Global Clinical Documentation Improvement Market By Component (Software, Services) By Deployment Mode (Cloud-Based, On-Premise, Hybrid) By Function (Clinical Coding and Compliance, Charge capture, Quality Reporting and Performance Measurement, Revenue Cycle Management Optimization, Physician Query Management, Others) By End-User (Healthcare providers, Hospitals, Inpatient Settings, Outpatient Settings, Long-term care facilities, Ambulatory surgical centers, Others Healthcare payers) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164103

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

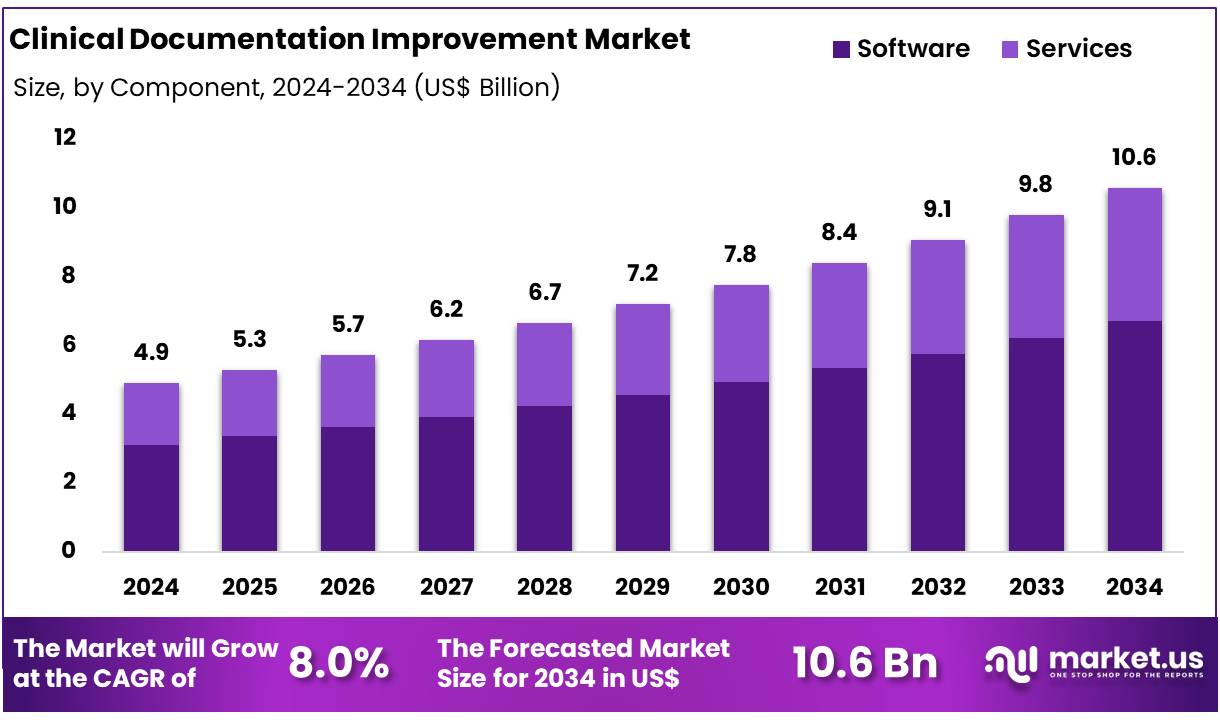

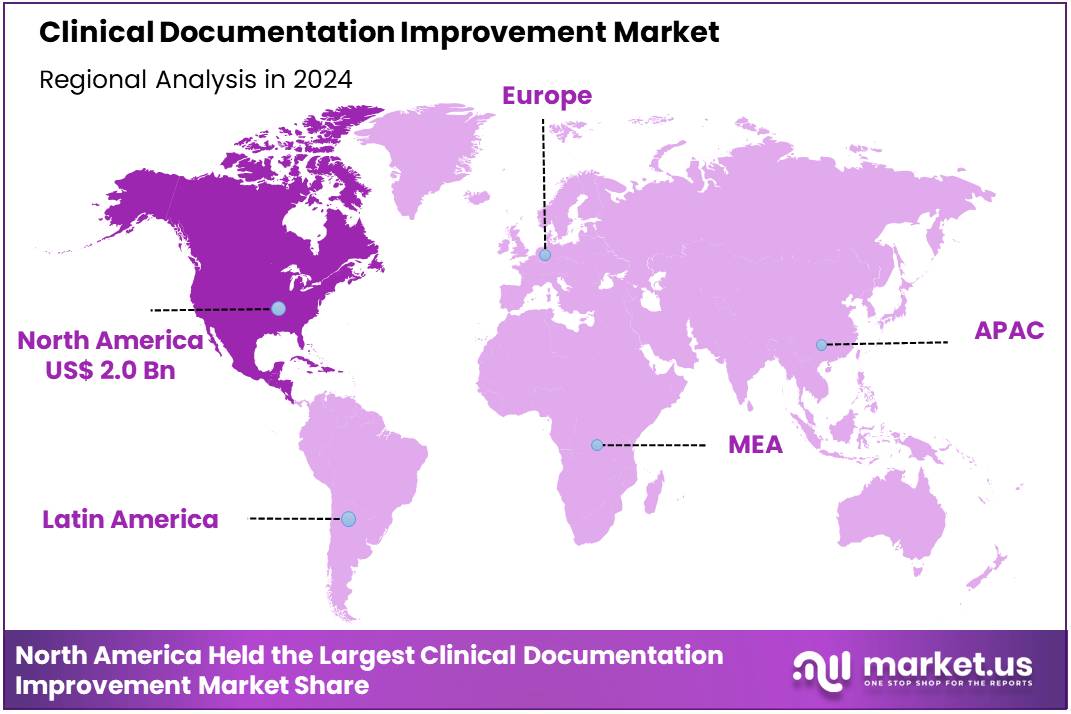

Global Clinical Documentation Improvement Market size is expected to be worth around US$ 10.6 Billion by 2034 from US$ 4.9 Billion in 2024, growing at a CAGR of 8.0% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 40.2% share with a revenue of US$ 2.0 Billion.

Growth in Clinical Documentation Improvement (CDI) is being driven by stronger data standards. The adoption of ICD-11 has been advanced worldwide. It brings clearer terms, digital design, and better links to clinical workflows. These updates improve coding accuracy and allow easier data exchange across systems.

The 2025 ICD-11 update emphasized interoperability and ease of use, which supports scaled CDI programs in hospitals and payers. As a result, investments in CDI tools and training are rising. Policy pressure is also accelerating demand. In the United States, the CMS Interoperability and Prior Authorization Final Rule requires payers to expose documentation requirements via APIs and to support electronic prior authorization. This creates a clear need for complete, structured clinical documentation.

