Global Clinical Trial Imaging Market By Modality (Computed Tomography Scan, X-Ray, Ultrasound, Optical Coherence Tomography (OCT), Magnetic Resonance Imaging, and Other), By Services (Reading & Analytical Services, System & Technology Support Services, Project & Data Management, Operational Imaging Services, and Clinical Trial Design & Consultation Services), By Application (Oncology, Orthopedics & MSK Disorders, Ophthalmology, Neurovascular Diseases, Nephrology, Cardiovascular Diseases, and Other), By End-user (Biotechnology & Pharmaceutical Companies, Medical Devices Manufacturers, Contract Research Organizations (CROs), Academic & Government Research Institutes, and Other), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 77788

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

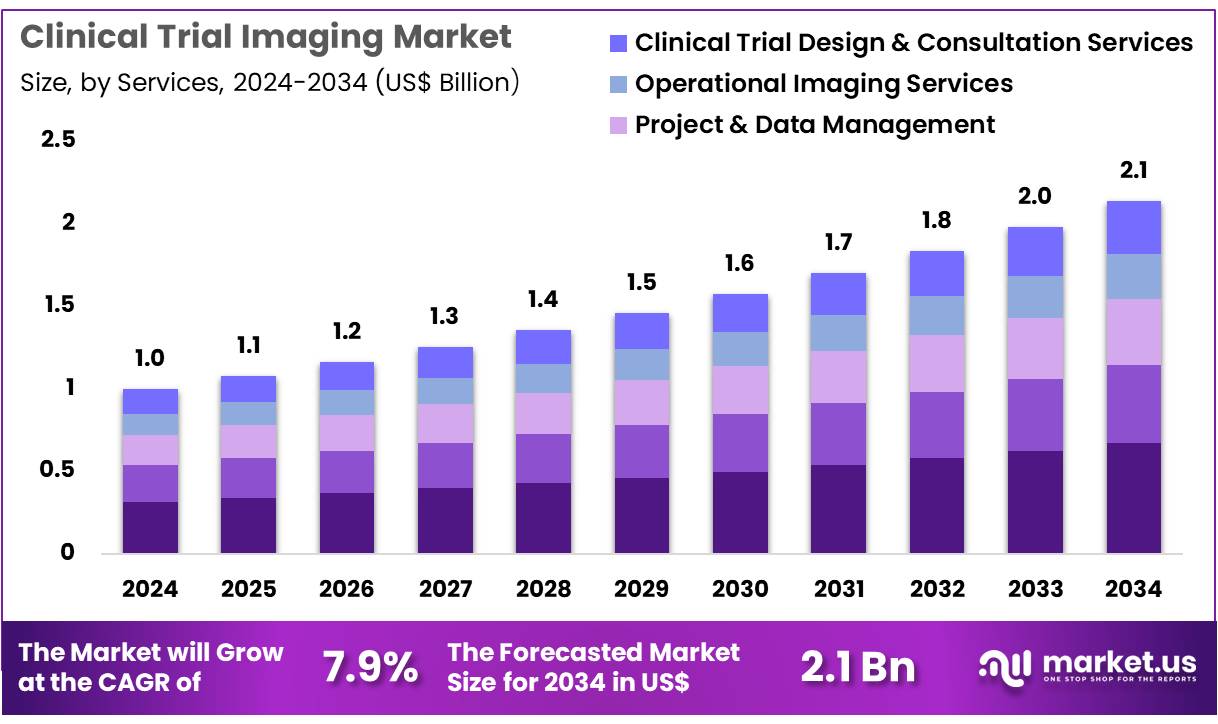

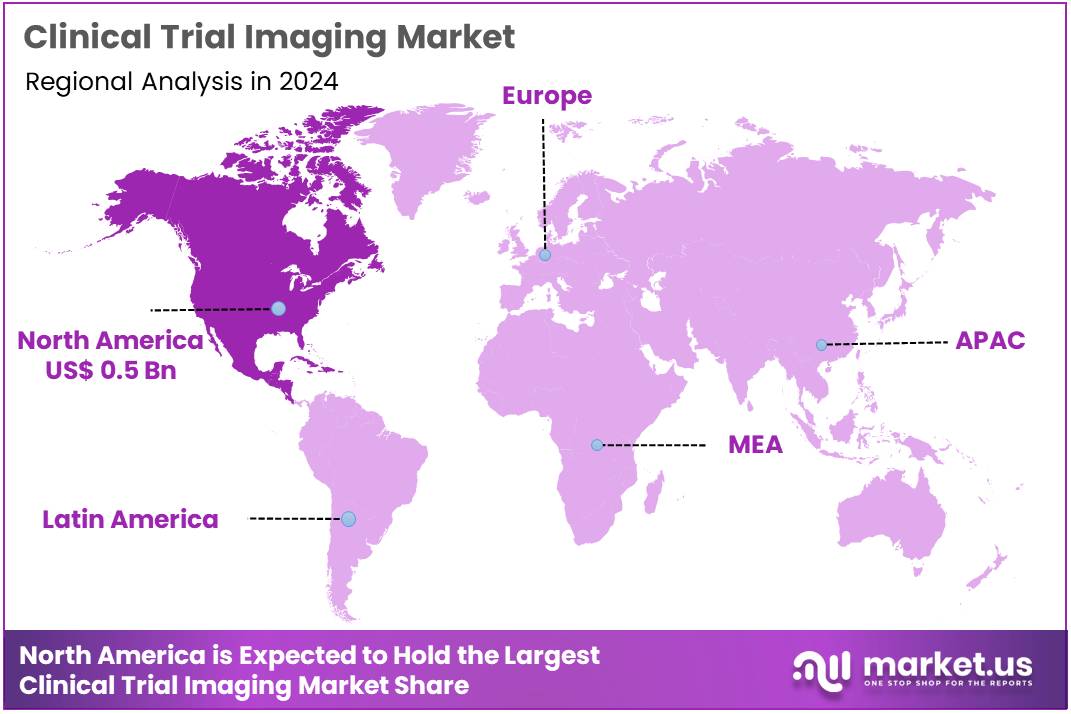

Global Clinical Trial Imaging Market size is expected to be worth around US$ 2.1 Billion by 2034 from US$ 1.0 Billion in 2024, growing at a CAGR of 7.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 46.8% share with a revenue of US$ 0.5 Billion.

Rising research and development (R&D) expenditure by pharmaceutical and biotechnology companies is a key driver of the clinical trial imaging market. Medical imaging is increasingly recognized as a vital component of clinical research, providing objective biomarkers and surrogate endpoints that help evaluate a drug’s efficacy and safety.

According to a 2023 report from ClinicalTrials.gov, there were over 452,604 clinical trials registered worldwide, with a significant number utilizing advanced imaging modalities such as MRI, CT, and PET to monitor disease progression and treatment response. The high volume of trials, especially in complex therapeutic areas like oncology and neurology, highlights the essential role of imaging in modern drug development and fuels the consistent demand for sophisticated imaging services and software.

