Global Additive Manufacturing with Metal Powders Market By Form(Powder Bed, Blown Powder, Others), By Material(Alloy, Aluminium Nitride, Aluminium Oxide Powder, Magnesium, Molybdenum, Precious, Silicon Carbide, Stainsteel Steel, Tungsten, Tungsten Carbide, Zirconium, Zirconium Dioxide, Others), By Technology(Selective Laser Melting (SLM), Electron Beam Melting (EBM), Others), By Application(Automotive Industry, Aerospace Industry, Healthcare and Dental Industry, Others) and by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 22861

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

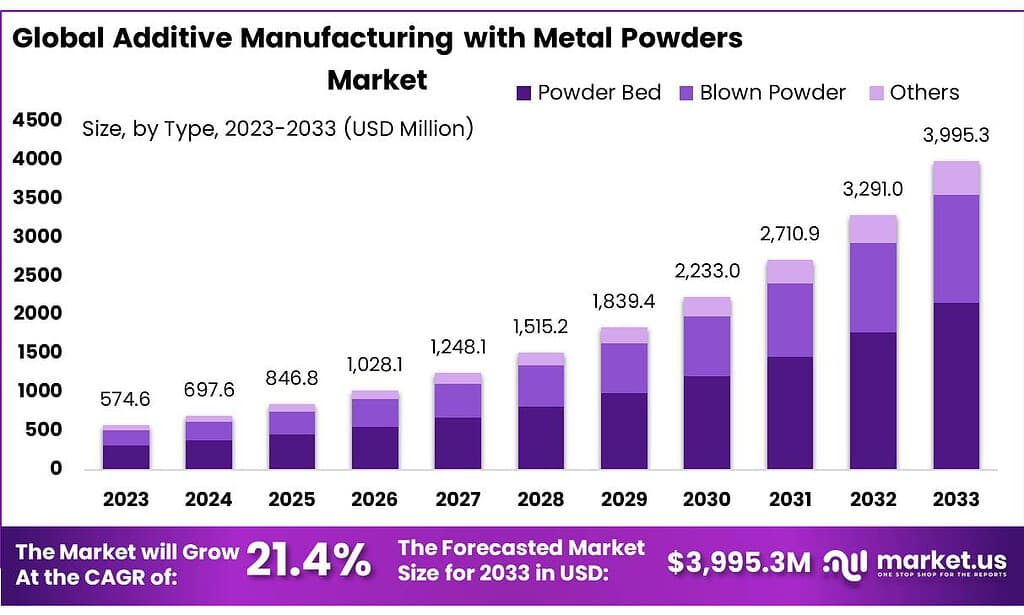

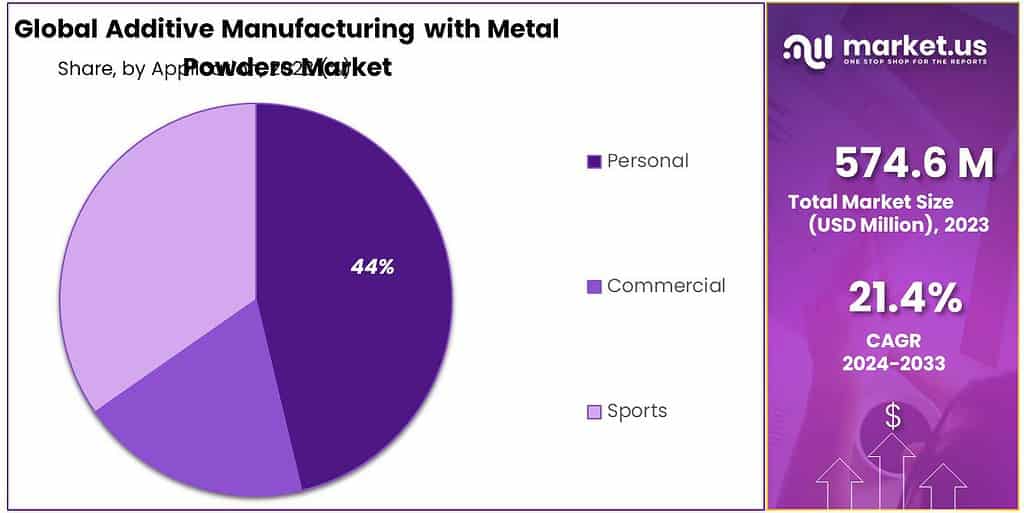

The global Additive Manufacturing with Metal Powders market size is expected to be worth around USD 3995.3 Million by 2033, from USD 574.6 Million, growing at a CAGR of 21.4% during the forecast period from 2023 to 2033.

