Global Botulinum Toxin-A in Urology Market Product Type (Botox, Dysport, Xeomin and Other Product Types), Indication (Overactive Bladder (OAB) and Neurogenic Detrusor Overactivity (NDO)) and End-User- (Hospitals, Urology Clinics and Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 107424

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

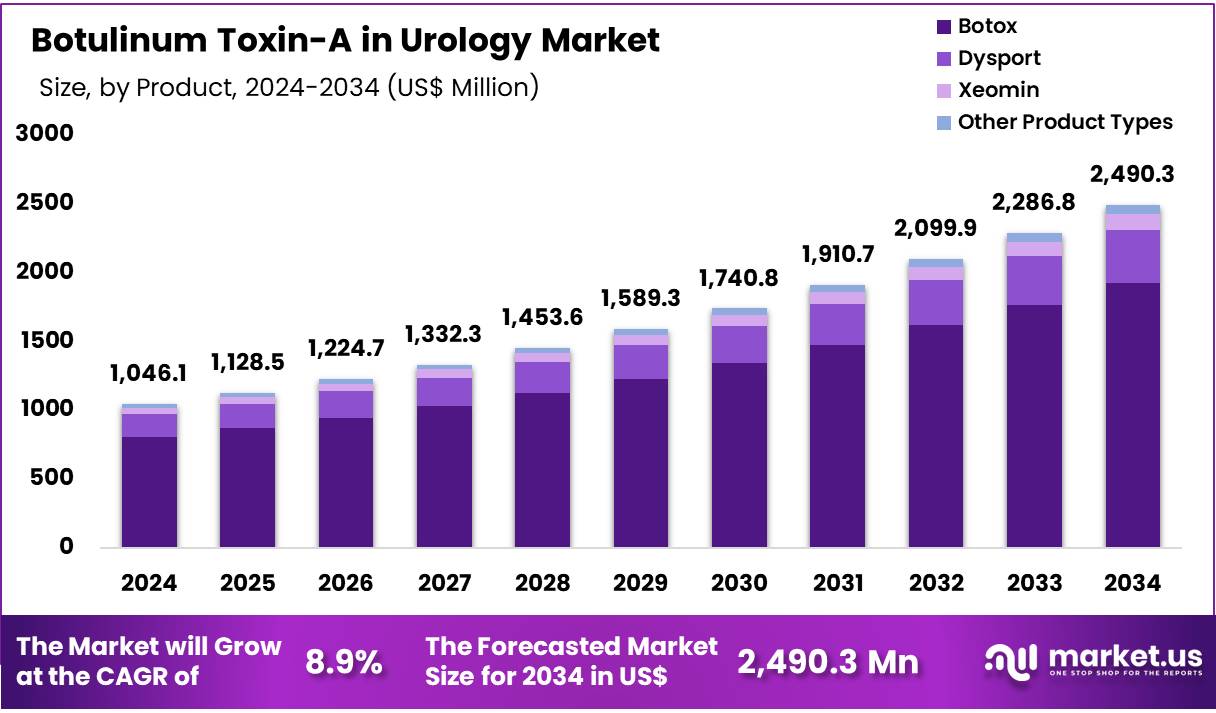

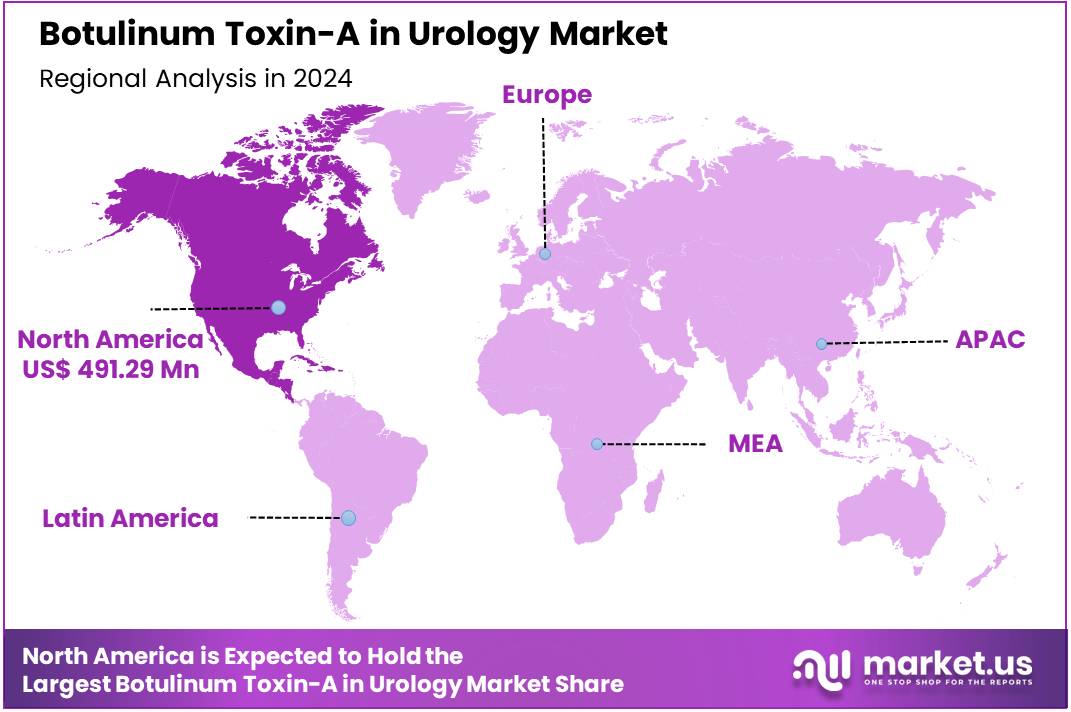

Global Botulinum Toxin-A in Urology Market was valued at US$ 1,046.09 Million in 2024 and is expected to grow at a CAGR of 8.9% from 2024 to 2034. In 2024, North America led the market, achieving over 47.0% share with a revenue of US$ 491.29 Million.

Botulinum Toxin-A in Urology Market, Global Analysis, 2020-2024 (US$ Million)

Global 2020 2021 2022 2023 2024 CAGR Revenue 820.1 862.1 911.1 974.9 1,046.1 8.9% The global Botulinum Toxin-A in Urology market is experiencing significant growth, driven by the increasing prevalence of urological disorders, advancements in minimally invasive treatments, and rising awareness among patients and healthcare providers. Botulinum Toxin-A (BoNT-A) is widely used in urology for conditions such as neurogenic detrusor overactivity (NDO), overactive bladder (OAB), and interstitial cystitis (IC). Its ability to temporarily inhibit nerve activity and reduce muscle overactivity makes it a preferred option for patients who do not respond to conventional therapies.

The growing geriatric population is a significant driver of the Botulinum Toxin-A (BoNT-A) in Urology market, as aging individuals are more susceptible to urological disorders such as overactive bladder (OAB), neurogenic detrusor overactivity (NDO), and urinary incontinence. With increasing life expectancy and a rise in age-related health conditions, the demand for effective, long-lasting treatments like BoNT-A is on the rise.

- For Instance, in 2023, life expectancy in the United States rose to 78.4 years.

- According to UNFPA India, the elderly population in India is expected to constitute 20% of the total population by 2050.

- According to WHO, the global population aged 60 years and older is projected to grow from 1 billion in 2020 to 1.4 billion in the near future. By 2050, this population will double to 2.1 billion, while the number of individuals aged 80 years and older is expected to triple, reaching 426 million.

Another key factor is the increasing preference for BoNT-A over traditional anticholinergic medications. While anticholinergics have been the conventional treatment for urological disorders, they often come with side effects such as dry mouth, constipation, and cognitive impairment, particularly in elderly patients. In contrast, BoNT-A injections provide longer-lasting relief with fewer systemic side effects, making them a more attractive treatment option for both patients and healthcare providers.

