Global Care Management Systems Market By Component (Software and Services), By Mode of Delivery (Web-based, Cloud-based, and On premise), By End Use (Healthcare Providers, Healthcare Payers, and Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150703

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

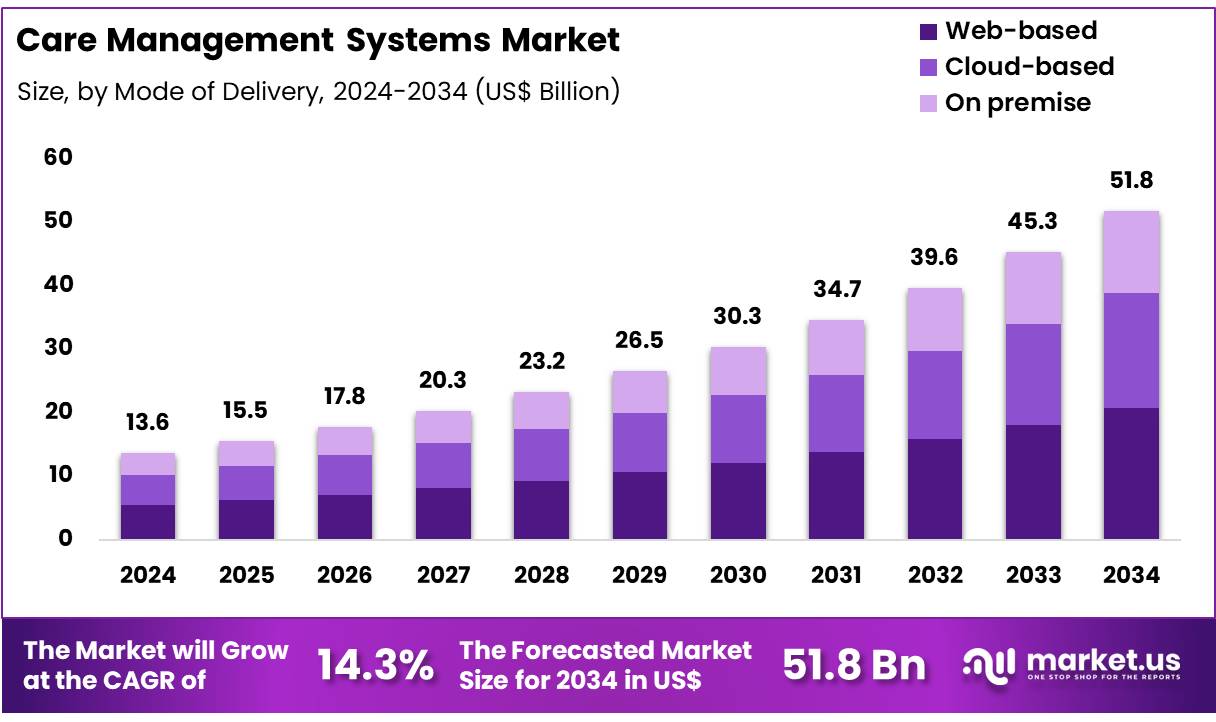

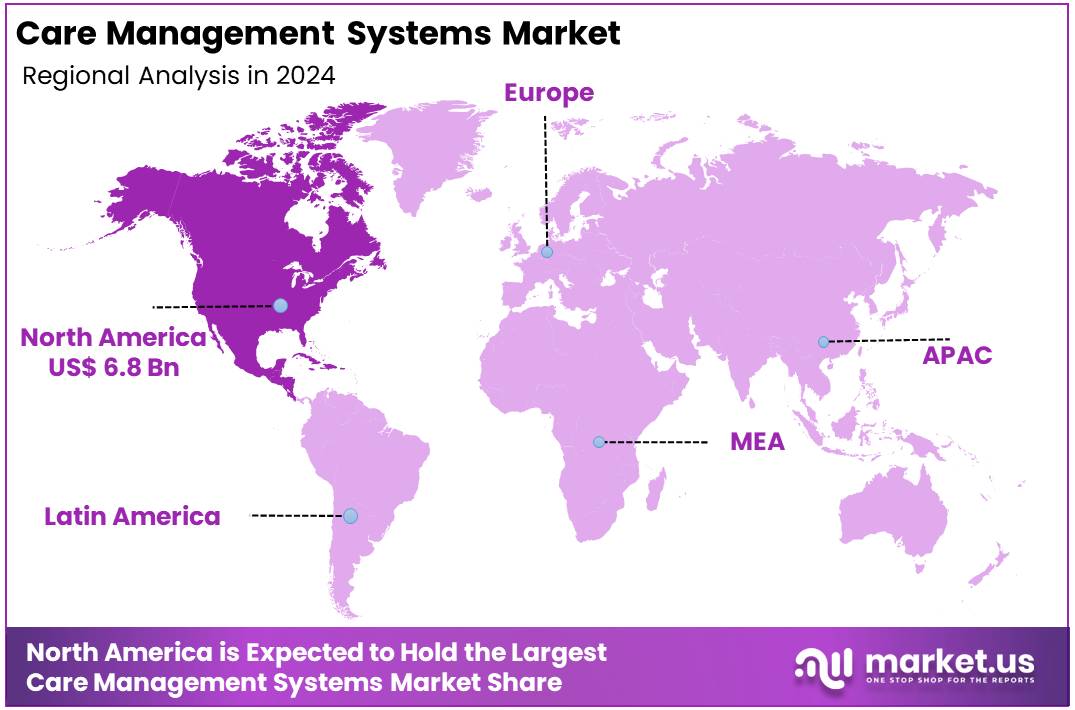

Global Care Management Systems Market size is expected to be worth around US$ 51.8 Billion by 2034 from US$ 13.6 Billion in 2024, growing at a CAGR of 14.3% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 50.2% share with a revenue of US$ 6.8 Billion.

The global Care Management Systems (CMS) market is experiencing robust growth, driven by several key market dynamics. Supportive government initiatives and investments play a pivotal role in accelerating the adoption of healthcare information technology solutions, aimed at improving patient care while reducing costs. Governments across the globe are increasingly prioritizing the digital transformation of healthcare systems to enhance operational efficiency, facilitate care coordination, and improve patient outcomes.

- For instance, in February 2023, the Canadian government allocated USD 149 billion to strengthen its healthcare system, highlighting a growing commitment to healthcare innovation and technology. Such investments not only provide the necessary infrastructure for the adoption of CMS but also create favorable regulatory environments that encourage healthcare providers to implement these systems.

Additionally, the rising shift towards value-based care models, which focus on improving outcomes and reducing expenditures, is fueling the demand for CMS solutions. The need for efficient chronic care management and the growing prevalence of chronic diseases further boost the market, as healthcare organizations seek integrated systems to manage complex patient populations. Furthermore, advancements in artificial intelligence (AI), machine learning (ML), and cloud technology are enhancing the capabilities of CMS, enabling real-time data sharing, personalized care, and predictive analytics. These factors combined are expected to continue driving the global CMS market’s expansion.

Key Takeaways

- The global care management systems market was valued at USD 13.6 billion in 2024 and is anticipated to register substantial growth of USD 51.8 billion by 2034, with 14.3% CAGR.

- In 2024, the Software segment took the lead in the global market, securing 56.4% of the total revenue share.

- The Web-based segment took the lead in the global market, securing 40.3% of the total revenue share.

