Global Canned Seafood Market By Product Type [Fish (Tuna, Salmon, Sardines and Others) Prawns, Shrimps and Others] By Distribution Channel (Foodservices and Retail) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2023

- Report ID: 56150

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

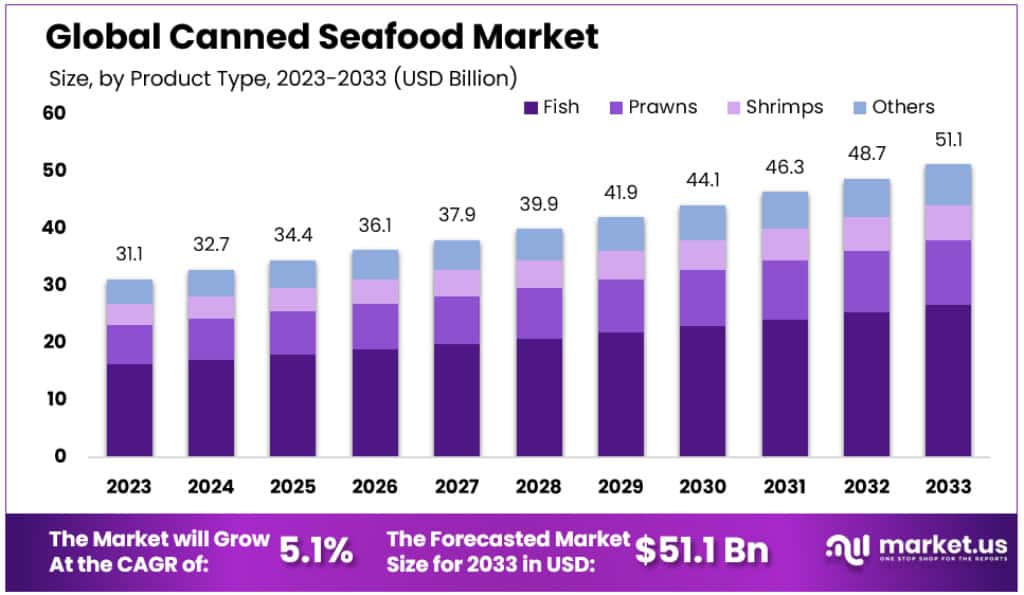

The Global Canned Seafood Market size is expected to be worth around USD 51.1 Billion by 2033, from USD 31.1 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

Canned seafood refers to seafood that has been processed, sealed in an airtight container, and heated for sterilization. Canning is a method of preserving food and provides a typical shelf life ranging from one to five years. Canned seafood includes various types of fish, such as tuna, sardines, anchovies, mackerel, and scallops, among others. Canned seafood is cooked during the canning process, making it ready to eat straight out of the can. Canned seafood is a convenient and healthy option, as it is a rich source of lean protein and omega-3 fatty acids.

This industry growth is expected to be driven by the increasing popularity of ready-to-eat seafood products, which has been facilitated by improvements in distribution infrastructure. The Food and Agriculture Organization of the United Nations reported that canned-tune imports to the United States increased by 15.2% in 2020. The industry’s growth is likely to be driven by factors like changing lifestyles and increasing affordability.

The COVID-19 pandemic saw a spike in canned seafood demand, particularly among those who don’t like cooking. People who work from home or prefer to stay at home preferred canned food because it is quick and easy to prepare. Restaurants also restricted their services to prevent an increase in coronavirus infections. Therefore, consumers made more canned seafood at home.

Key Takeaways

- The Global Canned Seafood Market is expected to reach a value of approximately USD 51.1 billion by 2033.

- In 2023, the market size for Canned Seafood was USD 31.1 billion.

- The market growth is projected to have a Compound Annual Growth Rate (CAGR) of 5.1% from 2023 to 2033.

- The Food and Agriculture Organization of the United Nations reported a 15.2% increase in canned tuna imports to the United States in 2020.

