Global Centella Cosmetics Market Size, Share, Growth Analysis By Product (Skin Care, Fragrance, Hair Care, Makeup, Others), By End-use Channel (Women, Men), By Formulation (Creams and Lotions, Gels, Serums, Masks), By Distribution Channel (Supermarkets/Hypermarkets, Drugstores/Pharmacies, Specialty Beauty Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 153733

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

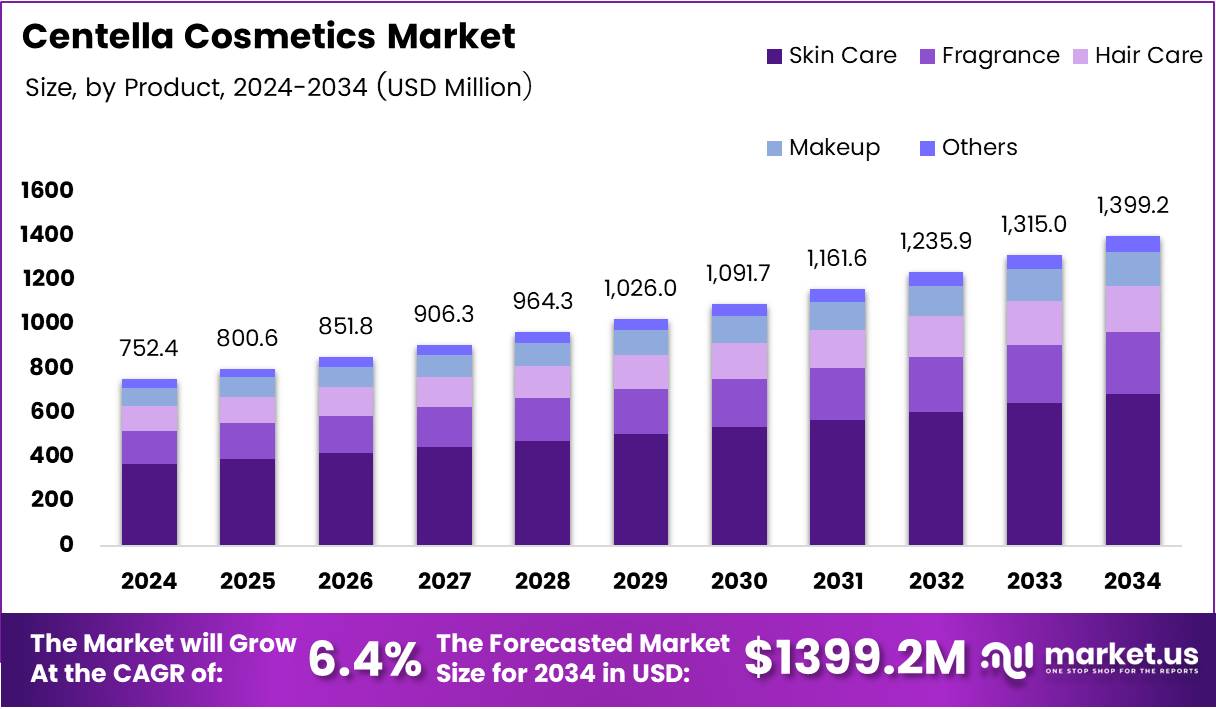

The Global Centella Cosmetics Market size is expected to be worth around USD 1399.2 Million by 2034, from USD 752.4 Million in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

The US Centella Cosmetics Market is gaining momentum as consumers increasingly seek natural, skin-healing ingredients. Centella Asiatica, also known as Gotu Kola, is valued for its ability to support skin regeneration and soothe inflammation. Brands are integrating it into serums, moisturizers, and facial creams to meet the rising demand for clean, botanical formulations.

Demand has notably surged due to its proven skincare benefits. According to Core, cream extract of C. asiatica 10% showed the highest increase in collagen levels by an average of 77.89%, strengthening its position in anti-aging products. This evidence is pushing formulators to prioritize Centella in premium skincare lines.

