Global Ceiling Tiles Market By Material Type(Mineral Fiber, Metal, Gypsum, Others), By Property Type(Acoustic, Non-Acoustic), By Installation Type(Suspended, Surface Mounted, By Form(Laminated, Fissured, Patterned, Plain, Textured, Coffered, Other), By End-User(Non-Residential, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Sep 2024

- Report ID: 128265

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

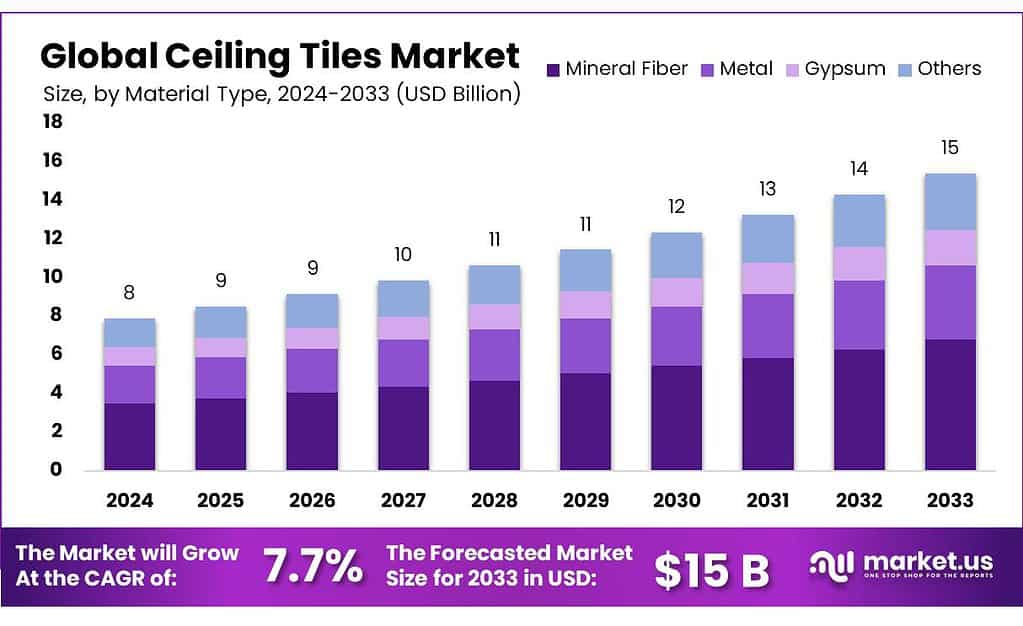

The global Ceiling Tiles Market size is expected to be worth around USD 15 billion by 2033, from USD 8 billion in 2023, growing at a CAGR of 7.7% during the forecast period from 2023 to 2033.

The ceiling tiles market focuses on creating products used mainly in building construction for enhancing the ceilings of various spaces like offices, schools, and hospitals. These tiles not only enhance the aesthetic appeal of a room but also serve functional purposes such as noise reduction and energy efficiency through insulation.

This market is segmented based on materials like mineral fiber, metal, and gypsum, each chosen for specific properties like durability, sound absorption, and fire resistance. For instance, mineral fiber tiles, which make up about 38% of the market in 2023, are particularly appreciated for their ability to improve thermal insulation and reduce noise, making them ideal for use in environments that require quiet and temperature control.

The bulk of the market demand comes from non-residential sectors such as commercial buildings and healthcare facilities where the benefits of ceiling tiles, like acoustic control and environmental sustainability, are essential. These settings frequently demand materials that can meet strict fire safety standards while also providing significant aesthetic and functional benefits.

In response to technological advancements and shifting market demands, companies are increasingly leaning towards eco-friendly solutions, developing ceiling tiles from recycled materials that offer enhanced performance in terms of durability and maintenance. This shift is influenced by both consumer preference for sustainable materials and stringent government regulations promoting green building practices.

Key Takeaways

- Market Growth Projection: Expected to reach USD 15 billion by 2033 from USD 8 billion in 2023, with a CAGR of 7.7%.

- Mineral Fiber: Dominates with a 44.6% market share in 2023, valued for its superior sound absorption and thermal insulation properties.

- Suspended Tiles: Hold a 74.3% share, preferred for their flexibility, ease of installation, and maintenance, ideal for commercial spaces.

- Plain Tiles: Capture 27.4% of the market, favored for their versatility and minimalist aesthetic, suitable for various architectural styles.

- Non-Residential Segment: Accounts for 75.7% of the market, driven by demand from commercial buildings and institutional facilities.

- North America: Holds a 35% market share in 2023, supported by strong construction activity and significant investments in green technologies.

By Material Type

In 2023, Mineral Fiber ceiling tiles held a dominant market position, capturing more than a 44.6% share. This segment leads due to its excellent sound absorption and thermal insulation properties, which are highly valued in both residential and commercial settings. Mineral fiber tiles are preferred for their versatility and ability to enhance the comfort and functionality of indoor spaces.

