Global Clinical Research Organization Market By Service Type (Early Phase Development, Clinical Trial Services, Laboratory Services and Regulatory Consulting), By Therapeutic Area (Oncology, CNS & Cardiovascular and Infectious Disease & Gastroenterology), By End-User (Pharma/Biotech, Medical Device Companies and Academic/Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178807

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

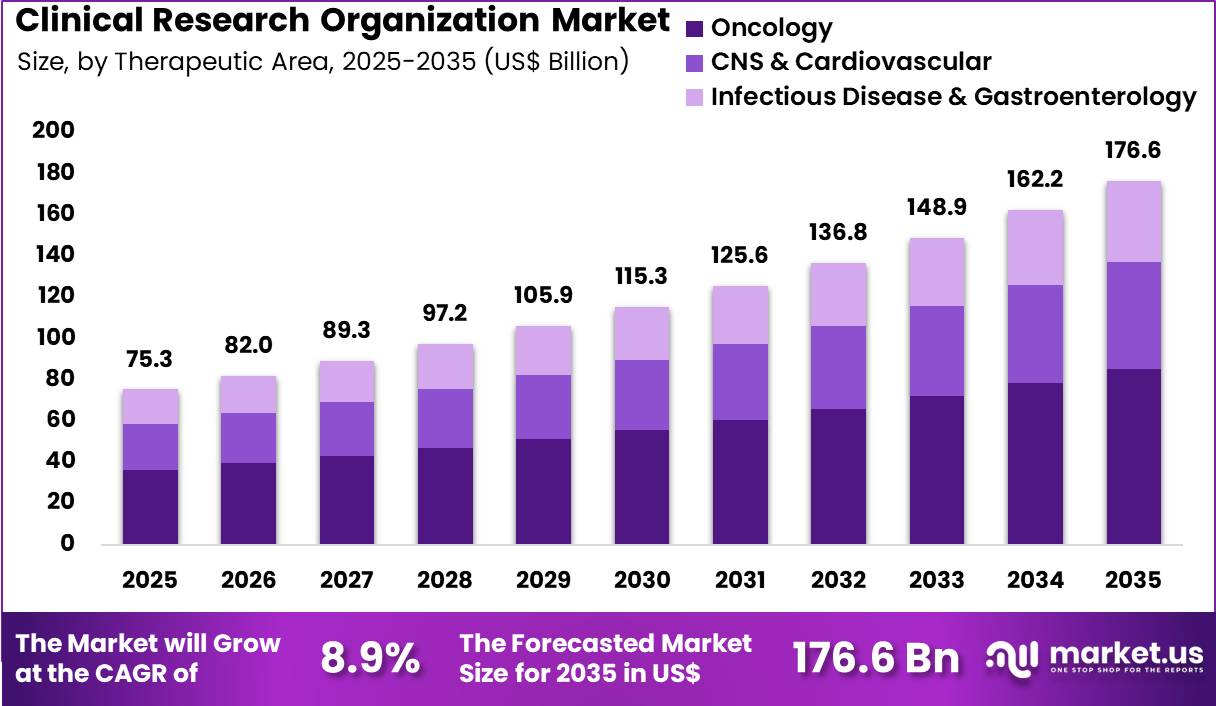

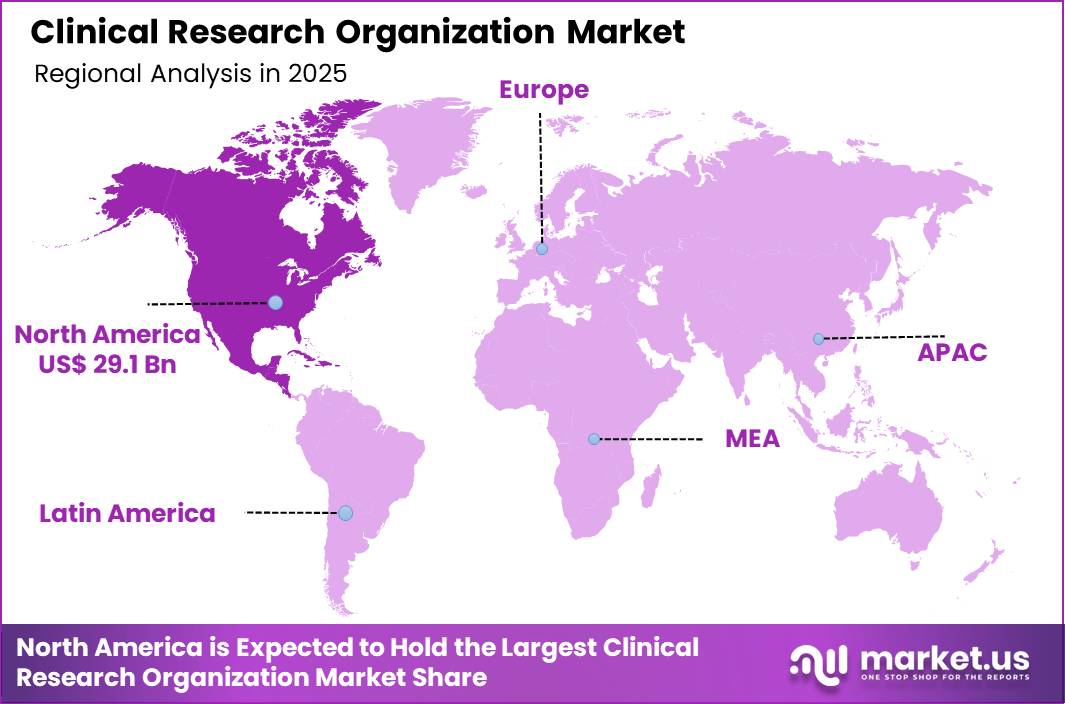

The Global Clinical Research Organization Market size is expected to be worth around US$ 176.6 Billion by 2035 from US$ 75.3 Billion in 2025, growing at a CAGR of 8.9% during the forecast period 2026-2035. In 2025, North America led the market, achieving over 38.6% share with a revenue of US$ 29.1 Billion.

Increasing complexity and cost pressures in drug development compel pharmaceutical and biotechnology companies to partner with clinical research organizations that provide specialized expertise and operational efficiency across the clinical trial lifecycle.

Sponsors increasingly outsource phase I studies to CROs for first-in-human safety assessments, leveraging their experience in dose escalation, pharmacokinetics, and early tolerability evaluations. These organizations support phase II proof-of-concept trials by managing multi-center recruitment, site monitoring, and data management for oncology and rare disease indications where patient populations remain limited.