Key trends shaping the market’s trajectory include the growing adoption of AI-driven analytics and portable imaging technologies. AI is revolutionizing clinical trials by automating image analysis, improving diagnostic accuracy, and reducing the time required to interpret large datasets. This trend is attracting substantial investment, as evidenced by HOPPR securing US$ 31.5 million in June 2025 to enhance its AI-driven medical imaging platform.

At the same time, the development of portable imaging devices is creating new opportunities for decentralized and remote clinical trials. In April 2025, Chipiron raised US$ 17 million to bring its portable MRI scanner to market, addressing the challenges of remote trial imaging by delivering the technology directly to patients.

Increasing strategic partnerships and mergers and acquisitions are also shaping a more integrated and efficient market. Large healthcare and technology corporations are acquiring specialized imaging companies to strengthen their portfolios and provide comprehensive, end-to-end solutions for clinical research.

For example, in April 2025, RadNet announced its agreement to acquire iCAD for US$ 103 million in an all-stock deal, aimed at strengthening its AI-powered breast imaging services. This consolidation facilitates the integration of cutting-edge technology and streamlines workflows. Additionally, the FDA’s “Critical Path Initiative” emphasizes the modernization of the drug development process, which includes an increasing reliance on imaging technologies to provide objective evidence and reduce trial timelines, further supporting the market’s growth.

Key Takeaways

- In 2024, the market for clinical trial imaging generated a revenue of US$ 1.0 Billion, with a CAGR of 7.9%, and is expected to reach US$ 2.1 Billion by the year 2034.

- The modality segment is divided into computed tomography scan, x-ray, ultrasound, optical coherence tomography (OCT), magnetic resonance imaging, and other, with computed tomography scan taking the lead in 2023 with a market share of 38.4%.