Metal ceiling tiles also play a crucial role in the market, appreciated for their durability and aesthetic flexibility. They offer a modern look and are often used in corporate environments and retail spaces. Metal tiles are easy to maintain and are excellent for creating sophisticated, high-tech interior designs.

Gypsum ceiling tiles are known for their ease of installation and ability to offer a smooth, finished appearance. These tiles are commonly used in office settings where a simple, clean aesthetic is desired. Gypsum is lightweight, which makes it easy to handle and install, and it offers good acoustic properties, making it a practical choice for many builders and designers.

By Property Type

In 2023, Acoustic ceiling tiles held a dominant market position, capturing more than a 67.8% share. This segment’s popularity stems from its ability to significantly reduce noise levels within indoor environments, making them ideal for schools, offices, hospitals, and other settings where sound control is crucial. Acoustic tiles are engineered to absorb sound, preventing echoes and reducing the transmission of noise between floors and rooms, thus enhancing the acoustic comfort of any space.

Non-acoustic ceiling tiles, while holding a smaller market share, are chosen for areas where sound control is less of a priority but where other properties such as aesthetics or specific material benefits like moisture resistance are more important.

These tiles are typically used in spaces like warehouses, home interiors, and areas where the primary concerns are cost-effectiveness and maintenance rather than sound absorption. This category includes tiles made from materials such as metal or vinyl, which are easy to clean and maintain, offering a practical solution in many commercial and residential applications.

By Installation Type

In 2023, Suspended ceiling tiles held a dominant market position, capturing more than a 74.3% share. This installation type is widely preferred in commercial and institutional buildings due to its versatility in design and functionality. Suspended ceiling tiles are particularly valued for their ease of installation and maintenance, allowing easy access to wiring and ductwork above the tiles, and their ability to improve acoustics and conceal infrastructure elements.

Conversely, Surface-mounted ceiling tiles cater to a niche segment of the market, typically used when the ceiling height is a constraint or where a more permanent solution is required. These tiles are directly attached to the ceiling surface, offering a streamlined look that can be beneficial in residential settings or smaller commercial spaces. Although they represent a smaller portion of the market, they are appreciated for their simplicity and the seamless finish they provide.

By Form

In 2023, Plain ceiling tiles held a dominant market position, capturing more than a 27.4% share. This form is widely favored for its versatility and seamless integration into various architectural styles, from modern to traditional. Plain tiles offer a clean and unobtrusive look, making them ideal for settings that require a minimalist or understated aesthetic. They are particularly popular in commercial environments such as offices and retail spaces, where the focus is often on simplicity and functionality.

Laminated tiles are also notable in the market, appreciated for their durability and moisture resistance, which make them suitable for kitchens, bathrooms, and other high-humidity environments. Fissured and patterned tiles provide textured surfaces that enhance acoustics and add visual interest to ceilings, often used in public spaces and institutions to create an engaging atmosphere.

Textured tiles, with their varied surface patterns, add a tactile dimension to interiors, enhancing the overall sensory experience of a space. Coffered tiles offer a more decorative option, providing depth and sophistication through their recessed patterns, typically used in residential and luxury settings for their elegant appearance.

By End-User

In 2023, the Non-Residential segment held a dominant market position in the ceiling tiles market, capturing more than a 75.7% share. This segment’s prominence is largely due to the extensive use of ceiling tiles in commercial settings such as corporate offices, retail spaces, hospitals, and educational institutions. In these environments, ceiling tiles are crucial for their acoustic properties, fire resistance, and aesthetic value, enhancing both functionality and design appeal.

Residential, although a smaller segment, is also significant and is driven by the growing trend of home renovation and the increasing interest in enhancing interior aesthetics and functionality.

In residential spaces, ceiling tiles are used to improve acoustics, especially in multi-story buildings, and to add decorative elements to living spaces. The versatility and range of design options available make ceiling tiles an attractive option for homeowners looking to upgrade their interiors.

Key Market Segments

By Material Type

- Mineral Fiber

- Metal

- Gypsum

- Others

By Property Type

- Acoustic

- Non-Acoustic

By Installation Type

- Suspended

- Surface Mounted

By Form

- Laminated

- Fissured

- Patterned

- Plain

- Textured

- Coffered

- Other

By End-User

- Non-Residential

- Residential

Driving Factors

Emphasis on Energy Efficiency

One of the primary driving factors for the growth of the ceiling tiles market is the increasing emphasis on energy efficiency in building construction and renovations. This trend is particularly noticeable as both governments and private entities strive to reduce energy consumption and enhance building sustainability.

