Global Call Center Outsourcing Market Size, Share Analysis Report By Outsourcing Type (Offshore, Onshore), By Services (Inbound Services, Outbound Services), By Enterprise Size (Large Enterprises, Small Enterprises), By Industry Vertical (BFSI, Healthcare, Retail, IT & Telecom, Manufacturing, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151711

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

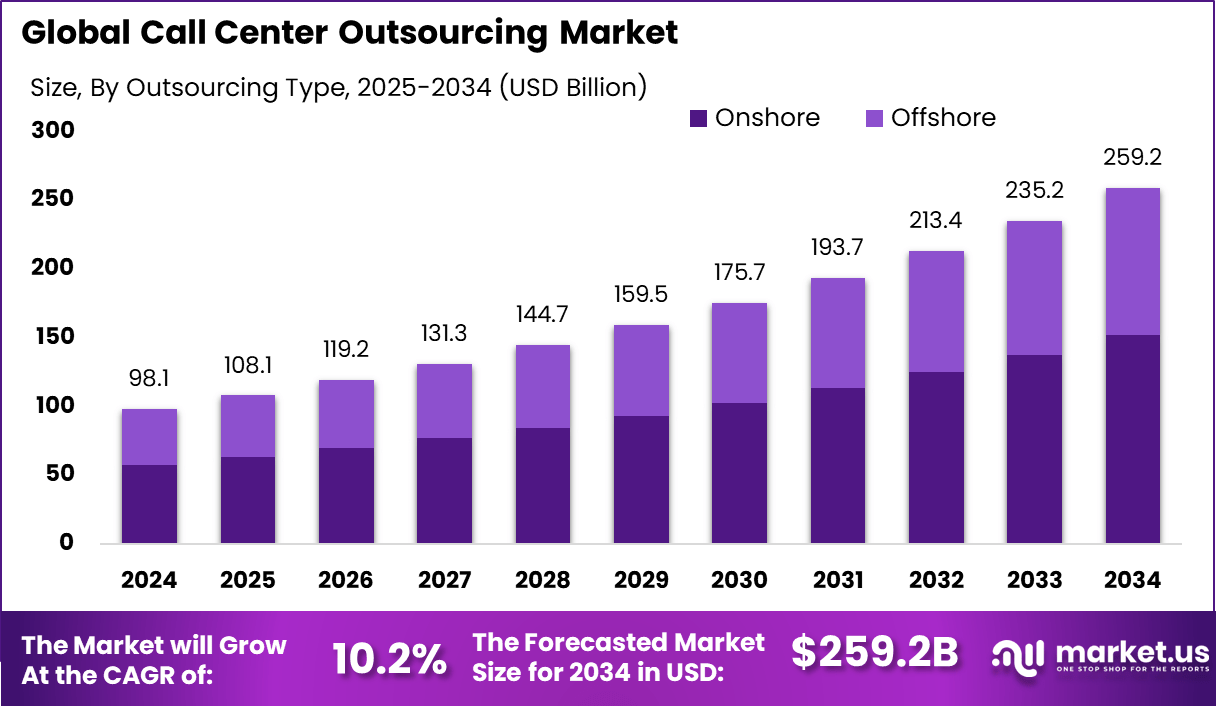

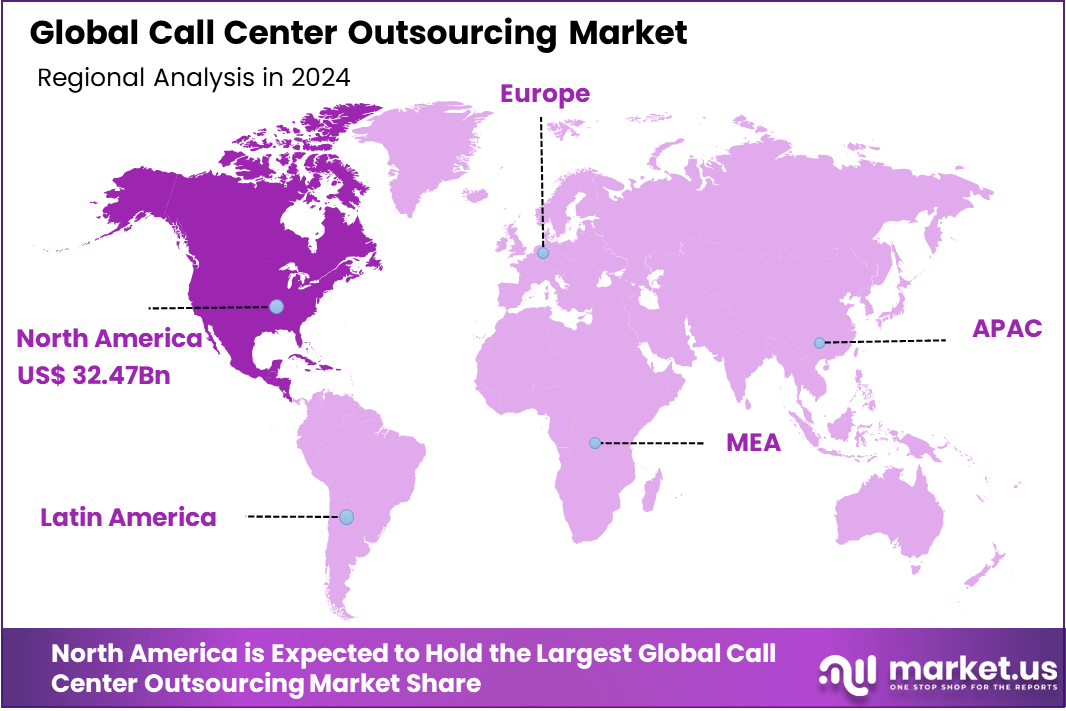

The Global Call Center Outsourcing Market size is expected to be worth around USD 259.2 Billion By 2034, from USD 98.1 billion in 2024, growing at a CAGR of 10.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 33.1% share, holding USD 32.47 Billion revenue.

The Call Center Outsourcing Market has gained significant momentum as organizations pursue enhanced customer experience and operational efficiency. Pressure to deliver high‑quality, personalised customer support has driven businesses in retail, banking, healthcare, and telecommunications to outsource these functions to specialist vendors.

Primary drivers include the necessity to contain costs, scale operations rapidly, and access specialised expertise. Lower labour and infrastructure expenses in offshore and near‑shore markets are compelling incentives for outsourcing. Additionally, organisations benefit from 24 / 7 support capabilities, enabling round‑the‑clock customer service across time zones.

Demand is rising in both voice and digital engagement channels. While voice still commands a substantial share, digital channels such as chat, email and messaging are expanding at a faster rate due to consumer preferences for seamless omnichannel experiences. Key sectors such as banking, financial services and telecom rely heavily on these solutions, with healthcare emerging as one of the most rapidly growing verticals.

