Global Clinical Trials Market- By Phase (Phase I, Phase II, Phase III, Phase IV), By Indication (Pain Management, Oncology, CNS Condition, Diabetes, Obesity), By End-User (Pharmaceutical & Biopharmaceutical Companies, Clinical Research Organizations, and Healthcare Providers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032.

- Published date: Aug 2024

- Report ID: 66238

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

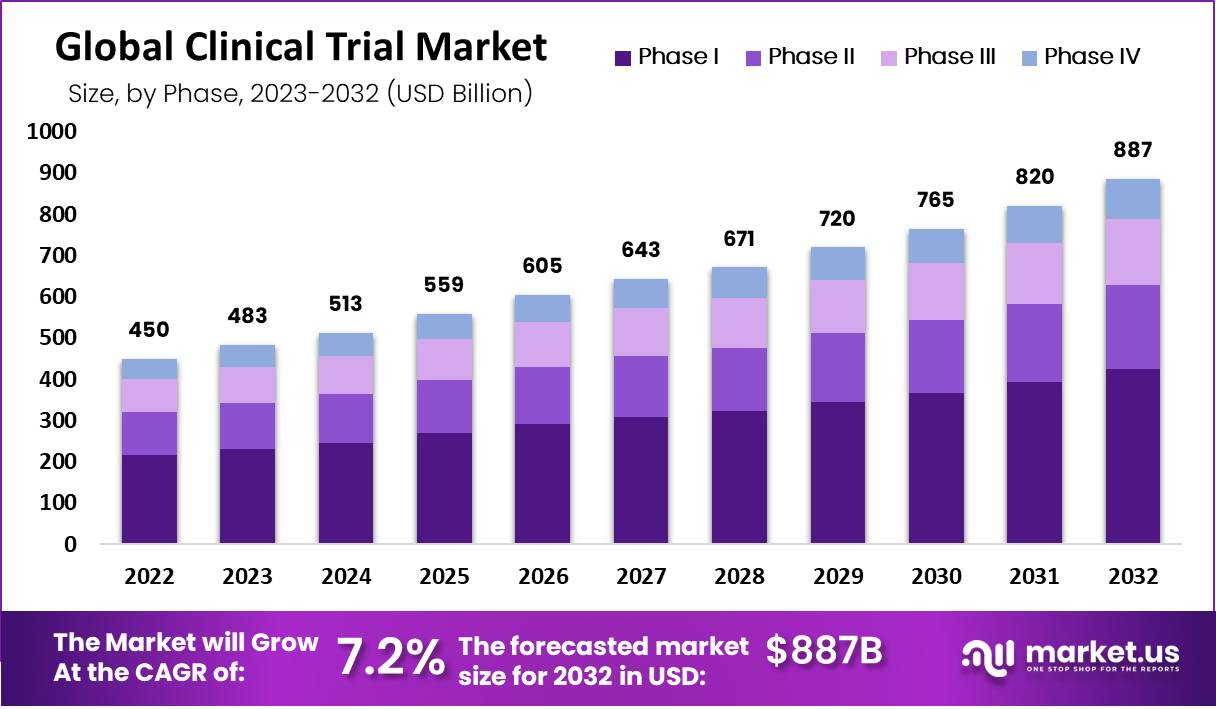

Clinical Trials Market size is expected to be worth around USD 886.5 Billion by 2032 from USD 450.1 Billion in 2022, growing at a CAGR of 7.2% during the forecast period from 2023 to 2032.

The research studies carried out on human subjects to discover a novel treatment, such as a new diet, medical device, or drug, are known as clinical trials. Additionally, it is used to determine whether it is safe and effective in humans.

The major factors driving the expansion of the clinical trials market include the rising demand for clinical trials in developing nations, the expanding geriatric population, the globalization of clinical trials, and technological advancement. The market’s expansion is also anticipated to be aided by utilizing online resources to boost patient recruitment rates for clinical trials.

The market’s overall growth is also accelerated by the globalization of drug development activities and the rising incidence of chronic diseases. However, the high cost of these clinical trials impeded the market’s expansion. Additionally, it is anticipated that the extended approval period will impede the market’s overall growth.

The market is anticipated to generate profitable opportunities due to the increasing demand for clinical research organizations (CROs) in the pharmaceutical industry. This is due to the CROs’ diverse expertise and the adoption of advanced technologies in clinical trials. On the other hand, the market’s expansion may be hampered by a lack of skilled personnel to operate the devices.

