Global Chromatography Resin for Pharmaceuticals and Biotechnology Application Market By Type(Natural, Synthetic, Inorganic), By Technique(Ion Exchange, Affinity, Size Exclusion, Hydrophobic Interaction, Multimodal, Others), By Application(Protein Purification, Antibody Purification, Vaccine Production, DNA & RNA Purification, Cell Therapy, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: March 2024

- Report ID: 74500

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

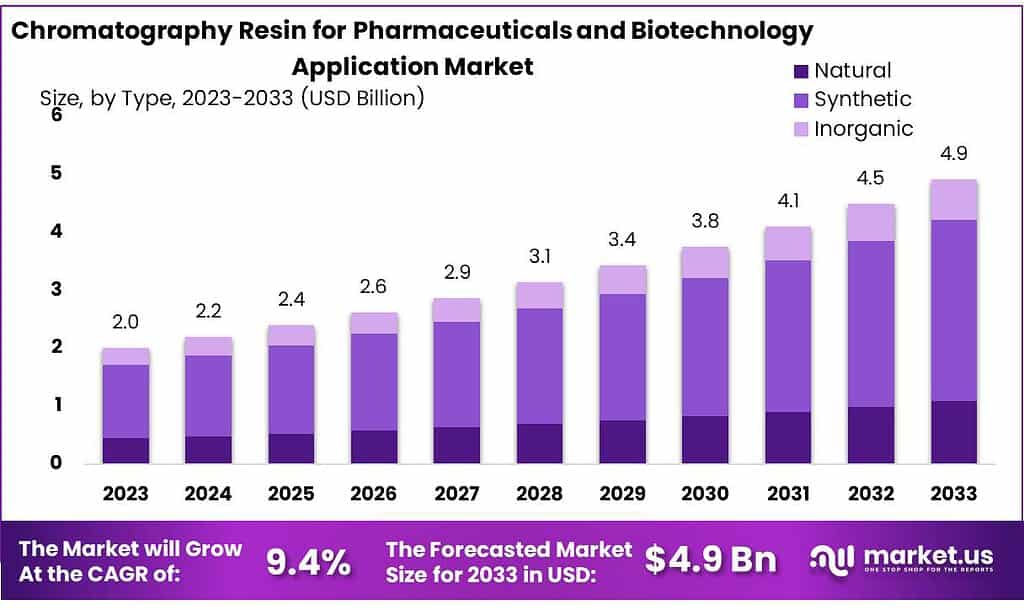

The global Chromatography Resin for Pharmaceuticals and Biotechnology Application Market size is expected to be worth around USD 4.9 billion by 2033, from USD 2.0 billion in 2023, growing at a CAGR of 9.4% during the forecast period from 2023 to 2033.

Chromatography Resin for Pharmaceuticals and Biotechnology Application Market” refers to a specialized market segment that deals with chromatography resins designed and utilized specifically for applications in the pharmaceutical and biotechnology industries. Chromatography is a widely used technique in these sectors for separating and purifying various biomolecules, such as proteins, peptides, nucleic acids, and other pharmaceutical compounds.

Chromatography Resin for Pharmaceuticals and Biotechnology Application Market represents a specific industry segment that caters to the production, distribution, and utilization of chromatography resins tailored for the unique needs and challenges of the pharmaceutical and biotechnology sectors. This market is characterized by specialized products designed to meet the stringent requirements of purifying and separating biomolecules in the production of pharmaceuticals and biotechnological products.

Key Takeaways

- Market Growth: Expected to reach USD 4.9 billion by 2033, growing at a CAGR of 9.4% from USD 2.0 billion in 2023.

- Dominant Type: Synthetic chromatography resin leads with over 63.7% market share due to reliability and versatility.

- Leading Technique: Ion Exchange chromatography resin dominates with more than 42.7% market share in 2023.

- Key Application: Protein Purification holds a dominant market position, capturing over 32.4% share.

- Regional Market: North America commands a substantial share of 35.7% of the global market.

- The binding capacity of chromatography resins, measured in milligrams of target molecule per milliliter of resin (mg/mL), ranges from 10 to 100 mg/mL for most applications.

