Global Cage Free Eggs Market By Colour(White, Brown), By Size(Small and Medium, Large, Extra Large, Jumbo), By Distribution Channel( Supermarkets/Hypermarkets, Convenience Stores, Independent Retailers, Online Sales), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 24566

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

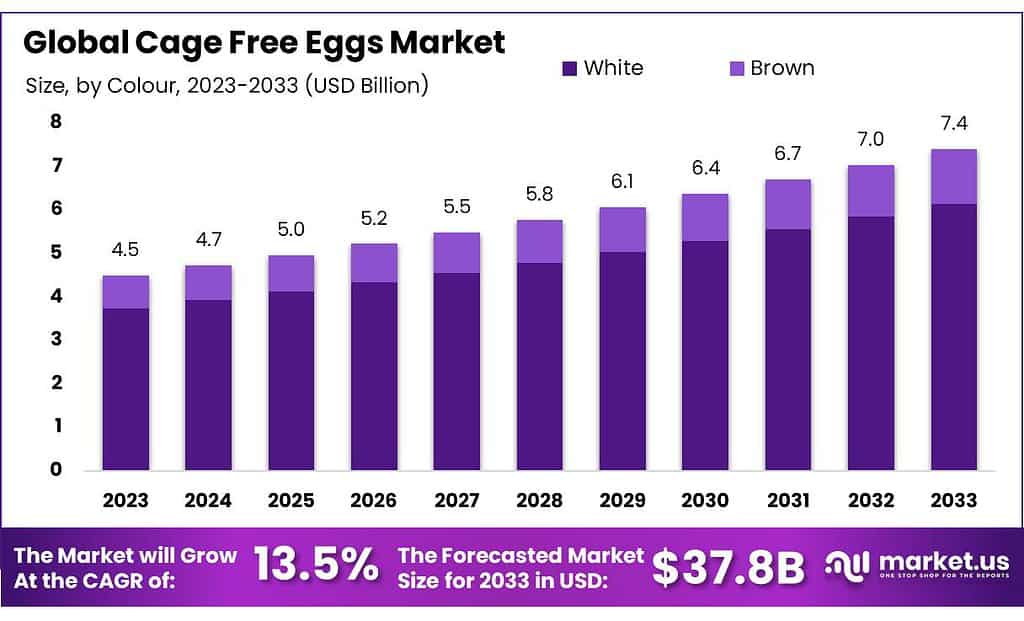

The global Cage Free Eggs Market size is expected to be worth around USD 7.4 billion by 2033, from USD 4.5 billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

The Cage Free Eggs Market refers to the segment of the egg industry that deals with the production, distribution, and sale of eggs from hens that are not confined in cages. Unlike conventional egg-laying practices where hens are kept in restrictive cages, cage-free hens roam freely within an enclosed shelter, which typically provides nesting space, perches, and areas to exhibit natural behaviors such as scratching and dust bathing.

This method of egg production is viewed as more humane, aligning with increasing consumer demand for ethically produced food products. Cage-free eggs are often marketed as healthier and more environmentally friendly options, attracting premium pricing. The growth in the cage-free eggs market is driven by changing consumer preferences, corporate buying policies, and legislative changes aimed at improving animal welfare in the poultry industry. As awareness of animal welfare and sustainable farming practices continues to rise, the demand for cage-free eggs is expected to grow, reflecting a significant shift in consumer values towards more ethically produced food.

Key Takeaways

- Market Growth: Expected to reach USD 7.4 billion by 2033, from USD 4.5 billion in 2023, with a CAGR of 5.1%.

- Color Preferences: In 2023, white eggs held over 83.3% of the market share, while brown eggs had a smaller market share.

- Size Segment Dominance: In 2023, small and medium-sized eggs held over 59.5% of the market share.

- Distribution Channels: In 2023, supermarkets/hypermarkets captured over 43.5% of the market share, with other channels contributing to the rest.