Key Takeaways

- The global clinical trials market is projected to reach USD 886.5 billion by 2032, increasing from USD 450.1 billion in 2022.

- The market is expected to grow steadily at a compound annual growth rate (CAGR) of 7.2% during the forecast period 2023–2032.

- Among phases, Phase III generated the highest revenue share, driven by large-scale patient participation and advanced trial requirements compared to earlier phases.

- Phase II secured the second-largest revenue share, supported by rising demand for efficacy studies that bridge early research and large-scale patient outcomes.

- Oncology clinical trials accounted for the largest market revenue share, reflecting the rising prevalence of cancer and demand for advanced therapeutic research globally.

- Pharmaceutical and biopharmaceutical companies are anticipated to remain the leading end-user segment, owing to their extensive research pipelines and large-scale trial investments.

- North America dominated the market with 47.2% share, valued at USD 212.4 billion in 2022, and is expected to maintain leadership.

Phase Analysis

Phase III Segment Has Collected the Highest Market Revenue than the Other Phases, while Phase II Acquired Second Highest Position.

The most significant portion of the global market’s revenue came from the Phase III segment. Phase III trials have the most subjects and are the most expensive. Phase III necessitates more patients and more extended treatment duration. Regarding market share, the Phase II segment came in second. Additionally, it is Phase III’s second-most expensive stage. This study consists of two parts: The first section explores a variety of doses and conducts efficacy studies; the second finalizes the dose.

Phase II is crucial, especially in studies that are related to oncology. According to the FDA, about 33.0% of medications typically undergo a Phase II trial. Additionally, several therapeutics and vaccines in Phase II are currently approved for the treatment of COVID-19, boosting market expansion. There are currently 43 COVID-19 therapeutics in Phase II development. AstraZeneca plc; AB Science SA; Apeiron Biologics GmbH; Arch Biopartners, Inc.; 4D Pharma plc; Applied Therapeutics, Inc.; and additional are among the companies working on these vaccines.

Businesses are working together to speed up the creation of therapeutics and vaccines. For instance, Eli Lilly and AbCellera developed vaccines together; in collaboration with the Bill & Melinda Gates Foundation, Novartis, GSK, and MSD. Additionally, Sanofi and GSK are collaborating on creating an adjuvant COVID-19 vaccine.