- The average lifespan of chromatography resins ranges from 6 months to 2 years, depending on the type of resin, application, and operating conditions.

By Type

In 2023, the Chromatography Resin for Pharmaceuticals and Biotechnology Application Market exhibited a distinct segmentation based on resin types, namely Natural, Synthetic, and Inorganic. Among these segments, Synthetic chromatography resin emerged as the dominant player, capturing more than a 63.7% share of the market.

Synthetic Chromatography Resin: Synthetic chromatography resin secured a leading market position owing to its widespread adoption and superior performance characteristics. These resins are engineered using advanced manufacturing processes, allowing for precise control over their properties. The dominance of Synthetic chromatography resin is attributed to its consistent quality, high binding capacity, and versatile applicability in various pharmaceutical and biotechnological processes. Manufacturers and end-users prefer synthetic resins for their reliability, reproducibility, and adaptability to diverse separation and purification requirements.

Natural Chromatography Resin: Natural chromatography resin, although holding a substantial market share, faced a comparatively lower position than its synthetic counterpart. These resins are derived from natural sources such as agarose, cellulose, or agar, offering specific binding properties suitable for certain applications. While natural resins may be favored for specific purification challenges, the overall market share suggests that synthetic counterparts are more extensively adopted due to their broader applicability and consistent performance.

Inorganic Chromatography Resin: Inorganic chromatography resin represents a segment characterized by materials like silica or metals. In 2023, it secured a notable but smaller market share. The use of inorganic resins is often driven by their unique properties, such as high thermal stability and compatibility with harsh chemical conditions. However, their application may be limited in comparison to synthetic resins, which offer a more versatile and customizable solution for the diverse needs of the pharmaceutical and biotechnology industries.

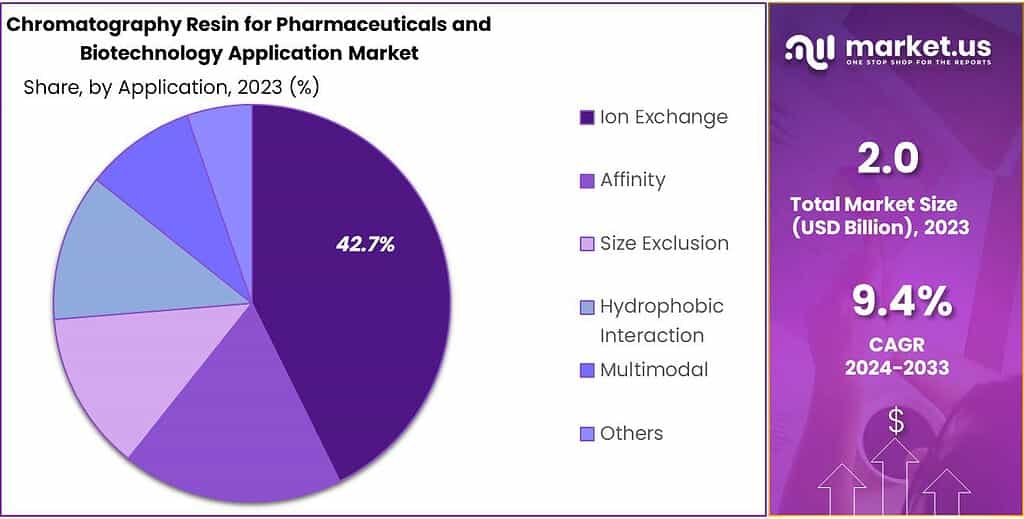

By Technique

In 2023, the Chromatography Resin for Pharmaceuticals and Biotechnology Application Market witnessed a distinctive segmentation based on various chromatography techniques, including Ion Exchange, Affinity, Size Exclusion, Hydrophobic Interaction, Multimodal, and others. Among these, Ion Exchange chromatography resin stood out by securing a dominant market position, capturing more than a 42.7% share.

