Global Box Truck Market Size, Share, Growth Analysis By Truck Type (Dry Box Trucks, Refrigerated Box Trucks), By Fuel Type (Diesel, Gasoline, Electric, Hybrid), By Tonnage Capacity (Light-duty (Class 3–5), Medium-duty (Class 6–7), Heavy-duty (Class 8)), By Application (Logistics & Transportation, Food & Beverage Distribution, Retail & E-commerce, Construction & Building Materials, Healthcare & Pharmaceuticals, Others), By End-User (Fleet Operators, Independent Truck Owners), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140126

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

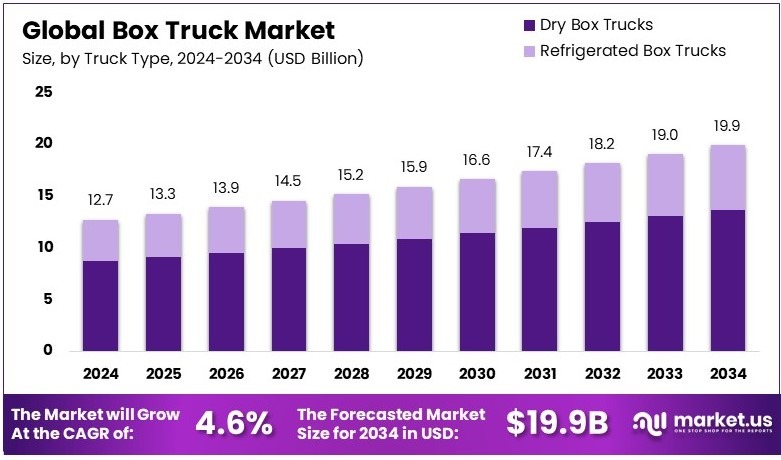

The Global Box Truck Market size is expected to be worth around USD 19.9 Billion by 2034, from USD 12.7 Billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

Box Truck is a commercial vehicle with an enclosed cargo area. It is designed to transport goods securely and protect shipments from weather and damage. The vehicle is widely used for local deliveries, moving services, and distribution operations. Its box-like structure offers efficient space utilization and versatile transport solutions efficiently.

Box Truck Market comprises companies involved in manufacturing, leasing, and operating box trucks. The market serves businesses needing secure and versatile transportation for goods. Providers offer sales, rentals, and maintenance services. Companies focus on reliability and efficiency. The sector caters to local and regional distribution, supporting commercial logistics operations seamlessly.

The Box Truck market is experiencing dynamic growth, particularly in the electric vehicle sector. In 2022, sales of medium- and heavy-duty electric trucks hit around 60,000 units globally, which is about 1.2% of total truck sales. China was a major player, with 52,000 electric truck sales, making up 4% of its market and 85% of global sales. This shift highlights a significant move towards sustainability in freight transport.

Additionally, the market faces challenges like high initial costs and limited charging infrastructure. However, government initiatives are helping overcome these barriers. For example, the U.S. Infrastructure Investment and Jobs Act allocated $1 billion to upgrade fleets to electric models, easing the transition. In Europe, the commitment by ten companies to purchase 15,000 electric vans signifies strong momentum towards market electrification.

Moreover, on a broader scale, the integration of advanced technologies like telematics and AI in fleet management is enhancing operational efficiency. Innovations such as leasing programs are also making electric box trucks more accessible to smaller businesses. These developments are not just expanding market opportunities but are also making a significant impact on local and global logistics networks.

Key Takeaways

- The Box Truck Market was valued at USD 12.7 billion in 2024 and is forecast to reach USD 19.9 billion by 2034, with a CAGR of 4.6%.

- In 2024, Dry Box Trucks dominate the truck type segment with 68.4%, driven by their versatility and efficiency in logistics.

- In 2024, Diesel leads the fuel type segment with 75.2%, driven by its availability and energy output in commercial trucks.

- In 2024, Medium-duty Trucks lead the tonnage capacity segment with 57.8%, reflecting performance and cost efficiency in mid-range freight operations.

