Global Butyl Phenol Market Report By Grade (Industrial Grade, Pharmaceutical Grade), By Application (Chemical, Lubricant, Pharmaceuticals, Rubber, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 123672

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

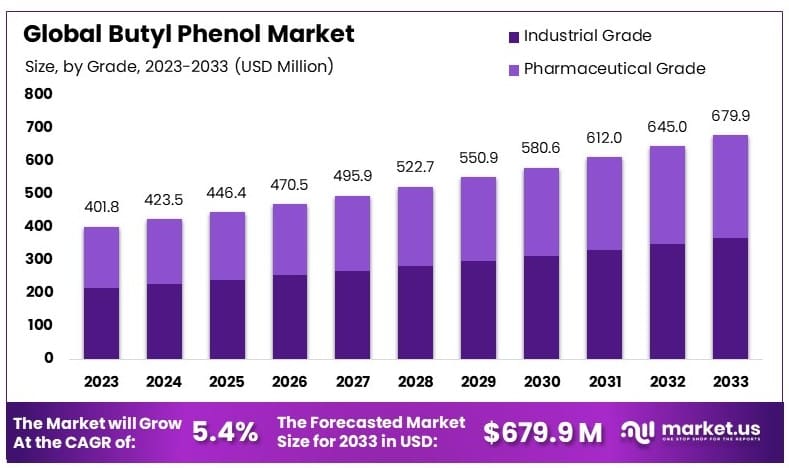

The Global Butyl Phenol Market size is expected to be worth around USD 679.9 Million by 2033, from USD 401.8 Million in 2023, growing at a CAGR of 5.4% during the forecast period from 2024 to 2033.

The butyl phenol market centers on chemical compounds used in producing resins, plastics, and lubricants. These compounds enhance product durability and performance. The market is driven by the demand for high-performance materials in automotive, construction, and industrial applications. Innovations in chemical synthesis improve product quality and environmental compliance.

The Butyl Phenol market is poised for significant growth driven by multiple industry applications and rising demand. In 2022, the global demand for phenol reached approximately 12 million metric tons, highlighting the extensive use of phenol derivatives in various sectors. Butyl phenol, a key derivative, finds substantial usage in the construction industry, where it is a critical component in manufacturing resins and adhesives. This sector’s steady growth bolsters the butyl phenol market.

Moreover, the agrochemical industry presents a notable growth avenue for butyl phenol. It serves as an intermediate in producing pesticides and herbicides, which are vital for modern agriculture. The global consumption of agricultural pesticides is expected to increase from 4.3 million metric tons in 2023 to approximately 4.41 million metric tons by 2027. This rise underscores the growing reliance on agrochemicals to meet food production demands, thereby driving butyl phenol consumption.

Technological advancements and innovations in production processes are further enhancing the efficiency and cost-effectiveness of butyl phenol manufacturing. Companies are investing in research and development to improve product quality and expand application areas. This trend is likely to open new market opportunities.

The butyl phenol market exhibits strong growth prospects, supported by its diverse applications in construction and agriculture. Continuous innovation and strategic investments will be crucial in capitalizing on emerging opportunities while addressing regulatory challenges.

Key Takeaways

- Butyl Phenol Market was valued at USD 401.8 million in 2023, and is expected to reach USD 679.9 million by 2033, with a CAGR of 5.4%.

- Industrial Grade dominates the grades with 54.1%, key for its broad industrial applications.

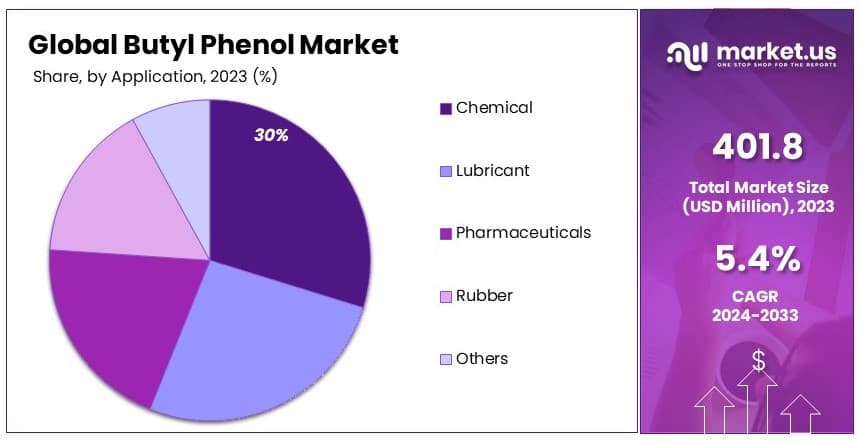

- Chemical segment leads in application with 30.3%, essential for various chemical processes.

