China Direct Selling Market Size, Share, Growth Analysis By Product (Health & Wellness, Cosmetics & Personal Care, Household Goods & Durables), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151650

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

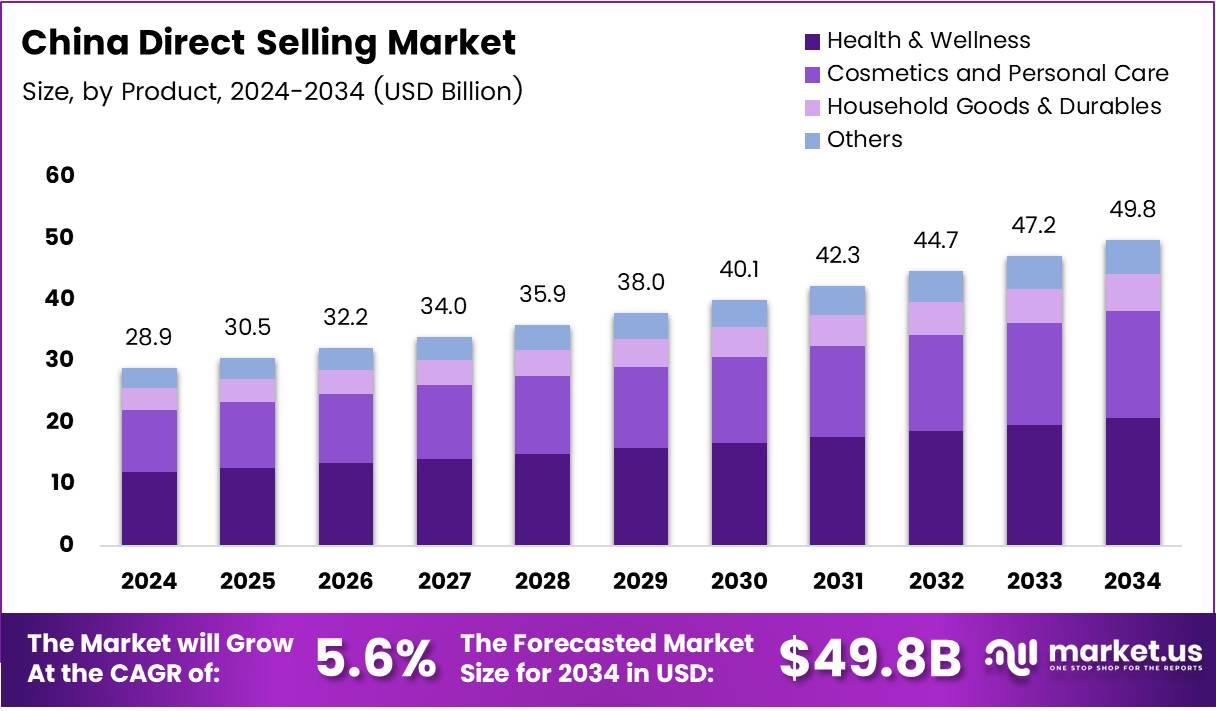

The China Direct Selling Market size is expected to be worth around USD 49.8 Billion by 2034, from USD 28.9 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

The China Direct Selling Market is experiencing significant transformation as consumer behaviors evolve, driven by technological advancements and shifting economic factors. Direct selling in China has moved beyond traditional methods to incorporate digital platforms, allowing businesses to directly connect with consumers without intermediary distributors. This growth is evident in industries ranging from beauty products to health supplements, which have gained strong popularity through direct-to-consumer channels.

One of the key factors driving the growth of the China Direct Selling Market is the increasing digital adoption in the country. In 2021, only 20% of freight forwarders gated their pricing tools, but by 2024, this number surged to 65%, according to Freightos. This digital shift has had a profound impact on direct selling, with platforms embracing e-commerce and social media to increase market outreach and consumer engagement. Direct selling companies are capitalizing on this trend to enhance customer acquisition and retention strategies, which will likely continue expanding through 2024 and beyond.

Additionally, the Chinese government is showing growing interest in supporting industries such as direct selling, through policy changes and financial backing. The government’s favorable stance towards e-commerce and direct-to-consumer sales channels, coupled with investments in digital infrastructure, has created a more favorable environment for direct selling businesses to thrive. These efforts align with China’s broader economic strategy of encouraging domestic consumption, thus presenting a significant opportunity for businesses operating in the direct selling sector.