Ion Exchange Chromatography Resin: Ion Exchange chromatography resin emerged as the leading technique within the market landscape in 2023. This technique relies on the exchange of ions between the chromatography resin and the target biomolecules, allowing for the separation based on the net charge of the molecules. The dominance of Ion Exchange resin is attributed to its versatility in separating a wide range of biomolecules, including proteins, peptides, and nucleic acids, making it a preferred choice in pharmaceutical and biotechnological applications. The high market share underscores the effectiveness and widespread adoption of Ion Exchange chromatography resin in purifying and analyzing biomolecules in these industries.

Affinity Chromatography Resin: Affinity chromatography resin represents a notable segment within the market, offering a selective and specific method for biomolecule separation. While holding a significant market share, it ranked slightly lower than Ion Exchange resin in 2023. Affinity chromatography relies on the specific interactions between biomolecules and ligands on the resin surface, allowing for highly selective separations. The segment’s prominence is attributed to its precision in isolating target biomolecules based on their specific biological interactions.

Size Exclusion Chromatography Resin: Size Exclusion chromatography resin, also known as gel filtration or gel permeation chromatography, accounted for a considerable market share in 2023. This technique separates biomolecules based on their size, with larger molecules eluting faster than smaller ones. Size Exclusion chromatography resin is valued for its role in achieving high purity levels by removing impurities and aggregates from biomolecular samples.

Hydrophobic Interaction Chromatography Resin: Hydrophobic Interaction chromatography resin, offering selective separation based on hydrophobic interactions, contributed to the diverse chromatography techniques in the market. It is often employed for the purification of proteins and other biomolecules. While holding a specific market share, it represents a valuable technique in the chromatography resin landscape.

Multimodal Chromatography Resin: Multimodal chromatography resin combines multiple separation mechanisms, providing enhanced selectivity. In 2023, it held a notable market share, signifying its significance in addressing complex separation challenges in pharmaceutical and biotechnological applications.

By Application

In 2023, Protein Purification held a dominant market position, capturing more than a 32.4% share of the chromatography resin market for pharmaceuticals and biotechnology applications. This segment’s leading position can be attributed to the widespread use of chromatography resins in protein purification processes across various industries, including biopharmaceuticals, food and beverages, and academic research.

Protein purification is essential for isolating and purifying proteins from complex biological samples, enabling downstream applications such as drug development, diagnostic testing, and protein characterization. The increasing demand for biologics and recombinant proteins, coupled with advancements in chromatography resin technologies, further fuels the growth of this segment. Additionally, the growing focus on personalized medicine and targeted therapies drives the need for efficient protein purification techniques, bolstering market demand.

Antibody Purification emerged as another significant application segment in the chromatography resin market for pharmaceuticals and biotechnology applications in 2023. This segment witnessed robust growth, driven by the rising adoption of monoclonal antibodies (mAbs) for therapeutic and diagnostic purposes.

Antibody purification plays a crucial role in isolating and purifying monoclonal antibodies from cell culture supernatants or hybridoma cell lines, ensuring high product purity and yield. The increasing prevalence of chronic diseases, coupled with the growing demand for biologics-based therapies, propels the demand for chromatography resins in antibody purification processes. Moreover, advancements in antibody engineering and production technologies contribute to the expansion of this segment, fostering innovation and market growth.

Key Маrkеt Ѕеgmеntѕ

By Type

- Natural

- Synthetic

- Inorganic

By Technique

- Ion Exchange

- Affinity

- Size Exclusion

- Hydrophobic Interaction

- Multimodal

- Others

By Application

- Protein Purification

- Antibody Purification

- Vaccine Production

- DNA & RNA Purification

- Cell Therapy

- Others

Market Drivers

Booming Biopharmaceuticals and Stringent Regulations Fuel Chromatography Resin Market Growth

The global chromatography resin market for pharmaceutical and biotechnology applications is experiencing significant growth, driven by a confluence of factors.

Stringent Regulatory Requirements

Regulatory bodies worldwide enforce strict quality control measures for pharmaceuticals and biopharmaceuticals. These regulations, such as those set forth by the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA), mandate the use of high-performance purification techniques like chromatography.

