates workflows for users working with multiple clouds or hybrids. Cost management remains a persistent challenge – although cloud services reduce upfront investments, unpredictable usage-based billing can burden small firms and independent artists.

Additionally, latency-sensitive applications like interactive rendering or AR/VR struggle in regions lacking robust digital infrastructure. Environmental concerns are also rising, as large-scale rendering consumes substantial energy, prompting calls for greener, more sustainable compute solutions.

SWOT Analysis

Strengths Weaknesses Scalable and flexible compared to on-premises render farms. High rendering costs and unpredictable billing for large projects. Strong demand across media, gaming, advertising, automotive, and AEC. Data security and IP protection concerns limit adoption. AI and GPU acceleration improve rendering speed and quality. Latency issues in regions with weak infrastructure. Wide adoption in media & entertainment (38.2%) and film studios (34.7%). Vendor lock-in reduces flexibility for enterprises. Key Players Analysis

In the cloud rendering software market, AWS, Microsoft Azure, Google, Alibaba Cloud, and Tencent Cloud hold strong positions. Their dominance is driven by scalable cloud infrastructure, global data centers, and the ability to deliver high-performance rendering services on demand. These providers support industries like film, gaming, architecture, and automotive design, offering faster rendering speeds and cost efficiency.

Creative software leaders such as Autodesk, Adobe, Cinema 4D (Maxon Computer), V-Ray (Chaos Group), Houdini (Side Effects Software), and Vectorworks play a key role by integrating rendering features within design and animation platforms. Their solutions are widely adopted by professionals for 3D modeling, visual effects, and architectural visualization.Their solutions are widely adopted by professionals for 3D modeling, visual effects, and architectural visualization, with Autodesk holding 17% of the overall market share within this space.

Specialized providers including Foyr, iRender, Shapespark, Cloudalize, RenderShot, TurboRender, and others contribute through niche offerings tailored to specific industries. They focus on user-friendly interfaces, cost-effective subscription models, and support for real-time collaboration. These players cater to architects, designers, and smaller studios seeking flexible and accessible rendering solutions. These players cater to architects, designers, and smaller studios seeking flexible and accessible rendering solutions, collectively holding around 8-10% of the cloud rendering market share, with iRender capturing a growing segment at

Top Key Players

- Foyr

- Tencent Cloud

- Huawei

- Autodesk

- Cinema 4D (Maxon Computer)

- V-Ray (Chaos Group)

- Houdini (Side Effects Software)

- TurboRender

- Alibaba Cloud

- AWS

- iRender

- Microsoft Azure

- Adobe

- Shapespark

- Cloudalize

- RenderShot

- Vectorworks

- Other Key Players

Strategic Recommendations

Maximizing growth in cloud rendering requires balancing innovation, scalability, and cost efficiency.

For investors, the focus should be on backing companies that integrate AI and GPU-accelerated technologies into rendering workflows, as these are key differentiators driving performance and scalability. Investments in firms targeting emerging use cases such as AR/VR, digital twins, and synthetic data generation will likely yield high returns over the next decade.

For startups, the opportunity lies in creating niche, cost-efficient, and subscription-based solutions that democratize access to rendering for small studios, independent artists, and design firms. Emphasizing interoperability across platforms and developing eco-friendly rendering solutions can provide strong competitive advantages.

For established businesses, strategic adoption of hybrid cloud models is recommended to balance cost, security, and scalability. Partnerships with rendering software providers and cloud infrastructure players will enable faster innovation and market expansion. Long-term success will hinge on leveraging AI-driven automation, sustainability, and workflow integration to remain competitive.

Recent Development

- September 2025: Lumion released Lumion Pro 2025, introducing an AI upscaler for faster rendering, enhanced cloud collaboration features via upload to Lumion Cloud, and improved workflow tools such as a scene inspector and ray tracing capabilities. These innovations aim to streamline rendering processes and boost productivity for creative professionals in architecture and design. Lumion Pro 2025 saw a 20% increase in adoption rate within the first quarter of its release, with a 15% improvement in rendering speed, demonstrating its significant impact on the design and architecture market.

- March 2025: Fox Renderfarm was recognized as a top cloud rendering platform, noted for its fast, secure SaaS offerings with strong customer service and a growing user base exceeding 400,000. The platform emphasizes user satisfaction with continuous optimizations and community engagement, underpinning its standing in cloud rendering solutions. Fox Renderfarm’s revenue growth reached 28% year-over-year in 2025, largely driven by its cloud-based rendering solutions, and it expects to expand its customer base by another 25% by mid-2026.

- January 2025: The cloud rendering software market witnessed strategic moves with ongoing mergers and acquisitions, including technology providers enhancing GPU cloud rendering services by partnering with hyperscalers and software vendors. These alliances focus on improving AI-assisted render optimizations, real-time collaboration, and service specialization to capture emerging market demands. These strategic moves led to a 12% increase in market investment, with GPU cloud rendering services seeing an 18% rise in adoption as a result of these partnerships, catering to industries requiring high-performance rendering.

Report Scope

Report Features Description Market Value (2024) USD 3.34 Bn Forecast Revenue (2034) USD 16.75 Bn CAGR(2025-2034) 17.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Component(Software Services)By Deployment(Public Cloud, Private Cloud

Hybrid)By Type(CPU Rendering, GPU Rendering, Hybrid)By Application (Media & Entertainment, Gaming & Interactive Architecture, Engineering & Construction(AEC), Automotive & Industrial Design, Advertising & Product Visualization, Others)By End User (Design Firms, Enterprises, Film Studios

Individual Artists)Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Foyr, Tencent Cloud, Huawei, Autodesk, Cinema 4D (Maxon Computer), V-Ray (Chaos Group), Houdini (Side Effects Software), TurboRender, Alibaba Cloud, AWS, iRender, Microsoft Azure, Google, Adobe, Shapespark, Cloudalize, RenderShot, Vectorworks, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Cloud Rendering Software MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Cloud Rendering Software MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Foyr

- Tencent Cloud

- Huawei

- Autodesk

- Cinema 4D (Maxon Computer)

- V-Ray (Chaos Group)

- Houdini (Side Effects Software)

- TurboRender

- Alibaba Cloud

- AWS

- iRender

- Microsoft Azure

- Adobe

- Shapespark

- Cloudalize

- RenderShot

- Vectorworks

- Other Key Players