Global Cellular Health Screening Market By Test Type [Single Test Panels (Telomere Tests, Oxidative Stress Tests, Inflammation Tests and Heavy Metals Tests) Multi-test Panels] By Sample Type (Blood, Saliva, Serum and Urine) By Collection Site (Hospital, Home, Office and Diagnostic Labs) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 48727

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

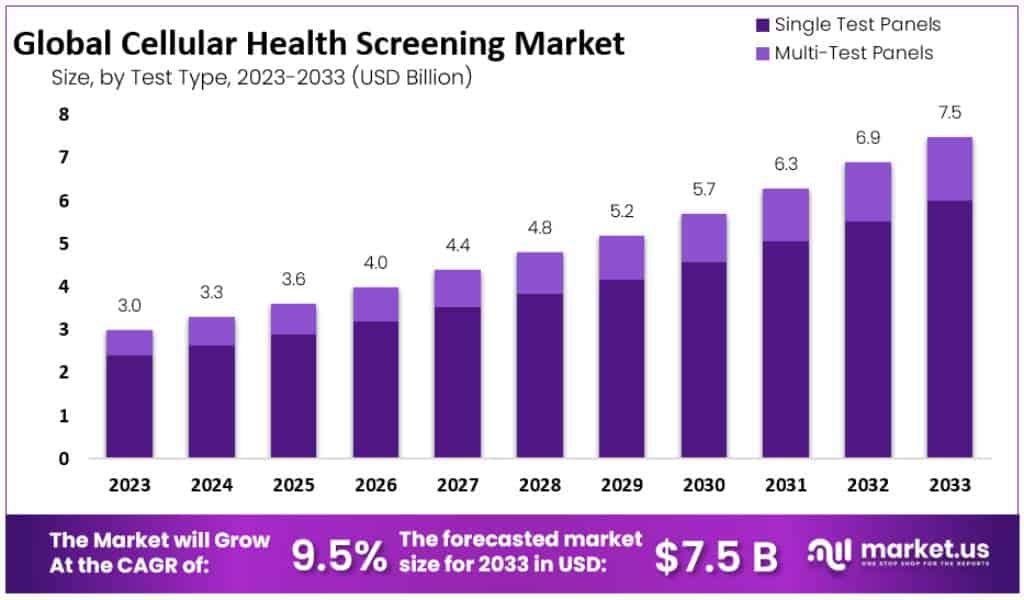

The Global Cellular Health Screening Market size is expected to be worth around USD 7.5 Billion by 2033, from USD 3.0 Billion in 2023, growing at a CAGR of 9.5% during the forecast period from 2024 to 2033.

Cellular health screening is a process that involves assessing an individual’s health at a cellular level. It can provide insights into various aspects of health, such as the body’s aging process, energy production in cells, overall cellular health and function, levels of toxicity, body composition, and fitness levels. This screening typically involves tests such as telomere tests, oxidative stress tests, inflammation tests, and heavy metals tests, which can help detect biological age, cellular toxicity, and the risk of diseases.Cellular health screening is gaining importance in personalized medicine and preventive healthcare, and it is used to assess and monitor patients who may need to detoxify, lose excess body fat, or develop a long-term strategy for healthy aging.

Key Takeaways

- Market Size: Cellular Health Screening Market size is expected to be worth around USD 7.5 Billion by 2033, from USD 3.0 Billion in 2023.

- Market Growth: The market growing at a CAGR of 9.5% during the forecast period from 2024 to 2033.

- Test Type Analysis: Single Test Panels held a dominant market position, capturing more than an 80.2% share in the Cellular Health Screening Market.

