Global Brokers & Corporate Agents Market Size, Share, Industry Analysis Report By Type (Insurance Brokers, Corporate Agents, Online Aggregators, Reinsurance Brokers), By Product Type (Life Insurance, Health Insurance, Property & Casualty, Liability Insurance, Travel Insurance, Reinsurance Services), By End-User (Individuals, SMEs, Corporates, Government Entities, Bancassurance Clients), By Distribution Channel (Offline, Online) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165578

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Digital Adoption Rates

- Key Usage Statistics

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Type Analysis

- Corporate Agents Analysis

- Product Type Analysis

- End-User Analysis

- Distribution Channel Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Top Key Players in the Market

- Recent Developments

- Report Scope

Report Overview

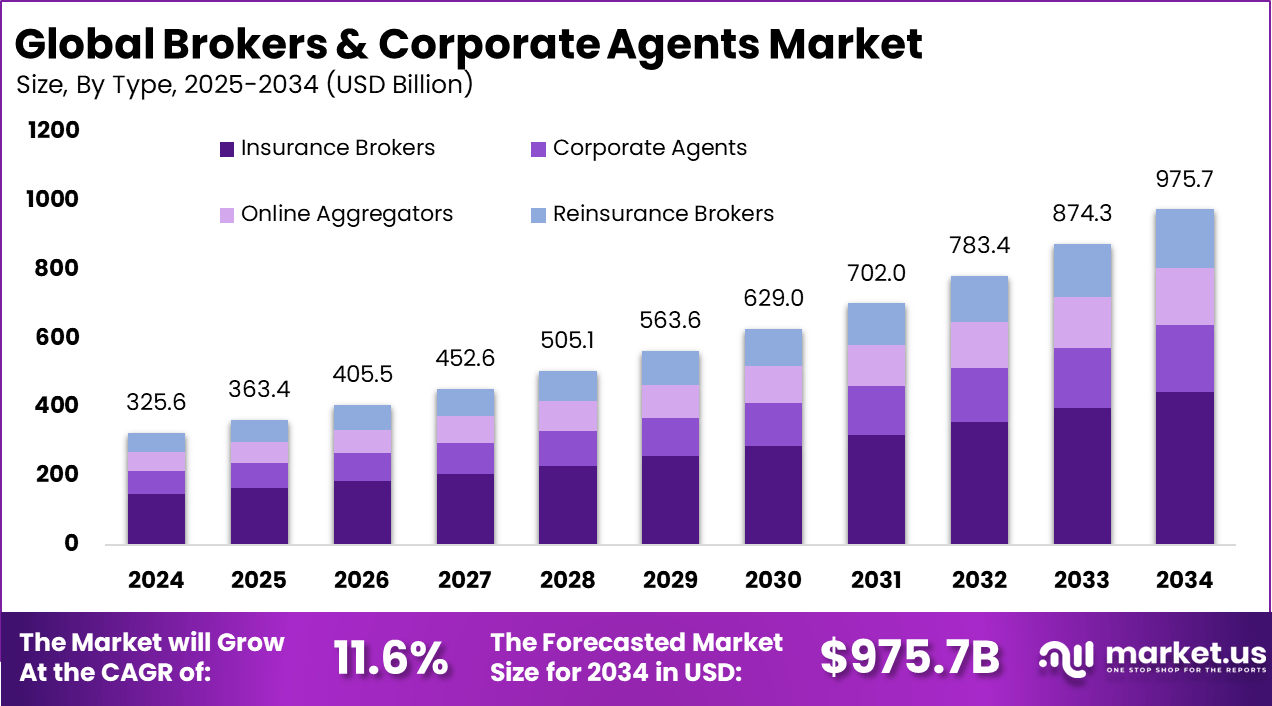

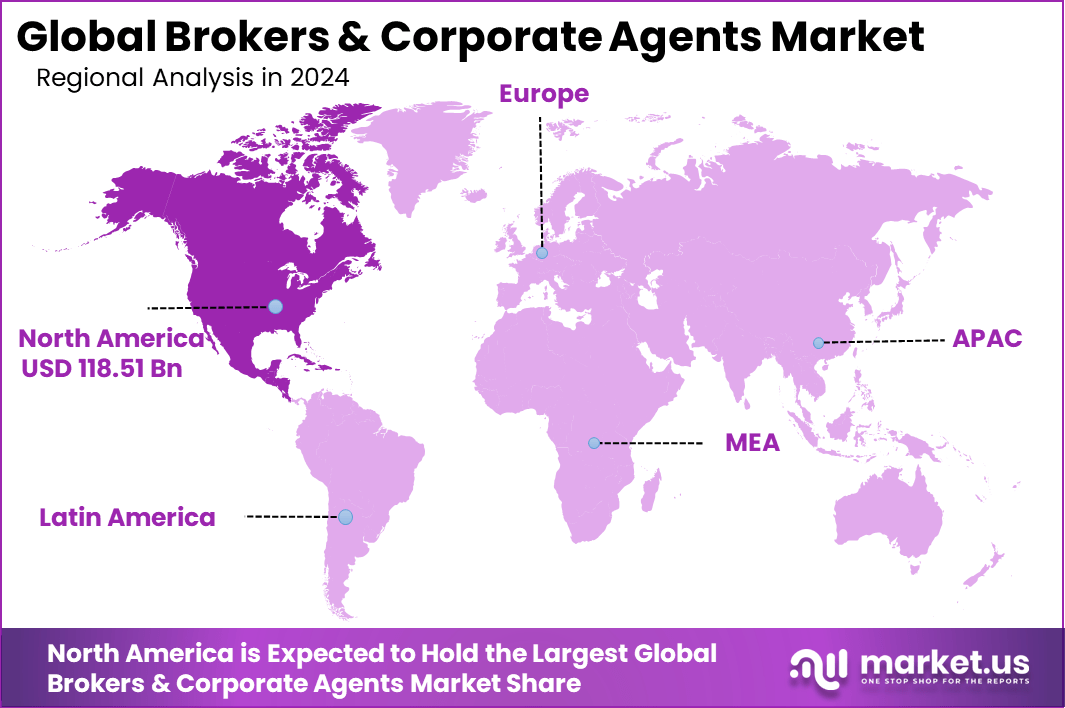

The Global Brokers & Corporate Agents Market size is expected to be worth around USD 975.7 billion by 2034, from USD 325.6 billion in 2024, growing at a CAGR of 11.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36.4% share, holding USD 118.51 billion in revenue.

The Brokers & Corporate Agents market is experiencing strong growth, driven by rising demand for expert risk management and personalized insurance solutions in a complex global environment. As businesses and individuals face more diverse risks, the role of brokers and agents as trusted advisors is becoming increasingly critical. This market is evolving rapidly, with digital transformation and regulatory changes shaping how services are delivered and consumed.

The market is expanding due to economic growth in emerging markets, rising healthcare costs, and the lingering effects of global events like the pandemic. Increased awareness of risk management and the need for comprehensive coverage are pushing more clients to seek expert guidance. For example, in 2024, a major insurance brokerage reported a 20% increase in client inquiries for cyber insurance, reflecting heightened concerns about digital threats.

Demand for brokers and corporate agents is increasing steadily, driven by a rise in chronic disease management needs, expansion of the middle class, and more pronounced risk awareness among individuals and businesses. Digital tools have also expanded market reach by offering convenient and personalized services. The growing reliance on data analytics and machine learning improves risk assessments, capturing a broader clientele.

For instance, in August 2025, Allianz Commercial announced new global and regional leadership roles to drive growth in the Benelux and Nordics regions. It introduced a new Nordics region and appointed new leaders for broker management and client activities to strengthen market-facing strategies.

Digital platforms, AI-driven analytics, and mobile-first strategies are transforming how brokers operate. AI is being used for risk assessment, personalized product recommendations, and automated client onboarding. For instance, a leading brokerage introduced an AI-powered portal in 2023 that reduced policy placement time by 30%, improving client satisfaction and operational efficiency.