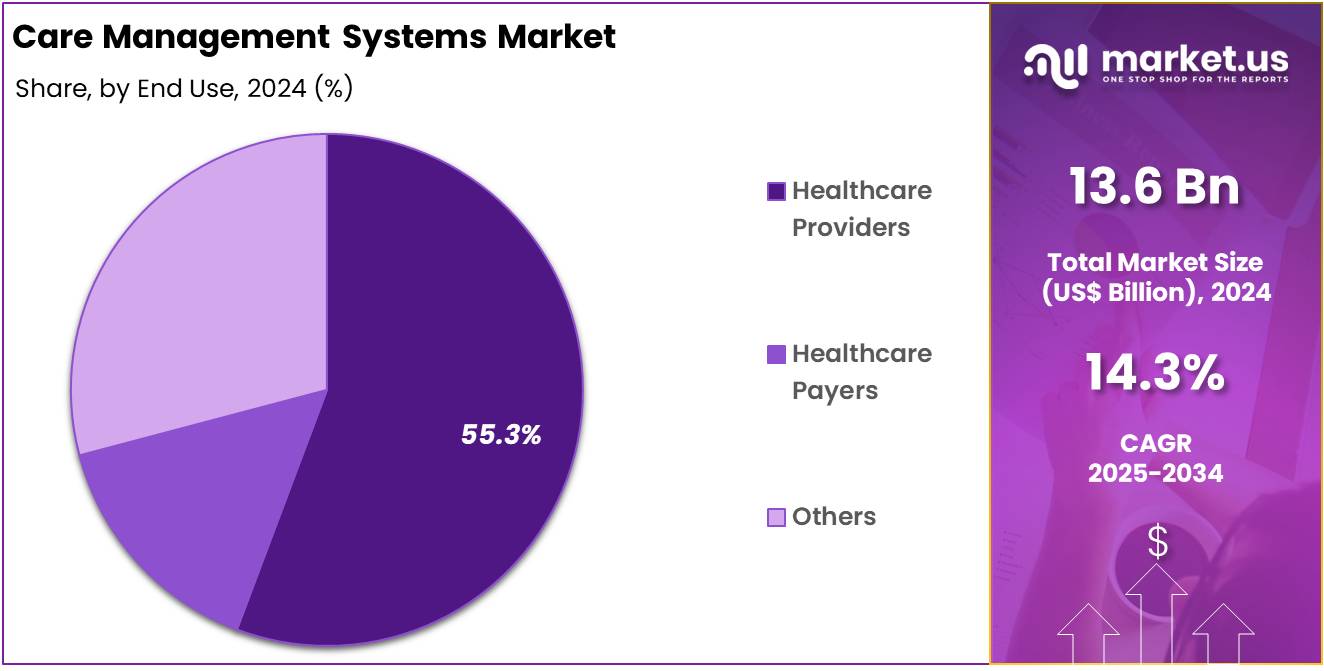

- The healthcare providers segment took the lead in the global market, securing 55.3% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 50.2% of the total revenue.

Component Analysis

Based on product type the market is fragmented into software and services. Amongst these, software segment dominated the global care management systems market capturing a significant market share of 56.4% in 2024. The software segment has dominated the global CMS market due to the growing demand for comprehensive solutions that improve care coordination, enhance patient engagement, and streamline healthcare processes.

Software-based CMS solutions enable healthcare providers to manage patient data more efficiently, automate administrative tasks, and ensure better integration of electronic health records (EHR), chronic care management (CCM), and remote patient monitoring (RPM). These software solutions also leverage technologies such as artificial intelligence (AI) and machine learning (ML) to offer predictive insights, personalize care plans, and optimize resource allocation, thus driving improved patient outcomes.

The increasing focus on value-based care, coupled with the need to manage complex patient populations, has led to a rise in the adoption of CMS software across hospitals, clinics, and healthcare organizations. Furthermore, the shift towards cloud-based solutions has made these software platforms more accessible and scalable, supporting seamless data sharing and interoperability among healthcare providers.

The ability of CMS software to integrate multiple healthcare functions, from patient engagement and care coordination to outcomes tracking and reporting, has solidified its position as the dominant segment in the CMS market. As healthcare systems continue to digitalize, the demand for robust, software-driven CMS solutions is expected to grow, further consolidating the segment’s market leadership.

Mode of Delivery Analysis

The market is fragmented by mode of delivery into web-based, cloud-based, and on premise. Web-based dominated the global care management systems market capturing a significant market share of 40.3% in 2024. Web-based CMS solutions are hosted on the cloud, allowing healthcare providers to access and manage patient data from any location with an internet connection. This eliminates the need for on-site infrastructure, reducing upfront costs and enabling healthcare organizations to scale their operations easily.

The increasing adoption of cloud technology in healthcare has further driven the growth of web-based solutions, as they offer enhanced data storage, security, and real-time updates, which are critical for efficient care coordination. Additionally, web-based platforms enable seamless integration with other healthcare systems, such as electronic health records (EHR) and remote patient monitoring (RPM), supporting improved patient care and outcomes.

The ability to offer continuous updates and real-time data sharing between healthcare providers, caregivers, and patients has made web-based CMS solutions indispensable in a healthcare landscape that is increasingly focused on value-based care and patient-centered approaches.

