Global Buy Now Pay Later Market By Channel (Online and Point Of Sale (POS)), By Enterprise Size (Large Enterprises and Small & Medium Enterprises), By End User (Banking, Financial Services & Insurance (BFSI), Consumer Electronics, Fashion & Garment, Healthcare, Leisure & Entertainment, Retail, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: May 2025

- Report ID: 103992

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

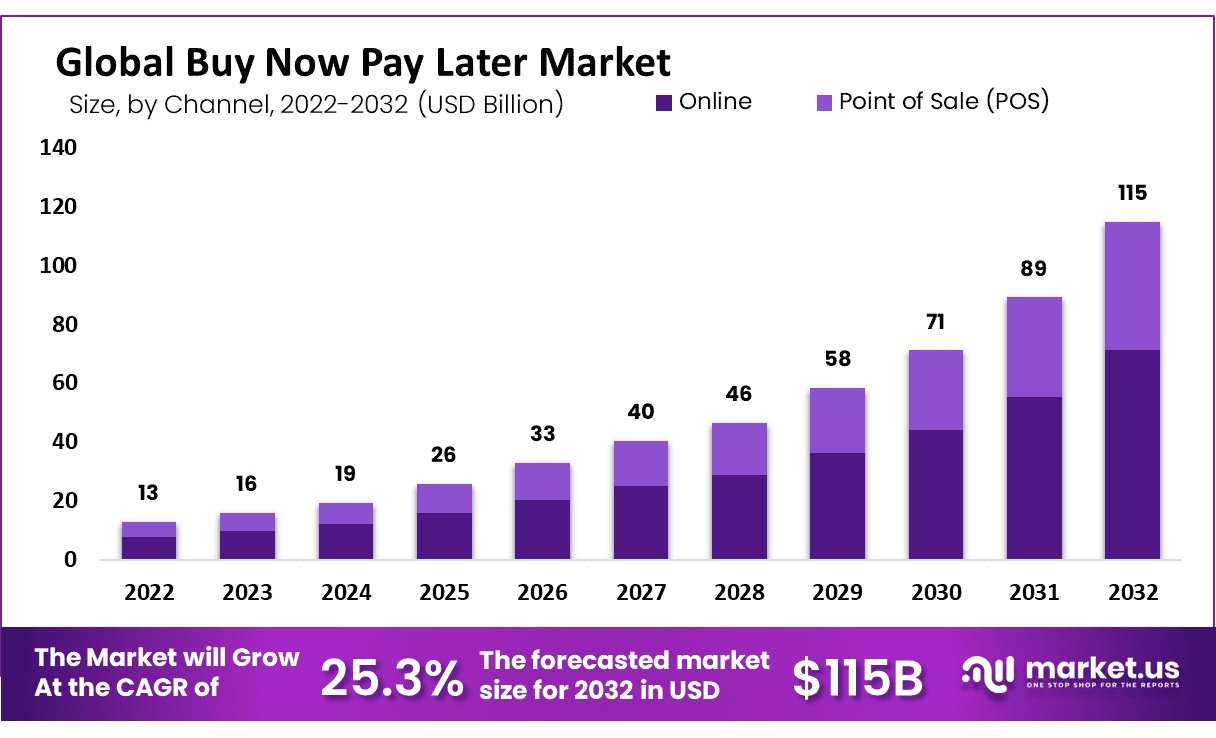

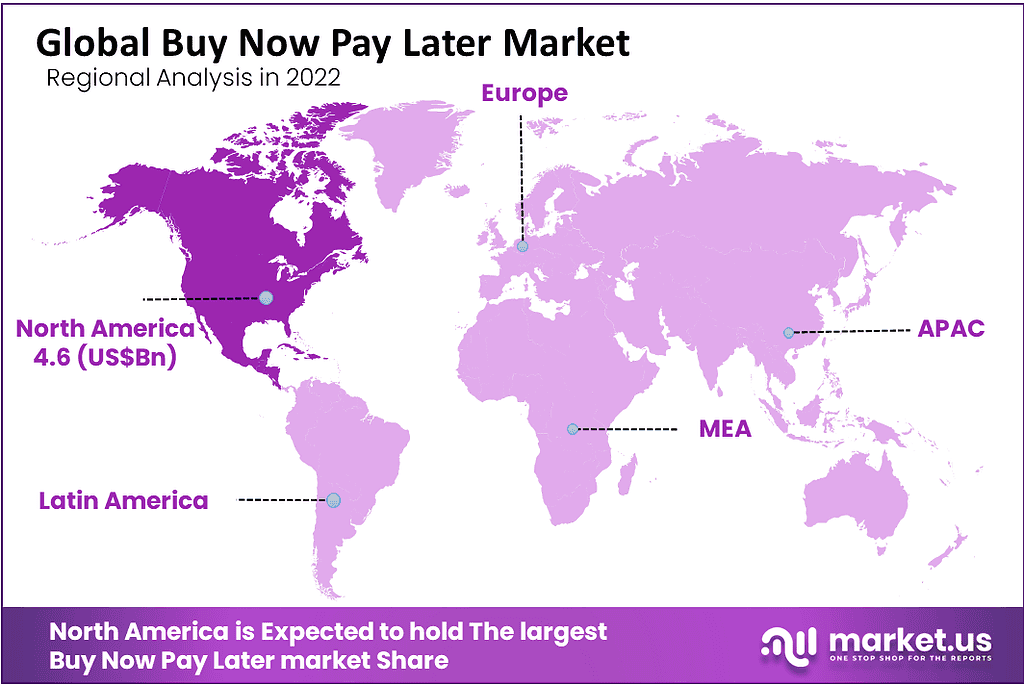

The Global Buy Now Pay Later Market size is expected to be worth around USD 115 Billion By 2032, from USD 16 Billion in 2023, growing at a CAGR of 25.3% during the forecast period from 2023 to 2032. In 2022, North America held a dominant market position in the Buy Now Pay Later (BNPL) market, capturing more than a 32% share, with revenues reaching approximately USD 4.6 billion.

Buy Now Pay Later is a payment option that allows customers to purchase items immediately and pay for them later, often in installments. This method usually doesn’t require upfront fees or interest if the customer pays back the money on time. BNPL is becoming a popular choice among shoppers for its flexibility and ease, especially for those who may not have the full amount to pay at the moment of purchase. This service is often offered through digital platforms at the point of sale, both online and in-store.

The Buy Now Pay Later market has experienced significant growth in recent years, driven by the rising demand for flexible payment solutions. Many retailers, both online and in physical stores, are partnering with BNPL providers to offer this service to their customers. The market’s expansion can be attributed to the increasing adoption of e-commerce, the popularity of digital payment methods, and consumers’ preference for interest-free installment plans.

