Global Life Sciences Software Market By Deployment Mode (Cloud-based and On-premises), By End-User (Pharmaceuticals, Biotechnology, Academic & Research Institutions and Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 48012

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

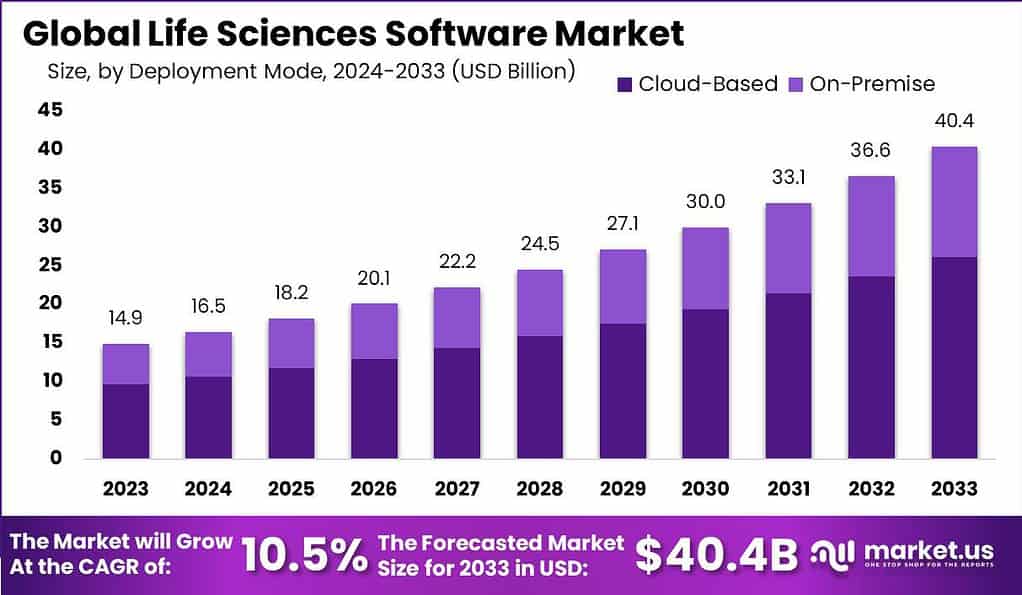

The Global Life Sciences Software Market size is expected to be worth around USD 40.4 Billion by 2033, from USD 14.9 Billion in 2023, growing at a CAGR of 10.5% during the forecast period from 2024 to 2033.

Life Sciences Software encompasses a broad range of applications designed to support the operations, research, and regulatory compliance needs of organizations within the pharmaceutical, biotechnology, and medical device industries. This software category includes solutions for laboratory information management systems (LIMS), clinical trial management systems (CTMS), electronic lab notebooks (ELN), patient registry databases, and more.

The Life Sciences Software Market is witnessing significant growth, driven by the increasing demand for digitization and automation across the life sciences industry. Factors such as the rising focus on precision medicine, the growth of biopharmaceutical research, and the need for more efficient regulatory compliance mechanisms are fueling this expansion.

As organizations continue to seek ways to reduce time-to-market for new therapies and enhance research and development productivity, the demand for integrated, scalable life sciences software solutions is expected to rise, propelling the market forward. This growth is further supported by the ongoing shift towards personalized medicine and the global emphasis on improving healthcare outcomes, positioning life sciences software as an indispensable tool in the modern healthcare and biotech landscapes.

The life sciences software sector has experienced a notable fluctuation in private funding and investment patterns, as evidenced by recent data. In the year-to-date (YTD) for 2023, the sector witnessed investments amounting to $20.5 billion across 462 deals, according to PitchBook data.

This figure represents a significant 44% decrease in deal value when juxtaposed with the corresponding period in 2022. Despite this decline in investment volume, the number of deals executed remains relatively stable, underscoring a sustained interest in the sector albeit at lower valuation levels or investment sizes per deal.