As a response to this surge, cosmetics manufacturers are investing in R&D to improve the efficacy of Centella-based formulations. Market players are also leveraging the ingredient’s versatility, including it in both therapeutic and cosmetic segments, leading to broad-based consumer appeal in the US clean beauty market.

According to Seppic, by the year 2000, demand for Centella Asiatica was growing considerably due to major developments in its cosmetic applications. Over eighteen years, the market expanded by 30%, with 60% sold in cosmetics, 30% in the pharmacy sector, and 10% in agribusiness, illustrating its broad commercial relevance.

With U.S. consumers prioritizing transparency and safety, Centella’s plant-based profile aligns with federal and FDA trends encouraging clean-label innovation. While not heavily regulated yet, new discussions on botanical ingredient standards could increase compliance requirements for future Centella-based formulations.

In addition, startups and indie beauty brands in the U.S. are seizing this opportunity, introducing Centella serums and creams targeting sensitive and aging skin. The lower cost of botanical ingredients combined with high consumer trust is encouraging innovation and niche product launches across e-commerce platforms.

Government support for sustainable farming and green chemistry is also creating upstream opportunities. Initiatives promoting organic agriculture could indirectly benefit Centella producers as brands demand traceable, eco-friendly supply chains for their formulations.

Furthermore, the expansion of functional skincare in the U.S.—including K-beauty imports and derma brands—is creating a favorable market entry path. Centella, often a core ingredient in Korean cosmetics, is gaining traction through these channels and increasing its footprint in U.S. retail.

Retailers are reporting growing shelf space for Centella-rich products in the facial skincare aisle. U.S. consumers’ growing awareness of herbal actives has led to higher trial rates, creating room for mass and prestige brands to expand their natural skincare lines with Centella.

Digital platforms and influencer marketing are accelerating brand discovery and education around Centella. The U.S. market is responding well to content focused on its wound-healing, anti-inflammatory, and collagen-boosting benefits, further stimulating market penetration.

Key Takeaways

- The Global Centella Cosmetics Market is projected to reach USD 1399.2 Million by 2034, up from USD 752.4 Million in 2024, growing at a CAGR of 6.4% from 2025 to 2034.

- In 2024, Skin Care led the product segment with a 31.4% market share, driven by demand for soothing and anti-aging Centella-based products.