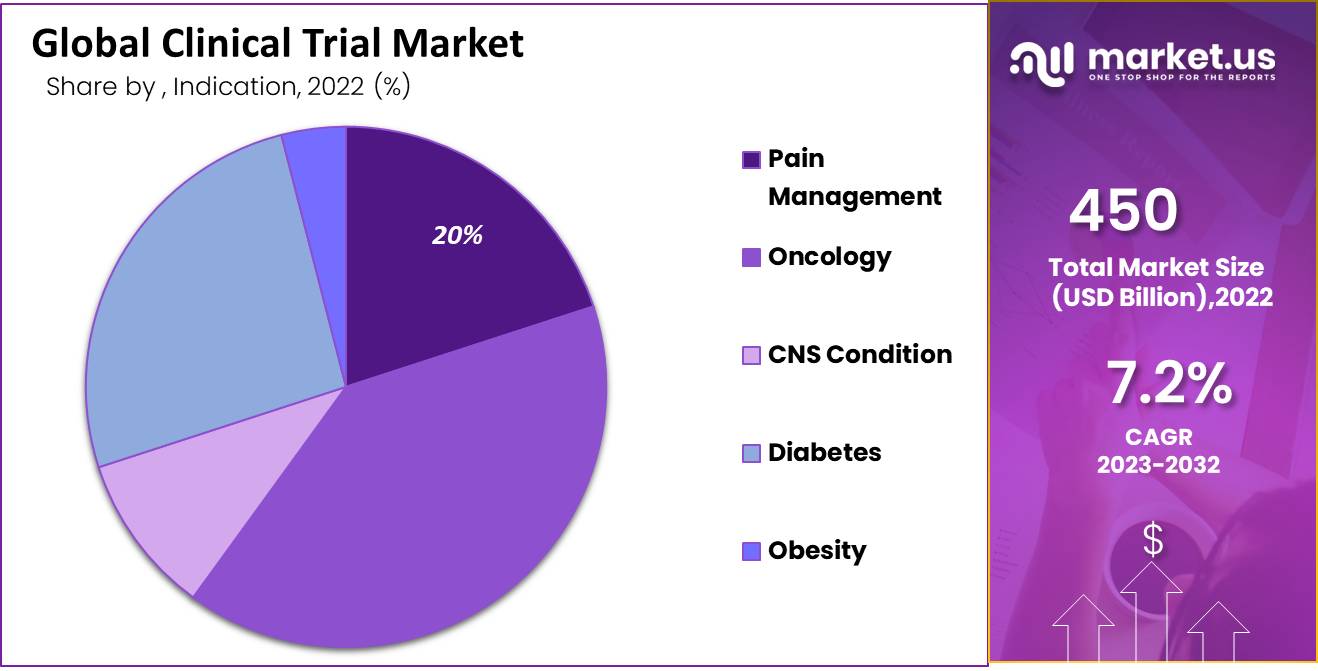

Indication Analysis

The Oncology Segment Accounted for the Most Significant Revenue Share.

In the global market, the oncology segment generated the most significant revenue. Additionally, the segment is expected to experience the highest CAGR over the forecast period. The pharmaceutical industry is investing more money in the clinical and preclinical development of oncology therapy products, according to the U.S. Food and Drug Administration (FDA) and various other sources.

Over the forecast period, it is also anticipated that the cardiovascular condition segment will experience profitable growth in CAGR. There has been a significant increase in investment in research and development (R&D) in this market, with over 190 drugs currently in the pipeline due to the growing worldwide demand for affordable medications.

Most drugs in development are meant to treat heart failure, stroke, vascular diseases, and lipid disorders. It is anticipated that rising demand for affordable medicines in low- and middle-income nations will increase government R&D expenditures, boosting market expansion. Conversely, the current pandemic has hampered clinical trials’ efforts to discover effective treatments and cures.

The pandemic has reportedly caused disruptions in clinical trials for at least 18 pharmaceutical or biotech companies. The average number of new patients enrolled worldwide in March 2020 decreased by approximately 65.0 percent year-over-year. Japan and India reported declines of 84.0% and 43%, respectively, while the United States experienced a decline of 67.0%.

End-User Analysis

The Pharmaceutical and Biopharmaceutical Companies Segment is Anticipated to Maintain the Highest Position in the Market Throughout the Forecast Period.

Due to the growth of pharmaceutical & biopharmaceutical companies and initiatives taken by private and public organizations to develop the pharmaceutical industry, the pharmaceutical & biopharmaceutical companies segment was the most significant contributor and is anticipated to maintain its lead throughout the forecast period.

Due to a rise in the prevalence of chronic and rare diseases, an increase in the number of clinical trials, and an increase in investments in R&D activities in the pharmaceutical and biopharmaceutical sector, the clinical research organizations segment is nonetheless anticipated to experience significant growth over the course of the forecast period.

Key Market Segments

Based on Phase

- Phase I

- Phase II

- Phase III

- Phase IV

Based on Indication

- Pain Management

- Oncology

- CNS Condition

- Diabetes

- Obesity

Based on End-User

- Pharmaceutical & Biopharmaceutical Companies

- Clinical Research Organizations

- Healthcare Providers

Drivers

Outsourcing Clinical Trials Benefits the Global Clinical Trials Market.

Due to the growing use of advanced medical technologies and the rising demand for novel drugs, the clinical trials industry is expanding rapidly worldwide. However, due to the low approval rates and high costs of the drug development process for biotechnology and pharmaceutical companies, demand for clinical trials may decrease.

As a result, more clinical trial activities are being outsourced to contract research organizations (CROs), which helps sponsors save money and time. Because of this, they can concentrate primarily on finding effective drugs. In the long run, outsourcing clinical trials will become the latest key trend and greatly benefit the global market.

The market may benefit from countries’ supportive governments. To cite a source, the WHO developed “Solidarity,” a global clinical trial launched to find a COVID-19 treatment. To evaluate their efficacy in dealing with the novel coronavirus, it compares the effectiveness of four treatment options to the healthcare standard. As one of the “Solidarity trials” for vaccines, the World Health Organization (WHO) also confirmed an international alliance to develop several candidate vaccines to help stop the virus from spreading.

Restraints

Budgetary Constraints and a Lack of FDI Restraints the Market Growth.

The lack of infrastructure and research facilities in some nations may be one of the growth-limiting factors. Research infrastructures like specialized academic clinical research centers (CRCs) and clinical trial units (CTUs) provide various services, such as clinical research for particular diseases. Due to budgetary constraints and a lack of FDI, however, these are typically absent from many developing nations.

Opportunities

Innovative Advancements in Technology and Several Government Initiatives Boost the Market Growth.