The Additive Manufacturing with Metal Powders market, also known as metal 3D printing, is witnessing steady growth propelled by advancements in technology and increasing adoption across various industries. This market segment encompasses the use of metal powders as raw materials to create intricate and complex three-dimensional structures layer by layer.

Key drivers of this market include the demand for lightweight and customized components in aerospace, automotive, healthcare, and other sectors. Additionally, the ability of additive manufacturing to reduce material waste and production time is attracting attention from manufacturers seeking cost-effective and sustainable production solutions.

The market is characterized by a growing number of players offering diverse metal powders, printing technologies, and post-processing services to cater to the evolving needs of industries. Despite challenges such as high initial investment and regulatory constraints, the Additive Manufacturing with Metal Powders market is poised for expansion, driven by ongoing research and development efforts aimed at enhancing process efficiency, material properties, and application versatility.

Key Takeaways

- The market is poised to reach USD 3995.3 Mn by 2033, with a 21.4% CAGR projection.

- Powder Bed tech dominates with a 54.4% share; Blown Powder follows at 34.8% in 2024.

- Alloy leads materials with 43.3% share, and Stainless Steel follows with 25.6%.

- SLM tech leads with a 34.8% share, and EBM follows with 28.5% in 2024.

- The automotive industry holds a 45.4% market share, and Aerospace follows with 31.2%.

- Asia Pacific commands a 38% market share, led by aerospace, and automotive demand.

- As of 2024, the medical industry is expected to account for approximately 15% of the total metal additive manufacturing market share.

- The average particle size of metal powders used in additive manufacturing ranges from 10 to 100 micrometers.

By Form

In 2024, Powder Bed held a dominant market position, capturing more than a 54.4% share. This method involves spreading a layer of metal powder over a build platform, then selectively melting or sintering the powder using a laser or electron beam to create each layer of the desired object. It’s widely favored for its precision and ability to produce complex geometries with high accuracy.

Blown Powder, on the other hand, accounted for a notable portion of the market, capturing around 34.8% share. This technique involves blowing metal powder through a nozzle where it’s melted by a laser or electron beam to create the desired shape. It’s often preferred for its flexibility in handling different types of metals and its suitability for large-scale production.

Other methods, including Directed Energy Deposition (DED) and Binder Jetting, made up the remaining market share. These techniques offer unique advantages such as the ability to repair existing parts, create large-scale structures, or produce parts with varying material compositions. While they have smaller market shares, they cater to specific industry needs and contribute to the overall diversity and innovation within the additive manufacturing landscape.

By Material

In 2024, Alloy held a dominant market position, capturing more than a 43.3% share. This versatile category encompasses a wide range of metal blends tailored to specific industrial applications, offering properties such as strength, corrosion resistance, and thermal conductivity.

Following closely, Stainless Steel accounted for a significant portion of the market, with approximately 25.6% share. Renowned for its durability and resistance to corrosion, stainless steel finds extensive use in industries ranging from aerospace to medical devices.

Aluminium Powder secured a notable market share, around 15.2%, owing to its lightweight nature and excellent thermal conductivity. It is favored in aerospace and automotive applications where weight reduction and heat dissipation are critical factors.

Other materials, including Titanium, Tungsten Carbide, and Precious Metals like gold and silver, collectively comprised the remaining market share. Each material offers distinct properties suited to specific applications, contributing to the diverse landscape of additive manufacturing with metal powders.

By Technology

In 2024, Selective Laser Melting (SLM) held a dominant market position, capturing more than a 34.8% share. This technology employs a high-powered laser to selectively melt and fuse metal powders layer by layer, offering precise control and high resolution in the manufacturing process.

Following closely, Electron Beam Melting (EBM) accounted for a significant portion of the market, with approximately 28.5% share. EBM utilizes an electron beam to melt and solidify metal powders, making it suitable for producing large, complex parts with high material density.