Moreover, the growing demand for remote care, particularly due to the rise of telehealth and virtual consultations, has further strengthened the adoption of web-based CMS platforms. With their ease of use, scalability, and ability to facilitate collaboration, web-based solutions are set to continue leading the CMS market.

End Use Analysis

The market is fragmented by end use into healthcare providers, healthcare payers, and others. Healthcare providers dominated the global care management systems market capturing a significant market share of 55.3% in 2024. Healthcare providers, including hospitals, clinics, and physician practices, are increasingly adopting CMS to manage complex patient populations, streamline workflows, and enhance communication between care teams.

CMS solutions enable providers to integrate and analyze patient data from various sources, including electronic health records (EHR), chronic care management (CCM), and remote patient monitoring (RPM) systems. This comprehensive approach allows healthcare providers to offer personalized care plans, track patient progress, and intervene early, thus improving patient engagement and satisfaction.

Additionally, the shift toward value-based care has further fuelled the demand for CMS solutions, as providers are incentivized to focus on preventative care, reduce readmissions, and optimize resource utilization. With healthcare systems moving toward more integrated and patient-centered models, CMS platforms help providers align care delivery with patient needs while adhering to regulatory standards.

Moreover, the growing focus on reducing operational costs and improving care efficiency has made CMS a vital tool for healthcare organizations aiming to stay competitive in a rapidly evolving healthcare environment. As a result, healthcare providers continue to be the dominant force driving the growth of the global CMS market.

Key Segments Analysis

By Component

- Software

- Services

By Mode of Delivery

- Web-based

- Cloud-based

- On premise

By End Use

- Healthcare Providers

- Healthcare Payers

- Others

Market Dynamics

Increased Prevalence of Chronic Disorders

The rising prevalence of chronic diseases is significantly driving the growth of the care management systems market. Chronic conditions such as heart disease, diabetes, hypertension, and respiratory disorders are increasingly common, leading to higher demand for effective management solutions.

- In 2023, approximately 76.4% of U.S. adults reported having at least one chronic condition, with 51.4% experiencing multiple chronic conditions. This trend is mirrored globally; for instance, in China, chronic diseases account for about 80% of total deaths and 70% of disability-adjusted life years lost.

The financial burden of chronic diseases is substantial. In the United States, nearly 90% of the annual $4.5 trillion in healthcare expenditures are attributed to individuals with chronic and mental health conditions. This escalating cost underscores the need for efficient care management systems that can streamline patient care, enhance coordination among healthcare providers, and improve patient outcomes.

Moreover, the aging global population is contributing to the increased prevalence of chronic diseases. Older adults are more susceptible to multiple chronic conditions, necessitating comprehensive care strategies. The growing recognition of these challenges is prompting healthcare systems worldwide to invest in CMS solutions, thereby expanding the market and fostering innovation in chronic disease management.

Market Restraints

Implementation of Value-Based Care Models

The implementation of value-based care (VBC) models is restraining the growth of the Care Management Systems (CMS) market, as these models emphasize prevention, coordination of care, and the efficient use of resources rather than the volume of services provided. Under the VBC approach, healthcare providers are incentivized to focus on improving patient outcomes while reducing overall healthcare costs.

As a result, many healthcare systems are shifting their focus from fee-for-service models to value-based models, which inherently rely on the effectiveness of care management systems. While CMS technologies support the integration and coordination of patient care, they also add to the complexity and cost of care delivery, which could lead to slow adoption or reduced growth in the market for these systems.

- According to the U.S. Centers for Medicare & Medicaid Services (CMS) report for 2024, out-of-pocket spending on healthcare rose by 7.2% in 2023, totaling USD 505.7 billion, which accounted for 10% of total national health expenditure.

This financial burden has shifted healthcare priorities towards cost-effective care models, encouraging the adoption of value-based care, which may limit the need for expensive CMS solutions. Healthcare institutions are prioritizing preventative care, care coordination, and resource optimization over the deployment of costly technological systems. As value-based care models evolve, healthcare providers are increasingly looking for cost-effective ways to deliver patient care without over-relying on complex management systems.