Key Takeaway

- The Insurance Brokers segment led the market in 2024, securing a 45.6% share as personalized advisory services remained highly valued by customers.

- Online Aggregators dominated digital distribution with a 62.5% share, reflecting strong consumer preference for comparison-based insurance purchases.

- The Life Insurance segment held a 36.7% share, supported by rising demand for long-term protection and investment-linked policies.

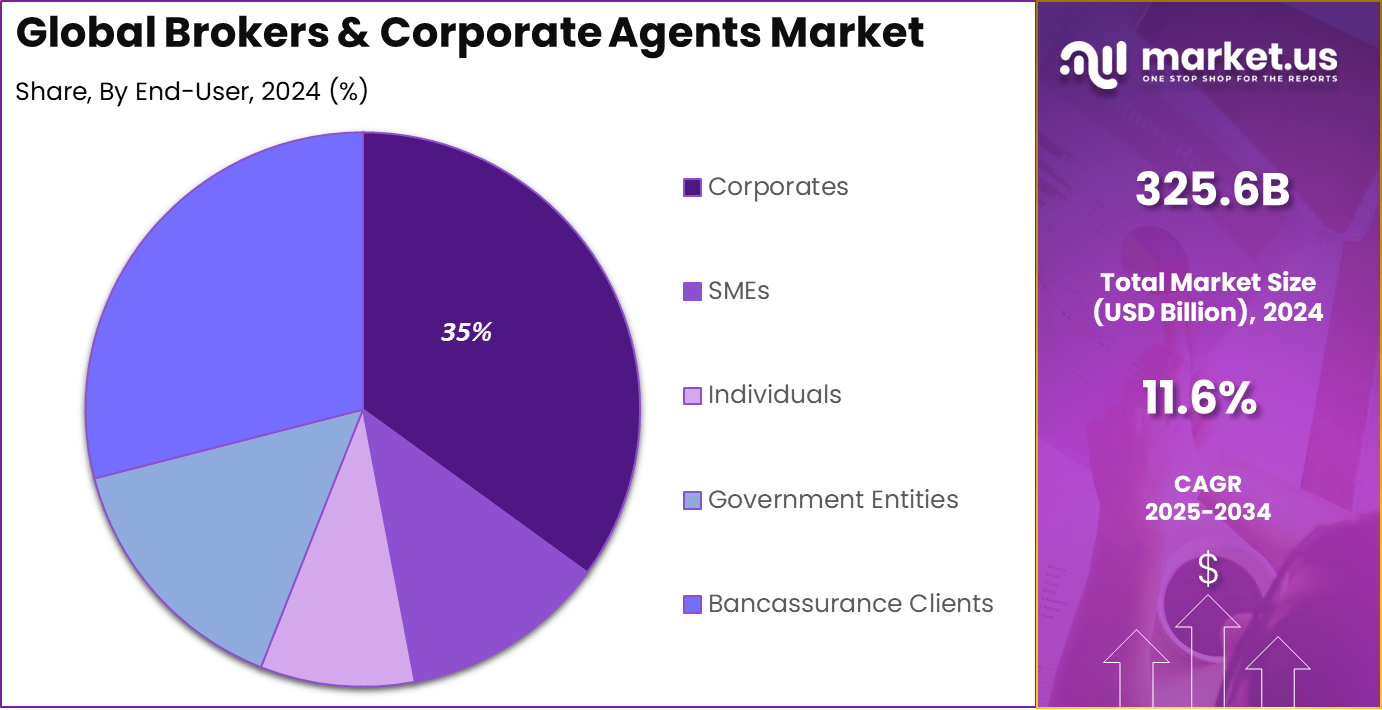

- Corporate clients accounted for 35%, showing steady adoption of structured insurance solutions for employee and business risk coverage.

- The Offline distribution channel maintained leadership with 60.8%, indicating continued trust in face-to-face advisory for complex insurance decisions.