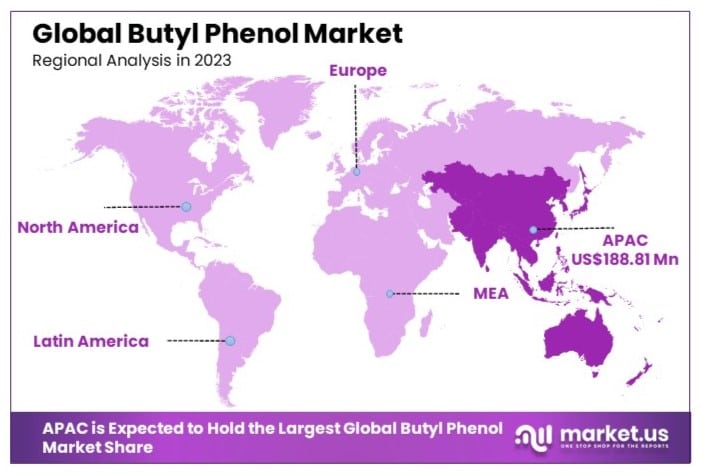

- APAC dominates the market with 42.3%, equivalent to a market value of USD 188.81 million, driven by extensive industrial activities.

Driving Factors

Increasing Demand from the Construction Industry Drives Market Growth

The construction industry significantly boosts the demand for butyl phenols. These chemicals are key intermediates in producing phenolic resins, used extensively in construction materials like insulation, adhesives, and coatings. The rise in construction activities, especially in developing regions, drives this demand. For example, booming infrastructure development in countries like China, India, and Southeast Asian nations has led to a surge in the need for construction materials, thereby increasing the consumption of butyl phenol. In 2022, the construction sector in Asia-Pacific was projected to grow by 5.8%, indicating a substantial rise in butyl phenol demand.

As construction projects expand, the need for high-quality materials grows. Butyl phenols, essential for durable and effective construction materials, see heightened demand. This growth in the construction sector directly impacts the butyl phenol market, underscoring the importance of these chemicals in modern construction practices. The synergy between construction activities and the use of butyl phenols fosters market expansion, ensuring a continuous supply to meet rising demands.

Rising Application in the Automotive Industry Drives Market Growth

The automotive industry’s continuous growth fuels the demand for butyl phenols. These chemicals are crucial in producing antioxidants and stabilizers for automotive plastics. The shift towards using more plastic components to reduce vehicle weight and improve fuel efficiency has driven the demand for butyl phenol-based additives. In 2023, the global automotive market was estimated to grow by 3.5%, reflecting the increasing need for high-performance materials.

Butyl phenols play a vital role in enhancing the durability and stability of automotive components. As the industry focuses on lightweight and fuel-efficient vehicles, the demand for butyl phenol-based products rises. This interaction between the automotive sector’s evolution and the need for specialized chemicals drives market growth. The ongoing advancements in automotive technology ensure a steady demand for butyl phenols, reinforcing their market position.

Growing Use in Agrochemicals and Pesticides Drives Market Growth

The agricultural sector’s focus on efficient crop protection and yield enhancement drives the demand for butyl phenols. These chemicals are precursors for synthesizing certain agrochemicals and pesticides. The need for effective herbicides and insecticides has led to the development of butyl phenol-based agrochemical formulations, particularly in regions with intensive agricultural activities. In 2022, the global agrochemicals market was projected to grow by 3.1%, highlighting the rising demand for butyl phenols.

