Global Chlamydia Diagnostics Market Analysis By Test Type (Nucleic Acid Amplification Tests (NAATs), Culture methods, Serology Tests, Direct Fluorescent Antibody (DFA) Tests, Other Tests), By Sample Type (Urine, Swabs, Others), By End-User (Hospitals, Diagnostic laboratories, Homecare settings, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164503

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

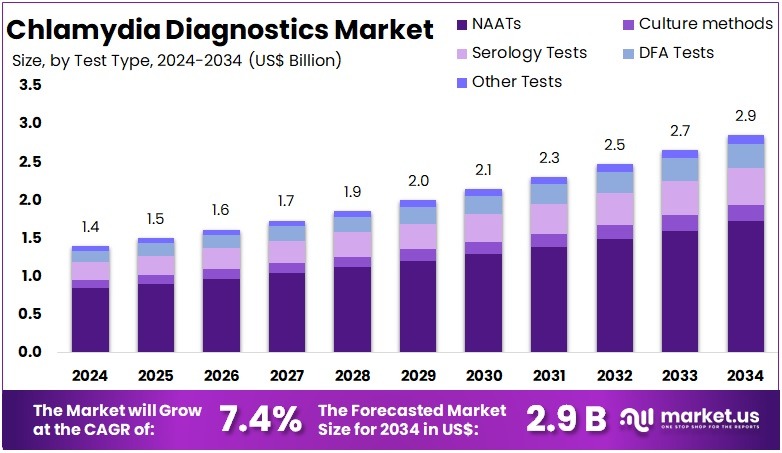

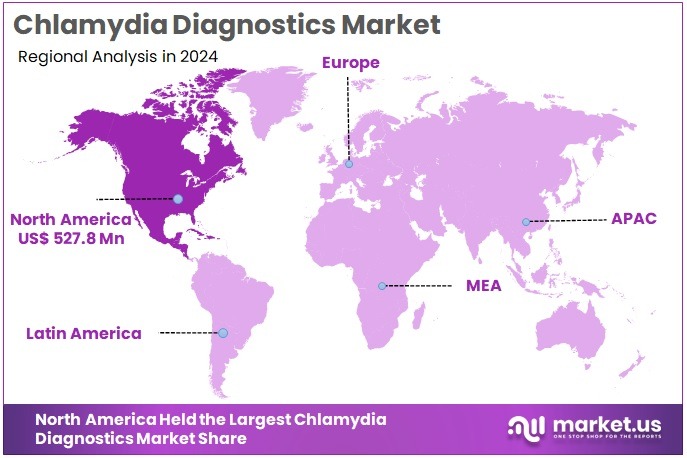

The Global Chlamydia Diagnostics Market size is expected to be worth around US$ 2.9 Billion by 2034, from US$ 1.4 Billion in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 37.7% share and holds US$ 527.8 Million market value for the year.

Chlamydia diagnostics plays a central role in detecting Chlamydia trachomatis, which remains one of the most widespread sexually transmitted infections worldwide. The need for these tests has been rising because a large proportion of infections show no symptoms, leading to ongoing transmission. According to World Health Organization, 128.5 million new infections were recorded in 2020, with prevalence reaching 4.0 percent in women and 2.5 percent in men. These indicators emphasize the importance of accessible diagnostic services.

The diagnostic market is strongly influenced by clinical standards and the steady shift toward molecular platforms. Nucleic acid amplification tests continue to dominate due to their high accuracy and reliability. Study by WHO confirmed them as the gold standard, reinforcing their adoption in laboratories. For example, screening recommendations from the U.S. Preventive Services Task Force advise routine testing for sexually active women aged 24 and younger, while CDC guidance encourages retesting after treatment. These policies drive consistent test utilization.

Epidemiological patterns also support sustained diagnostic demand. Although overall STI totals declined in 2024, the burden remains substantial enough to maintain high testing volumes. CDC surveillance shows more than 2.2 million cases of chlamydia, gonorrhea, and syphilis combined in 2024, despite a 9 percent drop from 2023. Chlamydia alone declined 8 percent, and gonorrhea fell 10 percent, yet congenital syphilis increased nearly 700 percent over a decade, reaching almost 4,000 cases. These trends highlight the continued relevance of screening.