Cloud‑based CCaaS platforms are being adopted to support scalable, flexible operations. Natural language processing, AI‑driven chatbots, and predictive analytics are being integrated into workflows to handle routine queries and guide agents. Robotic process automation is also increasingly leveraged for routine back‑office tasks.

As per the latest insights from callin.io, 78% of companies now outsource some part of their customer service operations. Adoption varies across sectors, with 72% in financial services, 65% in healthcare, 61% in retail, and 58% in technology. These differences are shaped by industry-specific needs like compliance, interaction complexity, and competition.

Outsourcing partners have improved significantly, with top providers achieving customer satisfaction scores of 85-90% and first-call resolution rates averaging 78%, only slightly below internal teams. Technology continues to reshape the outsourcing model, with 76% of providers using artificial intelligence in some form.

Despite automation, the human role remains central, supported by a global workforce of approximately 3.5 million agents. Demographic shifts highlight increased experience and diversity, as the average agent age has risen to 29 years, and 58% of the workforce now consists of women. The adoption of advanced technologies is driven by the demand to reduce service costs, improve response times, guarantee consistent quality, and manage high volumes of customer contacts efficiently.

Key Insight Summary

- The Global Call Center Outsourcing Market is forecast to grow from USD 98.1 billion in 2024 to approximately USD 259.2 billion by 2034, expanding at a CAGR of 10.2% over the forecast period.

- In 2024, North America emerged as a key regional leader, capturing 33.1% of the market, with revenues reaching around USD 32.47 billion.

