Global Car Rental Market Report By Car Type (Executive Car, Luxury Car, Sports Utility Vehicle (SUV), Economical Car, Multi-Utility Vehicle (MUV)), By Rental Category (Airport Transport, Local Usage, Outstation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 62087

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Car Rental Market size is expected to be worth around USD 280.7 Billion by 2033, from USD 121.9 Billion in 2023, growing at a CAGR of 8.7% during the forecast period from 2024 to 2033.

Car rental is a service where individuals or businesses rent vehicles for short periods. Customers use these services for travel, business, or personal needs. It offers a flexible transportation solution without the cost of owning a car.

The car rental market includes companies that provide vehicles for rent on a short-term or long-term basis. The market covers various segments like airport rentals, luxury rentals, and long-term leasing for corporate clients. The growth of the market is driven by increasing travel, both for business and leisure, and rising demand for car-sharing services

Increasing consumer interest in flexible, short-term transportation options is fueling market growth. Technological improvements, such as online booking platforms and mobile apps, are enhancing customer convenience and accessibility. Additionally, the rise of electric and hybrid rental vehicles is attracting eco-conscious customers, further diversifying the consumer base.

Increasing consumer interest in flexible, short-term transportation options is fueling market growth. Technological improvements, such as online booking platforms and mobile apps, are enhancing customer convenience and accessibility. Additionally, the rise of electric and hybrid rental vehicles is attracting eco-conscious customers, further diversifying the consumer base.The U.S. car rental market is expanding, driven by changing consumer preferences, economic factors, and technological advancements. In 2023, approximately 48 million Americans rented vehicles, showing a 19.4% increase from the previous year.

This growth represents around 18% of the U.S. adult population, indicating a rising trend in car rental usage. Projections suggest this figure will grow further, reaching 52 million by 2028. The market consists of over 3,000 car rental companies, highlighting a highly fragmented and competitive landscape.

The rising costs of car ownership in the U.S. are one of the major drivers of the car rental market. According to AAA, the average annual cost of owning a vehicle has climbed to over $12,000 (around $1,000 per month), considering fuel, insurance, maintenance, and other expenses.

The car rental market shows moderate to high saturation levels, especially in densely populated urban centers and popular tourist destinations. The presence of many companies creates intense competition, with major players like Enterprise, Hertz, and Avis dominating a significant market share.

Smaller and regional players, however, continue to find opportunities through niche markets, such as luxury, recreational vehicles and specialized vehicle rentals, or by offering unique services like subscription-based models.

At the local level, the industry impacts urban areas and tourist hubs by providing smart mobility solutions. Regions with high tourism rates, like Florida and California, see higher demand for rentals, making these areas critical markets for rental companies. Local economic conditions and transportation infrastructure significantly affect rental volumes, creating varied opportunities and challenges for companies across different regions.

Key Takeaways

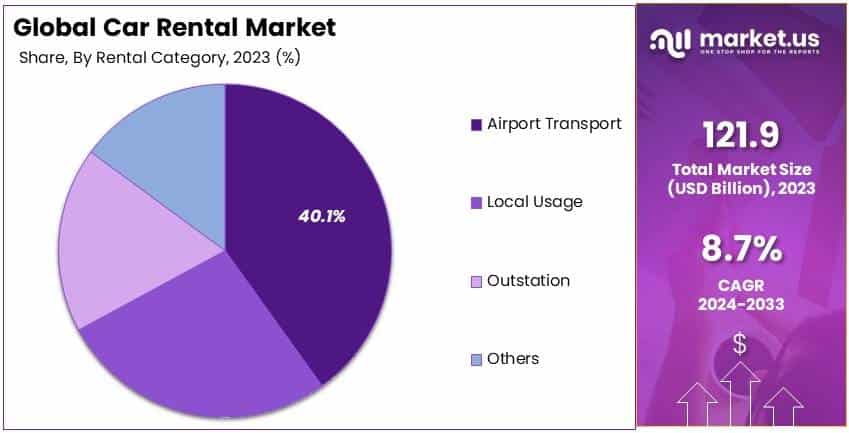

- The Car Rental Market was valued at USD 121.9 billion in 2023 and is expected to reach USD 280.7 billion by 2033, with a CAGR of 8.7%.

