Global China Gas Detector Equipment Market Size, Share, Growth Analysis By Product (Fixed Gas Detector, Portable Gas Detector), By Technology (Semiconductor, Infrared (IR), Laser-based Detection, Catalytic, PID, Others), By End Use (Medical, Building Automation & Domestic Appliances, Environmental, Petrochemical, Automotive, Industrial, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 68336

- Number of Pages: 282

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

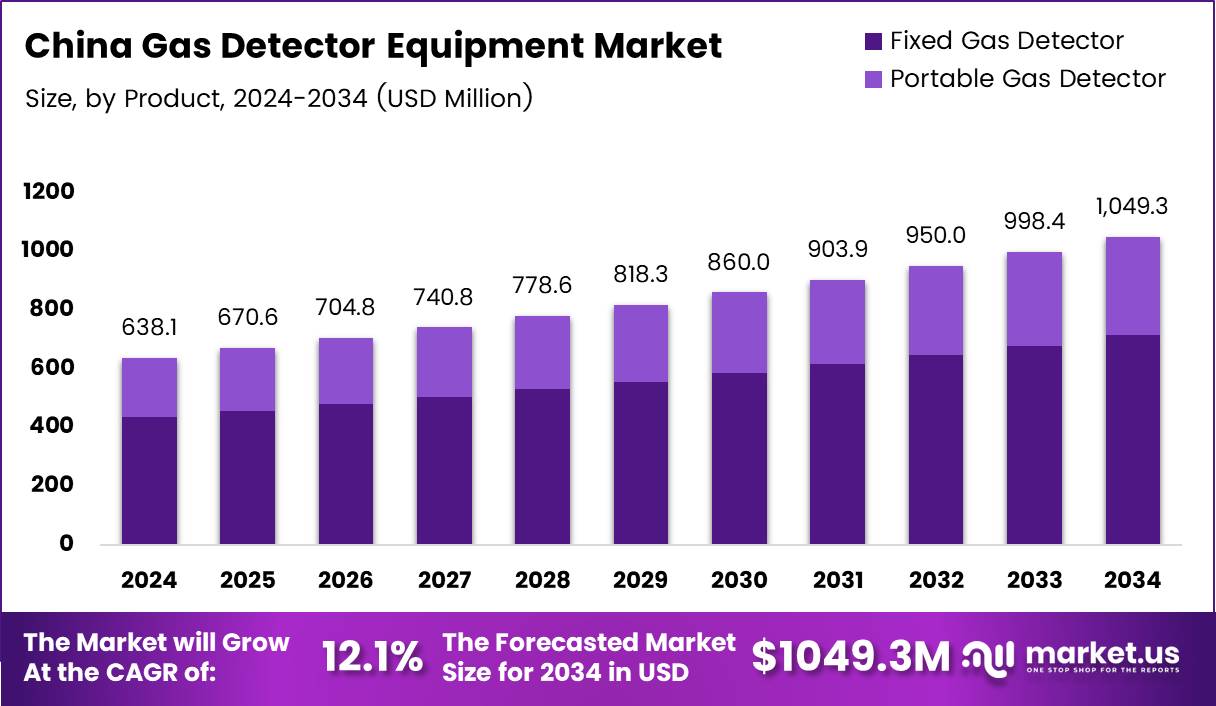

The Global China Gas Detector Equipment Market size is expected to be worth around USD 1049.3 Million by 2034, from USD 638.1 Million in 2024, growing at a CAGR of 12.1% during the forecast period from 2025 to 2034.

Key Takeaways

- The China Gas Detector Equipment Market size is expected to reach USD 1049.3 Million by 2034, growing from USD 638.1 Million in 2024 at a CAGR of 12.1%.

- Fixed Gas Detectors dominate the market in 2024, driven by demand for continuous gas level monitoring in hazardous industrial environments.