European data demonstrates similar momentum for diagnostic expansion. Increasing notification levels are encouraging member states to maintain active surveillance systems. According to ECDC reports, 230,199 laboratory-confirmed chlamydia cases were recorded in 2023, with a 3 percent rise in the notification rate compared with 2022. For instance, national screening frameworks such as England’s program target a detection benchmark of 3,250 per 100,000 females aged 15–24, reinforcing procurement of diagnostic supplies across public health settings.

Policy Influence and Technology-Led Market Evolution

Regional analysis offers additional insight into how local screening targets influence diagnostic volumes. In the United Kingdom, varying STI rates across local authorities reflect different levels of healthcare engagement and testing access. According to UKHSA, new STI diagnoses ranged from 406 per 100,000 in Northumberland to 849 per 100,000 in Newcastle upon Tyne. For example, female chlamydia detection in 2023 ranged from 1,847 per 100,000 in Sunderland to 3,694 per 100,000 in Hartlepool, supporting ongoing testing demand.

Regulatory developments are creating new channels for diagnostic expansion and improving patient convenience. The approval of home-based testing options is reshaping access pathways by reducing the need for clinic visits. In 2023, FDA cleared the first chlamydia and gonorrhea test enabling at-home sample collection. In March 2025, the agency authorized the first over-the-counter at-home molecular test for chlamydia, gonorrhea, and trichomoniasis, delivering results in about 30 minutes. These milestones strengthen retail and remote testing uptake.

Technological improvement is also shifting diagnostics closer to point-of-care use. Innovations are enhancing turnaround time and simplifying workflows, enabling testing in more decentralized settings. WHO has noted progress in point-of-care molecular platforms, even as some systems continue to evolve toward target-product expectations. According to CDC analysis, self-collected rectal swabs perform comparably to clinician-collected samples when assessed using NAATs. This capability lowers screening barriers and supports broader patient participation.

Co-infection patterns continue to create additional testing requirements and reinforce multi-pathogen platforms. Study by WHO indicated that 10 to 40 percent of individuals with gonorrhea are co-infected with chlamydia, which sustains demand for combined NAAT panels. For instance, extragenital screening recommendations for men who have sex with men increase the number of samples collected per visit. These epidemiological and policy factors collectively indicate that the global chlamydia diagnostics market will maintain steady growth supported by accuracy-driven, rapid, and accessible testing solutions.

Key Takeaways

- The Global Chlamydia Diagnostics Market is projected to reach about US$ 2.9 billion by 2034, rising from US$ 1.4 billion in 2024 at 7.4% CAGR.

- Nucleic Acid Amplification Tests (NAATs) led the test type category in 2024, securing over 60.3% of the total Chlamydia Diagnostics Market share.

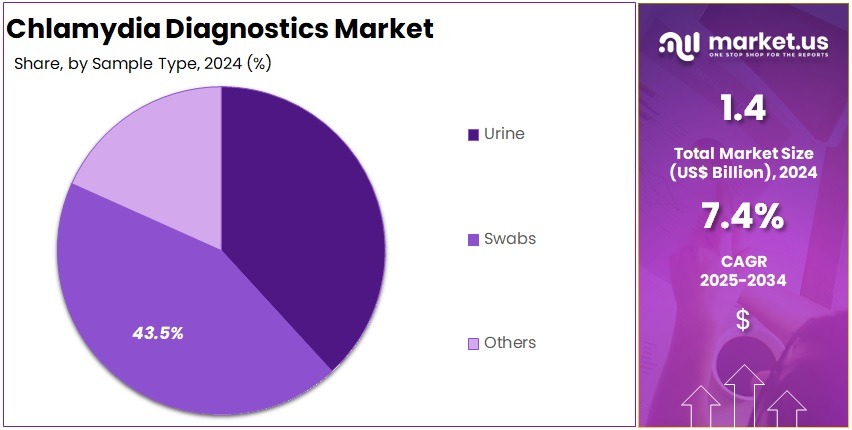

- Swabs represented the leading sample type segment in 2024, capturing more than 43.5% of the overall market share for chlamydia diagnostics.

- Hospitals remained the key end-user segment in 2024, accounting for over 39.8% of the global Chlamydia Diagnostics Market value.

