Global Casino Management Systems Market Size, Share Analysis By Component (Solution, Services), By Application (Security & Surveillance, Analytics, Accounting & Cash Management, Player Tracking, Property Management, Marketing & Promotions, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2025

- Report ID: 114948

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

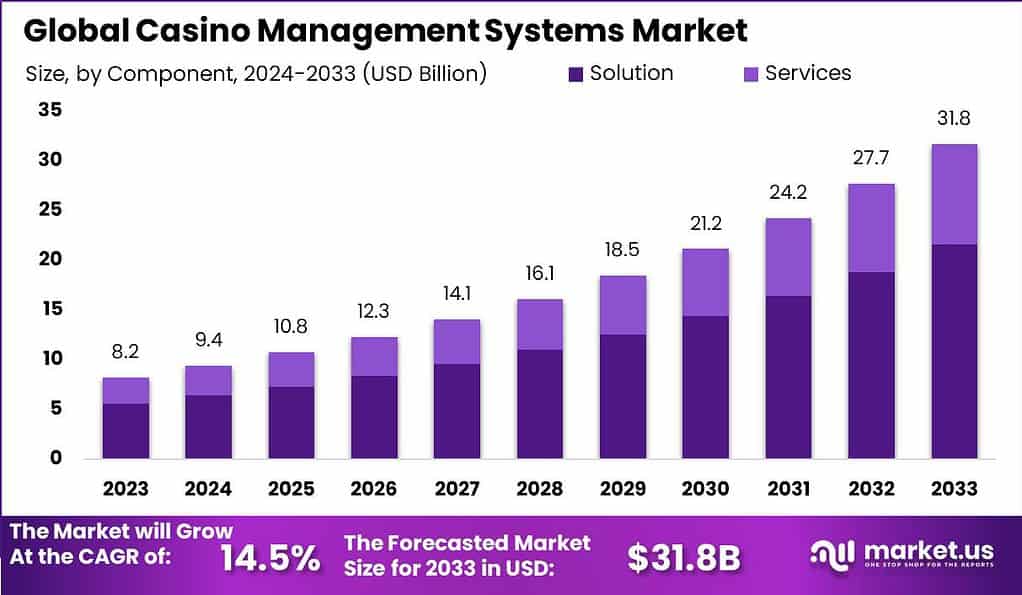

The Global Casino Management Systems Market size is expected to be worth around USD 31.8 Billion by 2033, from USD 8.2 Billion in 2023, growing at a CAGR of 14.5% during the forecast period from 2024 to 2033.

Casino Management Systems (CMS) are sophisticated software solutions designed to streamline and optimize the management of casino operations. These systems encompass a range of functionalities including security and surveillance, player tracking, cash and accounting management, and hotel and hospitality services.

The market for casino management systems is experiencing robust growth, propelled by the expansion of the casino industry globally and the rising adoption of technological innovations. These systems are critical for casinos to enhance operational effectiveness, offer personalized customer experiences, and maintain high security and compliance standards.

The primary drivers include the integration of advanced technologies such as artificial intelligence, machine learning, and data analytics, which significantly improve decision-making processes and operational efficiencies. Additionally, the increasing regulatory requirements across various regions necessitate robust systems that can ensure compliance and manage risks effectively.

Casinos adopt CMS primarily to enhance security, improve operational efficiency, and comply with stringent regulatory requirements. The systems also help in creating sophisticated customer relationship management strategies to cater to the preferences of diverse clientele, thereby boosting loyalty and customer retention.

Investment in CMS offers substantial benefits including improved operational control, enhanced customer insight, and better compliance with gaming laws. These systems provide significant ROI by reducing costs through optimized resource management and improved decision-making through real-time data analytics.

Scientific Games Corporation (SGMS) experienced a notable downturn in its share price, registering at USD 14.06, reflecting a year-to-date (YTD) decrease of 44.4%. Despite this decline, the company secured a substantial financial maneuver by obtaining a $500 million loan in October 2023. This strategic funding initiative indicates Scientific Games’ commitment to leveraging financial resources to bolster its market position and fund future growth endeavors.

