Global Brand Licensing Market Size, Share, Growth Analysis By Type (Apparels, Toys, Home Decoration, Others), By Application (Entertainment, Corporate Trademarks, Fashion, Sports, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 153103

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

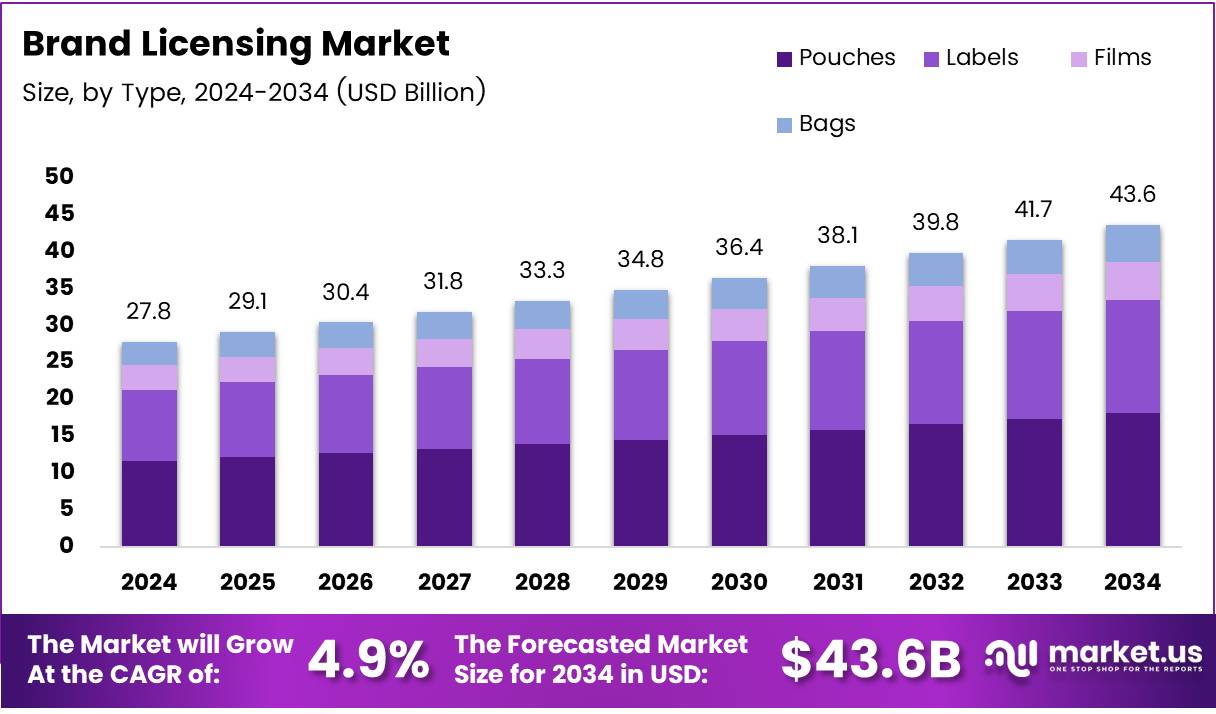

The Global Brand Licensing Market size is expected to be worth around USD 43.6 Billion by 2034, from USD 27.8 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

The Brand Licensing market involves the authorization granted by a brand owner to a third party, allowing them to use the brand’s intellectual property to manufacture or sell products. This market has seen significant growth in recent years, driven by both domestic and international demand for established brands.

In recent years, the Brand Licensing market has been witnessing a steady increase in its growth trajectory. The expansion can be attributed to rising consumer preference for branded products and the increasing use of brands to influence purchasing decisions. Notably, industries like fashion, entertainment, and sports are experiencing high demand for licensing partnerships.

The market’s growth is further fueled by the increasing recognition of brands as assets, opening new revenue streams for companies. Brand owners are capitalizing on licensing opportunities to enhance their market reach while minimizing operational risks. As a result, the global licensing business continues to diversify, catering to various industries such as media, retail, and consumer goods.

Opportunities within the Brand Licensing market are abundant, especially as companies recognize the importance of strategic brand partnerships. Many companies are leveraging licensing to enter new geographical markets or explore product extensions. Notably, sectors like apparel, toys, and technology are projected to continue thriving with licensing initiatives aimed at targeting younger, tech-savvy consumers.