- In 2023, Economical Cars led the car type segment with 34.3%, driven by demand for affordable travel solutions.

- In 2023, Airport Transport dominated the rental category with 40.1%, reflecting high mobility needs among travelers.

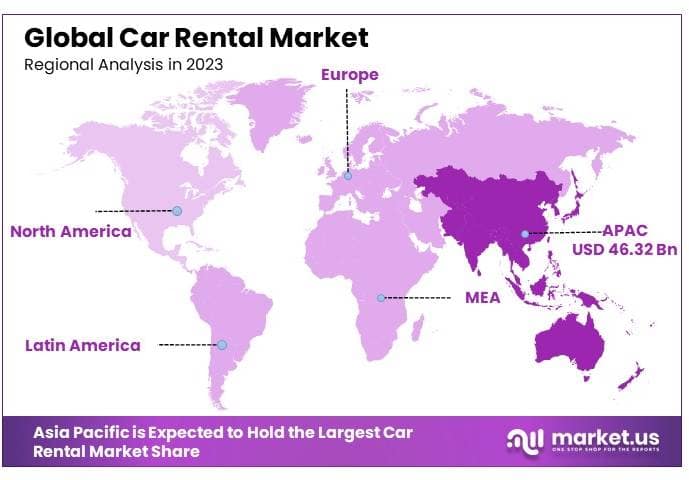

- In 2023, Asia Pacific held the largest share at 38.0%, fueled by tourism growth and rising mobility services in the region.

Car Type Analysis

Economical cars dominate with 34.3% due to their affordability and fuel efficiency.

In the car rental market, Economical Cars hold a significant position with a market share of 34.3%. This dominance is largely attributed to their affordability and fuel efficiency, which are crucial factors for most renters. Economical cars are the preferred choice for individuals and families looking to manage travel costs, especially in economically volatile times.

These vehicles cater to daily rental needs, providing a budget-friendly option for short-term use, such as for city commuting or short trips. Their cost-effectiveness doesn’t only stem from lower rental prices but also from better fuel efficiency, which appeals to cost-conscious consumers.

While Economical Cars lead the segment, other categories like Executive Cars, Luxury Cars, SUVs, and MUVs also have their distinct markets. SUVs and MUVs, for instance, are favored for group travels and rough terrains, offering more space and power. However, their higher rental and operational costs can deter the budget-sensitive renters that Economical Cars attract.

The future growth of the Economical Car segment seems promising due to the increasing sensitivity towards rental costs and environmental concerns. As more consumers lean towards cost efficiency and lower carbon footprints, the demand for economical and eco-friendly rental options is expected to grow, ensuring the segment’s continuing dominance.

Rental Category Analysis

Airport transport dominates with 40.1% due to high demand from air travelers.

Airport transport is the largest category in the rental car market, commanding a 40.1% share. This segment’s leadership is driven by the consistent demand from air travelers who require convenient and timely transportation to and from airports.

This segment primarily serves business travelers and tourists who value time and convenience. The presence of rental facilities within or near airports, coupled with streamlined booking and return processes, enhances the user experience, further bolstering the segment’s position.

Though Airport Transport leads, other rental categories like Local Usage, Outstation, and Others play important roles in the market. Local Usage covers short-term rentals for city commuting, while Outstation services cater to travelers looking for rentals for trips outside the city limits. Each category meets specific customer needs and contributes to the overall market ecosystem.

The segment is poised for further growth as air travel continues to recover post-pandemic and as airports around the world enhance their rental facilities to accommodate rising passenger numbers. Moreover, integration with airline bookings and partnerships with hotels could provide additional growth avenues for the Airport Transport segment in the car rental industry.

Key Market Segments

By Car Type

- Executive Car

- Luxury Car

- Sports Utility Vehicle (SUV)

- Economical Car

- Multi-Utility Vehicle (MUV)

By Rental Category

- Airport Transport

- Local Usage

- Outstation

- Others

Drivers

Expansion of Car-Sharing Services Drives Market Growth

The expansion of car-sharing services, the integration of electric vehicles (EVs), increased business and leisure travel, and partnerships with travel agencies significantly contribute to the car rental market’s growth.