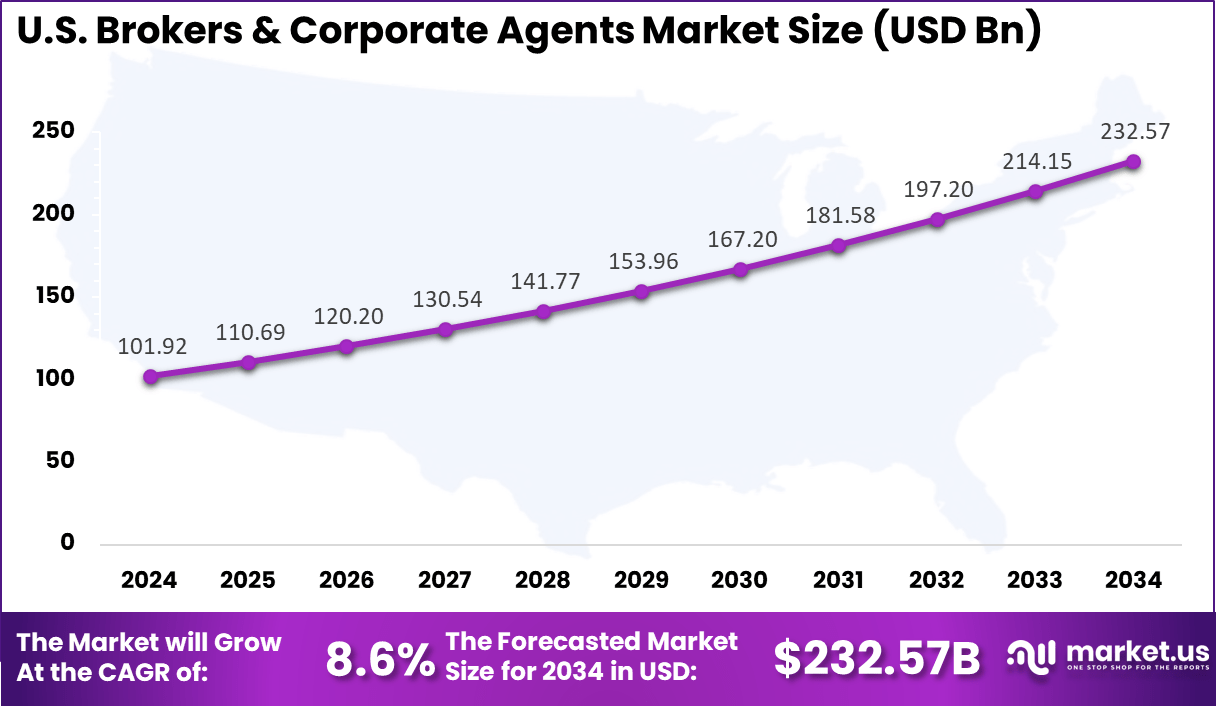

- The U.S. market reached USD 101.92 billion in 2024, expanding at a CAGR of 8.6%, supported by strong demand for diversified insurance products.

- North America dominated globally with 36.4% share, driven by mature insurance ecosystems and high penetration of broker-led distribution.

Digital Adoption Rates

- Cloud computing: Cloud usage has become a standard technology in the insurance sector. Adoption increased from about one-third of companies in 2020 to nearly 85-88% in 2023, reflecting a strong shift toward scalable digital infrastructure.

- Artificial intelligence: AI adoption continues to rise across the industry. A 2025 survey showed that 78% of insurance leaders plan to increase technology budgets, with AI listed as the top priority.

- Generative AI implementation: By mid-2024, about 76% of U.S. insurance companies had implemented generative AI in at least one business function, indicating rapid integration across underwriting, claims, fraud detection, and customer service.

- Sales usage: Around 49% of sales professionals in insurance use generative AI to analyze data and deliver personalized recommendations to clients.

- Satisfaction: Among insurers already using AI for decision-making, 68% report satisfaction with their return on investment, showing confidence in AI-driven modernization.

- Customer portals: About 39% of agents offer online portals that allow customers to manage policies, make payments, and report claims without manual intervention.

- Social media: Nearly 78% of agents use platforms such as Facebook and LinkedIn to attract new customers and support brand visibility.