Favorable reimbursement policies in developed countries like the United States, Canada, Germany, and the United Kingdom further encourage market growth. Many healthcare systems and insurance providers cover BoNT-A treatments for urological conditions, making it accessible to a broader patient base. These policies help reduce out-of-pocket expenses for patients, promoting higher adoption rates.

Additionally, ongoing clinical research continues to expand the applications of BoNT-A in urology. Studies are exploring new indications, optimized dosages, and innovative administration techniques to improve patient outcomes. Emerging research also focuses on combinations of BoNT-A with other therapies to enhance efficacy and prolong treatment effects. As scientific advancements continue, BoNT-A’s role in urological treatment is expected to grow further, driving market expansion in the coming years.

Key Takeaways

- The Botulinum Toxin-A in Urology market generated a revenue of US$ 1,046.09 Million and is predicted to reach US$ 2,490.34 Million, with a CAGR of 8.9%.

- Based on the Product Type, the Botox products segment generated the most revenue for the market with a market share of 77.2%.

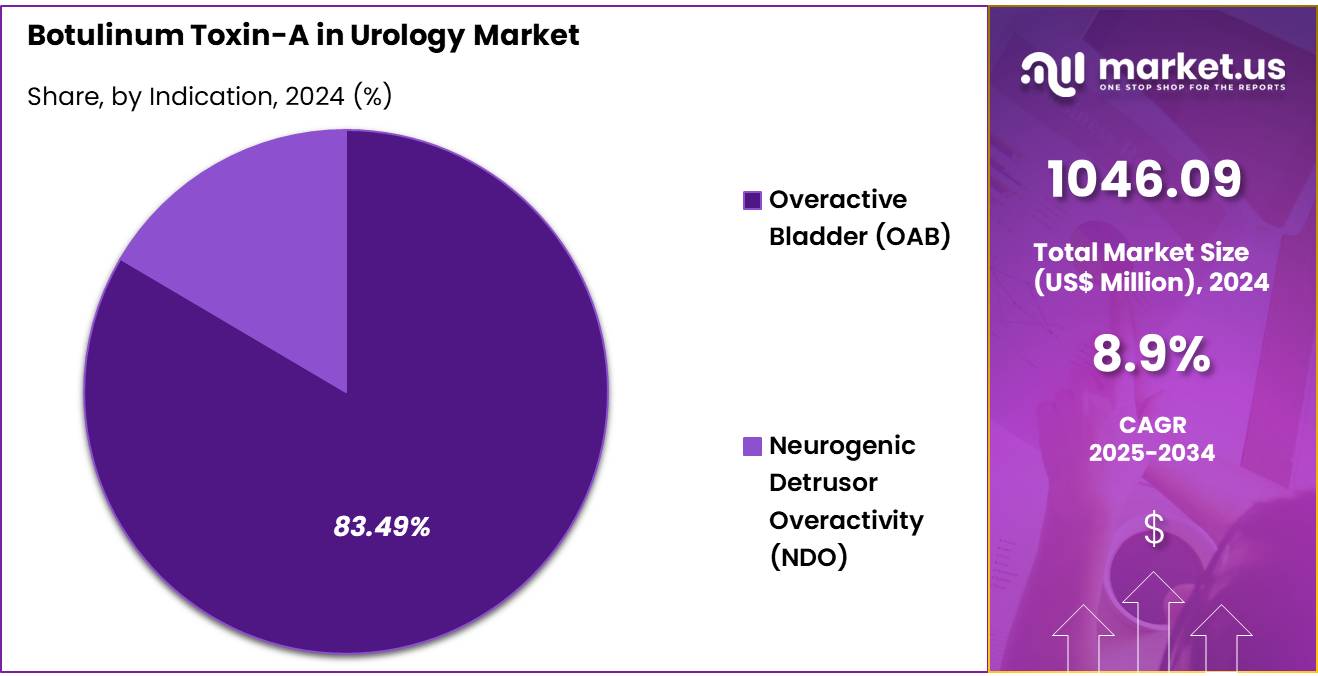

- Based on the Indication, the Overactive Bladder (OAB) segment generated the most revenue for the market with a market share of 83.5%.