It is anticipated that several government initiatives and the expanding use of technologically advanced digital solutions will contribute to the expansion of the market. Another factor increasing the burden of chronic disorders and the demand for the clinical trials market is the expanding geriatric population base.

Companies have increasingly emphasized developing novel medications for genetic or rare conditions that necessitate specialized and focused clinical trials in response to the rising incidence of such diseases. The industry’s growth is anticipated to be fuelled by it.

Treatments and New tests are the subjects of extensive clinical trials examining how they affect human health outcomes. Patients and different groups of people willingly participate in clinical trials to test medical interventional studies like biological products, drugs, and medical devices. Regulatory bodies closely monitor the four phases of the clinical trials throughout the study’s duration.

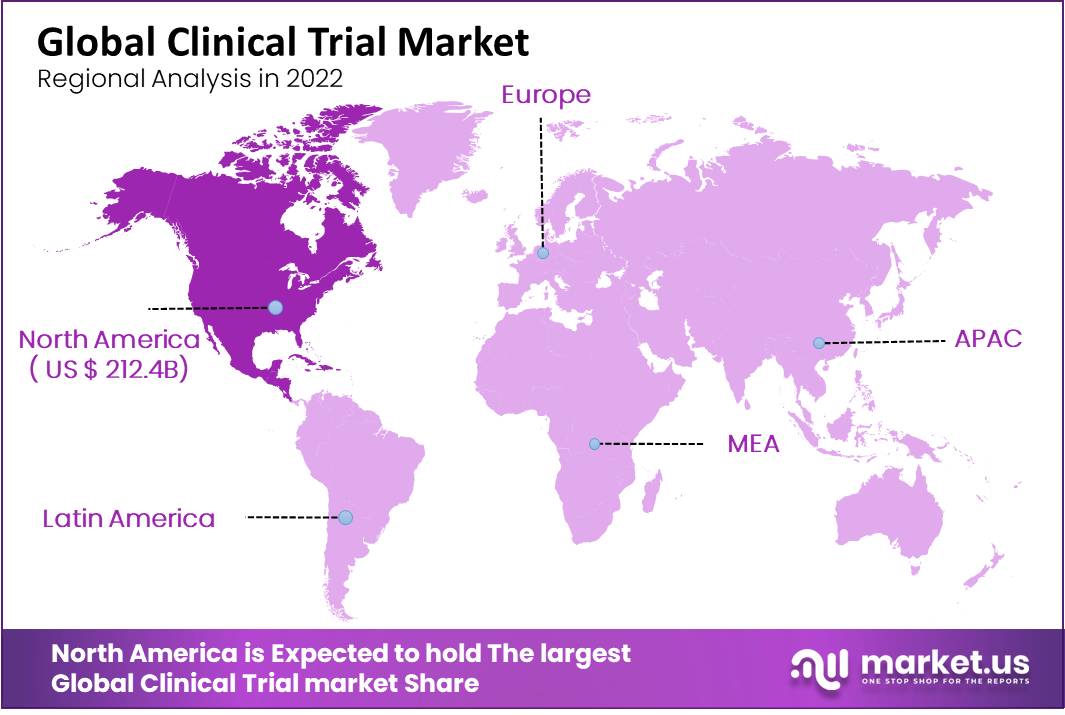

Regional Analysis

North America dominates the global clinical trials market during the forecast period.

North America held 47.2% of the global market and is anticipated to maintain its dominance throughout the forecast period. This is because new technologies are being used in more clinical trials in this region, and more money is being spent on research and development. Major companies like PRA Health Sciences and IQVIA are expected to accelerate the expansion of the North American market by incorporating virtual services at various stages of clinical trials.

In addition, demand is anticipated to rise due to favorable government support for clinical trials in the United States market. The FDA launched the Coronavirus Treatment Acceleration Program (CTAP) in March 2020 to accelerate the development of therapies for coronavirus-related global diseases. The program uses every method to deliver novel treatments to patients as quickly as possible while determining whether they are beneficial.

Due to the availability of a large patient pool that facilitates easy recruitment, the Asia-Pacific region is anticipated to grow at the fastest CAGR of 6.8% over the forecast period. One of the key driving factors of the market is the global pandemic.

Due to its high quality and quick turnaround, “Novotech,” the most significant and experienced biotech CRO in Asia Pacific, has reported increased research demand from biotechnology sponsors. For COVID-19 trials, many biotechnology companies prefer the APAC region due to its large patient pool and expedited procedures.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Wuxi AppTec Expanded its Service Capabilities to Accelerate Cell and Gene Therapy Development, Production, and Launch. Also, Acurian and Synexus launched SynexusPlus, to Increase the Efficacy of Clinical Trials.