Other emerging technologies, such as Direct Energy Deposition (DED) and Binder Jetting, collectively comprised the remaining market share. These methods offer unique advantages such as enhanced speed, material efficiency, and the ability to work with a wide range of metal powders, contributing to the innovation and diversification of additive manufacturing with metal powders.

By Application

In 2024, the Automotive Industry held a dominant market position, capturing more than a 45.4% share. This sector extensively utilizes additive manufacturing with metal powders for prototyping, tooling, and the production of lightweight components, contributing to improved fuel efficiency and performance.

Following closely, the Aerospace Industry accounted for a significant portion of the market, with approximately 31.2% share. Metal 3D printing is integral to aerospace applications, enabling the production of complex, high-performance parts with reduced lead times and enhanced design flexibility.

The Healthcare & Dental Industry secured a notable market share, around 18.7%, driven by the demand for custom implants, prosthetics, and medical devices produced through additive manufacturing. This technology offers personalized solutions and improved patient outcomes.

Other sectors, including the Electronics, Energy, and Defense industries, collectively comprised the remaining market share. These industries leverage additive manufacturing with metal powders for various applications such as electronics housing, energy-efficient components, and military-grade parts, contributing to the widespread adoption and advancement of this technology across diverse sectors.

Key Market Segments

By Form

- Powder Bed

- Blown Powder

- Others

By Material

- Alloy

- Aluminium Nitride

- Aluminium Oxide Powder

- Magnesium

- Molybdenum

- Precious

- Silicon Carbide

- Stainsteel Steel

- Tungsten

- Tungsten Carbide

- Zirconium

- Zirconium Dioxide

- Others

By Technology

- Selective Laser Melting (SLM)

- Electron Beam Melting (EBM)

- Others

By Application

- Automotive Industry

- Aerospace Industry

- Healthcare & Dental Industry

- Others

Drivers

Advancements in Materials and Processes

Advancements in materials and processes stand as a pivotal driver propelling the growth of the Additive Manufacturing with Metal Powders market. This driver encompasses a spectrum of innovations ranging from the development of new metal powders to the refinement of printing technologies, all aimed at enhancing the capabilities and applications of additive manufacturing.

Firstly, the continuous evolution of metal powders plays a crucial role in driving market expansion. Manufacturers are investing heavily in research and development to create metal powders with improved properties such as strength, durability, and heat resistance.

By expanding the range of available materials, including alloys, stainless steels, and exotic metals like titanium and nickel-based superalloys, additive manufacturing becomes increasingly viable for a wider array of applications across industries. These advancements enable the production of complex, high-performance components that meet stringent industry standards, driving adoption in sectors such as aerospace, automotive, and healthcare.

Furthermore, advancements in printing technologies contribute significantly to market growth. Selective Laser Melting (SLM), Electron Beam Melting (EBM), and other additive manufacturing processes continue to undergo refinement, resulting in increased precision, speed, and scalability. Improvements in machine capabilities, such as larger build volumes and faster printing speeds, enhance productivity and enable the production of larger and more intricate parts.

Additionally, innovations in process monitoring and control systems ensure quality assurance and consistency throughout the manufacturing process, instilling confidence in the reliability of additive manufacturing for critical applications.

Moreover, the integration of additive manufacturing with complementary technologies further drives market expansion. Hybrid manufacturing approaches, which combine additive and subtractive processes in a single machine, offer enhanced flexibility and efficiency in producing complex parts with tight tolerances.

Post-processing techniques, such as heat treatment, surface finishing, and machining, enable the refinement of printed components to meet specific requirements for aesthetics, functionality, and performance. These integrated solutions provide end-to-end manufacturing capabilities, streamlining production workflows and expanding the scope of applications for additive manufacturing with metal powders.

Restraints

High Initial Investment and Operational Costs

High initial investment and operational costs emerge as a significant restraint hindering the widespread adoption of Additive Manufacturing with Metal Powders. While additive manufacturing offers numerous benefits such as design flexibility, rapid prototyping, and customization, the substantial upfront investment required to establish and maintain additive manufacturing facilities presents a barrier for many potential adopters.

Firstly, the cost of acquiring additive manufacturing equipment, including metal powder deposition systems, printers, and ancillary machinery, represents a considerable financial burden. High-end machines capable of achieving precision and reliability often come with premium price tags, making them inaccessible to smaller businesses and startups.