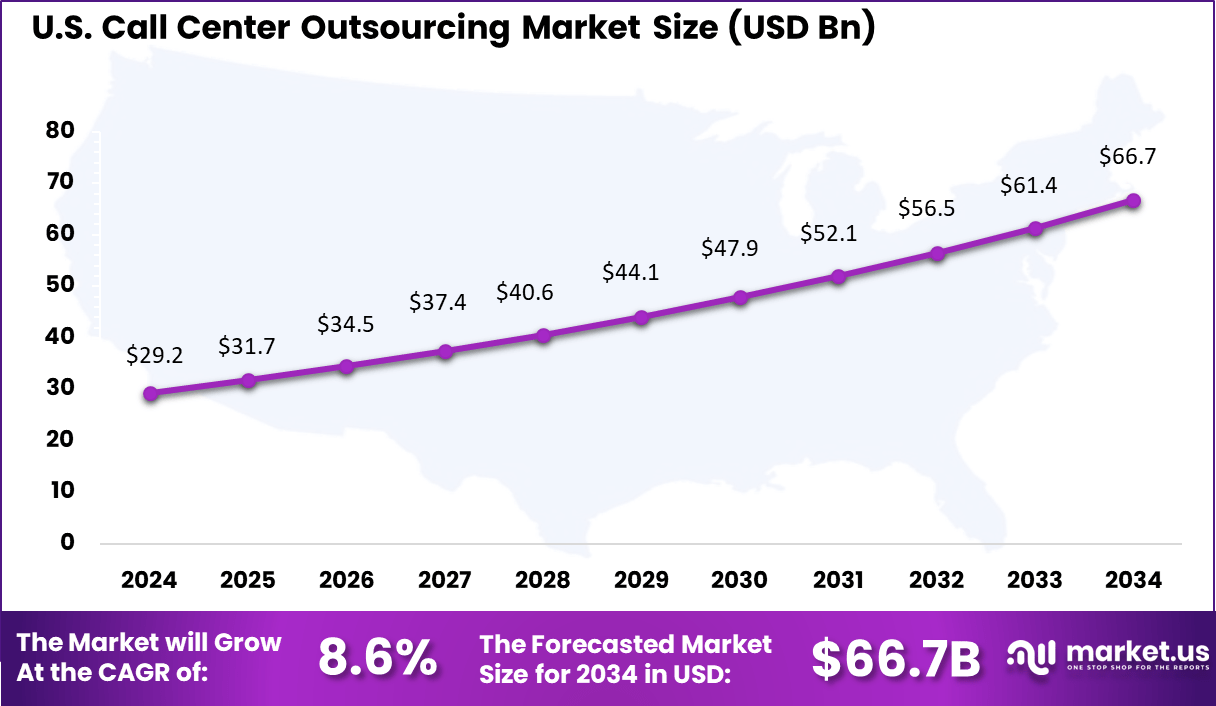

- The U.S. market alone was valued at USD 29.22 billion in 2024, registering a CAGR of 8.6%, indicating steady outsourcing activity across industries.

- Based on outsourcing type, Onshore outsourcing dominated with a 58.6% share, reflecting the preference for proximity and control in service delivery.

- In terms of services, Inbound Services held the largest market share at 63.7%, driven by growing demand for customer support and technical assistance.