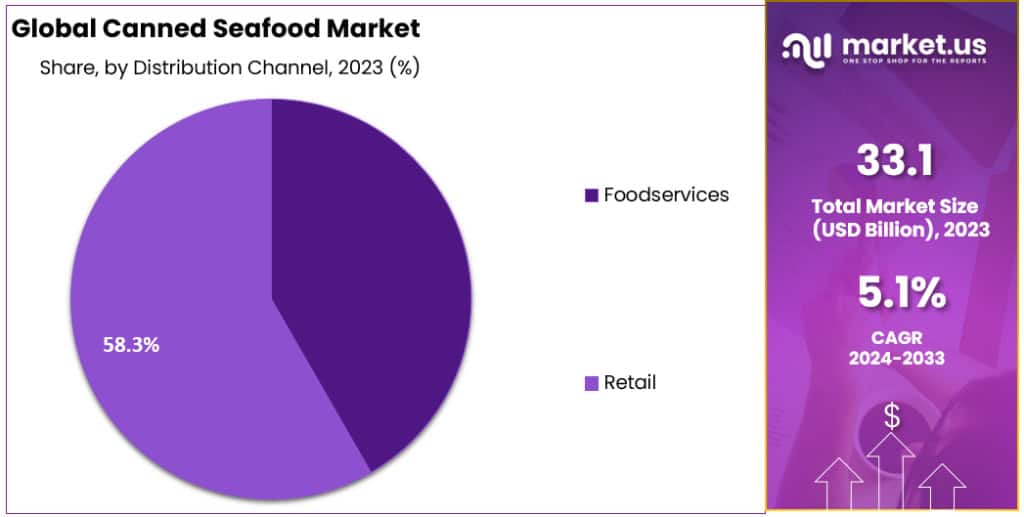

- In 2023, the retail sector accounted for more than 58.3% of the market, thanks to supermarkets, convenience stores, and local shops.

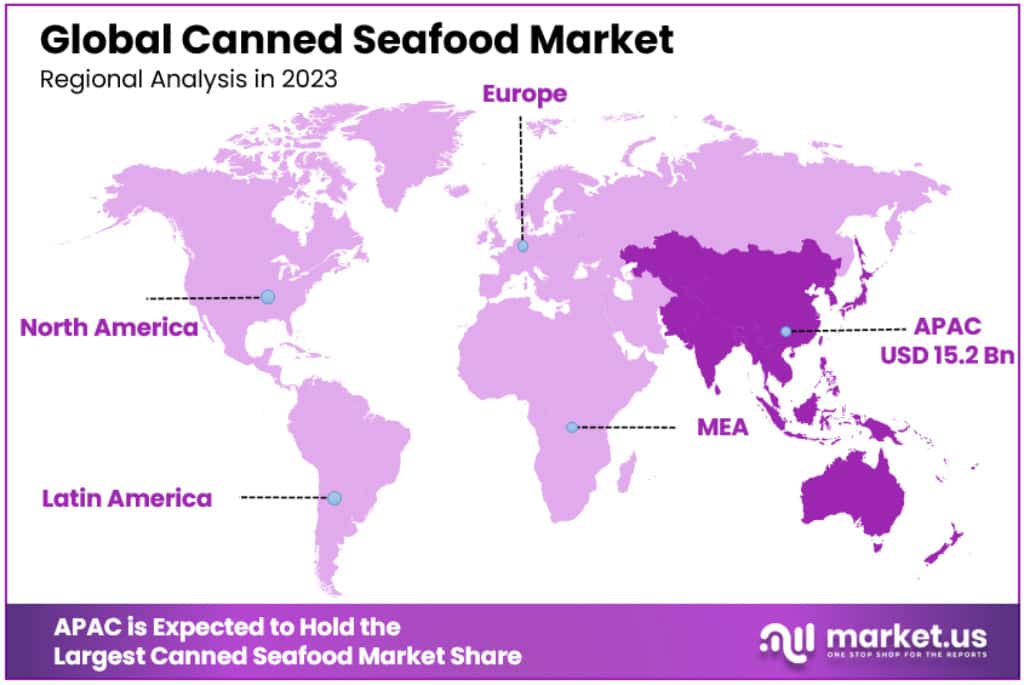

- The Asia Pacific region leads the global canned seafood market, with a market share of 45.9% in 2023 and a value of USD 15.2 billion.