CROs facilitate large-scale phase III confirmatory studies, coordinating global regulatory submissions and endpoint adjudication for cardiovascular, neurology, and infectious disease programs. They also handle post-marketing phase IV surveillance, conducting real-world evidence studies and long-term safety monitoring for approved therapies.

In addition, CROs offer specialized services in adaptive trial design, biomarker validation, and decentralized trial execution, enabling sponsors to accelerate timelines while maintaining data integrity. Contract research organizations pursue opportunities to expand integrated services that combine clinical operations with regulatory consulting and pharmacovigilance, streamlining end-to-end development for emerging biotech clients.

Developers advance digital platforms that incorporate artificial intelligence for patient matching, risk-based monitoring, and predictive analytics, broadening applications in precision medicine trials targeting specific genetic subgroups. These innovations facilitate hybrid and decentralized models that reduce site burden and enhance patient access in rare disease and pediatric studies.

Opportunities emerge in therapeutic area expertise for cell and gene therapies, where CROs manage complex logistics and long-term follow-up requirements. Companies invest in quality management systems and electronic trial master files that ensure compliance across global submissions.

Recent trends emphasize strategic alliances with sponsors for co-development models and data-driven trial optimization, positioning CROs as critical partners in accelerating innovative therapies to market while controlling development risks and costs.