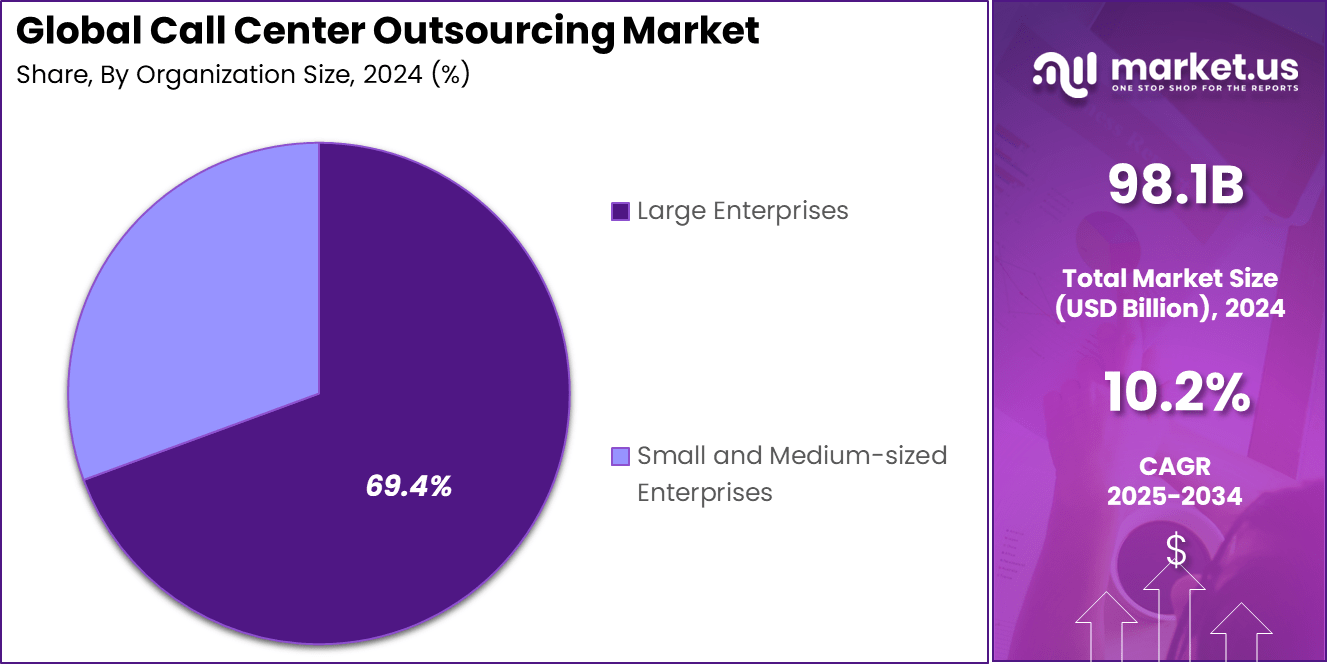

- By enterprise size, Large Enterprises accounted for a dominant 69.4% share, showcasing their reliance on outsourcing for cost efficiency and scalability.

- Among industry verticals, the BFSI sector led the market with a 26.7% share, due to its high customer interaction volume and focus on compliance and service quality.

Impact of AI

The impact of artificial intelligence on the call center outsourcing market has been both transformative and strategic. As AI tools like chatbots, voice analytics, and natural language processing become more advanced, they are being widely integrated into customer support operations. These technologies are not only automating repetitive tasks but also assisting human agents in real-time, improving service quality and reducing wait times.

AI is also changing the way workforce planning is done within outsourced contact centers. Providers are now able to process large volumes of data to predict customer behavior, improve staffing schedules, and minimize resource wastage. In some cases, predictive analytics has helped increase call resolution efficiency by more than 30%.

Cost savings remain one of the most prominent benefits. AI-enabled solutions have led to a reported 50 percent reduction in cost per contact across several outsourcing hubs. These savings are realized through fewer human errors, reduced training time, and less need for large agent teams. However, the benefits are not just financial.

US Market Expansion

The U.S. Call Center Outsourcing Market was valued at USD 29.2 Billion in 2024 and is anticipated to reach approximately USD 66.7 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 8.6% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 33.1% share and generating approximately USD 32.47 billion in revenue within the call center outsourcing market. This leading position can be attributed to the high concentration of global enterprises across the United States and Canada, which have consistently prioritized cost efficiency, service scalability, and multilingual customer support.

The widespread adoption of cloud-based communication platforms and AI-driven voice assistants has further supported the shift toward third-party service providers in this region. Outsourcing has become a strategic necessity for firms aiming to optimize customer experience while minimizing operational costs.

The region’s leadership is also driven by a mature digital infrastructure, regulatory clarity, and availability of highly skilled agents in nearshore destinations such as Mexico and the Caribbean. These nearshore hubs provide time zone advantages and cultural compatibility, which enhance service quality and agent retention.

By Outsourcing Type Analysis

In 2024, Onshore segment held a dominant market position, capturing more than a 58.6% share, reflecting a strong preference among businesses for localized outsourcing solutions. Onshore outsourcing has gained prominence due to its inherent advantages in communication, regulatory compliance, and customer experience.

Service providers operating within the same country maintain cultural alignment, mitigate language barriers, and ensure familiarity with domestic regulations – elements that enhance service quality and trust. Companies have increasingly prioritized the preservation of brand image and customer satisfaction, leading to a preference for onshore arrangements whenever feasible.