Another important aspect to consider is the rise of logistic professions, directly impacting the direct selling market in China. According to the U.S. Bureau of Labor Statistics, jobs for logisticians, which include freight brokers, are expected to increase 18% through 2032. This growth will contribute to more efficient delivery systems for direct selling companies, enhancing their ability to meet the demands of a more extensive consumer base. Moreover, the income potential for freight brokers, ranging from $45,000 to $90,000 per year according to NDFCA, indicates the growing importance of logistics in supporting China’s expanding e-commerce sector.

The China Direct Selling Market is poised for substantial expansion. Companies investing in digital strategies, coupled with government backing, will drive growth opportunities. This market is expected to be further boosted by innovations in logistics and consumer engagement tools, making it an attractive sector for investors. Looking forward, the future remains promising, with continuous improvements in technology and regulations paving the way for even greater success in direct selling.

Key Takeaways

- The China Direct Selling Market is expected to reach USD 49.8 Billion by 2034, from USD 28.9 Billion in 2024, growing at a CAGR of 5.6%.

- Health & Wellness dominated the market in 2024, driven by increased focus on preventive healthcare, nutrition, immunity, and fitness.

- The rise of e-commerce platforms is boosting the direct selling market by enabling quicker, more cost-effective sales without traditional retail channels.

- Strategic partnerships with digital influencers present a significant growth opportunity to expand brand reach and engage new customer segments.

- The shift to mobile-first shopping is reshaping the market, with companies optimizing platforms for seamless mobile shopping experiences.

By Product Analysis

Health & Wellness leads with a dominant share in 2024

In 2024, Health & Wellness held a dominant market position in the By Product Analysis segment of the China Direct Selling Market. This category benefitted from increasing consumer focus on preventive healthcare and holistic living. Rising awareness about nutrition, immunity, and fitness further accelerated demand for dietary supplements, traditional health remedies, and functional foods.

Cosmetics & Personal Care maintained a strong presence within the market, supported by consumer interest in skincare routines and beauty enhancement. Direct selling offers personalized consultations and demonstrations, which align well with the buying preferences in this segment. The category also gained momentum through influencer-led promotions and product trials via home visits.

Household Goods & Durables contributed steadily to the overall market, with products such as kitchenware, cleaning appliances, and home care essentials being frequently distributed through direct selling channels. The emphasis on quality, affordability, and product demonstrations has sustained interest in this category, particularly in tier-2 and tier-3 cities where trust in direct sellers is higher.

Key Market Segments

By Product

- Health & Wellness

- Cosmetics & Personal Care

- Household Goods & Durables

Drivers

Increasing Adoption of E-commerce Platforms Drives China Direct Selling Market Growth

The rise of e-commerce platforms is significantly boosting the direct selling market in China. As more consumers prefer the convenience of shopping online, direct selling businesses are increasingly using these platforms to reach their target audiences. This digital shift enables companies to sell products directly to consumers without relying on traditional retail channels, making the process quicker and more cost-effective. E-commerce has also allowed businesses to create personalized shopping experiences, which appeal to the growing demand for convenience.

Additionally, the younger, tech-savvy population in China is driving this trend. They are more inclined to use online platforms for shopping and are comfortable purchasing from direct sellers. This shift toward online buying presents opportunities for direct selling companies to expand their reach and grow their customer base across China, including in rural and less-developed areas.

Restraints

Lack of Consumer Trust in Direct Selling Models as a Restraint in China

One of the major barriers to the growth of the direct selling market in China is the lack of consumer trust. Many consumers are hesitant to engage with direct selling models due to concerns about legitimacy. Past issues such as fraudulent schemes or deceptive sales tactics have made some people wary of this sales approach. Without strong trust-building measures, these concerns can prevent consumers from fully embracing direct selling.

To address this challenge, companies need to prioritize transparency and ethical business practices. Providing clear, honest information about products and ensuring a positive customer experience can help build trust and credibility. Overcoming this hurdle is critical for the direct selling market to grow and reach its full potential in China.