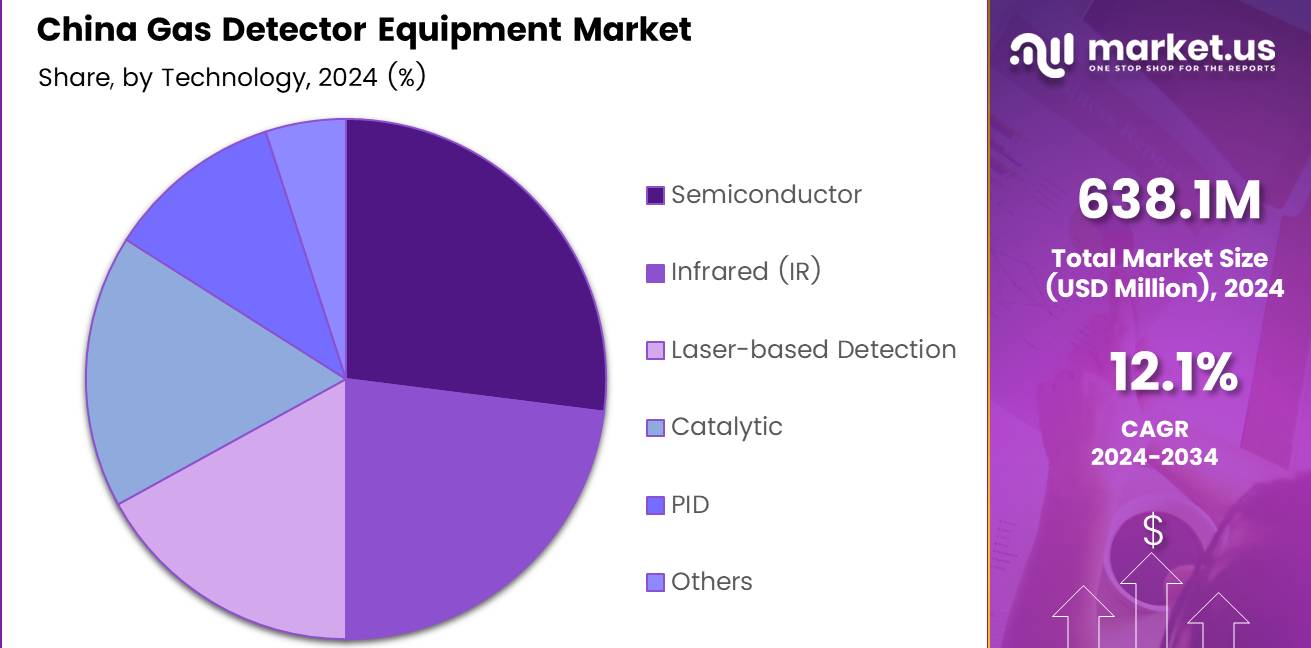

- Semiconductor sensors lead the Technology Analysis segment in 2024, praised for affordability, compact design, and fast detection of multiple gases.

- The Medical sector holds the largest share in the End Use Analysis segment in 2024, driven by gas detection needs in anesthesia, oxygen leak detection, and controlled healthcare environments.

The China Gas Detector Equipment Market is gaining traction amid increasing industrial safety norms and environmental compliance. Growing awareness around workplace safety and air quality has led to rising demand for gas detection technologies. Industries such as oil & gas, chemicals, and mining are among the top adopters. The integration of smart detection systems is further pushing growth.

China’s expanding urban and industrial footprint is generating fresh demand for gas detector equipment. As construction of manufacturing and energy facilities grows, the need for advanced safety monitoring rises. Moreover, rising adoption of IoT-enabled gas sensors in smart city projects adds a critical layer of opportunity for innovation.

Government-backed initiatives remain pivotal. Beijing’s stricter environmental regulations and workplace safety norms have enforced the mandatory installation of gas leak detectors in high-risk industries. These mandates are catalyzing the installation of fixed and portable gas detection systems across public infrastructure and private industries alike.

The shift toward green energy sources, while positive, has created complex gas handling environments. Hydrogen, methane, and other flammable gases used in renewable energy processes require precision detection. This evolving scenario supports the market’s steady transition toward high-accuracy, multi-gas detectors in compliance with new standards.

The sector is also benefiting from cross-border investments and regional support. For example, according to the Asian Development Bank, $10 billion is committed to urban development in India, including metro rail expansion. While this directly aids India, it indirectly supports regional players, including Chinese manufacturers, to scale operations and adopt best practices.

Additionally, demand from the petrochemical sector remains robust due to frequent plant expansions. Advanced gas detectors, with remote monitoring capabilities, are being rapidly deployed to avoid leakages and reduce fatalities. This has led companies to prioritize investments in maintenance-free, long-lifecycle detection devices.