Key Usage Statistics

- Efficiency gains: Low-code and no-code tools have improved operations, with 82% of insurance companies reporting greater efficiency after adoption. AI-supported claims automation has reduced processing times by 55-75%, cutting manual workloads and accelerating settlements.

- Customer preferences: Digital channels continue to expand, but in-person interactions remain important. Only 20% of customers choose digital channels for all interactions, especially for complex tasks like purchasing policies or resolving disputes.

- Corporate agent focus: In India, corporate agents and brokers distribute about 60% of non-life policies, particularly for large commercial segments such as group health and motor insurance.

- InsurTech impact: Digital players in urban India now account for more than 20% of new broking premiums, reflecting rising adoption of online platforms. The number of individual life insurance agents increased by 10% in FY 2024, reaching almost 2.9 million, underscoring growth in hybrid distribution models.

Role of Generative AI

Generative AI makes a significant difference for brokers and corporate agents by automating routine tasks and improving customer interactions. It helps agents quickly analyze client information and recommend suitable insurance products, which makes the process faster and more accurate.

Studies show this technology can lift agent productivity by about 15% to 20% while reducing operational costs by 5% to 15%. It also powers virtual assistants that provide immediate answers to customer questions, allowing agents to focus on complex cases and improving overall service quality.

Despite these benefits, brokers must oversee the AI outputs carefully to avoid errors from incomplete or biased data. Human expertise remains essential to ensure clients receive the best advice. Overall, generative AI strengthens brokers’ ability to serve clients efficiently while opening new opportunities for revenue growth through enhanced data insights and automation.

Investment and Business Benefits

Investment opportunities are prominent in developing digital brokerage platforms, AI tools for risk analytics, and CRM systems specialized for insurance. Growing demand in emerging markets with expanding middle classes presents fertile ground for new entrants and expansion. There is also an opportunity in training and upskilling agents and brokers to use technology effectively.

Strategic partnerships between brokers, insurers, and fintech firms can unlock value by streamlining operations and creating new product offerings. Using brokers and corporate agents helps clients access tailored insurance solutions suited to their specific risk profiles.

Businesses benefit from expert risk assessment, competitive pricing, and better policy management. Brokers provide ongoing advice and risk management services that reduce coverage gaps. For insurance companies, agents, and brokers to expand market reach and improve customer retention with personalized service. The use of technology enhances these benefits by boosting efficiency and customer engagement.

U.S. Market Size

The market for Brokers & Corporate Agents within the U.S. is growing tremendously and is currently valued at USD 101.92 billion, the market has a projected CAGR of 8.6%. This growth is driven by rising demand for expert insurance advice amid an increasingly complex risk landscape faced by businesses and individuals. Factors such as climate-related events and growing cybersecurity threats are prompting more risk management efforts.

Additionally, advances in technology are enabling brokers and agents to provide personalized service through digital platforms, improving customer engagement. Regulatory changes and consolidation within the industry are pushing firms to become more efficient and competitive. These trends collectively support steady market expansion and evolving brokerage roles.

For instance, in April 2025, WTW (Willis Towers Watson) expanded its U.S. footprint by acquiring the Michigan-based insurance broker Global Risk Advisors. The acquisition strengthens WTW’s presence in the Midwest market and enhances its capabilities in risk management and employee benefits advisory. Global Risk Advisors brings deep industry expertise and client relationships, aligning with WTW’s strategy to grow through targeted acquisitions in key regional markets.

In 2024, North America held a dominant market position in the Global Brokers & Corporate Agents Market, capturing more than a 36.4% share, holding USD 118.51 billion in revenue. This dominance stems from a highly mature and deeply penetrated financial services sector in the region. The market benefits from strong demand for both personalized and digital insurance solutions across commercial and personal segments.

Additionally, increasing awareness of cyber risks, regulatory compliance requirements, and expanding risk management needs are boosting demand for specialized brokerage services. The presence of leading global brokerage firms continually innovating and adapting their offerings also reinforces North America’s market leadership and growth.