The demand for Buy Now Pay Later (BNPL) services has increased significantly in recent years. This rise is driven by consumers, especially younger ones like millennials and Generation Z, who are looking for more flexible payment methods that align with their financial capabilities and shopping habits. Many consumers are turning to BNPL services to manage their finances more effectively, avoiding the high interest rates associated with traditional credit cards.

The convenience of spreading the cost of purchases over several payments without additional fees is also a strong draw, particularly for online shopping where instant gratification is a key selling point. The growing demand for BNPL services presents numerous opportunities for businesses and financial service providers. Retailers that integrate BNPL options at checkout can potentially increase their sales by making their products more accessible to a broader audience.

Additionally, there is an opportunity for innovation in financial services, as companies can develop new BNPL products that cater to specific needs of diverse consumer segments, such as tailored repayment plans. The expansion of BNPL into markets beyond retail, like healthcare and education, also offers new avenues for growth. Furthermore, as consumer behavior continues to evolve with digital shopping trends, BNPL providers who continually adapt and offer seamless, secure payment experiences are likely to thrive.

According to a February 2023 survey by Forbes Advisor, cash transactions have seen a significant decline, with only 9% of Americans using cash for shopping. In contrast, a substantial 54% of shoppers primarily utilize debit and credit cards for their purchases. This shift highlights a broader trend towards digital payment solutions.