China is also nurturing innovation through R&D subsidies and tax benefits to sensor manufacturers. The push for domestic technology production helps reduce dependency on imports and build competitive gas detection ecosystems. These incentives directly support small and medium enterprises.

As Chinese cities continue to grow vertically and underground utilities expand, there’s a heightened need for toxic and combustible gas detection in subways, tunnels, and basements. Local governments have begun to include gas detection technologies in infrastructure development protocols.

Product Analysis

Fixed Gas Detector dominates due to its continuous monitoring capabilities in industrial environments.

In 2024, Fixed Gas Detector held a dominant market position in the By Product Analysis segment of the China Gas Detector Equipment Market. This dominance is primarily attributed to the growing demand in hazardous industrial areas where constant gas level monitoring is crucial for safety.

Fixed detectors are preferred in applications such as manufacturing plants, chemical factories, and refineries where gas presence is persistent. Their ability to deliver real-time alerts and automation integration further supports adoption.

On the other hand, Portable Gas Detectors are gaining attention for their mobility and suitability in confined or remote spaces. These are often used during maintenance or in temporary setups, making them complementary rather than competitive to fixed systems.

Technology Analysis

Semiconductor leads due to its cost-effectiveness and rapid response capabilities.

In 2024, Semiconductor held a dominant market position in the By Technology Analysis segment of the China Gas Detector Equipment Market. Semiconductor gas sensors are widely chosen for their affordability, compact design, and fast detection of a wide range of gases.

The Semiconductor technology’s dominance is reinforced by increasing adoption in residential and low-risk commercial environments, where low-cost solutions are highly preferred. Its scalability in consumer electronics and household appliances also adds to market traction.

Other technologies such as Infrared (IR), Catalytic, and PID are utilized in more specific industrial or sensitive applications. Laser-based Detection is emerging for its high precision, while Others include niche sensing technologies.

End Use Analysis

Medical sector dominates due to stringent safety norms and increasing hospital infrastructure.

In 2024, Medical held a dominant market position in the By End Use Analysis segment of the China Gas Detector Equipment Market. The healthcare industry’s reliance on gas detectors for anesthesia gas monitoring, oxygen leak detection, and controlled environments is a key driver of this leadership.

Hospitals and medical research labs require strict air quality management, making reliable gas detection systems indispensable. The sector’s rapid infrastructure development and modernization efforts also contribute significantly.

Meanwhile, sectors like Building Automation & Domestic Appliances and Petrochemical follow closely, owing to urbanization and industrial expansion. Environmental and Industrial applications further bolster demand, especially in monitoring emissions and ensuring worker safety.

Key Market Segments

By Product

- Fixed Gas Detector

- Portable Gas Detector

By Technology

- Semiconductor

- Infrared (IR)

- Laser-based Detection

- Catalytic

- PID

- Others

By End Use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Others

Drivers

Expansion of Urban Infrastructure and Public Utilities Drives Market Growth in China Gas Detector Equipment Market

China’s rapid urbanization has significantly expanded the demand for gas detection equipment. As cities grow, so do the needs for more advanced infrastructure and public utilities. Urban areas require efficient and safe management of gas supplies for residential, commercial, and industrial use.

The growing number of construction projects, transportation networks, and public utilities requires the installation of reliable gas detection systems to ensure public safety. This expansion, coupled with increasing government regulations, pushes for higher demand for advanced gas detection systems across the country.

Restraints

High Initial Capital Investment for Advanced Systems Restrains China Gas Detector Equipment Market

A key challenge faced by the gas detection equipment market in China is the high initial investment needed for advanced systems. These state-of-the-art systems offer enhanced accuracy and features but come with a hefty price tag, making it difficult for smaller businesses or startups to adopt such technology.

In industries where cost-cutting is a priority, some companies may hesitate to invest in these systems despite their long-term benefits, which limits overall market growth. As a result, there’s a financial barrier that hinders the widespread use of more sophisticated gas detection technologies.

Growth Factors

Adoption of Wireless and Portable Gas Detection Devices Drives Growth in China Gas Detector Equipment Market

The increasing adoption of wireless and portable gas detection devices is a key growth opportunity for China’s gas detector market. These devices offer greater flexibility, portability, and convenience compared to traditional fixed gas detectors. Industries like mining, chemical plants, and construction benefit from portable detectors as they allow real-time monitoring in hazardous locations.