Governments around the world are also investing in brand licensing, acknowledging its role in supporting domestic businesses and the economy. Initiatives that encourage intellectual property protection have been instrumental in facilitating a conducive environment for brand owners and licensees. Moreover, regulations are continuously evolving to adapt to the increasing scope of licensing agreements, ensuring compliance and fair practices.

However, as the market continues to expand, there are growing concerns regarding IP infringement and counterfeit products. Governments are stepping up regulations to safeguard the interests of brand owners, ensuring that licensing agreements are properly enforced. Additionally, both brands and licensees must remain vigilant in their compliance with these evolving regulations.

Looking ahead, the Brand Licensing market is expected to experience even stronger growth. Increasing globalization and digitalization are expected to drive new licensing models. With innovation and creativity at the forefront of brand partnerships, businesses can look forward to novel licensing opportunities in emerging sectors, including virtual reality and AI-based applications.

Key Takeaways

- The Global Brand Licensing Market is expected to reach USD 43.6 Billion by 2034, growing at a CAGR of 4.9% from 2025 to 2034.

- The apparels segment holds a dominant share of 51.9% in 2024, driven by the strong presence of major apparel brands.

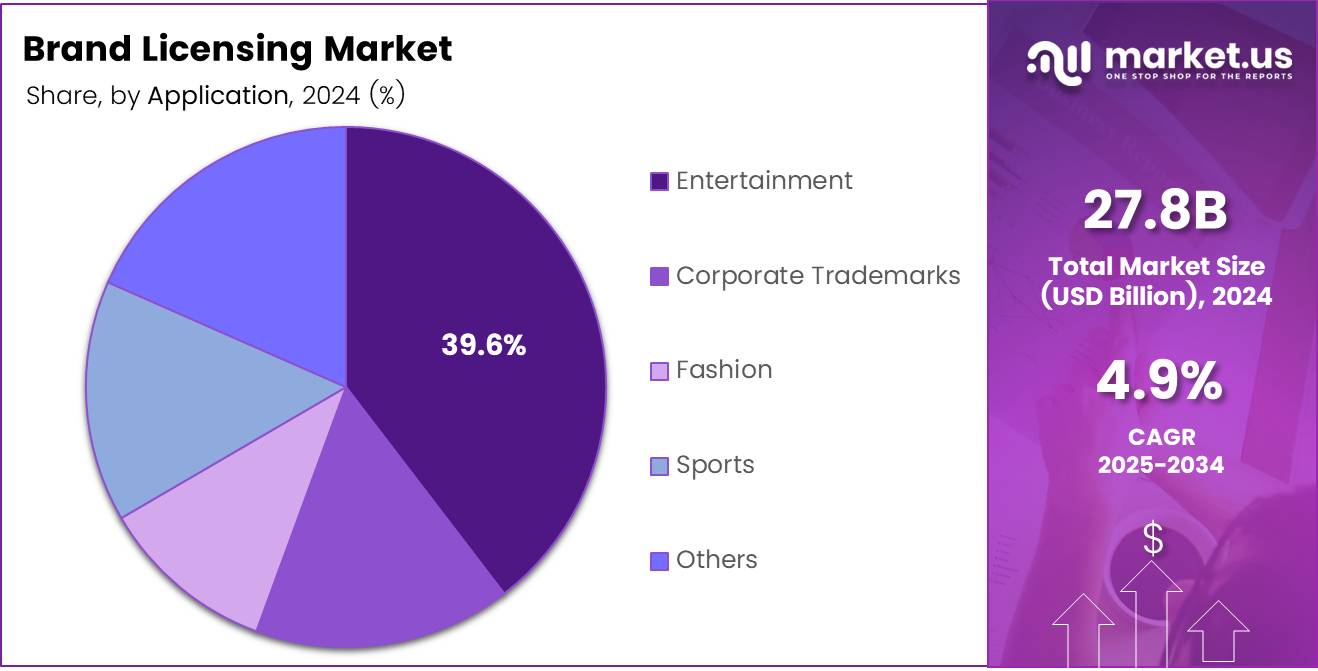

- The entertainment segment leads the market with a share of 39.6% in 2024, fueled by licensing of popular movies, TV shows, and streaming content.