Butyl phenols are essential for creating effective agricultural solutions. As the emphasis on crop protection grows, the need for high-quality agrochemicals increases. This demand directly impacts the butyl phenol market, promoting the development of new formulations to meet agricultural needs. The interaction between agricultural advancements and the use of butyl phenols fosters market growth, ensuring a continuous supply for crop protection and enhancement products.

Restraining Factors

Stringent Environmental Regulations Restrain Market Growth

The production and use of butyl phenol are subject to strict environmental regulations due to its potential toxicity and adverse effects on health and the environment. Compliance with these regulations increases operational costs and can limit market growth.

For example, in the European Union, the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations restrict the use of certain butyl phenol derivatives. This creates challenges for manufacturers and end-users who must invest in alternative processes or materials to meet these regulatory standards. The cost of compliance and the complexity of navigating different regional regulations can slow down market expansion and increase production costs.

Availability of Substitutes Restrains Market Growth

The availability of alternative compounds or substitutes for butyl phenol in various applications may hinder market growth. Manufacturers often opt for cheaper or more environmentally friendly alternatives to meet specific requirements and regulations.

For example, in the production of antioxidants for plastics, manufacturers might choose hindered phenolic antioxidants or phosphite antioxidants instead of butyl phenol. These alternatives can provide similar or improved performance while being more cost-effective or less harmful to the environment. The shift to substitutes reduces the demand for butyl phenol, thereby limiting its market growth and creating competitive pressures on butyl phenol producers.

Grade Analysis

Industrial Grade dominates with 54.1% due to its widespread use in various industries.

The Butyl Phenol market is primarily segmented by grade, with Industrial Grade being the dominant sub-segment, accounting for 54.1% of the market. This dominance is driven by its widespread use across multiple industries, including chemicals, lubricants, and rubber. Industrial Grade Butyl Phenol is favored for its excellent stability and effectiveness in various applications, making it a versatile and valuable component in industrial processes.

Industrial Grade Butyl Phenol is extensively used as an antioxidant in the production of rubber and plastics, enhancing the durability and lifespan of these materials. Its ability to prevent oxidation makes it a critical ingredient in the manufacturing of high-performance rubber products, such as tires and industrial belts. The demand for high-quality, long-lasting rubber products in the automotive and construction industries further drives the market for Industrial Grade Butyl Phenol.

In the chemical industry, Industrial Grade Butyl Phenol is utilized as an intermediate in the synthesis of other chemical compounds. Its chemical properties make it suitable for producing various derivatives used in the formulation of coatings, adhesives, and resins. The increasing demand for specialty chemicals and advanced materials boosts the market for Industrial Grade Butyl Phenol.

Pharmaceutical Grade Butyl Phenol, while not as dominant, plays a significant role in the market. It is used in the pharmaceutical industry for the synthesis of active pharmaceutical ingredients (APIs) and other medicinal compounds. The stringent quality requirements and regulatory standards in the pharmaceutical sector necessitate the use of high-purity Butyl Phenol, driving the demand for Pharmaceutical Grade. However, its market share is relatively smaller due to the limited scope of its applications compared to Industrial Grade.

Application Analysis

Chemical dominates with 30.3% due to extensive use in chemical synthesis and production.

In the application segment, the Chemical industry holds a significant 30.3% share of the Butyl Phenol market. This dominance is attributed to the extensive use of Butyl Phenol in chemical synthesis and production processes. It serves as a crucial intermediate in the manufacturing of various chemical compounds, including antioxidants, stabilizers, and specialty chemicals. The chemical industry’s reliance on Butyl Phenol for these essential applications underpins its leading position in the market.

The demand for specialty chemicals and advanced materials is on the rise, driven by the growth of industries such as automotive, electronics, and construction. Butyl Phenol plays a pivotal role in producing these high-value products, ensuring its continued importance in the chemical sector. Its effectiveness in preventing oxidation and enhancing the stability of chemical formulations makes it indispensable in the production of coatings, adhesives, and resins.

The Lubricant industry is another significant application area for Butyl Phenol. It is used as an additive in lubricant formulations to improve performance and extend the life of lubricants. The growing demand for high-performance lubricants in automotive and industrial applications drives the market for Butyl Phenol in this sector. Lubricants formulated with Butyl Phenol exhibit enhanced thermal stability and oxidation resistance, making them suitable for use in high-stress environments.