- In 2024, Logistics & Transportation dominates the application segment with 43.7%, underscoring its role in supply chain operations.

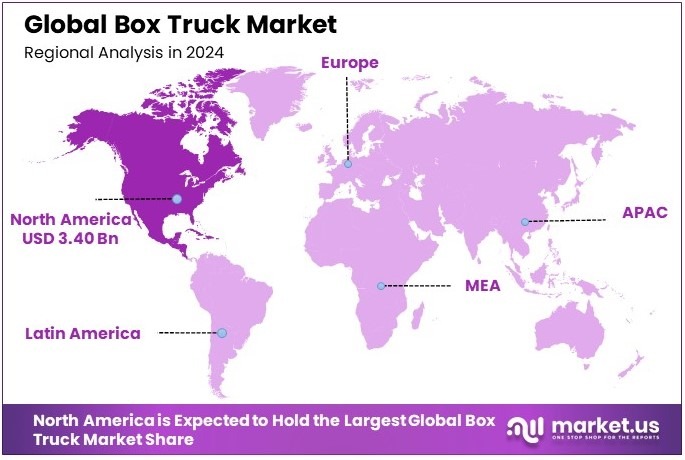

- In 2024, North America leads the regional segment with 26.8%, highlighting a USD 3.40 billion contribution in box truck logistics.

Truck Type Analysis

Dry Box Trucks dominate with 68.4% due to their versatility in various industries.

Dry Box Trucks are the most commonly used type in the Box Truck Market, primarily because of their versatility and functionality across multiple industries. They are designed to transport dry goods, including electronics, furniture, and packaged products, making them indispensable for logistics and distribution networks.

This sub-segment’s dominance is further solidified by the fact that dry box trucks can be easily customized with shelving and racks to meet specific transportation needs, enhancing their utility and appeal to businesses.

Refrigerated Box Trucks, while serving a crucial role, are specialized for perishable goods. They are essential in industries like food and pharmaceuticals, where temperature control is necessary to maintain product integrity during transport.

Fuel Type Analysis

Diesel engines dominate with 75.2% due to their long-range capability and durability.

Diesel-powered box trucks are preferred for their efficiency and durability, making them suitable for long-haul transportation. Diesel engines are known for their high torque and better fuel economy over long distances, which is essential for reducing operational costs in the transport sector.

Gasoline-powered trucks offer a cost-effective solution for shorter routes due to their lower initial purchase price. However, they are less efficient over long distances compared to diesel.

Electric and Hybrid trucks are emerging segments with growing interest due to environmental concerns and increasing regulations on emissions. These trucks are gaining traction in urban areas where shorter routes and sustainability goals align with their capabilities.

Tonnage Capacity Analysis

Medium-duty (Class 6–7) trucks dominate with 57.8% due to their balance between maneuverability and capacity.

Medium-duty box trucks strike a perfect balance between capacity and maneuverability, making them suitable for a wide range of applications from urban deliveries to inter-city transport. This class of trucks is particularly valued in congested urban environments where larger trucks would face accessibility issues.

Light-duty trucks are ideal for smaller loads and are commonly used by businesses for local deliveries within cities.

Heavy-duty trucks are essential for the largest loads and long-distance hauls, providing the necessary power and capacity for heavy industrial goods.

Application Analysis

Logistics & Transportation lead with 43.7% due to the critical role of distribution in supply chains.

The Logistics & Transportation sector heavily relies on box trucks to efficiently manage the distribution of goods across vast networks. This application’s dominance is driven by the ongoing growth in e-commerce, which demands reliable and timely transportation solutions to meet consumer expectations.

Food & Beverage Distribution utilizes refrigerated box trucks extensively to ensure the safe transport of perishables.

Retail & E-commerce sectors leverage dry box trucks for the final delivery of goods to stores or direct to consumers, which is crucial for maintaining inventory flow and customer satisfaction.

Construction & Building Materials, Healthcare & Pharmaceuticals, and other sectors also depend on box trucks to transport materials and products safely and efficiently, each contributing to the diverse uses and continued demand for these vehicles.