The year 2022 was marked by robust private funding and investments in life sciences software startups, with the total investment reaching $5.3 billion across 260 deals globally. This period was highlighted by several significant mega-rounds, indicative of strong investor confidence in the sector’s growth potential.

Notably, Nautilus led the way with a $191 million investment, followed closely by Benchling, which secured $150 million, and Starburst Health, raising $100 million. These substantial investments underscored the perceived value and innovation potential within the life sciences software domain.

Furthermore, the aggregate investment in life sciences software companies globally in 2022 reached an impressive $36.8 billion, distributed across 786 deals, as reported by PitchBook. This investment activity was not limited to mega-rounds but also included other key funding rounds such as $75 million for Cradle, $70 million for Strateos, and $55 million for Octant.

Key Takeaways

- The life sciences software market is projected to witness substantial expansion, with an estimated CAGR of 10.5% from 2024 to 2033, reaching a value of USD 40.4 billion by 2033.

- Despite fluctuations in private funding, the sector has seen significant investments, with notable rounds in 2022 reaching $36.8 billion globally. Major players like Thermo Fisher Scientific and IQVIA are leading the way with strategic acquisitions and partnerships.

- In 2023, the Cloud-Based segment held a dominant market position in the Life Sciences Software Market, capturing more than a 64.7% share.

- In 2023, the Pharmaceutical Companies segment held a dominant market position in the Life Sciences Software Market, capturing more than a 42.9% share.

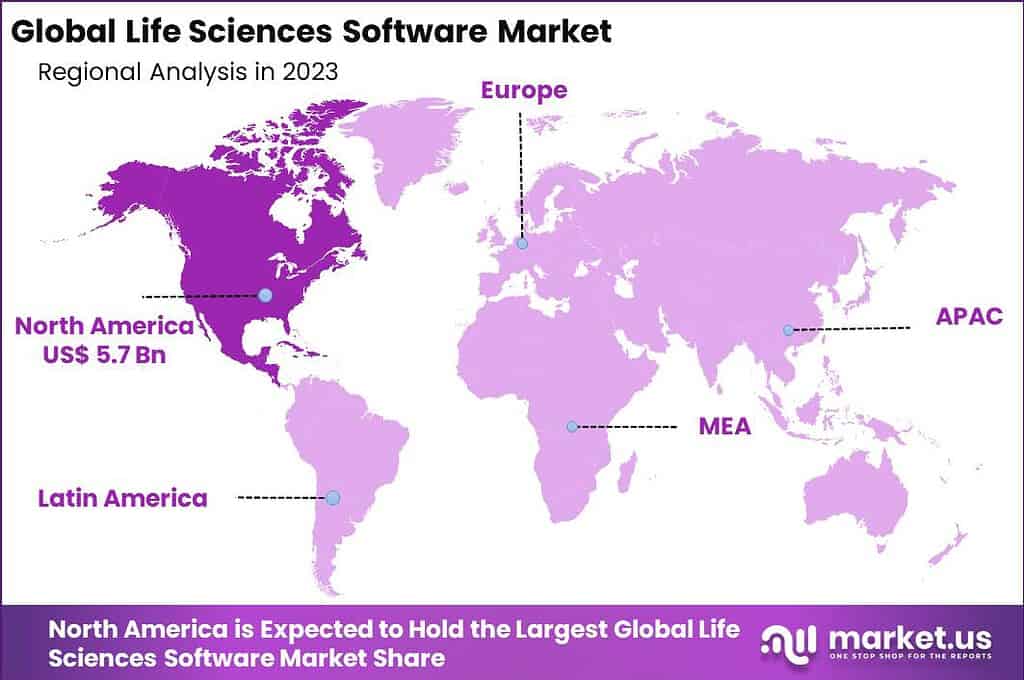

- In 2023, North America held a dominant market position in the Life Sciences Software Market, capturing more than a 38.4% share.