- Considering services, the market is divided into reading & analytical services, system & technology support services, project & data management, operational imaging services, and clinical trial design & consultation services. Among these, reading & analytical services held a significant share of 30.5%.

- Furthermore, concerning the application segment, the market is segregated into oncology, orthopedics & MSK disorders, ophthalmology, neurovascular diseases, nephrology, cardiovascular diseases, and other. The oncology sector stands out as the dominant player, holding the largest revenue share of 40.3% in the clinical trial imaging market.

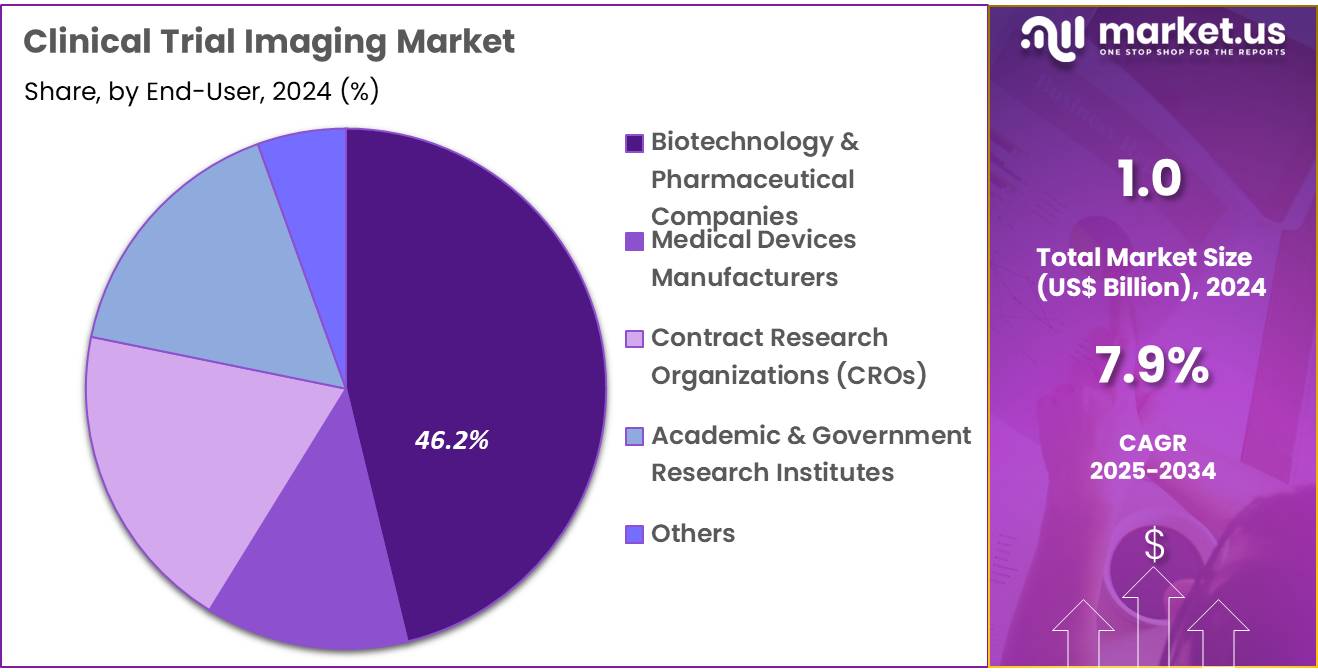

- The end-user segment is segregated into biotechnology & pharmaceutical companies, medical devices manufacturers, contract research organizations (CROs), academic & government research institutes, and other, with the biotechnology & pharmaceutical companies segment leading the market, holding a revenue share of 46.2%.

- North America led the market by securing a market share of 46.8% in 2023.

Modality Analysis

Computed tomography (CT) scans represent the largest modality in the clinical trial imaging market, holding a 38.4% share. This growth is expected to continue as CT scans provide detailed cross-sectional images of the body, which are essential in clinical trials for disease diagnosis, staging, and monitoring treatment responses. The increasing demand for precise imaging in clinical trials, especially in oncology and cardiology, is expected to drive this segment’s growth. CT scans are crucial in assessing tumor sizes, vascular issues, and other critical health markers, making them invaluable in clinical studies.

The integration of advanced CT technology, including low-dose CT for better patient safety, is anticipated to further contribute to the expansion of this segment. Hospitals, medical research centers, and pharmaceutical companies are expected to invest in high-resolution CT equipment to enhance trial outcomes.