- Based on the End-User, the Hospitals segment generated the most revenue for the market with a market share of 67.4%.

- Region-wise, North America remained the lead contributor to the market, by claiming the highest market share, amounting to 47.0%.

Product Type Analysis

The global Botulinum Toxin-A in Urology market is segmented by product type, with major categories including Botox, Dysport, Xeomin, and other formulations. Among these, Botox leads the segment by capturing a dominant 77.2% market share in 2024. Botox’s strong market position is attributed to its long-standing reputation as the top-selling product in its class and its widespread approval for treating a variety of urological conditions, such as overactive bladder (OAB) and neurogenic detrusor overactivity (NDO).

The product’s proven efficacy, extensive clinical research, and favorable safety profile contribute to its continued preference among both patients and healthcare providers. Additionally, Allergan, the maker of Botox, has established a strong global distribution network, ensuring the product’s widespread availability. While Dysport and Xeomin also capture market share, Botox remains the preferred choice due to its well-documented clinical history and effectiveness in treating complex urological disorders.

Botulinum Toxin-A in Urology Market, Product Type Analysis, 2020-2024 (US$ Million)

Product Type 2020 2021 2022 2023 2024 Botox 630.3 663.8 703.0 752.7 807.9 Dysport 129.1 135.0 142.0 151.9 163.3 Xeomin 38.3 40.0 41.9 44.6 47.7 Other Product Types 22.3 23.2 24.2 25.6 27.2 Indication Analysis

The Overactive Bladder (OAB) indication is the dominant segment in the Botulinum Toxin-A in Urology market, capturing a significant 83.5% market share. This dominance is largely driven by the high prevalence of OAB, a condition that affecsts millions globally, particularly among the elderly and those with neurogenic bladder disorders. Botulinum Toxin-A (BoNT-A) has proven to be highly effective in treating OAB by relaxing the bladder muscles, thus reducing symptoms such as urgency, frequency, and incontinence.

The treatment offers patients a minimally invasive solution, with long-lasting effects (typically 6-9 months), which makes it a preferred choice over other therapies like oral medications. The growing awareness of BoNT-A’s benefits in managing OAB, coupled with positive clinical outcomes, has contributed to its widespread adoption.

Furthermore, favorable reimbursement policies and increasing support from healthcare providers further reinforce BoNT-A’s leading position in addressing OAB, strengthening its market share in the urology sector.

Botulinum Toxin-A in Urology Market, Indication Analysis, 2020-2024 (US$ Million)

Indication 2020 2021 2022 2023 2024 Overactive Bladder (OAB) 671.2 708.6 752.5 809.5 873.4 Neurogenic Detrusor Overactivity (NDO) 148.9 153.5 158.7 165.4 172.7 End-User Analysis

In the global Botulinum Toxin-A in Urology market, hospitals dominate the end-user segment. Hospitals account for the largest share due to their role in providing specialized care and access to advanced treatments for urological disorders. They offer comprehensive treatment plans for conditions such as overactive bladder (OAB), neurogenic detrusor overactivity (NDO), and benign prostatic hyperplasia (BPH), which often require highly skilled healthcare professionals and advanced technologies like Botulinum Toxin-A (BoNT-A).

Additionally, hospitals benefit from the ability to offer minimally invasive therapies with long-lasting effects, making them a preferred setting for Botox injections and other BoNT-A treatments. Reimbursement policies in many regions, including insurance coverage, also support hospital adoption of BoNT-A, as it provides patients with effective and less invasive solutions. Furthermore, the ability of hospitals to handle more complex cases and offer post-treatment care enhances their position as the leading end-user in the urology market.