PlayAGS, Inc. (AGS) also faced a challenging period with its share price falling to USD 5.09, marking a 57.9% YTD decrease. However, the company made a significant strategic acquisition by purchasing iLottery provider Roto-Grinders for $50 million in December 2023. This acquisition highlights PlayAGS’s strategic direction towards diversifying its product offerings and enhancing its competitive edge in the digital lottery space.

Konami Corporation (TYO: 9848) presented a positive shift in its market performance with a share price of 4,950 JPY and an 8.5% YTD increase. The partnership forged with Microsoft for cloud gaming in April 2023 serves as a testament to Konami’s innovative strategies to harness technology advancements, aiming to enhance its gaming offerings and user experience through cloud-based solutions.

Aristocrat Leisure Limited (ASX: ALL) reported a modest YTD increase of 1.2% in its share price, standing at 10.28 AUD. The acquisition of Plarium Inc. for $5.3 billion in December 2023 is a significant move, marking Aristocrat’s aggressive expansion into the digital gaming and mobile gaming sectors. This acquisition is indicative of Aristocrat’s strategic emphasis on diversifying its portfolio and securing a dominant position in the global gaming market.

Key Takeaways

- The Casino Management Systems Market is estimated to grow at a significant CAGR of 14.5%, reaching a value of USD 31.8 billion by 2033 from USD 8.2 billion in 2023. This growth is fueled by the increasing demand for efficient management solutions in the expanding global casino and gaming industry.

- In 2023, the Solution segment dominated the market with over 68% share, driven by the demand for comprehensive management solutions. These solutions encompass gaming management, security, cash operations, and analytics, facilitating digital transformation within the industry.

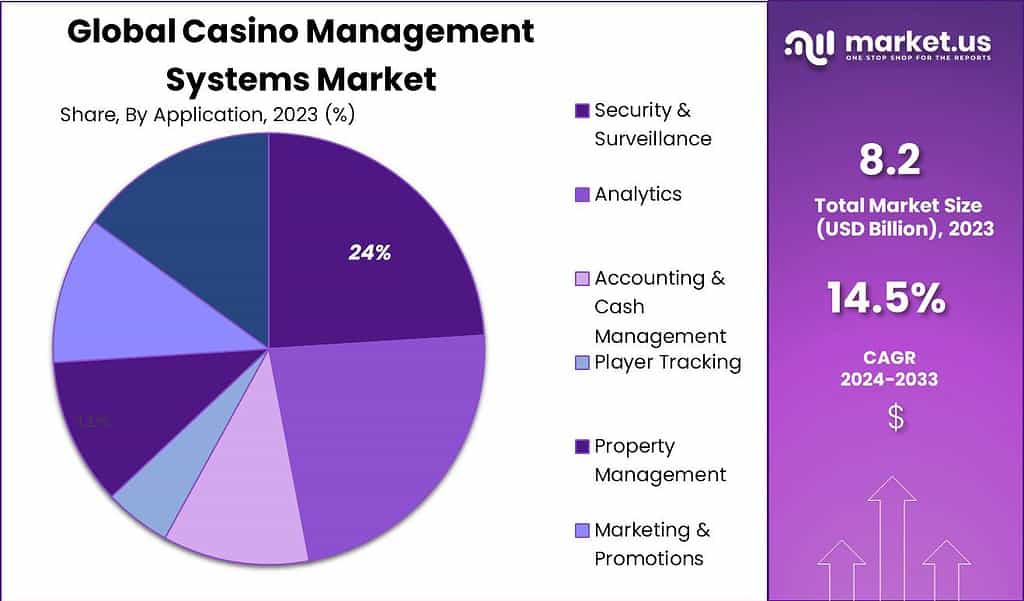

- The Security and Surveillance segment held a dominant position in 2023, capturing more than 24% market share. This reflects the paramount importance of security measures in casinos, driven by the need to safeguard assets, ensure compliance, and provide a secure gaming environment.