- North America dominated the regional landscape in 2024, contributing above 37.7% of the total market and reaching US$ 527.8 million in value.

Test Type Analysis

In 2024, the Nucleic Acid Amplification Tests (NAATs) section held a dominant market position in the Test Type Segment of the Chlamydia Diagnostics Market, and captured more than a 60.3% share. This dominance was attributed to the high sensitivity and accuracy of NAATs in detecting Chlamydia trachomatis. The tests can identify infections even in patients without symptoms. Growing preference for molecular diagnostic tools and the need for reliable results have further strengthened NAATs’ presence across global healthcare facilities.

Culture methods continued to hold a moderate share of the market. Their relevance has declined due to their time-consuming process and the requirement for viable organisms. However, they remain significant for research and confirmatory testing purposes. Serology tests showed limited demand, mainly for epidemiological investigations. These tests detect antibody responses, not active infections. Their application continues in regions where advanced molecular diagnostics are not widely available or affordable.

The Direct Fluorescent Antibody (DFA) tests accounted for a smaller portion of the market. While DFA provides quick results, its lower accuracy limits widespread adoption. Other test types, such as rapid antigen and point-of-care assays, are gaining gradual traction. The expansion of self-testing kits and portable diagnostics supports this growth. However, their precision remains below that of molecular tests. The overall market trend indicates a strong shift toward molecular diagnostics, where NAATs will likely maintain their leading position.

Sample Type Analysis

In 2024, the Swabs Section held a dominant market position in the Sample Type Segment of the Chlamydia Diagnostics Market, and captured more than a 43.5% share. This dominance was linked to the high diagnostic accuracy of swab-based tests. These tests are widely used in clinics and diagnostic centers. Swab samples enable precise detection of Chlamydia trachomatis using nucleic acid amplification tests. Their proven reliability and strong clinical acceptance have made them the preferred choice for accurate diagnosis.

Urine-based testing accounted for a significant portion of the market. Its growth was mainly driven by the convenience and non-invasive nature of urine collection. This sample type is preferred in mass screening programs and home-based testing kits. It is especially used among male patients for easy testing. Continuous advancements in sample processing technologies have also improved the sensitivity of urine tests. These innovations have enhanced diagnostic accuracy and increased overall market adoption.

The Others segment, including blood and tissue samples, contributed a smaller share to the market. However, steady growth is expected in this category. The rise is supported by ongoing studies in advanced serological methods and multiplex diagnostic systems. These innovations aim to improve test efficiency and expand diagnostic applications. As technology evolves, the segment is projected to gain more clinical relevance. Nonetheless, swabs are likely to maintain their leadership due to their proven effectiveness and broad healthcare usage.

End-User Analysis

In 2024, the Hospitals Section held a dominant market position in the End-User Segment of the Chlamydia Diagnostics Market, and captured more than a 39.8% share. This dominance was attributed to advanced diagnostic infrastructure and a strong presence of trained healthcare professionals. Hospitals served as the main centers for testing due to higher patient visits and access to modern diagnostic systems. Their focus on early detection and comprehensive screening further supported their leadership in the global market.

Diagnostic Laboratories represented a key contributor to market growth. Their expansion was driven by increased outsourcing of testing services and the adoption of automated diagnostic platforms. These facilities offered reliable results and faster turnaround times, which improved efficiency and accuracy. Rising awareness of sexually transmitted infections also encouraged more patients to opt for laboratory-based testing. Continuous investments in technology enhanced service quality, positioning laboratories as an essential support system for hospital testing networks.

The Homecare Settings segment witnessed consistent growth due to the growing use of self-testing kits. Consumers increasingly preferred convenient and private testing solutions. Easy-to-use and affordable diagnostic kits improved access to early detection. This trend was reinforced by public health campaigns promoting awareness and prevention. The Others category, including research centers and community health clinics, recorded a smaller share but remained vital for disease surveillance. Together, these segments contributed to the overall expansion of the Chlamydia Diagnostics Market.