End-User Analysis

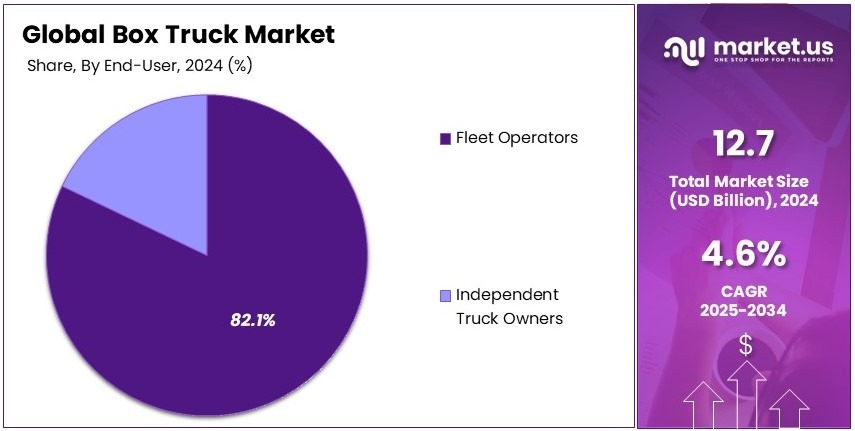

Fleet Operators dominate with 82.1% due to their large-scale operational capabilities.

Fleet operators are the primary end-users in the Box Truck Market, managing extensive collections of vehicles to support a wide range of services from package delivery to specialized industrial transport. Their dominance is attributed to their ability to offer versatile, reliable service across multiple customer segments.

Independent truck owners, though smaller in number, play a vital role in the market by providing flexible and personalized transport services, often filling niches that larger fleet operators might not cover.

Key Market Segments

By Truck Type

- Dry Box Trucks

- Refrigerated Box Trucks

By Fuel Type

- Diesel

- Gasoline

- Electric

- Hybrid

By Tonnage Capacity

- Light-duty (Class 3–5)

- Medium-duty (Class 6–7)

- Heavy-duty (Class 8)

By Application

- Logistics & Transportation

- Food & Beverage Distribution

- Retail & E-commerce

- Construction & Building Materials

- Healthcare & Pharmaceuticals

- Others

By End-User

- Fleet Operators

- Independent Truck Owners

Driving Factors

Increasing Last-Mile Demand Drives Market Growth

The box truck market is growing as e-commerce boosts last-mile delivery services. Companies rely on box trucks to move goods quickly and efficiently to customers’ doorsteps. This trend is especially strong in urban areas where fast delivery is a top priority. Retailers value speed and reliability to satisfy rising customer expectations.

Small and medium-sized enterprises are increasingly using box trucks for their daily operations. These businesses need flexible and affordable transport solutions. Box trucks offer an ideal option for local deliveries and service calls. Their versatility helps SMEs manage logistics without heavy capital investments.

Cold chain logistics is another key driver. Refrigerated box trucks are in demand to support the safe transport of perishable goods. Food, pharmaceuticals, and other temperature-sensitive items benefit from specialized vehicles. This trend supports market growth as more industries require reliable temperature control.

The rising adoption of electric and hybrid box trucks further propels the market. Companies seek sustainable operations that lower fuel costs and reduce environmental impact. These modern trucks meet stricter emission standards while offering efficient performance. This shift towards greener solutions aligns with global sustainability goals.

Restraining Factors

High Costs and Regulatory Pressures Restraint Market Growth

High purchase prices and ongoing maintenance costs challenge market growth. Companies often face steep initial investments when acquiring box trucks. These expenses make it difficult for small operators to upgrade fleets. Cost considerations remain a major barrier for many potential buyers.

Stringent emission regulations add another layer of complexity. Manufacturers must ensure that trucks meet rigorous standards. This often results in higher production costs and limits design flexibility. Compliance with environmental laws can delay new model releases and slow market expansion.