The Pharmaceuticals segment, while smaller in market share, utilizes Butyl Phenol for the synthesis of active pharmaceutical ingredients (APIs) and other medicinal compounds. The high purity requirements in the pharmaceutical industry ensure a steady demand for Pharmaceutical Grade Butyl Phenol. Although its share is limited compared to other applications, its role in producing essential medicines and healthcare products is critical.

The Rubber industry also significantly contributes to the Butyl Phenol market. It is used as an antioxidant in rubber production, enhancing the durability and performance of rubber products. The automotive and construction industries, which demand high-quality rubber materials, drive the market for Butyl Phenol in this segment. Its ability to prevent degradation and extend the lifespan of rubber products makes it a valuable component in the rubber industry.

Other applications of Butyl Phenol include its use in the production of plastics and as a stabilizer in various industrial processes. While these applications represent a smaller share of the market, they collectively contribute to the overall demand for Butyl Phenol.

Key Market Segments

By Grade

- Industrial Grade

- Pharmaceutical Grade

By Application

- Chemical

- Lubricant

- Pharmaceuticals

- Rubber

- Others

Growth Opportunities

Increasing Demand for Bio-based and Sustainable Products Offers Growth Opportunity

The growing emphasis on sustainability and environmental consciousness has led to a rising demand for bio-based and eco-friendly products across various industries. This trend presents an opportunity for the development of bio-based butyl phenol derivatives or alternative production processes that are more sustainable and environmentally friendly.

For instance, researchers are exploring the production of butyl phenol from renewable sources, such as lignin or plant-based materials, to meet this demand. Industries like construction, automotive, and pharmaceuticals are particularly interested in these sustainable alternatives. By shifting towards bio-based production, companies can not only reduce their environmental footprint but also attract environmentally conscious consumers, thereby driving market growth.

Emerging Applications in Renewable Energy Offers Growth Opportunity

Butyl phenol and its derivatives have significant applications in the renewable energy sector, particularly in the production of solar panels and wind turbine components. The growing focus on renewable energy sources creates new opportunities for the butyl phenol market.

For example, butyl phenol-based antioxidants are used in the production of solar panel backsheets and wind turbine blade coatings due to their ability to protect against environmental degradation and extend the lifespan of these components. As the renewable energy sector continues to expand, the demand for durable and efficient materials like butyl phenol is expected to rise, contributing to market growth.

Trending Factors

Increasing Focus on Specialty Applications Are Trending Factors

There is a growing trend towards developing specialized butyl phenol derivatives for niche applications in industries such as electronics, coatings, and advanced materials. This trend presents opportunities for product differentiation and higher profit margins.

The development of butyl phenol-based flame retardants for electronic components and specialty coatings for harsh environments has gained traction due to their unique properties and performance advantages. As industries seek to enhance the performance and safety of their products, the demand for specialized butyl phenol derivatives is likely to increase, making this a significant trending factor in the market.

Emphasis on Product Quality and Purity Are Trending Factors

As end-use industries become more demanding in terms of product quality and purity, there is an increasing focus on improving production processes and purification techniques for butyl phenol. This trend ensures that the market remains competitive and meets the stringent requirements of various applications.

The pharmaceutical industry’s stringent requirements for high-purity butyl phenol derivatives have driven manufacturers to invest in advanced purification technologies and quality control measures to ensure compliance with regulatory standards. By maintaining high product quality and purity, manufacturers can meet the demands of critical industries, thus driving market competitiveness and growth.

Regional Analysis

APAC Dominates with 42.3% Market Share in the Butyl Phenol Market

APAC holds a substantial 42.3% market share in the butyl phenol market, valued at USD 188.81 million. This region’s dominance is largely due to its extensive chemical manufacturing sector and the high demand for butyl phenol in various applications such as resins, adhesives, and fragrance ingredients. The presence of key global players and large-scale production facilities in countries like China, South Korea, and Japan further strengthens APAC’s market position.