Key Market Segments

By Test Type

- Nucleic Acid Amplification Tests (NAATs)

- Culture methods

- Serology Tests

- Direct Fluorescent Antibody (DFA) Tests

- Other Tests

By Sample Type

- Urine

- Swabs

- Others

By End-User

- Hospitals

- Diagnostic laboratories

- Homecare settings

- Others

Drivers

Rising Burden of Infection as a Core Market Driver

The high rate of asymptomatic chlamydia infection has created a persistent and often undetected reservoir of disease. A significant portion of infected individuals remains unaware of their status. As a result, routine screening becomes essential for early case identification. This dynamic has strengthened the need for accessible and reliable diagnostic solutions. The growth of the diagnostics market has been supported by the clear requirement to detect infections that would otherwise remain hidden within the population.

Global prevalence estimates have indicated that the disease burden remains substantial across age groups and regions. The World Health Organization reported about 128.5 million new cases among adults in 2020. Additional evidence has shown prevalence levels of 4.2 percent in women and 2.7 percent in men worldwide. These figures have underlined the sustained transmission of the infection. The scale of this burden has increased the need for comprehensive screening programs and improved diagnostic coverage.

Age-specific data have further illustrated the concentration of cases among young adults, particularly women under 25. Prevalence of 14.6 percent in this group has demonstrated the continued vulnerability of younger populations. Rates decline with age, yet the underlying infection load remains significant. This trend has emphasized the necessity for routine testing in high-risk groups. The continued identification of infections through screening has reinforced demand for advanced diagnostic tools and supported market expansion.

Restraints

Social Barriers and Asymptomatic Infections

The market is constrained by persistent social and structural barriers. Social stigma reduces testing uptake in many regions. Confidentiality concerns further discourage individuals from seeking screening services. Evidence shows that socioeconomic disadvantage is linked with higher infection risk, which reflects ongoing disparities in access to diagnostic tools. These factors limit the reach of testing programs. As a result, the overall expansion of the market is slowed because large population groups remain untested despite being at higher risk.

A major restraint is the large reservoir of asymptomatic infections. An estimated 45 to 95 percent of cases present no symptoms. Research shows that about 70 percent of women with endocervical chlamydia experience no or very mild signs. This creates significant screening gaps. Individuals do not seek testing without symptoms. This limits early detection. It also restricts natural demand for diagnostics. The absence of symptoms therefore reduces testing volume and slows the scale-up of diagnostic services.

The challenge is more pronounced in low and middle income countries. Studies report that over half of infected women in these regions show no symptoms. Chlamydia prevalence has been observed at 3 to 6 percent in such populations. Limited awareness and restricted access increase the burden. As many infections remain silent, routine screening becomes essential. However, active screening demands operational capacity, stable funding and trained staff. These requirements pose implementation barriers. Consequently, market penetration stays shallow, and growth potential is reduced in resource-limited settings.

Opportunities

Expansion of Chlamydia Diagnostics Through Self-Collection and Point-of-Care Testing

Advances in point-of-care molecular diagnostics and self-collected specimen methods are transforming chlamydia testing. These technologies enable accurate results outside traditional clinical settings. Studies show high reliability — for example, vaginal self-swabs for chlamydia achieve 92% sensitivity and 98% specificity, nearly matching clinician-collected samples. This accuracy validates self-testing as a viable option for routine screening, helping expand diagnostic access to individuals who may avoid clinical testing due to privacy or accessibility concerns.

The rise of home-based and decentralized testing creates new opportunities in the chlamydia diagnostics market. Evidence from Nature highlights that self-collected specimens offer comparable diagnostic accuracy to health-worker-collected ones. Similarly, JAMA Network reported 93.3% sensitivity and 99.1% specificity for molecular point-of-care assays in asymptomatic men. These findings reinforce the potential for reliable, rapid detection beyond laboratories, enabling earlier intervention and better disease management across varied population segments.

This shift supports broader market expansion and inclusion. By enabling home sampling, rapid on-site testing, and decentralized diagnostics, companies can reach underserved and remote communities. The convenience and confidentiality of self-testing also appeal to privacy-sensitive users. This trend opens significant growth channels for diagnostic firms, encouraging partnerships between technology developers, public health programs, and telehealth platforms. Ultimately, it positions chlamydia diagnostics as a more accessible, scalable, and patient-centered market segment.