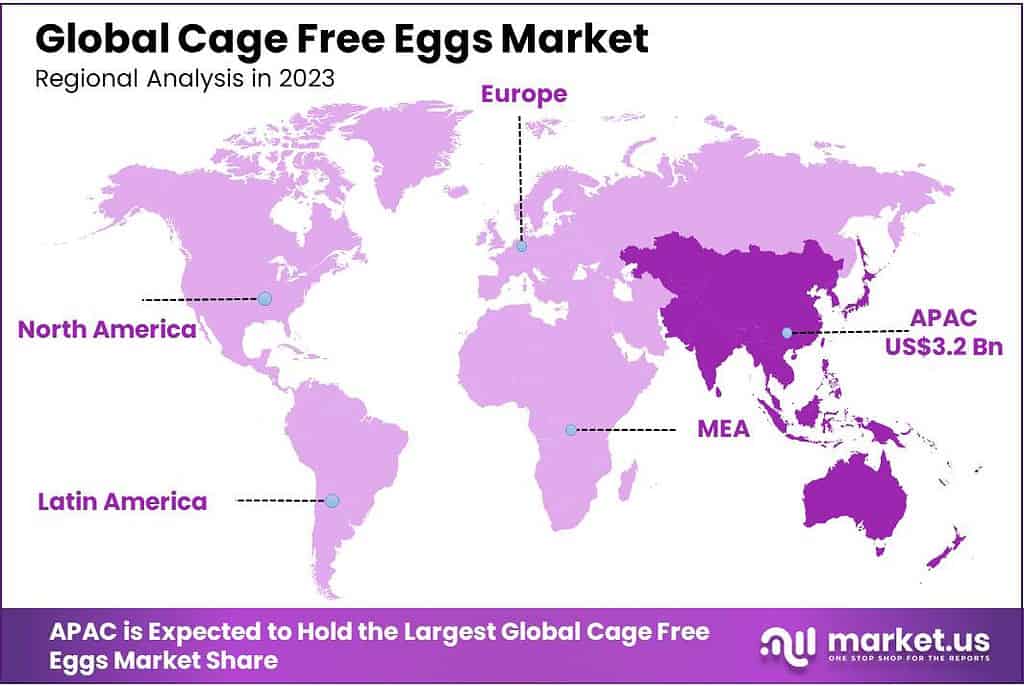

- Regional Dynamics: The Asia Pacific region is poised to lead the market, capturing a significant share of 41%, followed by North America and Europe.

By Colour

In 2023, White held a dominant market position, capturing more than an 83.3% share. White cage-free eggs are favored for their wide availability and general consumer preference in many markets, especially in the United States where white eggs are traditionally associated with standard egg purchases. They are commonly used in both household cooking and in commercial food production due to their consistent quality and familiar appearance.

On the other hand, Brown cage-free eggs, while holding a smaller market share, are often perceived by consumers as being more ‘natural’ or healthier, though nutritionally they are equivalent to white eggs. Brown eggs typically come from different breeds of hens than those that lay white eggs, which can sometimes make them more expensive to produce and purchase. Despite their smaller market share, the demand for brown cage-free eggs is growing in certain regions and demographic segments that prioritize perceived quality and ethical food production practices.

Both color segments cater to evolving consumer preferences, with significant market potential driven by increasing awareness of animal welfare and a shift towards more sustainably produced eggs.

By Size

In 2023, Small & Medium held a dominant market position, capturing more than a 59.5% share. These sizes are particularly popular among consumers due to their versatility and affordability, making them suitable for a wide range of cooking applications. Small and medium eggs are commonly used in everyday recipes and are a staple in household kitchens, as well as in many food service settings where large volumes of eggs are required for baking and cooking.

Large eggs, often preferred for their generous size, are favored in recipes where larger yolks or more egg white is desirable. They are commonly used in breakfast dishes and baking, offering good value for consumers looking for bigger eggs without stepping into the premium price range.

Extra Large and Jumbo sizes, while having smaller market shares, cater to specific consumer needs. Extra Large eggs are ideal for culinary uses where more egg content is required, such as in omelets or when baking in larger batches. Jumbo eggs are often seen as a specialty product, appealing to consumers looking for the largest eggs available, whether for specific recipes or for their perceived value.

The diverse range of egg sizes allows consumers to choose products that best meet their cooking needs and budget, supporting sustained demand across the segment. Each size category serves different consumer preferences, contributing to the overall growth and resilience of the cage-free egg market.

By Distribution Channel

In 2023, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 43.5% share. These retail giants are the primary choice for consumers purchasing cage-free eggs due to their wide availability, variety of options, and the convenience of finding multiple grocery items in one place. Supermarkets and hypermarkets typically offer a range of egg sizes and colors, catering to diverse consumer preferences and dietary needs, which makes them a popular shopping destination.