This trend is especially pronounced in sectors such as financial services, healthcare, and government, where data privacy and regulatory adherence are of paramount importance. Moreover, the onshore model offers greater operational control and responsiveness. Proximity enables easier oversight, agile adaptation to service-level requirements, and reduced risks associated with time-zone discrepancies and geopolitical uncertainties.

Enterprises are thus able to manage quality standards more effectively and foster stronger relationships with key outsourcing partners. As such, the dominance of the onshore segment in 2024 is a direct result of its strategic alignment with business priorities centered around compliance, customer experience, and operational resilience.

By Services Analysis

In 2024, Inbound Services segment held a dominant market position, capturing more than a 63.7% share of the global call center outsourcing market. This leadership can be attributed to the central role that inbound services play in maintaining customer satisfaction and loyalty.

Businesses across industries continue to prioritize efficient handling of incoming calls, customer inquiries, support requests, and issue resolution – activities that directly impact brand reputation and retention rates. The prevalence of inbound outsourcing reflects a strategic shift toward optimizing customer-facing operations through specialized external partners.

By leveraging third-party providers, firms are able to scale support during peak demand periods, implement advanced customer engagement technologies, and maintain consistent service quality – all without the overhead associated with in-house teams. This trend is further supported by the adoption of AI‑enabled routing, knowledge management platforms, and omnichannel integration, which collectively enhance first-contact resolution and reduce operational latency.

By Enterprise Size Analysis

In 2024, Large Enterprises segment held a dominant market position, capturing more than a 69.4% share, driven by their expansive customer bases, intricate service requirements, and robust capacity to invest in advanced outsourcing solutions.

Large organizations typically manage vast and diverse customer interactions spanning multiple channels, necessitating deep operational expertise, scalable infrastructure, and strict adherence to service-level agreements. These factors collectively tilt outsourcing preference toward providers capable of offering complex, high-volume support tailored to enterprise-grade expectations, thereby reinforcing dominance within this segment.

The prominence of large enterprises in the outsourcing ecosystem is further strengthened by their pursuit of innovation-driven efficiency and superior customer engagement. By collaborating with seasoned outsourcing partners, these firms leverage artificial intelligence, workforce analytics, and omnichannel integration to enhance customer experience while maintaining cost-effectiveness.

Moreover, their financial strength enables long-term strategic partnerships, resulting in customized service frameworks, priority access to talent, and greater flexibility in deploying emergent technologies. Consequently, the large-entity segment continues to anchor the call center outsourcing market, aligning customer service excellence with corporate-scale demands.

By Industry Vertical Analysis

In 2024, BFSI segment held a dominant market position, capturing more than a 26.7% share, reinforced by the financial services industry’s inherent reliance on high-quality customer engagement and stringent compliance mandates.

The complexity of banking, investment, and insurance processes demands outsourcing partners capable of handling sensitive data, navigating extensive regulatory frameworks, and delivering personalized support across multiple channels.

This need has driven financial institutions to externalize both customer-facing and technical back-office services to experienced providers that ensure reliability, precision, and protection of consumer trust. As a result, the BFSI vertical continues to outpace other sectors in call center outsourcing adoption.

Beyond compliance, the BFSI sector benefits from economies of scale when outsourcing large volumes of customer interactions such as transaction inquiries, fraud alerts, and technical support for digital banking. The integration of AI-powered analytics, voice biometrics, and omnichannel platforms has elevated the quality of service while containing operational costs.

Additionally, the push for 24/7 availability and rapid response times aligns well with outsourcing models, enabling financial institutions to maintain high service levels without expanding internal infrastructure. This synergy between service volume, regulatory adherence, and technological sophistication has solidified BFSI’s leadership in the call center outsourcing market.