Data from Adobe Analytics during the 2023 Amazon Prime Day Sale further underscores this shift, revealing a 20% increase in consumer preference for Buy Now, Pay Later (BNPL) plans compared to the previous year. This indicates a growing consumer interest in flexible payment options.

Furthermore, the U.S. Federal Reserve reports that credit card utilization is currently at around 21%. The integration of BNPL services into traditional credit card offerings could potentially increase U.S. credit limits to approximately USD 1.28 trillion by 2025. This integration could offer a substantial growth opportunity for banks, providing customers with increased flexibility in managing their credit.

The Bank of America Corp. projects that the BNPL market could expand by 10 to 15 times by 2025. This prediction aligns with broader market trends, suggesting a significant surge in the popularity and adoption of BNPL payment systems. Such growth prospects emphasize the shift towards more adaptable and user-friendly payment solutions in the financial services sector.

Key Takeaways

- The Buy Now Pay Later (BNPL) market is poised for substantial growth, with projections indicating its expansion from USD 16 billion in 2023 to an estimated USD 115 billion by 2032. This represents a robust compound annual growth rate (CAGR) of 25.3% throughout the forecast period from 2023 to 2032.

- In 2022, the online segment secured a commanding position within the BNPL market, accounting for over 62% of the market share. This dominance underscores the significant consumer preference for online shopping and the integration of BNPL services into e-commerce platforms.

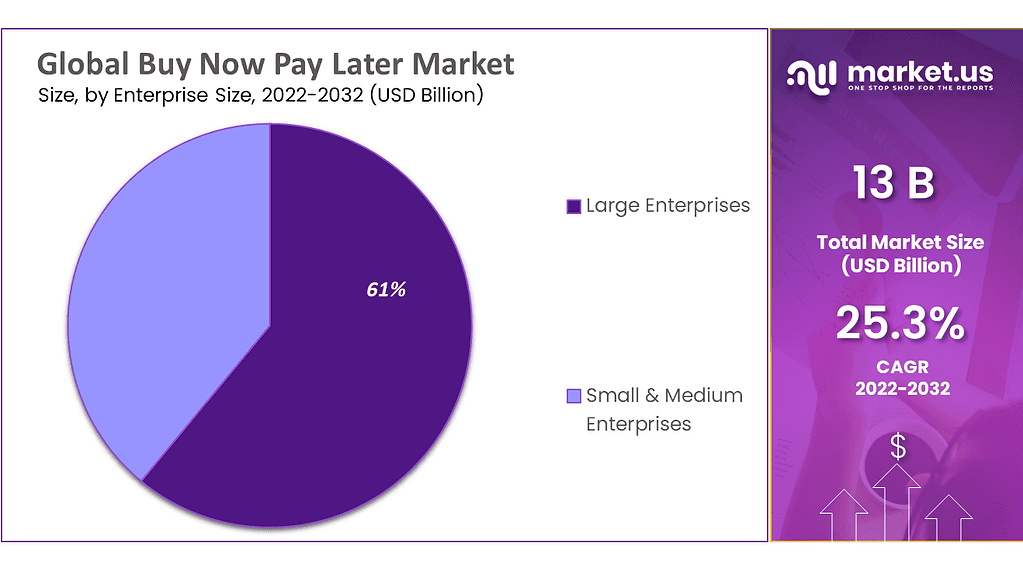

- Additionally, large enterprises emerged as the primary beneficiaries in the BNPL space, holding more than 61% of the market share in 2022. The adoption of BNPL solutions by these organizations reflects their strategic move to enhance customer acquisition and retention by offering flexible payment solutions.

- The retail sector also displayed a strong inclination towards BNPL services, capturing more than 71.3% of the market share in 2022. This significant adoption rate highlights the retail industry’s effort to boost sales and improve consumer purchasing power through deferred payment options.

- Regionally, North America led the BNPL market in 2022, with a share exceeding 32% and generating revenues around USD 4.6 billion. The region’s market leadership is attributed to the widespread acceptance of BNPL solutions among consumers and merchants, driven by the desire for more accessible and manageable payment methods.