For instance, in July 2024, Marsh McLennan Agency continued its acquisition streak by acquiring the Horton Group. This acquisition further reinforced Marsh McLennan’s dominance in the North American Brokers & Corporate Agents market by expanding its footprint and service capabilities. The move is part of a broader trend where key players in the region strengthen their market position through strategic acquisitions to enhance their competitive edge and service offerings.

Type Analysis

In 2024, The Insurance Brokers segment held a dominant market position, capturing a 45.6% share of the Global Brokers & Corporate Agents Market. These brokers act as intermediaries between clients and multiple insurers, helping customers compare and choose the best policies that fit their needs. Brokers provide a wider range of options and personalized guidance compared to agents tied to a specific insurance provider. This role allows brokers to offer flexible solutions and advice based on a comprehensive view of the market.

Insurance brokers play a key role in tailoring insurance packages for both individuals and businesses. Their expertise and independence make them trusted advisers in the insurance purchase process, helping clients navigate complex offerings and claims support.

For Instance, in October 2025, Marsh McLennan announced it would unify its brand to “Marsh” by January 2026. This change aims to enhance client experience by consolidating expertise and streamlining services across all broker operations. Marsh reported strong Q3 2025 results, including 11% revenue growth, reinforcing its leadership in the insurance broker segment. The company is also investing in data and AI capabilities to improve advisory services for clients globally.

Corporate Agents Analysis

In 2024, the Online Aggregators segment held a dominant market position, capturing a 62.5% share of the Global Brokers & Corporate Agents Market. These digital platforms leverage technology to offer a broad range of insurance products from multiple insurers efficiently. Aggregators simplify the buying process by providing easy online comparisons and instant access to policies.

The growth of online aggregators is driven by increasing internet usage, digital influence, and customer preference for convenient, technology-enabled solutions. Digital brokers on these platforms use advanced analytics and robo-advisor features to enhance decision-making, optimizing the customer experience.

For instance, in October 2025, Aon plc reported robust third-quarter results with 7% revenue growth, driven by expansions in risk capital and human capital services. The company focused on scaling data analytics and expanding in diverse markets, reinforcing the rising influence of online aggregators, which constitute 62.5% of the corporate agent segment. Aon’s digital and strategic initiatives embody this shift toward technology-enabled insurance distribution.

Product Type Analysis

In 2024, The Life Insurance segment held a dominant market position, capturing a 36.7% share of the Global Brokers & Corporate Agents Market. This segment continues to be favored due to its role in providing long-term financial security and protection for families and individuals. Life insurance products are gaining importance as awareness grows on the need for financial planning and risk mitigation.

The life insurance category benefits from demographic trends like aging populations and rising disposable incomes, which increase demand. It remains a preferred product for both personal and corporate insurance buyers aiming to secure future financial needs.

For Instance, in January 2025, WTW reflected incremental progress 2025 by launching innovative excess liability policies and continuing to digitize its broking platforms. This consistent evolution helps maintain stability in specialties like life insurance by expanding capacity and improving risk assessments. These steps mark their ongoing focus on meeting client needs through practical innovation without abrupt changes.

End-User Analysis

In 2024, the Corporates segment held a dominant market position, capturing a 35% share of the Global Brokers & Corporate Agents Market. Many businesses turn to insurance brokers and corporate agents to manage employee benefits, liability, and risk management solutions. Corporations seek tailored insurance plans that align with their operational risks and compliance requirements.

Insurance services for corporate clients often involve more complex policy structures and higher-value transactions. This segment continues to grow as companies prioritize comprehensive insurance coverage for employees and business operations.

For Instance, in July 2025, Arthur J. Gallagher & Co. announced that it had completed nine mergers in the quarter, adding significant new revenue streams and expanding its corporate client base. The acquisition of AssuredPartners in August 2025 further consolidates Gallagher’s position among top insurance brokers serving corporate end-users, emphasizing its strategy of growth through acquisition.

Distribution Channel Analysis

In 2024, The Offline segment held a dominant market position, capturing a 60.8% share of the Global Brokers & Corporate Agents Market. Despite digital trends, many customers still trust in-person brokers for personalized service and detailed advice. Direct contact offers reassurance and clarity during the insurance purchasing process.