Trends

Rising Demand for Youth-Focused and Multiplex Chlamydia Diagnostic Solutions

The Chlamydia diagnostics market is witnessing a shift toward advanced multiplex testing and high-sensitivity molecular platforms. These technologies allow detection of multiple pathogens, such as Chlamydia trachomatis and Neisseria gonorrhoeae, in a single assay. This trend enhances efficiency, increases throughput, and supports comprehensive STI screening. The adoption of molecular diagnostic methods is growing due to their improved accuracy, faster results, and suitability for high-volume testing environments like public health programs and reproductive health clinics.

A strong age-related concentration is shaping the diagnostic landscape. In 2023, over 55.8% of U.S. chlamydia cases were reported among individuals aged 15–24 years, indicating a major public health concern in this demographic. Similarly, Europe reported 216,508 cases in 2022, a 16% rise from 2021, underscoring growing infection rates. This pattern emphasizes the urgent need for targeted diagnostic programs in younger, sexually active populations who drive much of the transmission and require accessible, rapid testing options.

These shifts have direct market implications. Diagnostic technology providers are increasingly focusing on youth-friendly, reproductive-health, and prenatal screening settings. With global prevalence among pregnant women estimated at 8.4%, the need for early detection and monitoring tools is critical. The rising notification and reporting rates across multiple regions point toward an expanding diagnostics market, where innovation, sensitivity, and outreach to younger populations will define future competitive success.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 37.7% share and achieving a market value of US$ 527.8 million in the Chlamydia Diagnostics Market. This dominance was supported by a strong healthcare system and a high level of disease awareness. The region has implemented structured screening programs for sexually transmitted infections, which increased early detection rates. The widespread adoption of advanced diagnostic tools has also strengthened the region’s position in global market growth.

The regional market expansion was further supported by government-led initiatives promoting STI prevention and control. Public health organizations, such as the CDC, have actively conducted awareness programs to encourage early testing and treatment. Subsidized diagnostic campaigns and regular testing drives have enhanced access to care. As a result, the population’s growing participation in preventive health programs contributed significantly to the higher adoption of Chlamydia diagnostic procedures.

Technological innovation has been a major driving factor in North America’s market dominance. Diagnostic laboratories and research institutions across the United States and Canada have invested in developing high-accuracy and rapid testing methods. The introduction of nucleic acid amplification tests (NAATs) has improved diagnostic reliability and reduced turnaround time. The increased presence of key diagnostic manufacturers has further ensured a steady supply of advanced testing kits and devices across the healthcare sector.

Favorable healthcare policies and reimbursement frameworks have played a vital role in maintaining market leadership. Public and private insurers have supported coverage for diagnostic services, improving affordability and accessibility. Higher healthcare spending and investments in disease surveillance programs have created a supportive environment for market growth. These combined factors are expected to help North America retain its leading position in the global Chlamydia Diagnostics market over the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Chlamydia diagnostics market is driven by the presence of established molecular diagnostics companies offering advanced testing solutions. The market’s growth is supported by increasing screening programs and technological innovations. Hologic Inc., Danaher Corporation, Abbott Laboratories, F. Hoffmann-La Roche Ltd., and Becton Dickinson and Company are among the leading players. Their dominance is attributed to strong product portfolios, wide distribution networks, and continuous research investment. These firms focus on automation, faster turnaround times, and high test accuracy to meet the growing demand for reliable chlamydia screening solutions worldwide.

Hologic Inc. holds a strong position due to its comprehensive women’s health and molecular diagnostics portfolio. Its advanced NAAT platforms deliver high sensitivity and throughput, ideal for centralized laboratories. Danaher Corporation, through its Cepheid brand, leads in near-patient testing with rapid GeneXpert systems that provide same-visit results. Abbott Laboratories integrates its chlamydia diagnostics within large laboratory networks, offering efficiency and connectivity advantages. These players maintain steady growth through continuous innovation, strategic collaborations, and strong after-sales support in global markets.

F. Hoffmann-La Roche Ltd. dominates the centralized molecular testing segment through its cobas systems, known for high reliability and automation. The company benefits from a global footprint and strong customer relationships. Becton Dickinson and Company leverages its dual strength in specimen collection and molecular testing, ensuring comprehensive diagnostic coverage. Both players invest heavily in expanding assay menus and automation to improve laboratory efficiency. Their strategic focus on improving workflow integration and global distribution continues to strengthen their market position in chlamydia diagnostics.