The dynamics of the APAC butyl phenol market are influenced by rapid industrial growth and development in manufacturing sectors such as automotive, construction, and electronics. These industries rely heavily on products that incorporate butyl phenol due to its chemical properties, which contribute to the durability and performance of end products. Additionally, the increasing focus on expanding chemical export capabilities within the region supports continued market growth.

North America: North America holds a 25.7% market share in the butyl phenol market, driven by its robust chemical industry and stringent regulatory standards which demand high-quality chemical products. The region’s focus on environmentally friendly and sustainable chemicals is likely to enhance market growth further.

Europe: Europe accounts for 20.0% of the market, influenced by its advanced chemical manufacturing sector and strict environmental regulations. The demand in Europe is also driven by the need for high-performance chemicals in the automotive and construction industries.

Middle East & Africa: The Middle East and Africa have a 6.0% market share. While smaller, the market in these regions is growing due to increasing industrialization and investment in chemical production capabilities, particularly in the Gulf countries.

Latin America: Latin America also captures a 6.0% share of the butyl phenol market. The growth here is primarily fueled by expanding manufacturing sectors in countries like Brazil and Mexico, along with a gradual increase in local chemical production and processing facilities.Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Butyl Phenol Market is influenced by several key players known for their strategic positioning and market impact. SI Group and Sasol lead the market with their extensive product portfolios and strong global distribution networks, ensuring widespread availability of butyl phenol. Sanors and Tasco Group emphasize innovation and quality, providing high-performance products for various industrial applications.

Nainkaware Chemicals and Songwon Industrial are recognized for their cost-effective solutions and efficient production capabilities, enhancing their market presence. Anshan Wuhuan Chemical and Sigma-Aldrich focus on research and development, driving advancements in butyl phenol applications. Aurora Fine Chemicals LLC and Merck Millipore are known for their high-purity products and reliable supply chains, catering to niche markets and specialized applications.

These companies collectively drive the Butyl Phenol Market through innovation, strategic global positioning, and a commitment to quality and efficiency, ensuring their leadership and market influence.

Market Key Players

- SI group

- Sasol

- Sanors

- Tasco Group

- Nainkaware Chemicals

- Songwon Industrial

- Anshan Wuhuan Chemical

- Sigma-Aldrich (a subsidiary of Merck)

- Aurora Fine Chemicals LLC

- Merck Millipore

Recent Developments

- March 2024: The Indian government imposed anti-dumping duties on PTBP imports from South Korea, Singapore, and the USA. The duties range from $208 to $881 per metric ton, depending on the country and producer. This measure aims to protect domestic industries from the adverse effects of dumping.

- April 2024: LyondellBasell announced the acquisition of a 35% stake in Saudi-based National Petrochemical Industrial Company (NATPET) from Alujain Corporation, valued at approximately USD 1.5 billion. This acquisition enhances LyondellBasell’s market presence and expands its product offerings.

Report Scope

Report Features Description Market Value (2023) USD 401.8 Million Forecast Revenue (2033) USD 679.9 Million CAGR (2024-2033) 5.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Industrial Grade, Pharmaceutical Grade), By Application (Chemical, Lubricant, Pharmaceuticals, Rubber, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape SI group Sasol, Sanors, Tasco Group, Nainkaware chemicals, Songwon industrial, Anshan Wuhuan Chemical, Sigma-Aldrich, Aurora Fine Chemicals LLC, Merck Millipore Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected market size of the Butyl Phenol Market by 2033?The Global Butyl Phenol Market size is expected to reach USD 679.9 million by 2033. The market is expected to grow at a CAGR of 5.4% during the forecast period.

Which region dominates the Butyl Phenol Market?The Asia-Pacific (APAC) region dominates with a 42.3% market share

Who are the key players in the Butyl Phenol Market?Key players include SI Group, Sasol, Sanors, Tasco Group, Nainkaware Chemicals, and Songwon Industrial.

-

-

- SI group

- Sasol

- Sanors

- Tasco Group

- Nainkaware Chemicals

- Songwon Industrial

- Anshan Wuhuan Chemical

- Sigma-Aldrich (a subsidiary of Merck)

- Aurora Fine Chemicals LLC

- Merck Millipore