Key Takeaways

- In 2025, the market generated a revenue of US$ 75.3 Billion, with a CAGR of 8.9%, and is expected to reach US$ 176.6 Billion by the year 2035.

- The service type segment is divided into early phase development, clinical trial services, laboratory services and regulatory consulting, with clinical trial services taking the lead with a market share of 35.1%.

- Considering therapeutic area, the market is divided into oncology, CNS & cardiovascular and infectious disease & gastroenterology. Among these, oncology held a significant share of 48.3%.

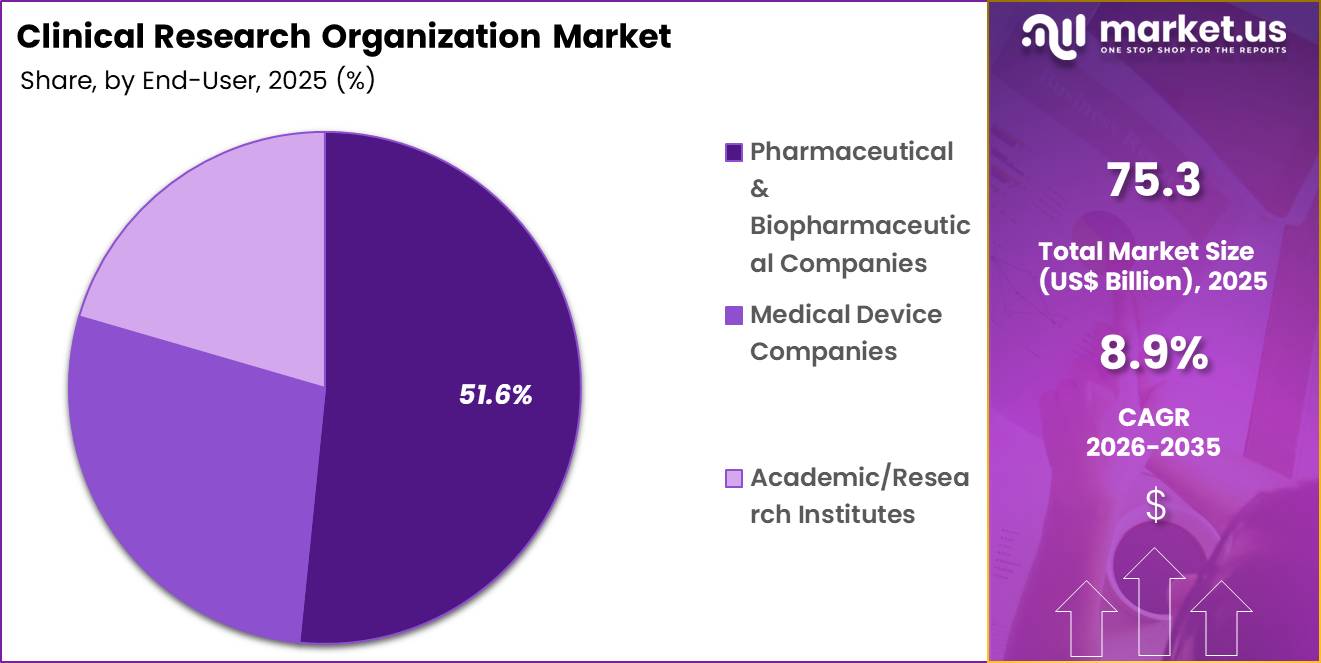

- Furthermore, concerning the end-user segment, the market is segregated into pharma/biotech, medical device companies and academic/research institutes. The pharmaceutical and biopharmaceutical companies sector stands out as the dominant player, holding the largest revenue share of 51.6% in the market.

- North America led the market by securing a market share of 38.6%.