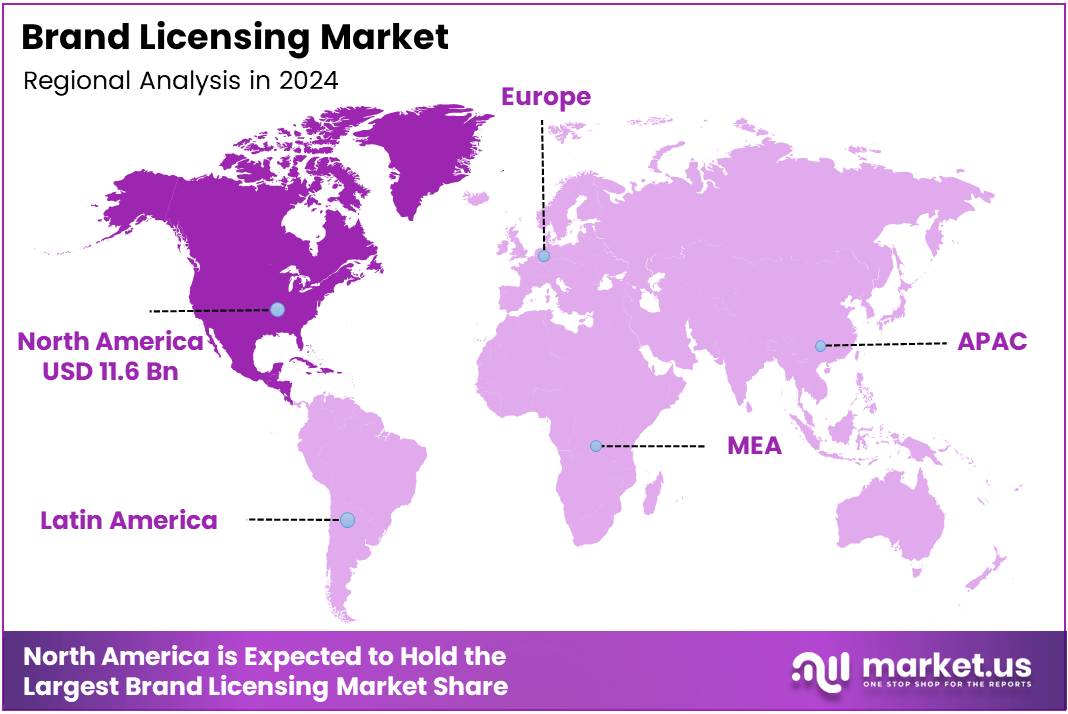

- North America commands 42.4% of the global market share in 2024, valued at USD 11.6 billion, supported by high demand and strong intellectual property protection.

Type Analysis

Apparels held a dominant market position in 2024 with a 51.9% share in the Brand Licensing Market.

In 2024, the apparels segment was the leading contributor to the Brand Licensing Market. With a share of 51.9%, it outperformed other categories significantly. The strong presence of major apparel brands leveraging licensing deals has been a key factor driving the segment’s dominance. Consumers’ continued affinity for branded clothing, coupled with the widespread appeal of fashion collaborations, has kept this category at the forefront.

The toys segment followed, exhibiting steady growth as licensed characters and franchises continue to fuel the demand for branded toys. Despite its growth, it lagged behind apparels in terms of market share.

Home decoration, though gaining traction, occupied a smaller share in comparison. Licensing in the home decor space has witnessed an uptick, but it has not yet reached the heights of apparel or toys. The others category, which includes diverse licensing opportunities in various industries, contributed a modest portion to the market share.

The dominance of apparels in the Brand Licensing Market is a result of both high consumer demand and the scalability of licensing agreements in fashion and clothing.

Application Analysis

Entertainment held a dominant market position in 2024 with a 39.6% share in the Brand Licensing Market.

In 2024, the entertainment segment led the Brand Licensing Market with a significant share of 39.6%. Licensing of entertainment properties, including movies, TV shows, and streaming content, remains a powerful force within the market. Popular franchises and iconic characters continue to drive licensing deals across various products, making this segment a central player.

Corporate trademarks also commanded attention, securing a solid market presence. Businesses leveraging their corporate logos for brand licensing have seen consistent success, though they are still behind entertainment in terms of market dominance.

Fashion, while still influential, contributed a smaller share compared to entertainment and corporate trademarks. Fashion-related licensing has grown with collaborations, yet its overall share remains limited in comparison.

