Global Cable Management System Market By Product Type (Cable Trays, Boxes, Connectors, and Distribution Boards, Cable Trunks, Cable Conduits, Other Product Types), By Material Type (Non-Metallic, Metallic), By End-Use Industry (IT & Telecommunications, Manufacturing, Oil & Gas, Healthcare, Energy & Utilities, Construction, Other End-Use Industries), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: Jan. 2024

- Report ID: 12156

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

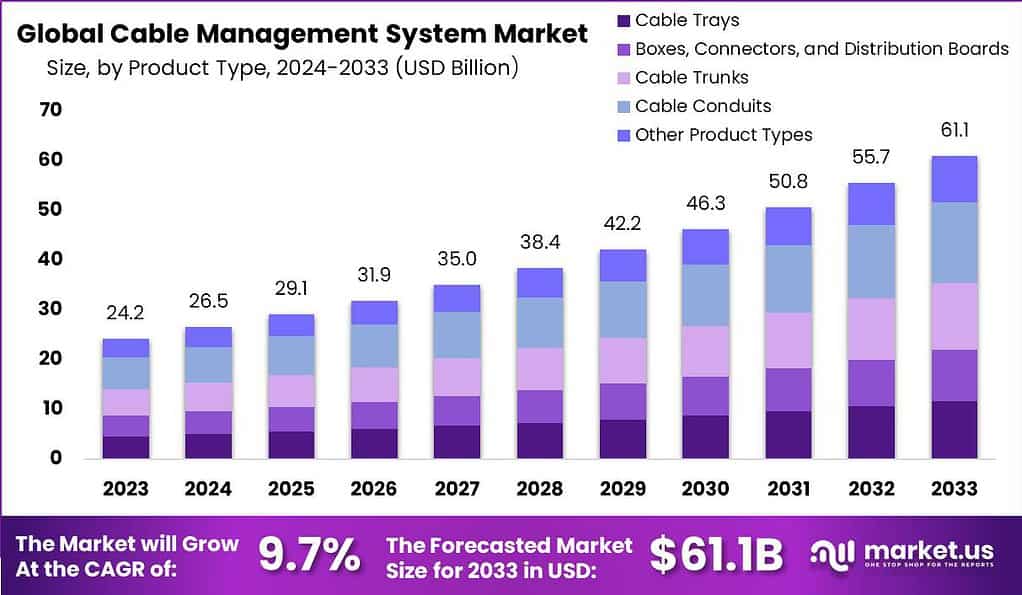

The Global Cable Management System Market size is expected to be worth around USD 61.1 Billion by 2033 from USD 24.2 Billion in 2023, growing at a CAGR of 9.7% during the forecast period from 2024 to 2033.

A cable management system refers to a set of products and techniques used to organize, protect, and manage cables in various settings. It involves the arrangement, routing, and containment of cables to ensure they are organized, easily accessible, and free from damage or interference. A cable management system helps to maintain a neat and tidy appearance, improves safety by reducing tripping hazards, and facilitates efficient maintenance and troubleshooting of cable connections.

The cable management system market refers to the industry that supplies and offers solutions for cable management needs. It involves the production, distribution, and installation of various cable management products and services. The market caters to a wide range of sectors, including construction, IT and telecommunications, manufacturing, energy, and utilities.

Analyst Viewpoint

Cable management systems are widely used in various industries, including information technology, telecommunications, construction, manufacturing, energy, and utilities. These systems are essential for organizing and protecting cables in these sectors, ensuring efficient connectivity and minimizing potential hazards.

The demand for cable management systems is driven by the increasing need for advanced IT infrastructure, such as data centers and cloud computing, which require organized and properly managed cable networks. The expansion of telecommunication networks, including the deployment of 5G technology, also fuels the demand for robust cable management solutions to support reliable and high-speed connectivity.

Technological advancements play a significant role in the cable management system market. Innovations in cable management products and techniques, such as the development of modular cable trays, advanced cable routing systems, and cable management software, enhance the efficiency and effectiveness of cable installations. These advancements enable easier installation, maintenance, and future upgrades of cable networks, meeting the evolving requirements of industries.

Key Takeaways

- The Cable Management System Market is expected to reach approximately USD 61.1 billion by 2033, with a steady Compound Annual Growth Rate (CAGR) of 9.7%. This growth is substantial, indicating a robust market.

- In 2023, Cable Conduits emerged as a dominant product category, capturing over 26.7% of the market share. This segment’s success is attributed to factors like secure cable protection, flexibility in installation, regulatory compliance, and energy efficiency.