Offline channels remain important in regions and segments that value personal relationships. They provide tailored consultations and help clarify policy details, especially for corporate and group coverage that often requires in-depth discussions.

For Instance, in October 2025, Brown & Brown, Inc. reported 2025 a 35% revenue increase driven by acquisitions and strong organic growth in both its retail and specialty insurance segments. The firm continues to focus on offline distribution channels, integrating new businesses to better serve clients with face-to-face service, maintaining its reputation in personalized insurance brokerage.

Emerging Trends

A major trend in the brokers and corporate agents sector is the rise of digital tools such as AI, automated underwriting, and data analytics. These help brokers manage large client bases and create customized plans faster than before. The use of mobile platforms and online portals is also growing, making access to insurance products easier for clients and broadening brokers’ market reach.

Spending on AI and automation tools in this space has been increasing by nearly 50% annually, reflecting their importance in helping brokers stay competitive. Another development is the use of Internet of Things (IoT) data and big data analytics to inform risk assessment and policy pricing.

Brokers incorporate environmental and behavioral data to offer more accurate insurance options, especially in emerging risk areas like cybercrime and climate impacts. Regulatory compliance is also shaping broker strategies, with brokers adapting to stricter rules to ensure transparency and client protection.

Growth Factors

Growth in the broker and corporate agent market is driven by rising insurance awareness among individuals and businesses who want better coverage options. Increasing middle-class populations, especially in emerging regions, are seeking expert advice to navigate complex insurance choices.

Regulatory support encouraging the use of intermediaries further boosts this trend. Brokers’ adoption of digital tools eases client onboarding and enhances service delivery, helping to sustain growth and customer loyalty.

Economic growth and the impact of chronic health conditions are expanding the demand for life and health insurance products. As insurance becomes a more essential part of financial planning, brokers are well-positioned to meet client needs. Ongoing digital innovation boosts their ability to scale efficiently and tap into new customer segments.

Key Market Segments

By Type

- Insurance Brokers

- Corporate Agents

- Online Aggregators

- Reinsurance Brokers

By Product Type

- Life Insurance

- Health Insurance

- Property & Casualty

- Liability Insurance

- Travel Insurance

- Reinsurance Services

By End-User

- Individuals

- SMEs

- Corporates

- Government Entities

- Bancassurance Clients

By Distribution Channel

- Offline

- Online

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Demand for Insurance Policies

The market for brokers and corporate agents is being driven by a rising demand for a variety of insurance policies. More individuals and businesses are seeking insurance to protect against risks such as health issues, property damage, and financial losses. This growing need pushes brokers and agents to offer more tailored solutions and reach more customers.

With an expanding middle class and rising awareness about insurance benefits, brokers are seeing a steady increase in clients. This helps the market grow as brokers act as key connectors between insurance companies and policy buyers, making insurance accessible and understandable for everyone.

For instance, in October 2025, Marsh McLennan reported strong revenue growth driven by an increase in client demand for tailored insurance and risk solutions. The company highlighted its focus on expanding specialized services to meet complex business risks, reflecting the broader market need for risk protection.

Restraint

Increasing Regulatory Pressure

The brokers and corporate agents market faces challenges due to growing regulatory demands. Governments are introducing stricter rules to ensure brokers and agents act fairly and protect consumers. While this is positive for customer protection, it raises operational costs and adds complexity for brokers.

This regulatory burden especially affects brokers in emerging markets, where laws frequently change. Brokers must invest more in compliance and training, which limits their speed and flexibility. These factors can slow down market growth and create barriers to entry.

For instance, in July 2025, Aon plc completed the merger of its broking operations in India to streamline compliance under a single regulatory license. This step was necessary due to tightening regulations in the Indian insurance market that required brokers to operate under unified frameworks.

Opportunities

Digital Transformation and Technology Use

A major opportunity in this market is the adoption of digital technologies such as AI, mobile apps, and online platforms. Brokers and agents are leveraging these tools to provide easier access to insurance products and to enhance customer service. Digital tools help automate routine tasks, improve risk assessment, and personalize insurance options.