Sports, known for its loyal fan base, maintained a competitive position in the market. The licensing of sports teams and athletes continues to generate revenue, but it remains slightly behind the other sectors.

The others segment, consisting of niche applications, further diversified the Brand Licensing Market but did not pose significant competition to the leading categories of entertainment and corporate trademarks.

Key Market Segments

By Type

- Apparels

- Toys

- Home Decoration

- Others

By Application

- Entertainment

- Corporate Trademarks

- Fashion

- Sports

- Others

Drivers

Growing Demand for Brand Visibility and Recognition Drives Brand Licensing Market Growth

Brand visibility and recognition are key factors driving the growth of the brand licensing market. As businesses seek to establish a strong presence in the market, licensing offers a strategic way to expand brand recognition.

By allowing third-party companies to use established trademarks and logos, brands can increase their visibility across different sectors, making them more recognizable to consumers. This demand for enhanced brand visibility is becoming a top priority, particularly in industries such as fashion, entertainment, and consumer goods.

The rise of retail channels and e-commerce platforms has further fueled this demand. Brands are now able to reach a broader audience online, and through licensed products, they can effectively engage with consumers in various regions. Additionally, consumers increasingly prefer licensed products, as these products often promise higher quality and authenticity. As a result, businesses are investing more in brand licensing agreements to tap into this growing consumer trend.

Restraints

High Costs and Complexities Restrain the Growth of the Brand Licensing Market

One of the significant challenges facing the brand licensing market is the high cost of licensing agreements. These agreements often require considerable financial investment, making it difficult for smaller businesses to participate in brand licensing partnerships. Additionally, intellectual property protection remains a complex issue, with companies facing difficulties in safeguarding their trademarks, designs, and copyrights.

Another challenge comes from the regulatory complexities, especially when expanding into international markets. Different countries have varied rules regarding licensing, which can create hurdles for businesses trying to scale their brand globally.

Furthermore, there is a risk of brand dilution when too many licensing agreements are made, leading to overexposure. Over-licensing can weaken the brand’s uniqueness and credibility, reducing its appeal to consumers.

Growth Factors

New Licensing Opportunities Drive Future Growth in the Brand Licensing Market

The brand licensing market presents several growth opportunities in the form of emerging niches and categories. As new industries and sectors evolve, there are increasing opportunities for brand collaborations in areas such as eco-friendly products and digital goods.

The entertainment and sports licensing sectors, in particular, continue to expand as fan engagement grows, opening up lucrative prospects for brands to partner with high-profile personalities and franchises.

Emerging markets also offer untapped potential for brand licensing growth. Many regions, such as Asia-Pacific, Latin America, and Africa, present new opportunities for brands to expand their presence.

Additionally, strategic collaborations with influencers and celebrities are becoming a key growth driver. These collaborations allow brands to tap into the influencer’s established audience, increasing brand recognition and market reach.

Emerging Trends

Trending Factors Shaping the Brand Licensing Market

Several trending factors are shaping the future of the brand licensing market. The integration of augmented reality and digital licensing is revolutionizing how consumers interact with licensed products. With advancements in technology, brands can create more engaging and immersive experiences for customers, increasing the appeal of licensed merchandise.

Sustainability is also gaining momentum in brand licensing. Consumers are increasingly concerned about the environmental impact of products, leading to a rise in eco-conscious licensing partnerships. Brands are aligning with sustainability initiatives, offering licensed products that are environmentally friendly.

Social media and online platforms are also playing a significant role in influencing licensing trends. The ability for brands to directly interact with consumers and influencers through platforms like Instagram and TikTok is reshaping licensing strategies. This, combined with the increasing focus on sustainability in licensed products, is driving the future of brand licensing.

Regional Analysis

North America Dominates the Brand Licensing Market with a Market Share of 42.4%, Valued at USD 11.6 Billion

In 2024, North America holds a dominant position in the global brand licensing market, commanding a 42.4% market share, valued at USD 11.6 billion. The region’s robust market is driven by the high demand for licensed products across various industries, particularly in entertainment, sports, and fashion. The well-established intellectual property rights protection and mature retail infrastructure contribute to its market leadership.

Europe Brand Licensing Market Trends

Europe is another significant player in the brand licensing market, contributing to a large share of global revenues. With a mature retail environment and strong demand for branded goods, particularly in fashion and automotive sectors, Europe continues to maintain a competitive stance. The increasing interest in sustainability and eco-friendly licensing agreements has opened new avenues for growth in the region.