Providers must capture the right data the first time to meet these rules and to speed approvals. Similar interoperability agendas are influencing procurement decisions in other markets. Patient safety and cost control act as additional catalysts. Medication errors remain a major, avoidable burden. The global cost has been estimated at about US$42 billion per year. Better documentation reduces ambiguity, improves medication reconciliation, and lowers error rates.

Health systems are therefore prioritizing CDI to cut waste, improve outcomes, and support value-based care models. These objectives are aligned with national patient safety campaigns and with hospital accreditation needs.

Digital maturity further supports growth. Electronic health record (EHR) availability in OECD countries has risen markedly, including in hospitals. Yet fragmentation and variable data quality persist.

CDI solutions are being adopted to standardize inputs, enrich clinician notes, and enable secondary use of data. As EHR coverage expands and analytics use increases, CDI becomes a foundational capability for coding, quality reporting, and revenue integrity. This dynamic is expected to sustain steady CDI spending across regions.

Key Takeaways

- Market Size: Global Clinical Documentation Improvement Market size is expected to be worth around US$ 10.6 Billion by 2034 from US$ 4.9 Billion in 2024.

- Market Growth: The market growing at a CAGR of 8.0% during the forecast period from 2025 to 2034.

- Product Analysis: The Software segment has been observed as the dominant category, accounting for an estimated 63.5% of the total market share in 2024.

- Application Analysis: The Cloud-Based segment dominated the market, securing an estimated 51.2% share in 2024.