Product Type Analysis

In the canned seafood market, distinct segments exhibit varying trends and growth trajectories. In 2023, the tuna segment held a dominant market position, capturing more than a 42.3% share. This prominence can be attributed to the widespread consumption of ready-to-eat meals among working-class individuals globally.

The National Fisheries Institute’s 2020 article reveals a significant penetration of canned tuna in American households, with 88% reporting consumption. Regular consumption patterns are notable, with 50% of households consuming canned tuna monthly and 17% weekly. The segment’s growth is further bolstered by new product introductions, such as Mind Fish Co.’s Fair Trade Certified canned tuna in August 2021.

Contrastingly, Canned sardines, preferred for their convenience as a ready-to-eat snack, have surpassed their fresh counterparts in popularity. Manufacturers are capitalizing on this trend by launching innovative products. For example, Minnow introduced its first line of tinned seafood in January 2022, including options like Alaskan salmon, Icelandic cod liver, and Spanish sardines.

Moving beyond fish, Prawns and Shrimps marked their presence, albeit with slightly smaller market shares. These seafood options, known for their unique taste and culinary versatility, attracted a niche audience, contributing meaningfully to the overall canned seafood market

Distribution Channel Analysis

In the canned seafood market, distribution channels play a pivotal role in shaping market dynamics. In 2023, the retail sector held a dominant position, capturing more than a 58.3% share of the market. This channel’s predominance is largely due to its encompassing supermarkets, hypermarkets, convenience stores, grocery stores, and local shops. The proliferation of these outlets across various regions has significantly bolstered the distribution of canned seafood.

Supermarket News, in a February 2021 article, highlighted the crucial role of convenience stores in driving canned seafood sales, with the retail sector accounting for approximately 48% of the distribution market. The accessibility of canned seafood products in physical stores worldwide is expected to sustain the segment’s growth momentum in the forthcoming years.

Conversely, the foodservice distribution channel is projected to experience a more rapid expansion. This channel is increasingly becoming a significant revenue generator, primarily driven by the rising consumption of canned seafood in restaurants and hotels. The preference for canned seafood in these establishments stems from growing consumer awareness regarding food safety.

The expansion of food services, as indicated by the U.S. Census Bureau’s report of 107,541 chain restaurant businesses in the U.S. as of 2022, marks a 1.6% increase from the previous year. This growth signifies the potential for increased distribution of canned seafood through foodservices. Overall, the canned seafood market exhibits a diverse distribution landscape, with each channel contributing uniquely to the market’s expansion.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Fish

- Tuna

- Salmon

- Sardines

- Others

- Prawns

- Shrimps

- Others

By Distribution Channel

- Foodservice

- Retail

Drivers

- Health Awareness: Increasing awareness about the health benefits of canned seafood is a significant driver. With high levels of omega-3 fatty acids, canned seafood is recognized for its positive impact on overall health. According to the Office of Disease Prevention and Health Promotion, seafood offers around 7 grams of protein per ounce, making it a highly nutritious choice.

- Plant-Based Alternatives: The market for plant-based canned seafood is expected to reach USD 165 billion by 2032, as reported by Bloomberg Intelligence. This surge is due to the increasing consumer demand for healthy, plant-based alternatives that mimic the taste and texture of real seafood.

- Sustainability: Consumer preference for sustainably sourced products is rising. For example, Bumble Bee Seafoods’ acquisition of Marine Stewardship Council certification highlights the market’s shift towards sustainable practices.