Market Opportunities

Increasing adoption of cloud-based CDMS solutions

Advancements in healthcare information technology (IT) and the ongoing digitalization of healthcare systems are creating significant growth opportunities for the Care Management Systems (CMS) market. The increasing adoption of digital solutions in healthcare has laid the groundwork for the widespread implementation of CMS. As of 2023, over 90% of U.S. hospitals have implemented electronic health records (EHR) systems, providing a strong infrastructure for the integration of care management platforms. This widespread use of EHRs has enabled more seamless data exchange and improved care coordination, which are key features of CMS.

The advancements in healthcare IT are further bolstered by technologies like data analytics, machine learning (ML), and artificial intelligence (AI). These technologies are transforming care management systems by enhancing patient engagement, personalizing care plans, and offering predictive insights that help identify potential health risks before they become critical. AI and ML, for instance, can analyze large volumes of health data to predict patient outcomes and recommend targeted interventions, leading to improved healthcare delivery and patient satisfaction.

Furthermore, government initiatives are driving the digitization of healthcare systems, creating additional opportunities for the growth of CMS. In India, the Ayushman Bharat Digital Mission aims to provide digital healthcare services to a large population, further expanding the need for efficient care management solutions. Similarly, the European Union’s eHealth Action Plan promotes the digitalization of healthcare services across its member states, fostering greater adoption of care management systems in the region.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic and geopolitical factors significantly impact the growth and adoption of CMS in healthcare. Economic fluctuations, such as recessions or inflation, can influence healthcare spending, potentially reducing budgets for the implementation of expensive digital solutions like CMS. For example, in periods of economic downturn, healthcare institutions may prioritize immediate cost-saving measures over long-term investments in technology, which could slow the market’s growth.

Geopolitical factors, such as trade tensions or regulatory changes, also play a crucial role. For instance, trade restrictions can affect the availability of key components for CMS platforms, leading to delays or increased costs. Additionally, shifting healthcare regulations or policy reforms in different regions, such as the Affordable Care Act in the U.S. or India’s National Digital Health Mission, can either drive or hinder the adoption of care management systems, depending on the support or restrictions placed on digital healthcare infrastructure.

The geopolitical stability and government support for healthcare digitization can accelerate CMS adoption. Countries that actively promote healthcare IT through policy initiatives or public-private partnerships foster a more conducive environment for CMS growth. For example, the European Union’s push for digital healthcare interoperability supports market expansion by encouraging cross-border data sharing and collaboration among healthcare providers. These factors collectively shape the landscape for CMS adoption, influencing both market growth and technological advancements.

Latest Trends

The CMS market is evolving rapidly in response to technological advancements and changing healthcare needs. One key trend is the increased integration of artificial intelligence (AI) and machine learning (ML) into CMS platforms. These technologies help automate administrative tasks, provide predictive insights, and personalize care plans, thereby improving patient outcomes and care efficiency. Another trend is the growing emphasis on data interoperability, with standards like the HL7 FHIR® framework enabling seamless information exchange between healthcare providers, enhancing coordination and decision-making.

Additionally, the shift towards value-based care and alternative payment models (APMs) is driving demand for CMS solutions that support preventive care, patient engagement, and care coordination. Remote patient monitoring (RPM) is also gaining traction, as wearable devices and telehealth platforms enable continuous monitoring of chronic conditions and timely interventions, particularly for aging populations.

Furthermore, government initiatives, such as India’s Ayushman Bharat Digital Mission and the European Union’s eHealth Action Plan, are promoting digital health technologies and encouraging healthcare providers to adopt CMS solutions. These trends, underpinned by a focus on patient-centered care and operational efficiency, are transforming the CMS market, driving innovation, and enhancing the quality and accessibility of healthcare services.

Regional Analysis

North America has dominated the care management solutions market due to the widespread adoption of patient care solutions that help healthcare providers achieve goals such as reduced costs and improved care quality. The region benefits from the increasing shift towards cloud-based software, which enables efficient data management, collaboration, and remote patient monitoring.

Technological advancements in artificial intelligence, machine learning, and data analytics are further driving the adoption of care management platforms, enhancing patient engagement and facilitating more personalized care. The growing investment in healthcare technology also plays a crucial role in North America’s market dominance.