Other notable participants include DiaSorin SpA, Bio-Rad Laboratories Inc., QIAGEN N.V., bioMérieux SA, Quidel-Ortho Corp., Thermo Fisher Scientific Inc., Meridian Bioscience Inc., Seegene Inc., and Binx Health Inc. These companies contribute to market diversity through niche product offerings, rapid testing technologies, and syndromic diagnostic solutions. Seegene and Binx Health emphasize rapid molecular testing for decentralized settings, while Thermo Fisher and Bio-Rad serve as essential technology enablers. Collectively, these players enhance competition, promote technological advancements, and expand access to effective chlamydia testing globally.

Market Key Players

- Hologic Inc.

- Danaher Corporation

- Abbott Laboratories

- F. Hoffmann‑La Roche Ltd.

- Becton Dickinson and Company

- DiaSorin SpA

- Bio‑Rad Laboratories Inc.

- QIAGEN N.V.

- bioMérieux SA

- Quidel-Ortho Corp.

- Bio-Rad Laboratories Inc.

- Thermo Fisher Scientific Inc.

- Meridian Bioscience Inc.

- Seegene Inc.

- Binx Health Inc.

Recent Developments

- In November 2023: Hologic disclosed that its Aptima collection devices (Aptima® Urine Specimen Collection Kit and Aptima® Multitest Swab Specimen Collection Kit) are used by partner LetsGetChecked in the first-ever FDA-authorized at-home sample collection system for chlamydia and gonorrhea. The partner’s “Simple 2” kit uses Hologic’s collection devices.

- On July 17 2024: Danaher announced that it is opening two new innovation centres: one in the UK (on the campus of its subsidiary Leica Biosystems) and one in the US. These labs will support instrument and assay development (including PCR and immunoassay capabilities) across Danaher’s diagnostics subsidiaries such as Cepheid, which has a test portfolio that includes chlamydia/NG detection. This development enhances Danaher’s ability to develop next-generation diagnostics relevant to chlamydia testing.

- In March 2023: BD received U.S. FDA 510(k) clearance for the BD Vaginal Panel on the BD COR™ System, a high-throughput molecular diagnostic platform designed for large laboratories. While this assay does not directly test for chlamydia, the clearance is significant in the broader STI diagnostics / women’s health diagnostics space in which chlamydia diagnostics operate. The BD Vaginal Panel simultaneously detects bacterial vaginosis (BV), vulvovaginal candidiasis (VVC) and Trichomonas vaginalis (TV) using a single swab. The clearance also enables laboratories using the BD COR™ platform to run both the BD Vaginal Panel and the BD CTGCTV2 assay from one patient collection, thereby enhancing workflow and sample utilisation for STI diagnostics inclusive of chlamydia.

Report Scope

Report Features Description Market Value (2024) US$ 1.4 Billion Forecast Revenue (2034) US$ 2.9 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test Type (Nucleic Acid Amplification Tests (NAATs), Culture methods, Serology Tests, Direct Fluorescent Antibody (DFA) Tests, Other Tests), By Sample Type (Urine, Swabs, Others), By End-User (Hospitals, Diagnostic laboratories, Homecare settings, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Hologic Inc., Danaher Corporation, Abbott Laboratories, F. Hoffmann‑La Roche Ltd., Becton Dickinson and Company, DiaSorin SpA, Bio‑Rad Laboratories Inc., QIAGEN N.V., bioMérieux SA, Quidel-Ortho Corp., Bio-Rad Laboratories Inc., Thermo Fisher Scientific Inc., Meridian Bioscience Inc., Seegene Inc., Binx Health Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Chlamydia Diagnostics MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Chlamydia Diagnostics MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Hologic Inc.

- Danaher Corporation

- Abbott Laboratories

- F. Hoffmann‑La Roche Ltd.

- Becton Dickinson and Company

- DiaSorin SpA

- Bio‑Rad Laboratories Inc.

- QIAGEN N.V.

- bioMérieux SA

- Quidel-Ortho Corp.

- Bio-Rad Laboratories Inc.

- Thermo Fisher Scientific Inc.

- Meridian Bioscience Inc.

- Seegene Inc.

- Binx Health Inc.