Key Market Segments

By Outsourcing Type

- Offshore

- Onshore

By Services

- Inbound Services

- Outbound Services

By Enterprise Size

- Large Enterprises

- Small Enterprises

By Industry Vertical

- BFSI

- Healthcare

- Retail

- IT & Telecom

- Manufacturing

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers Impact Analysis

Driver Impact Insight Digital transformation and automation High Adoption of AI-powered chatbots, NLP, and robotic process automation is enabling service providers to enhance efficiency and reduce costs, making outsourcing more attractive. Globalization and multilingual support demand High As companies expand into new geographies, there is growing need for local language and timezone-aware service. Outsourcing partners fulfill this requirement through multilingual teams. Cost containment and operational flexibility High Third-party providers reduce capital investment in hiring, infrastructure, and training, enabling firms to scale operations as needed and focus on core business. Omnichannel customer experience expectations Medium-High Rising customer expectations for seamless support across voice, chat, email, and social media drive firms to partner with specialized providers capable of integrated engagements. Restraints Impact Analysis

Restraint Impact Insight Loss of direct control over interactions Medium-High Delegation to external vendors can lead to inconsistent service quality and weaker brand alignment, eroding customer trust. Data security and privacy concerns High Sensitive information handling by third parties increases risk of breaches, especially in heavily regulated industries—raising concerns over vendor reliability. Cultural and linguistic mismatches Medium Offshore agents may struggle with local dialects, tone, and references, impacting customer satisfaction unless mitigated by training programs. Geopolitical and regulatory risks Medium Political instability, exchange rate fluctuations, and evolving data sovereignty laws can disrupt operations and increase compliance burdens. Key Player Analysis

Alorica, Inc., Concentrix, and Teleperformance are widely recognized for delivering large-scale multilingual support and omnichannel contact center solutions. Their competitive advantage lies in advanced automation capabilities and global delivery models that enable scalability and consistent customer experience. These firms have been expanding into AI-driven customer support and data analytics to improve efficiency.

Companies such as Arvato, Capgemini, and Infosys BPM have demonstrated robust capabilities in digital customer experience management. Their strength lies in blending business process expertise with cloud-based technologies and robotic process automation (RPA). Arvato focuses heavily on European and e-commerce clients, while Capgemini and Infosys BPM extend strong IT-BPO integration for enterprise clients.

Mid-sized and regional players like CGS Inc., DATAMARK Inc., Konecta Group, Raya Customer Experience, SCICOM, SERCO GROUP, TTEC, Webhelp, Wipro, and others contribute to niche excellence and localized services. Many focus on specific industries such as government, travel, and healthcare, offering customized engagement models. Webhelp and TTEC are notable for rapid geographic expansion and CX strategy consulting.

Top Key Players Covered

- Alorica, Inc.

- Arvato

- Concentrix

- Capgemini

- CGS Inc

- DATAMARK Inc.

- Infosys BPM

- Konecta Group

- Raya Customer Experience

- SCICOM (MSC) BERHAD

- SERCO GROUP

- Teleperformance

- TTEC

- Webhelp

- Wipro

- Others

Recent Developments

- A notable strategic acquisition was completed in February 2025, when Concentrix acquired VoiceWorx.AI, a Texas‑based provider of AI‑driven conversational analytics. This move enhances Concentrix’s conversational intelligence offerings by integrating advanced AI and natural language processing capabilities.

- In February 2025, RAYA CX previewed its presence at LEAP 2025 in Riyadh, showcasing its AI‑powered automation, omnichannel capabilities, and generative AI enhancements—an indicator of its continued innovation in digital CX.

Report Scope

Report Features Description Market Value (2024) USD 98.1 Bn Forecast Revenue (2034) USD 259.2 Bn CAGR (2025-2034) 10.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Outsourcing Type (Offshore, Onshore), By Services (Inbound Services, Outbound Services), By Enterprise Size (Large Enterprises, Small Enterprises), By Industry Vertical (BFSI, Healthcare, Retail, IT & Telecom, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Alorica, Inc., Arvato, Concentrix, Capgemini, CGS Inc, DATAMARK Inc., Infosys BPM, Konecta Group, Raya Customer Experience, SCICOM (MSC) BERHAD, SERCO GROUP, Teleperformance, TTEC, Webhelp, Wipro, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Call Center Outsourcing MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Call Center Outsourcing MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alorica, Inc.

- Arvato

- Concentrix

- Capgemini

- CGS Inc

- DATAMARK Inc.

- Infosys BPM

- Konecta Group

- Raya Customer Experience

- SCICOM (MSC) BERHAD

- SERCO GROUP

- Teleperformance

- TTEC

- Webhelp

- Wipro

- Others