This shift to digital allows brokers to reach more customers with less effort and cost. It also helps build trust and satisfaction by offering faster and clearer communication. The use of technology is shaping the future of brokerage by making processes smoother and more efficient.

For instance, in November 2025, Aon launched its Claims Copilot, a digital platform that uses advanced analytics and automation to speed up claims processing. This innovation supports better client outcomes and showcases how technology improves service delivery in brokerage.

Challenges

Intense Competition and Market Fragmentation

Brokers and corporate agents face strong competition due to a large number of service providers in the market. Low barriers to entry mean many players operate in this space, leading to market fragmentation and varied levels of service quality. This intense competition pressures profit margins and makes it harder to stand out.

Additionally, some regulations favor corporate agents over brokers, which can marginalize brokers’ roles. Brokers must continuously innovate and improve their offerings, but this challenge makes it difficult to maintain long-term client loyalty and business growth.

For instance, in November 2025, Lockton expanded its presence by entering the Saudi Arabian market and appointing new local leadership. This strategic move aims to capture share in a highly competitive regional insurance market, demonstrating the pressures brokers face to expand and differentiate themselves globally.

Key Players Analysis

Marsh McLennan, Aon, and WTW lead the brokers and corporate agents market with strong advisory capabilities and global client reach. Their focus on structured insurance solutions, analytics-driven risk assessment, and broad industry coverage supports large enterprises seeking comprehensive risk-management services. Arthur J. Gallagher and Brown & Brown strengthen market depth through mid-market specialization and digital tools that simplify policy placement and improve client engagement.

Allianz and Lockton Companies maintain influential positions by combining international networks with specialized brokerage and corporate agency services. Allianz leverages its global operations to support complex commercial risks, while Lockton focuses on privately held advisory with personalized placement strategies. Both firms are improving digital platforms to enhance policy servicing and strengthen customer retention across multiple industries.

Other major players support market growth through technology adoption, automated workflows, and improved customer engagement models. Their emphasis on digital distribution, compliance support, and risk-specific consulting is increasing efficiency across the brokerage value chain. Rising demand for tailored insurance solutions is encouraging closer collaboration between brokers, agents, and insurers, leading to more specialized service offerings and stronger competitive differentiation.

Top Key Players in the Market

- Marsh McLennan

- Aon plc

- WTW

- Arthur J. Gallagher & Co.

- Brown & Brown, Inc.

- HUB International Limited

- Allianz

- Lockton Companies

- Other Major Players

Recent Developments

- In April 2024, Aon plc completed its $13 billion acquisition of middle-market property and casualty broker NFP ahead of the originally anticipated schedule. The deal was funded with $7 billion in cash and $6 billion in Aon stock. NFP CEO Doug Hammond will continue to lead NFP as an independent but connected platform operating under the brand “NFP, an Aon company.”

- In July 2025, Allianz Commercial announced new global and regional leadership roles to drive growth in the Benelux and Nordics regions. They appointed a new Global Head of Broker Management and created a dedicated Nordics region. These moves reflect a sharpened market strategy focused on client and broker services in commercial insurance.

Report Scope

Report Features Description Market Value (2024) USD 325.6 Bn Forecast Revenue (2034) USD 975.7 Bn CAGR(2025-2034) 11.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Insurance Brokers, Corporate Agents, Online Aggregators, Reinsurance Brokers), By Product Type (Life Insurance, Health Insurance, Property & Casualty, Liability Insurance, Travel Insurance, Reinsurance Services), By End-User (Individuals, SMEs, Corporates, Government Entities, Bancassurance Clients), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Marsh McLennan, Aon plc, WTW, Arthur J. Gallagher & Co., Brown & Brown, Inc., HUB International Limited, Allianz, Lockton Companies, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Brokers & Corporate Agents MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Brokers & Corporate Agents MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Marsh McLennan

- Aon plc

- WTW

- Arthur J. Gallagher & Co.

- Brown & Brown, Inc.

- HUB International Limited

- Allianz

- Lockton Companies

- Other Major Players