Furthermore, the growing prevalence of chronic diseases and cancers worldwide is projected to fuel demand for clinical trial imaging solutions, including CT scans, as an essential part of patient monitoring and treatment efficacy assessment. The increasing adoption of AI and machine learning technologies to enhance CT image interpretation is expected to contribute to the market’s growth.

Services Analysis

Reading and analytical services account for 31.5% of the services segment in the clinical trial imaging market. These services provide critical support by analyzing complex imaging data, ensuring accurate interpretation of results, and optimizing trial outcomes. As clinical trials become more data-intensive, the need for expert analysis of imaging results is expected to increase. These services are essential in interpreting results from modalities like CT scans, MRIs, and X-rays, especially when trials involve multiple imaging modalities.

The demand for expert reading and interpretation is projected to grow as the complexity of trials increases, particularly in oncology and neurovascular disease trials. With more clinical trials incorporating advanced imaging techniques, the need for specialized reading and analytical services will expand. Healthcare providers and pharmaceutical companies are expected to partner with service providers offering high-quality, accurate image analysis to ensure the success of clinical trials.

The growing regulatory focus on data accuracy and reproducibility in clinical trials will further drive the demand for these services. Additionally, the rise in personalized medicine, which requires detailed imaging data for individualized treatment plans, is anticipated to push the demand for reading and analytical services.

Application Analysis

Oncology is the dominant application in the clinical trial imaging market, holding a 40.3% share. This segment’s growth is expected to continue due to the increasing global burden of cancer and the corresponding need for effective treatments. Clinical trial imaging is crucial for monitoring tumor progression, assessing treatment efficacy, and determining patient eligibility for clinical trials. As new cancer therapies, including immunotherapies and targeted therapies, continue to emerge, the need for advanced imaging to track their effects will grow.

The increasing use of imaging in early cancer detection and monitoring the response to new treatments will likely drive demand for imaging services in oncology trials. Advances in imaging technology, such as molecular imaging and the integration of AI to enhance diagnostic accuracy, will further contribute to the growth of this segment.

Additionally, the global push for personalized medicine, which relies on detailed imaging data to tailor treatment plans, will spur the demand for oncology clinical trial imaging. The increasing focus on non-invasive methods to monitor cancer treatment is expected to drive the market for imaging in oncology. Regulatory support for oncology drugs, such as expedited approval processes, will also drive the adoption of clinical trial imaging solutions.

End-User Analysis

Biotechnology and pharmaceutical companies represent the largest end-user segment in the clinical trial imaging market, with a 46.2% share. This growth is primarily driven by the increasing number of clinical trials being conducted to test new therapies, particularly in oncology, cardiology, and infectious diseases. These companies are at the forefront of developing innovative therapeutics and rely heavily on clinical trial imaging for the efficient evaluation of drug safety and efficacy. The growth of biologics, gene therapies, and personalized medicine is expected to increase the need for sophisticated imaging technologies to assess complex biological treatments.

As competition among pharmaceutical and biotechnology companies intensifies, these companies are projected to invest heavily in cutting-edge imaging technologies to gain a competitive advantage in drug development. Additionally, the increasing regulatory requirements for clinical trials, including the need for precise and reproducible data, will likely spur further investment in imaging solutions.

The growing focus on the global health burden of chronic diseases, especially cancer and cardiovascular disorders, will lead pharmaceutical and biotechnology companies to expand their use of imaging in clinical trials. Moreover, advancements in imaging technologies and the adoption of AI and machine learning to improve image analysis will drive the market growth among these companies.

Key Market Segments

By Modality

- Computed Tomography Scan

- X-Ray

- Ultrasound

- Optical Coherence Tomography (OCT)

- Magnetic Resonance Imaging

- Other

By Services

- Reading & Analytical Services

- System & Technology Support Services

- Project & Data Management

- Operational Imaging Services

- Clinical Trial Design & Consultation Services

By Application

- Oncology

- Orthopedics & MSK Disorders

- Ophthalmology

- Neurovascular Diseases

- Nephrology

- Cardiovascular Diseases

- Other

By End-user

- Biotechnology & Pharmaceutical Companies

- Medical Devices Manufacturers

- Contract Research Organizations (CROs)

- Academic & Government Research Institutes

- Other

Drivers

The increasing complexity of clinical trials is driving the market.