Additionally, the need for specialized facilities with controlled environments, such as temperature and humidity-controlled chambers, further adds to the capital expenditure required to establish additive manufacturing capabilities.

Moreover, operational costs associated with additive manufacturing with metal powders pose ongoing challenges for manufacturers. The cost of metal powders, which constitute a significant portion of the overall manufacturing expenses, can vary depending on factors such as material composition, purity, and supply chain dynamics.

Furthermore, the energy consumption required to power additive manufacturing processes, particularly for technologies like Selective Laser Melting (SLM) and Electron Beam Melting (EBM), contributes to operational expenses and environmental impact.

Additionally, post-processing and finishing operations add to the overall cost and complexity of additive manufacturing with metal powders. While additive manufacturing enables the production of near-net-shape parts with minimal material waste, additional steps such as heat treatment, machining, and surface finishing are often necessary to achieve desired properties and surface quality. These post-processing techniques require specialized equipment, skilled labor, and time, further driving up production costs and lead times.

Furthermore, the lack of standardized processes and regulatory frameworks poses challenges for the widespread adoption of additive manufacturing with metal powders, particularly in safety-critical industries such as aerospace and healthcare. Manufacturers must invest in quality assurance measures, certification processes, and compliance with industry standards to ensure the reliability and safety of printed components, adding to the overall cost and complexity of implementation.

Opportunity

Customization and Personalization

One major opportunity that stands out for the Additive Manufacturing with Metal Powders market is the ability to offer unparalleled customization and personalization in manufacturing processes. Additive manufacturing technologies empower manufacturers to create highly customized products tailored to the specific needs and preferences of individual customers, presenting a significant competitive advantage in today’s consumer-driven market.

With additive manufacturing, manufacturers can easily modify designs and parameters to accommodate unique requirements, whether it’s adjusting dimensions, incorporating intricate geometries, or integrating personalized features. This level of flexibility enables the production of one-of-a-kind components and products that align perfectly with customer preferences, driving customer satisfaction and brand loyalty.

Customization opportunities extend across various industries, including aerospace, automotive, healthcare, and consumer goods. In the aerospace sector, for example, additive manufacturing allows for the production of lightweight, complex parts optimized for specific aircraft configurations, leading to improved fuel efficiency and performance.

In the automotive industry, customized components such as personalized dashboards, interior trims, and exterior accents enable automakers to offer premium, differentiated products that resonate with discerning consumers.

Moreover, additive manufacturing facilitates the creation of personalized medical devices and implants tailored to individual patient anatomy, improving treatment outcomes and patient comfort. Dental prosthetics, orthopedic implants, and hearing aids are just a few examples of medical applications benefiting from the customization capabilities of additive manufacturing with metal powders.

Furthermore, the rise of Industry 4.0 and digital manufacturing technologies opens up new avenues for mass customization and on-demand production. With advancements in digital design tools, simulation software, and additive manufacturing automation, manufacturers can efficiently manage small-batch production runs and respond swiftly to changing market demands without the need for expensive tooling or lengthy lead times.

Additionally, the growing trend towards sustainable and eco-friendly manufacturing presents an opportunity for additive manufacturing to shine. By enabling on-demand production, additive manufacturing reduces material waste, energy consumption, and carbon emissions associated with traditional manufacturing processes. Customized products produced through additive manufacturing with metal powders are inherently more resource-efficient, as they are precisely tailored to meet specific requirements, minimizing excess material usage.

Trends

Industry 4.0 Integration and Digitalization

One major trend shaping the Additive Manufacturing with Metal Powders market is the increasing integration of Industry 4.0 principles and digitalization into additive manufacturing workflows. Industry 4.0, also known as the Fourth Industrial Revolution, represents the convergence of digital technologies with traditional manufacturing processes, enabling greater automation, connectivity, and data-driven decision-making.

At the forefront of this trend is the adoption of digital design and simulation tools that facilitate the creation and optimization of complex geometries for additive manufacturing. Advanced CAD (Computer-Aided Design) software allows engineers to design intricate parts with optimized structures for additive manufacturing, maximizing strength-to-weight ratios and minimizing material usage. Additionally, simulation software enables virtual testing and analysis of designs, predicting performance outcomes and identifying potential issues before physical production begins.