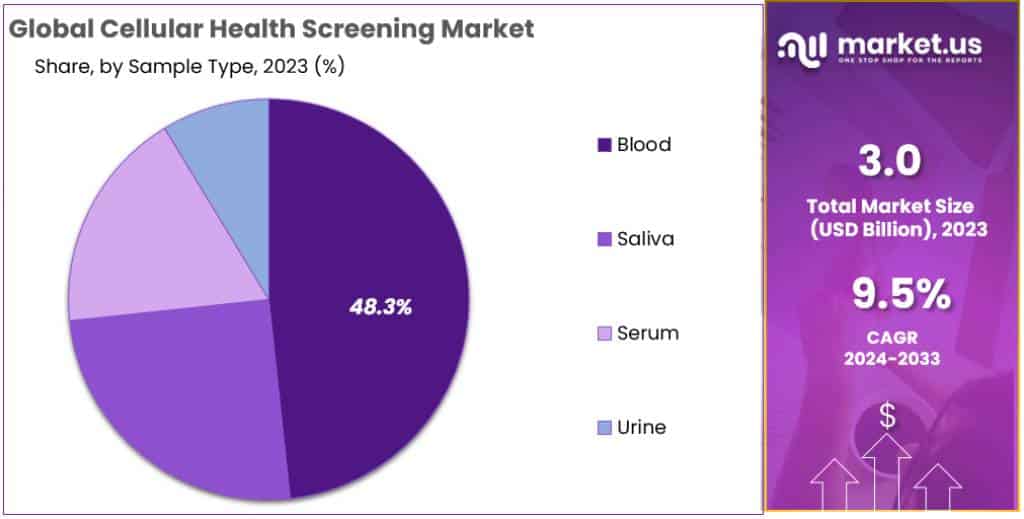

- Sample Type Analysis: Blood held a dominant market position in the Cellular Health Screening Market, capturing more than a 48.3% share in 2023.

- Collection Site Analysis: In 2023, Hospitals held a dominant market position in the Cellular Health Screening Market, capturing more than a 40.5% share.

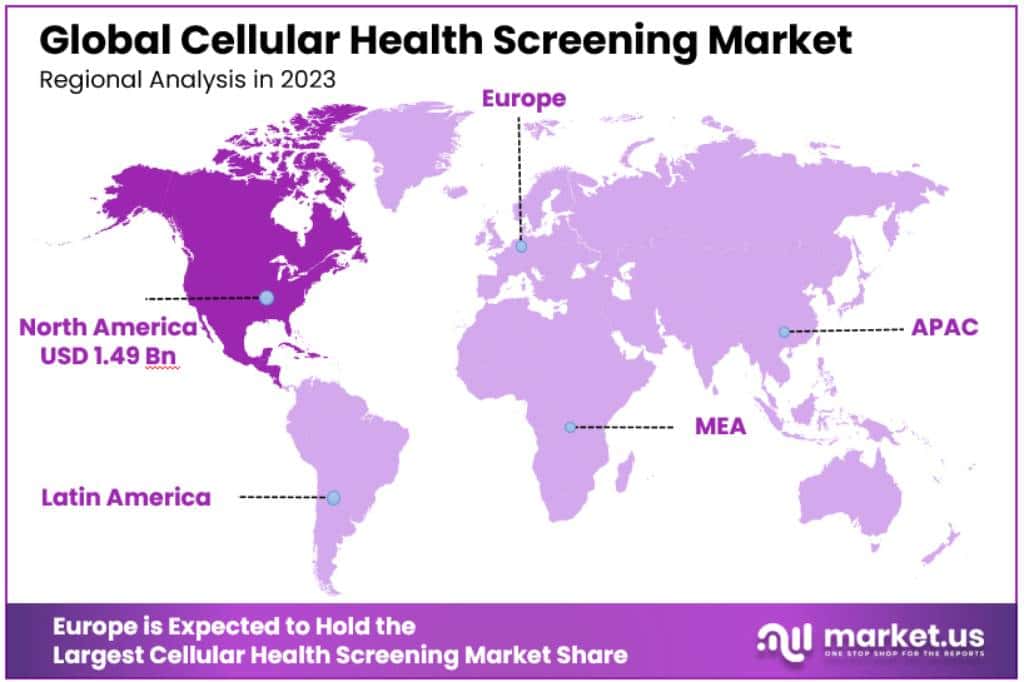

- Regional Analysis: North america region dominate 49.9% market share, valued at USD 1.49 Billion in 2023.

- Technological Advancements: Innovations in biomarker identification and advanced diagnostic technologies are enhancing the accuracy and efficiency of cellular health screening tests.