Deployment Mode Analysis

In 2023, the Cloud-Based segment held a dominant market position in the Life Sciences Software Market, capturing more than a 64.7% share. This substantial market share can be attributed to the escalating demand for scalable, flexible, and cost-effective software solutions within the life sciences sector. Cloud-based platforms offer several advantages over traditional on-premises solutions, including reduced IT infrastructure costs, enhanced data security, and the ability to easily scale up or down based on the organization’s needs.

Furthermore, the cloud facilitates seamless collaboration among researchers and healthcare professionals across different geographic locations, enabling real-time data sharing and analysis. This is particularly crucial in the life sciences field, where collaborative research and data analysis play a pivotal role in advancing medical research and drug development.

The dominance of the Cloud-Based segment is also bolstered by the rapid digital transformation within the healthcare and life sciences industries. As organizations increasingly move towards digital operations, the integration of cloud-based software becomes essential to manage vast amounts of data generated from research, clinical trials, and patient care.

Cloud-based life sciences software provides the agility and efficiency required to process, store, and analyze this data, supporting faster decision-making and innovation. Additionally, regulatory compliance is a key consideration in the life sciences sector, and cloud-based solutions often offer robust security features and compliance tools designed to meet stringent data protection standards.

Moreover, the ongoing pandemic has underscored the importance of cloud-based systems in ensuring business continuity and enabling remote work capabilities. The ability of cloud-based life sciences software to support remote research activities, virtual clinical trials, and telemedicine consultations has further accelerated its adoption.

With the growing emphasis on personalized medicine and patient-centric approaches, the demand for cloud-based solutions that can handle complex data workflows and support advanced analytics is expected to continue rising. This trend underscores the cloud-based segment’s leading position in the market, driven by its ability to address the evolving needs of the life sciences sector with flexibility, efficiency, and scalability.

End-User Insights

In 2023, the Pharmaceutical Companies segment held a dominant market position in the Life Sciences Software Market, capturing more than a 42.9% share. This leadership position originate from the critical role that digital technologies and software solutions play in modern pharmaceutical research, development, and operations. Pharmaceutical companies are at the forefront of adopting advanced software for drug discovery, clinical trials management, regulatory compliance, and supply chain optimization.

The need to accelerate the time-to-market for new drugs, coupled with the increasing complexity of regulatory requirements, drives these companies to invest in comprehensive life sciences software solutions. These tools not only streamline research and development processes but also enhance data management, analysis, and reporting capabilities, thereby improving efficiency and productivity.

The dominance of this segment is further reinforced by the growing emphasis on personalized medicine and patient-centric care. As pharmaceutical companies shift towards developing targeted therapies, the demand for sophisticated data analytics and management software that can handle vast amounts of genomic and clinical data increases.

Life sciences software facilitates the integration and interpretation of this data, supporting the identification of biomarkers and the optimization of treatment pathways. Moreover, the global push for digital transformation within the healthcare sector encourages pharmaceutical companies to leverage software solutions for better collaboration with healthcare providers, regulatory bodies, and patients, ensuring a more integrated approach to drug development and patient care.

Additionally, the ongoing challenges posed by the COVID-19 pandemic have highlighted the importance of agility and innovation in the pharmaceutical industry. Life sciences software has played a pivotal role in enabling rapid vaccine development, remote clinical trials, and real-time monitoring of drug efficacy and safety.

The ability of these software solutions to support decentralized trials, advanced data analytics, and regulatory submission processes has been instrumental in responding to the pandemic’s demands. As pharmaceutical companies continue to navigate the complexities of global health challenges, the reliance on life sciences software is expected to grow, further solidifying the segment’s leading position in the market.