Service Type Analysis

Clinical trial services accounted for 35.1% of growth within service type and led the clinical research organization market due to rising outsourcing of Phase II and Phase III studies. Sponsors increasingly rely on CROs to manage site selection, patient recruitment, monitoring, and data management across multi-country trials.

Expanding therapeutic pipelines and global regulatory complexity increase the need for specialized operational expertise. The segment is expected to reach 41% by late 2026 as sponsors expand late-stage development portfolios.

Growth strengthens as decentralized and hybrid trial models require advanced coordination and digital tools. CROs invest in risk-based monitoring and analytics platforms to improve trial efficiency. Competitive pressure to reduce development timelines further drives outsourcing.

Strategic long-term partnerships between sponsors and CROs increase recurring service demand. The segment is anticipated to maintain leadership as clinical trial execution remains the largest and most resource-intensive component of drug development.

Therapeutic Area Analysis

Oncology generated 48.3% of growth within therapeutic area and emerged as the leading segment due to the high volume of active cancer drug pipelines. Sponsors prioritize oncology research because of strong unmet medical needs and accelerated regulatory pathways.

Increasing use of targeted therapies and immuno-oncology agents expands trial complexity and patient stratification requirements. CROs provide specialized oncology trial management expertise that supports biomarker-driven study designs.

Growth accelerates as global cancer incidence continues to rise. Precision medicine initiatives increase the need for adaptive trial frameworks. Oncology studies often require multi-arm and combination regimens, which elevate operational demand. Investment in cell and gene therapies further strengthens oncology trial activity. The segment is projected to remain dominant as oncology continues to represent the most active area of clinical research.

End-User Analysis

Pharmaceutical and biopharmaceutical companies accounted for 51.6% of growth within end-user and dominated the clinical research organization market due to expanding global R&D expenditure. These sponsors manage diverse pipelines that span small molecules, biologics, and advanced therapies.

Outsourcing to CROs enables cost control, geographic expansion, and access to therapeutic expertise. Increasing regulatory scrutiny also encourages collaboration with experienced service providers.

Growth strengthens as emerging biotech firms rely heavily on external partners for clinical execution. Large pharmaceutical companies pursue strategic outsourcing models to improve efficiency. Portfolio diversification into rare and specialty diseases increases trial demand.

Competitive pressure to accelerate time-to-market further supports CRO engagement. The segment is expected to remain the primary growth driver as pharmaceutical and biopharmaceutical innovation continues to expand worldwide.

Key Market Segments

By Service Type

- Early Phase Development

- Clinical Trial Services

- Laboratory Services

- Regulatory Consulting

By Therapeutic Area

- Oncology

- CNS & Cardiovascular

- Infectious Disease & Gastroenterology

By End-User

- Pharma/Biotech

- Medical Device Companies

- Academic/Research Institutes

Drivers

Increasing number of clinical trials is driving the market.

The global proliferation of clinical trials has substantially elevated the demand for clinical research organizations to manage complex study protocols and ensure regulatory compliance. Pharmaceutical sponsors are increasingly outsourcing trials to CROs to leverage specialized expertise and reduce internal operational burdens.

Healthcare regulators are approving more novel therapies, necessitating robust CRO support for efficient trial execution. The correlation between expanding biopharma pipelines and trial initiations further accelerates market growth for outsourced services. Government agencies are funding more collaborative studies that rely on CRO capabilities for multi-site coordination.

Clinical research organizations provide comprehensive solutions from design to data analysis, improving trial timelines. National databases document yearly increases in registered studies across therapeutic areas. Key CROs are scaling global networks to handle this surge in demand. This driver fosters innovation in decentralized trial methodologies. The clinical trials market was valued at US$84.7 billion in 2024, reflecting strong underlying activity driving CRO services.

Restraints

High costs associated with clinical trials are restraining the market.

The substantial expenses involved in conducting complex clinical trials pose significant barriers to market expansion for clinical research organizations. Rising costs for patient recruitment, data management, and regulatory compliance strain sponsor budgets and CRO pricing models.