Asia Pacific Brand Licensing Market Trends

Asia Pacific is experiencing rapid growth in the brand licensing market, driven by an expanding middle class, increasing disposable income, and the rising popularity of international brands. The region is particularly strong in the licensing of entertainment and sports brands, as well as consumer goods. With the growing adoption of digital platforms, brand licensing in Asia Pacific is expected to expand significantly.

Middle East and Africa Brand Licensing Market Trends

The Middle East and Africa region is witnessing steady growth in the brand licensing market, with rising consumer demand for premium and luxury branded goods. While still emerging compared to other regions, the growing influence of young consumers and the expansion of retail networks are fueling market expansion. Key sectors driving growth include fashion, sports, and entertainment.

Latin America Brand Licensing Market Trends

Latin America is a developing region for brand licensing, showing a steady increase in demand for licensed products across various sectors, including fashion, food & beverage, and entertainment. However, challenges such as economic fluctuations and varying levels of intellectual property enforcement are limiting its growth potential. Despite these challenges, the region’s youthful population and increasing retail infrastructure provide long-term growth opportunities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Brand Licensing Company Insights

In 2024, the Walt Disney Company continues to be a leading force in the global brand licensing market. The company’s diverse portfolio, which includes iconic characters from its movies and theme parks, allows it to dominate across various industries, including entertainment, apparel, and toys. Disney’s global reach and continued investment in innovative content ensure strong demand for its licensed properties.

Meredith Corporation stands as a key player in the market, leveraging its extensive media presence to drive brand licensing initiatives. Known for its portfolio of lifestyle and women’s magazines, Meredith has successfully expanded its licensing ventures into the home, apparel, and beauty segments, capitalizing on the strong brand recognition of its media properties.

PVH Corp., with its extensive portfolio of fashion brands such as Tommy Hilfiger and Calvin Klein, holds a prominent position in the brand licensing landscape. PVH’s licensing strategy focuses on leveraging its established names to expand into new product categories and global markets, ensuring consistent growth and brand equity.

Iconix Brand Group has maintained a strong foothold in the global brand licensing market by acquiring a diverse range of fashion and lifestyle brands. With properties in the apparel, footwear, and home goods sectors, Iconix continues to deliver strong licensing revenue through strategic partnerships and extensive global distribution.

Top Key Players in the Market

- The Walt Disney Company

- Meredith Corporation

- PVH Corp.

- Iconix Brand Group

- Authentic Brands Group

- Universal Brand Development

- Nickelodeon (ViacomCBS)

- Major League Baseball

- Learfield IMG College

- Sanrio

Recent Developments

- In March 2025, UK’s top licensing company was acquired by Bioworld, strengthening Bioworld’s market position and expanding its portfolio in the licensing sector. The acquisition is expected to significantly enhance Bioworld’s reach in Europe and beyond.

- In April 2025, Cascadia successfully advised Badgley Mischka on its acquisition by ACI Licensing and Established Incorporated, helping secure the deal which will strengthen Badgley Mischka’s licensing strategy and enhance its brand presence globally.

- In February 2025, Markettcom Licensing Agency was acquired by JABS LLC and SAYAPLUS private equity group, marking a significant move to expand both companies’ portfolios in the fashion and lifestyle licensing markets, with an emphasis on increasing brand engagement.

- In June 2024, Dolby Laboratories announced an agreement to acquire GE Licensing from GE Aerospace, marking a strategic expansion into the aerospace and defense sector, which is expected to diversify Dolby’s licensing business and improve its technology integration.

Report Scope

Report Features Description Market Value (2024) USD 27.8 Billion Forecast Revenue (2034) USD 43.6 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Apparels, Toys, Home Decoration, Others), By Application (Entertainment, Corporate Trademarks, Fashion, Sports, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape The Walt Disney Company, Meredith Corporation, PVH Corp., Iconix Brand Group, Authentic Brands Group, Universal Brand Development, Nickelodeon (ViacomCBS), Major League Baseball, Learfield IMG College, Sanrio Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The Walt Disney Company

- Meredith Corporation

- PVH Corp.

- Iconix Brand Group

- Authentic Brands Group

- Universal Brand Development

- Nickelodeon (ViacomCBS)

- Major League Baseball

- Learfield IMG College

- Sanrio