Key Market Segments

Deployment Mode

- Cloud-based

- On-premises

End-User

- Pharmaceuticals

- Biotechnology

- Academic & Research Institutions

- Others

Driver

Accelerated Drug Development Processes

The imperative to expedite drug development processes serves as a significant driver in the life sciences software market. As global health challenges, including pandemics and chronic diseases, continue to rise, pharmaceutical companies and research institutions are under increasing pressure to accelerate the discovery, development, and delivery of new therapies. Life sciences software facilitates this acceleration by enabling more efficient data management, analysis, and collaboration across the drug development lifecycle.

Advanced software solutions offer streamlined workflows for clinical trials, regulatory compliance, and personalized medicine, significantly reducing the time and cost associated with bringing new drugs to market. This drive for speed and efficiency in drug development not only meets urgent healthcare needs but also provides competitive advantages for companies in the life sciences sector, fueling the demand for innovative software solutions.

Restraint

High Costs of Implementation

The high costs associated with implementing life sciences software solutions represent a significant restraint in the market. These costs are not limited to the initial purchase or subscription fees but also include expenses related to integration, customization, training, and ongoing maintenance. For many small to medium-sized enterprises (SMEs) and academic institutions, these financial requirements can be prohibitive, limiting their ability to adopt and leverage advanced software tools.

Furthermore, the complexity of some life sciences software solutions necessitates significant investment in training to ensure users can fully utilize the software’s capabilities. This financial barrier can slow down the adoption rate of new technologies within the sector, particularly among organizations with limited IT budgets, hindering the overall growth and technological advancement of the life sciences industry.

Opportunity

Integration of Artificial Intelligence and Machine Learning

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies presents a substantial opportunity in the life sciences software market. These technologies have the potential to transform various aspects of life sciences, from drug discovery and clinical trials to patient diagnostics and personalized medicine. AI and ML can analyze vast datasets more efficiently and accurately than traditional methods, uncovering insights and patterns that can lead to breakthroughs in research and treatment options.

The adoption of AI and ML within life sciences software not only enhances the efficiency and effectiveness of research and development activities but also opens new avenues for innovation and collaboration. As these technologies continue to evolve, their integration into life sciences software will likely drive significant market growth, offering companies the tools to tackle complex biological and medical challenges with unprecedented precision and speed.

Challenge

Data Security and Compliance

Ensuring data security and compliance with regulatory standards poses a major challenge in the life sciences software market. The life sciences sector deals with highly sensitive data, including patient information, proprietary research, and regulatory submissions. Protecting this data against breaches and ensuring compliance with global regulations such as GDPR, HIPAA, and others require sophisticated security measures and constant vigilance. As life sciences organizations increasingly rely on digital and cloud-based solutions, the complexity of managing data security and regulatory compliance grows.

The challenge lies in implementing robust security frameworks that can adapt to evolving threats and regulatory changes without impeding the accessibility and functionality of the software. Failure to adequately address this challenge can result in significant financial penalties, loss of trust, and potential harm to patients, underscoring the critical need for secure and compliant software solutions in the life sciences industry.

Regional Analysis

In 2023, North America held a dominant market position in the Life Sciences Software Market, capturing more than a 38.4% share. This importance is attributed to the region’s robust pharmaceutical and biotechnology sectors, coupled with a strong focus on research and development.

The demand for Life Sciences Software in North America was valued at US$ 5.7 billion in 2023 and is anticipated to grow significantly in the forecast period. North America, particularly the United States, is home to some of the world’s leading life sciences companies and research institutions, which are at the forefront of adopting advanced software solutions to enhance drug development, clinical trials, and patient care.

The region’s regulatory environment, led by the FDA, encourages the adoption of digital solutions to ensure compliance and efficiency in healthcare and life sciences operations. Additionally, the presence of a sophisticated healthcare IT infrastructure and a high degree of digital literacy among professionals further facilitate the integration of advanced software solutions, reinforcing North America’s leading position in the global market.

Europe follows closely, representing a significant market for life sciences software, driven by its advanced healthcare systems and strong emphasis on research and innovation. The European market benefits from substantial government and private investment in life sciences research, along with a regulatory framework that supports the adoption of digital health technologies.