- Technological Advancements: Innovations in biomarker identification and advanced diagnostic technologies are enhancing the accuracy and efficiency of cellular health screening tests.

- Regulatory Support: Supportive regulatory frameworks and guidelines are facilitating the development and approval of new cellular health screening tests, boosting market growth.Rising

- Chronic Diseases: The prevalence of chronic diseases, such as cancer and cardiovascular disorders, is increasing the demand for early diagnostic tools like cellular health screenings.

- Consumer Demand: Growing consumer interest in health and wellness, along with the availability of direct-to-consumer testing kits, is propelling market growth.

- Healthcare Integration: Integration of cellular health screening with routine healthcare check-ups is becoming more common, emphasizing the importance of early detection and preventive measures.

Test Type Analysis

In 2023, Single Test Panels held a dominant market position, capturing more than an 80.2% share in the Cellular Health Screening Market. This segment is characterized by various types of tests that focus on specific aspects of cellular health.

- Telomere Tests: These tests are crucial for understanding cellular aging. They measure the length of telomeres, the protective caps at the ends of chromosomes. Shorter telomeres are associated with aging and increased disease risk. This segment benefits from growing awareness about aging-related health issues.

- Oxidative Stress Tests: These tests assess the balance between antioxidants and free radicals in the body. Oxidative stress is linked to numerous health conditions, including chronic diseases. The demand for these tests is driven by the rising prevalence of lifestyle diseases.

- Inflammation Tests: Inflammation is a critical response of the immune system but can lead to health problems when chronic. These tests help in detecting hidden inflammation, guiding treatment for various conditions. Their importance is underscored by the increasing focus on preventive healthcare.

- Heavy Metals Tests: Exposure to heavy metals like lead, mercury, or arsenic is a growing health concern. These tests detect the presence and concentration of heavy metals, aiding in the diagnosis and management of toxicity. The rising awareness about environmental toxins boosts their relevance.

In contrast, Multi-test Panels, although smaller in market share, present significant growth opportunities. These panels combine several tests, offering a comprehensive assessment of cellular health. This holistic approach aligns well with the growing trend towards personalized and preventive healthcare, making it a promising segment for future expansion.

Sample Type Analysis

In 2023, Blood held a dominant market position in the Cellular Health Screening Market, capturing more than a 48.3% share. This segment’s prominence is due to the comprehensive data blood samples provide, crucial for accurate cellular health analysis.

- Blood: As the primary medium for cellular health screening, blood samples are favored for their reliability and the depth of information they offer. Blood tests can detect a wide range of biomarkers, making them indispensable in diagnosing and monitoring various health conditions. The ease of collecting blood samples and the established infrastructure for blood analysis contribute to this segment’s dominance.

- Saliva: Gaining traction for its non-invasive nature, saliva is an emerging sample type in cellular health screening. It is particularly convenient for frequent monitoring and home-based testing, appealing to consumers seeking ease and comfort. Saliva tests are gaining popularity for hormonal and genetic screenings, reflecting a shift towards more patient-friendly testing methods.

- Serum: A vital component of blood, serum is used for specific types of cellular health assessments. It is particularly useful for detecting antibodies and other proteins. Serum-based tests are essential in immunological screenings and are valued for their specificity and accuracy.

- Urine: Urine tests are a key segment, primarily used for metabolic and kidney function assessments. They offer a non-invasive, easy-to-collect sample type, suitable for a range of diagnostic purposes. The growing focus on metabolic health and kidney diseases is likely to fuel the demand for urine-based cellular health screening.

Collection Site Analysis

In 2023, Hospitals held a dominant market position in the Cellular Health Screening Market, capturing more than a 40.5% share. The trust and comprehensive care offered by hospitals contribute significantly to their leading status in this market.

- Hospital: Hospitals are the primary collection sites for cellular health screening, known for their reliability and comprehensive healthcare services. They offer a wide range of tests with the advantage of immediate medical attention if needed. The presence of specialized equipment and expert medical staff makes hospitals a preferred choice for many, particularly for more complex health screenings.

- Home: Home collection has emerged as a convenient option, especially appealing in the era of personalized healthcare. This segment is growing due to the rise in home health testing kits and the increasing preference for privacy and comfort. Home collection is particularly popular for routine screenings and in situations where patients prefer to avoid hospital visits.