Growth Factors

Strategic Partnerships and Expansion Create Growth Opportunities for Direct Selling in China

There are several growth opportunities for the direct selling market in China. One key opportunity is forming strategic partnerships with digital influencers. Influencers have strong relationships with large audiences, and partnering with them allows direct selling companies to effectively promote their products. These collaborations can drive brand awareness and help businesses tap into new customer segments that are hard to reach through traditional advertising.

Another growth opportunity lies in expanding into China’s tier-2 and tier-3 cities. These regions are seeing a rise in disposable income and a growing middle class, creating a larger customer base for direct selling companies. Furthermore, incorporating sustainable and eco-friendly products into their offerings can attract environmentally conscious consumers, further expanding their market share and tapping into new, ethical product demand.

Emerging Trends

Shift Towards Mobile-First Shopping Drives Direct Selling Trends in China

A major trend shaping the direct selling market in China is the shift to mobile-first shopping. With the widespread use of smartphones, consumers are increasingly relying on mobile devices for their shopping needs. Direct selling companies are adapting by optimizing their platforms for mobile use, ensuring that customers have a smooth and convenient shopping experience on their phones. This trend allows businesses to capture more sales by offering mobile-optimized services to meet the changing habits of consumers.

Additionally, there is a growing focus on wellness and health-related products within the direct selling market. As Chinese consumers become more health-conscious, there is a rising demand for products that promote well-being. The increasing popularity of subscription-based models also plays a significant role in the market’s evolution, providing customers with a personalized shopping experience and creating a steady stream of revenue for companies. These trends are helping to reshape the direct selling industry in China.

Key China Direct Selling Company Insights

In the 2024 China Direct Selling Market, several global companies continue to hold significant influence, leveraging both brand recognition and strategic local adaptations.

Amway Corporation maintains its strong foothold through a deep-rooted presence and localized health and wellness offerings. Its continued focus on personalized nutrition and digitized customer engagement tools positions it as a resilient player amid evolving consumer behaviors.

Herbalife Ltd benefits from a robust product portfolio and a strong community-based selling model. Its science-backed wellness solutions and focus on weight management resonate with Chinese consumers seeking healthier lifestyles, sustaining its relevance in the competitive market.

Natura &Co Holding SA, while primarily known for its beauty and personal care brands, has made strides in sustainability-driven marketing. Its direct selling model appeals to environmentally conscious Chinese consumers, helping to differentiate itself from conventional beauty brands.

Friedrich Vorwerk Group SE, though traditionally focused on industrial technology, has made strategic moves into lifestyle solutions through partnerships and niche product innovations. Its relatively recent entry into the direct selling space in China indicates potential but is yet to reach the scale of legacy players.

These companies collectively demonstrate how diverse strategies—from wellness to sustainability and innovation—are shaping the competitive landscape of China’s direct selling industry in 2024. Their ability to localize offerings and leverage digital ecosystems will be key to sustaining momentum in this dynamic market.

Top Key Players in the Market

- Amway Corporation

- Herbalife Ltd

- Natura &Co Holding SA

- Friedrich Vorwerk Group SE

- Nu Skin Enterprises Inc

- Tupperware Brands Corp

- Oriflame

Recent Developments

- In June 2025, China’s fast-fashion giant Shein is set to raise $2 billion in a new funding round to strengthen its global operations and e-commerce capabilities. The company is also aiming for a highly anticipated U.S. IPO later this year, signaling its global expansion ambitions.

- In February 2025, Chinese heavy equipment maker Sany is considering selling a majority equity stake in its India unit to streamline operations and attract local investment. The move reflects a strategic shift as Sany evaluates restructuring options to boost profitability in the South Asian market.

Report Scope

Report Features Description Market Value (2024) USD 28.9 Billion Forecast Revenue (2034) USD 49.8 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Health & Wellness, Cosmetics & Personal Care, Household Goods & Durables) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Amway Corporation, Herbalife Ltd, Natura &Co Holding SA, Friedrich Vorwerk Group SE, Nu Skin Enterprises Inc, Tupperware Brands Corp, Oriflame Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  China Direct Selling MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample

China Direct Selling MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amway Corporation

- Herbalife Ltd

- Natura &Co Holding SA

- Friedrich Vorwerk Group SE

- Nu Skin Enterprises Inc

- Tupperware Brands Corp

- Oriflame