Channel Analysis

In 2022, the Online segment held a dominant market position in the Buy Now Pay Later (BNPL) market, capturing more than a 62% share. This segment’s leadership is primarily driven by the global increase in e-commerce activities and the digital nature of online shopping. Consumers are increasingly turning to online platforms for their shopping needs, driven by the convenience of browsing products from home and the ease of comparing prices across different vendors.

BNPL options are seamlessly integrated into online payment systems, offering a smooth checkout process that appeals to the digital-savvy consumer base. The prevalence of BNPL in the online segment is further bolstered by the growing consumer preference for digital and contactless payments, which has been significantly accelerated by the COVID-19 pandemic.

As people became more accustomed to online shopping during lockdowns and social distancing, the demand for flexible payment solutions that could be easily managed from mobile devices or computers increased. BNPL providers capitalized on this trend by partnering with major e-commerce platforms and retailers, ensuring that they are a visible and attractive payment option during the checkout process.

Moreover, the online dominance in the BNPL market is supported by the technological advancements in financial technologies that enable real-time lending decisions and instant credit approval. This tech-driven approach fits perfectly with the fast-paced nature of online shopping, where consumers expect quick service and immediate gratification.

The integration of artificial intelligence and machine learning algorithms has also made it possible for BNPL services to offer personalized payment plans, increasing their attractiveness to consumers who seek customized shopping and payment experiences.

Enterprise Size Analysis

In 2022, the Large Enterprises segment held a dominant market position in the Buy Now Pay Later (BNPL) market, capturing more than a 61% share. This segment’s leadership is attributed to the substantial financial resources and extensive customer bases that large enterprises possess, which allow them to implement BNPL services more effectively across their sales channels.

Large enterprises often have the infrastructure and technological capabilities to integrate complex payment systems, making the adoption of flexible payment solutions like BNPL smoother and more scalable. Large enterprises also benefit from stronger brand recognition and consumer trust, which are crucial for the adoption of financial services like BNPL.

When a well-known retailer offers a BNPL option, consumers are more likely to use it due to the perceived security and legitimacy associated with the brand. Furthermore, these enterprises frequently engage in aggressive marketing campaigns and strategic partnerships with BNPL providers, which help to educate consumers about the benefits of using BNPL services and drive its adoption.

Additionally, large enterprises typically have a broader international presence, enabling them to offer BNPL services across different markets and regulatory environments. This global reach helps to diversify their consumer base and tailor BNPL offerings to fit regional consumer spending behaviors and preferences, thereby increasing the uptake of BNPL solutions. The ability to manage such complexities more effectively gives large enterprises a significant advantage over smaller businesses in leveraging the potential of BNPL services.

End-User Analysis

In 2022, the Retail segment held a dominant market position in the Buy Now Pay Later (BNPL) market, capturing more than a 71.3% share. This segment’s predominance is largely due to the natural alignment between retail shopping, both online and in-store, and the flexibility offered by BNPL services.

Retail consumers often face large one-time expenses, particularly in sectors like electronics, home furnishings, and fashion, where the ability to spread payments over time without interest can significantly ease financial burdens. This makes BNPL an attractive option for boosting purchasing power and driving sales.

The Retail segment’s success with BNPL is also driven by the increasing competition among retailers to offer superior customer experiences. BNPL services enhance the customer journey by providing a more accessible way to manage budgets, particularly during economic downturns when discretionary spending tightens.

By incorporating BNPL options, retailers can attract price-sensitive consumers who might otherwise hesitate to make bigger purchases. Additionally, the instant approval process and minimal upfront costs associated with BNPL encourage impulse buying, further boosting sales volumes for retailers.

Moreover, the integration of BNPL into retail aligns with broader digital transformation trends within the sector. As e-commerce continues to grow, the demand for seamless and flexible payment solutions that can be easily integrated into digital checkouts is increasing.

Retailers who adopt BNPL solutions are better positioned to capitalize on the surge in online shopping, providing a smoother checkout experience that can reduce cart abandonment rates and increase conversion.