- Convenience and Shelf Life: High shelf-life and the convenience of ready-to-eat products are crucial drivers. During the COVID-19 pandemic, the demand for canned seafood increased significantly, particularly among consumers who preferred easy-to-prepare foods.

Restraints

- Supply Chain Challenges: Disruptions in the global supply chain, possibly due to factors like the COVID-19 pandemic, can hinder market growth.

- Environmental Concerns: Overfishing and environmental concerns associated with seafood procurement can negatively impact consumer perception and demand.

Opportunities

- Innovation in Product Offerings: Companies are innovating with value-added seafood products. For instance, Pacific Seafood’s introduction of canned, frozen, and seasoned shrimp products enhanced with nutrients is an example of market innovation.

- Expansion in Emerging Markets: With rising incomes and changing lifestyles, emerging markets present significant opportunities for the canned seafood industry.

Challenges

- Maintaining Product Quality: Ensuring high quality and freshness from capture to canning remains a challenge, especially with increased demand.

- Adapting to Consumer Preferences: Keeping pace with rapidly changing consumer preferences and dietary trends is a constant challenge for market players.

Trends

- Convenience Food Preference: The trend towards convenience foods, driven by changes in lifestyle and increased disposable income, is shaping market dynamics. The need for long-shelf-life and convenient food options is more pronounced post the COVID-19 pandemic.

- Technological Advancements: Advances in canning technology and packaging materials are playing a crucial role. Metal, being 100% recyclable and effective in preserving food quality, is a preferred choice for canned seafood.

- Global Market Expansion: Key players are expanding their reach in global markets, focusing on sustainable practices, and offering a variety of seafood products. Their presence in regions like North Atlantic and Arctic is part of a strategy to leverage local expertise and ensure a consistent supply chain.

Regional Analysis

The Asia Pacific region is leading the global canned seafood market, holding a significant 45.9% share in 2023, with a market value of USD 15.2 billion. This dominance is attributed to the abundance of raw materials and numerous canneries in the area, particularly supporting aquaculture. A notable statistic from the Marine Products Export Development Authority highlights India’s substantial contribution, with seafood exports reaching ~13L metric tons valued at USD 6.6 billion in 2019. This figure is projected to increase by ~12.5% by 2032. The region’s market growth is driven mainly by the surging demand for ready-to-cook canned fish in emerging economies.

In the Middle East, the market is expected to grow at a CAGR of ~6% from 2023 to 2033. This growth is fueled by the increasing demand for sustainably sourced seafood and its health benefits. Retail distributors in the region are launching private-label brands to cater to this demand. South Africa-based Woolworths, for example, offers a wide range of canned seafood products in its stores and online, contributing to the market’s expansion. Prominent brands in the region include Oceana Group Limited, Saldanha, Goody, and Al-Alali.

The United States is a key player in the North American canned seafood market, contributing ~3.5% to the region’s total sales and is expected to reach a market size of USD ~11 billion. The demand for ready-to-cook foods has notably increased, as evidenced by the import of 158,200 tons of canned tuna in 2018, a 15% rise from 2017 according to the United States National Marine Fisheries Services (NMFS). The market’s success is supported by a robust distribution system and growing online sales.

China, a key player in the Asia Pacific region, holds ~3% of the total sales and is expected to reach a market value of USD ~3 billion. The country’s market growth is bolstered by the availability of raw materials and numerous aquaculture canneries. Chinese companies are expanding internationally, focusing on products like tuna and striving to establish long-term business relationships.

Key Regions and Countries covered

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The market for canned seafood is fragmented due to the presence of many international players. Market players are subject to intense competition, particularly from top market players, who have large consumer bases, strong brand recognition, and extensive distribution networks. To stay on top of the market, companies have implemented various expansion strategies such as partnerships and product launches.

Маrkеt Кеу Рlауеrѕ

- Thai Union Group

- Bumble Bee Foods LLC

- Maruha Nichiro Corporation

- Dongwon Industries (StarKist)

- Nippon Suisan Kaisha, Ltd.