This ensures the safety, efficacy, and purity of drugs reaching patients. The increasing stringency of these regulations necessitates the use of advanced chromatography resins for effective biomolecule separation and purification.

Continuous Developments in Biologics and Gene Therapies

The biopharmaceutical landscape is constantly evolving, with the emergence of novel therapeutics like monoclonal antibodies and gene therapies. These complex biomolecules require specialized purification techniques due to their unique properties. Chromatography resins are being continuously developed and optimized to meet the specific needs of these new classes of drugs, further driving market growth.

Focus on Efficiency and Cost-Effectiveness

The biopharmaceutical industry is constantly striving for increased efficiency and cost-effectiveness in production processes. Chromatography resins play a crucial role here. Advancements in resin technology are leading to the development of high-performance resins with improved binding capacities, faster processing times, and better regeneration capabilities. This translates to increased productivity and reduced overall production costs for biopharmaceutical companies.

Restraints

Limited Availability of Skilled Personnel

Operating and maintaining chromatography systems effectively requires skilled personnel with a deep understanding of resin functionalities and purification protocols. The biopharmaceutical industry, particularly in developing regions, might face a shortage of such skilled personnel. This lack of expertise can hinder the efficient utilization of chromatography resins and limit the adoption of advanced techniques, potentially slowing down market growth.

Environmental Concerns and Sustainability Considerations

The production and disposal of certain chromatography resins can raise environmental concerns. Some resins might contain hazardous materials or require the use of harsh chemicals during regeneration processes. A growing focus on sustainable practices in the biopharmaceutical industry necessitates the development of eco-friendly chromatography resins. However, such advancements are still under development, and the limited availability of sustainable alternatives can be a restraint for companies prioritizing environmentally responsible practices.

Competition from Alternative Purification Techniques

While chromatography remains a dominant purification technique, alternative methods like membrane filtration and precipitation are constantly evolving. These alternative techniques can sometimes offer advantages like lower costs or faster processing times. While chromatography offers unmatched precision and purity, advancements in these alternative methods could pose a potential threat to the market share of chromatography resins in specific applications.

Market Opportunities

A Future of Innovation and High-Purity Separations

The biopharmaceutical industry is experiencing a constant influx of novel therapeutics, including complex biologics and gene therapies. These next-generation drugs require highly specific and efficient purification techniques. Chromatography resins are uniquely positioned to address this need. The development of specialized resins tailored for these emerging biomolecules presents a significant opportunity for market expansion.

Focus on Continuous Improvement and Automation

The biopharmaceutical industry constantly strives for enhanced efficiency and streamlined processes. Advancements in chromatography resin technology are leading to the development of high-performance resins with improved binding capacities, faster processing times, and better reusability.

Additionally, automation solutions for chromatography systems are gaining traction. These advancements not only improve purification efficiency but also reduce labor costs and human error, creating a win-win situation for biopharmaceutical companies.

Growing Adoption in Developing Regions: The biopharmaceutical industry is witnessing significant growth in developing regions like Asia Pacific. Government initiatives promoting biotechnology research and development in these regions further fuel this trend.

For instance, China’s Healthy China 2030 initiative aims to boost domestic biopharmaceutical innovation. This growth translates to an increasing demand for high-performance chromatography resins for biopharmaceutical purification, presenting a lucrative opportunity for market expansion.

Focus on Single-Use and Disposable Technologies

The biopharmaceutical industry is witnessing a rising trend towards single-use and disposable technologies for faster production cycles and reduced risk of contamination. The development of single-use chromatography columns pre-packed with specialized resins caters to this trend, offering convenience and ease of use. This focus on single-use solutions presents a significant growth opportunity for the chromatography resin market.

Market Trends

Focus on High-Performance Resins and Process Optimization

Stringent regulatory requirements and a growing demand for high-purity biopharmaceuticals are driving the development and adoption of high-performance chromatography resins. These next-generation resins boast improved binding capacities, faster processing speeds, and better reusability. Additionally, advancements in automation and process optimization software are streamlining purification workflows, leading to increased efficiency and reduced production costs.