Furthermore, wireless technology helps with remote data transmission, enabling operators to act swiftly in case of gas leaks or dangerous situations. This growing trend is expected to drive the demand for portable and wireless systems across industries in China.

Emerging Trends

Shift Toward Multi-Gas Detection Solutions Trends in China Gas Detector Equipment Market

One of the significant trends in China’s gas detector equipment market is the growing shift toward multi-gas detection solutions. Businesses are increasingly seeking devices that can detect a combination of gases simultaneously, improving overall safety and operational efficiency.

Multi-gas detectors are cost-effective and reduce the need for multiple single-gas detectors, making them highly attractive for industries that deal with several hazardous gases. As industries become more aware of the risks of exposure to various gases, this trend is expected to gain momentum. Additionally, the rise of cloud-based monitoring and predictive analytics is further boosting the adoption of multi-gas detection systems.

Key China Gas Detector Equipment Company Insights

In the global China Gas Detector Equipment Market in 2024, Teledyne Technologies Inc is poised to maintain a strong presence. With a rich portfolio of advanced sensors and gas detection technologies, Teledyne continues to innovate in environmental monitoring solutions, catering to both industrial and safety sectors in China.

Siemens AG stands as a prominent player, leveraging its global footprint and robust research capabilities. Siemens’ gas detection solutions are known for their integration with smart building technologies, and its focus on automation and IoT ensures continued relevance in China’s rapidly evolving market for industrial safety.

GE Aerospace brings a high level of precision to the gas detection sector, particularly in aviation and industrial applications. With its long-standing expertise in aerospace technologies, GE’s solutions offer highly reliable detection systems, especially useful in environments that demand rigorous safety standards and real-time data analytics.

Thales Group focuses on providing cutting-edge gas detection systems that combine advanced sensor technologies with connectivity and data integration. With strong ties to defense and aerospace industries, Thales brings reliability and high performance to sectors in China where critical safety measures are necessary.

Together, these companies represent the forefront of innovation, driving the growth and evolution of the gas detector equipment market in China. Their unique technologies and strategic investments position them to capitalize on the region’s growing demand for safety and environmental monitoring solutions.

Top Key Players in the Market

- Teledyne Technologies Inc

- Siemens AG

- GE Aerospace

- Thales Group

- Thermo Fisher Scientific Inc

- Honeywell International Inc

- ATI Airtest Technologies Inc

- Opgal

Recent Developments

- In April 2024, ABB’s Sensi+™ natural gas analyzer was recognized with the “Most Competitive Innovation Product” award at the 19th China Automation Industry Awards, celebrated during the 2024 China Automation Industry Annual Conference. This honor highlights ABB’s ongoing commitment to leading-edge technology in industrial automation.

- In February 2023, NevadaNano secured $30 million in Series C funding to accelerate the development of advanced emissions-tracking technology. This investment is set to fuel the company’s growth and innovation in monitoring and mitigating environmental impacts.

Report Scope

Report Features Description Market Value (2024) USD 638.1 Million Forecast Revenue (2034) USD 1049.3 Million CAGR (2025-2034) 12.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Fixed Gas Detector, Portable Gas Detector), By Technology (Semiconductor, Infrared (IR), Laser-based Detection, Catalytic, PID, Others), By End Use (Medical, Building Automation & Domestic Appliances, Environmental, Petrochemical, Automotive, Industrial, Others) Competitive Landscape Teledyne Technologies Inc, Siemens AG, GE Aerospace, Thales Group, Thermo Fisher Scientific Inc, Honeywell International Inc, ATI Airtest Technologies Inc, Opgal Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  China Gas Detector Equipment MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample

China Gas Detector Equipment MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- MSA Safety Incorporated

- Siemens AG

- Dragerwerk AG & Co. KGAA

- Emerson Electric Co.

- California Analytical Instruments Inc.

- Honeywell International Inc.

- ABB Ltd.

- AMETEK Inc

- Fortive Corporation (Industrial Scientific Corp.)

- Trolex Ltd.

- Beijing Topsky Century Holding Co. Ltd