The popularity of shared mobility offers customers more flexible and economical options, making short-term rentals attractive. Additionally, rental companies integrating EVs appeal to environmentally conscious customers, increasing demand for sustainable travel solutions.

As business and leisure travel grow due to economic recovery, the need for car rentals also rises, particularly for flexible and short-term transportation solutions. Strategic collaborations with travel agencies further enhance accessibility, providing bundled offers that attract more customers and promote usage.

Restraints

High Operational Costs and Competition Restrain Market Growth

High operational costs, stringent regulations, fluctuating fuel prices, and intense competition from ride-hailing services act as restraints on the car rental market.

Maintaining and operating a fleet incurs significant expenses, including vehicle maintenance, insurance, and compliance with government regulations, which often increase operational complexities. Fluctuating fuel prices add to these challenges, making it difficult for rental companies to maintain consistent pricing models.

Furthermore, the market faces strong competition from ride-hailing services that provide on-demand transportation, often perceived as more convenient and cost-effective.

Opportunity

Adoption of Self-Driving Cars Provides Opportunities

The adoption of self-driving cars, expansion into emerging markets, growing demand for luxury travel, and advanced digital marketing strategies present significant growth opportunities for the car rental market.

The integration of autonomous vehicles offers new service models, reducing the need for drivers and attracting tech-savvy customers. Expansion into emerging markets opens untapped customer bases, where rising disposable incomes create demand for rentals.

Luxury and premium vehicles also gain popularity, meeting the needs of affluent travelers seeking exclusivity and comfort. Additionally, leveraging digital marketing and personalized engagement strategies improves brand visibility and customer retention, enhancing market reach.

Challenges

Cybersecurity and Fleet Management Challenges Market Growth

Cybersecurity risks, fleet management challenges, seasonal demand fluctuations, and customer service concerns present ongoing challenges in the car rental market.

As rental firms rely on digital platforms and connected systems, they face increasing threats to data privacy, requiring investment in secure technologies. Fleet management, including maintenance and logistics, remains complex, affecting operational efficiency.

Seasonal demand fluctuations also create instability, leading to periods of both underutilization and high demand. Furthermore, delivering consistent customer service is crucial but challenging, with competition high and customer expectations continually rising.

Growth Factors

Increased Disposable Income Is Growth Factor

Rising urbanization, increased disposable income, growth in corporate mobility solutions, and smart city developments are key growth factors for the car rental market.

Urbanization and population growth boost demand for convenient mobility, while higher disposable income, especially among middle-class populations, increases affordability for car rentals.

Corporate mobility solutions also expand, as businesses seek flexible and efficient transportation options for employees. Furthermore, the development of smart cities enhances infrastructure, providing better connectivity and rental access.

Emerging Trends

Growing Preference for Eco-Friendly Options Is Latest Trending Factor

The rising preference for eco-friendly rental options, adoption of subscription models, app-based solutions, and focus on customer experience are trending factors in the car rental market.

Consumers increasingly favor sustainable and environmentally responsible choices, prompting companies to include hybrid and electric vehicles in their fleets. Subscription-based rental models also gain traction, offering flexible usage without long-term commitment, appealing to urban consumers.

App-based solutions simplify booking and provide a seamless customer experience, aligning with tech-savvy travelers. Additionally, companies are enhancing personalization and customer engagement to build loyalty, making customer experience a key competitive advantage.

Regional Analysis

Asia Pacific Dominates with 38.0% Market Share

Asia Pacific leads the Car Rental Market with a 38.0% share, amounting to USD 46.32 billion. The region’s dominance is driven by increasing tourism and business travel in countries like China, India, and Japan. Rising urbanization and expanding middle-class income levels also contribute to a growing demand for affordable and flexible transport options.

The region benefits from the presence of both international and local car rental companies, offering a wide range of vehicles. Strong infrastructure development and the expansion of online rental platforms make car rental services accessible and convenient. Additionally, governments are investing in tourism promotion, further supporting the market’s growth.

Asia Pacific’s influence in the car rental market is expected to grow as the demand for flexible and economical transportation solutions rises. The shift towards electric vehicles and eco-friendly rental options will further enhance the region’s market presence in the coming years, attracting environmentally conscious travelers.