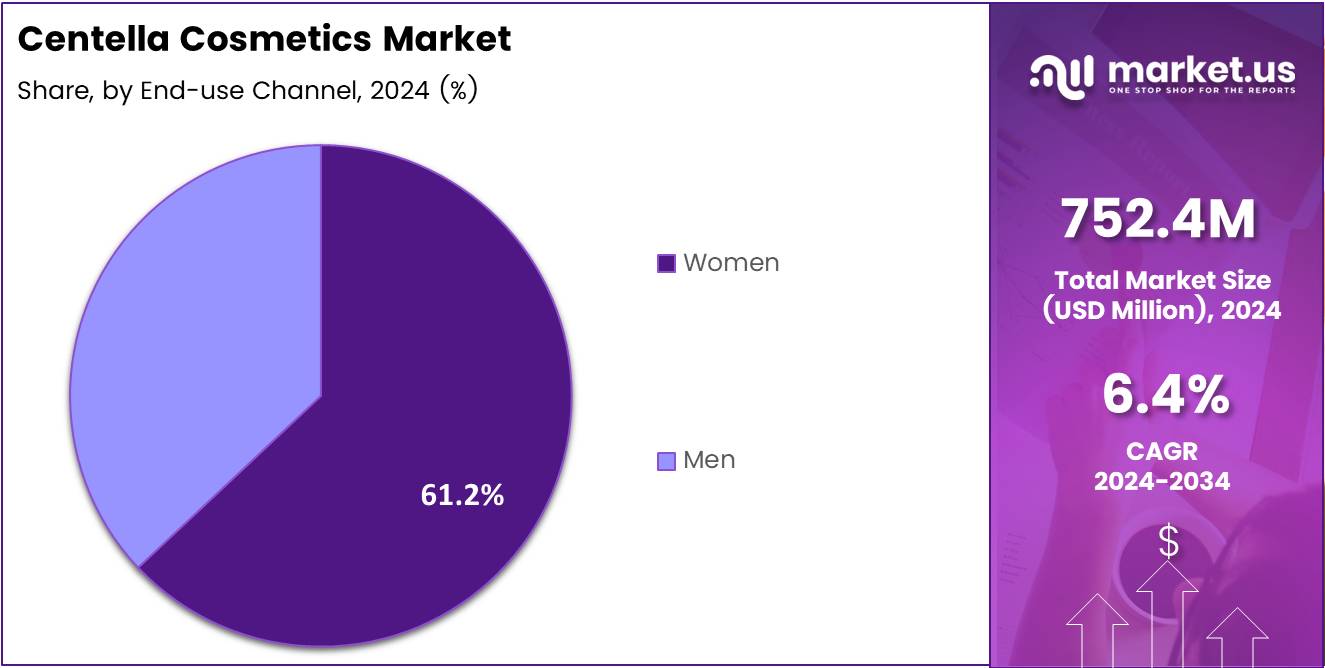

- Women accounted for the largest end-use share at 61.2% in 2024, reflecting a strong focus on natural and wellness-driven skincare.

- Creams and Lotions dominated the formulation segment in 2024, holding a 38.6% share due to ease of use and product stability.

- Supermarkets/Hypermarkets were the leading distribution channel in 2024, with a 37.9% share, offering visibility and trust in Centella cosmetics.

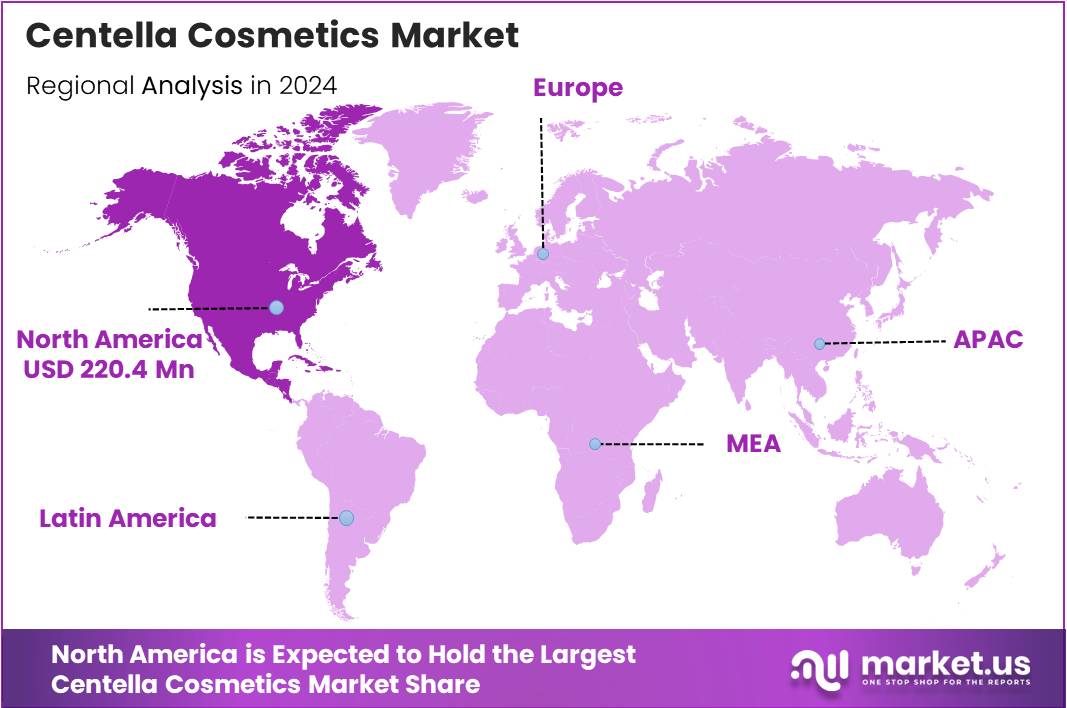

- North America led the regional market with a 29.3% share and a valuation of USD 220.4 Million, driven by clean beauty trends and U.S. retail strength.