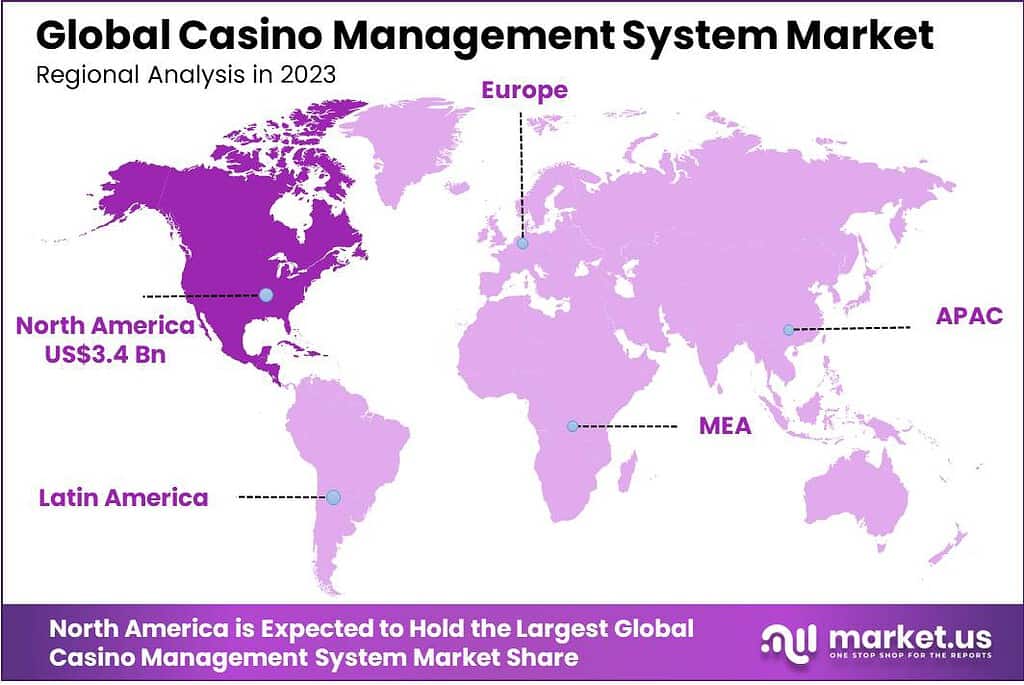

- North America leads the market, holding over 42% market share in 2023, driven by the well-established gaming industry and early adoption of advanced technologies. Europe follows closely, focusing on regulatory compliance and digitalization of casino operations.

US Tariff Impact Analysis

The impact of Trump’s tariffs has been particularly pronounced on the US casino management systems market, bringing about a variety of challenges and strategic shifts for operators and stakeholders within the industry.

- Increased Equipment and Technology Costs: The imposition of a 25% tariff on imported goods from countries like China, Canada, and Mexico has elevated costs for casino technology and equipment. This increase directly affects the production expenses for slot machines and other gaming technology, which are crucial for casino operations.

- Stock Market Volatility: The announcement of tariffs led to significant drops in the stock prices of major casino operators. For example, the share prices of Wynn Resorts and Las Vegas Sands saw significant declines due to investor concerns over increased operational costs and the potential impact on global tourism and consumer spending.

- Operational Challenges and Strategic Responses: Casino operators are bracing for higher operational costs, especially with potential increases in energy prices which could affect their profit margins. This situation necessitates a strategic review of cost structures and revenue management to maintain profitability.

- Impact on Expansion and Investment Strategies: The tariff implications extend beyond immediate financial impacts, influencing strategic partnerships and product launches. Casinos are increasingly turning to partnerships with technology providers to integrate advanced management systems that can offset some of the cost pressures through enhanced operational efficiency.

Component Analysis

In 2023, the Solutions segment held a dominant position in the Casino Management Systems (CMS) market, capturing over 68% of the market share. This commanding lead can be primarily attributed to the integral role these solutions play in optimizing casino operations across various dimensions.

Casino management solutions are comprehensive platforms that integrate multiple functional areas such as gaming management, security, cash operations, and customer analytics. These systems are crucial for enhancing operational efficiency, ensuring regulatory compliance, and elevating the overall customer experience.