- Trident Seafoods Corporation

- F.C.F. Fishery Co., Ltd.

- Maldives Industrial Fisheries Company Limited (MIFCO)

- Jim Pattison Group Inc

- LDH (La Doria) Ltd

- Icicle Seafoods Inc.

- Universal Canning, Inc.

- Wild Planet Foods

- American Tuna, Inc.

- Tri Marine Group

- Connors Bros. Ltd.

- Other Key Players

Recent Developments

Product Developments

- October 2023: Bumble Bee Seafoods launched a new line of canned tuna pouches with innovative flavors like “Sriracha Lime” and “Lemon Pepper.”

- November 2023: Wild Planet Foods introduced a new range of organic canned sardines sourced from sustainable fisheries.

- October 2023: Thai Union Group announced plans to invest in innovative packaging technology to extend the shelf life of canned seafood products.

Sustainability Initiatives

- November 2023: The Marine Stewardship Council (MSC) certified several new canned tuna brands for their commitment to sustainable fishing practices.

- October 2023: The World Wildlife Fund (WWF) launched a campaign to raise awareness about the importance of sustainable seafood consumption, highlighting the role of canned seafood in responsible sourcing.

Report Scope

Report Features Description Market Value (2023) USD 31.1 Billion Forecast Revenue (2033) USD 51.1 Billion CAGR (2023-2032) 5.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type [Fish (Tuna, Salmon, Sardines and Others) Prawns, Shrimps and Others] By Distribution Channel (Foodservices and Retail) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Thai Union Group, Bumble Bee Foods LLC, Maruha Nichiro Corporation, Dongwon Industries (StarKist), Nippon Suisan Kaisha, Ltd., Trident Seafoods Corporation, F.C.F. Fishery Co., Ltd., Maldives Industrial Fisheries Company Limited (MIFCO), Jim Pattison Group Inc, LDH (La Doria) Ltd, Icicle Seafoods Inc., Universal Canning, Inc., Wild Planet Foods, American Tuna, Inc., Tri Marine Group, Connors Bros. Ltd. and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the size of the canned seafood market in 2023?A: The Canned seafood market size is USD 31.1 Billion in 2023.

Q: What is the projected CAGR at which the Canned Seafood Market is expected to grow at?A: The Canned seafood market is expected to grow at a CAGR of 5.1% (2023-2033).

Q: List the segments encompassed in this report on the Canned seafood market?A: Market.US has segmented the Canned seafood market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, the market has been segmented into Tuna, Salmon, Sardines, and Other Seafood. By Distribution channel, the market has been further divided into Foodservices and Retail.

Q: List the key industry players of the Canned seafood market?A: Thai Union Group, Bumble Bee Foods LLC, Maruha Nichiro Corporation, Dongwon Industries (StarKist), Nippon Suisan Kaisha, Ltd., Trident Seafoods Corporation, F.C.F. Fishery Co., Ltd., Maldives Industrial Fisheries Company Limited (MIFCO), Jim Pattison Group Inc, LDH (La Doria) Ltd, Icicle Seafoods Inc., Universal Canning, Inc., Wild Planet Foods, American Tuna, Inc., Tri Marine Group, Connors Bros. Ltd. and Other Key Players engaged in the Canned Seafood market.

-

-

- Thai Union Group

- Bumble Bee Foods LLC

- Maruha Nichiro Corporation

- Dongwon Industries (StarKist)

- Nippon Suisan Kaisha, Ltd.

- Trident Seafoods Corporation

- F.C.F. Fishery Co., Ltd.

- Maldives Industrial Fisheries Company Limited (MIFCO)

- Jim Pattison Group Inc

- LDH (La Doria) Ltd

- Icicle Seafoods Inc.

- Universal Canning, Inc.

- Wild Planet Foods

- American Tuna, Inc.

- Tri Marine Group

- Connors Bros. Ltd.

- Other Key Players