Key Market Segments

Based on Channel

- Online

- Point of Sale

Based on Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

Based on End-User

- Banking, Financial Services & Insurance (BFSI)

- Consumer Electronics

- Fashion & Garment

- Healthcare

- Leisure & Entertainment

- Retail

- Other End-Users

Driver

Growth of E-commerce and Digital Payment Platforms

The Buy Now Pay Later (BNPL) market is primarily driven by the significant growth of e-commerce and the increasing adoption of digital payment methods across various sectors. As more consumers shop online, the demand for flexible payment options that allow for the distribution of payment over time without interest is rising.

This trend is supported by the broadening base of digital payment platforms that integrate BNPL services at the point of sale, both online and in-store, facilitating instant financial solutions for consumers. The integration of BNPL services into e-commerce platforms not only enhances consumer experience by offering financial flexibility but also increases merchant sales through higher conversion rates and average order values.

Restraint

Regulatory Scrutiny and Consumer Credit Risk

One significant restraint facing the BNPL market is the increasing regulatory scrutiny aimed at protecting consumers from potential financial risks. Regulators are concerned about over-indebtedness and are imposing stricter requirements on BNPL providers to ensure transparency and fairness in lending practices.

This includes mandates for more thorough credit assessments and clear communication of terms and conditions to consumers. These regulations aim to safeguard consumer interests while maintaining healthy market growth, but they also pose challenges for BNPL providers who must navigate complex regulatory landscapes and potentially face limitations on their operational flexibility.

Opportunity

Expansion into Diverse Market Segments

The BNPL sector presents substantial opportunities for expansion into various market segments, including healthcare, education, and large-ticket items like electronics and home appliances. As BNPL platforms diversify their services, they can tap into new customer bases that require flexible payment solutions for different types of expenses.

For example, in the healthcare sector, BNPL can offer patients a way to manage high out-of-pocket expenses over time, making medical care more accessible. Similarly, the education sector benefits from BNPL services by providing students and families with manageable payment plans for tuition and other fees. This expansion not only broadens the market reach of BNPL services but also enhances customer retention and satisfaction across different industries.

Challenge

Competition and Market Saturation

A major challenge in the BNPL market is the intense competition and potential market saturation as more companies enter this space. The increasing number of fintech companies offering BNPL services has led to a crowded marketplace, making it difficult for individual providers to maintain market share and profitability.

To stay competitive, companies must innovate continuously, improve customer service, and possibly reduce fees, which can impact their revenue streams. Additionally, the challenge of differentiating services in a highly competitive market pressures BNPL providers to offer more value to both merchants and consumers, potentially squeezing margins.

Emerging Trend

Integration with Major Retailers and Customization of Services

A significant emerging trend in the BNPL market is the strategic integration of BNPL services with major retail and e-commerce platforms. Major retailers are increasingly adopting BNPL solutions to improve the checkout experience and reduce cart abandonment rates.

This trend is complemented by the customization of BNPL offerings to meet specific consumer needs, such as tailored payment plans and integration with mobile and web applications for a seamless user experience. These integrations and customizations not only enhance the shopping experience but also foster loyalty and increase sales, positioning BNPL as a critical component of modern retail and e-commerce strategies.

Regional Analysis

In 2022, North America held a dominant market position in the Buy Now Pay Later (BNPL) market, capturing more than a 32% share, with revenues reaching approximately USD 4.6 billion. This leadership is largely attributed to the high penetration of e-commerce and advanced digital payment infrastructures prevalent in the region.

Consumers in North America are increasingly inclined towards convenient, flexible financial solutions that integrate seamlessly with their online shopping habits, making BNPL a preferred choice for many. The substantial growth of the BNPL market in North America is also fueled by the presence of major BNPL providers and fintech innovators who are continuously enhancing their offerings.

These companies are not only expanding their services to new retail partners but also innovating in the areas of mobile technology and customer experience. This innovation drives consumer adoption as BNPL options become more accessible and attractive through user-friendly apps and minimalistic, easy-to-understand terms.