Convenience stores also play a significant role in the distribution of cage-free eggs, providing easy access for quick shopping needs. Although they command a smaller share of the market, convenience stores are crucial for last-minute purchases or in areas where larger supermarkets may not be readily accessible.

Independent retailers, including local grocery stores and farm shops, are valued for their focus on local produce and support of sustainable and ethical food choices. These outlets often source cage-free eggs from nearby farms, which appeals to consumers who prioritize freshness and support for local businesses.

Online sales are growing rapidly as consumers seek more convenient purchasing options. This channel offers the advantage of direct home deliveries and the ability to easily compare prices and read product reviews. As more consumers become accustomed to online shopping, the market share of online egg sales is expected to increase, driven by the demand for convenience and the rising trend of digital purchasing.

Each distribution channel complements the others, ensuring that cage-free eggs are accessible to a broad spectrum of consumers, from those who shop in person at large retail outlets to those who prefer the convenience of online ordering.

Key Market Segments

By Colour

- White

- Brown

By Size

- Small & Medium

- Large

- Extra Large

- Jumbo

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Independent Retailers

- Online Sales

Drivers

Increasing Consumer Demand for Ethically Produced Food

A major driver of the Cage Free Eggs Market is the increasing consumer demand for ethically produced food. As awareness of animal welfare grows, more consumers are making purchasing decisions based on how food products are sourced and produced. Cage-free eggs are perceived as a more humane option compared to eggs from caged hens, as they allow chickens to exhibit natural behaviors such as walking, nesting, and spreading their wings, which are severely restricted in conventional cage systems.

This shift in consumer preferences is supported by various animal welfare organizations and campaigns that highlight the conditions in which many egg-laying hens live. As a result, both individual consumers and large corporations are moving towards more ethically responsible food products. Many major food service companies, retailers, and manufacturers have committed to sourcing only cage-free eggs, influencing supply chains and market trends.

Moreover, the trend towards ethical consumption extends beyond animal welfare, encompassing broader concerns about sustainability and environmental impact. Cage-free egg production often aligns with these values, as it can be part of more sustainable farming practices that use less intensive and environmentally damaging methods.

Legislative changes also reflect and reinforce this shift towards ethical food production. In several regions, laws are being introduced or proposed that mandate more humane conditions for farm animals, including egg-laying hens. These regulations not only encourage producers to adopt cage-free systems but also reassure consumers about the standardization of animal welfare practices, further driving demand.

Additionally, the label “cage-free” often enhances product value in the eyes of consumers, enabling producers to command a premium price. This perceived value is significant in competitive markets where consumers are willing to pay more for products that align with their ethical standards and personal beliefs.

Restraints

Higher Production Costs

A major restraint facing the Cage Free Eggs Market is the higher production costs associated with cage-free egg farming compared to conventional caged systems. Cage-free environments require more space per hen, leading to larger facilities or reduced bird density, which in turn increases land and building expenses. Additionally, cage-free systems often necessitate more complex management and labor due to the need to maintain the hens’ health and welfare in a more open environment. These factors contribute to higher operational costs, which can affect the profitability of egg producers.

The requirement for more space not only increases direct costs related to land and construction but also impacts indirect costs such as heating, cooling, and ventilation, which are more extensive in larger, open systems than in confined cage systems. Furthermore, cage-free systems typically have higher feed costs per egg produced because hens in these systems tend to be less feed-efficient and more active, leading to greater feed consumption overall.

Another significant cost factor is the management of hen welfare. Cage-free systems expose hens to a higher risk of injuries and feather pecking, which can result in increased veterinary costs and higher mortality rates. Ensuring proper environmental enrichment and managing hen behavior to reduce stress and aggression requires careful planning and continuous oversight, adding to labor costs.

These increased production costs often translate to higher prices for consumers, which can limit market growth, especially in price-sensitive markets. While many consumers express a preference for ethically produced eggs, the actual purchasing decision can still hinge on price, particularly in economic downturns or among price-sensitive consumer segments.

Moreover, transitioning from a cage to a cage-free system involves significant upfront investment in new infrastructure and training for farm workers, which can be a deterrent for existing producers considering switching to cage-free production. The initial cost and disruption of such a transition can be substantial, potentially delaying or discouraging producers from making the change despite the growing demand for cage-free eggs.