Increasing Investment in Energy Efficiency

Significant investments are being directed toward energy efficiency improvements, which are seen as crucial for meeting broader environmental and economic goals. For instance, global energy efficiency investments have increased substantially, totaling around USD 560 billion in 2022, a 16% rise from the previous year.

This investment trend is expected to continue growing, potentially reaching USD 840 billion annually by 2030. The focus here includes sectors such as transport and buildings, where efficiency improvements can significantly reduce energy costs and emissions.

Government Initiatives and Economic Benefits

Governments worldwide are playing a pivotal role by funneling substantial funds into energy efficiency projects. From 2020 to 2023, about USD 250 billion a year has been allocated, representing two-thirds of total clean energy recovery expenditures.

These funds have not only spurred advancements in energy-efficient technologies but also helped cushion economic impacts, such as job creation in energy-efficient product manufacturing and installation, including ceiling tiles that contribute to better thermal insulation and energy conservation in buildings.

Impact on the Ceiling Tiles Market

The push for energy-efficient buildings has directly influenced the ceiling tiles market, promoting products that offer better insulation and energy management properties. Ceiling tiles that enhance energy efficiency are increasingly favored in new constructions and renovations, aligning with global trends towards sustainability and reduced operational costs.

This demand aligns with the broader adoption of green construction practices, which prioritize materials that contribute to energy savings and environmental conservation.

Restraining Factors

High Energy Consumption and Environmental Impact

One significant factor restraining the growth of the ceiling tiles market is the high energy consumption and environmental impact associated with the production of building materials, including ceiling tiles. This concern is particularly acute given the global push towards reducing carbon footprints and enhancing sustainability in manufacturing processes.

High Energy Consumption in Production

The production of ceiling tiles, especially those made from mineral fibers and gypsum, involves energy-intensive processes. These processes often rely on the extraction and processing of raw materials, which contribute to substantial energy use.

The high energy requirements are due to the need for heating and processing materials at high temperatures to achieve the desired properties in the final product. The energy-intensive nature of these processes makes the ceiling tiles less attractive from an environmental sustainability perspective.

Environmental Impact of Raw Materials

The extraction and processing of raw materials for ceiling tiles can have significant environmental impacts. For example, the mining of gypsum and the production of mineral fibers can lead to land degradation, water pollution, and loss of biodiversity. Moreover, the disposal of ceiling tiles poses challenges, as they are not always recyclable, leading to increased landfill waste.

Governmental and Regulatory Challenges

Governments and regulatory bodies are increasingly imposing strict environmental regulations that impact the ceiling tiles market. These regulations aim to reduce the ecological footprint of manufacturing processes by limiting emissions and encouraging the use of sustainable materials.

For instance, some regions require the use of eco-friendly materials in public buildings, which can restrict the use of conventional ceiling tiles that do not meet these standards.

Economic Constraints

The economic impact of adhering to environmental regulations can also be a restraining factor. Compliance often requires significant investment in cleaner technologies and materials, which can increase production costs. These higher costs may be passed on to consumers, potentially reducing market competitiveness against alternative building materials that are less regulated.

Growth Opportunity

Adoption of Sustainable and Energy-Efficient Materials

One of the most significant growth opportunities for the ceiling tiles market is the increasing adoption of sustainable and energy-efficient building materials. This shift is driven by growing environmental awareness, stricter regulations, and economic incentives that promote greener construction practices.

Surge in the Green Building Materials Market

This growth represents a compound annual growth rate (CAGR) of approximately 12% over the forecast period. This trend reflects a broader movement towards sustainability in the construction industry, creating substantial opportunities for ceiling tiles that meet these eco-friendly criteria

Government Initiatives and Regulations

Governments globally are implementing policies and incentives to promote energy efficiency and sustainable building practices. For example, the U.S. Environmental Protection Agency’s (EPA) Energy Star program and the EU’s Green Deal aim to reduce carbon footprints and encourage the use of energy-efficient materials in construction.

These initiatives include incentives for buildings that meet high energy performance standards, which often involve the use of advanced ceiling tiles that improve insulation and energy conservation.

Technological Advancements in Ceiling Tiles

Technological innovations in ceiling tile production are aligning with the demand for sustainable materials. Modern ceiling tiles are being developed with features such as improved thermal insulation, recycled content, and enhanced durability.

For instance, ceiling tiles that incorporate recycled materials or advanced insulation properties can help buildings achieve better energy ratings and lower operational costs. The development of such products supports the overall trend towards greener buildings and provides a competitive edge in the market.

Market Impact and Opportunities

The focus on sustainability is not only driven by regulations but also by economic benefits. Buildings that use energy-efficient materials, including ceiling tiles, often experience lower energy bills and increased property value.

This creates a strong incentive for builders and property owners to invest in sustainable building practices. As a result, ceiling tiles that offer superior environmental performance are increasingly sought after, presenting significant growth opportunities in both new construction and renovation projects.