Botulinum Toxin-A in Urology Market, End-User Analysis, 2020-2024 (US$ Million)

End-User 2020 2021 2022 2023 2024 Hospitals 546.2 575.4 609.7 654.6 705.0 Urology Clinics 225.8 236.2 248.4 264.3 282.0 Research Institutes 48.1 50.4 53.1 56.0 59.1

Key Market Segments

By Product Type

- Botox

- Dysport

- Xeomin

- Other Product Types

By Indication

- Overactive Bladder (OAB)

- Neurogenic Detrusor Overactivity (NDO)

By End-User

- Hospitals

- Urology Clinics

- Research Institutes

Drivers

Rising Prevalence of Urological Disorders

As the global population continues to age, there is a notable rise in age-related health conditions, including urological disorders. Among these, conditions such as overactive bladder (OAB) and benign prostatic hyperplasia (BPH) are becoming increasingly prevalent in the elderly population, driving the demand for effective treatments.

Botulinum Toxin-A (BoNT-A) has emerged as a preferred therapeutic option due to its efficacy in managing these conditions, offering long-lasting relief where conventional treatments may fall short. As the aging demographic expands, the demand for BoNT-A in urological applications is expected to grow, further strengthening its market presence.

- A study published in The Lancet Healthy Longevity, utilizing GBD 2019 analytical and modeling strategies, estimated that the global prevalence of BPH reached 94 million cases in 2019, a significant increase from 51.1 million cases in 2000. The age-standardized prevalence was 2,480 per 100,000 people, reflecting a 70.5% rise in total cases between 2000 and 2019, despite a stable age-standardized prevalence rate.

- Additionally, autopsy studies indicate that BPH prevalence increases with age, affecting 8% of individuals in their 40s, 50% in their 70s, and 80% in their 90s. Similarly, data from the National Overactive Bladder Evaluation Program, a validated U.S. national telephone survey, reports that OAB prevalence is 16.9% in women and 16.2% in men, highlighting the widespread nature of this condition.

With rising life expectancy and an aging global population, the increasing burden of urological disorders will continue to drive the demand for advanced and minimally invasive treatment options like BoNT-A, reinforcing its critical role in urological care.

Restrains

Side Effects and Adverse Reactions

Although Botulinum Toxin-A (BoNT-A) is widely regarded as a safe and effective treatment for various urological disorders, no medical intervention is entirely free of side effects. While most patients tolerate the treatment well, some may experience mild to moderate adverse reactions, and in rare cases, more severe complications may arise. These potential risks can influence both patient decisions and physician recommendations, particularly when alternative treatment options exist.

Common side effects associated with BoNT-A injections in urology include urinary tract infections (UTIs), temporary urinary retention, hematuria (blood in urine), and localized discomfort at the injection site. Clinical studies indicate that UTIs occur in 15-35% of patients following BoNT-A treatment for overactive bladder (OAB) or neurogenic detrusor overactivity (NDO). Additionally, urinary retention—where patients experience difficulty in emptying the bladder—has been reported in up to 20% of cases, often requiring temporary catheterization.

Severe side effects, though rare, may include systemic botulinum toxin spread, leading to muscle weakness, fatigue, or respiratory difficulties. According to the U.S. Food and Drug Administration (FDA), these risks are minimal when BoNT-A is used within approved dosages and guidelines. However, the possibility of such reactions makes some patients and healthcare providers cautious about opting for this therapy.

Despite these risks, BoNT-A remains a preferred treatment option for refractory urological conditions due to its high efficacy and long-lasting effects (typically 6-9 months per injection). Nonetheless, a careful assessment of patient history, risk factors, and alternative treatments is crucial before administration to ensure safety and optimal outcomes.

Opportunities

Research and Development

The field of urology research is both dynamic and rapidly advancing. Researchers are continuously exploring new therapeutic possibilities, including the expansion of Botulinum Toxin-A (BoNT-A) applications. As scientific exploration progresses, several promising indications for BoNT-A are emerging, indicating significant untapped growth potential.

These discoveries could substantially expand BoNT-A’s role in urology, opening new avenues for its use in treating various urological conditions. As more resources are allocated to research and development (R&D), it is highly likely that further advancements will continue to enhance BoNT-A’s therapeutic capabilities, cementing its position in the market as a cornerstone of minimally invasive urological treatments.