Product Analysis

Skin Care leads with 31.4% due to rising consumer demand for natural and soothing solutions.

In 2024, Skin Care held a dominant market position in the By Product Analysis segment of the Centella Cosmetics Market, with a 31.4% share. The popularity of Centella-based formulations in soothing, hydrating, and anti-aging routines continues to drive demand across global markets.

Fragrance products are also gaining traction due to consumer interest in herbal and botanical-based scents. These natural alternatives are seen as safer and skin-friendly, contributing to their increasing presence in retail and online platforms.

Hair Care represents another steadily growing segment. Consumers are leaning toward organic solutions for scalp health, hair growth, and dandruff control, areas where Centella asiatica’s therapeutic properties are showing notable promise.

Makeup is evolving with skin-beneficial ingredients, but its share remains comparatively lower due to slower adoption of functional botanicals in color cosmetics. However, brands experimenting with hybrid formulas are likely to see long-term growth.

The Others segment includes body washes and mists incorporating Centella extracts, supported by niche but growing demand from wellness-conscious users. These offerings cater to consumers seeking holistic skin wellness beyond traditional facial products.

End-use Channel Analysis

Women dominate with 61.2% due to their increasing adoption of botanical skincare solutions.

In 2024, Women held a dominant market position in the By End-use Channel Analysis segment of the Centella Cosmetics Market, with a 61.2% share. Women across all age groups are prioritizing skincare and wellness routines, particularly those involving natural, calming, and anti-inflammatory ingredients.

This preference has significantly benefited Centella-based cosmetics, especially in moisturizers, serums, and facial masks. Product lines marketed toward hydration, skin barrier repair, and anti-aging are particularly resonating with the female demographic.

On the other hand, Men are gradually entering the natural skincare market, with a growing focus on simplified grooming routines. Products offering dual benefits like cleansing and soothing are increasingly accepted, though the segment still trails behind female consumers.

With rising awareness and wellness trends, the gender gap in usage is narrowing slowly, particularly in urban and digitally connected markets. However, women remain the primary target group, influencing innovation, marketing strategies, and brand positioning across the Centella Cosmetics landscape.

Formulation Analysis

Creams and Lotions lead with 38.6% thanks to their ease of use and effective hydration properties.

In 2024, Creams and Lotions held a dominant market position in the By Formulation Analysis segment of the Centella Cosmetics Market, with a 38.6% share. These formulations are widely preferred due to their versatile application and ability to deliver Centella extracts in a stable, user-friendly format.

Consumers appreciate the moisturizing and healing properties of Centella creams, particularly for sensitive or acne-prone skin. Their non-irritating, calming profiles make them ideal for daily use, especially in harsh climates or dry skin conditions.

Gels have grown in popularity, especially among younger users and those in humid regions. These offer lightweight, fast-absorbing hydration without leaving a greasy residue, aligning with trends toward minimal and breathable skincare.

Serums, while potent and concentrated, have a more niche appeal, often attracting consumers with targeted skin concerns like pigmentation or fine lines. Their higher price point can limit broader adoption despite their effectiveness.

Masks offer periodic intensive treatment and remain popular in the self-care category. Their share is stable, bolstered by the spa-like experience they provide and the deeper penetration of active ingredients like Centella asiatica.

Distribution Channel Analysis

Supermarkets/Hypermarkets dominate with 37.9% due to strong retail presence and product accessibility.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel Analysis segment of the Centella Cosmetics Market, with a 37.9% share. These outlets offer the advantage of product visibility, bulk purchasing, and the trust associated with established retail chains.