Driver shortages and rising labor costs further restrain growth in the trucking industry. A lack of qualified drivers pushes companies to rely on higher wages or alternative staffing models. This issue impacts the overall profitability of box truck operations and deters some businesses from expanding their fleets.

Infrastructure limitations and urban congestion also pose significant challenges. In many cities, narrow streets and heavy traffic hinder efficient deliveries. Limited parking and docking facilities add to the difficulty. These logistical challenges force companies to seek creative solutions, impacting overall market growth.

Growth Opportunities

Innovative Ownership and Tech Solutions Provide Opportunities

Leasing and subscription-based ownership models offer new opportunities in the box truck market. These flexible arrangements lower the entry barrier for businesses that cannot afford high upfront costs. Leasing allows companies to update fleets more frequently and manage expenses effectively.

Development of lightweight and aerodynamic box truck designs drives fuel efficiency and performance. Manufacturers invest in new materials and engineering techniques to reduce vehicle weight. These innovations help lower fuel consumption and improve handling. The result is a more cost-effective and sustainable transport option.

Expansion of telematics and fleet management solutions is also creating opportunities. Real-time tracking and data analytics help companies optimize routes and monitor vehicle health. These digital tools improve operational efficiency and reduce downtime. Enhanced fleet management leads to better resource allocation and reduced costs.

There is an increasing demand for custom-built and specialized box trucks in various industries. Tailored solutions meet the unique needs of sectors such as retail, construction, and healthcare. Customization enhances vehicle functionality and provides a competitive edge. Manufacturers are now focusing on versatile designs to serve diverse market demands.

Emerging Trends

Electric and Digital Innovations Are Latest Trending Factor

The rising adoption of electric box trucks with extended range capabilities is a key trend in the market. These vehicles offer lower emissions and reduced fuel costs. Companies are attracted to the long-term savings and sustainability benefits they provide. Extended range models also meet the demands of longer delivery routes.

Integration of AI and IoT for smart fleet monitoring and predictive maintenance is reshaping operations. Digital systems enable real-time tracking and faster decision-making. They improve safety and reduce unexpected breakdowns. This technology drives efficiency across the entire logistics network.

Contactless and autonomous delivery solutions using box trucks are gaining popularity. Automation minimizes human contact and streamlines delivery processes. These innovations improve customer experience and reduce labor costs. Autonomous features also promise greater reliability and consistency in service.

Government incentives for sustainable commercial vehicle adoption are influencing market trends. Financial support and tax breaks encourage investment in cleaner technologies. These policies help offset high initial costs and promote greener operations. As a result, more companies are transitioning to sustainable box truck fleets.

Regional Analysis

North America Dominates with 26.8% Market Share

North America leads the Box Truck Market with a 26.8% share, amounting to USD 3.40 billion. This dominance is fueled by a robust distribution network and a thriving e-commerce sector.

The region’s vast logistics and transportation infrastructure supports the widespread use of box trucks for freight and delivery services. Furthermore, North America’s focus on enhancing transportation efficiency and vehicle safety standards drives demand for new and technologically advanced box trucks.

Looking ahead, North America’s influence in the global Box Truck Market is expected to grow. As e-commerce continues to expand and urbanization increases, the demand for efficient delivery solutions will likely boost further investment in box trucks, enhancing the region’s market share.

Regional Mentions:

- Europe: Europe holds a notable position in the Box Truck Market, driven by stringent emissions regulations and a focus on fuel efficiency. The region’s commitment to environmental sustainability influences the adoption of newer, greener box truck models, supporting steady market growth.

- Asia Pacific: Asia Pacific is rapidly advancing in the Box Truck Market, fueled by economic growth and the expansion of retail and e-commerce. The increasing need for transportation solutions in densely populated cities like Beijing and Mumbai is spurring demand for box trucks.

- Middle East & Africa: The Middle East and Africa are witnessing growth in the Box Truck Market, with infrastructure development and increasing trade activities. The expansion of commercial sectors in these regions drives the need for effective transport vehicles, such as box trucks.