Furthermore, the implementation of digital twin technology is revolutionizing additive manufacturing by creating virtual replicas of physical products and production processes. Digital twins enable real-time monitoring and optimization of additive manufacturing operations, providing insights into process performance, quality control, and predictive maintenance. By leveraging data from sensors, IoT (Internet of Things) devices, and machine learning algorithms, manufacturers can enhance productivity, efficiency, and reliability across the additive manufacturing value chain.

Another key aspect of Industry 4.0 integration is the proliferation of additive manufacturing automation and robotics. Automated systems for powder handling, part removal, and post-processing streamline production workflows, reduce manual labor, and minimize human error. Robotics and cobots (collaborative robots) are increasingly being utilized for tasks such as powder spreading, powder recycling, and part inspection, enhancing process efficiency and scalability in additive manufacturing with metal powders.

Moreover, the emergence of additive manufacturing ecosystems and digital marketplaces is facilitating collaboration and knowledge sharing within the industry. Online platforms connect additive manufacturing service providers, materials suppliers, equipment manufacturers, and end-users, enabling seamless communication, collaboration, and access to resources. These digital platforms also support the democratization of additive manufacturing by providing on-demand access to expertise, equipment, and materials, empowering businesses of all sizes to embrace additive manufacturing technologies.

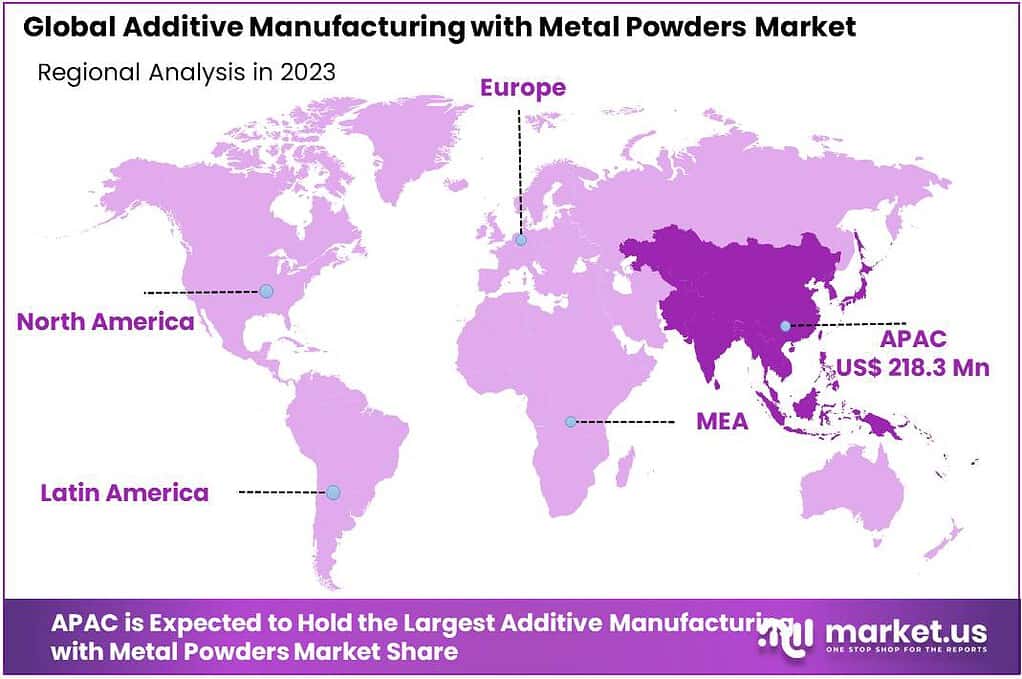

Regional Analysis

The Asia Pacific region emerges as the frontrunner in driving the global Additive Manufacturing with Metal Powders market, commanding a significant market share of 38%. This growth trajectory is primarily fueled by escalating demand for metal powder-based additive manufacturing across key sectors such as aerospace, automotive, and healthcare.

Countries like China, India, and Southeast Asian nations including Korea, Thailand, Malaysia, and Vietnam are witnessing a surge in the production of metal powder-based additive manufacturing components. This upsurge is expected to propel market expansion in the region over the forecast period.