- End-Use Analysis: The Clinical Coding and Compliance segment held the leading position, accounting for approximately 29.6% of the market in 2024.

- Regional Analysis: In 2024, North America led the market, achieving over 40.2% share with a revenue of US$ 2.0 Billion.

Component Analysis

By Component, the market is bifurcated into Software and Services. The Software segment has been observed as the dominant category, accounting for an estimated 63.5% of the total market share in 2024. The significant adoption of software solutions can be attributed to increasing digitization in healthcare facilities, real-time data accessibility, and advancements in automated CDI platforms.

Enhanced accuracy in clinical coding, compliance support, and integration with electronic health record (EHR) systems further strengthened the software demand. AI-driven CDI tools and natural language processing capabilities were increasingly implemented to streamline clinical workflows and reduce documentation errors.

The Services segment is expected to grow at a steady rate owing to expanding demand for specialized consulting, coding audits, and training programs. Healthcare providers continued to rely on professional CDI services to address skill gaps, ensure regulatory compliance, and improve documentation quality. The segment growth is supported by continuous staff training requirements and evolving clinical standards.

Deployment Mode Analysis

By Deployment Mode, the Clinical Documentation Improvement market is categorized into Cloud-Based, On-Premise, and Hybrid solutions. The Cloud-Based segment dominated the market, securing an estimated 51.2% share in 2024. This dominance can be attributed to increasing demand for scalable platforms, reduced operational costs, and the need for remote accessibility within healthcare environments.

Cloud-based CDI solutions were widely preferred due to seamless integration with existing systems, improved data storage capabilities, and enhanced flexibility to support distributed care models. Furthermore, heightened focus on secure data exchange and interoperability with electronic health records contributed to cloud adoption.

The On-Premise segment continued to hold a notable share, primarily driven by institutions prioritizing in-house data control and security customization. Meanwhile, the Hybrid segment demonstrated steady expansion as providers adopted mixed models to balance internal data governance with cloud efficiency. Growing compliance requirements and the gradual transition from legacy systems are expected to maintain hybrid deployment momentum.

Function Analysis

By Function, segmented into Clinical Coding and Compliance, Charge Capture, Quality Reporting and Performance Measurement, Revenue Cycle Management Optimization, Physician Query Management, and Others. The Clinical Coding and Compliance segment held the leading position, accounting for approximately 29.6% of the market in 2024.

This dominance can be attributed to the rising emphasis on accurate documentation to meet regulatory standards, support claim integrity, and minimize reimbursement risks. Increasing adoption of automated coding tools and compliance-driven CDI workflows strengthened the segment’s growth trajectory, enabling healthcare providers to reduce errors and ensure adherence to evolving coding guidelines.

Charge Capture and Revenue Cycle Management Optimization segments exhibited consistent demand owing to their role in improving financial performance and reducing claim denials. Quality Reporting and Performance Measurement continued expanding due to value-based care initiatives, while Physician Query Management tools gained traction for enhancing communication between coders and clinicians. The Others category includes supplementary CDI functions supporting operational efficiency.

End-User Analysis

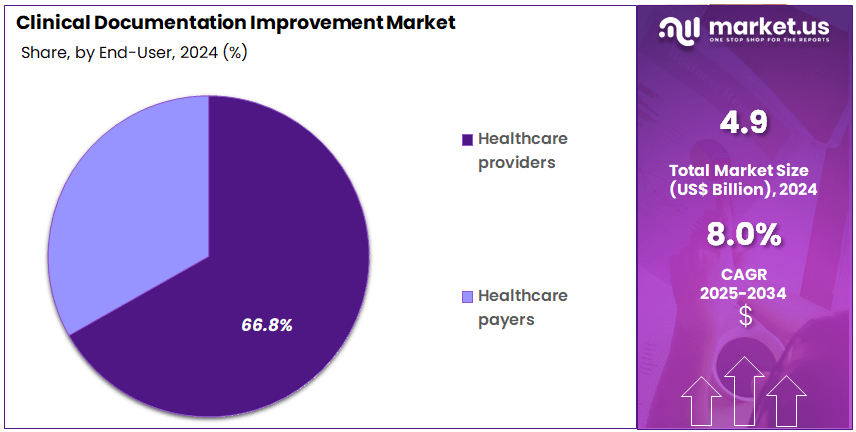

By End-User classified into Healthcare Providers and Healthcare Payers. Healthcare providers dominated the market with an estimated 66.8% share in 2024. The significant share held by this segment can be attributed to the growing need for accurate clinical documentation within hospitals, clinics, and specialty centers to ensure precise coding, optimized reimbursement, and improved patient outcomes.