An article published in May 2023 by the Department of Urology at Hualien Tzu Chi Hospital, Taiwan, highlights the ongoing exploration of BoNT-A in treating bladder pain syndrome (BPS) and interstitial cystitis (IC), both of which are often challenging to manage with conventional therapies. These conditions, characterized by chronic pelvic pain, urgency, and frequency of urination, impact millions of patients globally.

Although BoNT-A has shown efficacy in managing overactive bladder (OAB) and neurogenic detrusor overactivity (NDO), its potential for alleviating the symptoms of BPS and IC is being actively researched. Early findings suggest that BoNT-A may provide significant relief for individuals with these complex, often debilitating urological conditions, further supporting the growing role of BoNT-A in urology.

As ongoing R&D delves deeper into these possibilities, the market for BoNT-A is poised for further expansion, with potential to revolutionize treatments for previously difficult-to-manage urological disorders.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a significant role in shaping the global Botulinum Toxin-A (BoNT-A) in Urology market. Economic conditions, political stability, and international relations influence not only market demand but also the availability, pricing, and accessibility of medical treatments like BoNT-A.

Macroeconomic factors, such as economic growth, inflation, and healthcare spending, directly affect healthcare budgets and the affordability of treatments. In times of economic prosperity, increased healthcare expenditures can promote the adoption of advanced treatments like BoNT-A, which is considered a premium therapeutic option. Conversely, during economic downturns, healthcare institutions may prioritize cost-effective treatments, limiting the growth of high-cost therapies. Additionally, inflation and currency fluctuations can impact pricing strategies, especially in emerging markets where affordability is a concern.

Geopolitical factors such as trade policies, regulatory changes, and international relations also impact the global distribution and accessibility of BoNT-A. International trade tensions or sanctions may disrupt the supply chain for critical raw materials, affecting the production of Botulinum Toxin-A. Regulatory hurdles across different countries can delay or restrict the approval of BoNT-A for new indications, influencing its availability in various regions. Political stability in certain countries can also affect the investment in healthcare infrastructure, potentially limiting access to advanced treatments in less-developed or conflict-affected regions.

Ultimately, while economic growth and stable geopolitical conditions can facilitate BoNT-A’s widespread adoption, adverse macroeconomic or geopolitical events may impede its market expansion, especially in regions with high sensitivity to price fluctuations and supply chain disruptions.

Latest Trends

The global Botulinum Toxin-A (BoNT-A) in Urology market is witnessing several key trends driven by advancements in medical technology, evolving patient preferences, and expanding therapeutic indications. One prominent trend is the increasing use of BoNT-A for a wider range of urological conditions, particularly in the treatment of bladder pain syndrome (BPS) and interstitial cystitis (IC).

Ongoing research is uncovering new potential applications, making BoNT-A a versatile solution in managing chronic urological disorders that were previously challenging to treat effectively. Another trend is the growth of minimally invasive treatments, with BoNT-A becoming the preferred choice for patients seeking non-surgical, low-risk options. The shift toward non-invasive therapies is driven by the growing demand for better patient outcomes, quicker recovery times, and minimal side effects compared to traditional interventions.

Additionally, advancements in BoNT-A formulations and delivery methods are improving its effectiveness, with longer-lasting results and reduced complications. This trend is also supported by increased clinical evidence, further bolstering confidence in BoNT-A for treating conditions like neurogenic detrusor overactivity and overactive bladder. Finally, regional expansion in Asia-Pacific and Latin America is a key trend, driven by rising healthcare investments, expanding patient access, and increasing awareness about advanced urological treatments.

Regional Analysis

North America Dominates the Global Botulinum Toxin-A in Urology Market

North America remains the dominant region in the global Botulinum Toxin-A (BoNT-A) in Urology market, driven by factors such as advanced healthcare infrastructure, high healthcare expenditure, and wide adoption of innovative treatments. North America held the market share of 47.0% in 2024. The region is particularly known for its robust healthcare systems, where advanced therapeutic solutions like BoNT-A are more accessible to a larger patient population.