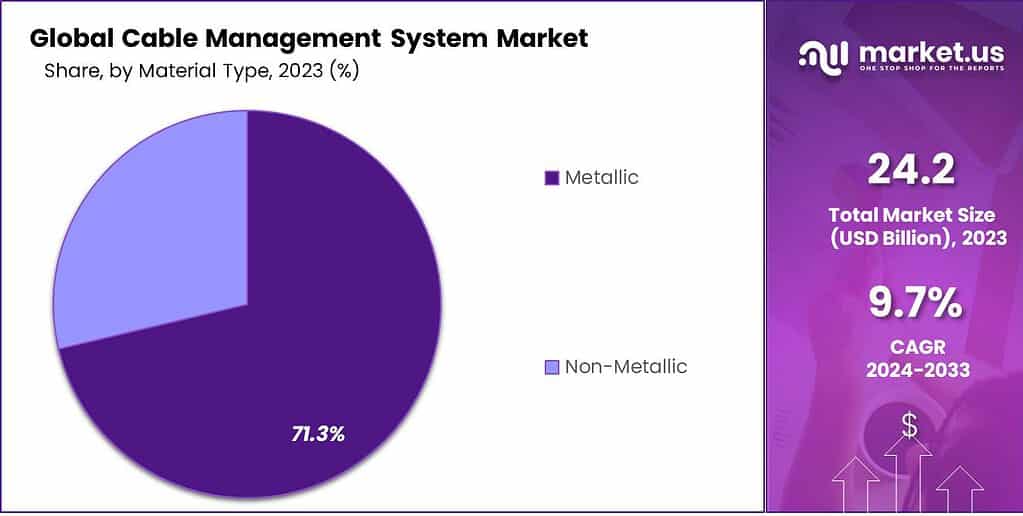

- Metallic cable management systems dominated with a market share of more than 71.3% in 2023. The durability, resistance to environmental factors, and versatility of metallic systems contributed to their popularity.

- The IT & Telecommunications segment was the leader in 2023, with a market share of over 25.4%. The expansion of these industries, adoption of advanced technologies, and investments in data centers drove the demand for cable management.

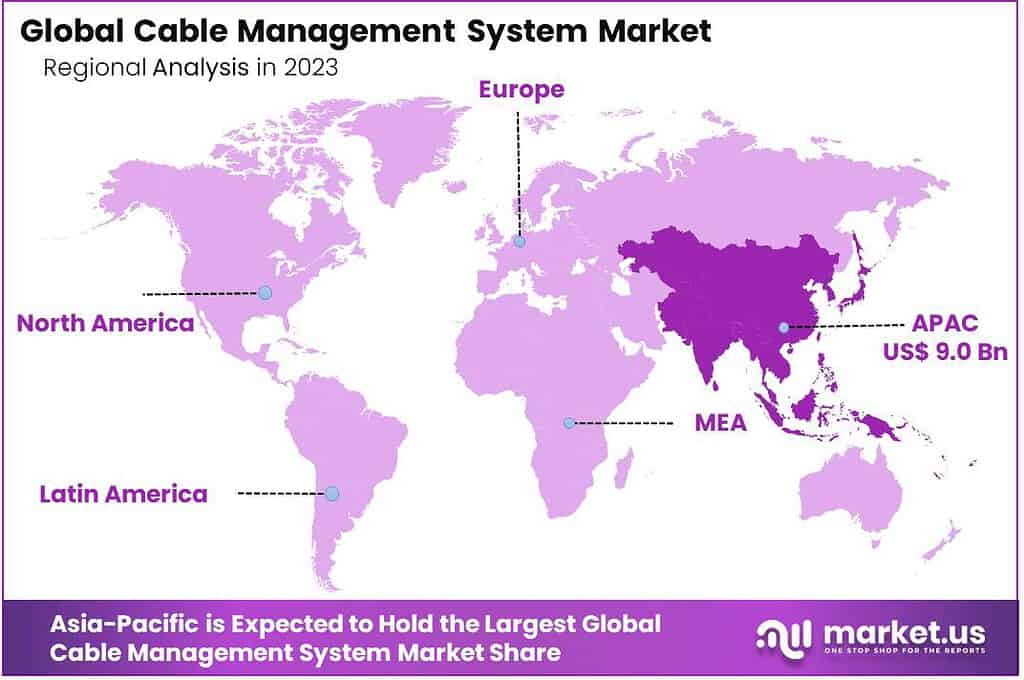

- Asia-Pacific dominated the market in 2023, with a market share of more than 37.3%. Factors contributing to its dominance include rapid industrialization, expansion of IT & telecommunications, government initiatives, and a strong manufacturing base.