Consumers prefer shopping for everyday personal care products in these formats due to convenience and in-store promotions. The ability to physically evaluate product texture, scent, and packaging also adds to their appeal.

Drugstores/Pharmacies are also key players, particularly for dermatologically-backed Centella skincare ranges. Their medical alignment and credibility attract customers seeking therapeutic or problem-solving solutions.

Specialty Beauty Stores cater to a more niche, brand-loyal customer base. These channels perform well in urban centers and shopping districts, where curated collections and informed staff add value to the purchasing experience.

Online platforms continue to expand, driven by e-commerce growth and influencer marketing. Although the share is smaller than physical stores, rising digital penetration and mobile commerce are fueling steady growth.

The Others category includes local shops and wellness boutiques, which hold minor but meaningful shares in select regions focusing on organic and herbal cosmetic offerings.

Key Market Segments

By Product

- Skin Care

- Fragrance

- Hair Care

- Makeup

- Others

By End-use Channel

- Women

- Men

By Formulation

- Creams and Lotions

- Gels

- Serums

- Masks

By Distribution Channel

- Supermarkets/Hypermarkets

- Drugstores/Pharmacies

- Specialty Beauty Stores

- Online

- Others

Drivers

Rising Demand for Natural and Organic Skincare Products Drives Market Growth

The Centella cosmetics market is growing due to rising consumer preference for natural and organic skincare. Centella Asiatica, known for its calming and healing properties, fits perfectly with this demand. Its popularity is further supported by the global rise of K-beauty trends, where Centella is a key ingredient in many bestselling products.

Consumers are also increasingly aware of the anti-inflammatory benefits of Centella, making it popular for sensitive skin and acne care. Additionally, the growth of e-commerce has allowed niche skincare brands to reach broader audiences, especially in international markets, further driving demand for Centella-based products.

Restraints

High Cost of Centella-Based Formulations Poses Market Challenge

Centella cosmetics face challenges due to their higher production costs compared to conventional products. The extraction process and natural preservation add to pricing, which may deter budget-conscious buyers.

Limited long-term clinical research on Centella’s effects also raises questions about its lasting efficacy. Furthermore, strict regulatory standards in different countries can delay product approvals and limit international expansion. Lastly, the short shelf life of natural formulations increases inventory risks for brands and reduces consumer convenience.

Growth Factors

Development of Dermatologist-Endorsed Centella Skincare Lines Unlocks New Potential

Endorsements from dermatologists can boost credibility for Centella skincare, especially among consumers with sensitive skin. Clinical backing helps products stand out in a competitive market.

Men’s grooming is another untapped opportunity, with Centella offering post-shave calming benefits. The rise of personalized skincare also opens doors for Centella to be used in customizable routines. Lastly, emerging markets offer strong growth potential, with rising demand for quality natural skincare and increased online access to global brands.

Emerging Trends

Surge in Clean Beauty Certification and Transparency Labeling Shapes Market Trends

Trends like clean beauty certifications and transparent ingredient labeling are reshaping consumer expectations. Products highlighting Centella’s natural benefits and eco-friendly sourcing gain more trust.

Social media campaigns and influencer partnerships are also boosting Centella product visibility. Additionally, hybrid products that combine skincare with makeup are gaining traction, offering convenience and multi-functionality. Finally, advancements in biotechnology are enhancing the potency and effectiveness of Centella extracts, allowing brands to innovate and differentiate their offerings.

Regional Analysis

North America Dominates the Centella Cosmetics Market with a Market Share of 29.3%, Valued at USD 220.4 Million

North America leads the global Centella cosmetics market, capturing a significant 29.3% market share and reaching a valuation of USD 220.4 Million. The region’s dominance is fueled by increasing consumer awareness of natural skincare ingredients and a growing preference for clean beauty products. The U.S. market, in particular, plays a central role due to its advanced retail infrastructure and evolving wellness trends.

Europe Centella Cosmetics Market Outlook

Europe holds a notable position in the Centella cosmetics market, supported by its long-standing tradition in herbal skincare and stringent regulatory standards that favor natural product formulations. Rising demand for anti-aging and skin-repair products further drives market growth across countries like Germany, France, and the U.K.