The push towards digital transformation in the casino industry has significantly driven the demand for advanced management solutions. Casinos are increasingly adopting technologies like artificial intelligence, machine learning, and blockchain to further this transformation. These technologies are employed to enhance fraud detection, optimize customer personalization, and secure transactions, ensuring a competitive edge in a highly dynamic market.

Moreover, the integration of IoT devices and mobile platforms into casino management solutions has enabled operators to offer a more seamless and personalized gaming experience. This adaptation is not only about keeping up with technological trends but also about responding to the evolving expectations of a tech-savvy customer base.

Application Analysis

In 2023, the Security and Surveillance segment in the Casino Management Systems Market was prominently dominant, securing more than a 24% market share. This segment’s leadership is underpinned by the crucial role of advanced security measures essential in casino operations, where safeguarding assets, ensuring regulatory compliance, and maintaining a secure environment for patrons are of utmost importance.

The core of this segment’s significance lies in the complex nature of casino environments which involve high-stake transactions and diverse patron activities requiring meticulous monitoring. Casinos deploy sophisticated surveillance technologies including high-definition video surveillance, biometric recognition, and AI-driven anomaly detection systems. These technologies are vital not just for crime prevention but also for ensuring operational integrity and compliance with stringent regulatory standards.

Furthermore, the integration of these advanced security technologies with digital systems enhances the ability to monitor and analyze vast amounts of data swiftly, aiding in the rapid identification of suspicious activities and potential threats. This integration supports a proactive approach to security management, crucial for maintaining a safe gaming atmosphere.

The demand for such integrated security solutions is expected to grow as casinos continue to evolve into comprehensive entertainment complexes, requiring even more robust and sophisticated management systems to ensure safety and compliance across all operations.

Key Market Segments

By Component

- Solution

- Services

By Application

- Security & Surveillance

- Analytics

- Accounting & Cash Management

- Player Tracking

- Property Management

- Marketing & Promotions

- Others

Driver

Expanding Gaming Industry as a Driver

The growth of the global casino management systems market is strongly propelled by the continuous expansion of the gaming industry. This sector not only includes traditional casino games but has also embraced the integration of technology such as digital and video gaming platforms, which have seen a surge in user engagement and revenue.

This diversification and technological adoption enable casinos to offer more engaging and varied entertainment options, thus driving the demand for sophisticated management systems that can handle complex, multi-faceted operations. These systems are essential for effective management, operational monitoring, and enhanced customer experience within gaming facilities.

Restraint

Cybersecurity Concerns as a Major Restraint

As the casino industry increasingly incorporates digital and cashless solutions, it faces significant challenges related to cybersecurity. The need to protect sensitive customer data and comply with stringent regulatory requirements for data protection can be a substantial barrier. These challenges require casinos to invest heavily in secure casino management systems that might deter some operators due to the high costs and complexity of implementing advanced security measures

Opportunity

Integration of Advanced Technologies

There is a significant opportunity within the casino management systems market through the integration of advanced technologies like AI, IoT, and cashless payment systems. These technologies enhance operational efficiencies and customer personalization, which are critical in today’s competitive market.

Casinos are looking to leverage these technologies to improve customer experience, streamline operations, and boost overall security, presenting substantial growth opportunities for providers of advanced CMS solutions

Challenge

Regulatory Compliance and Ethical Gaming

A major challenge facing the casino management systems market is navigating the complex landscape of regulatory compliance and promoting ethical gaming practices. With regulations varying significantly by region and country, casinos must ensure that their systems comply with local laws concerning gambling practices, anti-money laundering measures, and responsible gambling initiatives. This need for compliance can be resource-intensive and challenging to manage, especially for casinos operating across multiple jurisdictions

Regional Analysis

In 2023, North America held a dominant market position in the Casino Management Systems Market, capturing more than a 42% share.

North America’s leadership in the Casino Management Systems Market can be attributed to several strategic and economic factors that uniquely position the region at the forefront of this industry. First and foremost, the region boasts a well-established and mature gaming market, particularly in areas such as Las Vegas and Atlantic City, which are iconic for their casino operations.