The evolution of clinical research towards more targeted and complex therapies, particularly in fields such as oncology and rare diseases, is a key driver for the clinical trial imaging market. Modern drug protocols often require precise, non-invasive methods to assess therapeutic efficacy, disease progression, and treatment response. Imaging modalities like MRI, CT, and PET are essential for providing these quantifiable insights.

A 2024 report by the National Cancer Institute highlighted that the number of active oncology trials registered on ClinicalTrials.gov increased by 11% from the previous year, with a significant portion of these trials incorporating imaging biomarkers as primary or secondary endpoints. This reliance on imaging to support intricate study designs and the use of imaging biomarkers as reliable endpoints is directly accelerating the demand for professional imaging services and technologies.

Restraints

The high cost and technical complexity are restraining the market.

A significant restraint on market growth is the substantial capital investment required for advanced imaging equipment, specialized software, and the highly trained personnel necessary to operate and interpret them. The procurement and maintenance of modalities like PET-CT and high-field MRI scanners can be prohibitively expensive for many organizations. These costs are a major barrier to entry, particularly for smaller biotechnology firms and academic institutions in emerging markets.

According to a 2023 study published in JAMA Internal Medicine, the average cost of developing a new drug exceeds US$1 billion, with clinical trial expenses, including imaging services, making up a significant portion. This is further compounded by the continuous need for software upgrades and compliance with evolving regulatory standards.

Opportunities

The rise of AI and machine learning creates growth opportunities.

The application of artificial intelligence (AI) and machine learning (ML) in clinical trial imaging presents a substantial opportunity for market growth by enhancing efficiency and accuracy. AI algorithms are increasingly being used to automate image analysis, identify subtle patterns, and predict treatment outcomes, which can significantly reduce the time and effort required for manual interpretation.

In 2022, the US Food and Drug Administration (FDA) reported that it had cleared or approved 139 new AI/ML-enabled medical devices, demonstrating a steep increase in regulatory acceptance of these technologies. This trend continued with 226 approvals in 2023, and a further 235 in 2024. This rapid acceleration in approvals underscores the growing trust in these technologies for image-based diagnostics and analysis. This trend is creating a new segment of AI-driven software and services that can streamline clinical trial workflows, improve data consistency across multiple sites, and ultimately accelerate the development of new therapies.

Impact of Macroeconomic / Geopolitical Factors

The clinical trial imaging market is navigating a complex macroeconomic and geopolitical landscape, which impacts both research costs and supply chain stability. Global pharmaceutical R&D investments, which surpassed $276 billion annually according to a study published in Nature Reviews Drug Discovery, reflect a robust commitment to innovation, but geopolitical risks can impede its translation to the market. For instance, new US tariffs on imported medical devices from the European Union now stand at 20%, a significant increase that raises the cost of high-end imaging equipment for clinical research.

Additionally, in a targeted move to address trade imbalances, the US International Trade Commission has documented new duties on specific medical technologies, including those used in imaging. Despite these challenges, the market is poised for significant growth. ClinicalTrials.gov, the world’s largest clinical trial registry, lists over 528,000 studies in its database, a strong indicator of sustained demand for imaging solutions to support new drug and device development. This continued investment, alongside efforts to diversify manufacturing, ensures the sector’s long-term prosperity.

Latest Trends

Decentralization of clinical trials is a recent trend.

A prominent recent trend is the shift towards decentralized and hybrid clinical trial models, which has a direct impact on the imaging market. These models reduce the need for patients to travel to a central site, improving patient recruitment and retention, and broadening the geographic reach of trials. This shift is enabled by technologies such as remote monitoring and cloud-based imaging platforms, which allow for the secure collection and centralized analysis of imaging data from diverse locations.

A 2023 study from the Tufts Center for the Study of Drug Development found that the percentage of new trials with at least one decentralized component has increased from 15% in 2019 to over 30% in 2022. This trend is driving the development of new, scalable solutions that support remote image acquisition and secure data transfer, fundamentally reshaping how imaging services are delivered and managed in modern clinical research.

Regional Analysis

North America is leading the Clinical Trial Imaging Market

The North American market for clinical trial imaging held a commanding 46.8% share of the global market in 2024. This leadership is a direct result of several key factors, including a mature and well-funded pharmaceutical and biotechnology sector, a high volume of clinical trials, and a strong regulatory environment that supports the use of advanced imaging technologies. The US has a particularly high burden of chronic diseases, which are the focus of many clinical trials.