Healthcare payers scrutinize trial expenditures, often leading to delayed project initiations or reduced scopes. The correlation between extended trial durations and escalating operational costs further constrains profitability. Government regulations require extensive documentation, adding administrative overheads.

Clinical research organizations must invest heavily in technology to mitigate inefficiencies. National reports highlight budget overruns as a common challenge in large-scale studies.

Key players face pressure to optimize costs without compromising quality. This restraint limits entry for smaller CROs in competitive landscapes. High costs associated with clinical trials and drug development, including quality assurance and adherence to international standards, act as a key market restraint.

Opportunities

Expansion into emerging markets is creating growth opportunities.

The rapid growth of clinical research activities in Asia-Pacific and Latin America presents substantial potential for clinical research organizations to establish new operations and partnerships. Governmental incentives for biotechnology investments support the development of local trial infrastructure in these regions.

Increasing outsourcing to cost-effective locations amplifies demand for CRO services in diverse patient populations. Strategic alliances with regional hospitals enable compliance with local regulations and efficient trial execution. The large untapped patient pools in populous nations magnify prospects for multi-center studies.

Educational programs for local investigators promote standardized CRO practices. This opportunity allows established firms to diversify beyond saturated Western markets. Key corporations are investing in capacity building to capture market share. Overall, emerging expansions align with global efforts to accelerate drug development.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic cycles influence the clinical research organization market by shaping sponsor funding, trial budgets, and outsourcing priorities across pharmaceutical and biotech companies. When inflation persists and capital becomes expensive, smaller sponsors reduce trial scope or delay program starts, which directly affects CRO revenue flow.

Currency volatility and shifting trade relations add complexity to cross border studies and increase administrative costs. Current US tariffs on imported laboratory equipment, IT infrastructure, and certain clinical supplies raise operating expenses for CRO facilities, which pressures margins and contract pricing.

Geopolitical instability also complicates patient recruitment and site management in some regions, increasing execution risk. These constraints can slow expansion plans and heighten scrutiny around project efficiency.

At the same time, sponsors rely more heavily on experienced CRO partners to manage cost control, regulatory compliance, and global coordination. With strong operational discipline and diversified geographic presence, the CRO market continues to demonstrate structural resilience and long term growth potential.

Latest Trends

Adoption of decentralized and hybrid clinical trial models is a recent trend in the market.

In 2023, clinical research organizations increasingly implemented decentralized approaches using digital tools for remote patient monitoring and virtual site visits. These models reduce reliance on traditional brick-and-mortar sites, improving enrollment speed and diversity.

Manufacturers focused on integrating wearable devices and e-consent platforms into trial protocols. Clinical studies demonstrated higher retention rates with hybrid decentralized designs. This development addresses challenges in patient access for rare disease studies. The trend emphasizes flexibility in site selection and data collection methods.

Regulatory agencies issued guidance to support decentralized elements in study designs. Industry collaborations refined telehealth integrations for real-time oversight. These innovations aim to lower costs while maintaining data quality in complex trials. The rising acceptance of decentralized and hybrid clinical trial models across the region is a key market trend.

Regional Analysis

North America is leading the Clinical Research Organization Market

North America accounted for a 38.6% share of the Clinical Research Organization market in 2024, reflecting sustained outsourcing by pharmaceutical and biotechnology sponsors. Drug developers increasingly partnered with external service providers to manage complex trial protocols, regulatory documentation, and multi site coordination.

Growth in oncology, rare disease, and advanced biologic pipelines increased the need for specialized data management and patient recruitment capabilities. Decentralized and hybrid study models further strengthened demand for digital trial oversight and remote monitoring services. Academic medical centers collaborated with contract research partners to accelerate translational programs.