Countries like Germany, the United Kingdom, and Switzerland are notable contributors to the region’s market share, leveraging life sciences software to streamline operations, enhance research capabilities, and improve patient outcomes. The push towards personalized medicine and the European Union’s strict data protection laws also play a crucial role in driving the demand for secure and compliant software solutions.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The Life Sciences Software Market is characterized by the presence of several key players, each contributing to the evolution and growth of the sector through innovative solutions and strategic initiatives. These companies are pivotal in driving advancements in drug discovery, clinical trials, regulatory compliance, and patient care through the deployment of cutting-edge software technologies.

Top Market Leaders

- Thermo Fisher Scientific Inc.

- IQVIA

- SAP SE

- IBM Corporation

- Oracle Corporation

- Medidata Solutions

- PerkinElmer, Inc.

- Veeva Systems Inc.

- LabWare, Inc.

- ArisGlobal

- Accenture plc

- SAS Institute

- Other Key Players

Recent Developments

1. Thermo Fisher Scientific Inc.:

- March 2023: Acquired Phactree, a provider of scientific data management solutions, to strengthen its informatics capabilities.

- June 2023: Launched the Ion Torrent G4 sequencing platform, offering improved speed and accuracy for genetic analysis.

- October 2023: Partnered with Microsoft to develop cloud-based solutions for life sciences research and development.

2. IQVIA:

- April 2023: Acquired RealWorld data and analytics specialist Clariness Life Sciences to enhance its real-world evidence capabilities.

- August 2023: Launched Orchestrated Clinical Trials, a new platform for streamlining clinical trial operations.

- November 2023: Partnered with Accenture to offer consulting services for life sciences digital transformation.

Report Scope

Report Features Description Market Value (2023) US$ 14.9 Bn Forecast Revenue (2033) US$ 40.4 Bn CAGR (2024-2033) 10.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Mode (Cloud-based and On-premises), By End-User (Pharmaceuticals, Biotechnology, Academic & Research Institutions and Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., IQVIA, SAP SE, IBM Corporation, Oracle Corporation, Medidata Solutions, PerkinElmer Inc., Veeva Systems Inc., LabWare Inc., ArisGlobal, Accenture plc, SAS Institute, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is life sciences software?Life sciences software refers to specialized software solutions designed to support various aspects of research, development, and commercialization in the life sciences industry, including pharmaceuticals, biotechnology, medical devices, and healthcare.

How big is Life Sciences Software Market?The Global Life Sciences Software Market size is expected to be worth around USD 40.4 Billion by 2033, from USD 14.9 Billion in 2023, growing at a CAGR of 10.5% during the forecast period from 2024 to 2033.

What are the primary applications of life sciences software?Life sciences software is used for drug discovery and development, clinical research, laboratory management, regulatory compliance, quality control, and patient management.

What are the challenges associated with implementing life sciences software?Challenges may include the complexity of integrating the software with existing systems, ensuring data security and compliance, and training staff to use the software effectively.

Who are the key players in the Life Sciences Software Market?Thermo Fisher Scientific Inc., IQVIA, SAP SE, IBM Corporation, Oracle Corporation, Medidata Solutions, PerkinElmer Inc., Veeva Systems Inc., LabWare Inc., ArisGlobal, Accenture plc, SAS Institute, Other Key Players are leading player in Life Sciences Software Market.

What factors are driving the growth of the life sciences software market?Factors such as the increasing complexity of drug development, the need for improved efficiency and productivity, and the growing importance of data-driven decision-making are driving market growth.

Life Sciences Software MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample

Life Sciences Software MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc.

- IQVIA

- SAP SE

- IBM Corporation

- Oracle Corporation

- Medidata Solutions

- PerkinElmer, Inc.

- Veeva Systems Inc.

- LabWare, Inc.

- ArisGlobal

- Accenture plc

- SAS Institute

- Other Key Players