Opportunity

Increasing Regulatory Support and Consumer Advocacy

A significant opportunity within the Cage Free Eggs Market arises from increasing regulatory support and consumer advocacy for more humane animal treatment. As public awareness of animal welfare grows, governments and regulatory bodies around the world are increasingly implementing and enforcing standards and regulations that promote the welfare of farm animals, including egg-laying hens. This regulatory environment is creating a more level playing field, where cage-free egg production is becoming the norm rather than the exception.

Many regions have already introduced legislation that either bans or phases out conventional battery cages, mandating more humane alternatives such as cage-free systems. These legal changes not only ensure better living conditions for hens but also push egg producers toward adopting cage-free practices. This transition is often supported by subsidies, grants, or tax breaks, which can alleviate some of the financial burdens associated with switching to cage-free systems.

Moreover, consumer advocacy groups are playing a pivotal role in shaping market dynamics by conducting awareness campaigns and lobbying for stricter animal welfare laws. Their efforts help keep animal welfare in public discourse, influencing consumer preferences and encouraging more ethical consumption patterns. As consumers become more ethically conscious, the demand for cage-free eggs is expected to rise, providing a growing market for producers who are ready to meet these new standards.

This trend towards ethical consumption is not limited to individual consumers but is also being embraced by large corporations, particularly in the food service and retail sectors. Many companies have committed to sourcing only cage-free eggs by certain deadlines, driven by both ethical considerations and consumer demand. This corporate shift not only expands the market for cage-free eggs but also reinforces the trend towards more sustainable and responsible food production practices across the supply chain.

Trends

Corporate Commitment to Cage-Free Sourcing

A major trend shaping the Cage Free Eggs Market is the growing commitment from large corporations, especially those in the food service and retail sectors, to switch to cage-free eggs. This shift is largely driven by increasing consumer demand for transparency and ethical standards in food production. As public awareness and concern over animal welfare continue to rise, companies are recognizing the importance of aligning their sourcing policies with consumer values to maintain brand loyalty and market competitiveness.

Prominent global corporations, including multinational fast-food chains, grocery store chains, and food manufacturers, have publicly pledged to source only cage-free eggs by set deadlines. These commitments often come in response to consumer advocacy campaigns and the broader social movement toward sustainable and humane practices. The influence of these corporate decisions is substantial, leading to significant changes in supply chain practices and increased demand for cage-free eggs across various markets.

This trend is not only limited to Western countries but is also gaining momentum in emerging markets where urbanization and rising incomes are enabling more consumers to make choices based on ethical considerations. As a result, egg producers worldwide are increasingly transitioning to cage-free systems to meet this new corporate and consumer demand, ensuring their place in supply chains that are now prioritizing animal welfare.

Furthermore, the move towards cage-free eggs is often part of a broader corporate responsibility strategy that includes sustainability and environmental stewardship. Companies are using their commitment to cage-free eggs as a way to demonstrate their overall dedication to making positive social and environmental impacts. This not only appeals to ethically minded consumers but also to investors who are increasingly attentive to environmental, social, and governance (ESG) criteria.

Regional Analysis

The Asia Pacific region is poised to lead the global Cage Free Eggs Market, capturing a significant market share of 41%. This robust growth is primarily driven by increasing consumer demand for ethically produced eggs in crucial applications such as food services and retail sectors.

The surge in cage-free egg production in countries like China, India, and various Southeast Asian nations, including Korea, Thailand, Malaysia, and Vietnam, is expected to drive market expansion across the region during the forecast period. This growth trajectory is supported by the region’s expanding food industry, rising disposable incomes, and growing consumer awareness regarding animal welfare and sustainable farming practices.

In North America, economic prosperity, coupled with the growth of industries that rely on ethically sourced products, is anticipated to boost the demand for cage-free eggs. The region’s focus on ethical farming practices, coupled with the increasing emphasis on natural and organic food ingredients, further propels this demand, positioning North America as a pivotal market for cage-free eggs.

Europe is also projected to witness substantial growth in the Cage Free Eggs Market. This growth is driven by the growing consumer preference for eggs from farms that provide better living conditions for hens, as well as the increasing demand from the food processing and hospitality sectors. Europe’s stringent animal welfare regulations contribute to the rising adoption of cage-free eggs, enhancing their appeal in consumer markets.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the burgeoning cage-free eggs market, several key players have emerged as leaders, each contributing to the industry’s growth and evolution. Cal-Maine Foods, Inc., a prominent figure in the United States, has expanded its production and distribution channels to meet the escalating demand for ethically sourced eggs. Pilgrim’s Pride Corporation, a major poultry producer, has strategically invested in cage-free egg production to adapt to shifting consumer preferences and regulatory standards.