The global market for clinical trials is extremely competitive. Pharmaceutical Product Development, IQVIA, LLC, PAREXEL International Corporation, and Charles River Laboratory are a few of the market’s players. The rapid adoption of cutting-edge technology for better healthcare is the key factor influencing the competitive nature. To maintain their market share and expand their product line, major players frequently engage in mergers and acquisitions as well as new product launches.

For instance, Wuxi AppTec expanded its service capabilities in January 2020 by announcing the availability of a fully integrated adeno-associated virus vector suspension platform to accelerate cell and gene therapy development, production, and launch.

Acurian and Synexus, which is part of PPD, launched SynexusPlus, a site solution for patient enrollment in clinical studies. It is anticipated that this initiative will increase the efficiency of clinical trials. Additionally, it aids in reducing on-site footprints, which is helpful during the current pandemic.

Listed below are some of the most prominent global clinical trial market players.

Market Key Players

- Eli Lilly and Company

- Parexel International Corporation

- Pfizer

- Charles River Laboratory

- Syneous Health

- Novo Nordisk A/S

- IQVIA

- ICON Plc.

- Other Key Players.

Key Industry developments

- In June 2024: Charles River Laboratories completed the acquisition of Vigene Biosciences, a gene therapy contract development and manufacturing organization (CDMO). The transaction, valued at $292.5 million with additional contingent payments of up to $57.5 million based on future performance, significantly enhances Charles River’s capabilities in viral vector manufacturing for gene therapies and gene-modified cell therapies. This acquisition aligns with Charles River’s strategy to expand its portfolio in the high-growth cell and gene therapy market.

- In June 2024: Parexel International Corporation entered into a definitive agreement to be acquired by Pamplona Capital Management. This transaction, valued at approximately $5.0 billion, includes the acquisition of all outstanding shares of Parexel for $88.10 per share in cash, reflecting a significant premium over the previous stock price. This acquisition is set to transform Parexel into a privately held company, enhancing its flexibility and ability to capitalize on market opportunities.

- In May 2023: Syneos Health announced that it would be acquired by a consortium of private investment firms, including Elliott Investment Management L.P., Patient Square Capital, and Veritas Capital. The transaction, valued at approximately $7.1 billion, was aimed at leveraging Syneos Health’s capabilities in biopharmaceutical solutions to drive further investments and enhance medical innovations. This acquisition, expected to be finalized in the second half of 2023, was approved by Syneos Health shareholders by August 2023, making Syneos Health a privately held company

- In March 2023: Pfizer completed the acquisition of Seagen, a major move in bolstering its oncology portfolio. This acquisition enhances Pfizer’s capabilities with Seagen’s advanced antibody-drug conjugate (ADC) technology. This strategic acquisition aims to accelerate the delivery of innovative cancer treatments, expanding Pfizer’s influence in the oncology sector.

Report Scope

Report Features Description Market Value (2022) USD 450.1 Bn Forecast Revenue (2032) USD 886.5 Bn CAGR (2023-2032) 7.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Phase- Phase I, Phase II, Phase III, Phase IV; By Indication- Pain Management, Oncology, CNS Condition, Diabetes, Obesity; By End-User- Pharmaceutical & Biopharmaceutical Companies, Clinical Research Organizations, and Healthcare Providers. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Eli Lilly and Company, Parexel International Corporation, Pfizer, Charles River Laboratory, Syneous Health, Novo Nordisk A/S, IQVIA, ICON Plc., and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How much is the Clinical Trials Market worth?Global market size is worth USD 886.5 Billion by 2032.

What was the value of the Clinical Trials Market in 2023?In 2023, the market value stood at USD 450.1 Billion.

What is the CAGR of Clinical Trials Market?The global Clinical Trials Market is growing at a CAGR of 7.2% during the forecast period 2022 to 2033.

Who are the major players operating in the Clinical Trials Market?Eli Lilly and Company, Parexel International Corporation, Pfizer, Charles River Laboratory, Syneous Health, Novo Nordisk A/S, IQVIA, ICON Plc., and Other Key Players.

Which region will lead the Clinical Trials Market?North America is estimated to be the fastest-growing region during the forthcoming years.

-

-

- Eli Lilly and Company

- Parexel International Corporation

- Pfizer

- Charles River Laboratory

- Syneous Health

- Novo Nordisk A/S

- IQVIA

- ICON Plc.

- Other Key Players.