Product Analysis

In 2023, the Cable Conduits segment emerged as a dominant force in the Cable Management System market, accounting for over 26.7% of the overall market share. This segment’s remarkable performance can be attributed to several factors. Firstly, cable conduits provide a secure and organized pathway for cables, ensuring protection against physical damage, moisture, and other environmental factors. This feature has significantly contributed to their widespread adoption across various industries, including construction, manufacturing, and telecommunications.

Moreover, cable conduits offer flexibility in terms of installation, allowing cables to be routed effortlessly in complex and demanding environments. This versatility has made cable conduits an ideal choice for large-scale projects where multiple cables need to be managed efficiently. Additionally, advancements in materials technology have led to the development of robust and durable conduits that can withstand harsh conditions, making them suitable for both indoor and outdoor applications.

Furthermore, regulatory compliance and safety standards have played a crucial role in driving the demand for cable conduits. Industries are required to adhere to strict guidelines to ensure the safety of personnel and equipment. Cable conduits help meet these standards by minimizing the risk of electrical hazards and ensuring compliance with industry-specific regulations.

The growing emphasis on energy efficiency and the increasing adoption of sustainable practices have further boosted the demand for cable conduits. These conduits not only facilitate the organization and protection of cables but also enable efficient cable management, reducing the energy losses associated with tangled or poorly routed cables.

Material Analysis

In 2023, the Metallic segment emerged as the dominant player in the cable management system market, capturing a significant market share of more than 71.3%. This segment’s remarkable performance can be attributed to several key factors that have propelled its growth and maintained its competitive edge.

One of the primary reasons for the dominance of the Metallic segment is its inherent durability and strength. Metallic cable management systems are often made from sturdy materials such as steel or aluminum, which provide robust protection and support for cables. This strength ensures the safe and reliable organization, routing, and protection of cables in various applications, including industries, commercial buildings, and data centers.

Furthermore, Metallic cable management systems offer excellent resistance to environmental factors such as heat, moisture, and corrosion. These systems are designed to withstand harsh conditions and provide long-lasting performance, making them suitable for use in demanding environments. This durability factor has significantly contributed to the segment’s popularity, as it ensures the longevity and reliability of cable management systems.

Additionally, Metallic cable management systems often offer a wide range of options and configurations to meet the diverse needs of end-users. They are available in various forms, such as cable trays, conduits, raceways, and trunking systems. This versatility allows for flexible installation and customization, accommodating different cable types, sizes, and routing requirements. By providing adaptable solutions, Metallic cable management systems have gained favor among users seeking tailored and efficient cable organization solutions.

Moreover, the Metallic segment has benefited from the growing demand for efficient power distribution and data transmission systems across various industries. With the increasing adoption of advanced technologies such as Internet of Things (IoT), artificial intelligence and cloud computing, the need for organized and reliable cable management has become paramount. Metallic cable management systems effectively address this requirement by ensuring proper cable routing, minimizing signal interference, and facilitating efficient maintenance and repairs.

End-Use Analysis

In 2023, the IT & Telecommunications segment emerged as the dominant player in the cable management system market, capturing a significant market share of more than 25.4%. This segment’s dominance can be attributed to several key factors that have contributed to its strong market position and sustained growth.

One of the primary reasons for the IT & Telecommunications segment’s dominance is the rapid expansion of the global information technology and telecommunications industries. With the increasing reliance on digital connectivity and the growing demand for high-speed data transmission, these sectors require efficient and organized cable management systems to ensure smooth operations. Cable management systems play a crucial role in these industries by providing effective cable routing, protection, and organization, which are essential for maintaining reliable communication networks and data centers.

Furthermore, the IT & Telecommunications segment has benefitted from the constant advancements in technology and the rising adoption of emerging technologies such as 5G, Internet of Things (IoT), and cloud computing. These technologies require extensive cabling infrastructure to support the transfer of large volumes of data and ensure uninterrupted connectivity. Cable management systems enable the effective installation, maintenance, and scalability of these complex network infrastructures, making them indispensable for IT and telecommunications companies.

Moreover, the IT & Telecommunications segment has witnessed significant investments and developments in data centers, both in terms of expansion and construction of new facilities. Data centers serve as the backbone of modern IT and telecommunications operations, hosting critical servers, networking equipment, and storage systems. Cable management systems play a vital role in these facilities, ensuring efficient cable organization, airflow management, and cable accessibility for quick maintenance and repairs. The increasing demand for data centers has consequently driven the adoption of cable management systems in the IT and telecommunications sector.