- Office: Office-based collection is a niche but growing segment, catering to corporate wellness programs. Companies are increasingly adopting health screening services as part of their employee wellness initiatives. This trend is driven by the recognition that a healthy workforce contributes to increased productivity and reduced healthcare costs.

- Diagnostic Labs: Diagnostic laboratories are key players in the Cellular Health Screening Market. They are equipped with advanced technologies and specialize in a wide array of tests. The efficiency and quick turnaround time of diagnostic labs make them a popular choice for both individual and corporate clients.

Key Market Segments

Test Type

- Single Test Panels

- Telomere Tests

- Oxidative Stress Tests

- Inflammation Tests

- Heavy Metals Tests

- Multi-test Panels

Sample Type

- Blood

- Saliva

- Serum

- Urine

Collection Site

- Hospital

- Home

- Office

- Diagnostic Labs

Drivers

- Increased Focus on Precision Medicine: The expanding role of precision medicine and the need to analyze biomarkers for aging and general cellular health are driving the market. By 2030, the demand for personalized healthcare solutions is expected to surge, bolstering the market growth.

- Rising Chronic Disease Incidence: The link between chronic diseases and cellular health, particularly in aging populations, is a key driver. Studies show that factors like infections and stress impact telomere length, influencing aging and related disorders. The growing awareness of these connections is expected to increase the market demand.

- Growing Geriatric Population: The United Nations Department of Economics and Social 2022 report highlights that the global population aged 65 years or over is projected to reach 994 million by 2030. This demographic shift increases the demand for cellular health screening, as older individuals are more prone to chronic diseases.

- Advancements in Home Diagnostic Tests: The rise in the adoption of home diagnostic tests, especially in regions with limited lab facilities, is propelling market growth. These tests offer convenience, lower costs, and are increasingly accurate, making them a popular choice.

- Government Initiatives in Preventive Healthcare: Governments worldwide are focusing more on preventive healthcare. For instance, in November 2022, the Haryana government launched a mobile health screening initiative, indicating a trend towards government-supported health screening programs.

Challenges

- Transportation Risks: The risks associated with transporting samples, such as potential degradation or loss, pose a significant challenge. These issues can impact the reliability of test results and hinder market growth.

- Data Privacy Concerns: The collection of sensitive personal health data raises privacy and security concerns. Compliance with regulations like GDPR and CCPA is crucial but challenging, potentially limiting market expansion.

- Lack of Standardization: The absence of standardized procedures and varying kit costs by different organizations can hamper market growth, as it leads to inconsistency in test results and consumer trust issues.

- Limited Accessibility: In some regions, especially those with resource constraints, accessibility to advanced cellular health screening remains limited, restricting market growth potential.

Opportunities

- Awareness Campaigns and Collaborative Efforts: Organizations like WHO and CDC are intensifying awareness campaigns and collaborative efforts for preventive healthcare. These initiatives are expected to boost the market by increasing consumer awareness and demand for cellular health screening.

- Technological Innovations and Product Launches: Continuous innovation and new product launches, such as Menarini Silicon Biosystems’ CELL SEARCH test in November 2021, present significant growth opportunities. These advancements cater to the rising demand for efficient and reliable cellular health screening solutions.

Trends

- Telomere Tests Segment Growth: The Telomere Tests segment is anticipated to hold a significant market share. Innovations in test sensitivity and techniques, along with increasing consumer preference for aging-related cellular health assessments, are driving this segment’s growth.

- Growth of Direct-to-Consumer Testing: The direct-to-consumer approach is gaining traction, offering users more control and convenience in health monitoring.

- Digital Testing Technologies: The adoption of digital technologies in cellular health screening is expected to increase, enhancing the efficiency and accuracy of these tests.

Regional Analysis

In the evolving landscape of the Cellular Health Screening Market, North America is positioned to maintain its dominance, with projections indicating it will hold a commanding 49.9% market share, valued at USD 1.49 Billion in 2023. This robust market position can be attributed to a confluence of factors, including a significant patient population and a marked rise in disease prevalence.