Tailored Resins for Emerging Biologics

The biopharmaceutical landscape is witnessing a surge in complex biologics and gene therapies. These novel molecules require highly specific purification techniques due to their unique properties. The market is responding with the development of specialized chromatography resins designed to address the specific needs of these emerging drug classes. This trend signifies a shift towards more targeted and customized purification solutions.

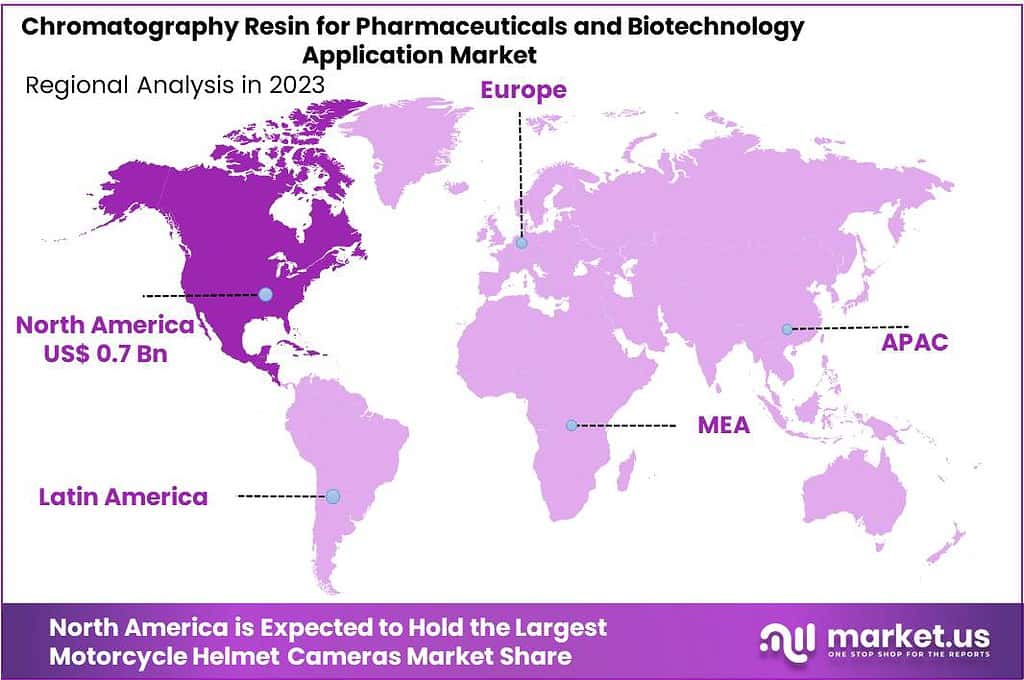

Regional Analysis

North America stands out as the most lucrative market segment within the global Chromatography Resin for Pharmaceuticals and Biotechnology Application Market, commanding a substantial share of 35.7% in 2023. The United States, in particular, holds one of the highest rates of utilizing chromatography resin for pharmaceutical and biotechnological applications, driven by its notable prevalence in the region’s laboratories and manufacturing facilities.

The region’s well-developed Chromatography Resin for Pharmaceuticals and Biotechnology Application healthcare infrastructure, featuring numerous veterinary professionals and healthcare facilities, facilitates the adoption and distribution of chromatography resin for pharmaceutical and biotechnological applications. Veterinarians in North America often prescribe or recommend specific chromatography resin products to meet the unique needs of their clients, further contributing to the market’s growth.

Prominent manufacturers of chromatography resin, with a significant presence in North America, heavily invest in research and development initiatives. This commitment to innovation results in the introduction of cutting-edge and high-quality chromatography resin offerings to the market. The region’s emphasis on advancing chromatography technologies positions North America as a hub for the development and distribution of chromatography resin tailored for pharmaceutical and biotechnological applications.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

In the chromatography resin market for pharmaceuticals and biotechnology applications, several key players drive innovation and competition. These players include companies such as GE Healthcare, Merck KGaA, Thermo Fisher Scientific Inc., Bio-Rad Laboratories Inc., and Purolite Corporation, among others. GE Healthcare, a subsidiary of General Electric Company, offers a wide range of chromatography resins tailored for various applications in the pharmaceutical and biotech industries.