The United States is a key driver of this dominance, with an increasing prevalence of urological disorders such as overactive bladder (OAB), neurogenic detrusor overactivity (NDO), and benign prostatic hyperplasia (BPH). According to the National Institutes of Health (NIH), OAB affects approximately 33 million Americans, creating a large patient pool for BoNT-A treatments. Furthermore, reimbursement policies and insurance coverage in the U.S. support the widespread use of BoNT-A, making it accessible to many patients in need of non-surgical interventions.

Clinical evidence and FDA approvals further reinforce the growth of BoNT-A in the region. The U.S. FDA has approved BoNT-A for various urological conditions, providing physicians with confidence in its safety and efficacy. Additionally, the growing trend of minimally invasive treatments in the region aligns with BoNT-A’s characteristics of providing non-surgical, effective, and long-lasting solutions. With increasing demand for innovative urological care, North America continues to lead the market and drive future growth.

Botulinum Toxin-A in Urology Market, Region Analysis, 2020-2024 (USD Million)

Indication 2020 2021 2022 2023 2024 North America 1,526.1 1,607.4 1,702.8 1,826.6 1,965.2 Asia Pacific 345.1 359.9 377.2 399.4 423.9 Latin America 537.2 569.3 607.0 656.4 712.1

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Botulinum Toxin-A (BoNT-A) in Urology market is dominated by key players such as Allergan (AbbVie), Ipsen, and Medytox, which are leading the market with their established product portfolios and strong presence in the urology space. Allergan’s Botox, one of the most widely used BoNT-A formulations, holds a significant market share due to its proven efficacy in treating urological conditions like overactive bladder (OAB) and neurogenic detrusor overactivity (NDO).

Ipsen offers Dysport, another major product in the BoNT-A market, which is also gaining traction for urological applications, particularly in lower urinary tract dysfunction. Medytox has been expanding its footprint in the Asia-Pacific market, contributing to regional market growth.

The market is highly competitive, with key players focusing on R&D innovations, new product developments, and strategic partnerships to enhance their market share. As more indications for BoNT-A are explored, competition is likely to intensify, further expanding treatment options and market potential.

Top Key Players

- AbbVie Inc

- Ipsen Pharma

- Merz Pharma

- Medytox

- Bio-Med Private Limited

- HUGEL, Inc.

- Daewoong Pharmaceutical Co., Ltd.

- Galderma (Distributor)

Recent Developments

- In June 2022, Ipsen announced that Dysport® (abobotulinumtoxinA) has received positive opinion in Europe for the management of urinary incontinence (UI) in adults with neurogenic detrusor overactivity (NDO) due to spinal cord injury (SCI) (traumatic or non-traumatic) or multiple sclerosis (MS), who are regularly performing clean intermittent catheterization (CIC).

- In November 2022, Allergan Aesthetics, a subsidiary of AbbVie (NYSE: ABBV), is encouraging people nationwide to take a “Moment for You” on Wednesday, November 16, to celebrate the biggest event of the year for BOTOX® Cosmetic. This annual holiday honors the top-selling product in its category, featuring special rewards and offers that make it the busiest day of the year for the brand.

Report Scope

Report Features Description Market Value (2024) US$ 1,046.09 Million Forecast Revenue (2034) US$ 2,490.34 Million CAGR (2025-2034) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product Type- Botox, Dysport, Xeomin and Other Product Types, Indication- Overactive Bladder (OAB) and Neurogenic Detrusor Overactivity (NDO) and End-User- Hospitals, Urology Clinics and Research Institutes Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AbbVie Inc, Ipsen Pharma, Merz Pharma, Medytox, Bio-Med Private Limited, HUGEL, Inc., Daewoong Pharmaceutical Co., Ltd. and Galderma (Distributor) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Botulinum Toxin-A in Urology MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Botulinum Toxin-A in Urology MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AbbVie Inc

- Ipsen Pharma

- Merz Pharma

- Medytox

- Bio-Med Private Limited

- HUGEL, Inc.

- Daewoong Pharmaceutical Co., Ltd.

- Galderma (Distributor)