The data from the American Cancer Society in 2022, estimating 1.9 million new cancer cases in the United States, underscores the increasing incidence of chronic diseases in the region. This trend is expected to amplify the demand for cellular health screening, as these tools provide effective and early diagnosis, contributing significantly to market growth.

Additionally, the Centers for Disease Control and Prevention (CDC) reported in July 2022 that coronary heart disease is the most prevalent heart disease in the U.S., affecting approximately 20.1 million adults aged 20 and older. Further emphasizing the healthcare burden, CDC data from October 2022 indicates that heart attacks occur every 40 seconds in the United States, affecting nearly 805,000 individuals annually. The critical need for early diagnostic measures in managing cardiovascular diseases is expected to further drive the market’s growth.

The market’s expansion is also bolstered by innovative diagnostic solutions like Grail’s single blood test, launched in June 2021, capable of detecting multiple cancers. Targeting individuals at elevated cancer risk, such as those over 50, this and similar initiatives by key market players are enhancing the adoption of cellular health screening in North America.

Meanwhile, the Asia Pacific region is emerging as the fastest-growing market, driven by a growing population contributing to a larger patient pool and developing healthcare infrastructure due to increasing economies. Improved test adoption and heightened health consciousness among adults are key growth drivers in Asia Pacific. Additionally, increased research on telomere senescence and government initiatives for disease prevention support regional growth, positioning the Asia Pacific as a dynamic and rapidly evolving market in the cellular health screening landscape.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The Cellular Health Screening Market is characterized by a dynamic mix of both established and emerging players, creating a competitive landscape. This market is distinguished by ongoing innovations in screening technologies, product launches, and strategic partnerships aimed at expanding geographical reach and market share. For instance, notable developments include Virtua Health’s launch of a mobile health & cancer screening unit in April 2023, enhancing access to crucial cancer diagnostics. Furthermore, in January 2023, Atomo Diagnostics, an Australian company, forged a long-term agreement with NG Biotech SAS to manufacture and distribute rapid blood-based pregnancy tests, marking a significant expansion into major markets.

Prominent players in this market encompass a diverse range of organizations, from specialized diagnostic firms to global healthcare corporations. Key companies such as Bio-Reference Laboratories Inc., Genova Diagnostics, Immundiagnostik AG, Quest Diagnostics, SpectraCell Laboratories Inc., and Telomere Diagnostics Inc. are among those leading the charge in this sector. Their contributions span from developing innovative cellular screening tests to adopting strategic approaches to capture and expand their market presence.

Маrkеt Кеу Рlауеrѕ

- Telomere Diagnostics

- SpectraCell Laboratories

- Life Length

- Repeat Diagnostics, Inc.

- Cell Science Systems Corp.

- DNA Labs India

- ARUP Laboratories

- Zimetry LLC

- Immundiagnostik AG

- Cleveland Heartlab, Inc.

- Quest Diagnostics

- BioReference Laboratories (US)

- LabCorp Holdings

- OPKO

- Genova Diagnostics

- DNA Labs

- Other Key Players

Recent Developments

Product Launches and Innovations

- November 2023: Imagene Labs: Launched the AI-powered Cellular Health Report, which analyzes blood samples to provide insights into overall cellular health and risk of age-related diseases. This uses artificial intelligence to personalize the results.

- November 2023: TruDiagnostic: Unveiled the TruCellular Home Test Kit, a convenient and affordable option for individuals to assess their cellular health from the comfort of their homes.

- October 2023: Bloom Diagnostics: Announced the launch of the Bloom Inflammation Test, which measures C-reactive protein (CRP) in the blood to detect inflammation in the body. This aids in early diagnosis and treatment of various chronic diseases.

- October 2023: Menarini Silicon Biosystems: Launched the CELLSEARCH Circulating Tumor Cell (CTC) Kit for the quantification of circulating tumor cells in blood samples. This enables non-invasive monitoring of cancer progression and treatment response.

- October 2023: Elysium Health: Introduced the Basis Cellular Health Test, a comprehensive panel that measures multiple cellular health markers, including telomere length, DNA methylation, and mitochondrial function. This provides a deeper understanding of individual cellular health and aging.