Latest Trends

Integration of Smart Technology and Sustainable Materials

One of the most notable trends in the ceiling tiles market is the integration of smart technology with sustainable materials. This trend is driven by the increasing demand for smart building solutions and eco-friendly construction practices, reflecting a broader shift towards improving both functionality and sustainability in building materials.

Growth of Smart Ceiling Tiles

The market for smart ceiling tiles is expanding rapidly as part of the broader smart building technology sector. These advanced ceiling tiles incorporate technology such as LED lighting, sensors for air quality monitoring, and integrated climate control systems. This significant growth underscores the increasing interest and investment in smart building solutions that enhance building efficiency and user experience.

Sustainable Materials Trend

The trend towards using sustainable materials is also gaining momentum. This growth is driven by the rising focus on reducing environmental impact and improving energy efficiency in buildings. Sustainable ceiling tiles made from recycled materials or designed to improve energy efficiency are becoming increasingly popular as part of this broader market trend.

Government Initiatives and Regulations

Government policies and regulations are playing a crucial role in driving these trends. For example, the U.S. Green Building Council’s LEED certification and the EU’s Green Deal are pushing for more sustainable building practices, which include the use of eco-friendly and energy-efficient materials. The EU’s Green Deal aims to make Europe the first climate-neutral continent by 2050, influencing the construction industry to adopt sustainable materials and technologies.

Technological Innovations

Technological advancements are enhancing the capabilities of ceiling tiles. Innovations such as integrated sensors for real-time monitoring of environmental conditions and energy-efficient lighting solutions are becoming more common. These smart features not only contribute to better building management but also align with the growing demand for sustainability and efficiency.

Regional Analysis

In 2023, North America held a leading position in the ceiling tiles market, commanding approximately 35% of the market share, equating to USD 2.8 billion. The region’s dominance is attributed to robust construction activities and a strong focus on innovative building materials. The growth is further supported by substantial investments in green building initiatives and smart technologies.

Europe is another significant market, driven by stringent environmental regulations and a high demand for energy-efficient building solutions. The European market is characterized by a growing emphasis on sustainability, with substantial government incentives for eco-friendly construction practices. The European ceiling tiles market is projected to continue expanding as countries adhere to the EU’s Green Deal, which aims for climate neutrality by 2050.

The Asia Pacific region is experiencing rapid growth, driven by urbanization and expanding infrastructure projects. The market in this region is expected to witness a robust CAGR, fueled by increasing construction activities in countries like China and India. The growing middle class and rising disposable incomes contribute to the rising demand for aesthetically pleasing and functional ceiling solutions.

The Middle East and Africa market is growing steadily, supported by infrastructural development and urbanization in key areas such as the Gulf Cooperation Council (GCC) countries. Investment in new construction projects and a focus on energy-efficient building practices are driving the demand for ceiling tiles in this region.

Latin America shows moderate growth potential due to increasing construction activities and infrastructure development. Countries like Brazil and Mexico are seeing a rise in demand for ceiling tiles as they undertake significant urban development projects.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Frequently Asked Questions (FAQ)

What is the Size of Ceiling Tiles Market?Ceiling Tiles Market size is expected to be worth around USD 15 billion by 2033, from USD 8 billion in 2023

What is the CAGR for the Ceiling Tiles Market?The Ceiling Tiles Market is expected to grow at a CAGR of 7.7% during 2023-2032.List the key industry players of the Global Ceiling Tiles Market?Aerolite Industries Pvt. Ltd., Armstrong World Industries, Inc., Foshan Ron Building Material Trading Co. Ltd, Gebr. Knauf KG, Georgia-Pacific, Guangzhou Tital Commerce Co. Ltd, Haining Shamrock Import & Export Co. Ltd, Hunter Douglas, IMREYS, KET Ceilings, Knauf, MADA GYPSUM, New Ceiling Tiles LLC, Odenwald Faserplattenwerk GmbH, Rockfon Saint Gobain SA, Saint-Gobain S.A., SAS International, Shandong Huamei Building Materials Co. Ltd, Techno Ceiling Products

-

-

- Aerolite Industries Pvt. Ltd.

- Armstrong World Industries, Inc.

- Foshan Ron Building Material Trading Co. Ltd

- Gebr. Knauf KG

- Georgia-Pacific

- Guangzhou Tital Commerce Co. Ltd

- Haining Shamrock Import & Export Co. Ltd

- Hunter Douglas

- IMREYS

- KET Ceilings

- Knauf

- MADA GYPSUM

- New Ceiling Tiles LLC

- Odenwald Faserplattenwerk GmbH

- Rockfon Saint Gobain SA

- Saint-Gobain S.A.

- SAS International

- Shandong Huamei Building Materials Co. Ltd

- Techno Ceiling Products