Additionally, the IT & Telecommunications segment’s dominance can be attributed to the sector’s stringent regulatory compliance requirements. Data security, privacy, and regulatory standards necessitate the implementation of robust cable management systems to maintain the integrity and confidentiality of data transmission. These systems help prevent signal interference, reduce the risk of cable damage or accidental disconnection, and facilitate easy identification and traceability of cables, ensuring compliance with industry regulations.

Key Market Segments

Product

- Cable Trays

- Boxes, Connectors, and Distribution Boards

- Cable Trunks

- Cable Conduits

- Others

Material

- Non-metallic

- Metallic

End Use

- IT & Telecom

- Oil & Gas

- Energy & Utilities

- Manufacturing

- Healthcare

- Commercial

- Public Infrastructure

- Residential

- Others

Driver

Increasing demand for efficient cable organization

The global cable management system market is being driven by the increasing demand for efficient cable organization across various industries. As industries such as IT & telecommunications, manufacturing, healthcare, and energy & utilities continue to grow, the need for organized cable management systems becomes paramount. These systems ensure proper cable routing, protection, and organization, which are vital for maintaining reliable communication networks, data centers, and power distribution systems.

With the rapid adoption of advanced technologies such as 5G, Internet of Things (IoT), and cloud computing, the volume of cables used in these industries has significantly increased. Efficient cable organization is essential to minimize signal interference, optimize airflow, and facilitate easy maintenance and repairs. Cable management systems provide the necessary infrastructure to achieve these objectives, driving their demand in the market.

Restraint

High installation and maintenance costs

A key restraint faced by the global cable management system market is the high cost associated with the installation and maintenance of these systems. Cable management systems often require skilled labor for proper installation, which can increase the overall project costs. Additionally, regular maintenance is necessary to ensure optimal performance and longevity of the systems, further adding to the expenses.

The high initial investment and ongoing maintenance costs can be a deterrent, especially for small and medium-sized enterprises (SMEs) with limited budgets. SMEs may find it challenging to allocate funds for cable management systems, potentially hindering market growth. Manufacturers and service providers need to address this restraint by offering cost-effective solutions and promoting the long-term benefits of efficient cable organization to overcome budget constraints.

Opportunity

Growing demand from emerging economies

The global cable management system market presents a significant opportunity with the growing demand from emerging economies. Countries in Asia-Pacific, Latin America, and Africa are experiencing rapid industrialization, urbanization, and infrastructure development. These regions are witnessing a surge in construction activities, the establishment of manufacturing facilities, and the expansion of telecommunications networks.

Infrastructure projects in these emerging economies require robust cable management systems to ensure efficient power distribution, communication networks, and data centers. The increasing demand for electricity, telecommunications services, and internet connectivity further fuels the need for reliable cable management solutions.

Market players can capitalize on this opportunity by expanding their presence in these regions, offering tailored solutions to meet the specific requirements of emerging economies. Collaborations with local partners, investment in distribution networks, and customization of products and services can help tap into the growing demand and drive market growth.

Challenge

Rapid technological advancements

The global cable management system market faces the challenge of keeping pace with rapid technological advancements. As new technologies emerge and existing ones evolve, the requirements for cable management systems may change. For instance, the implementation of 5G networks, smart factories, and IoT devices introduces new complexities and increases the density of cables.

Market players need to continuously innovate and develop new solutions to address these evolving needs. This includes designing cable management systems that can accommodate higher data transmission rates, handle increased cable density, and support advanced networking protocols.

Moreover, the challenge lies in ensuring compatibility and integration with other emerging technologies. Cable management systems must seamlessly integrate with intelligent building systems, automation platforms, and cloud-based management solutions to provide a holistic approach to cable organization.

Regional Analysis

In 2023, Asia-Pacific emerged as the dominant region in the global cable management system market, capturing a significant market share of more than 37.3%. This regional dominance can be attributed to several key factors that have contributed to its strong market position and growth. The demand for Cable Management System in North America reached US$ 9.0 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future.

One of the primary reasons for Asia-Pacific’s dominance is the region’s rapid industrialization and urbanization. Countries such as China, India, and Southeast Asian nations have witnessed substantial growth in manufacturing, infrastructure development, and commercial construction activities. These sectors require efficient cable management systems to support power distribution, data transmission, and communication networks. The increasing demand for organized cable management solutions in these industries has propelled the market in the Asia-Pacific region.