- Latin America: Latin America’s Box Truck Market is developing, thanks to economic improvements and growing manufacturing sectors. As more businesses require reliable transportation for goods, the demand for box trucks is on the rise, aiding the market’s growth in the region.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Box Truck Market, four companies stand out for their significant roles and market influence: Daimler AG, Volvo Group, PACCAR Inc., and Isuzu Motors Limited. These leaders are pivotal in shaping the industry through their innovation, reliability, and comprehensive market reach.

Daimler AG, renowned for its Mercedes-Benz trucks, is a top player in the global box truck market. Daimler’s commitment to quality and advanced engineering ensures their trucks are both reliable and efficient, catering to a broad range of commercial needs and setting high standards in the industry.

Volvo Group is another key market leader known for its focus on safety and environmental sustainability. Volvo’s box trucks are designed with the latest in fuel efficiency and emission control technologies, making them popular among businesses looking to reduce environmental impact while maintaining operational excellence.

PACCAR Inc., known for its Kenworth and Peterbilt truck brands, excels in manufacturing durable and high-performance box trucks. Their vehicles are favored for long-haul deliveries due to their robustness and advanced technology features, which include enhanced driver comfort and superior drivetrain configurations.

Isuzu Motors Limited specializes in lighter weight box trucks, which are highly maneuverable and ideal for urban deliveries. Isuzu’s commitment to utility and affordability makes their trucks a preferred choice for small to medium-sized businesses, emphasizing cost-effectiveness and reliability.

These top companies not only lead in sales and technological innovations but also drive trends within the box truck market. Their ongoing developments in truck design, environmental standards, and digital integration are crucial for meeting the evolving demands of the logistics and transportation industry.

Major Companies in the Market

- Daimler AG

- Volvo Group

- PACCAR Inc.

- Isuzu Motors Limited

- Hino Motors, Ltd.

- Navistar International Corporation

- Mitsubishi Fuso Truck and Bus Corporation

- Tata Motors Limited

- MAN SE

- Scania AB

- Hyundai Motor Company

- Iveco S.p.A.

- Ford Motor Company

Recent Developments

- PDI Technologies and Comdata Merchant Solutions: On December 2024, PDI Technologies, a leader in convenience retail and petroleum wholesale solutions, announced the acquisition of Comdata Merchant Solutions from Corpay Inc. This acquisition includes point-of-sale hardware and software systems tailored for truck stops and unattended commercial fueling locations, enhancing PDI’s service offerings in the transportation sector.

- TFI International: In 2024, TFI International expanded its footprint through multiple acquisitions, including Hercules Forwarding in March, Daseke for $1.1 billion in April, Entreposage Marco in June, and Groupe CRS Express in July. These acquisitions bolster TFI’s position in specialized freight services and the box truck market.

Report Scope

Report Features Description Market Value (2024) USD 12.7 Billion Forecast Revenue (2034) USD 19.9 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Truck Type (Dry Box Trucks, Refrigerated Box Trucks), By Fuel Type (Diesel, Gasoline, Electric, Hybrid), By Tonnage Capacity (Light-duty (Class 3–5), Medium-duty (Class 6–7), Heavy-duty (Class 8)), By Application (Logistics & Transportation, Food & Beverage Distribution, Retail & E-commerce, Construction & Building Materials, Healthcare & Pharmaceuticals, Others), By End-User (Fleet Operators, Independent Truck Owners) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Daimler AG, Volvo Group, PACCAR Inc., Isuzu Motors Limited, Hino Motors, Ltd., Navistar International Corporation, Mitsubishi Fuso Truck and Bus Corporation, Tata Motors Limited, MAN SE, Scania AB, Hyundai Motor Company, Iveco S.p.A., Ford Motor Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Daimler AG

- Volvo Group

- PACCAR Inc.

- Isuzu Motors Limited

- Hino Motors, Ltd.

- Navistar International Corporation

- Mitsubishi Fuso Truck and Bus Corporation

- Tata Motors Limited

- MAN SE

- Scania AB

- Hyundai Motor Company

- Iveco S.p.A.

- Ford Motor Company