Merck KGaA, a leading science and technology company, provides high-quality chromatography resins under its BioProcessing division, catering to the stringent requirements of the biopharmaceutical sector. Thermo Fisher Scientific Inc., a global leader in serving science, offers chromatography resin solutions for purification and separation processes in drug discovery and bioproduction.

Bio-Rad Laboratories Inc., renowned for its life science research and clinical diagnostics products, provides chromatography resins known for their reliability and performance in biopharmaceutical manufacturing. Purolite Corporation specializes in ion exchange and adsorbent resin technologies, offering a diverse portfolio of chromatography resins for downstream processing applications in the pharmaceutical and biotech sectors.

These key players leverage their technological expertise, extensive research capabilities, and global presence to address the evolving needs of the pharmaceutical and biotechnology industries, driving innovation and growth in the chromatography resin market.

Top Key Рlауеrѕ

- Bio-Rad Laboratories Inc.

- Merck KGaA

- Danaher Corporation

- Tosoh Corporation

- Bio-Works Technologies AB

- Avantor Performance Materials, Inc.

- Mitsubishi Chemical Corporation

- GE Healthcare

- Waters Corporation

- Expedeon Ltd.

- Agilent Technologies

- Navigo Proteins & Eleva GmbH

- Thermo Fisher Scientific

- Pall Corporation

- PerkinElmer Inc.

Report Scope

Report Features Description Market Value (2023) USD 2.0 Bn Forecast Revenue (2033) USD 4.9 Bn CAGR (2024-2033) 9.4% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Natural, Synthetic, Inorganic), By Technique(Ion Exchange, Affinity, Size Exclusion, Hydrophobic Interaction, Multimodal, Others), By Application(Protein Purification, Antibody Purification, Vaccine Production, DNA & RNA Purification, Cell Therapy, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Bio-Rad Laboratories Inc., Merck KGaA, Danaher Corporation, Tosoh Corporation, Bio-Works Technologies AB, Avantor Performance Materials, Inc., Mitsubishi Chemical Corporation, GE Healthcare, Waters Corporation, Expedeon Ltd., Agilent Technologies, Navigo Proteins & Eleva GmbH, Thermo Fisher Scientific, Pall Corporation, PerkinElmer Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Size of Chromatography Resin for Pharmaceuticals and Biotechnology Application Market?Chromatography Resin for Pharmaceuticals and Biotechnology Application Market size is expected to be worth around USD 4.9 billion by 2033, from USD 2.0 billion in 2023

What is the CAGR for the Chromatography Resin for Pharmaceuticals and Biotechnology Application Market?The Chromatography Resin for Pharmaceuticals and Biotechnology Application Market expected to grow at a CAGR of 9.4% during 2023-2032.

Who are the key players in the Chromatography Resin for Pharmaceuticals and Biotechnology Application Market ?Bio-Rad Laboratories Inc., Merck KGaA, Danaher Corporation, Tosoh Corporation, Bio-Works Technologies AB, Avantor Performance Materials, Inc., Mitsubishi Chemical Corporation, GE Healthcare, Waters Corporation, Expedeon Ltd., Agilent Technologies, Navigo Proteins & Eleva GmbH, Thermo Fisher Scientific, Pall Corporation, PerkinElmer Inc.

Chromatography Resin for Pharmaceuticals and Biotechnology Application MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Chromatography Resin for Pharmaceuticals and Biotechnology Application MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Bio-Rad Laboratories Inc.

- Merck KGaA

- Danaher Corporation

- Tosoh Corporation

- Bio-Works Technologies AB

- Avantor Performance Materials, Inc.

- Mitsubishi Chemical Corporation

- GE Healthcare

- Waters Corporation

- Expedeon Ltd.

- Agilent Technologies

- Navigo Proteins & Eleva GmbH

- Thermo Fisher Scientific

- Pall Corporation

- PerkinElmer Inc.