In North America, economic prosperity, coupled with the expansion of additive manufacturing services and industrial applications, is anticipated to drive the demand for metal powder-based additive manufacturing. The region’s focus on innovation and technological advancement further accelerates this demand, making it a significant market for additive manufacturing with metal powders.

Europe is poised to witness substantial growth in the additive manufacturing with metal powders market, driven by increasing adoption across various industries such as automotive, aerospace, and medical. The region’s commitment to sustainability and technological innovation further bolsters this growth, making it a prominent hub for additive manufacturing with metal powders.

This shift towards additive manufacturing with metal powders reflects global trends in technological advancement and industrial innovation, mirroring similar growth dynamics observed in other sectors but within the specific context of additive manufacturing with metal powders.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the Additive Manufacturing with Metal Powders market, several key players stand out for their significant contributions and market presence. These players include EOS GmbH, a leading provider of metal 3D printing solutions, offering technologies like Selective Laser Melting (SLM) and Direct Metal Laser Sintering (DMLS).

Market Key Players

- 3D Systems Corporation

- Additive Industries

- Arcam AB (a GE Additive company

- Carpenter Technology Corporation

- Concept Laser GmbH (a GE Additive company)

- Desktop Metal

- EOS GmbH

- ExOne Company

- GE Additive

- HP Inc.

- Markforged

- Materialise NV

- Optomec

- Proto Labs

- Renishaw plc

- Sintavia

- SLM Solutions Group AG

- Trumpf

- Velo3D

- XJet

Recent Development

In 2024 Additive Industries: Additive Industries announced the expansion of its MetalFAB1 platform with the introduction of new modules for post-processing and quality control. These enhancements aim to streamline the additive manufacturing workflow and improve the overall efficiency of metal powder-based production.

Report Scope

Report Features Description Market Value (2023) USD 574.6 Mn Forecast Revenue (2033) USD 3995.3 Mn CAGR (2024-2033) 21.4% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Form(Powder Bed, Blown Powder, Others), By Material(Alloy, Aluminium Nitride, Aluminium Oxide Powder, Magnesium, Molybdenum, Precious, Silicon Carbide, Stainsteel Steel, Tungsten, Tungsten Carbide, Zirconium, Zirconium Dioxide, Others), By Technology(Selective Laser Melting (SLM), Electron Beam Melting (EBM), Others), By Application(Automotive Industry, Aerospace Industry, Healthcare and Dental Industry, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape 3D Systems Corporation, Additive Industries, Arcam AB (a GE Additive company, Carpenter Technology Corporation, Concept Laser GmbH (a GE Additive company), Desktop Metal, EOS GmbH, ExOne Company, GE Additive, HP Inc., Markforged, Materialise NV, Optomec, Proto Labs, Renishaw plc, Sintavia, SLM Solutions Group AG, Trumpf, Velo3D, XJet Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Additive Manufacturing with Metal Powders Market?Additive Manufacturing with Metal Powders market size is expected to be worth around USD 3995.3 Million by 2033, from USD 574.6 Million

What CAGR is projected for the Additive Manufacturing with Metal Powders Market?The Additive Manufacturing with Metal Powders Market is expected to grow at 21.4% CAGR (2024-2033).Name the major industry players in the Additive Manufacturing with Metal Powders Market?3D Systems Corporation, Additive Industries, Arcam AB (a GE Additive company, Carpenter Technology Corporation, Concept Laser GmbH (a GE Additive company), Desktop Metal, EOS GmbH, ExOne Company, GE Additive, HP Inc., Markforged, Materialise NV, Optomec, Proto Labs, Renishaw plc, Sintavia, SLM Solutions Group AG, Trumpf, Velo3D, XJet

Additive Manufacturing with Metal Powders MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Additive Manufacturing with Metal Powders MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- 3D Systems Corporation

- Additive Industries

- Arcam AB (a GE Additive company

- Carpenter Technology Corporation

- Concept Laser GmbH (a GE Additive company)

- Desktop Metal

- EOS GmbH

- ExOne Company

- GE Additive

- HP Inc.

- Markforged

- Materialise NV

- Optomec

- Proto Labs

- Renishaw plc

- Sintavia

- SLM Solutions Group AG

- Trumpf

- Velo3D

- XJet