- For instance, in February 2024, HealthSnap, a provider of Chronic Care Management (CCM) and Remote Patient Monitoring (RPM) solutions, raised USD 25 million in a Series B funding round. This investment, led by Acronym Venture Capital, Florida Opportunity Fund, and Sands Capital, highlights the increasing venture capital interest in digital health solutions.

These factors, combined with government incentives and healthcare reforms promoting value-based care models, contribute to the region’s continued leadership in the care management solutions market. As healthcare systems in North America increasingly focus on improving outcomes while managing costs, the demand for effective care management solutions is expected to grow steadily.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The CMS market is characterized by a dynamic and competitive landscape, driven by technological advancements, strategic partnerships, and a growing emphasis on value-based care models. Key players such as Cerner Corporation, ZeOmega Inc., i2i Systems, and Allscripts Healthcare Solutions lead the market by offering comprehensive CMS platforms that integrate electronic health records (EHR), patient engagement tools, and analytics capabilities. These solutions are designed to enhance care coordination, improve patient outcomes, and reduce healthcare costs.

Veeva Systems Inc., is a leading provider of cloud-based software solutions tailored for the global life sciences industry. The company specializes in applications for clinical trials, regulatory compliance, quality management, and commercial operations. Veeva’s offerings, such as Veeva Vault and Veeva Clinical Suite, are designed to streamline processes, enhance collaboration, and ensure compliance with industry standards.

Oracle Corporation, is a multinational technology company renowned for its comprehensive suite of enterprise software solutions. The company specializes in database management systems, cloud applications, and enterprise resource planning (ERP) software. Oracle’s flagship product, Oracle Database, is widely utilized across various industries for data management and analytics.

Top Key Players

- Veradigm LLC

- Epic Systems Corporation

- Cognizant

- Koninklijke Philips N.V.

- Oracle

- ZeOmega

- Medecision

- IBM

- ExlService Holdings, Inc.

- HealthSnap, Inc.

Recent Developments

- In August 2024, Clinical Ink, a global life sciences technology company, launched EDCXtra, an advanced electronic data capture (EDC) system for clinical trials. The system combines direct data capture (DDC), electronic clinical outcome assessments (eCOAs), and electronic consent (eConsent) solutions into a unified web-based platform. This integrated solution is designed to streamline the data capture process in clinical trials, ensuring compliance with good clinical practice (GCP) standards.

- In April 2025, Veeva Systems introduced Veeva SiteVault CTMS, a clinical trial management system tailored for research sites. The platform integrates SiteVault eISF and SiteVault eConsent, providing research sites with a comprehensive system for managing clinical trials. Integration with Veeva’s Clinical Platform allows seamless bidirectional data flow between sites and sponsors, reducing manual tasks and enhancing overall efficiency.

- In January 2024, BSI Life Sciences announced a new partnership with Ocular Therapeutix, which will utilize BSI’s cloud-based Clinical Trial Management System for its clinical trial needs.

- In November 2024, Medidata, a Dassault Systèmes brand and a leading provider of clinical trial solutions, was recognized as a leader in Everest Group’s inaugural Life Sciences Clinical Trial Management System Products PEAK Matrix® Assessment 2024. The assessment evaluated 13 providers based on their market impact and ability to deliver high-quality, successful offerings.

Report Scope

Report Features Description Market Value (2024) US$ 13.6 Billion Forecast Revenue (2034) US$ 51.8 Billion CAGR (2025-2034) 14.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Licensed Enterprise (on-premise) Solutions, and Wed-hosted (On-demand) Solutions), By Mode of Delivery (Web-based, Contract Research Organizations (CROs), Medical Device Companies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Watson Health, Veeva System, Oracle Corporation, Ennov, OpenClinica, LLC, Fortress Medical, Medidata Solutions (Dassault Systems), Perceptive Informatics, Medidata Rave, Forte Research Systems, IBM Watson Health, and Fortress Medical Systems Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Care Management Systems MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Care Management Systems MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Veradigm LLC

- Epic Systems Corporation

- Cognizant

- Koninklijke Philips N.V.

- Oracle

- ZeOmega

- Medecision

- IBM

- ExlService Holdings, Inc.

- HealthSnap, Inc.