Additionally, the regulatory environment in North America provides a fertile ground for the growth of BNPL services. While there is scrutiny to ensure consumer protection, regulations have also fostered a healthy competitive market where multiple BNPL services can coexist and flourish. This competition leads to better terms for consumers and more customized offerings, increasing the overall market uptake.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Emerging key players are focused on various strategic policies to develop their respective businesses in foreign markets. Several buy now pay later market companies are concentrating on expanding their existing operations and R&D facilities. Furthermore, businesses in the buy now pay later market are developing new products and portfolio expansion strategies through investments, mergers, and acquisitions.

In addition, several key players are now focusing on different marketing strategies, such as spreading awareness to boost the target products’ growth. With the presence of many local and regional players, the market for buy now pay later is fragmented. Market players are subject to intense competition from top players, particularly those with strong brand recognition and high distribution networks. Companies have gained various expansion strategies, such as partnerships and product launches, to stay on top of the market.

Top Key Players in the Market

- Affirm, Inc.

- Afterpay Pty Ltd

- Atome

- Flipkart Internet Private Limited

- Grab Holdings Inc.

- Hoolah Holdings Pte Ltd.

- Klarna Inc.

- LatitudePay Australia Pty Ltd

- Laybuy Group Holdings Limited.

- Mastercard International Incorporated

- Monzo Bank Limited

- One97 Communications Limited (Paytm)

- Openpay Pty Ltd.

- Payl8r (Social Money Ltd.)

- PayPal Holdings, Inc.

- Perpay Inc.

- Sezzle Inc

- SPLITIT USA INC.

- Zip Co Limited

- Other Key Players

Recent Developments

- In March 2025, Starlink Qatar entered into a strategic collaboration with PayLater, marking the rollout of Buy Now, Pay Later (BNPL) services across all Starlink retail outlets in Qatar. The initiative is designed to enhance consumer purchasing flexibility by enabling easy installment-based payments, allowing customers to align their spending with personal financial preferences.

- Earlier, in December 2024, equipifi partnered with Synergent to empower Synergent’s network of credit unions to launch their own BNPL offerings directly through digital banking applications. This partnership enables credit union members to split larger transactions into manageable installment loans, enhancing accessibility to short-term credit while maintaining a seamless digital experience.

- In September 2024, Sunbit and Stripe announced a strategic collaboration aimed at integrating Sunbit’s BNPL technology into Stripe’s payment infrastructure, particularly for in-person service businesses. Through this partnership, merchants using Stripe’s platform can offer Sunbit’s installment payment solutions, enhancing their ability to meet consumer demand for flexible financing options.

Report Scope

Report Features Description Market Value (2023) USD 16 Bn Forecast Revenue (2032) USD 115 Bn CAGR (2023-2032) 25.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Channel- Online, Point Of Sale (POS); By Enterprise Size – Large Enterprises, Small & Medium Enterprises; By End User- Banking, Financial Services & Insurance (BFSI), Consumer Electronics, Fashion & Garment, Healthcare, Leisure & Entertainment, Retail, and Other End-Users Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Affirm, Inc., Afterpay Pty Ltd, Atome, Flipkart Internet Private Limited, Grab Holdings Inc., Hoolah Holdings Pte Ltd., Klarna Inc., LatitudePay Australia Pty Ltd, Laybuy Group Holdings Limited., Mastercard International Incorporated, Monzo Bank Limited, One97 Communications Limited (Paytm), Openpay Pty Ltd., Payl8r (Social Money Ltd.), PayPal Holdings, Inc., Perpay Inc., Sezzle Inc, SPLITIT USA INC., Zip Co Limited, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Affirm, Inc.

- Afterpay Pty Ltd

- com, Inc.

- Atome

- Flipkart Internet Private Limited

- Grab Holdings Inc.

- Hoolah Holdings Pte Ltd.

- Klarna Inc.

- LatitudePay Australia Pty Ltd

- Laybuy Group Holdings Limited.

- Mastercard International Incorporated

- Monzo Bank Limited

- One97 Communications Limited (Paytm)

- Openpay Pty Ltd.

- Payl8r (Social Money Ltd.)

- PayPal Holdings, Inc.

- Perpay Inc.

- Sezzle Inc

- SPLITIT USA INC.

- Zip Co Limited

- Other Key Players