Collaborations and Partnerships

- October 2023: LifeLabs and Cell Biosciences: Partnered to bring advanced cellular health testing to Canadian patients. This collaboration expands access to personalized and proactive healthcare solutions.

- October 2023: Elysium Health and Mayo Clinic: Announced a joint research initiative to study the impact of aging-related interventions on cellular health and disease prevention. This collaboration aims to accelerate scientific understanding and advance personalized healthcare.

- November 2023: Genomics England and Deep Longevity: Collaborated to develop a large-scale cellular health data platform. This platform will be used to identify genetic and environmental factors influencing cellular aging and longevity.

Regulatory Developments and Funding

- October 2023: FDA granted Breakthrough Device Designation to Human Longevity Inc.’s Cellular Health Test for early detection of age-related diseases. This designation recognizes the potential of the test to revolutionize preventative healthcare.

- October 2023: National Institutes of Health awarded a $5 million grant to researchers at Harvard Medical School to study the use of cellular health markers in predicting and preventing Alzheimer’s disease.

Report Scope

Report Features Description Market Value (2023) USD 3.0 Billion Forecast Revenue (2033) USD 7.5 Billion CAGR (2023-2032) 9.5% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Test Type [Single Test Panels (Telomere Tests, Oxidative Stress Tests, Inflammation Tests and Heavy Metals Tests) Multi-test Panels] By Sample Type (Blood, Saliva, Serum and Urine) By Collection Site (Hospital, Home, Office and Diagnostic Labs) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Telomere Diagnostics, SpectraCell Laboratories, Life Length, Repeat Diagnostics, Inc., Cell Science Systems Corp., DNA Labs India, ARUP Laboratories, Zimetry LLC, Immundiagnostik AG, Cleveland Heartlab, Inc., Quest Diagnostics, BioReference Laboratories (US), LabCorp Holdings, OPKO, Genova Diagnostics, DNA Labs and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is cellular health screening?Cellular health screening involves tests that assess the condition and functionality of cells in the body. These tests can provide insights into cellular aging, oxidative stress, and overall health.

How big is the Cellular Health Screening Market?The global Cellular Health Screening Market size was estimated at USD 7.5 Billion in 2023 and is expected to reach USD 3.0 Billion in 2033.

What is the Cellular Health Screening Market growth?The global Cellular Health Screening Market is expected to grow at a compound annual growth rate of 9.5%. From 2024 To 2033

Who are the key companies/players in the Cellular Health Screening Market?Some of the key players in the Cellular Health Screening Markets are Telomere Diagnostics, SpectraCell Laboratories, Life Length, Repeat Diagnostics, Inc., Cell Science Systems Corp., DNA Labs India, ARUP Laboratories, Zimetry LLC, Immundiagnostik AG, Cleveland Heartlab, Inc., Quest Diagnostics, BioReference Laboratories (US), LabCorp Holdings, OPKO, Genova Diagnostics, DNA Labs and Other Key Players.

Why is cellular health screening important?Cellular health screening helps detect early signs of chronic diseases, monitor aging processes, and guide personalized healthcare plans to improve overall well-being.

Who can benefit from cellular health screening?Individuals interested in preventive healthcare, those with a family history of chronic diseases, and people looking to optimize their health and wellness can benefit from these screenings.

Are cellular health screening tests covered by insurance?Coverage depends on the specific test and insurance policy. Some tests may be covered under preventive health plans, while others might require out-of-pocket payment.

How do cellular health screening tests contribute to personalized medicine?By providing detailed information on an individual's cellular health, these tests enable tailored healthcare interventions, lifestyle modifications, and treatment plans to enhance overall health outcomes.

Cellular Health Screening MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Cellular Health Screening MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Telomere Diagnostics

- SpectraCell Laboratories

- Life Length

- Repeat Diagnostics, Inc.

- Cell Science Systems Corp.

- DNA Labs India

- ARUP Laboratories

- Zimetry LLC

- Immundiagnostik AG

- Cleveland Heartlab, Inc.

- Quest Diagnostics

- BioReference Laboratories (US)

- LabCorp Holdings

- OPKO

- Genova Diagnostics

- DNA Labs

- Other Key Players