Asia Pacific Centella Cosmetics Market Trends

Asia Pacific is a vital contributor to the Centella cosmetics market, owing to the ingredient’s origin and historical use in traditional skincare across countries like South Korea, China, and Japan. The region experiences strong demand driven by innovative product launches and consumer preference for herbal and botanical formulations.

Middle East and Africa Centella Cosmetics Market Insights

The Middle East and Africa region is witnessing steady growth in the Centella cosmetics market, propelled by increasing urbanization and expanding e-commerce channels. Although still emerging, consumer awareness around natural skincare solutions is growing, particularly in the Gulf countries.

Latin America Centella Cosmetics Market Overview

Latin America presents growth opportunities for the Centella cosmetics market as demand for herbal and plant-based skincare continues to rise. Countries such as Brazil and Mexico are seeing a gradual increase in consumer inclination toward organic beauty products, supported by social media influence and changing beauty standards.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Centella Cosmetics Company Insights

The global Centella Cosmetics Market in 2024 continues to witness significant momentum, largely driven by consumer preference for natural and functional skincare ingredients. L’Oréal remains a pivotal player, leveraging its vast research capabilities and global brand strength to expand Centella-based product lines. The company’s strategy focuses on integrating Centella Asiatica into both premium and mass-market skincare ranges, which is fueling category growth.

Unilever is strategically positioning itself in the natural cosmetics space by expanding its sustainable product portfolio. With Centella’s reputation for soothing and healing properties, Unilever is incorporating it into its dermatologically tested lines to appeal to health-conscious and eco-aware consumers, particularly in emerging Asian markets.

Beiersdorf AG continues to focus on dermatological expertise, utilizing Centella in its NIVEA and Eucerin lines to meet rising demand for skin-repairing and anti-aging solutions. The brand’s investment in R&D and its strong retail network are supporting steady market penetration across Europe and Latin America.

Procter & Gamble is using Centella as a key differentiator in its premium skincare offerings, targeting consumers looking for gentle yet effective formulations. Its brand innovation, paired with robust marketing strategies, is strengthening its presence in the clean beauty segment.

These key players are shaping the competitive landscape through innovation, brand trust, and consumer engagement. Their efforts not only reflect the evolving beauty standards but also indicate Centella’s growing role as a cornerstone ingredient in modern skincare regimes.

Top Key Players in the Market

- Estee Lauder

- L’Oréal Paris

- Procter & Gamble

- Shiseido

- SKIN1004

- Amorepacific Corporation

- Unilever

- SkinRx Lab

- Purito

- Benton

Recent Developments

- In Mar 2025, Liman Korea launched the world’s first Centella smart farm to guarantee high-quality production. Investment of 10 billion won was made, using advanced Dutch smart farming technology for its construction.

- In Apr 2024, Cipla Ltd announced the acquisition of Ivia Beaute Pvt Ltd’s distribution and marketing business in cosmetics and personal care. This move strengthens Cipla’s consumer healthcare segment by expanding into the beauty and wellness market.

Report Scope

Report Features Description Market Value (2024) USD 752.4 Million Forecast Revenue (2034) USD 1399.2 Million CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Skin Care, Fragrance, Hair Care, Makeup, Others), By End-use Channel (Women, Men), By Formulation (Creams and Lotions, Gels, Serums, Masks), By Distribution Channel (Supermarkets/Hypermarkets, Drugstores/Pharmacies, Specialty Beauty Stores, Online, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Estee Lauder, L’Oréal Paris, Procter & Gamble, Shiseido, SKIN1004, Amorepacific Corporation, Unilever, SkinRx Lab, Purito, Benton Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Estee Lauder

- L’Oréal Paris

- Procter & Gamble

- Shiseido

- SKIN1004

- Amorepacific Corporation

- Unilever

- SkinRx Lab

- Purito

- Benton