The Centers for Disease Control and Prevention (CDC) reported in 2023 that approximately six in ten adults in the US live with a chronic disease, with cancer and cardiovascular disease being a primary focus of new drug and device development. Furthermore, the National Institutes of Health (NIH) awarded over 3,000 grants in 2024, many of which are specifically for research that utilizes imaging to evaluate the efficacy of new treatments. The FDA’s streamlined processes, such as Fast-Track and Breakthrough Device designations, also accelerate the clinical development of drugs, necessitating the rapid and accurate data provided by centralized imaging services.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific clinical trial imaging market is anticipated to experience robust growth during the forecast period. This is largely a result of a rapidly expanding healthcare sector, a significant and rising disease burden, and increasing government investment in biomedical research. According to the International Agency for Research on Cancer (IARC), in 2022, there were an estimated 9.8 million new cancer cases in Asia, representing a substantial patient pool for clinical trials. This high disease prevalence fuels the need for innovative and effective treatment options, which in turn drives the demand for imaging services to monitor drug efficacy and patient response.

The market’s growth is also supported by more streamlined regulatory processes in key countries and significant government investment in research. For instance, in 2024, China’s total expenditure on research and development (R&D) exceeded 3.6 trillion yuan, demonstrating its commitment to becoming a leader in medical technology and clinical research.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the clinical trial imaging market are driving growth through several strategic initiatives. Companies are heavily investing in integrating advanced technologies, particularly artificial intelligence and machine learning, to automate image analysis and improve data accuracy, which ultimately shortens trial timelines. They also focus on expanding their service portfolios to include comprehensive solutions that streamline clinical workflows, from trial design and consultation to data management and analysis.

Furthermore, market leaders are actively pursuing mergers and acquisitions and forming strategic partnerships to expand their global footprint, access new therapeutic areas, and enhance their technological capabilities. This combination of innovation and strategic business development is crucial for maintaining a competitive edge.

ICON plc, a leading global contract research organization, has solidified its position in the market by providing a full suite of services that support the entire drug development lifecycle. The company offers specialized imaging services through its dedicated business unit, which leverages a global network of imaging experts, advanced technology, and streamlined processes to support clinical trials across various therapeutic areas.

ICON’s strategy involves continuously investing in its technology platform and acquiring companies that complement its service offerings, enabling them to provide a seamless and comprehensive service to pharmaceutical and biotechnology clients worldwide. The company’s focus on operational excellence and end-to-end solutions makes it a key partner for many of the world’s largest and most innovative life science companies.

Top Key Players

- Resonance Health

- Radiant Sage LLC

- ProScan Imaging

- Navitas Life Sciences

- Medpace

- IXICO plc

- Intrinsic Imaging

- Cleerly

- Clario

- Biomedical Systems Corp

Recent Developments

- In March 2023, Clario introduced a cloud-based image viewer designed specifically for clinical trials. This solution is intended to simplify the analysis of medical images and enhance accessibility for clinical research teams.

- In May 2023, Cleerly entered into a partnership with ProScan Imaging to deliver personalized cardiovascular solutions. The collaboration focuses on analyzing coronary CT angiography (CCTA) images and developing tailored treatment strategies using Cleerly’s AI-driven platform.

Report Scope

Report Features Description Market Value (2024) US$ 1.0 Billion Forecast Revenue (2034) US$ 2.1 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Modality (Computed Tomography Scan, X-Ray, Ultrasound, Optical Coherence Tomography (OCT), Magnetic Resonance Imaging, and Other), By Services (Reading & Analytical Services, System & Technology Support Services, Project & Data Management, Operational Imaging Services, and Clinical Trial Design & Consultation Services), By Application (Oncology, Orthopedics & MSK Disorders, Ophthalmology, Neurovascular Diseases, Nephrology, Cardiovascular Diseases, and Other), By End-user (Biotechnology & Pharmaceutical Companies, Medical Devices Manufacturers, Contract Research Organizations (CROs), Academic & Government Research Institutes, and Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Resonance Health, Radiant Sage LLC, ProScan Imaging, Navitas Life Sciences, Medpace, IXICO plc, Intrinsic Imaging, Cleerly, Clario , Biomedical Systems Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Clinical Trial Imaging MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Clinical Trial Imaging MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Resonance Health

- Radiant Sage LLC

- ProScan Imaging

- Navitas Life Sciences

- Medpace

- IXICO plc

- Intrinsic Imaging

- Cleerly

- Clario

- Biomedical Systems Corp