The adoption of advanced CDI platforms across provider settings has increased as healthcare facilities focused on reducing claim denials and adhering to stringent regulatory and quality reporting standards. Additionally, the expansion of electronic health records and integration of AI-enabled tools supported process automation and clinical workflow enhancement.

Healthcare payers represented the second-largest segment, driven by the rising emphasis on audit management, fraud detection, and claims validation. Payers continued to invest in CDI technology to strengthen data accuracy, enhance reimbursement integrity, and support population health management initiatives, contributing to steady segment growth.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- Cloud-Based

- On-Premise

- Hybrid

By Function

- Clinical Coding and Compliance

- Charge capture

- Quality Reporting and Performance Measurement

- Revenue Cycle Management Optimization

- Physician Query Management

- Others

By End-User

- Healthcare providers

- Hospitals

- Inpatient Settings

- Outpatient Settings

- Long-term care facilities

- Ambulatory surgical centers

- Others

- Hospitals

- Healthcare payers

Driving Factors

The growth of the clinical documentation improvement (CDI) market is significantly propelled by increasing regulatory and compliance requirements. For example, the Centers for Medicare & Medicaid Services (CMS) utilises quality measures to assess provider performance across domains such as effectiveness, safety and patient-centredness. Accurate documentation is foundational to correct coding (e.g., ICD-10) and risk adjustment, which in turn influence reimbursement and penalties under value-based care models.

Additionally, the widespread adoption of Electronic Health Records (EHRs) has created a large volume of structured and unstructured clinical data that organisations must manage and interpret; this has driven demand for CDI solutions to improve documentation completeness, accuracy and usability.

Trending Factors

An important trend in the CDI market is the expansion of CDI programmes beyond acute inpatient settings into outpatient, post-acute and ambulatory care contexts. As longitudinal and value-based care models become more prevalent, the need for accurate documentation across the continuum of care is rising.

Moreover, technological innovation—specifically the application of natural language processing (NLP) and artificial intelligence (AI) in CDI workflows—is becoming more prominent. These technologies enable real-time identification of documentation gaps, automate provider queries and support improved coding precision and data quality.

Restraining Factors

One key restraint on the CDI market is the significant resource investment required for implementation and ongoing management. Healthcare organisations face high upfront costs related to CDI staffing, technology integration, training and change management. This is particularly challenging for smaller providers with limited budgets.

In addition, integration and interoperability issues remain problematic: disparate systems, complex workflows and heavy clinician documentation burdens can undermine CDI efficacy and acceptance. Poor provider engagement or excessive query volume may lead to provider resistance and programme inefficiency.

Opportunity

A substantial opportunity exists around leveraging CDI to support broader population health and value-based care initiatives. Accurate, comprehensive documentation facilitates risk adjustment, quality measurement and analytics, enabling providers to identify high-risk patients and improve outcomes while reducing costs.

Furthermore, as regulatory agencies increasingly prioritise transparency and data integrity (e.g., CMS quality reporting and value-based purchasing programmes), CDI programmes that align with external reporting requirements can provide differentiators in provider network contracts and remuneration models.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 40.2% share and holds US$ 2.0 Billion market value for the year. The large share of the region can be attributed to advanced healthcare systems and early adoption of digital health technologies. The presence of strong regulatory structures has also supported adoption, as accurate medical documentation is prioritized to enhance care quality and reimbursement accuracy.

High electronic health record (EHR) penetration has played a central role in driving Clinical Documentation Improvement (CDI) solutions in the region. Hospitals and healthcare providers have been investing in clinical data accuracy and coding compliance to improve revenue cycle outcomes. The demand for structured documentation and real-time data access has increased due to complex billing processes and evolving clinical standards.