Stable regulatory pathways and strong intellectual property protection encouraged sponsors to conduct pivotal trials in the region. A clear supporting indicator comes from the National Institutes of Health, which reported a fiscal year 2023 budget of USD 47.5 billion, underscoring the scale of research activity that supports professional trial management services.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Clinical Research Organization market in Asia Pacific is expected to expand steadily during the forecast period as global sponsors increase study footprints across diverse patient populations. Governments streamline approval timelines and strengthen ethical review frameworks to attract multinational trials.

Large treatment naive patient pools accelerate enrollment rates, which enhances regional competitiveness. Academic hospitals build research partnerships with international biopharma firms to support complex late stage programs. Rising investments in data analytics and digital monitoring tools improve operational efficiency.

Skilled investigators and lower operating costs further encourage outsourcing activity. A verifiable signal of momentum appears in 2023 updates from China’s National Medical Products Administration, which continues to report growing numbers of registered clinical trials annually, highlighting strong structural growth in organized research services across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the clinical research organization market grow by expanding service portfolios that span early-phase development through global Phase III execution, helping sponsors streamline timelines and manage complex regulatory landscapes.

They also strengthen client value by integrating advanced data analytics, decentralized trial capabilities, and risk-based monitoring that improve decision-making and operational efficiency across diverse therapeutic areas.

Firms pursue strategic alliances with biotech innovators, technology providers, and academic research networks to embed their expertise into emerging modalities and accelerate protocol execution. Geographic expansion into North America, Europe, and high-growth Asia Pacific diversifies revenue exposure while capturing rising clinical trial investments and patient recruitment demand.

IQVIA Holdings Inc. exemplifies a leading life sciences services company with deep real-world data assets, broad clinical development capabilities, and a coordinated global commercialization strategy that supports sponsors’ end-to-end research objectives.

The company advances its competitive agenda through disciplined investment in analytics platforms, targeted acquisitions that broaden capabilities, and a customer-centric approach that aligns service execution with evolving research priorities.

Top Key Players

- IQVIA

- ICON plc

- Charles River Laboratories

- Laboratory Corporation of America Holdings

- Parexel International (MA)

- Medpace Holdings

- Syneos Health

- WuXi Clinical (WuXi AppTec)

- Pharmaceutical Product Development (PPD)

- CMIC HOLDINGS

- EPS Holdings

- Iris Pharma

- Caidya

Recent Developments

- In July 2025, Labcorp introduced a neurofilament light chain (NfL) blood assay designed to support the detection and confirmation of neurodegenerative conditions. The test aims to assist clinicians in evaluating diseases such as multiple sclerosis, Alzheimer’s disease, Parkinson’s disease, and related neurological disorders through measurable biomarker analysis.

- In January 2024, Charles River entered into a research collaboration with Takeda Pharmaceutical Company Limited to advance early-stage drug discovery programs. The partnership centers on Takeda’s primary therapeutic focus areas, including oncology, gastroenterology, neuroscience, and rare diseases, with the objective of accelerating the progression of preclinical development candidates.

Report Scope

Report Features Description Market Value (2025) US$ 75.3 Billion Forecast Revenue (2035) US$ 176.6 Billion CAGR (2026-2035) 8.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type (Early Phase Development, Clinical Trial Services, Laboratory Services and Regulatory Consulting), By Therapeutic Area (Oncology, CNS & Cardiovascular and Infectious Disease & Gastroenterology), By End-User (Pharma/Biotech, Medical Device Companies and Academic/Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IQVIA, ICON plc, Charles River Laboratories, LabCorp, Parexel, Medpace, Syneos Health, WuXi Clinical, PPD, CMIC HOLDINGS, EPS Holdings, Iris Pharma, Caidya. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Clinical Research Organization MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Clinical Research Organization MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- IQVIA

- ICON plc

- Charles River Laboratories

- Laboratory Corporation of America Holdings

- Parexel International (MA)

- Medpace Holdings

- Syneos Health

- WuXi Clinical (WuXi AppTec)

- Pharmaceutical Product Development (PPD)

- CMIC HOLDINGS

- EPS Holdings

- Iris Pharma

- Caidya