Market Key Players

- Avril Group

- Cal-Maine Foods, Inc

- Eggland’s Best, LLC

- Farm Pride Foods Ltd.

- Granja Agas SA

- Herbruck’s Poultry Ranch, Inc.

- Hickman’s Family Farms

- Hillandale Farms

- Kuramochi Sangyo Co., Ltd.

- Lintz Hall Farm

- Midwest Poultry Services L.P.

- Pazo de Vilane S.L

- Rembrandt Enterprises, Inc.

- Rose Acre Farms Inc.

- Sparboe Companies

- St Ewe Free Range Eggs LLP

- Sunny Queen Farms Pty Ltd

- The Lakes Free Range Egg Co Ltd

- Trillium Farm Holdings, LLC

- Versova

- Weaver Brothers Inc.

- Weaver Egg

Recent Development

In July 2023, Avril Group implemented innovative farming practices to further enhance the welfare of hens in its cage-free systems, garnering positive attention from consumers and industry stakeholders.

By February 2023 Cal-Maine Foods, the company had expanded its cage-free egg offerings, introducing new product lines tailored to meet evolving consumer preferences.

Report Scope

Report Features Description Market Value (2023) USD 4.5 Bn Forecast Revenue (2033) USD 7.4 Bn CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Colour(White, Brown), By Size(Small and Medium, Large, Extra Large, Jumbo), By Distribution Channel( Supermarkets/Hypermarkets, Convenience Stores, Independent Retailers, Online Sales) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Avril Group, Cal-Maine Foods, Inc, Eggland’s Best, LLC, Farm Pride Foods Ltd., Granja Agas SA, Herbruck’s Poultry Ranch, Inc., Hickman’s Family Farms, Hillandale Farms, Kuramochi Sangyo Co., Ltd., Lintz Hall Farm, Midwest Poultry Services L.P., Pazo de Vilane S.L, Rembrandt Enterprises, Inc., Rose Acre Farms Inc., Sparboe Companies, St Ewe Free Range Eggs LLP, Sunny Queen Farms Pty Ltd, The Lakes Free Range Egg Co Ltd, Trillium Farm Holdings, LLC, Versova, Weaver Brothers Inc., Weaver Egg Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Cage Free Eggs Market?Cage Free Eggs Market size is expected to be worth around USD 7.4 billion by 2033, from USD 4.5 billion in 2023

What CAGR is projected for the Cage Free Eggs Market?The Cage Free Eggs Market is expected to grow at 5.1% CAGR (2024-2033).Name the major industry players in the Cage Free Eggs Market?Avril Group, Cal-Maine Foods, Inc, Eggland's Best, LLC, Farm Pride Foods Ltd., Granja Agas SA, Herbruck's Poultry Ranch, Inc., Hickman's Family Farms, Hillandale Farms, Kuramochi Sangyo Co., Ltd., Lintz Hall Farm, Midwest Poultry Services L.P., Pazo de Vilane S.L, Rembrandt Enterprises, Inc., Rose Acre Farms Inc., Sparboe Companies, St Ewe Free Range Eggs LLP, Sunny Queen Farms Pty Ltd, The Lakes Free Range Egg Co Ltd, Trillium Farm Holdings, LLC, Versova, Weaver Brothers Inc., Weaver Egg

-

-

- Avril Group

- Cal-Maine Foods, Inc

- Eggland's Best, LLC

- Farm Pride Foods Ltd.

- Granja Agas SA

- Herbruck's Poultry Ranch, Inc.

- Hickman's Family Farms

- Hillandale Farms

- Kuramochi Sangyo Co., Ltd.

- Lintz Hall Farm

- Midwest Poultry Services L.P.

- Pazo de Vilane S.L

- Rembrandt Enterprises, Inc.

- Rose Acre Farms Inc.

- Sparboe Companies

- St Ewe Free Range Eggs LLP

- Sunny Queen Farms Pty Ltd

- The Lakes Free Range Egg Co Ltd

- Trillium Farm Holdings, LLC

- Versova

- Weaver Brothers Inc.

- Weaver Egg