The United States has been the primary contributor to the regional market. The focus on reducing healthcare fraud, improving reporting accuracy, and enhancing patient outcomes has supported strong CDI solution acceptance. Government policies promoting transparent healthcare data usage have reinforced the trend. In addition, rising pressure on hospitals to boost productivity and reduce claim denials has accelerated CDI adoption.

Canada has also shown steady progress. The expansion of digital health infrastructure and rising awareness regarding documentation accuracy have supported market activity. Investment in healthcare digitalization and training of medical coders has strengthened the region’s CDI ecosystem.

Overall, the region has benefited from strong healthcare spending and technology awareness. It is expected that demand for CDI solutions in North America will continue to grow. Increasing provider focus on clinical data standardization and artificial intelligence-driven documentation tools is likely to shape the next phase of growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key participants in the Clinical Documentation Improvement market focus on enhancing coding accuracy, real-time documentation support, and regulatory compliance. Leading firms operate through advanced CDI platforms, AI-enabled workflow solutions, and integrated revenue cycle management tools. Their competitive advantage is driven by strong digital capabilities, extensive product portfolios, and partnerships with healthcare systems to support quality reporting and reimbursement integrity.

Continuous product upgrades, clinical NLP integration, and cloud-based platforms are used to strengthen market presence. Strategic investments in training services and clinical knowledge support programs enhance user adoption.

Expansion strategies include geographic persification and collaboration with hospitals, physician groups, and health IT networks. The market landscape remains dynamic, with innovation in automated documentation accuracy tools and decision-support modules shaping long-term growth prospects.

Market Key Players

- 3M Company

- Nuance Communications

- Iodine Software

- AGS Health

- R1 RCM

- Solventum

- Accuity Healthcare

- Dolbey Systems

- Vitalware

- Chartwise

- Craneware

- Epic Systems

- AQuity Solutions

- Claro Healthcare

Recent Developments

- 3M Company ((3M) Apr 2023): 3M’s Health Information Systems business entered a partnership with Amazon Web Services (AWS) to leverage machine-learning and generative AI services for its M*Modal ambient clinical documentation platform, enhancing real-time speech recognition across more than 250 EHR systems.

- Nuance Communications (Mar 2023): Nuance (a Microsoft company) introduced the Dragon Ambient eXperience (DAX™) Express, an AI-automated clinical documentation application embedding GPT-4 to capture clinician-patient interactions and generate structured notes.

- AGS Health (Jul 2025): AGS Health was named the top mid-cycle RCM outsourcing vendor by Black Book Research, highlighting its CDI services’ accuracy, automation and staffing scalability under rising documentation demands.

- R1 RCM (Oct 2025): R1 agreed to acquire Phare Health Ltd., an AI-native platform focused on inpatient coding and pre-bill clinical documentation improvement, integrating into R1’s “R37” innovation lab for next-gen revenue cycle automation.

Report Scope

Report Features Description Market Value (2024) US$ 4.9 Billion Forecast Revenue (2034) US$ 10.6 Billion CAGR (2025-2034) 8.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Services) By Deployment Mode (Cloud-Based, On-Premise, Hybrid) By Function (Clinical Coding and Compliance, Charge capture, Quality Reporting and Performance Measurement, Revenue Cycle Management Optimization, Physician Query Management, Others) By End-User (Healthcare providers, Hospitals, Inpatient Settings, Outpatient Settings, Long-term care facilities, Ambulatory surgical centers, Others Healthcare payers) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape 3M Company, Nuance Communications, Iodine Software, AGS Health, R1 RCM, Solventum, Accuity Healthcare, Dolbey Systems, Vitalware, Chartwise, Craneware, Epic Systems, AQuity Solutions, Claro Healthcare Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Clinical Documentation Improvement MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Clinical Documentation Improvement MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- Nuance Communications

- Iodine Software

- AGS Health

- R1 RCM

- Solventum

- Accuity Healthcare

- Dolbey Systems

- Vitalware

- Chartwise

- Craneware

- Epic Systems

- AQuity Solutions

- Claro Healthcare