Regional Mentions:

- North America: North America has a strong car rental market, with demand driven by domestic and international tourism and the convenience of airport rentals.

- Europe: Europe’s car rental market remains steady, benefiting from well-developed infrastructure and high tourism activity, especially in Western and Southern Europe.

- Middle East & Africa: The Middle East and Africa are developing their car rental market, supported by the growth of tourism and business travel in countries like the UAE and South Africa.

- Latin America: Latin America is gradually expanding its car rental market, with rising tourism in countries like Brazil and Mexico driving demand for rental services.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The car rental market is dynamic, with several global and regional players competing for market share. Key companies include Avis Budget Group, Europcar, Enterprise Holdings Inc., The Hertz Corporation, Toyota Rent-a-Car, Sixt SE, Alamo Rent-a-Car LLC, Carzonrent India Pvt Ltd, Localiza, ANI Technologies Pvt. Ltd, and other players. The market is driven by tourism, business travel, and the growing preference for mobility services over car ownership.

Pricing strategies vary. Global players like Enterprise Holdings Inc. and The Hertz Corporation offer tiered pricing based on vehicle type and rental duration. They often provide loyalty programs and corporate discounts. Regional companies like Carzonrent India use competitive pricing to attract local customers and promote their services.

Geographical presence is essential in this market. Companies like Avis Budget Group, The Hertz Corporation, and Enterprise Holdings Inc. have a strong presence in North America, Europe, and Asia, using their vast fleet and airport locations to reach customers. Regional companies focus on local markets, providing personalized services that cater to local needs and preferences.

Innovation is key, with major players investing in digital platforms, mobile apps, and contactless rental options. They also offer electric and hybrid vehicles, appealing to environmentally conscious customers. Partnerships with hotels, airlines, and ride-hailing companies help expand their customer base and service offerings.

Top Key Players in the Market

- Avis Budget Group

- Europcar

- Enterprise Holdings Inc.

- The Hertz Corporation

- Toyota Rent-a-Car

- Sixt SE

- Alamo Rent-a-Car LLC

- Carzonrent India Pvt Ltd

- Localiza

- ANI Technologies Pvt. Ltd.

- Others

Recent Developments

- Enterprise Mobility: In October 2024, Enterprise Mobility expanded its Asia-Pacific presence by opening new locations in Thailand through its franchise partner Thai Rent a Car. The expansion includes Enterprise Rent-A-Car, National Car Rental, and Alamo branches in major tourist locations such as Bangkok, Pattaya, Chiang Mai, and Phuket.

- Moosa Rent a Car: In October 2024, Moosa Rent a Car launched its services as the most affordable car rental company in Dubai, offering rentals without requiring a deposit. The company aims to provide accessible and cost-effective car rental solutions, particularly targeting tourists and expatriates in Dubai.

- Eco Mobility: In September 2024, Eco Mobility expanded its corporate car rental services to 10 new cities across India, enhancing its footprint in the country’s mobility sector. This launch aims to meet the increasing demand for corporate rentals, offering a variety of services including long-term leasing and chauffeur-driven vehicles for business clients.

Report Scope

Report Features Description Market Value (2023) USD 121.9 Billion Forecast Revenue (2033) USD 280.7 Billion CAGR (2024-2033) 8.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Car Type (Executive Car, Luxury Car, Sports Utility Vehicle (SUV), Economical Car, Multi-Utility Vehicle (MUV)), By Rental Category (Airport Transport, Local Usage, Outstation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Avis Budget Group, Europcar, Enterprise Holdings Inc., The Hertz Corporation, Toyota Rent-a-Car, Sixt SE, Alamo Rent-a-Car LLC, Carzonrent India Pvt Ltd, Localiza3, ANI Technologies Pvt. Ltd, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Avis Budget Group

- Europecar

- Enterprise Holdings Inc.

- The Hertz Corporation

- Toyota Rent-a-Car

- Sixt SE

- Alamo Rent-a-Car LLC

- Carzonrent India Pvt Ltd

- Localiza3

- ANI Technologies Pvt. Ltd

- Others