This established market has created a robust infrastructure and a deep-rooted culture of innovation in gaming technologies, facilitating the adoption and integration of advanced casino management systems. Additionally, the regulatory environment in North America, particularly in the United States and Canada, is highly developed and conducive to the adoption of new technologies that ensure compliance and enhance operational efficiencies.

Regulatory bodies in these countries enforce strict standards that necessitate the use of sophisticated management tools to ensure compliance, safeguard assets, and prevent fraud, driving the demand for advanced casino management systems.

Moreover, the presence of major technology companies and system integrators that specialize in casino management solutions further supports the region’s dominance. These companies continuously develop and refine their offerings, ensuring that they meet the evolving needs of casino operators.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The Casino Management Systems Market is characterized by the presence of several key players, each contributing to the dynamic and competitive landscape of the industry. These companies play a crucial role in driving innovation, enhancing operational efficiency, and meeting the diverse needs of casino operators worldwide

IGT is a leading provider of gaming technology and casino management systems. The company offers a comprehensive suite of solutions, including player tracking, loyalty programs, marketing tools, and analytics. IGT’s systems are known for their scalability, reliability, and advanced features that cater to the diverse needs of casinos.

Top Market Leaders

- Novomatic

- Playtech plc

- Agilysys

- IGT.

- Konami Gaming, Inc.

- Light & Wonder, Inc.

- LGS

- Honeywell International, Inc.

- Aristocrat

- Next Level Security Systems, Inc.

- Other key players

Recent Developments

- In January 2025, NOVOMATIC announced the acquisition of Vikings Casinos SAS, a prominent French casino group. This strategic move represents a pivotal advancement in NOVOMATIC’s broader international expansion agenda. By entering one of Europe’s most lucrative gaming markets, the company not only gains access to a well-established casino network but also deepens its operational presence in France.

- In February 2024, Light & Wonder, Inc. entered into a collaboration with SHR Group, enabling the integration of SHR’s Allora CRS booking engine into L&W ENGAGE, Light & Wonder’s loyalty platform. This partnership is designed to deliver next-generation personalization tools for hotel operators within the gaming and hospitality sector.

Report Scope

Report Features Description Market Value (2023) US$ 8.2 Bn Forecast Revenue (2033) US$ 31.8 Bn CAGR (2024-2033) 14.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Application (Security & Surveillance, Analytics, Accounting & Cash Management, Player Tracking, Property Management, Marketing & Promotions, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Novomatic, Playtech plc, Agilysys, IGT., Konami Gaming Inc., Light & Wonder Inc., LGS, Honeywell International Inc., Aristocrat, Next Level Security Systems Inc., Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a casino management system (CMS)?A casino management system is a comprehensive software solution designed to manage and streamline various aspects of casino operations, including player tracking, accounting, security, and marketing.

How big is Casino Management Systems Market?The Global Casino Management Systems Market size is expected to be worth around USD 31.8 Billion by 2033, from USD 8.2 Billion in 2023, growing at a CAGR of 14.5% during the forecast period from 2024 to 2033.

What are the primary applications of a casino management system?A CMS is used to enhance operational efficiency, improve player experience, increase revenue, and ensure regulatory compliance in casinos and gaming establishments.

Who are the key players in the Casino Management Systems Market?Novomatic, Playtech plc, Agilysys, IGT., Konami Gaming Inc., Light & Wonder Inc., LGS, Honeywell International Inc., Aristocrat, Next Level Security Systems Inc., Other key players are the leading players in Casino Management Systems market.

What factors are driving the growth of the casino management systems market?Factors such as the increasing adoption of technology in the gaming industry, the need for improved operational efficiency, and the growing popularity of online and mobile gaming are driving market growth.

Which region has the biggest share in Casino Management Systems Market?In 2023, North America held a dominant market position in the Casino Management Systems Market, capturing more than a 42% share.

Casino Management Systems MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Casino Management Systems MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Novomatic

- Playtech plc

- Agilysys

- IGT.

- Konami Gaming, Inc.

- Light & Wonder, Inc.

- LGS

- Honeywell International, Inc.

- Aristocrat

- Next Level Security Systems, Inc.

- Other key players