Furthermore, the region’s expanding IT & telecommunications sector has significantly contributed to the market’s growth. Asia-Pacific is home to some of the world’s largest and fastest-growing telecommunications markets. The rising adoption of advanced technologies, increasing internet penetration, and the demand for high-speed data transmission have created a need for robust cable management systems to ensure reliable communication networks. The deployment of 5G networks and the expansion of data centers have further fueled the demand for efficient cable organization solutions in the region.

Moreover, favorable government initiatives and investments in infrastructure development have boosted the market in Asia-Pacific. Governments in countries like China, India, and Japan have launched various programs to enhance their infrastructure, including the development of smart cities, transportation networks, and industrial parks. These initiatives require extensive cabling infrastructure and, consequently, drive the adoption of cable management systems.

In addition, the region’s strong manufacturing base and the presence of major electronics and automotive industries have contributed to the demand for cable management systems. The need for efficient cable routing and organization in manufacturing facilities and assembly lines has propelled the market in Asia-Pacific.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the realm of Cable Management Systems, several key companies have played pivotal roles, shaping the competitive landscape and influencing market dynamics. These industry leaders have been instrumental in driving innovation and providing cutting-edge solutions to meet the evolving needs of consumers and businesses alike.

Moreover, significant investments in research and development are being made by these stakeholders, with the goal of introducing a reliable and cost-effective management system. ABB Ltd. has emerged as a key player, capturing a significant market share attributed to its widespread global footprint. The company is dedicated to creating innovative products across various production units and distributing them through extensive networks in countries such as Germany, Brazil, the U.S., and China.

Biggest Companies in Cable Management System Market

- ABB Ltd.

- Legrand SA

- Eaton Corporation plc

- Schneider Electric SE

- Chatsworth Products, Inc.

- Niedax Group

- Atkore International Group Inc.

- Enduro Composites

- Panduit Corporation

- Pemsa Cable Management Systems

- Oglaend System Group

- Leviton Manufacturing Company, Inc.

- Other Key Players

Recent Developments

- In 2023, Pemsa launched its innovative Metatray® range, featuring insulated cable trays. This not only protects cables from the environment but also offers fire resistance, making it ideal for sensitive applications.

- In 2023, Oglaend System Group: Oglaend acquired Hilti Firestop, a leading provider of passive fire protection solutions. This strengthens Oglaend’s position in the fire safety segment within cable management.

Report Scope

Report Features Description Market Value (2023) US$ 24.2 Bn Forecast Revenue (2033) US$ 61.1 Bn CAGR (2024-2033) 9.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cable Trays, Boxes, Connectors, and Distribution Boards, Cable Trunks, Cable Conduits, Other Product Types), By Material Type (Non-Metallic, Metallic), By End-Use Industry (IT & Telecommunications, Manufacturing, Oil & Gas, Healthcare, Energy & Utilities, Construction, Other End-Use Industries) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape ABB Ltd., Legrand SA, Eaton Corporation plc, Schneider Electric SE, Chatsworth Products Inc., Niedax Group, Atkore International Group Inc., Enduro Composites, Panduit Corporation, Pemsa Cable Management Systems, Oglaend System Group, Leviton Manufacturing Company Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a Cable Management System?A cable management system is a set of products and solutions designed to organize and secure cables, wires, and cords in various applications, ensuring a neat and efficient infrastructure.

How big is Cable Management System Market?The Global Cable Management System Market size is expected to be worth around USD 61.1 Billion by 2033 from USD 24.2 Billion in 2023, growing at a CAGR of 9.7% during the forecast period from 2024 to 2033.

Who are the key players operating in the Market?The market include ABB Ltd., Legrand SA, Eaton Corporation plc, Schneider Electric SE, Chatsworth Products Inc., Niedax Group, Atkore International Group Inc., Enduro Composites, Panduit Corporation, Pemsa Cable Management Systems, Oglaend System Group, Leviton Manufacturing Company Inc., Other Key Players

What factors drive the growth of the Cable Management System Market?Increasing demand for organized cabling infrastructure, rapid industrialization, and the need for efficient cable protection in the IT and telecommunication sectors are key drivers of market growth.

Which regions show significant growth in the Cable Management System Market?In 2023, Asia-Pacific emerged as the dominant region in the global cable management system market, capturing a significant market share of more than 37.3%.

Cable Management System MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample

Cable Management System MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Legrand SA

- Eaton Corporation plc

- Schneider Electric SE

- Chatsworth Products, Inc.

- Niedax Group

- Atkore International Group Inc.

- Enduro Composites

- Panduit Corporation

- Pemsa Cable Management Systems

- Oglaend System Group

- Leviton Manufacturing Company, Inc.

- Other Key Players